Africa And Saudi Arabia Tools For Road And Bridge Construction Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.50 Billion

USD

3.50 Billion

2024

2032

USD

2.50 Billion

USD

3.50 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.50 Billion | |

|

|

|

|

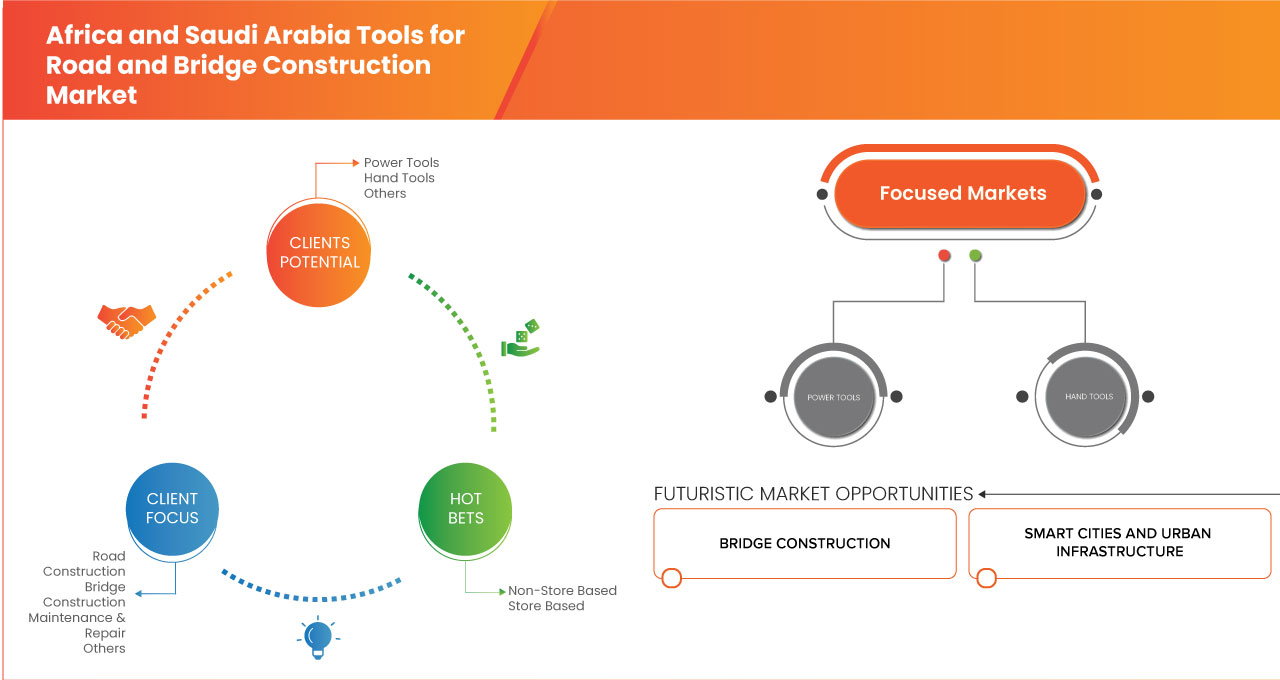

África e Arábia Saudita: Mercado de Ferramentas para a Construção de Estradas e Pontes, por Produto (Ferramentas Elétricas, Ferramentas Manuais e Outros), Aplicação (Construção de Estradas, Construção de Pontes, Manutenção e Reparação e Outros), Canal de Vendas (Baseado em Loja e Não Loja) – Tendências e Previsão do Setor até 2032

