The U.S. satellite launch services market is dynamic, supported by a strong infrastructure for satellite deployment. Dominated by industry leaders such as SpaceX, United Launch Alliance, and Northrop Grumman, it provides diverse launch vehicles for various payloads. Crucial for national security, exploration, and commerce, the U.S. has emerged as a global leader with successful launches, attracting domestic and international clients. As demand for satellite connectivity and Earth observation rises, the U.S. satellite launch services sector remains integral to advancing communication, navigation, and scientific research in the broader space industry.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-satellite-launch-services-market

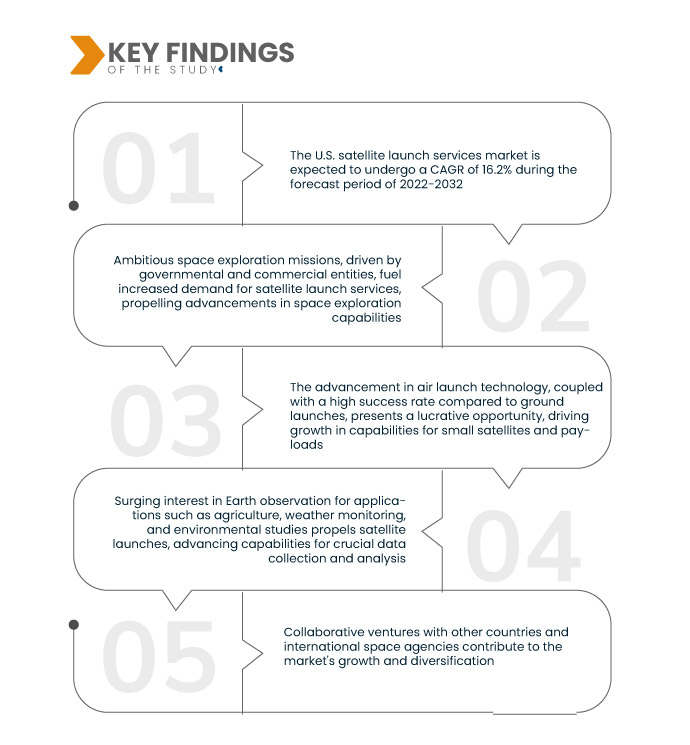

Data Bridge Market Research analyses that the U.S. Satellite Launch Services Market will grow at a CAGR of 16.2% during the forecast period of 2022 to 2032. The rising demand for connectivity propels additional satellite launches to meet the increasing requirements of satellite-based communication and broadband services, reflecting the growing dependence on space-based technology for global connectivity solutions.

Key Findings of the Study

Growing demand for satellite IOT and M2M services is expected to drive the market's growth rate

The rising demand for satellite Internet of Things (IoT) and machine-to-machine (M2M) services stems from the global connectivity provided by satellites. IoT devices interconnected through the internet, benefit from pervasive satellite coverage, making satellite data crucial for seamless operation in remote applications. This reliability and extensive reach of satellite networks contribute significantly to the market's growth, meeting the increasing need for efficient and connected solutions in diverse sectors.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2032

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Segments Covered

|

Rocket Type (Small-Lift Launch Vehicle, Medium-Lift Launch Vehicle, Heavy-Lift Launch Vehicle, Others), Form Of Energy (Thermodynamic Rockets, Electrodynamic Rockets), Satellite (CubeSat (0.27–25 U), Small Satellites (1–500 Kg), Medium Satellites (500-2,500 Kg) And Large Satellites (>2,500 Kg)), Application (Communication, Earth Observation And Remote Sensing, Mapping And Navigation, Surveillance And Security, Meteorology, Scientific Research And Exploration, Space Observation, Exploration Of Outer Planets), End User (Commercial, Government And Defence And Dual Users (Commercial, Government And Defence)), Orbit (Into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO), Beyond Geosynchronous Orbit)

|

|

Market Players Covered

|

Airbus (U.S.), Lockheed Martin Corporation (U.S.), L3Harris Technologies Inc. (U.S.), Northrop Grumman (U.S.), SPACEX (U.S.), Raytheon Technologies Corporation (U.S.), Sierra Nevada Corporation (U.S.), BLUE ORIGIN (U.S.), VIRGIN ORBIT (U.S.), Spaceflight (U.S.), Rocket Lab USA (U.S.), Mitsubishi Heavy Industry (Japan), ILS (U.S.), Honeywell and Boeing (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The U.S. satellite launch services market is segmented on the basis of type, form of energy, satellite, application, end user, and orbit.

