Asia Pacific Metal Injection Molding Mim Powders And Feedstock Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.00 Billion

USD

2.32 Billion

2025

2033

USD

1.00 Billion

USD

2.32 Billion

2025

2033

| 2026 –2033 | |

| USD 1.00 Billion | |

| USD 2.32 Billion | |

|

|

|

|

Segmentação do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico, por tipo de material (pós de aço inoxidável, pós de aço de baixa liga, pós à base de níquel e cobalto, pós de titânio e outros), método de produção (atomização a gás, atomização a água, liga mecânica e outros métodos (plasma, ultrassom)), aplicação (automotiva, médica e odontológica, máquinas industriais, eletrônicos de consumo, aeroespacial, armas de fogo e defesa e outras), usuário final (eletrônica e elétrica, OEMs automotivos, dispositivos médicos, equipamentos industriais, defesa e aeroespacial e outros), canal de distribuição (vendas diretas, distribuidores) - Tendências e previsões do setor até 2033.

Tamanho do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

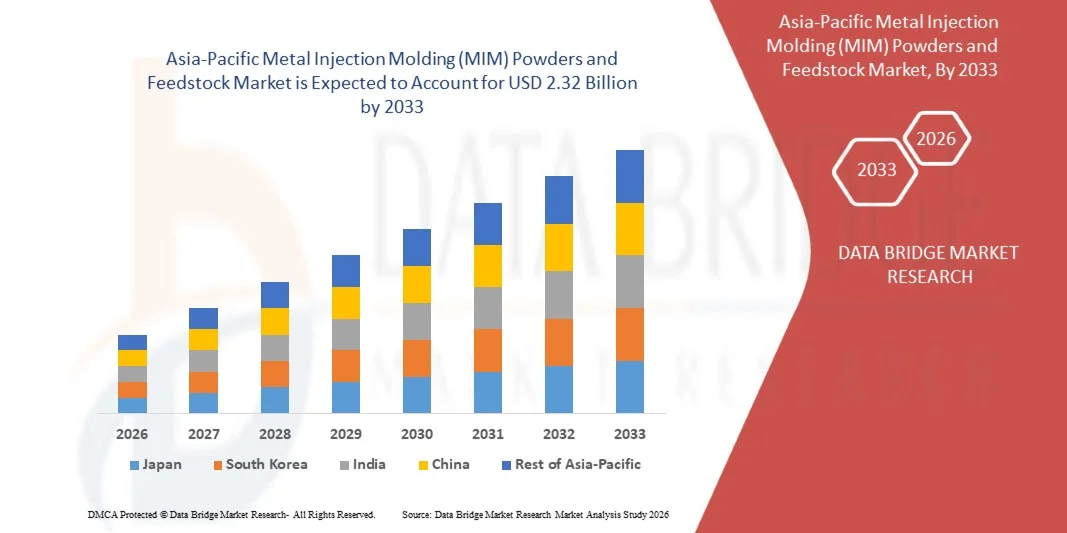

- O mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico foi avaliado em US$ 1 bilhão em 2025 e deverá atingir US$ 2,32 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 11,1% durante o período de previsão.

- Os pós e matérias-primas para MIM representam uma classe especializada de pós metálicos finos e esféricos — principalmente aços inoxidáveis, aços de baixa liga, ligas magnéticas macias, titânio e materiais à base de níquel — combinados com aglutinantes termoplásticos para permitir a fabricação de peças complexas com formato próximo ao final. Essa tecnologia preenche a lacuna entre a moldagem por injeção de plástico e a conformação de metais convencional, oferecendo tolerâncias rigorosas, alta utilização de material e custo-benefício para geometrias complexas que não seriam economicamente viáveis por usinagem.

- Os processos de produção, dominados pela atomização a gás para pós e pela mistura controlada de matérias-primas, garantem distribuição uniforme do tamanho das partículas, alta fluidez e comportamento de sinterização consistente. Esses atributos são essenciais para aplicações críticas, como componentes de transmissão automotiva, implantes médicos e odontológicos, braquetes ortodônticos, instrumentos cirúrgicos, invólucros eletrônicos, conectores, peças de armas de fogo e subsistemas aeroespaciais que exigem precisão dimensional e confiabilidade mecânica.

Análise do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

- Os pós e matérias-primas para MIM (Moldagem por Injeção de Metal), produzidos por meio de atomização a gás e mistura precisa de aglutinantes, permitem a fabricação em larga escala de componentes complexos com formato próximo ao final. Na região Ásia-Pacífico, a demanda concentra-se em sistemas automotivos e de veículos elétricos, eletrônicos de consumo, máquinas industriais, dispositivos médicos e aplicações de defesa, apoiados por ecossistemas de manufatura em larga escala, mas desafiados pelos requisitos de controle de qualidade das matérias-primas e pelas operações de sinterização com alto consumo de energia.

