The U.K. fleet management market is an evolving sector, characterized by a diverse range of players offering comprehensive solutions. Increasing focus on optimizing vehicle utilization, enhancing operational efficiency, and ensuring regulatory compliance, this market has seen significant technological advancements in telematics, IoT integration, and predictive analytics. The growing emphasis on sustainability and cost-effectiveness has increased demand for eco-friendly solutions and streamlined management platforms. Despite market maturity, the continuous evolution of technology and the emergence of new mobility trends are expected to drive further innovation and market growth in the foreseeable future.

Access Full Report @ https://www.databridgemarketresearch.com/reports/uk-fleet-management-market

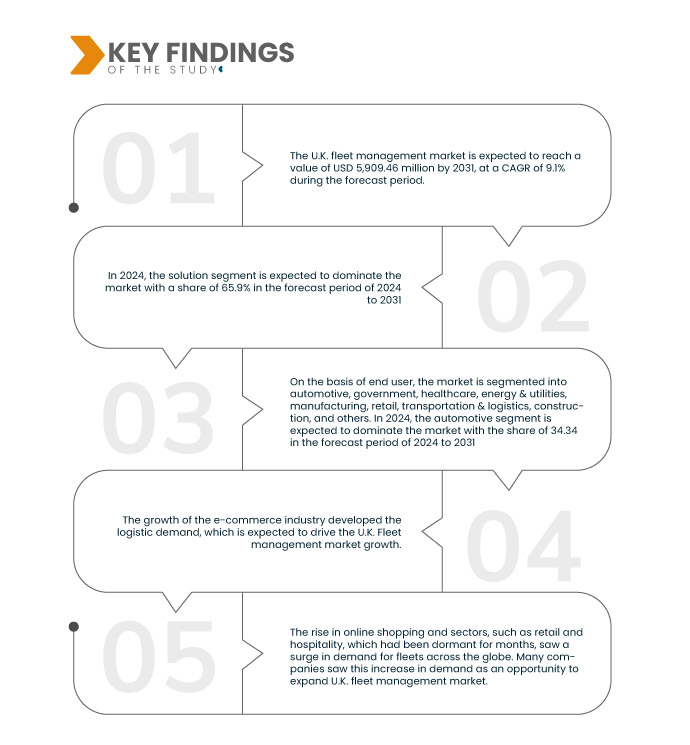

Data Bridge Market Research analyses that the U.K. Fleet Management Market is expected to reach a value of USD 5,909.46 million by 2031, at a CAGR of 9.1% during the forecast period. The U.K. fleet management market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

Key Findings of the Study

Increasing Focus of Fleet Owners on Operational Efficiency

Fleet management solutions are becoming increasingly popular as businesses look for ways to improve their fleets' efficiency, safety, and profitability. These can help businesses to improve efficiency by tracking the location of vehicles, managing fuel usage, and monitoring driver behavior. This information can ensure that vehicles are on schedule, identify drivers wasting fuel, and implement fuel-saving measures. Fleet management solutions improve operational efficiency by optimizing various aspects of fleet operations.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Component (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, and Rolling Stock), Hardware (Tracking, Optimization, ADAS, Diagnostics, and Others), Fleet Size ( Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles), and Large & Enterprise Fleets (20-50+ Vehicles)), Communication Range(Short Range Communication and Long Range Communication), Deployment (On-Premise, Cloud, and Hybrid), Communication Type (GNSS, Cellular Systems, and Others), Functions (Asset Management, Route Management, Fuel Consumption, Real Time Vehicle Location, Delivery Schedule, Accident Prevention, ELD Compliance, Mobile Apps, Monitoring Driver Behaviour, Vehicle Maintenance Updates, Vehicle Maintenance & Diagnostics, and Others), Operations (Commercial and Private), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Construction, Healthcare, Government, Energy & Utilities, and Others)

|

|

Country Covered

|

U.K.

|

|

Market Players Covered

|

AURELIUS (Germany), Holman, Inc. (U.S.), Continental AG (Germany), Siemens (Germany), AT&T Intellectual Property (U.S.), IBM Corporation (U.S.), MiX Telematics (South Africa), TRAXALL (U.K.), Verizon (U.S.), Zonar Systems, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Robert Bosch Ltd (Germany), FleetCheck Limited (U.K.), Alphabet (Germany, and Midas FMS (U.K.), among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The U.K. fleet management market is segmented on the basis of components, lease type, mode of transport, hardware, fleet size, communication range, deployment, communication type, functions, operations, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

- On the basis of component, the market is segmented into solutions and services

In 2024, the solutions segment is expected to dominate the market

In 2024, the solutions segment is expected to dominate the market with a market share of 65.9% as passive U.K. fleet management provides comprehensive solutions for time tracking of the fleets.

- On the basis of lease type, the market is segmented into on-lease and without lease

In 2024, the on lease segment is expected to dominate the market.

In 2024, the on-lease segment is expected to dominate the market with a market share of 69.4% as it gives more opportunity to the companies for scheduling services and repairs of the vehicles.

