The increasing demand for online platforms to purchase insurance is a major driver in the U.S. business travel accident insurance market. As businesses seek efficient, accessible solutions for securing comprehensive travel insurance coverage for employees, digital platforms are transforming how companies evaluate, purchase, and manage policies.

The trend toward digital adoption aligns with a broader shift in business operations favoring technology-driven efficiency and real-time decision-making. Insurance providers now offer platforms that allow companies to compare coverage options, customize plans, and instantly secure policies that align with the specific travel needs and risk profiles of their employees. These platforms offer unprecedented convenience, enabling businesses to manage and modify policies without needing time-intensive consultations or in-person interactions. This immediacy meets the demand for swift policy activation in dynamic business environments where travel schedules can change at short notice.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-business-travel-accident-insurance-market

Data Bridge Market Research analyzes that U.S. Business Travel Accident Insurance Market is expected to reach 10.06 billion by 2031 from USD 2.83 billion in 2023, growing with a substantial CAGR of 17.4% in the forecast period of 2024 to 2031.

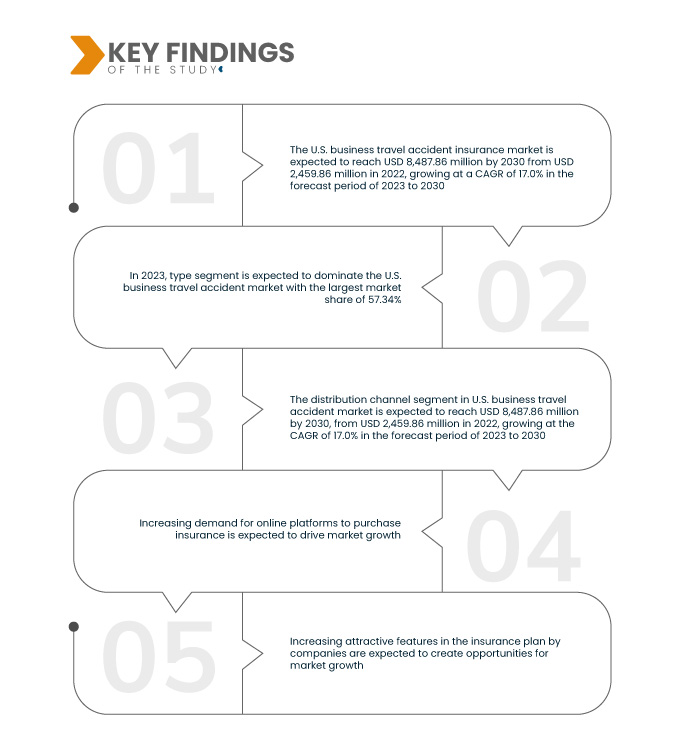

Key Findings of the Study

Rise in International Trade and Business Expansion Globally

Globalization has increased the integration of the world economy through the rise of international trade. Thus, both consumers and companies can now choose from a broader range of products and services. Also, many companies are expanding their geographical reach by investing in foreign companies and are setting up their branches in others countries. They have to travel from one place to another numerous times to expand their business and look into the flow of operations. Many insurance companies are coming up with different plans like multi-trip travel protection plans helping their clients for necessary coverage. Also, the companies are coming with a plan which can provide them complete travel safety.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Type (Single Trip Coverage, Annual Multi-Trip Coverage, and Others), User Type (B2B, B2C, and B2B2C), Distribution Channel (Insurance Brokers, Insurance Aggregators, Insurance Company, Bank, and Others), Coverage (Accidental Medical, Accidental Death, Accidental Dismemberment, Out-of-Country Medical, Emergency Medical Evacuation, Security Evacuation, and Others), Policy Type (Local Policies, Global Policies, and Controlled Master Program), Business Size (Large Businesses (More Than 500 Employees), Mid-Size Businesses (10 - 500 Employees), and Small Businesses (2 - 10 Employees)), End-User (Corporate, Government, International Travelers, and Employees (Expats)

|

|

Market Players Covered

|

Chubb (U.S.), AGA Service Company (Allianz Partners) (U.S.), American International Group, Inc. (AIG) (U.S.), AXA Partners USA S.A (U.S.), The Hartford (U.S.), American Express (U.S.), MetLife Services and Solutions, LLC (U.S.), Berkshire Hathaway Specialty Insurance (U.S.), Arch Capital Group Ltd. (Bermuda), Generali Global Assistance (U.S.), Jokio Marine HCC (U.S.), Travel Insured International (U.S.), International Medical Group, Inc. (A Subsidiary of SiriusPoint Ltd.) (U.S.), Berkley Accident and Health (U.S.), Travelex Insurance Services Inc. (U.S.), Visitors Coverage Inc (U.S.), Insubuy, LLC (U.S),

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The U.S. business travel accident insurance market is segmented into seven notable segments based on type, user type, distribution channel, coverage, policy type, business size, and end-user.

- On the basis of type, the market is segmented into single trip coverage, annual multi-trip coverage, and others

In 2024, the single trip coverage segment is expected to dominate the market with a 57.18% market share

In 2024, the single trip coverage segment is expected to dominate the market with a 57.18% market share due to most people going for vacation or holiday at least once a year because they prefer a single trip coverage policy raising its demand.