Dimensão do mercado de ferramentas para a construção de estradas e pontes

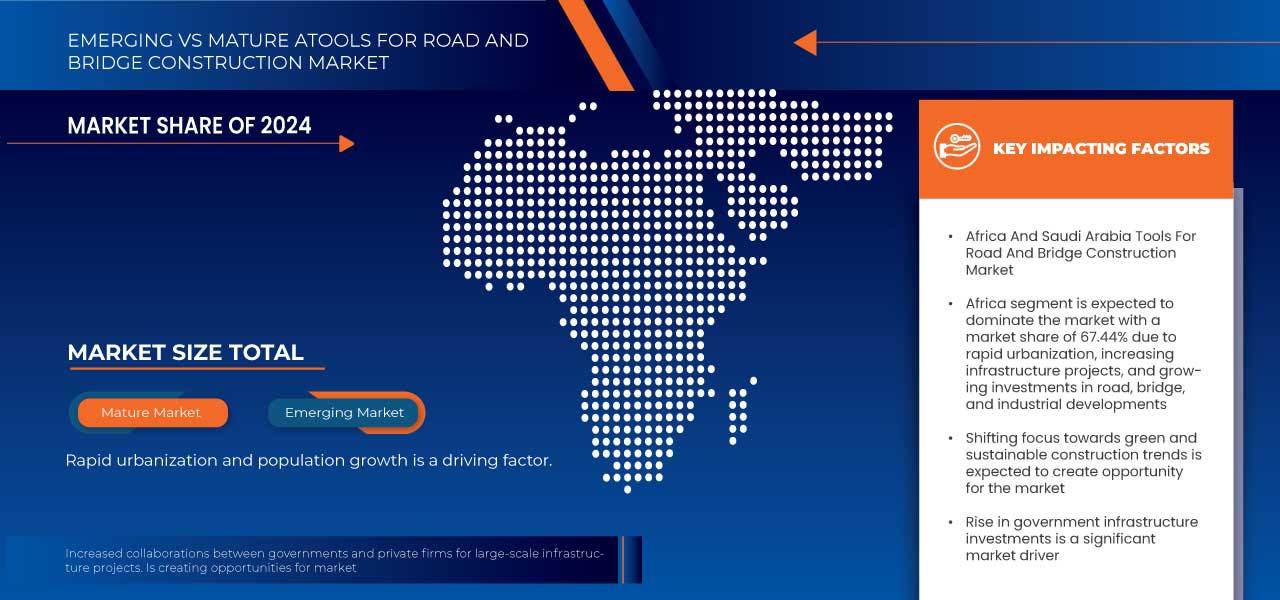

- O mercado de ferramentas para a construção de estradas e pontes em África e na Arábia Saudita foi avaliado em 2,5 mil milhões de dólares em 2024 e deverá atingir os 3,5 mil milhões de dólares até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 4,7%, impulsionado principalmente pelos investimentos em infraestruturas, urbanização, avanços tecnológicos e procura por soluções de construção duráveis e eficientes.

- Este crescimento é impulsionado por factores como o aumento de projectos de infra-estruturas, as necessidades de modernização, as tendências de construção inteligente e o apoio financeiro governamental.

Análise de Mercado de Ferramentas para a Construção de Estradas e Pontes em África e na Arábia Saudita

- As ferramentas de construção de estradas e pontes são essenciais para construir infraestruturas de transporte duráveis e eficientes, apoiando o desenvolvimento económico e a mobilidade urbana. Estas ferramentas são amplamente utilizadas no desenvolvimento de autoestradas, viadutos e vias rápidas em regiões como África e Arábia Saudita.

- A procura por estas ferramentas é significativamente impulsionada pelo desenvolvimento contínuo de infraestruturas, pela rápida urbanização e por iniciativas de modernização apoiadas pelo governo. O aumento dos projetos de cidades inteligentes e das práticas de construção sustentável também contribui para o crescimento do mercado.

- A região de África e da Arábia Saudita destaca-se pela adoção de tecnologias avançadas e métodos de construção ecológicos, garantindo um desenvolvimento de infraestruturas eficiente e ambientalmente responsável.

- Por exemplo, os projectos de construção em África enfatizam a utilização de materiais verdes e ferramentas de construção digital para melhorar a eficiência do projecto e reduzir as emissões de carbono.

- Em África e na Arábia Saudita, o mercado para estas ferramentas está a ganhar força devido ao crescente foco em técnicas de construção modernas, parcerias público-privadas e planeamento de infraestruturas inteligentes, tornando-as indispensáveis para projetos de desenvolvimento prontos para o futuro.

