Asia Pacific Fibc Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.48 Billion

USD

3.96 Billion

2025

2033

USD

2.48 Billion

USD

3.96 Billion

2025

2033

| 2026 –2033 | |

| USD 2.48 Billion | |

| USD 3.96 Billion | |

|

|

|

|

Segmentação do mercado de embalagens FIBC na Ásia-Pacífico, por tipo de produto (Tipo A, Tipo B, Tipo C (Condutivo), Tipo D (Dissipativo de Estática)), por construção da embalagem (Com defletor (Q-Bag), Painel em U, Quatro Painéis, Circular/Tubular), por aplicação (Químicos (2000), Alimentos e Bebidas (1000 e 1100), Agricultura (0100), Produtos Farmacêuticos (2100), Construção (4100), Mineração e Minerais (0100 e 0001), Resíduos e Reciclagem (3800), Outros), por usuário final (Fabricantes de Produtos Químicos (2000), Produtores e Cooperativas Agrícolas (0100), Processadores de Alimentos e Fornecedores de Ingredientes (1000 e 1100), Empreiteiras de Construção (4100), Empresas de Mineração (0100 e 0001), Empresas Farmacêuticas (2100), Empresas de Gestão de Resíduos e Reciclagem) (3800), Outros), Por Canal de Distribuição (Indireto, Direto) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de embalagens FIBC na região Ásia-Pacífico

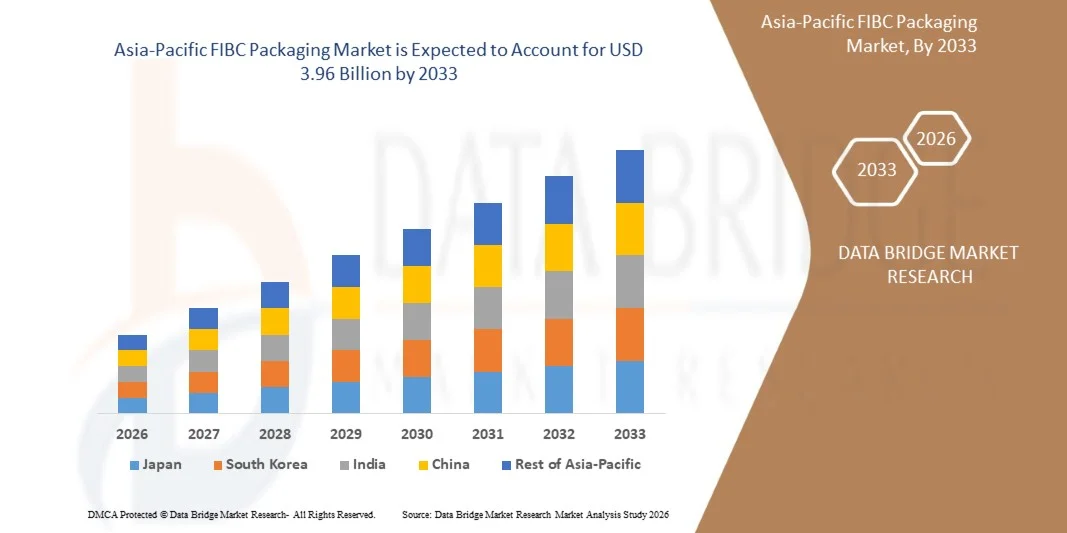

- O mercado de embalagens FIBC na região Ásia-Pacífico foi avaliado em US$ 2,48 bilhões em 2025 e deverá atingir US$ 3,96 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,1% durante o período de previsão.

- O mercado de embalagens FIBC na região Ásia-Pacífico está experimentando um crescimento constante, impulsionado pela demanda de setores industriais como o químico, o de alimentos e bebidas, o de materiais de construção e o de produtos agrícolas. O aumento do comércio intra-Ásia-Pacífico, as atividades de exportação e a necessidade de armazenamento eficiente e transporte a granel estão sustentando a expansão do mercado.

- A crescente ênfase em serviços de valor agregado, incluindo soluções FIBC personalizadas, integração 3PL/4PL e armazenamento em ambiente controlado para produtos a granel sensíveis, está reforçando a região Ásia-Pacífico como um mercado emergente com robusto potencial de crescimento a longo prazo em soluções de embalagens a granel.

Análise do mercado de embalagens FIBC na região Ásia-Pacífico

- O mercado de embalagens FIBC na região Ásia-Pacífico abrange a produção, distribuição e utilização de soluções de embalagens a granel (sacos FIBC) em diversos setores, como o químico, o de produtos agrícolas, o de materiais de construção, o farmacêutico, entre outros. O crescimento é impulsionado pela crescente demanda por soluções eficientes de armazenamento, transporte a granel e manuseio, sustentada pelo aumento do comércio intra-Ásia-Pacífico, da atividade industrial e da logística do comércio eletrônico.

- A China deverá dominar o mercado de embalagens FIBC na região Ásia-Pacífico, com a maior participação de mercado, de 19,93% em 2026, e também deverá registrar a maior taxa de crescimento anual composta (CAGR) durante o período de previsão. Isso se deve à sua forte base industrial, setor de manufatura avançado, investimentos substanciais em logística e infraestrutura de embalagens FIBC, além da adoção estratégica de soluções inovadoras para manuseio de materiais a granel por setores-chave.

- Espera-se que os produtos FIBC do tipo A dominem o mercado da Ásia-Pacífico, detendo a maior participação de 37,84%, devido à sua versatilidade, custo-benefício e adequação para o manuseio de uma ampla gama de materiais a granel em aplicações industriais e agrícolas.

