Market Analysis and Size

A health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholders against certain treatments. It also offers advantages including cashless hospitalization, coverage of pre and post-hospitalization reimbursement and various add-ons.

In the health insurance plan, several types of coverages are available including cashless and reimbursement claims. Cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from the hospitals which are not in the list network, in that case, the policyholder meets all the medical expenses and then claims for reimbursement in the insurance company by submitting all the medical bills. This private health insurance provides financial support to the policyholder as it covers all the medical expenses when the policyholder is hospitalized for the treatment.

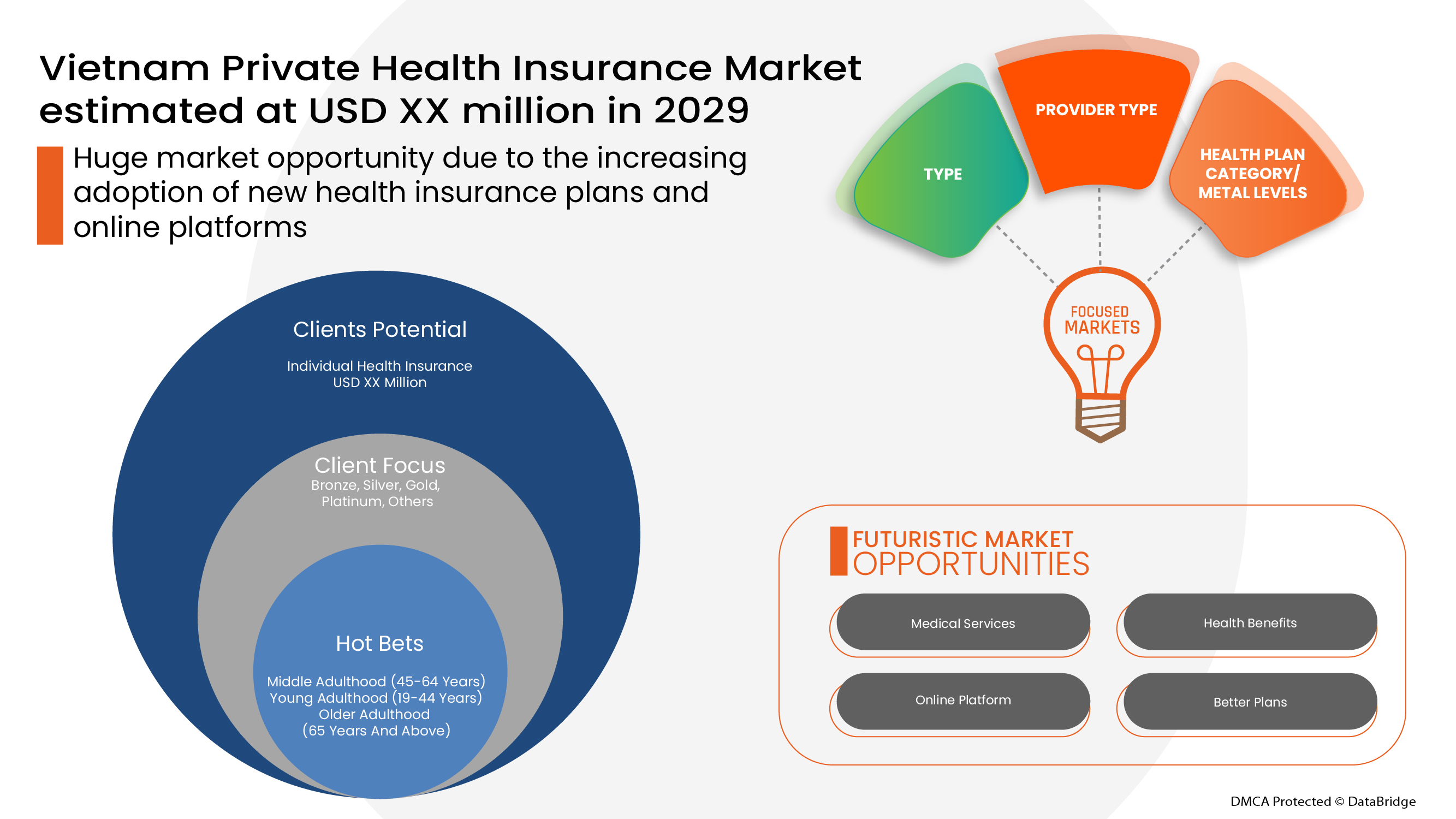

Data Bridge Market Research analyses that the Vietnam private health insurance market is expected to reach the value of USD 1,516.75 million by the year 2029, at a CAGR of 1.4% during the forecast period. “Individual Health Insurance” accounts for the most prominent type segment in the respective market owing to rise in private health insurance. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance, and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum, and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS), and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years), and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators, and Others) |

|

Countries Covered |

Vietnam |

|

Market Players Covered |

Aetna Inc. (A subsidiary of CVS Health) (U.S.), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japan), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy), Raffles Medical Group (Singapore), Dai-ichi Life Vietnam (Vietnam) |

Market Definition

Health insurance provides coverage for all types of surgical expenses as well as medical treatment incurred from the illness or injury. Health insurance applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. Health insurance provides financial support to the policyholder as it covers all the medical expenses when the policyholder is hospitalized for the treatment. Health insurance also covers pre as well as post-hospitalization expenses.

Regulatory Framework

Pursuant to the 1992 Constitution of the Socialist Republic of Vietnam, which was amended and supplemented under Resolution No. 51/2001/QH10; The National Assembly promulgates the Law on Health Insurance.

1. This Law provides the health insurance regime and policies, including participants, premium rates, responsibilities and methods of payment of health insurance premiums; health insurance cards; eligible health insurance beneficiaries; medical care for the insured; payment of costs of medical care covered by health insurance; health insurance fund; and rights and responsibilities of parties involved in health insurance.