- O crescimento do mercado é impulsionado pela rápida eletrificação de veículos, pela produção em larga escala de eletrônicos de consumo e pela expansão da fabricação de dispositivos médicos, sustentada pelo aumento dos gastos com saúde. Programas de incentivo à manufatura apoiados pelo governo, políticas industriais voltadas para a exportação e investimentos em infraestrutura de manufatura avançada estão fortalecendo as cadeias de suprimentos regionais de MIM (Metal Injetor Molding), com oportunidades em pós metálicos reciclados, matérias-primas com baixo teor de aglutinante e integração híbrida de MIM com manufatura aditiva.

- Prevê-se que a China domine o mercado de pós e matérias-primas para MIM na região Ásia-Pacífico em 2026, detendo uma participação estimada em 40,25%, impulsionada por sua extensa base de produção automotiva e de veículos elétricos, liderança global na fabricação de eletrônicos de consumo, processamento de pós com custos competitivos e adoção em larga escala da tecnologia MIM em componentes industriais e eletrônicos.

- Prevê-se que a Austrália seja o mercado de crescimento mais rápido na região Ásia-Pacífico, expandindo a uma taxa composta de crescimento anual (CAGR) de aproximadamente 12,8%, impulsionada pela crescente demanda por componentes de precisão em dispositivos médicos, aplicações aeroespaciais e de defesa, equipamentos de mineração e pelo aumento dos investimentos em capacidades avançadas de fabricação e processamento de materiais.

- Prevê-se que os pós de aço inoxidável dominem o mercado global de pós e matérias-primas para MIM em 2026, representando aproximadamente 63,21% da demanda total, devido à sua relação custo-benefício, resistência à corrosão e desempenho consistente de sinterização em aplicações automotivas, médicas, eletrônicas e industriais.

Escopo do relatório e segmentação do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico.

|

Atributos |

Análise do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico: principais insights |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem a análise das cinco forças de Porter, desafios e barreiras, análise comparativa/benchmarking, análise de despesas de capital (CAPEX) e operacionais (OPEX) para uma capacidade de produção de pó metálico de 20.000 toneladas/ano, análise de custos, cobertura de matérias-primas, análise da cadeia de suprimentos, avanços tecnológicos, análise da cadeia de valor, rastreador de inovação e análise estratégica, principais participantes por categoria de produto, tarifas e seu impacto no mercado, e cobertura regulatória. |

Tendências do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

“Adoção crescente de pós MIM 316L e 17-4PH em dispositivos médicos e cirúrgicos”

- A crescente complexidade dos procedimentos cirúrgicos e o rápido avanço da tecnologia médica aceleraram significativamente a demanda global por pós metálicos de alto desempenho, especificamente o 316L e o 17-4PH.

- A biocompatibilidade excepcional e a resistência à corrosão do aço 316L, aliadas à elevada resistência mecânica e ao desgaste do aço 17-4PH, posicionaram essas ligas como os principais materiais para dispositivos médicos de próxima geração.

- A trajetória ascendente na produção de instrumentos médicos complexos — caracterizada pela busca por miniaturização e materiais compatíveis com esterilização — consolidou o papel dos pós 316L e 17-4PH na indústria de moldagem por injeção de metal (MIM).

- Normas regulamentares rigorosas e requisitos de certificação para dispositivos implantáveis e cirúrgicos estão acelerando a adoção de materiais comprovados de grau MIM, como o 316L e o 17-4PH, visto que essas ligas oferecem desempenho bem documentado, comportamento de sinterização repetível e conformidade estabelecida com os padrões internacionais de materiais médicos.

- A relação custo-benefício e a capacidade de produção em larga escala da tecnologia MIM, utilizando pós de aço inoxidável 316L e 17-4PH, estão impulsionando uma adoção mais ampla em sistemas de saúde globais. Isso permite que os fabricantes produzam componentes médicos complexos e de alta precisão em grande escala, mantendo a qualidade consistente e reduzindo o desperdício de usinagem e os custos gerais de produção.

Dinâmica do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

Motorista

“A miniaturização de componentes automotivos e de veículos elétricos aumenta a demanda por peças complexas fabricadas por injeção de metal (MIM).”