Escopo do relatório e segmentação do mercado de embalagens FIBC na região Ásia-Pacífico

|

Atributos |

Principais informações sobre o mercado de embalagens FIBC na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens FIBC na região Ásia-Pacífico

“ Integração com embalagens FIBC digitais e automatizadas ”

- As empresas estão cada vez mais incorporando FIBCs em sistemas automatizados de armazenamento e movimentação de materiais, permitindo uma movimentação mais rápida, segura e eficiente de produtos a granel dentro de armazéns e centros de distribuição.

- A adoção de tecnologias digitais de gestão e rastreamento de estoque permite o monitoramento em tempo real dos estoques de FIBCs (contêineres FIBC), melhorando a visibilidade da cadeia de suprimentos, reduzindo erros e otimizando a utilização do espaço de armazenamento.

- A integração com soluções logísticas avançadas oferece suporte a operações de alto volume e distribuição de comércio eletrônico, impulsionando a demanda por soluções de embalagens FIBC padronizadas, duráveis e compatíveis com automação nos setores industrial e comercial.

Por exemplo,

- Em abril de 2024, a Packem Umasree Pvt Ltd (uma joint venture entre a brasileira Packem SA e a indiana Umasree Texplast) inaugurou aquela que provavelmente é a primeira fábrica da Índia a produzir FIBCs 100% sustentáveis a partir de garrafas PET recicladas (rPET). Essa fábrica, que transforma garrafas em sacolas, está localizada perto de Ahmedabad e utiliza tecnologia de produção avançada para converter PET pós-consumo em sacolas FIBC de alto desempenho.

- Em abril de 2023, a LC Packaging International BV anunciou uma "solução de reciclagem em circuito fechado" para FIBCs em parceria com a recicladora RAFF Plastics, com o objetivo de coletar Big Bags usados, reciclá-los e reintroduzir o material, alinhando as embalagens FIBC aos objetivos da economia circular.

Dinâmica do mercado de embalagens FIBC na região Ásia-Pacífico

Motorista

“Aumento do comércio transfronteiriço de produtos químicos e ingredientes alimentares”

- O aumento do comércio transfronteiriço de produtos químicos e ingredientes alimentares está impulsionando a demanda por soluções de embalagens a granel, como os FIBCs (Contêineres Fibre Channel), uma vez que exportadores e importadores necessitam de contêineres seguros, duráveis e padronizados para transportar materiais de forma eficiente pelos mercados internacionais.

- A expansão nos setores de fabricação química, processamento de alimentos e agroindustrial está impulsionando a necessidade de sistemas organizados de armazenamento e manuseio, incentivando as empresas a investir em sacos FIBC especializados de alta capacidade para matérias-primas, produtos intermediários e produtos acabados.

- As empresas estão adotando tecnologias modernas de cadeia de suprimentos, incluindo gerenciamento de estoque, manuseio automatizado e otimização logística, para garantir uma movimentação transfronteiriça mais rápida, segura e confiável de mercadorias a granel, apoiando diretamente o crescimento do mercado de embalagens FIBC na região Ásia-Pacífico.

Por exemplo

- Em dezembro de 2024, a Conferência das Nações Unidas sobre Comércio e Desenvolvimento (UNCTAD) informou que o comércio global de mercadorias deveria atingir quase US$ 33 trilhões em 2024, um aumento de US$ 1 trilhão em relação ao ano anterior, refletindo um amplo crescimento no comércio de bens em diversos setores, incluindo produtos químicos e ingredientes alimentícios.

- Em julho de 2025, a UNCTAD indicou que o comércio global cresceu aproximadamente 300 bilhões de dólares no primeiro semestre do ano, impulsionado em parte pela continuidade das importações e exportações das principais economias – um crescimento que implica em maiores fluxos transfronteiriços de mercadorias, exigindo soluções de embalagens a granel.

- A edição de 2024 do "Relatório de Comércio Mundial 2024" da Organização Mundial do Comércio (OMC) destacou que o crescimento do comércio internacional continua sendo um fator central para as indústrias dependentes do comércio, incluindo as de produtos químicos e alimentos a granel, que normalmente utilizam contêineres a granel e FIBCs para o transporte.

Restrição/Desafio

“Volatilidade do preço do polipropileno e interrupções no fornecimento impactam o custo dos FIBCs”

- A flutuação dos preços do polipropileno afeta diretamente o custo de fabricação dos FIBCs, resultando em preços mais altos para os usuários finais e impactando as margens de lucro gerais de produtores e distribuidores.

- Interrupções na cadeia de suprimentos, incluindo escassez de matéria-prima ou restrições logísticas, podem atrasar os cronogramas de produção e entrega de FIBCs (Big Bags), afetando setores que dependem de soluções de embalagem a granel com entregas rápidas.

- A volatilidade na disponibilidade de matérias-primas incentiva os fabricantes a explorar estratégias alternativas de fornecimento, mas a oferta inconsistente e a instabilidade de custos continuam sendo um desafio fundamental para o crescimento do mercado e a previsibilidade de preços.

Por exemplo,

- Em setembro de 2023, a ChemAnalyst relatou que os preços do PP dispararam em toda a Europa após a suspensão, por um mês, das operações de várias grandes fábricas (incluindo a Borealis), levando a um déficit mensal estimado de 13.333 toneladas métricas.

- Em janeiro de 2024, notícias do mercado de compras indicaram que os preços do PP na Europa subiram ligeiramente devido à redução das importações da Ásia e do Oriente Médio, consequência de interrupções no transporte marítimo global (como os riscos de trânsito no Mar Vermelho) que restringiram a oferta local.

- Em fevereiro de 2025, os relatórios sobre os preços do polipropileno no mercado asiático indicavam uma oferta mais restrita de PP devido a paralisações em fábricas e escassez regional. Como resultado, alguns compradores asiáticos foram forçados a recorrer à resina nacional de custo mais elevado, pressionando ainda mais os preços do PP.

