The inclusion of outpatient services in private health insurance plans reflects a comprehensive approach to healthcare coverage. Private health insurance policies typically offer coverage for doctor's visits, diagnostic tests, and minor medical procedures conducted outside a hospital setting. This feature ensures that policyholders have financial support for routine medical expenses, promoting proactive healthcare-seeking behavior. It distinguishes private health insurance from more focused or basic plans, offering policyholders a broader spectrum of coverage that extends beyond hospitalization to encompass various aspects of preventive and routine medical care.

Access Full Report @ https://www.databridgemarketresearch.com/reports/vietnam-private-health-insurance-market

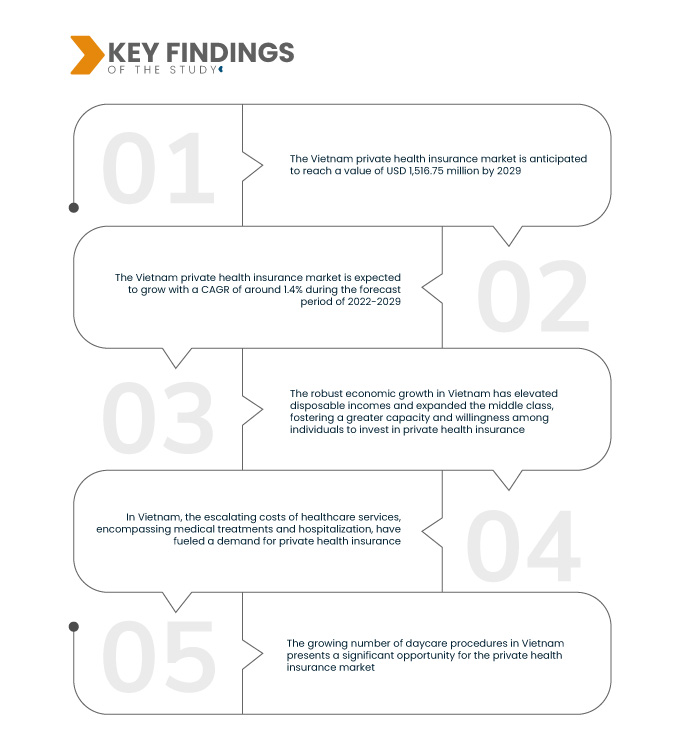

Data Bridge Market Research analyses the Vietnam Private Health Insurance Market, which was USD 1,357.09 million in 2021, is expected to reach the value of USD 1,516.75 million by the year 2029, at a CAGR of 1.4% during the forecast period 2022-2029. In Vietnam, a heightened awareness of health and well-being propels the escalating demand for private health insurance. As individuals seek better-quality healthcare, private health insurance serves as a key driver by enabling access to diverse medical facilities, including prestigious private hospitals and specialized clinics, meeting the rising expectations for enhanced medical services.

Key Findings of the Study

Increasing trend of urbanization in Vietnam is expected to drive the market's growth rate

The increasing trend of urbanization in Vietnam serves as a key driver for the growth of the private health insurance market. As more people migrate to urban areas, there is a corresponding rise in income levels and awareness of healthcare needs. Urban dwellers often seek better healthcare services and facilities, driving the demand for private health insurance as a means to access high-quality medical care. The lifestyle changes associated with urban living, such as sedentary jobs and increased stress, contribute to a growing awareness of the importance of health coverage, further fueling the expansion of the private health insurance market in Vietnam.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Price in USD, Volume in Units

|

|

Segments Covered

|

Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance, and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum, and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS), and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years), and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators, and Others)

|

|

Market Players Covered

|

Aetna Inc. (A subsidiary of CVS Health) (U.S.), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japan), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy), Raffles Medical Group (Singapore), Dai-ichi Life Vietnam (Vietnam)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Vietnam private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group, and distribution channel.

- On the basis of type, the Vietnam private health insurance market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance, and others

- On the basis of health plan category/metal levels, the Vietnam private health insurance market is segmented into bronze, silver, gold platinum, and others

- On the basis of provider type, the Vietnam private health insurance market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (epos), point-of-service (POS) plans, high-deductible health plans (HDHPS), and others

- On the basis of age group, the Vietnam private health insurance market is segmented into young adulthood (19-44 years), middle adulthood (45-64 years), and older adulthood (65 years and above)

- On the basis of distribution channel, the Vietnam private health insurance market is segmented into direct insurance companies, insurance aggregators, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major Vietnam private health insurance market players in Vietnam private health insurance market are Aetna Inc. (A subsidiary of CVS Health) (U.S.), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japan), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy)

Market Developments

- In February 2022, Assicuranzioni Generali S.P.A. marked a significant milestone by agreeing to the acquisition of La Me´dicale, an insurance company specializing in coverage for healthcare professionals. As part of this strategic move, the development outlined plans for selling Predica’s death coverage portfolio, which was both marketed and managed by La Me´dicale. This acquisition not only expanded Assicuranzioni Generali's footprint in the insurance sector but also signaled a reshaping of its product portfolio through the divestiture of specific coverage areas

- May 2021, Aetna Inc. secured noteworthy recognition by winning the coveted 'Best Individual International Healthcare Provider' award at the UK Health & Protection Awards. This triumph marked the company's first-time achievement in this category. Additionally, Aetna Inc. received high commendation from the judges for 'Best Group International Private Medical Insurance Provider.' Notably, the company has been consistently honored in the Health Insurance and Protection Awards as the 'Best Group International Private Medical Insurance Provider' for eight consecutive years, from 2013 to 2020. This series of accolades underscored Aetna Inc.'s commitment to excellence and bestowed global recognition on the company for its contributions to the international healthcare insurance landscape

For more detailed information about the Vietnam private health insurance market report, click here – https://www.databridgemarketresearch.com/reports/vietnam-private-health-insurance-market