- A indústria automotiva global está passando por uma transformação estrutural impulsionada pela eletrificação dos veículos e pela crescente miniaturização de componentes. À medida que as plataformas de motores de combustão interna (MCI) são progressivamente substituídas por veículos elétricos (VEs) e veículos elétricos híbridos (VEHs), a demanda está migrando de peças de motor grandes e mecanicamente complexas para componentes metálicos compactos, de alta precisão e multifuncionais. A moldagem por injeção de metal (MIM) tornou-se uma tecnologia essencial nessa transição, pois permite a produção economicamente viável de geometrias complexas utilizando materiais como o 316L e o 17-4PH, cuja fabricação por usinagem convencional seria inviável do ponto de vista econômico.

- Ao mesmo tempo, as iniciativas de redução de peso na indústria automotiva, visando aumentar a autonomia dos veículos elétricos, juntamente com a rápida proliferação de sensores miniaturizados para Sistemas Avançados de Assistência ao Condutor (ADAS), estão acelerando a adoção de componentes fabricados por MIM (Moldagem por Injeção de Metal). Essas tendências estão aumentando diretamente a demanda global por pós e matérias-primas especializadas para MIM, otimizadas para precisão, resistência e estabilidade dimensional.

- Por exemplo, em julho de 2024, o Grupo Sandvik destacou em seu relatório industrial que, embora os veículos elétricos tenham menos peças móveis no total do que os veículos com motor de combustão interna, os componentes restantes são significativamente mais complexos e especializados. O relatório observou especificamente que os principais fabricantes de veículos elétricos estão cada vez mais migrando para designs consolidados e "monolíticos" que exigem ferramentas de alta precisão e pós de grau MIM para atingir a complexidade de forma final e a redução de peso necessárias.

- A partir de 2025, a INDO-MIM expandiu sua divisão automotiva para se concentrar na produção em larga escala de componentes "inteligentes", como carcaças de sensores LiDAR, palhetas de turbocompressores e conectores de motores elétricos. Utilizando pó de 17-4PH, a empresa produz peças que mantêm alta permeabilidade magnética e resistência estrutural com uma fração do peso das peças fundidas tradicionais, apoiando a miniaturização da eletrônica de propulsão de veículos elétricos.

- Em maio de 2024, a publicação "Meet Sandvik" da Sandvik enfatizou que os futuros carros elétricos exigirão "menos componentes, porém mais complexos e caros". A transição para veículos elétricos a bateria (BEVs) está criando um aumento na demanda por "metais para eletrificação" e pós de aço inoxidável especializados, usados na produção de gaiolas de bateria de alta densidade e eixos de motor compactos que exigem a precisão de forma quase final do processo MIM.

Restrição

“A volatilidade dos preços do níquel, cobalto e titânio afeta a estabilidade do custo do pó”

- A volatilidade dos preços dos principais metais utilizados na fabricação de insumos — níquel, cobalto e titânio — representa um desafio substancial para a estabilidade de custos no mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico. Esses metais são componentes fundamentais de muitas matérias-primas para MIM, especialmente aços inoxidáveis (como o 17-4PH), superligas e pós à base de titânio utilizados em aplicações médicas, aeroespaciais e de alto desempenho. As flutuações de seus preços afetam o custo de aquisição da matéria-prima, a estratégia de estoque, os mecanismos de precificação e, em última instância, as margens de lucro dos fabricantes.

- Por exemplo, em março de 2022, de acordo com a Autoridade de Conduta Financeira (FCA), os preços do níquel na Bolsa de Metais de Londres (LME) quase quadruplicaram em poucos dias devido ao extremo estresse do mercado, levando a bolsa a suspender as negociações e cancelar várias horas de transações. A alta sem precedentes nos preços e a consequente suspensão evidenciaram a vulnerabilidade dos mecanismos de precificação do níquel que sustentam os custos das ligas relevantes para matérias-primas de metalurgia do pó (MIM) que contêm ligas ricas em níquel, como o 316L e o 17-4PH.

- Em março de 2025, de acordo com a Autoridade de Conduta Financeira (FCA), o órgão regulador do Reino Unido impôs uma multa de £ 9,2 milhões à LME por sua gestão do caos no mercado de níquel em 2022, observando que aumentos de preços superiores a 100% em curtos períodos "minaram a ordem e a confiança no mercado da LME". Essas constatações regulatórias refletem como eventos voláteis nos preços dos metais básicos podem ter impactos duradouros nos mercados globais de commodities metálicas, influenciando, em última instância, os custos das matérias-primas.

- Em março de 2025, o Relatório de Mercadorias Minerais de Titânio do USGS observou flutuações na produção de esponja de titânio alinhadas com a recuperação da demanda aeroespacial, resultando em pressão intermitente sobre os preços dos pós de titânio metálico usados em componentes MIM para aplicações médicas e aeroespaciais.