Âmbito do Relatório e Segmentação de Mercado

|

Atributos |

Ferramentas para a construção de estradas e pontes em África e na Arábia Saudita: principais insights de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

África e Arábia Saudita

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquéritos aos consumidores, análises demográficas, análises da cadeia de abastecimento, análises da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulamentar. |

Tendências do mercado de ferramentas para a construção de estradas e pontes em África e na Arábia Saudita

“Aumento dos investimentos em infraestruturas governamentais”

- O crescente foco no desenvolvimento de infra-estruturas no Luxemburgo, Bélgica, África, África e Arábia Saudita está a impulsionar significativamente a procura de ferramentas e equipamentos avançados no sector da construção de estradas e pontes. Os governos estão a investir fortemente em redes de transportes para aumentar a conectividade, apoiar a urbanização e impulsionar o crescimento económico

- Na região de África e da Arábia Saudita, a modernização das infra-estruturas é uma prioridade fundamental. Estão a ser atribuídos orçamentos significativos para a expansão de estradas, manutenção de pontes e projectos de infra-estruturas inteligentes

- O Acordo Verde da União Europeia está a impulsionar ainda mais a mudança para equipamentos e materiais de construção duráveis e ecológicos, aumentando a procura por ferramentas de precisão e tecnologias de automação

- Por exemplo, de acordo com um blogue publicado na Suzhou TECON Construction Technology Co., Ltd, os investimentos governamentais em infraestruturas na Europa Ocidental estão a impulsionar o crescimento em setores-chave, com as estradas a liderar com 46,1% de quota de mercado em 2022. Os fundos apoiados pela UE de 790 mil milhões de dólares no âmbito do Mecanismo de Recuperação e Resiliência (RRF) deverão acelerar os projetos, apesar dos aumentos de custos anteriores.

- Em todas estas regiões, o mercado de construção de estradas e pontes está a evoluir para uma execução de projetos mais inteligente, sustentável e eficiente, criando oportunidades de crescimento robustas para ferramentas e equipamentos inovadores.

Ferramentas de África e da Arábia Saudita para a dinâmica do mercado de construção de estradas e pontes

Motoristas

“ Urbanização rápida e crescimento populacional ”

- A rápida urbanização na região de África e da Arábia Saudita — que abrange a Bélgica, África e Luxemburgo — está a impulsionar significativamente a procura de construção de estradas e pontes, uma vez que a expansão das populações urbanas exige uma infraestrutura de transportes moderna e eficiente.

- Major cities such as Brussels, Amsterdam, and Luxembourg City are experiencing population growth due to economic prosperity, industrial development, and rural-to-urban migration, placing increased pressure on existing road networks and bridges

- The strain on transportation systems has led to accelerated infrastructure development, with governments prioritizing the expansion and modernization of roadways and bridges to ensure better traffic management and urban connectivity

- Africa and Saudi Arabia countries are also strongly committed to sustainable development goals, investing in eco-friendly construction practices such as green bridges, energy-efficient road systems, and low-emission construction tools and materials

For instance,

- In December 2024, according to an article published by Researchgate Gmbh., The paper emphasizes the need for "Urban Sustainability" in Saudi Arabia's Dammam Metropolitan Area (DMA) due to rapid urbanization. It analyses unsustainable practices, reviews global sustainable urbanization approaches, and recommends strategies to address urban challenges, promoting long-term sustainability in DMA's growth and development

- In September 2024, according to an article published by Elsevier, this paper explores urbanization and counter-urbanization in Saudi Arabia, using census data to highlight how rapid urban growth occurs without economic growth. It examines the impact of these processes on urban policy, emphasizing their role in shaping urban sustainability and offering insights into urban development in the global south

- As urbanization continues and environmental concerns rise, the need for advanced, sustainable, and high-performance construction tools grows, enabling the region to build future-ready, resilient infrastructure solutions

Opportunities

“Shifting Focus Towards Green and Sustainable Construction Trends”

- The shift toward green and sustainable construction is transforming the road and bridge construction market in the Africa and Saudi Arabia region, driven by environmental goals, innovation incentives, and a strong regulatory framework

