The inclusion of coverage for virtual consultations and telemedicine services in private health insurance reflects a forward-looking approach to healthcare delivery. This feature enhances the accessibility and convenience of medical consultations for policyholders, allowing them to connect with healthcare professionals remotely. Private health insurance plans incorporating telemedicine benefits demonstrate a commitment to meeting evolving healthcare needs, offering a cost-effective and efficient alternative to traditional in-person visits.

Access Full Report @ https://www.databridgemarketresearch.com/reports/thailand-private-health-insurance-market

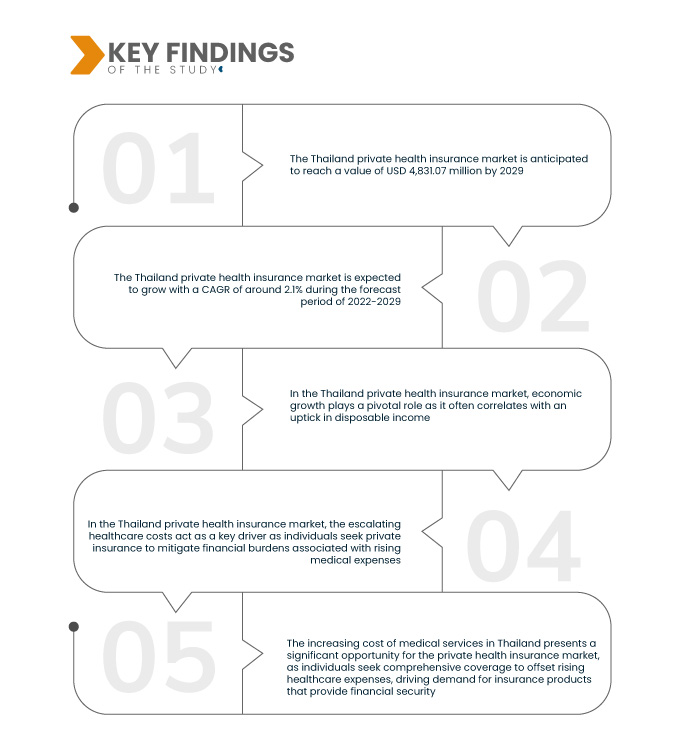

Data Bridge Market Research analyses the Thailand Private Health Insurance Market, which was USD 4,091.07 million in 2021 and is expected to reach the value of USD 4,831.07 million by the year 2029, at a CAGR of 2.1% during the forecast period of 2022-2029. The aging population in Thailand is a key driver for the demand in the private health insurance market. As the proportion of elderly individuals increases, there is a growing need for comprehensive health coverage, as older demographics typically require more healthcare services.

Key Findings of the Study

Increasing medical tourism hub is expected to drive the market's growth rate

The emergence of Thailand as a medical tourism hub serves as a potent driver for the country's private health insurance market. As international patients increasingly choose Thailand for medical procedures and treatments, the demand for comprehensive health coverage rises. Private health insurance becomes pivotal in catering to the specific needs of these medical tourists, offering coverage for healthcare expenses and additional benefits such as international medical evacuation and tailored services. This fosters growth in the private health insurance sector and positions Thailand as an attractive destination for that seeking high-quality medical care coupled with robust insurance protection.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Price in USD, Volume in Units

|

|

Segments Covered

|

Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS) and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years) and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators and Others)

|

|

Market Players Covered

|

Aetna Inc. (A subsidiary of CVS Health) (U.S.), Cigna (U.S.), AIA Group Limited (Hong Kong), Allianz (Germany), HSBC Group (Hong Kong), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy), AXA (France), Income (Australia)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Thailand private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group and distribution channel.

- On the basis of type, the Thailand private health insurance market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance and others

- On the basis of health plan category/metal levels, the Thailand private health insurance market is segmented into bronze, silver, gold platinum and others

- On the basis of provider type, the Thailand private health insurance market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (EPOS), point-of-service (POS) plans, high-deductible health plans (HDHPS) and others

- On the basis of age group, the Thailand private health insurance market is segmented into young adulthood (19-44 years), middle adulthood (45-64 years) and older adulthood (65 years and above)

- On the basis of distribution channel, the Thailand private health insurance market is segmented into direct insurance companies, insurance aggregators and others

Major Players

Data Bridge Market Research recognizes the following companies as the major Thailand private health insurance market players in Thailand private health insurance market are Aetna Inc. (A subsidiary of CVS Health) (U.S.), Cigna (U.S.), AIA Group Limited (Hong Kong), Allianz (Germany), HSBC Group (Hong Kong), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy)

Market Developments

- In March 2022, Allianz Real Estate's strategic acquisition of prime multi-family residential assets in Tokyo for approximately USD 90 million marked a significant move in the real estate sector andhighlights the importance of diversified investments. This strategic decision underscores the parallel considerations in the private health insurance market, where a diverse and well-managed portfolio of coverage options can be crucial. Just as Allianz Real Estate positioned itself for long-term profitability by tapping into Tokyo's real estate potential, private health insurers can enhance their market standing by offering a range of comprehensive coverage options. This parallel emphasizes the significance of strategic foresight and adaptability, key elements in both thriving real estate and insurance markets

- In March 2020, Aetna Inc. demonstrated a customer-centric approach by announcing a proactive measure in response to the challenges posed by the COVID-19 pandemic. The company revealed that small and medium-sized employer plan sponsors in Europe, the Middle East, and Africa renewing their Summit group health insurance policies within a specific timeframe—from May 1, 2020, to on or before July 1, 2020—would receive an unprecedented one-month complimentary extension of health cover. This initiative was part of Aetna's broader efforts to alleviate financial burdens and address the evolving healthcare needs of its customers during the pandemic

For more detailed information about the Thailand private health insurance market report, click here – https://www.databridgemarketresearch.com/reports/thailand-private-health-insurance-market