2. This Law applies to domestic and foreign organizations and individuals in Vietnam that are involved in health insurance.

3. This Law does not apply to commercial health insurance.

COVID-19 had a Minimal Impact on Private Health Insurance Market

COVID-19 impacted various manufacturing and service-providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to the outbreak of COVID-19 throughout the globe, the demand for private health insurance has increased tremendously. Also, the fear of the pandemic and the increased cost of medical services helped the health insurance market grow during the pandemic. In addition, health insurance companies introduced packages and solutions for covering the medical costs of treating covid19 infected insurers. Thus, even though the other industries suffered a lot during covid19 outbreak, the Vietnam private health insurance industry was growing significantly.

Market Dynamics of Private Health Insurance Market Include:

Drivers/Opportunities

- Increasing cost of medical services

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services’ costs for surgeries and hospital stays has created a new financial epidemic around the world. The cost of medical services is comprised of the cost of surgery, doctor fee, hospital stay cost, cost of the emergency room, and diagnostic testing cost, among others. Therefore, this increase in the cost of medical services propels the growth of the market.

- Growing number of daycare procedures

Daycare procedures are those types of medical procedure or surgery that primarily requires less stay time in the hospitals. In the daycare procedure patients are required to stay in the hospital for a short period. Most of the health insurance companies are now covering the procedures of daycare in their insurance plans, and for the claim of such types of surgery, there is no compulsion on spending 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While most of the health insurance plans cover hospital stays and major surgeries, the policyholders can also claim daycare procedures under their health insurance policy, which propels the demand of the market.

- Mandatory opting for health insurance in public and private sector

Buying a healthcare insurance policy is a mandatory provision for the employees in the public as well as the private sector. Health insurance offers key medical benefits which the employee can avail of while working in a corporate. In case of any emergency or medical issues, the health insurance cover is highly useful to meet treatment expenses. The employee’s health insurance is an extended benefit, given by the individual employer to their employees. The health insurance provided not only covers the employee but also covers their family members under the same policy plan. Also, in certain cases, the employer may pay a part of a premium or insurance coverage of the health insurance policy.