- Africa and Saudi Arabia countries—Belgium, the Africa, and Luxembourg—are leading Europe in adopting eco-friendly construction practices, including the use of recycled materials, low-carbon cement, and energy-efficient design in infrastructure projects

- Governments across the region are actively promoting public-private partnerships (PPPs) to accelerate sustainable infrastructure development, creating new opportunities for collaboration and innovation in green construction

- Sustainable construction tools such as low-emission machinery, advanced asphalt recycling equipment, and smart energy-efficient technologies are becoming essential components of infrastructure projects in the region

For instance,

- In January 2025, according to an article published by ITP Media Group, Saudi Arabia has completed its first road using recycled construction and demolition (C&D) waste in the asphalt mixture. This sustainable project, in collaboration with Al Ahsa Municipality and the National Centre for Waste Management (MWAN), supports the kingdom's Vision 2030 goals, promoting a circular economy and reducing environmental impact

- In January 2025, according to an article published by BLACK CAT GC, BlackCat GC is a leading construction company in Saudi Arabia, specializing in civil work, MEP (Mechanical, Electrical, Plumbing), excavation, infrastructure development, and green building practices. With a focus on sustainability, they offer energy-efficient and eco-friendly construction solutions, supporting Saudi Vision 2030’s goal of environmental and resource efficiency

- In October 2024, according to an article published by Cypher Environmental, Cypher Environmental offers sustainable and cost-effective road construction solutions, focusing on soil stabilization with products like ROAD//STABILIZR. This solution utilizes in-situ clay materials, reducing costs and maintenance. It’s ideal for developing regions, such as Africa, where it enhances infrastructure while ensuring minimal environmental impact and logistical advantages

- In May 2022, according to an article published by Autodesk Inc., the sustainable highway project in Rotterdam, Africa, aims to alleviate congestion while minimizing environmental impact. Key features include an energy-neutral tunnel with solar panels, wildlife protection, noise reduction, and intelligent systems for lighting and traffic management. BIM and 3D modeling ensure efficient, eco-friendly construction and operation

- This growing emphasis on climate-conscious development and strict adherence to EU environmental standards is encouraging companies to adopt and offer cutting-edge, sustainable construction solutions that align with Africa and Saudi Arabia’s long-term sustainability objectives

Restraints/Challenges

“Supply Chain Disruptions Affecting Project Timelines”

- Supply chain disruptions have become a major challenge in the road and bridge construction market, significantly impacting the availability and timely delivery of essential tools and materials

- In the Africa and Saudi Arabia region—comprising Belgium, the Africa, and Luxembourg—rising raw material costs and port congestion are delaying procurement processes, extending construction timelines and increasing overall project costs

- African countries, many of which depend heavily on imported construction equipment, are facing severe delays due to inadequate transport infrastructure, poor logistics networks, and difficulties in sourcing machinery and spare parts

- In Saudi Arabia, high demand for advanced construction tools under the Vision 2030 initiative has exposed vulnerabilities in the supply chain, with delays in tool availability affecting project scheduling and construction efficiency

For instance,

- In September 2022, EU-backed infrastructure projects faced delays due to supply chain disruptions caused by the global pandemic. The impact was most noticeable in the delivery of construction materials for large projects like road expansions and bridge repairs

- In April 2024, according to an article published by Law Business Research, Saudi Arabia’s NEOM smart city project faced delays in its early stages due to global supply chain issues, affecting the procurement of construction materials and machinery needed for the project’s infrastructure

- In April 2024, according to an article published there was a massive increase in the prices of global steel due to supply chain disruptions, affecting road and bridge construction projects in multiple regions, including Saudi Arabia and Africa and Saudi Arabia

- Across all three regions, these supply chain challenges are creating cost overruns, slowing progress on infrastructure projects, and highlighting the need for localized production, better logistics planning, and diversified sourcing strategies

Mainframe Market Scope

The market is segmented on the basis of product, application, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

Por canal de vendas |

|

Análise regional do mercado de ferramentas para a construção de estradas e pontes em África e na Arábia Saudita

“África é a região dominante no mercado de ferramentas para a construção de estradas e pontes em África e na Arábia Saudita”

- África lidera o mercado de ferramentas para a construção de estradas e pontes, impulsionada pelo forte foco na modernização de infraestruturas, metas de sustentabilidade, tecnologias de construção avançadas e logística de transporte eficiente em toda a região de África e da Arábia Saudita.