- On the basis of user type, the market is segmented into B2B, B2C, and B2B2C

In 2024, the B2B segment is expected to dominate the market with a 54.59% market share

In 2024, the B2B segment is expected to dominate the market with a 54.59% market share due to companies mostly purchasing travel insurance for their employees directly from the insurance company raising its demand in the market

- On the basis of distribution channel, the market is segmented into insurance brokers, insurance aggregators, insurance company, bank, and others

- On the basis of coverage, the market is segmented into accidental medical, accidental death, accidental dismemberment, out-of-country medical, emergency medical evacuation, security evacuation, and others

- On the basis of policy type, the market is segmented into local policies, global policies, and controlled master program

- On the basis of business size, the market is segmented into large businesses (more than 500 employees), mid-size businesses (10 - 500 employees), and small businesses (2 - 10 employees)

- Based on end-user, the market is segmented into corporate, government, and international travelers and employees (EXPATS)

Major Players

Data Bridge Market Research analyzes Chubb (U.S.), AGA Service Company (Allianz Partners) (U.S.), American International Group, Inc. (AIG) (U.S.), AXA Partners USA S.A (U.S.), and The Hartford (U.S.) as major market players.

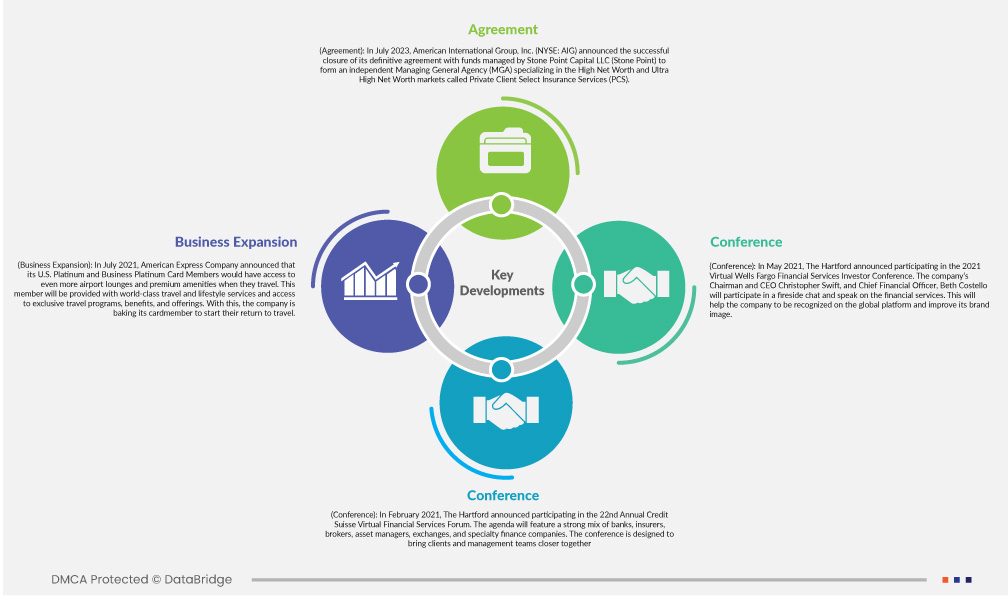

Market Developments

- In July 2022, Chubb completed the acquisition of the life and non-life insurance companies that house the personal accident, supplemental health, and life insurance business of Cigna in several Asian markets. Chubb paid approximately USD 5.4 billion in cash for the operations, which include Cigna's accident and health (A&H) and life business in Korea, Taiwan, New Zealand, Thailand, Hong Kong, and Indonesia, collectively referred to as Cigna's business in Asia. This complementary strategic acquisition expands our presence and advances our long-term growth opportunity in Asia. Effective July 1, 2022, the results of operations of this acquired business are reported primarily in our Life Insurance segment and, to a lesser extent, our Overseas General Insurance segment

- In October 2020, Chubb announced the launch of a new online accident insurance product for individuals and families. The new product provides access to extra insurance coverage and the ability to shop and purchase it virtually. The company has also provided its customers with flexible purchasing and servicing options such as offline, online, and via mobile. Thus, the company has provided its customer with online purchase options starting from accident products

- In September 2020, Chubb announced the launch of Chubb Studio, a new global platform that will simplify and streamline the distribution of the company's insurance products through its partners' digital channels. The product provides significant speed-to-market for the partners and offers a secure and scalable platform with multiple APIs to simplify the process. Thus, the company offers its partners a simple and frictionless solution to offer insurance within their ecosystems

- In July 2020, Chubb announced that they had integrated their North America Accident and Health (A&H) businesses to address the needs of middle-market, large corporate clients and distribution partners in a better way. This new structure will provide the company’s distribution partners and clients with greater resources and better access to products and services specially designed to meet the challenges of workplace and travel risk for individuals, employees, and a variety of organizational entities. With this new structure, the company will serve its partners and clients in a better way

For more detailed information about U.S. business travel accident insurance market report, click here – https://www.databridgemarketresearch.com/reports/us-business-travel-accident-insurance-market