- Increasing old age population

Old age people are likely to have more health problems due to aging and weak immune system, which may include dental issues, heart issues, cancer issues, and terminal illnesses. A good senior citizen health insurance can help senior citizens to opt for good health insurance services to reduce future financial worries. Thus, an increasing number of old age population can boost the growth of the health insurance market.

- Increasing awareness about the benefits of health insurance

In the face of a medical emergency, health insurance allows the consumers to take their mind off the stress related to healthcare costs and focus on the treatment instead with health insurance. Medical emergencies can happen at any time, regardless of our current good health or disciplined lifestyle. Therefore, it is important to plan for and protect our families and ourselves from any unforeseen medical situations, especially when there are elderly parents at home as they are more susceptible to infections or other illnesses.

Restraints/Challenges faced by the Private Health Insurance Market

- High cost of premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder since it covers all the medical expenses when the policyholder is hospitalized for the treatment. Health insurance also covers pre as well as post-hospitalization expenses. To purchase health insurance, the policyholder has to pay insurance premiums regularly to keep the health insurance policy active. The cost of insurance premium is high in the majority of cases based on the insurance plan, which is hampering the growth of the market.

- Lack of awareness regarding health insurance

In the field of healthcare, a large portion of the world population is still not aware of the benefits of health insurance policies. The expenses of medical care are increasing across the world with advancements made in the field. Through the advancement in technology, the healthcare sector is one of the growing segments, however, the penetration rate of health insurance policies remains low due to a lack of awareness regarding the benefits offered by them

This Vietnam private health insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the private health insurance market contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In February 2022, Assicuranzioni Generali S.P.A. signed an agreement for the acquisition of La Me´dicale, which is an insurance company for healthcare professionals. This development also foresees the sale of Predica’s1 death coverage portfolio, marketed and managed by La Me´dicale.

- In May 2021, Aetna Inc. won ‘Best Individual International Healthcare Provider’ at the UK Health & Protection Awards for the first time. Company was also highly commended by the judges for ‘Best Group International Private Medical Insurance Provider’. For eight consecutive years (2013 - 2020), company was chosen for Health Insurance and Protection Awards’ ‘Best Group International Private Medical Insurance Provider’. This development gave global recognition to the company.