Escopo do mercado de embalagens FIBC na região Ásia-Pacífico

O mercado global de embalagens FIBC na região Ásia-Pacífico é categorizado em cinco segmentos principais, com base no tipo de produto, construção da embalagem, aplicação, uso final e canal de distribuição.

Por tipo de produto

Com base no tipo de produto, o mercado global de embalagens FIBC na região Ásia-Pacífico é segmentado em Tipo A, Tipo B, Tipo C (Condutivo) e Tipo D (Dissipativo de Estática).

Espera-se que o segmento Tipo A domine o mercado com uma participação de 37,84% e apresente o maior crescimento anual composto (CAGR) de 6,2%, devido ao seu baixo custo, ampla disponibilidade e uso extensivo em aplicações para materiais a granel não perigosos. Sua versatilidade, facilidade de fabricação e forte demanda de indústrias de alto volume, como agricultura, ingredientes alimentícios, materiais de construção e produtos químicos em geral, fazem dos FIBCs Tipo A a escolha preferida para embalagens a granel. Além disso, a rápida expansão das exportações de commodities em economias emergentes e a crescente tendência em direção a soluções de embalagem com melhor custo-benefício continuam a reforçar a liderança de mercado dos FIBCs Tipo A.

Por construção de saco

Com base na construção da embalagem, o mercado global de embalagens FIBC na região Ásia-Pacífico é segmentado em Baffle (Q-Bag), U-Panel, Four-Panel e Circular/Tubular.

O segmento de embalagens com defletores (Q-Bag) deverá dominar o mercado com 37,26% e apresentar o maior CAGR (Taxa de Crescimento Anual Composta) de 7,4%, devido à sua excelente retenção de forma, maior eficiência de empilhamento e otimização do espaço durante o armazenamento e transporte. As embalagens Q-Bag oferecem até 30-40% mais eficiência de espaço em comparação com os FIBCs convencionais, tornando-as altamente preferenciais em setores que exigem embalagens estáveis e em formato de cubo, como ingredientes alimentícios, produtos farmacêuticos, produtos químicos e pós de alta densidade. Sua capacidade de manter uma forma uniforme, reduzir deformações e melhorar a capacidade de carga dos contêineres diminui significativamente os custos logísticos, impulsionando uma forte adoção em cadeias de suprimentos globais. Além disso, a crescente demanda por embalagens a granel voltadas para exportação e a mudança para sistemas de gerenciamento de armazéns com melhor custo-benefício reforçam ainda mais a liderança da construção com defletores (Q-Bag) no mercado de FIBCs.

Por meio de aplicação

Com base na aplicação, o mercado global de embalagens FIBC da Ásia-Pacífico é segmentado em Produtos Químicos (2000), Alimentos e Bebidas (1000 e 1100), Agricultura (0100), Produtos Farmacêuticos (2100), Construção (4100), Mineração e Minerais (0100 e 0001), Resíduos e Reciclagem (3800), Outros.

O segmento de Produtos Químicos (2000) deverá dominar o mercado com uma participação de 37,44% e apresentar o maior CAGR (Taxa de Crescimento Anual Composta) de 6,0%, devido à sua ampla dependência de FIBCs (Contêineres Compactos de Grande Porte) para o transporte de pós, grânulos, resinas, aditivos e produtos intermediários nas cadeias de suprimentos petroquímicas, de especialidades químicas e de produtos químicos industriais. A indústria química é uma das maiores consumidoras globais de embalagens a granel, impulsionada pelos altos volumes de produção, frequentes remessas internacionais e rigorosos requisitos de segurança para o manuseio de materiais perigosos e sensíveis à umidade. Os FIBCs oferecem durabilidade superior, controle de contaminação, custo-benefício e conformidade com as normas da ONU para produtos perigosos, tornando-os o formato de embalagem preferido pelos fabricantes de produtos químicos. Além disso, o crescente investimento em especialidades químicas, a expansão da produção de polímeros na região Ásia-Pacífico e o aumento do comércio global de compostos químicos reforçam ainda mais a forte dominância do segmento de Produtos Químicos no mercado.

Por uso final

Com base no uso final, o mercado global de embalagens FIBC da Ásia-Pacífico é segmentado em fabricantes de produtos químicos (2000), produtores agrícolas e cooperativas (0100), processadores de alimentos e fornecedores de ingredientes (1000 e 1100), empreiteiros de construção (4100), empresas de mineração (0100 e 0001), empresas farmacêuticas (2100), empresas de gerenciamento de resíduos e reciclagem (3800) e outros.

O segmento de Fabricantes de Produtos Químicos (2000) deverá dominar o mercado com 36,30% e apresentar o maior CAGR (Taxa de Crescimento Anual Composta) de 5,9%, devido à demanda excepcionalmente alta por FIBCs (Contêineres Compactos de Grande Porte) no manuseio, armazenamento e transporte global de produtos químicos a granel, polímeros, intermediários e compostos especiais. A indústria química opera com grandes volumes de pós, grânulos, resinas e substâncias perigosas que exigem soluções de embalagem seguras, eficientes e em conformidade com as normas. Os FIBCs, especialmente os tipos B, C e D, oferecem proteção superior contra contaminação, umidade e riscos eletrostáticos, que são críticos em ambientes químicos. Além disso, o aumento da produção química na região Ásia-Pacífico, o crescimento das exportações de produtos petroquímicos e químicos especiais e as rigorosas regulamentações globais para embalagens de materiais perigosos impulsionaram significativamente o uso de FIBCs nesse setor.

Por canal de distribuição

Com base no canal de distribuição, o mercado global de embalagens FIBC na região Ásia-Pacífico é segmentado em indireto e direto.