- Em novembro de 2025, a Outokumpu, uma importante produtora de aço inoxidável, reiterou em suas divulgações públicas sobre a sobretaxa de liga que as rápidas oscilações nos preços do níquel exigem ajustes frequentes de preços, impactando indiretamente as cadeias de valor baseadas em pó que dependem de aço inoxidável fundido para a produção de matéria-prima para moldagem por injeção de metal (MIM).

- Em agosto de 2023, o Departamento de Energia dos EUA identificou o cobalto e o níquel como minerais críticos vulneráveis a perturbações geopolíticas e impulsionadas pela demanda, observando que a volatilidade dos preços desses metais exerce pressão sobre os custos subsequentes nas cadeias de suprimentos da indústria de manufatura avançada, incluindo a metalurgia do pó e os produtores de matéria-prima para a moldagem por injeção de metal (MIM).

Em conjunto, esses exemplos ressaltam que a volatilidade dos preços do níquel, cobalto e titânio representa uma restrição estrutural para o mercado global de pós e matérias-primas para a fabricação por moldagem por injeção de metal (MIM). As fortes flutuações nesses metais críticos não apenas elevam os custos das matérias-primas, mas também complicam o planejamento de compras, a gestão de estoques e as estratégias de precificação para os produtores de matérias-primas. Apesar de estratégias de mitigação, como sobretaxas para ligas, contratos de fornecimento de longo prazo e estocagem estratégica, a imprevisibilidade inerente a esses metais continua a exercer pressão sobre a estabilidade de custos. À medida que a adoção da MIM cresce em aplicações médicas, aeroespaciais e de alto desempenho, gerenciar o impacto da volatilidade dos metais básicos na cadeia de suprimentos permanece um desafio crucial para os fabricantes que buscam um fornecimento consistente de matérias-primas de alta qualidade.

Escopo do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

O mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico está segmentado em cinco segmentos principais com base no tipo de material, método de produção, aplicação, usuário final e canal de distribuição.

- Por tipo de material

Com base no tipo de material, o mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é segmentado em pós de aço inoxidável, pós de aço de baixa liga, pós à base de níquel e cobalto, pós de titânio e outros. Em 2026, espera-se que os pós de aço inoxidável dominem o mercado com uma participação de 63,21%, devido ao seu excelente equilíbrio entre resistência mecânica, resistência à corrosão e custo-benefício, além de sua ampla adoção em aplicações automotivas, médicas, de eletrônicos de consumo e de máquinas industriais. A compatibilidade do material com o processamento MIM de alto volume e o comportamento consistente de sinterização reforçam ainda mais sua posição dominante no mercado.

O segmento de pós de titânio está crescendo com a maior taxa composta de crescimento anual (CAGR) de 12,6%, devido à excepcional relação resistência/peso e à resistência à corrosão, fatores que impulsionam a crescente adoção de pós de titânio em aplicações aeroespaciais, médicas, automotivas e de defesa, onde leveza, durabilidade e longa vida útil são requisitos de desempenho críticos.

- Por método de produção

Com base no método de produção, o mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é segmentado em atomização a gás, atomização a água, liga mecânica e outros métodos (plasma, ultrassom). Em 2026, espera-se que a atomização a gás domine o mercado com uma participação de 59,51%, devido à sua esfericidade superior do pó, distribuição controlada do tamanho das partículas e fluidez aprimorada, características essenciais para a obtenção de componentes MIM de alta densidade e sem defeitos. A crescente demanda por peças de precisão com tolerâncias rigorosas em aplicações automotivas, médicas e aeroespaciais continua impulsionando a adoção de pós atomizados a gás.

O segmento de ligas mecânicas está crescendo com a maior taxa composta de crescimento anual (CAGR) de 11,7%, devido à crescente demanda por sistemas de ligas avançadas e fora do equilíbrio, o que impulsiona a adoção da liga mecânica. Esse processo permite a produção de pós ultrafinos, nanoestruturados e reforçados por dispersão, algo que não pode ser obtido por meio de rotas convencionais de fusão ou atomização a gás.

- Por meio de aplicação

Com base na aplicação, o mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é segmentado em Automotivo, Médico e Odontológico, Maquinário Industrial, Eletrônicos de Consumo, Aeroespacial, Armas de Fogo e Defesa, e Outros. Em 2026, espera-se que o setor automotivo domine o mercado com 30,34% de participação, devido ao crescente uso da tecnologia MIM para componentes leves, de alta resistência e com formatos complexos, que contribuem para a eficiência de combustível, redução de emissões e otimização de desempenho. A crescente adoção de veículos elétricos e híbridos impulsiona ainda mais a demanda por componentes metálicos de precisão fabricados por meio de processos MIM.