- On the basis of the rocket type, the U.S. satellite launch services market is segmented into small-lift launch vehicle, medium-lift launch vehicle, heavy-lift launch vehicle and others

- On the basis of the form of energy, U.S. satellite launch services market is segmented into thermodynamic rockets and electrodynamic rockets

- On the basis of the satellite, the U.S. satellite launch services market is segmented into cubesats (0.27–25 u), small satellites (1–500 kg), medium satellites (500-2,500 kg) and large satellites (>2,500 kg)

- On the basis of the application, the U.S. satellite launch services market is segmented into communication, earth observation and remote sensing, mapping and navigation, surveillance and security, meteorology, scientific research and exploration, space observation and exploration of outer planets

- On the basis of the end user, the U.S. satellite launch services market is segmented into commercial, government, and defense and dual users (commercial, government, and defense)

- On the basis of the orbit, the U.S. satellite launch services market is segmented into low earth orbit (LEO), medium earth orbit (MEO), geostationary earth orbit (GEO), and beyond geosynchronous orbit

Major Players

Data Bridge Market Research recognizes the following companies as the major U.S. satellite launch services market players in U.S. satellite launch services market are Sierra Nevada Corporation (U.S.), BLUE ORIGIN (U.S.), VIRGIN ORBIT (U.S.), Spaceflight (U.S.), Rocket Lab USA (U.S.), Mitsubishi Heavy Industry (Japan), ILS (U.S.), Honeywell and Boeing (U.S.)

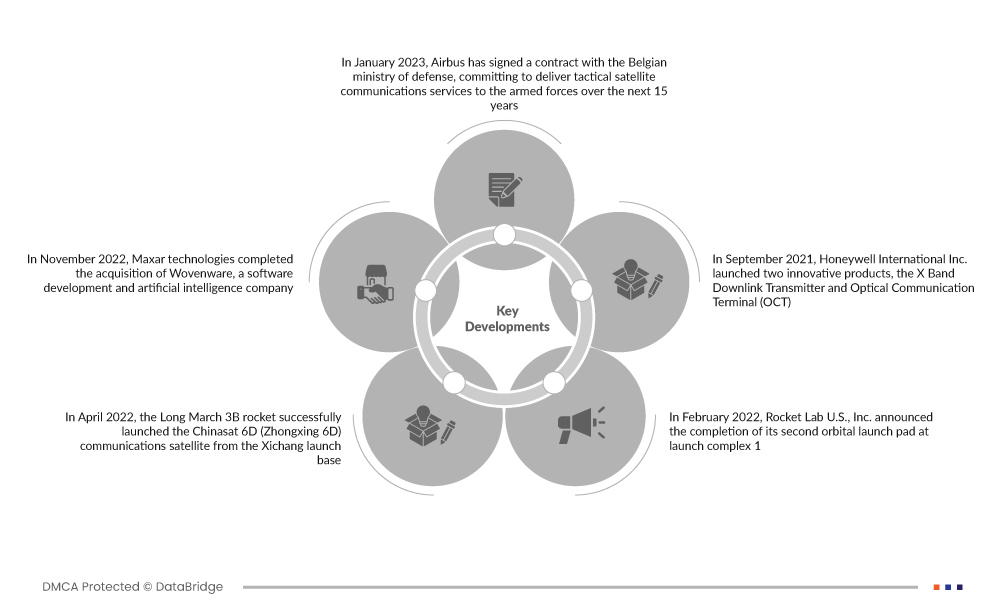

Market Developments

- In January 2023, Airbus signed a contract with the Belgian Ministry of Defense, committing to deliver tactical satellite communications services to the armed forces over the next 15 years. The company revealed plans to introduce a novel ultra-high frequency (UHF) communications service by 2024, extending its offerings to cater to the armed forces of additional Europe nations and NATO allies

- In November 2022, Maxar Technologies completed the acquisition of Wovenware, a software development and artificial intelligence company. This strategic move enhances Maxar's capabilities in software engineering and AI. The acquisition signifies Maxar's commitment to advancing technological expertise, strengthening its position as a leading provider in the space and geospatial intelligence industry, and leveraging Wovenware's innovative solutions to enhance further its offerings in the domain of satellite technology and artificial intelligence

- In April 2022, the Long March 3B rocket successfully launched the Chinasat 6D (Zhongxing 6D) communications satellite from the Xichang launch base. The satellite, part of China's space program, aims to enhance communication capabilities. The Long March 3B, a reliable workhorse in the Chinese space launch fleet, contributed to the seamless deployment of Chinasat 6D, marking another milestone in China's ongoing efforts to advance its space exploration and communication technologies

- In February 2022, Rocket Lab U.S., Inc. announced the completion of its second orbital launch pad at Launch Complex 1. This marks the company's third dedicated pad for its Electron rocket, expanding its capacity for commercial launches. The additional infrastructure positions Rocket Lab to generate more capital and undertake a greater number of projects with global operators, contributing to the growth of the U.S. satellite launch services market

- In September 2021, Honeywell International Inc. launched two innovative products, the X Band Downlink Transmitter and Optical Communication Terminal (OCT), to augment its portfolio for satellite launch services in the growing small-satellite market. These additions enhance the company's capabilities, positioning it to capitalize on the growing demand for small satellite solutions, consequently bolstering revenue and enabling a stronger market presence

For more detailed information about the U.S. satellite launch services market report, click here – https://www.databridgemarketresearch.com/reports/us-satellite-launch-services-market