Espera-se que o segmento indireto domine o mercado com uma participação de 62,96% e apresente o maior crescimento anual composto (CAGR) de 5,9%, devido ao seu amplo alcance, redes de fornecimento estabelecidas e forte presença em diversos setores de uso final. Distribuidores e revendedores desempenham um papel crucial ao oferecer disponibilidade confiável, entregas rápidas e preços competitivos, tornando-se a opção preferencial para compradores de pequeno e médio porte. Além disso, a rápida expansão das plataformas online e de comércio eletrônico impulsionou significativamente as vendas indiretas, oferecendo maior visibilidade dos produtos, facilidade de aquisição e comparação simplificada dos tipos de FIBC (caixas de contêineres FIBC).

Análise Regional do Mercado de Embalagens FIBC na Ásia-Pacífico

- A região Ásia-Pacífico (liderada pela China, Índia, Japão e Coreia do Sul) representa um mercado regional significativo para embalagens FIBC, com a China detendo a maior participação, com 19,93% da demanda regional. O mercado é sustentado por fortes setores industriais, incluindo os de produtos químicos, agropecuários, materiais de construção e farmacêuticos, que dependem de embalagens a granel para produtos secos, pós e commodities industriais. Espera-se que a região cresça de forma constante, impulsionada pelo comércio intra-Ásia-Pacífico, pela expansão da manufatura e pela crescente adoção de FIBCs para armazenamento e transporte eficientes de produtos a granel.

- A região Ásia-Pacífico se beneficia de infraestrutura industrial avançada, padrões regulatórios rigorosos (especialmente para segurança química, alimentar e farmacêutica) e redes logísticas e de armazenagem bem desenvolvidas. A crescente tendência de soluções FIBC de valor agregado, automação de armazéns e instalações de armazenamento especializadas fortalece a penetração no mercado, enquanto a liderança da China como maior contribuinte garante um potencial de crescimento estável e investimentos contínuos em soluções de embalagens a granel em toda a região.

Análise do Mercado de Embalagens FIBC na China e na Região Ásia-Pacífico

A China é o maior mercado de embalagens FIBC na região Ásia-Pacífico, atendendo à demanda regional impulsionada por sua forte base industrial e setores de manufatura avançados. Indústrias-chave como a química, a de produtos agrícolas, a de materiais de construção e a farmacêutica dependem fortemente de FIBCs para o armazenamento e transporte seguros e eficientes de pós, grânulos e produtos secos a granel. O crescimento do mercado é sustentado por infraestrutura logística moderna, padrões regulatórios rigorosos e pela adoção de automação de armazéns e sistemas digitais de gestão de estoque. Os FIBCs do tipo A dominam o mercado, representando uma parcela significativa, devido à sua versatilidade, custo-benefício e adequação a diversas aplicações de manuseio de materiais a granel.

Participação de mercado de embalagens FIBC na região Ásia-Pacífico

O setor de embalagens FIBC é liderado principalmente por empresas consolidadas, incluindo:

- Amcor plc (Suíça)

- IPG (EUA)

- Greif (EUA)

- LC Packaging (Países Baixos)

- Empresa Sonoco Products (EUA)

- Umasree Texplast Pvt. Ltd. (Índia)

- Gaoqing Antente Container Package Co., Ltd.

- FlexiTuff Ventures International Ltd. (Índia)

- Shankar Packaging Limited (Índia)

- BAG Corp (EUA)

- Global-Pak, Inc. (EUA)

- Bulk-Pack, Inc. (EUA)

Novidades no mercado de embalagens FIBC na região Ásia-Pacífico

- Em fevereiro de 2023, a LC Packaging anunciou uma parceria com a Buenassa (RDC) e a Shankar Packagings (Índia) para a distribuição de FIBCs e produção local no setor de mineração da RDC.

- Em fevereiro de 2025, a United Bags, Inc. adquiriu a BAG Corp, expandindo a oferta de produtos FIBC, incluindo os big bags SUPER SACK, para agregar valor aos clientes em embalagens a granel.

- Em agosto de 2025, a Sackmaker aumentou seu estoque de sacos de areia cheios para mais de 4.000 unidades, prontas para envio imediato, aprimorando a capacidade de resposta a emergências, defesa contra enchentes e necessidades de construção. O aumento do estoque e a capacidade de entrega rápida reforçam a confiabilidade operacional durante picos de demanda.

- Em março, a Greif concluiu a aquisição da Ipackchem, líder global em galões e pequenos recipientes plásticos de alto desempenho, com e sem barreira, em uma transação em dinheiro no valor de US$ 538 milhões. Isso expande a presença global da Greif no segmento de pequenos recipientes plásticos/galões e adiciona recursos de embalagens com barreira.

- Em 2025, a Jumbo Bag Limited fortaleceu sua capacidade de produção por meio de suas instalações de fabricação totalmente integradas em Chennai e Mumbai, com uma capacidade de produção anual superior a 4,3 milhões de big bags (FIBCs), e continuou focando na produção de FIBCs em salas limpas para aplicações alimentícias e farmacêuticas, refletindo seu compromisso em expandir soluções de embalagens a granel de alta qualidade e focadas no cliente.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC FIBC PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 SHIFT FROM PRICE-BASED TO VALUE-BASED PURCHASING