O segmento Médico e Odontológico está crescendo com a maior taxa composta de crescimento anual (CAGR) de 11,9%, devido ao rápido envelhecimento da população mundial e ao aumento dos gastos com saúde, que elevam o volume de procedimentos cirúrgicos, intervenções ortopédicas e tratamentos odontológicos, impulsionando diretamente a demanda por componentes metálicos de alta precisão produzidos por meio de Moldagem por Injeção de Metal (MIM).

- Por usuário final

Com base no usuário final, o mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é segmentado em Eletrônica e Elétrica, Fabricantes de Equipamentos Originais Automotivos (OEMs), Dispositivos Médicos, Equipamentos Industriais, Defesa e Aeroespacial e Outros. Em 2026, espera-se que o segmento de Eletrônica e Elétrica domine o mercado com uma participação de 36,75%, devido à crescente demanda por componentes metálicos miniaturizados e de alta precisão utilizados em conectores, carcaças, sensores e peças estruturais. A necessidade de produção em alto volume com qualidade consistente e tolerâncias dimensionais rigorosas impulsiona fortemente a adoção de pós e matérias-primas para MIM nesse segmento de usuários finais.

O segmento de Equipamentos Industriais está crescendo com a maior taxa composta de crescimento anual (CAGR) de 11,7%, devido à aceleração da adoção da automação industrial e da manufatura inteligente, que estão aumentando a demanda por componentes metálicos duráveis e de alta precisão usados em robótica, atuadores, sensores, válvulas e sistemas de controle de movimento, onde a MIM (Metal Information Molding) permite geometrias complexas e tolerâncias rigorosas em larga escala.

- Por canal de distribuição

Com base no canal de distribuição, o mercado global de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é segmentado em vendas diretas e distribuidores. Em 2026, espera-se que as vendas diretas dominem o mercado, visto que grandes fabricantes de equipamentos originais (OEMs) e fornecedores de primeiro nível preferem cada vez mais o contato direto com os fabricantes de pós e matérias-primas para garantir a personalização do material, qualidade consistente, suporte técnico e contratos de fornecimento de longo prazo para programas de produção em larga escala.

O segmento de Vendas Diretas está crescendo com a maior taxa composta de crescimento anual (CAGR) de 11,2%, devido à crescente demanda por sistemas de ligas avançadas e fora do equilíbrio, o que impulsiona a adoção da moagem mecânica. Esse processo permite a produção de pós ultrafinos, nanoestruturados e reforçados por dispersão, algo que não pode ser obtido por meio de rotas convencionais de fusão ou atomização a gás.

Análise do mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

- A China domina o mercado de pós e matérias-primas para MIM na região Ásia-Pacífico, representando aproximadamente 40,25% do mercado em 2026 e registrando uma taxa de crescimento anual composta (CAGR) de cerca de 10,9% durante o período de 2026 a 2033.

- O crescimento é impulsionado pela extensa base de fabricação automotiva e de eletrônicos de consumo da China, pelas cadeias de suprimentos MIM verticalmente integradas e pela produção doméstica em larga escala de aço inoxidável e pós de baixa liga.

- A forte demanda por veículos elétricos, automação industrial, eletrônicos de consumo, dispositivos médicos e aplicações de defesa — combinada com investimentos contínuos em manufatura avançada, ferramentas e capacidade de atomização de pó — continua a reforçar a posição de liderança da China no mercado regional de MIM (Metal Information Molding).

Análise do Mercado de Pós e Matérias-Primas para Moldagem por Injeção de Metal (MIM) na Austrália e na Região Ásia-Pacífico

A Austrália deverá apresentar a maior taxa de crescimento no mercado de pós e matérias-primas para MIM na região Ásia-Pacífico, com uma taxa de crescimento anual composta (CAGR) projetada de aproximadamente 12,8% entre 2026 e 2033, impulsionada pelo aumento dos investimentos em manufatura avançada, programas aeroespaciais e de defesa, produção de dispositivos médicos e equipamentos industriais de alto valor agregado. Iniciativas governamentais que apoiam a capacidade de manufatura soberana, a localização da produção para a defesa e o desenvolvimento de materiais críticos estão acelerando a adoção de tecnologias de manufatura de precisão, incluindo a MIM. A crescente demanda por componentes metálicos de alto desempenho, resistentes à corrosão e leves, combinada com o aumento das capacidades locais em engenharia de precisão e processamento de materiais, está impulsionando o consumo de pós e matérias-primas para MIM em toda a Austrália.

