Resistance to UV radiation is a crucial attribute of non-metallic enclosures, particularly those constructed from UV-stabilized plastics. In outdoor applications, prolonged exposure to sunlight can lead to material degradation in traditional enclosures. Non-metallic enclosures with UV-resistant properties ensure longevity and sustained functionality in harsh environmental conditions. This feature is especially vital in sectors such as renewable energy, telecommunications, and outdoor infrastructure installations, where protection against UV-induced wear and tear is paramount.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-non-metallic-enclosure-market

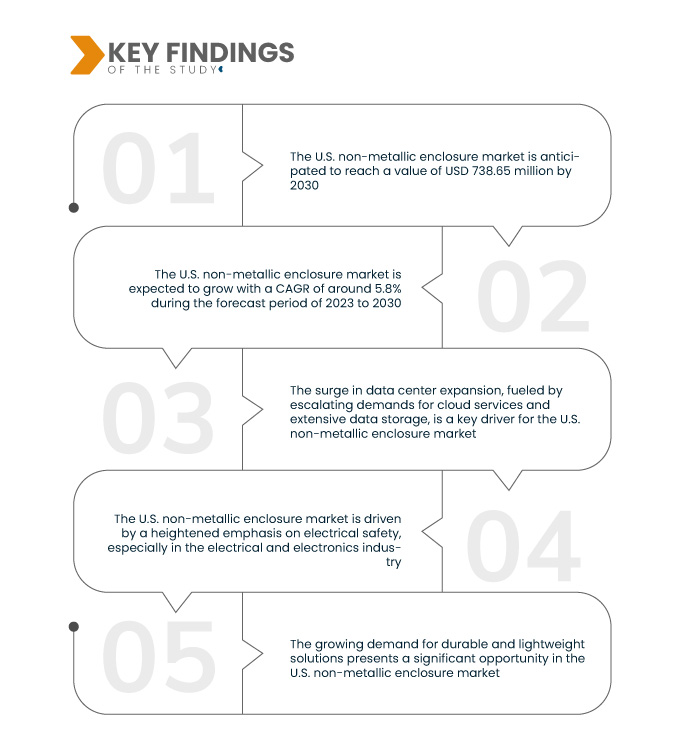

Data Bridge Market Research analyses the U.S. Non-Metallic Enclosure Market, which was USD 486.82 million in 2022, is expected to reach up to USD 738.65 million by 2030 and is expected to undergo a CAGR of 5.8% during the forecast period of 2023 to 2030. The market is driven by the rise in smart infrastructure projects, including smart cities and intelligent transportation systems. The need for advanced enclosures to safeguard electronic components and sensors in these projects favors non-metallic enclosures due to their lightweight and durable attributes, positioning them as optimal solutions for the evolving demands of modern, technology-driven infrastructure.

Key Findings of the Study

Growing industrial automation and control systems are expected to drive the market's growth rate

The growing adoption of automation and control systems in diverse U.S. industries is a key driver for the non-metallic enclosure market. As industries embrace advanced technologies, there is an escalating demand for enclosures that safeguard sensitive electronic components. Non-metallic enclosures, crafted from polycarbonate or fiberglass, fulfill this need by offering insulation and robust protection against electromagnetic interference (EMI). These enclosures ensure electronic systems' integrity and contribute to automated processes' efficiency and reliability.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Material Type (Fiberglass, Polycarbonate, PVC, Polyester), Type (Junction Enclosures, Disconnect Enclosures, Operator Interface Enclosures, Environment and Climate Control Enclosures and Push Button Enclosures), Design (Standard Type and Custom Type), Mounted Type (Wall Mounted Enclosure, Floor-Mounted/Free Standing Enclosure and Underground), Form Factor (Small Enclosure, Compact Enclosure and Free-Size Enclosure), Capacity Range (Less than 400 cu.in and More than 400 cu.in), Place (Indoor and Outdoor), Weight (Less than 10 lbs and More than 10 lbs), Vertical (Power Generation and Distribution, Oil and Gas, Metal and Mining, Medical, Pulp and Paper, Food and Beverages, Transportation and Others)

|

|

Market Players Covered

|

Allied Moulded Products, Inc. (U.S.), OMEGA Engineering (a subsidiary of Spectris) (U.S.), Arlington Industries, Inc. (U.S.), Robroy Industries (U.S.), Hubbell (U.S.), Schneider Electric (France), ABB (Switzerland), Legrand SA (France), Eaton (Ireland), Emerson Electric Co. (U.S.), Polycase (U.S.), nVent (U.K.), FIBOX Enclosures (Finland)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The U.S. non-metallic enclosure market is segmented on the basis of product type, wound type, wound class, end user, and distribution channel.