4.2.2 STRONG DEMAND FOR CUSTOMIZATION AND APPLICATION-SPECIFIC DESIGNS

4.2.3 GROWING IMPORTANCE OF TRACEABILITY, QUALITY ASSURANCE, AND CERTIFICATIONS

4.2.4 INCREASING ADOPTION OF SMART PACKAGING TECHNOLOGIES

4.2.5 SUSTAINABILITY AS A CORE PURCHASE DRIVER

4.2.6 PREFERENCE FOR RELIABLE, LARGE-SCALE VENDORS WITH ASIA-PACIFIC REACH

4.2.7 EMPHASIS ON SAFETY AND REGULATORY COMPLIANCE

4.2.8 COLLABORATIVE SUPPLIER RELATIONSHIPS OVER TRANSACTIONAL PURCHASING

4.2.9 INFLUENCE OF ASIA-PACIFIC ECONOMIC CONDITIONS ON BUYING VOLUME

4.2.10 CONCLUSION

4.3 COST ANALYSIS BREAKDOWN – ASIA-PACIFIC FIBC PACKAGING MARKET

4.3.1 INTRODUCTION

4.3.2 MATERIAL COSTS

4.3.3 MANUFACTURING AND PROCESSING COSTS

4.3.4 LABOR AND WORKFORCE COSTS

4.3.5 QUALITY ASSURANCE AND COMPLIANCE COSTS

4.3.6 LOGISTICS AND SUPPLY CHAIN COSTS

4.3.7 PACKAGING, HANDLING, AND POST-PRODUCTION COSTS

4.3.8 OVERHEADS AND ADMINISTRATIVE COSTS

4.3.9 CONCLUSION

4.4 PATENT ANALYSIS – ASIA-PACIFIC FIBC PACKAGING MARKET

4.4.1 INTRODUCTION

4.4.2 PATENT QUALITY AND STRENGTH

4.4.2.1 STRUCTURAL INNOVATION

4.4.2.2 MATERIAL-ORIENTED PATENTS

4.4.2.3 SAFETY-CENTRIC ENHANCEMENTS

4.4.2.4 SUSTAINABILITY-FOCUSED SOLUTIONS

4.4.3 PATENT FAMILIES

4.4.3.1 MATERIAL ENGINEERING FAMILIES

4.4.3.2 STRUCTURAL AND DESIGN FAMILIES

4.4.3.3 FILLING, HANDLING, AND DISCHARGE SYSTEM FAMILIES

4.4.3.4 SAFETY AND STATIC CONTROL FAMILIES

4.4.3.5 REUSABILITY AND SUSTAINABILITY FAMILIES

4.4.4 LICENSING AND COLLABORATIONS

4.4.4.1 MATERIAL SUPPLIER AND MANUFACTURER PARTNERSHIPS

4.4.4.2 TECHNOLOGY INTEGRATION AGREEMENTS

4.4.4.3 INDUSTRY–ACADEMIA COLLABORATION

4.4.4.4 CROSS-INDUSTRY KNOWLEDGE SHARING

4.4.5 REGIONAL PATENT LANDSCAPE

4.4.5.1 EUROPE

4.4.5.2 ASIA-PACIFIC

4.4.5.3 NORTH AMERICA

4.4.5.4 MIDDLE EAST

4.4.6 IP STRATEGY AND MANAGEMENT

4.4.6.1 STRATEGIC PATENT FILING

4.4.6.2 PORTFOLIO DIVERSIFICATION

4.4.6.3 CONTINUOUS MONITORING

4.4.6.4 LIFECYCLE OPTIMIZATION

4.4.6.5 ALIGNMENT WITH SUSTAINABILITY GOALS

4.4.7 CONCLUSION

4.5 PORTERS FIVE FORCES ANALYSIS

4.6 PRICING ANALYSIS

4.7 PROFIT MARGINS SCENARIO IN THE ASIA-PACIFIC FIBC PACKAGING MARKET

4.7.1 INTRODUCTION

4.7.2 RAW MATERIAL COST PRESSURES AND MARGIN SENSITIVITY

4.7.3 OPERATIONAL EFFICIENCY AND PRODUCTION COST OPTIMIZATION

4.7.4 MARKET PRICING DYNAMICS AND COMPETITIVE PRESSURE

4.7.5 REGIONAL PRODUCTION ECONOMICS AND MARGIN VARIABILITY

4.7.6 VALUE-ADDED PRODUCTS AND PREMIUM OFFERINGS

4.7.7 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 POLYPROPYLENE (PP): THE BACKBONE OF FIBC MANUFACTURING

4.8.2 POLYETHYLENE (PE) FOR LINERS AND PROTECTIVE BARRIERS

4.8.3 ADDITIVES AND MASTERBATCHES

4.8.4 CONDUCTIVE YARNS AND THREADS

4.8.5 SEWING THREADS AND WEBBING MATERIALS

4.8.6 FILMS, COATINGS & LAMINATION MATERIALS

4.8.7 RECYCLED PP & SUSTAINABLE MATERIAL STREAMS

4.8.8 METAL AND PLASTIC COMPONENTS

4.8.9 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 OVERVIEW

4.10.2 SMART FIBCS: RFID, QR CODES, AND SENSOR INTEGRATION

4.10.3 MATERIAL SCIENCE UPGRADES: LINERS, COATINGS, AND NANOTECH

4.10.4 SUSTAINABILITY: RECYCLED RESINS, BIODEGRADABLE BLENDS, AND CIRCULAR DESIGN

4.10.5 SAFETY AND COMPLIANCE TECHNOLOGIES

4.10.6 AUTOMATION AND SMARTER FABRICATION

4.10.7 CUSTOMISATION AND APPLICATION-SPECIFIC ENGINEERING

4.10.8 BUSINESS IMPLICATIONS

4.10.9 CHALLENGES AND WHERE THE MARKET GOES NEXT

4.10.10 CONCLUSION

4.11 ASIA-PACIFIC FBIC PACKAGING MARKET – VALUE CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 RAW MATERIAL SUPPLY

4.11.3 COMPONENT MANUFACTURING AND PROCESSING

4.11.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.11.5 DISTRIBUTION AND LOGISTICS