Análise do Mercado de Pós e Matérias-Primas para Moldagem por Injeção de Metal (MIM) na Região Ásia-Pacífico, Japão

O Japão representa um mercado maduro, porém em constante crescimento, no cenário de pós e matérias-primas para MIM (Metal-In-Modeling) na região Ásia-Pacífico, impulsionado por sua liderança em engenharia de precisão, sistemas automotivos, eletrônicos de consumo e fabricação de dispositivos médicos. O crescimento é impulsionado pela forte demanda por componentes metálicos miniaturizados de alta precisão, utilizados em veículos elétricos, eletrônicos avançados, robótica e instrumentos cirúrgicos. A consolidada expertise japonesa em ciência de materiais, os rigorosos padrões de qualidade e os investimentos contínuos em tecnologias avançadas de metalurgia do pó, ferramentas e sinterização reforçam a adoção de pós e matérias-primas de alta qualidade para MIM. O foco do país em automação, manufatura de alto valor agregado e aplicações críticas para a confiabilidade continua a sustentar o crescimento da demanda dentro do ecossistema regional de MIM.

Participação de mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

O mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico é liderado principalmente por empresas consolidadas, incluindo:

- Linde PLC (Reino Unido)

- BASF (Alemanha)

- Epson Atmix Corporation (Japão)

- Sandvik AB (Suécia)

- CRS Holdings, LLC (Carpenter Technology) (EUA)

- Tecnologia Avançada e Materiais Co., Ltda. (China)

- AMETEK Inc. (EUA)

- Pó CNPC (Canadá)

- Hoganas AB (Suécia)

- Tronox Holdings Plc (EUA)

- OC Oerlikon Management AG (Suíça)

- Pometon SPA (Itália)

- Metalurgia do Pó GKN (Reino Unido)

- MITSUBISHI STEEL MFG. CO., LTD. (Japão)

- Rio Tinto (Reino Unido)

Últimos desenvolvimentos no mercado de pós e matérias-primas para moldagem por injeção de metal (MIM) na região Ásia-Pacífico

- Em abril de 2024, a Linde Advanced Material Technologies (AMT) anunciou um acordo de licenciamento com a NASA para o revolucionário pó metálico de liga GRX-810, possibilitando a comercialização para aplicações de manufatura aditiva e MIM na indústria aeroespacial.

- Em setembro de 2025, a Linde AMT firmou uma parceria com a Velo3D para fornecer pó de CuNi (70-30 Cobre-Níquel) produzido internamente em sua unidade de Indiana, apoiando a construção naval da Marinha dos EUA por meio de processos MIM e aditivos para componentes resistentes à corrosão.

- Em fevereiro de 2025, a BASF lançou o Catamold motion 8620, uma nova matéria-prima de baixa liga que utiliza pós pré-ligados atomizados a gás para melhorar o desempenho da moldagem por injeção de metal (MIM) em aplicações estruturais.

- Em junho de 2025, a Epson Atmix iniciou as operações em sua nova planta de reciclagem de metais de US$ 38 milhões na Kita-Inter Plant No. 2. Essa instalação refina sucata metálica e pós fora de especificação do Grupo Epson em matéria-prima MIM de alta qualidade, apoiando a produção sustentável de dispositivos com eficiência energética.

- Em abril de 2025, a Epson Atmix firmou uma parceria com a Epson Europe Electronics GmbH para expandir a distribuição de pó MIM na Europa para aplicações de TI, automotivas e médicas. A colaboração visa atender à crescente demanda por tecnologias 5G e de direção autônoma.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 CHALLENGES AND BARRIERS