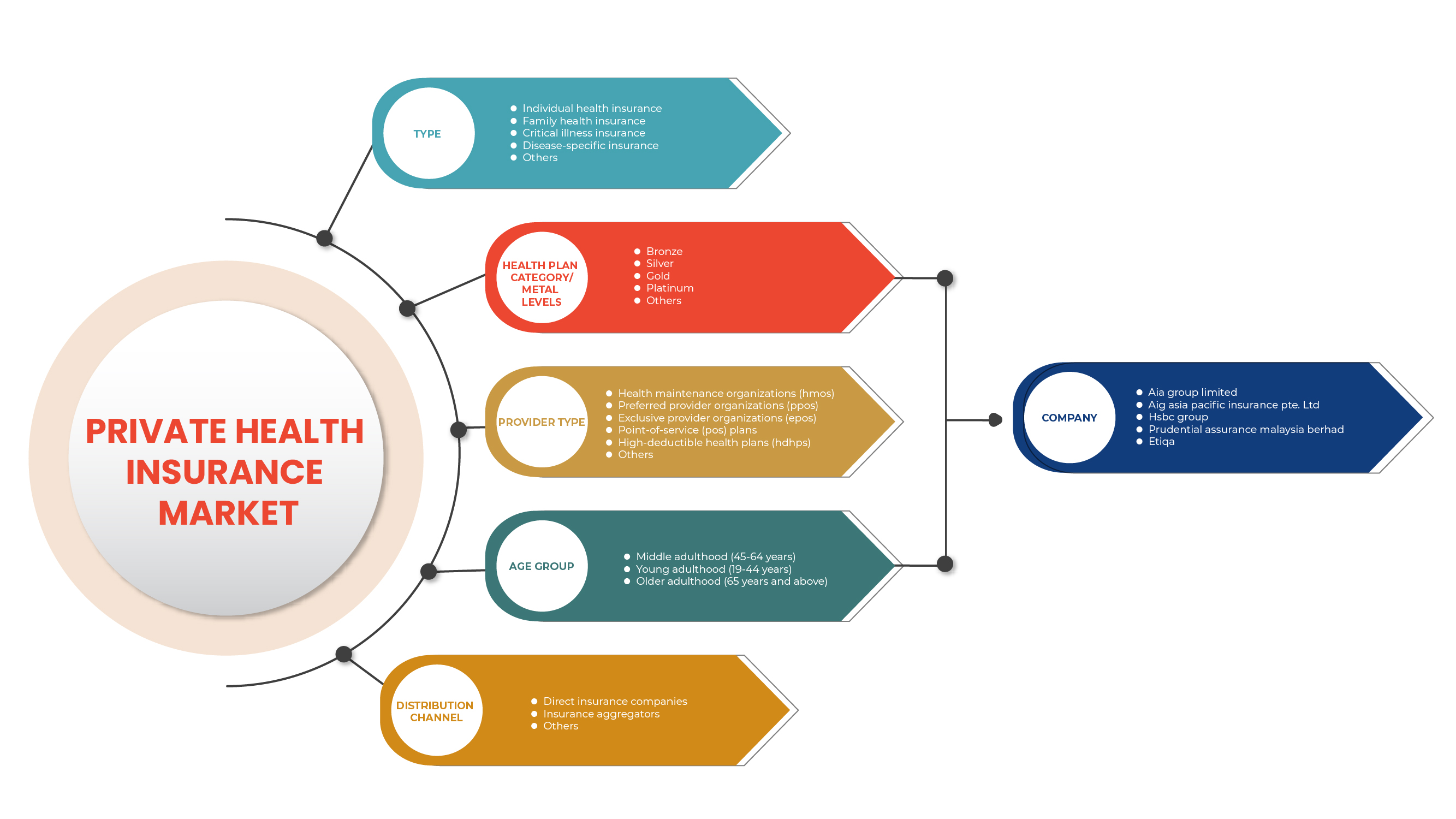

Vietnam Private health insurance Market Scope

The Vietnam private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group, and distribution channel. The growth amongst these segments will help you analyze growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Critical Illness Insurance

- Individual Health Insurance

- Family Health Insurance

- Disease-Specific Insurance

- Others

On the basis of type, Vietnam Private Health Insurance market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance and others.

Health Plan Category/Metal Levels

- Bronze

- Silver

- Gold

- Platinum

- Others

On the basis of health plan category/metal levels, Vietnam private health insurance market is segmented into bronze, silver, gold platinum and others.

Provider Type

- Health maintenance organizations (HMOS)

- Preferred provider organizations (PPOS)

- Exclusive provider organizations (EPOS)

- Point-of-service (POS) plans

- High-deductible health plans (HDHPS)

- Others

On the basis of provider type, Vietnam private health insurance market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (EPOS), point-of-service (POS) plans, high-deductible health plans (HDHPS) and others.

Age Group

- Young Adulthood (19-44 Years)

- Middle Adulthood (45-64 Years)

- Older Adulthood (65 Years And Above)

On the basis of age group, Vietnam private health insurance market is segmented into young adulthood (19-44 years), middle adulthood (45-64 years) and older adulthood (65 years and above).

Distribution Channel

- Direct Insurance Companies

- Insurance Aggregators

- Others

On the basis of distribution channel, Vietnam private health insurance market is segmented direct insurance companies, insurance aggregators and others.

Competitive Landscape and Private Health Insurance Market Share Analysis

The Vietnam private health insurance market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Vietnam presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Vietnam private health insurance market.