4.11.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.11.7 CONCLUSION

4.12 VENDOR SELECTION CRITERIA

4.12.1 PRODUCT QUALITY & TECHNICAL SPECIFICATIONS

4.12.2 CERTIFICATIONS & REGULATORY COMPLIANCE

4.12.3 MATERIAL INNOVATION & TECHNOLOGY ADOPTION

4.12.4 SUSTAINABILITY CAPABILITIES

4.12.5 CUSTOMISATION AND DESIGN FLEXIBILITY

4.12.6 PRODUCTION SCALE, RELIABILITY & LEAD TIMES

4.12.7 COST STRUCTURE & VALUE FOR MONEY

4.12.8 ASIA-PACIFIC PRESENCE & CUSTOMER SUPPORT

4.12.9 TRACK RECORD, REPUTATION & CLIENT PORTFOLIO

4.12.9.1 ETHICAL, SOCIAL & SAFETY PRACTICES

4.12.10 CONCLUSION

4.13 INNOVATION TRACKER & STRATEGIC ANALYSIS – ASIA-PACIFIC FIBC PACKAGING MARKET

4.13.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.13.1.1 Joint Ventures

4.13.1.2 Mergers and Acquisitions (M&A)

4.13.1.3 Licensing and Partnerships

4.13.1.4 Technology Collaborations

4.13.1.5 Strategic Divestments

4.13.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.13.3 TIMELINES AND MILESTONES

4.13.4 INNOVATION STRATEGIES AND METHODOLOGIES

4.13.5 RISK ASSESSMENT AND MITIGATION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CROSS-BORDER TRADE OF CHEMICALS, FOOD INGREDIENTS

7.1.2 AGRICULTURAL COMMODITIES USING BULK BAGS

7.1.3 COST EFFICIENCY AND HANDLING BENEFITS OVER DRUMS AND SMALL SACKS

7.1.4 GROWING PREFERENCE FOR REUSABLE/MULTI-TRIP FIBCS

7.2 RESTRAINS

7.2.1 POLYPROPYLENE PRICE VOLATILITY AND SUPPLY DISRUPTIONS IMPACTING FIBC COST

7.2.2 ENVIRONMENTAL REGULATIONS ON PLASTICS AND END-OF-LIFE WASTE MANAGEMENT

7.3 OPPORTUNITY

7.3.1 ADOPTION OF FOOD- AND PHARMA-GRADE FIBCS WITH ADVANCED LINERS AND HYGIENE CERTIFICATIONS

7.3.2 GROWTH IN TYPE C/TYPE D ANTISTATIC SOLUTIONS FOR HAZARDOUS POWDERS

7.3.3 RFID AND TRACK-AND-TRACE ADOPTION ENHANCES FIBC EFFICIENCY

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH UN HAZARDOUS GOODS NORMS AND ELECTROSTATIC SAFETY

7.4.2 QUALITY ASSURANCE, COUNTERFEIT RISKS, AND VARIABILITY IN ASIA-PACIFIC TESTING/STANDARDS

8 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TYPE A

8.2.1 COATED

8.2.2 UNCOATED

8.2.3 UNLINED

8.2.4 PE LINED

8.3 TYPE B

8.3.1 COATED

8.3.2 UNCOATED

8.3.3 UNLINED

8.3.4 PE LINED

8.4 TYPE C (CONDUCTIVE)

8.4.1 EXTERNAL GROUNDING CLIPS

8.4.2 SEWN-IN GROUND TABS

8.4.3 CONDUCTIVE LINER

8.4.4 ANTISTATIC LINER

8.5 TYPE D (STATIC DISSIPATIVE)

8.5.1 STATIC DISSIPATIVE YARNS

8.5.2 CORONA DISCHARGE FABRICS

8.5.3 ANTISTATIC LINER

8.5.4 FOOD-GRADE LINER

9 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION

9.1 OVERVIEW

9.2 BAFFLE (Q-BAG)

9.2.1 CORNER BAFFLES

9.2.2 INTERNAL TIES

9.2.3 VENTED

9.2.4 DUST-PROOF

9.3 U-PANEL

9.3.1 4 LOOP

9.3.2 2 LOOP

9.3.3 FLAT

9.3.4 CONICAL

9.3.5 FULL DISCHARGE

9.4 FOUR-PANEL

9.4.1 4-LOOP

9.4.2 SINGLE-POINT LIFT

9.4.3 WITH BAFFLES

9.4.4 WITHOUT BAFFLES

9.5 CIRCULAR / TUBULAR

9.5.1 4-LOOP

9.5.2 2-LOOP

9.5.3 COATED

9.5.4 UNCOATED

10 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CHEMICALS (2000)