- On the basis of material type, the U.S. non-metallic enclosure market is segmented into fiberglass, polycarbonate, PVC, and polyester

- On the basis of type, the U.S. non-metallic enclosure market is segmented into junction enclosures, disconnect enclosures, operator interface enclosures, environment and climate control enclosures, and push button enclosures

- On the basis of design, the U.S. non-metallic enclosure market is segmented into standard type and custom type

- On the basis of mounted type, the U.S. non-metallic enclosure market is segmented into wall mounted enclosure, floor-mounted/free standing enclosure, and underground

- On the basis of form factor, the U.S. non-metallic enclosure market is segmented into small enclosure, compact enclosure, and free-size enclosure

- On the basis of capacity range, the U.S. non-metallic enclosure market is segmented into less than 400 cu.in and more than 400 cu.in

- On the basis of place, the U.S. non-metallic enclosure market is segmented into indoor and outdoor

- On the basis of range, the U.S. non-metallic enclosure market is segmented into less than 10 lbs and more than 10 lbs

- On the basis of vertical, the U.S. non-metallic enclosure market is segmented into power generation and distribution, oil and gas, metal and mining, medical, pulp and paper, food and beverages, transportation, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major U.S. non-metallic enclosure market players in U.S. non-metallic enclosure market are Allied Moulded Products, Inc. (U.S.), OMEGA Engineering (a subsidiary of Spectris) (U.S.), Arlington Industries, Inc. (U.S.), Robroy Industries (U.S.), Hubbell (U.S.), Schneider Electric (France)

Market Developments

- In August 2021, Hammond Manufacturing Ltd announced a USD 24 million expansion initiative to enhance their painting and metal fabrication capacity. The company unveiled plans for a new 96,000-square-foot facility, slated to become operational by the end of 2022. Hammond Manufacturing Ltd specializes in the production of electronic and electrical products, encompassing metallic and non-metallic enclosures, racks, small cases, outlet strips, surge suppressors, and electronic transformers

- In March 2021, Hubbell Control Solutions, based in South Carolina, USA, launched an upgraded NX distributed intelligence lighting control panel, the NXP2 Series. This innovative product centralizes connection points within an enclosure, offering a solution that streamlines the deployment of code-compliant lighting control systems. The NXP2 Series is available with both surface mount and flush mount enclosure options, providing flexibility to users

- In February 2021, Legrand AV U.S. made a significant announcement about launching its latest product line, the On-Q Dual-Purpose In-Wall Enclosures. These solutions are presented in two form factors - 9-inch (ENP0900-NA) and 17-inch (ENP1700-NA). Designed for versatile applications, these in-wall enclosures can be utilized for AV storage behind a TV or as enclosures for structured wiring. The products cater to the housing needs of cable boxes, streaming players, and other devices, enhancing convenience for users

- In December 2020, Robroy Industries announced the development of cutting-edge 3D printing technology within its subsidiary, Robroy Enclosures. This technology was pivotal in creating unique solutions for enclosure accessories and demanding applications. The introduction of 3D printing enabled the company to rapidly prototype designs, facilitating quicker analysis and functionality testing before full-scale manufacturing. This technological advancement bolstered Robroy Industries' market presence

- In December 2020, Schneider Electric, at the Innovation Summit North America 2020, shared plans for a USD 40 million expansion project in the U.S. This expansion aimed to upgrade the company's manufacturing resources. Additionally, Schneider Electric introduced a new line of ruggedized data-center enclosures targeting the Industrial Internet of Things (IIoT). Known as the EcoStruxure Micro Data Center R-Series, these enclosures are designed for indoor industrial environments, offering a swift and efficient solution for deploying and managing edge computing infrastructure, particularly on factory floors

For more detailed information about the U.S. non-metallic enclosure market report, click here – https://www.databridgemarketresearch.com/reports/us-non-metallic-enclosure-market