Some of the major players operating in the private health insurance market are Aetna Inc. (A subsidiary of CVS Health) (U.S.), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japan), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaysia), ASSICURAZIONI GENERALI S.P.A. (Italy), Raffles Medical Group (Singapore), Dai-ichi Life Vietnam (Vietnam) among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF VIETNAM PRIVATE HEALTH INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE VIETNAM PRIVATE HEALTH INSURANCE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 VIETNAM PRIVATE HEALTH INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7. INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8. TECHNONLOGY ROADMAP

9. INSURANCE PLAN LANDSCAPE

9.1 INTERNATIONAL HEALTH PLAN

9.2 TRAVEL INSURANCE

9.3 HEALTH INSURANCE

10. INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11. REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12. OPPUTUNITY MAP ANALYSIS

13. VALUE CHAIN ANALYSIS

14. HEALTHCARE ECONOMY

14.1 HEALTHCARE EXPENDITURE

14.2 CAPITAL EXPENDITURE

14.3 CAPEX TRENDS

14.4 CAPEX ALLOCATION

14.5 FUNDING SOURCES

14.6 INDUSTRY BENCHMARKS

14.7 GDP RATION IN OVERALL GDP

14.8 HEALTHCARE SYSTEM STRUCTURE

14.9 GOVERNMENT POLICIES

14.10 ECONOMIC DEVELOPMENT

15. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY TYPE

15.1 OVERVIEW

15.2 SOLUTION

15.2.1 INTELLIGENT CASE MANAGEMENT SOLUTIONS

15.2.2 ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

15.2.3 VALUE-BASED PAYMENTS SOLUTIONS

15.2.4 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

15.2.5 INSURANCE CLOUD SOLUTIONS

15.2.6 ROBOTIC PROCESS AUTOMATION

15.2.7 REVENUE MANAGEMENT & BILLING SOLUTIONS

15.2.8 LEAD GENERATION SOLUTIONS

15.2.9 OTHERS

15.3 PRODUCT

15.3.1 PERMANENT HEALTH INSURANCE

15.3.2 UNIT LINKED HEALTH PLANS

15.3.3 CRITICAL ILLNESS INSURANCE

15.3.4 SENIOR CITIZEN COVERAGE INSURANCE

15.3.5 HOSPITALIZATION COVERAGE INSURANCE

15.3.6 FAMILY FLOATER COVERAGE INSURANCE

15.3.7 INDIVIDUAL COVERAGE INSURANCE

15.3.8 MEDICLAIM INSURANCE

15.3.9 OTHERS

16. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

16.1 OVERVIEW

16.2 BRONZE

16.3 SILVER

16.4 GOLD

16.5 PLATINUM

16.6 OTHERS

17. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

17.1 OVERVIEW

17.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

17.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

17.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

17.5 POINT-OF-SERVICE (POS) PLANS

17.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

17.7 OTHERS

18. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY ASSISTANCE/SERVICE TYPE

18.1 OVERVIEW

18.2 MEDICAL ASSURANCE

18.3 OUTPATIENT TREATMENT

18.4 INPATIENT TREATMENT

18.5 OTHERS

19. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

19.1 OVERVIEW

19.2 YOUNG ADULTHOOD (19-44 YEARS)

19.3 MIDDLE ADULTHOOD (45-64 YEARS)

19.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

20. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY COVERAGE TYPE

20.1 OVERVIEW

20.2 LIFETIME COVERAGE

20.2.1 YOUNG ADULTHOOD (19-44 YEARS)

20.2.2 MIDDLE ADULTHOOD (45-64 YEARS)

20.2.3 OLDER ADULTHOOD (65 YEARS AND ABOVE)

20.3 TERM COVERAGE

20.3.1 YOUNG ADULTHOOD (19-44 YEARS)

20.3.2 MIDDLE ADULTHOOD (45-64 YEARS)

20.3.3 OLDER ADULTHOOD (65 YEARS AND ABOVE)

21. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY PRICING CATEGORY

21.1 OVERVIEW

21.2 LOW

21.3 HIGH

21.4 MODERATE

22. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY END USER

22.1 OVERVIEW

22.2 FAMILY

22.2.1 SOLUTION

22.2.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.2.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.2.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.2.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.2.1.5. INSURANCE CLOUD SOLUTIONS