10.2.1 PETROCHEMICALS & POLYMERS

10.2.2 DYES, PIGMENTS & COLORANTS

10.2.3 INDUSTRIAL CHEMICALS

10.2.4 SPECIALTY CHEMICALS & ADDITIVES

10.2.5 DETERGENTS & CLEANING AGENTS

10.2.6 ADHESIVES & SEALANTS RAW MATERIALS

10.2.7 FERTILIZER INTERMEDIATES

10.3 FOOD & BEVERAGES (1000 & 1100)

10.3.1 CEREALS & GRAINS

10.3.2 SUGAR, SALT & FLOUR

10.3.3 NUTS & DRY FRUITS

10.3.4 POWDERED INGREDIENTS & SPICES

10.3.5 PET FOOD & ADDITIVES

10.3.6 OILS & FATS

10.3.7 BEVERAGE RAW MATERIALS

10.4 AGRICULTURE (0100)

10.4.1 GRAINS & SEEDS

10.4.2 FERTILIZERS

10.4.3 ANIMAL FEED & SUPPLEMENTS

10.4.4 FRUIT & VEGETABLE BULK PACKAGING

10.4.5 ORGANIC COMPOST & SOIL AMENDMENTS

10.4.6 HERBS & SPICES (RAW)

10.4.7 BULB & ROOT CROPS

10.5 PHARMACEUTICALS (2100)

10.5.1 ACTIVE PHARMACEUTICAL INGREDIENTS (APIS)

10.5.2 BULK INTERMEDIATES & EXCIPIENTS

10.5.3 NUTRACEUTICAL POWDERS & SUPPLEMENTS

10.5.4 FINE CHEMICALS

10.5.5 COSMETIC & PERSONAL CARE INGREDIENTS

10.5.6 MEDICAL SALT & SALINE

10.6 CONSTRUCTION (4100)

10.6.1 CEMENT & SAND

10.6.2 AGGREGATES

10.6.3 MORTAR & PLASTER PREMIXES

10.6.4 GYPSUM & LIME

10.6.5 INDUSTRIAL POWDERS

10.6.6 ROOFING & INSULATION MATERIALS

10.7 MINING & MINERALS (0100 & 0001)

10.7.1 COAL & COKE FINES

10.7.2 IRON ORE, COPPER ORE, BAUXITE

10.7.3 INDUSTRIAL MINERALS

10.7.4 METAL CONCENTRATES & POWDERS

10.7.5 LIMESTONE & DOLOMITE

10.7.6 PRECIOUS METAL RESIDUES

10.8 WASTE & RECYCLING (3800)

10.8.1 PLASTIC WASTE

10.8.2 CONSTRUCTION & DEMOLITION WASTE

10.8.3 HAZARDOUS & INDUSTRIAL WASTE

10.8.4 SCRAP METAL & METAL POWDERS

10.8.5 COMPOST & ORGANIC WASTE COLLECTION

10.8.6 ELECTRONIC WASTE (E-WASTE)

10.9 OTHERS

10.9.1 TEXTILE FIBERS & YARN WASTE

10.9.2 WOOD CHIPS & BIOMASS PELLETS

10.9.3 RUBBER & TIRE RECYCLING MATERIALS

10.9.4 PAPER & PULP MATERIALS

10.9.5 DEFENSE & RELIEF MATERIALS

10.9.6 HOUSEHOLD GOODS BULK TRANSPORT

11 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE

11.1 OVERVIEW

11.2 CHEMICAL MANUFACTURERS (2000)

11.2.1 TYPE C

11.2.2 TYPE B

11.2.3 TYPE D

11.2.4 TYPE A

11.3 AGRICULTURAL PRODUCERS & CO-OPS (0100)

11.3.1 TYPE A

11.3.2 TYPE B

11.3.3 TYPE C

11.3.4 TYPE D

11.4 FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100)

11.4.1 TYPE A

11.4.2 TYPE C

11.4.3 TYPE D

11.4.4 TYPE B

11.5 CONSTRUCTION CONTRACTORS (4100)

11.5.1 TYPE A

11.5.2 TYPE B

11.5.3 TYPE C

11.5.4 TYPE D

11.6 MINING COMPANIES (0100 & 0001)

11.6.1 TYPE A

11.6.2 TYPE C

11.6.3 TYPE D

11.6.4 TYPE B

11.7 PHARMACEUTICAL COMPANIES (2100)

11.7.1 TYPE A

11.7.2 TYPE C

11.7.3 TYPE D

11.7.4 TYPE B

11.8 WASTE MANAGEMENT & RECYCLING FIRMS (3800)

11.8.1 TYPE B

11.8.2 TYPE A

11.8.3 TYPE C

11.8.4 TYPE D

11.9 OTHERS

11.9.1 TYPE A

11.9.2 TYPE B

11.9.3 TYPE C

11.9.4 TYPE D

12 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.2.1 DISTRIBUTORS/DEALERS

12.2.2 ONLINE/E-COMMERCE

12.3 DIRECT

12.3.1 OEM DIRECT SALES

12.3.2 KEY ACCOUNT/ENTERPRISE CONTRACTS

13 ASIA-PACIFIC FIBC PACKAGING MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 INDONESIA

13.1.6 THAILAND

13.1.7 MALAYSIA

13.1.8 AUSTRALIA

13.1.9 PHILIPPINES

13.1.10 TAIWAN

13.1.11 SINGAPORE

13.1.12 NEW ZEALAND

13.1.13 HONG KONG

13.1.14 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC FIBC PACKAGING MARKET

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AMCOR PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVEOPMENT

16.2 IPG.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 GREIF.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LC PACKAGING

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 SONOCO PRODUCTS COMPANY (CONITEX SONOCO)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACTION BAGS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVEOPMENT

16.7 ALPINE FIBC PVT.LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVEOPMENT

16.8 AMERIGLOBE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVEOPMENT

16.9 BIG BAGS INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVEOPMENT

16.1 BAG CORP.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVEOPMENT

16.11 BULK-PACK, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVEOPMENT

16.12 CENTURY FIBC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVEOPMENT

16.13 FIBC SILVASSA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVEOPMENT

16.14 FLEXITUFF VENTURES INTERNATIONAL LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVEOPMENT

16.15 GLOBAL-PAK, INC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVEOPMENT

16.16 IPG.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 İŞBIR MEWAR.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 JUMBO BAG LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 LANGSTON BAG

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PALMETTO INDUSTRIES INTERNATIONAL INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PACIFICBULKBAGS.COM

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 RDA BULK PACKAGING LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 S.R. INDUSTRY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SACKMAKER

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SHANKAR PACKAGINGS LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SHREE MARUTI EXIM

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TAIHUA FIBC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TISZATEXTIL

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 UMASREE TEXPLAST PVT. LTD.