4.2.1 TECHNICAL CHALLENGES: POWDER PRODUCTION AND FEEDSTOCK MANUFACTURING

4.2.2 CONSTRAINTS

4.2.3 SUPPLY-CHAIN CHALLENGES

4.2.3.1 CERTIFICATION REQUIREMENTS

4.2.3.2 QUALITY EXPECTATIONS

4.2.4 CUSTOMER QUALIFICATION CYCLE AND VALIDATION CHALLENGES

4.3 COMPARATIVE ANALYSIS/ BENCHMARKING

4.3.1 INTRODUCTION

4.3.2 OVERVIEW ON MIM VS. AM POWDERS

4.3.3 ASIA-PACIFIC SUPPLIERS ANALYSIS AND PRICING COMPARISON

4.3.3.1 MIM POWDERS

4.3.3.1.1 COMPANY NAMES

4.3.3.1.2 PRODUCT PORTFOLIO

4.3.3.2 FEEDSTOCK

4.3.3.2.1 COMPANY NAMES

4.3.3.2.2 PRODUCT PORTFOLIO

4.3.4 SUPPLIER PRICING BENCHMARKING

4.3.4.1 DOMESTIC VS INTERNATIONAL

4.3.4.2 REASONS FOR PRICE DIFFERENCES BETWEEN SUPPLIERS

4.4 ANALYSIS ON CAPEX & OPEX, FOR METAL POWDER PRODUCTION CAPACITY OF 20,000 TONNE/YEAR

4.4.1 INTRODUCTION

4.4.2 CAPEX ANALYSIS FOR POWDER MANUFACTURING & FEEDSTOCK COMPOUNDING

4.4.2.1 Land & Infrastructure

4.4.2.2 Process Equipment

4.4.2.3 Utilities & Ancillaries

4.4.2.4 Indirect & Soft Costs

4.4.3 OPEX ANALYSIS FOR YEARLY OPERATIONS

4.4.3.1 Raw Materials

4.4.3.2 Utilities & Energy

4.4.3.3 Labor & Administration

4.4.3.4 Maintenance

4.4.3.5 Consumables & Packaging

4.4.3.6 Overheads & Miscellaneous

4.4.3.7 Profitability Indicators

4.4.3.7.1 Break-Even Analysis

4.4.3.8 Return on Investment (ROI)

4.4.3.9 Payback Analysis

4.5 COSTING ANALYSIS

4.5.1 POWDER COST BREAKDOWN

4.5.1.1 RAW MATERIALS (~40-60% of Powder Cost)

4.5.1.2 ATOMIZATION (~15-25% OF POWDER COST)

4.5.1.3 CLASSIFICATION (~10-20% of Powder Cost)

4.5.1.4 ALLOYING (~5-15% of Powder Cost)

4.5.1.5 QUALITY ASSURANCE AND QUALITY CONTROL (QA/QC) (~5-10% of Powder Cost)

4.5.1.6 BINDER INGREDIENTS (~15-25% of Feedstock Cost)

4.5.1.7 COMPOUNDING (~20-30% of Feedstock Cost)

4.5.1.8 PELLETIZING (~8-15% of Feedstock Cost)

4.5.1.9 PACKAGING (~5-15% of Feedstock Cost)

4.5.2 NUMERIC COST RANGES BY ALLOY (USD/KG)

4.6 RAW MATERIAL COVERAGE

4.6.1 INTRODUCTION

4.6.2 POWDER

4.6.2.1 POWDER CHARACTERISTICS

4.6.2.2 GRADES USED IN MIM

4.6.2.3 ANNUAL CONSUMPTION TRENDS

4.6.3 FEEDSTOCK FORMULATION TRENDS

4.6.3.1 BINDER SYSTEMS

4.6.3.2 POWDER LOADING

4.6.3.3 COMPOUNDING METHODS

4.6.4 DEMAND FORECAST ANALYSIS

4.6.4.1 MIM POWDERS

4.6.4.2 FEEDSTOCK

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENT

4.8.1 INTRODUCTION

4.8.2 INTEGRATION OF DIGITAL TWINS AND REAL-TIME MONITORING IN MIM POWDER & FEEDSTOCK PROCESSING

4.8.3 ADVANCED BINDER SYSTEMS FOR MIM POWDERS & FEEDSTOCK

4.8.4 MICRO-MIM FOR MINIATURIZATION ADVANCEMENT

4.8.5 INTEGRATION OF ADDITIVE MANUFACTURING (AM)

4.8.6 3D PRINTING ADVANCEMENTS DRIVING INNOVATION IN MIM POWDERS

4.8.7 CONCLUSION

4.9 VALUE CHAIN ANALYSIS

4.9.1 RAW MATERIAL EXTRACTION

4.9.1.1 VOLATILITY AND PRICING DYNAMICS

4.9.2 METAL POWDER PRODUCTION

4.9.3 FEEDSTOCK FORMULATION AND COMPOUNDING

4.9.4 PACKAGING, STORAGE, AND LOGISTICS

4.9.5 DISTRIBUTION AND SALES CHANNELS

4.9.6 TECHNICAL SUPPORT AND APPLICATION DEVELOPMENT

4.9.7 END-USE INDUSTRIES AND FEEDBACK LOOP

4.9.8 CONCLUSION

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND PARTNERSHIP

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 KEY ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS MANUFACTURERS, BY TOP COUNTRIES:

5 PRODUCT CATEGORY-WISE KEY PLAYERS

5.1 SANDVIK AB

5.1.1 COMPANY OVERVIEW

5.1.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.1.2.1 SUPPLY CHAIN MANAGEMENT