- On the basis of mode of transport, the market is segmented into automotive, rolling stock, and marine. In 2024, the automotive segment is expected to dominate the market with a market share of 62.51%

- On the basis of hardware, the market is segmented into tracking, optimization, ADAS, diagnostics, and others. In 2024, the tracking segment is expected to dominate the market with a market share of 34.25%

- On the basis of fleet size, the market is segmented into small fleets (1-5 vehicles), medium fleets (5-20 vehicles), and large and enterprise fleets (20-50+ vehicles). In 2024, the small fleets (1-5 vehicles) segment is expected to dominate the market with a market share of 46.93%

- On the basis of communication range, the market is segmented into short range communication and long range communication. In 2024, the short range communication segment is expected to dominate the market with a market share of 58.30%

- On the basis of deployment, the market is segmented into on premise, cloud, and hybrid. In 2024, the on-premise segment is expected to dominate the market with a market share of 59.15%

- On the basis of communication type, the market is segmented into GNSS, cellular systems, and others. In 2024, the GNSS segment is expected to dominate the market with a market share of 55.33%

- On the basis of functions, the market is segmented into monitoring driver behavior, fuel consumption, asset management, ELD compliance, route management, vehicle maintenance updates, delivery schedules, accident prevention, real-time vehicle location, mobile apps, and others. In 2024, the asset management segment is expected to dominate the market with a market share of 18.34%

- On the basis of operations, the market is segmented into private and commercial. In 2024, the commercial segment is expected to dominate the market with a market share of 67.02%

- On the basis of end user, the market is segmented into automotive, government, healthcare, energy & utilities, manufacturing, retail, transportation & logistics, construction, and others. In 2024, the automotive segment is expected to dominate the market with a market share of 34.34%

Major Players

Data Bridge Market Research analyzes AURELIUS (Germany), Holman, Inc. (U.S.), Continental AG (Germany), Siemens (Germany), and AT&T Intellectual Property (U.S) as the major market players in the U.K. fleet management market.

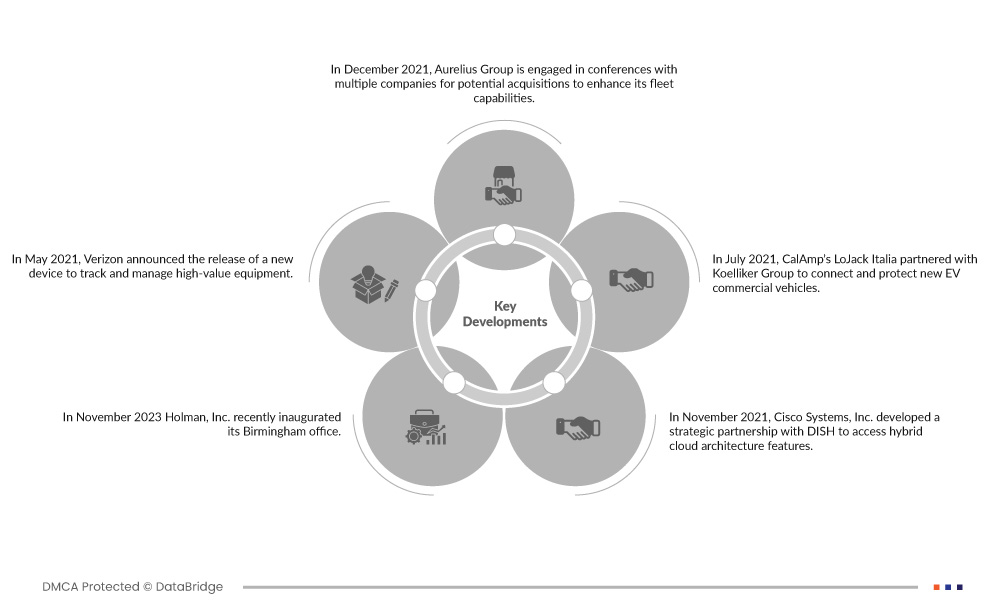

Market Developments

- In November 2023, Holman, Inc. recently inaugurated its Birmingham office. This expansion, alongside the existing Chippenham headquarters, resulted in over 100 new jobs in the Midlands, enlarging the workforce to over 300. The move into Birmingham was driven by Holman's success in securing new business contracts, substantially increasing the fleet management for clients ranging from SMEs to large corporations. This benefits the company to expand its consumer base and help it address customer service.

- In December 2021, Aurelius Group talked with multiple companies about potential acquisitions to enhance its fleet capabilities. The private equity firm acquired BT Fleet Solutions over two years ago and rebranded it as Rivus Fleet Solutions. It has since expanded its portfolio by acquiring Pullman Fleet Services, GKN Wheels and Structures, and AutoRestore. The acquisition indicates Aurelius Group commitment to further strengthening its position in the fleet-related services sector

- In May 2021, Verizon announced the release of a new device to track and manage high-value equipment. This new product will allow the company to diversify its product portfolio and widen its offerings to customers to attract new customers

- In November 2021, Cisco Systems, Inc. developed a strategic partnership with DISH to access hybrid cloud architecture features. This will help the company to offer better data management through cloud service for customers ,improve the efficiency of the service, and develop user-friendly technologies

- In July 2021, CalAmp’s LoJack Italia partnered with Koelliker Group to connect and protect new EV commercial vehicles. This partnership will help the company to develop new technology for EV vehicles and expand the service portfolio, which helps to attract new customers

For more detailed information about the U.K. fleet management market report, click here – https://www.databridgemarketresearch.com/reports/uk-fleet-management-market