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 WOVEN INTERNATIONAL

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 COMAPANY PROFILES DISTRIBUTOR

17.1 HALSTED CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 BULK BAG DEPOT

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 MIDWESTERN BAG

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 NATIONAL BULK BAG (A SUBSIDIARY COMPANY OF RAPID PACKAGING)

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FIBC DIRECT

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 CONSUMER PREFERENCE MATRIX

TABLE 3 ILLUSTRATIVE PROFIT MARGINS OF FIBC PRODUCTS (2018–2024)

TABLE 4 STAGE OF DEVELOPMENT

TABLE 5 INNOVATION AND STRATEGIC MILESTONES TIMELINE (2018–2024)

TABLE 6 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC TYPE C IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC CIRCULAR / TUBULAR IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC FIBC PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 88 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 90 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 100 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 CHINA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 CHINA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 113 CHINA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 114 CHINA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 115 CHINA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 116 CHINA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 117 CHINA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 118 CHINA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 119 CHINA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 120 CHINA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 121 CHINA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 122 CHINA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 123 CHINA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 124 CHINA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 CHINA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 126 CHINA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 127 CHINA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 128 CHINA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 129 CHINA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 CHINA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 CHINA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 CHINA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 CHINA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CHINA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 CHINA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 CHINA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 CHINA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 CHINA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 139 CHINA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 CHINA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 CHINA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CHINA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 CHINA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 CHINA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 CHINA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 CHINA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 CHINA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 CHINA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 CHINA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 INDIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 152 INDIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 153 INDIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 154 INDIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 155 INDIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 156 INDIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 157 INDIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 158 INDIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 159 INDIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 160 INDIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 161 INDIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 162 INDIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 163 INDIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 INDIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 165 INDIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 166 INDIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 167 INDIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 168 INDIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 169 INDIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 INDIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 INDIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 INDIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 INDIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 INDIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 INDIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 INDIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 178 INDIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 INDIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 INDIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 INDIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 187 INDIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 INDIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 JAPAN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 JAPAN TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 191 JAPAN TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 192 JAPAN TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 193 JAPAN TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 194 JAPAN TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 195 JAPAN TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 196 JAPAN TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 197 JAPAN TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 198 JAPAN FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 199 JAPAN BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 200 JAPAN BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 201 JAPAN U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 202 JAPAN U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 JAPAN FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 204 JAPAN FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 205 JAPAN CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 206 JAPAN CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 207 JAPAN FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 208 JAPAN CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 JAPAN FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 JAPAN AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 JAPAN PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 JAPAN CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 JAPAN MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 JAPAN WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 JAPAN OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 JAPAN FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 217 JAPAN CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 JAPAN AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 JAPAN FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 JAPAN CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 JAPAN MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 JAPAN PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 JAPAN WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 JAPAN OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 JAPAN FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 226 JAPAN INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 JAPAN DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 SOUTH KOREA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SOUTH KOREA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 230 SOUTH KOREA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 231 SOUTH KOREA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 232 SOUTH KOREA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 233 SOUTH KOREA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 234 SOUTH KOREA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 235 SOUTH KOREA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 236 SOUTH KOREA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 237 SOUTH KOREA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 238 SOUTH KOREA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 239 SOUTH KOREA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 240 SOUTH KOREA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 241 SOUTH KOREA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 SOUTH KOREA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 243 SOUTH KOREA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 244 SOUTH KOREA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 245 SOUTH KOREA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 246 SOUTH KOREA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 247 SOUTH KOREA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 SOUTH KOREA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 SOUTH KOREA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 SOUTH KOREA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 SOUTH KOREA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 SOUTH KOREA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 SOUTH KOREA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 SOUTH KOREA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 SOUTH KOREA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 256 SOUTH KOREA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 SOUTH KOREA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 SOUTH KOREA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 SOUTH KOREA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 SOUTH KOREA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 SOUTH KOREA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 SOUTH KOREA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 SOUTH KOREA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 SOUTH KOREA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 265 SOUTH KOREA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 SOUTH KOREA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 INDONESIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 INDONESIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 269 INDONESIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 270 INDONESIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 271 INDONESIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 272 INDONESIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 273 INDONESIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 274 INDONESIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 275 INDONESIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 276 INDONESIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 277 INDONESIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 278 INDONESIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 279 INDONESIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 280 INDONESIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 INDONESIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 282 INDONESIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 283 INDONESIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 284 INDONESIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 285 INDONESIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 286 INDONESIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 INDONESIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 INDONESIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 INDONESIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 INDONESIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 INDONESIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 INDONESIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 INDONESIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 295 INDONESIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 INDONESIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 INDONESIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 INDONESIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 INDONESIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 300 INDONESIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 INDONESIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 INDONESIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 INDONESIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 304 INDONESIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 INDONESIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 THAILAND FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 THAILAND TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 308 THAILAND TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 309 THAILAND TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 310 THAILAND TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 311 THAILAND TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 312 THAILAND TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 313 THAILAND TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 314 THAILAND TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 315 THAILAND FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 316 THAILAND BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 317 THAILAND BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 318 THAILAND U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 319 THAILAND U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 THAILAND FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 321 THAILAND FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 322 THAILAND CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 323 THAILAND CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 324 THAILAND FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 THAILAND CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 THAILAND FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 327 THAILAND AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 THAILAND PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 THAILAND CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 330 THAILAND MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 THAILAND WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 THAILAND OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 THAILAND FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 334 THAILAND CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 THAILAND AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 THAILAND FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 THAILAND CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 THAILAND MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 339 THAILAND PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 340 THAILAND WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 341 THAILAND OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 342 THAILAND FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 343 THAILAND INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 THAILAND DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 345 MALAYSIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 MALAYSIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 347 MALAYSIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 348 MALAYSIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 349 MALAYSIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 350 MALAYSIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 351 MALAYSIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 352 MALAYSIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 353 MALAYSIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 354 MALAYSIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 355 MALAYSIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 356 MALAYSIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 357 MALAYSIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 358 MALAYSIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 359 MALAYSIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 360 MALAYSIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 361 MALAYSIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 362 MALAYSIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 363 MALAYSIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 364 MALAYSIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 365 MALAYSIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 366 MALAYSIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 367 MALAYSIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 368 MALAYSIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 369 MALAYSIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)