22.2.1.6. ROBOTIC PROCESS AUTOMATION

22.2.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.2.1.8. LEAD GENERATION SOLUTIONS

22.2.1.9. OTHERS

22.2.2 PRODUCT

22.2.2.1. PERMANENT HEALTH INSURANCE

22.2.2.2. UNIT LINKED HEALTH PLANS

22.2.2.3. CRITICAL ILLNESS INSURANCE

22.2.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.2.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.2.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.2.2.7. INDIVIDUAL COVERAGE INSURANCE

22.2.2.8. MEDICLAIM INSURANCE

22.2.2.9. OTHERS

22.3 CORPORATE

22.3.1 SOLUTION

22.3.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.3.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.3.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.3.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.3.1.5. INSURANCE CLOUD SOLUTIONS

22.3.1.6. ROBOTIC PROCESS AUTOMATION

22.3.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.3.1.8. LEAD GENERATION SOLUTIONS

22.3.1.9. OTHERS

22.3.2 PRODUCT

22.3.2.1. PERMANENT HEALTH INSURANCE

22.3.2.2. UNIT LINKED HEALTH PLANS

22.3.2.3. CRITICAL ILLNESS INSURANCE

22.3.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.3.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.3.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.3.2.7. INDIVIDUAL COVERAGE INSURANCE

22.3.2.8. MEDICLAIM INSURANCE

22.3.2.9. OTHERS

22.4 INDIVIDUAL

22.4.1 SOLUTION

22.4.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.4.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.4.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.4.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.4.1.5. INSURANCE CLOUD SOLUTIONS

22.4.1.6. ROBOTIC PROCESS AUTOMATION

22.4.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.4.1.8. LEAD GENERATION SOLUTIONS

22.4.1.9. OTHERS

22.4.2 PRODUCT

22.4.2.1. PERMANENT HEALTH INSURANCE

22.4.2.2. UNIT LINKED HEALTH PLANS

22.4.2.3. CRITICAL ILLNESS INSURANCE

22.4.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.4.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.4.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.4.2.7. INDIVIDUAL COVERAGE INSURANCE

22.4.2.8. MEDICLAIM INSURANCE

22.4.2.9. OTHERS

22.5 OTHERS

23. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT INSURANCE COMPANIES

23.3 INSURANCE AGGREGATORS

23.4 OTHERS

24. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY GEOGRAPHY

24.1 VIETNAM PRIVATE HEALTH INSURANCE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 VIETNAM

24.1.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25. VIETNAM PRIVATE HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: VIETNAM

25.2 ANALYSIS OF KEY PLAYERS BY COUNTRY

25.3 MERGERS & ACQUISITIONS

25.4 NEW PRODUCT DEVELOPMENT & APPROVALS

25.5 EXPANSIONS

25.6 REGULATORY CHANGES

25.7 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26. VIETNAM PRIVATE HEALTH INSURANCE MARKET, SWOT AND DBMR ANALYSIS

