Asia Pacific Health Insurance Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

394,264.38 Million

USD

564,990.33 Million

2022

2030

USD

394,264.38 Million

USD

564,990.33 Million

2022

2030

| 2023 –2030 | |

| USD 394,264.38 Million | |

| USD 564,990.33 Million | |

|

|

|

Asia-Pacific Health Insurance Market, By Type (Product, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, Others) – Industry Trends and Forecast to 2030.

Asia-Pacific Health Insurance Market Analysis and Size

The growth of the health insurance market is one of the huge developments, changing the relationship between patients, providers, and insurers in many Asian countries. Growing costs for medical services and the increasing number of daycare methods are some of the main factors increasing the market growth. Furthermore, the elderly population is anticipated to support the growing demand for long-term investment, health, and retirement coverage as they shift towards secured protection and investment policies.

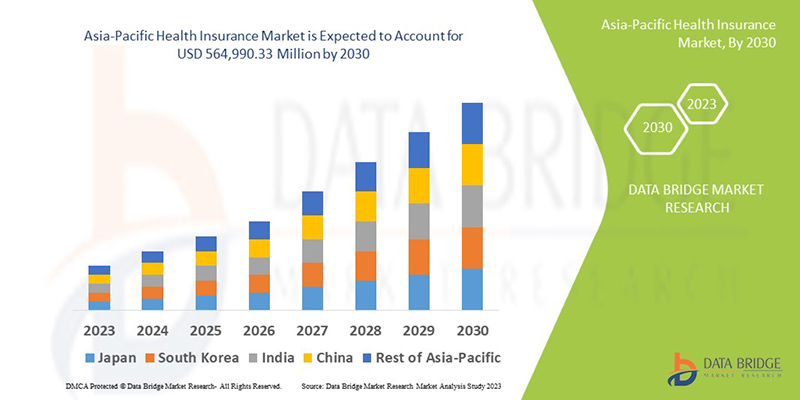

Data Bridge Market Research analyses a growth rate in the health insurance market in the forecast period 2023-2030. The expected CAGR of the health insurance market is around 4.6% in the mentioned forecast period. The market is valued at USD 394,264.38 million in 2022 and will grow to USD 564,990.33 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Asia-Pacific Health Insurance Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Product, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, Others) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

Cigna (U.S.), Bupa (U.K.), Now Health International (China), Aetna Inc. (U.S.), AXA (France), HBF Health Limited (Australia), International Medical Group, Inc. (U.S.), Allianz Care (Ireland), HealthCare International Global Network Limited (U.K.), Aviva (U.K.), MAPFRE (Spain) |

|

Market Opportunities |

|

Market Definition

Health insurance provides coverage for several kinds of surgical expenses and medical treatment suffered from any sort of disease or injury. It applies to a widespread range of medical services that cover specific services' full or partial costs. It provides financial support to the customers as it covers all the medical expenses when the respective person is hospitalized for treatment. It also covers the cost of pre as well as post-hospitalization expenses.

Asia-Pacific Health Insurance Market Dynamics

Drivers

- Increasing Rate of Daycare Procedures

Daycare procedures are in higher demand as they require less hospital stay time. The majority of health insurance companies are now covering daycare procedures in their insurance plans. There is no pressure to spend 24 hours in the hospital to avail this service. The policyholders can also claim daycare procedures under their health insurance policy even though many of the health insurance plans include hospital stays and major surgeries, which is anticipated to boost the market demand.

- Extensive Benefits of Health Insurance Plans

The huge benefits associated with health insurance plans are leading the market growth since more and more people are adopting them. In health insurance plans, the policyholder gets reimbursement for their medical expenses, such as surgeries, hospitalization, and treatments. Increasing accidents and major prolonged treatments benefit most from these plans as the insurance company agrees to guarantee payment for the treatment costs. Thus, the advantages of health insurance policies increase the market's growth.

Opportunities

- Growing Prevalence of the Elderly Population

The increasing rate of the aged population is boosting market growth. According to WHO, the population in South-East Asia Region is aging vastly. The proportion of people aged over 60 years or above was 9.8% in 2017, and it will be increased to 13.7% and 20.3% by 2030 and by 2050, respectively. Japan is one of the oldest countries, and aging continues rapidly. A lot of the elderly population is getting relied on insurance activities and is investing in health insurance policies that give them a sense of security. Thus, this factor boosts the growth of the market.

- Huge Expenditure on Medical Surgeries and Treatment

Health insurance offers financial support with regard to serious sickness or accident. Growing medical services' costs for surgeries and hospital stays has necessitated several new financial aids in this region. The cost of medical services consists of surgery, hospital stay, doctor fees, diagnostic testing, and emergency room, among others. Around 60% of all bankruptcies are associated with medical expenses, particularly for those families who don't have health insurance plans or have limited budgets. It has been witnessed that the high cost of medical services has burdened the patients, and in this regard, health insurance helps the victims and their families as it provides financial support to the patients. Therefore, this factor increases the growth of the market

Restraints/Challenges

- High Cost of Insurance Premiums

Health insurance incurs several types of medical treatment costs. It also covers pre and post-hospitalization expenses. The policyholder has to pay insurance premiums recurrently to keep the policy active for purchasing health insurance. The cost of insurance premium is more in most cases on the basis of the insurance plan, which is anticipated to impede the market's growth.

This health insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the health insurance market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Aetna Inc. announced the update of its policy for infectious diseases, including COVID-19, to support its members' physical health. This development assists the company in serving more customers and increasing the company portfolio.

Asia-Pacific Health Insurance Market Scope

The health insurance market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Product

- Solutions

Services

- Inpatient Treatment

- Outpatient Treatment

- Medical Assistance

- Others

Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

Service Providers

- Public Health Insurance Providers

- Private Health Insurance Providers

Health Insurance Plans

- Point of Service (POS)

- Exclusive Provider Organization (EPOS)

- Indemnity Health Insurance, Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Others

Demographics

- Adults

- Minors

- Senior Citizens

Coverage Type

- Lifetime Coverage

- Term Coverage

End User

- Corporates

- Individuals

- Others

Distribution Channel

- Direct Sales

- Financial Institutions

- E-commerce

- Hospitals

- Clinics

- Others

Health Insurance Market Regional Analysis/Insights

The health insurance market is analyzed and market size insights and trends are provided by type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel as referenced above.

The major countries covered in the health insurance market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China dominates the market as private healthcare provides feasibility to book appointments, shorter waiting times, access to state-of-the-art equipment, better treatments, and medication. Also, increasing demand for health insurance from the corporate sector is further boosting the growth in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The health insurance market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for health insurance market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the health insurance market. The data is available for historic period 2011-2021.

Competitive Landscape and Asia-Pacific Health Insurance Market Share Analysis

The health insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to health insurance market

Key players operating in the health insurance market include:

- Cigna (U.S.)

- Bupa (U.K.)

- Now Health International (China)

- Aetna Inc. (U.S.), AXA (France)

- HBF Health Limited (Australia)

- International Medical Group, Inc. (U.S.)

- Allianz Care (Ireland)

- HealthCare International Global Network Limited (U.K.)

- Aviva (U.K.)

- MAPFRE (Spain)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.