Rising demand for e-commerce packaging is an important driver for the U.S. brown paper market. Expansion in the application scope of cardboard for interior renovation and repair is expected to propel the growth of the U.S. brown paper market.

Access full Report @ https://www.databridgemarketresearch.com/reports/us-brown-paper-market

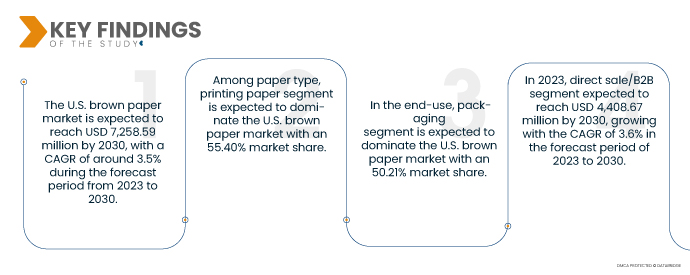

Data Bridge Market Research analyses that the U.S. Brown Paper Market is expected to grow at a CAGR of 3.5% in the forecast period of 2023 to 2030 and is expected to reach USD 7,258.59 million by 2030. The driving factors growth of the market includes improvement in the foodservice industry.

Key Findings of the Study

Rising demand for e-commerce packaging

The growing usage of compostable and sustainable packaging materials is increasing among consumers. This is owing to the increasing awareness regarding the detrimental impact of plastic and other non-biodegradable packaging variants and options, which is expected to be a primary driver propelling the growth of the U.S. brown paper market.

Brown paper packaging solutions are biodegradable, durable, and easy to use. Hence, their demand is constantly increasing in various end-use industries such as food & beverages, electronics & electrical, pharmaceuticals, and building & construction among others. In addition, increasing consumer inclination toward paper-based packaging materials coupled with shifting consumer preference towards recyclable packaging solutions is expected to support market growth in the near future. Moreover, the growing awareness among environmentalists and governments about the hazards of using plastic is also forcing consumers and governments to focus on greener alternatives, favoring the adoption of brown paper.

In today's times, sustainability is the central issue, and an average consumer is more aware of their product choices' environmental impact than a consumer was a few years ago. With the increase in awareness about sustainability and its significance and the rise in eco-friendly regulations, sustainable packaging is, now more than ever, an issue of concern for customers. Therefore, with the rising consumer awareness, brands have already started adopting sustainable marketing and packaging solutions for their products based on this shift in consumer mindset.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2020 - 2015)

|

|

Quantitative Units

|

Revenue in Million, Volumes in Kilo Tons, Pricing in USD

|

|

Segments Covered

|

By Paper Type (Printing Paper, Copier Paper, Waxed Paper, Greeting Card Paper, Bond Paper, Tracing Paper, Tissue Paper, Inkjet Paper, and Tobacco Rolling Paper), End-Use (Packaging, Stationery, Home Care and Personal Care, Building and Construction, and Others), Distribution Channel (Direct Sale/B2B, Specialty Stores, E-Commerce, and Others)

|

|

Country Covered

|

U.S.

|

|

Market Players Covered

|

Richerpaper.com (China), Primo Tedesco SA (Brazil), Georgia-Pacific (U.S.), Graphic Packaging International , LLC(U.S.), WestRock Company (U.S.), Oji Holdings Corporation (Japan), Nordic Paper (Sweden), and Smurfit Kappa (Ireland) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The U.S. brown paper market is segmented on the basis of paper type, end-use, and distribution channel

- On the basis of paper type, the U.S. brown paper market is classified into printing paper, copier paper, waxed paper, greeting card paper, bond paper, tracing paper, tissue paper, inkjet paper, and tobacco rolling paper.

In 2023, printing paper is expected to dominate the U.S. brown paper market due to the growing packaging, printing, and e-commerce industries.

In 2023, the packaging segment of the end-use segment is anticipated to dominate the U.S. brown paper market.

- On the basis of paper type, the U.S. brown paper market is segmented into printing paper, copier paper, waxed paper, greeting card paper, bond paper, tracing paper, tissue paper, inkjet paper, and tobacco rolling paper. In 2023, the printing paper segment is expected to dominate the U.S. brown paper market with a 55.53% market share. It is expected to reach USD 4,095.48 million by 2030, growing with the highest CAGR of 3.8% in the forecast period of 2023 to 2030.

- On the basis of end-use, the U.S. brown paper market is segmented into packaging, stationery, home care and personal care, building and construction, and others. In 2023, the packaging segment is expected to dominate the U.S. brown paper market with a 50.29% market share. It is expected to reach USD 3,691.98 million by 2030, growing with the highest CAGR of 3.7% in the forecast period of 2023 to 2030.

- On the basis of distribution channel, the U.S. brown paper market is segmented into direct sale/B2B, specialty stores, e-commerce, and others. In 2023, the direct sale/B2B segment is expected to dominate the U.S. brown paper market with a 60.45% market share. It is expected to reach USD 4,408.67 million by 2030, growing with the CAGR of 3.6% in the forecast period of 2023 to 2030.

Major Players

Data Bridge Market Research recognizes the following companies as the major brown paper market players in U.S. brown paper market are Richerpaper.com (China), Primo Tedesco SA (Brazil), Georgia-Pacific (U.S.), Graphic Packaging International , LLC (U.s), WestRock Company (U.S.), Oji Holdings Corporation (Japan), Nordic Paper (Sweden), and Smurfit Kappa (Ireland) among others.

Market Development

- In February 2023, Smurfit Kappa was recognized as a top ESG performer by leading research and analytics company Morningstar Sustainalytics. The Company's 2022 ESG Risk Rating has improved, seeing the FTSE 100 listed company positioned in Sustainalytics' list of Top Rated companies both for the industry and regional categories. The ESG Industry Top Rated badge, received by Smurfit Kappa, is a global benchmark and reaffirms Smurfit Kappa's ESG Risk Rating as 'low-risk.'

- In December 2022, WestRock Company announced the acquisition of the remaining interest in Grupo Gondi for USD 970 million plus the assumption of debt. The acquisition of Grupo Gondi includes four paper mills, nine corrugated packaging plants, and six high graphic plants throughout Mexico. This acquisition will enable the company to serve the Latin American market with a broad paper and packaging solutions portfolio.

- In November 2022, Georgia-Pacific got honored with an Innovation in Sustainability award for Juno Technology. This award boosts the organization's reputation, setting it apart from the crowd and increasing the credibility of the company.

- In October 2022, WestRock Company got acknowledged for earning six awards for packaging design excellence during the 79th annual North American Paperboard Packaging Competition, sponsored by the Paperboard Packaging Council. This acknowledgment helps the brands stand out on the shelf and get recognized all over the world.

- In February 2021, Graphic Packaging International launched ProducePack, a sustainable paperboard packaging range of solutions for fresh produce. The product launch led to new business relations as well as partnerships. Additionally, it has helped the company gain a lot of attention from larger customers around the globe.

For more detailed information about the brown paper market report, click here – https://www.databridgemarketresearch.com/reports/us-brown-paper-market