27. VIETNAM PRIVATE HEALTH INSURANCE MARKET, COMPANY PROFILE

27.1 GLOBAL COMPANIES

27.1.1 ALLIANZ CARE

27.1.1.1. COMPANY SNAPSHOT

27.1.1.2. REVENUE ANALYSIS

27.1.1.3. GEOGRAPHIC PRESENCE

27.1.1.4. PRODUCT PORTFOLIO

27.1.1.5. RECENT DEVELOPMENT

27.1.2 AETNA INC.

27.1.2.1. COMPANY SNAPSHOT

27.1.2.2. REVENUE ANALYSIS

27.1.2.3. GEOGRAPHIC PRESENCE

27.1.2.4. PRODUCT PORTFOLIO

27.1.2.5. RECENT DEVELOPMENT

27.1.3 AIA GROUP LIMITED AND ITS SUBSIDIARIES

27.1.3.1. COMPANY OVERVIEW

27.1.3.2. REVENUE ANALYSIS

27.1.3.3. GEOGRAPHIC PRESENCE

27.1.3.4. PRODUCT PORTFOLIO

27.1.3.5. RECENT DEVELOPMENTS

27.1.4 LIBERTY INSURANCE LIMITED

27.1.4.1. COMPANY OVERVIEW

27.1.4.2. COMPANY SNAPSHOT

27.1.4.3. REVENUE ANALYSIS

27.1.4.4. PRODUCT PORTFOLIO

27.1.4.5. RECENT DEVELOPMENTS

27.1.5 AMERICAN INTERNATIONAL GROUP, INC.

27.1.5.1. COMPANY OVERVIEW

27.1.5.2. REVENUE ANALYSIS

27.1.5.3. GEOGRAPHIC PRESENCE

27.1.5.4. PRODUCT PORTFOLIO

27.1.5.5. RECENT DEVELOPMENTS

27.1.6 THE MANUFACTURERS LIFE INSURANCE COMPANY

27.1.6.1. COMPANY OVERVIEW

27.1.6.2. REVENUE ANALYSIS

27.1.6.3. GEOGRAPHIC PRESENCE

27.1.6.4. PRODUCT PORTFOLIO

27.1.6.5. RECENT DEVELOPMENTS

27.1.7 AXA

27.1.7.1. COMPANY OVERVIEW

27.1.7.2. REVENUE ANALYSIS

27.1.7.3. GEOGRAPHIC PRESENCE

27.1.7.4. PRODUCT PORTFOLIO

27.1.7.5. RECENT DEVELOPMENTS

27.1.8 GREAT EASTERN HOLDINGS LIMITED

27.1.8.1. COMPANY OVERVIEW

27.1.8.2. REVENUE ANALYSIS

27.1.8.3. GEOGRAPHIC PRESENCE

27.1.8.4. PRODUCT PORTFOLIO

27.1.8.5. RECENT DEVELOPMENTS

27.1.9 LUMAHEALTH.COM

27.1.9.1. COMPANY OVERVIEW

27.1.9.2. REVENUE ANALYSIS

27.1.9.3. GEOGRAPHIC PRESENCE

27.1.9.4. PRODUCT PORTFOLIO

27.1.9.5. RECENT DEVELOPMENTS

27.1.10 PACIFIC PRIME INSURANCE BROKERS LIMITED (PPIB)

27.1.10.1. COMPANY OVERVIEW

27.1.10.2. REVENUE ANALYSIS

27.1.10.3. GEOGRAPHIC PRESENCE

27.1.10.4. PRODUCT PORTFOLIO

27.1.10.5. RECENT DEVELOPMENTS

27.1.11 MSIG INSURANCE VIETNAM CO., LTD.

27.1.11.1. COMPANY SNAPSHOT

27.1.11.2. REVENUE ANALYSIS

27.1.11.3. GEOGRAPHIC PRESENCE

27.1.11.4. PRODUCT PORTFOLIO

27.1.11.5. RECENT DEVELOPMENT

27.1.12 NOW HEALTH INTERNATIONAL

27.1.12.1. COMPANY SNAPSHOT

27.1.12.2. REVENUE ANALYSIS

27.1.12.3. GEOGRAPHIC PRESENCE

27.1.12.4. PRODUCT PORTFOLIO

27.1.12.5. RECENT DEVELOPMENT

27.1.13 CHUBB

27.1.13.1. COMPANY OVERVIEW

27.1.13.2. REVENUE ANALYSIS

27.1.13.3. GEOGRAPHIC PRESENCE