“ Prevê-se que África registe a maior taxa de crescimento”

- Espera-se que África testemunhe um crescimento significativo no mercado de ferramentas para a construção de estradas e pontes, impulsionado por investimentos em infraestruturas, metas de sustentabilidade, tecnologias inteligentes, expansão urbana e logística eficiente.

Os líderes de mercado em ferramentas para a construção de estradas e pontes em África e na Arábia Saudita que operam no mercado são:

- Robert Bosch GmbH (Alemanha)

- Stanley Black & Decker, Inc. (EUA)

- Makita Corporation (Japão)

- Ingersoll Rand (EUA)

- Atlas Copco Group (Suécia)

- Koki Holdings Co., Ltd. (Japão)

- PERI (Alemanha)

- Milwaukee Electric Tool Corporation (EUA)

- Ferramentas Lasher (África do Sul)

- Festool GmbH (Alemanha)

Últimos desenvolvimentos em África e na Arábia Saudita Ferramentas para o mercado de construção de estradas e pontes

- Em março de 2022, a Ingersoll Rand é líder global no fornecimento de soluções sustentáveis em tecnologias de ar e fluidos, com foco na melhoria da vida através de produtos e serviços inovadores. Reconhecida pelo seu compromisso com a sustentabilidade, foi nomeada para o Anuário de Sustentabilidade 2022 pela S&P Global, ganhando o prémio "Industry Mover" pelo seu significativo progresso em ESG.

- Em março de 2022, a Ingersoll Rand aderiu ao Desafio Climático Melhor do Departamento de Energia dos EUA, comprometendo-se a reduzir as emissões de gases com efeito de estufa em 50% durante a próxima década. No âmbito das suas metas ambientais, a empresa colabora em estratégias de descarbonização, visando mitigar as alterações climáticas e promover práticas sustentáveis em todos os setores

- Em março de 2023, a HiKOKI lançou uma nova geração de rebarbadoras angulares sem fios de 18 V e 36 V. Estas ferramentas oferecem um desempenho comparável aos modelos com fios, apresentando motores sem escovas avançados e características de segurança melhoradas. Os moedores são concebidos tanto para potência como para proteção do utilizador, visando atender às exigências profissionais

- Em dezembro de 2023, a HiKOKI Power Tools Polska Sp. z oo e a Metabo Polska Sp. z oo anunciou a sua fusão, em vigor a 1 de fevereiro de 2024, para formar a Koki Poland Sp. z oo Este movimento estratégico visa combinar a tecnologia japonesa avançada com a excelência da engenharia alemã, melhorando a qualidade do serviço e promovendo o crescimento das suas marcas: Metabo, HiKOKI e Carat

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 LOGISTIC COST SCENARIO

4.3.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.4 VALUE CHAIN ANALYSIS: AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

4.4.1 RAW MATERIAL PROCUREMENT:

4.4.2 EQUIPMENT & TOOL MANUFACTURING:

4.4.3 AUTOMATION AND SMART CONSTRUCTION TOOLS:

4.4.4 CONSTRUCTION COMPANIES & CONTRACTORS:

4.4.5 ADVANCED ROAD INFRASTRUCTURE WITH SMART TECHNOLOGIES:

4.4.6 CONCLUSION

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY OF PRODUCTS OR SERVICES:

4.5.2 COST AND VALUE

4.5.3 DELIVERY PERFORMANCE

4.5.4 FINANCIAL STABILITY

4.5.5 REPUTATION AND REFERENCES

4.5.6 CUSTOMER SERVICE

4.5.7 COMPLIANCE AND SUSTAINABILITY

4.6 TECHNOLOGICAL ADVANCEMENTS IN ROAD AND BRIDGE CONSTRUCTION IN AFRICA AND SAUDI ARABIA

4.6.1 AFRICA: ADOPTING COST-EFFECTIVE AND SCALABLE TECHNOLOGIES

4.6.1.1 DRONES FOR TOPOGRAPHIC MAPPING AND SITE SURVEYING

4.6.1.2 PREFABRICATED AND MODULAR BRIDGE CONSTRUCTION

4.6.1.3 RECYCLED PLASTIC AND ALTERNATIVE MATERIALS FOR ROADS

4.6.1.4 AI-POWERED TRAFFIC MANAGEMENT AND SMART INFRASTRUCTURE

4.6.1.5 INCREMENTAL LAUNCHING METHOD FOR BRIDGES

4.6.2 SAUDI ARABIA: HIGH-TECH INFRASTRUCTURE UNDER VISION 2030

4.6.2.1 ROBOTICS AND AI IN CONSTRUCTION

4.6.2.2 3D PRINTING FOR SUSTAINABLE ROADS AND BRIDGES

4.6.2.3 IOT AND SMART ROAD NETWORKS

4.6.2.4 AI-BASED ROAD CONDITION ASSESSMENT

4.6.3 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN GOVERNMENT INFRASTRUCTURE INVESTMENTS

6.1.2 RAPID URBANIZATION AND POPULATION GROWTH

6.1.3 INCREASED COLLABORATIONS BETWEEN GOVERNMENTS AND PRIVATE FIRMS FOR LARGE-SCALE INFRASTRUCTURE PROJECTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT COSTS

6.2.2 COMPLEX AND STRINGENT APPROVAL PROCESSES AND VARYING REGULATIONS

6.3 OPPORTUNITIES

6.3.1 SHIFTING FOCUS TOWARDS GREEN AND SUSTAINABLE CONSTRUCTION TRENDS

6.3.2 EXPANSION OF TRADE AND LOGISTICS NETWORKS

6.3.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN CONSTRUCTION TOOLS AND MACHINERY

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN DISRUPTIONS AFFECTING PROJECT TIMELINES

6.4.2 INSUFFICIENT AVAILABILITY OF SKILLED LABOR

7 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POWER TOOLS

7.3 HAND TOOLS

7.4 OTHERS

8 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ROAD CONSTRUCTION

8.3 BRIDGE CONSTRUCTION

8.4 MAINTENANCE & REPAIR

8.5 OTHERS

9 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 NON-STORE BASED

9.3 STORE BASED

10 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET BY COUNTRY

10.1 AFRICA

10.2 SAUDI ARABIA

11 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AFRICA AND SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ATLAS COPCO GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 ROBERT BOSCH GMBH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 INGERSOLL RAND

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 KOKI HOLDINGS CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 FESTOOL GMBH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 LASHER TOOLS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 MAKITA CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 PERI EGYPT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 STANLEY BLACK & DECKER, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE IN AFRICA AND SAUDI ARABIA FOR TOOLS IN ROAD AND BRIDGE CONSTRUCTION

TABLE 2 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 AFRICA AND SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 AFRICA AND SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 AFRICA AND SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 AFRICA AND SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 AFRICA AND SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 AFRICA AND SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA AND SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA AND SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA AND SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA AND SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AND SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA AND SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA AND SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA AND SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA AND SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA AND SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA AND SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 24 AFRICA AND SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 AFRICA AND SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 AFRICA AND SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 AFRICA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 AFRICA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 AFRICA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 AFRICA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 AFRICA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 AFRICA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 AFRICA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 AFRICA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 AFRICA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 AFRICA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 AFRICA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 AFRICA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 AFRICA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 AFRICA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AFRICA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 AFRICA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 AFRICA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 AFRICA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 AFRICA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 AFRICA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 74 SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 2 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISE IN GOVERNMENT INFRASTRUCTURE INVESTMENTS IS EXPECTED TO DRIVE THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE POWER TOOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VALUE CHAIN ANALYSIS OF AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 21 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY PRODUCT, 2024

FIGURE 22 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY APPLICATION, 2024

FIGURE 23 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2024

FIGURE 24 AFRICA AND SAUDI ARABIA: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.