27.1.13.4. PRODUCT PORTFOLIO

27.1.13.5. RECENT DEVELOPMENTS

27.1.14 CIGNA

27.1.14.1. COMPANY OVERVIEW

27.1.14.2. REVENUE ANALYSIS

27.1.14.3. GEOGRAPHIC PRESENCE

27.1.14.4. PRODUCT PORTFOLIO

27.1.14.5. RECENT DEVELOPMENTS

27.1.15 FOYER LUXEMBOURG

27.1.15.1. COMPANY OVERVIEW

27.1.15.2. REVENUE ANALYSIS

27.1.15.3. GEOGRAPHIC PRESENCE

27.1.15.4. PRODUCT PORTFOLIO

27.1.15.5. RECENT DEVELOPMENTS

27.1.16 MSH INTERNATIONAL

27.1.16.1. COMPANY OVERVIEW

27.1.16.2. REVENUE ANALYSIS

27.1.16.3. GEOGRAPHIC PRESENCE

27.1.16.4. PRODUCT PORTFOLIO

27.1.16.5. RECENT DEVELOPMENTS

27.1.17 SUN LIFE VIETNAM INSURANCE COMPANY LIMITED

27.1.17.1. COMPANY OVERVIEW

27.1.17.2. REVENUE ANALYSIS

27.1.17.3. GEOGRAPHIC PRESENCE

27.1.17.4. PRODUCT PORTFOLIO

27.1.17.5. RECENT DEVELOPMENTS

27.1.18 APRIL INTERNATIONAL

27.1.18.1. COMPANY OVERVIEW

27.1.18.2. REVENUE ANALYSIS

27.1.18.3. GEOGRAPHIC PRESENCE

27.1.18.4. PRODUCT PORTFOLIO

27.1.18.5. RECENT DEVELOPMENTS

27.1.19 ASSICURAZIONI GENERALI S.P.A

27.1.19.1. COMPANY OVERVIEW

27.1.19.2. REVENUE ANALYSIS

27.1.19.3. GEOGRAPHIC PRESENCE

27.1.19.4. PRODUCT PORTFOLIO

27.1.19.5. RECENT DEVELOPMENTS

27.2 LOCAL COMPANIES

27.2.1 BAOVIET BANK

27.2.1.1. COMPANY OVERVIEW

27.2.1.2. COMPANY SNAPSHOT

27.2.1.3. REVENUE ANALYSIS

27.2.1.4. PRODUCT PORTFOLIO

27.2.1.5. RECENT DEVELOPMENTS

27.2.2 PACIFIC CROSS VIETNAM

27.2.2.1. COMPANY OVERVIEW

27.2.2.2. COMPANY SNAPSHOT

27.2.2.3. REVENUE ANALYSIS

27.2.2.4. PRODUCT PORTFOLIO

27.2.2.5. RECENT DEVELOPMENTS

27.2.3 DAI-ICHI LIFE VIETNAM FUND MANAGEMENT COMPANY

27.2.3.1. COMPANY OVERVIEW

27.2.3.2. COMPANY SNAPSHOT

27.2.3.3. REVENUE ANALYSIS

27.2.3.4. PRODUCT PORTFOLIO

27.2.3.5. RECENT DEVELOPMENTS

27.2.4 TOKIO MARINE INSURANCE VIETNAM COMPANY LIMITED.

27.2.4.1. COMPANY OVERVIEW

27.2.4.2. COMPANY SNAPSHOT

27.2.4.3. REVENUE ANALYSIS

27.2.4.4. PRODUCT PORTFOLIO

27.2.4.5. RECENT DEVELOPMENTS

27.2.5 PTI LIMITED AND ITS SUBSIDIARIES

27.2.5.1. COMPANY OVERVIEW

27.2.5.2. COMPANY SNAPSHOT

27.2.5.3. REVENUE ANALYSIS

27.2.5.4. PRODUCT PORTFOLIO

27.2.5.5. RECENT DEVELOPMENTS

27.2.6 FWD VIETNAM

27.2.6.1. COMPANY OVERVIEW

27.2.6.2. COMPANY SNAPSHOT

27.2.6.3. REVENUE ANALYSIS

27.2.6.4. PRODUCT PORTFOLIO

27.2.6.5. RECENT DEVELOPMENTS

28. CONCLUSION

29. QUESTIONNAIRE

30. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.