5.1.2.2 RAW MATERIALS

5.1.2.3 PRODUCTION PROCESS

5.1.2.4 VALUE AND VOLUME ANALYSIS

5.1.2.5 COSTING ANALYSIS

5.1.3 STRATEGIC DEVELOPMENTS

5.2 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

5.2.1 COMPANY OVERVIEW

5.2.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDER)

5.2.2.1 SUPPLY CHAIN MANAGEMENT

5.2.2.2 RAW MATERIALS

5.2.2.3 PRODUCTION PROCESS

5.2.2.4 VALUE AND VOLUME ANALYSIS

5.2.2.5 COSTING ANALYSIS

5.2.3 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL POWDER)

5.2.3.1 SUPPLY CHAIN MANAGEMENT

5.2.3.2 RAW MATERIALS

5.2.4 PRODUCTION PROCESS

5.2.4.1 VALUE AND VOLUME ANALYSIS

5.2.4.2 COSTING ANALYSIS

5.2.5 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.2.5.1 SUPPLY CHAIN MANAGEMENT

5.2.5.2 RAW MATERIALS

5.2.5.3 PRODUCTION PROCESS

5.2.5.4 VALUE AND VOLUME ANALYSIS

5.2.5.5 COSTING ANALYSIS

5.2.6 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY)

5.2.6.1 SUPPLY CHAIN MANAGEMENT

5.2.6.2 RAW MATERIALS

5.2.6.3 PRODUCTION PROCESS

5.2.7 VALUE AND VOLUME ANALYSIS

5.2.7.1 COSTING ANALYSIS

5.2.8 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.2.8.1 SUPPLY CHAIN MANAGEMENT

5.2.8.2 RAW MATERIALS

5.2.8.3 PRODUCTION PROCESS

5.2.8.4 VALUE AND VOLUME ANALYSIS

5.2.8.5 COSTING ANALYSIS

5.2.9 STRATEGIC DEVELOPMENTS

5.3 EPSON ATMIX CORPORATION

5.3.1 COMPANY OVERVIEW

5.3.2 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.3.3 SUPPLY CHAIN MANAGEMENT

5.3.4 RAW MATERIALS

5.3.5 PRODUCTION PROCESS

5.3.6 VALUE AND VOLUME ANALYSIS

5.3.7 COSTING ANALYSIS

5.3.8 STRATEGIC DEVELOPMENTS

5.4 HOGANAS AB

5.4.1 COMPANY OVERVIEW

5.4.2 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY)

5.4.2.1 SUPPLY CHAIN MANAGEMENT

5.4.2.2 RAW MATERIALS

5.4.2.3 PRODUCTION PROCESS

5.4.2.4 VALUE AND VOLUME ANALYSIS

5.4.2.5 COSTING ANALYSIS

5.4.3 STRATEGIC DEVELOPMENTS

5.5 POMETON S.P.A.

5.5.1 COMPANY OVERVIEW

5.5.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDER)

5.5.2.1 SUPPLY CHAIN MANAGEMENT

5.5.2.2 RAW MATERIALS

5.5.2.3 PRODUCTION PROCESS

5.5.2.4 VALUE AND VOLUME ANALYSIS

5.5.2.5 COSTING ANALYSIS

5.5.3 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL POWDER)

5.5.3.1 SUPPLY CHAIN MANAGEMENT

5.5.3.2 RAW MATERIALS

5.5.3.3 PRODUCTION PROCESS

5.5.3.4 VALUE AND VOLUME ANALYSIS

5.5.3.5 COSTING ANALYSIS

5.5.4 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWER)

5.5.4.1 SUPPLY CHAIN MANAGEMENT

5.5.4.2 RAW MATERIALS

5.5.4.3 PRODUCTION PROCESS

5.5.4.4 VALUE AND VOLUME ANALYSIS

5.5.4.5 COSTING ANALYSIS

5.5.5 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.5.5.1 SUPPLY CHAIN MANAGEMENT

5.5.5.2 RAW MATERIALS

5.5.5.3 PRODUCTION PROCESS

5.5.5.4 VALUE AND VOLUME ANALYSIS

5.5.5.5 COSTING ANALYSIS

5.5.6 STRATEGIC DEVELOPMENTS

5.6 BASF

5.6.1 COMPANY OVERVIEW

5.6.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.6.3 SUPPLY CHAIN MANAGEMENT

5.6.4 RAW MATERIALS

5.6.5 PRODUCTION PROCESS

5.6.6 VALUE AND VOLUME ANALYSIS

5.6.7 COSTING ANALYSIS

5.6.8 STRATEGIC DEVELOPMENTS

5.7 CNPC POWDER

5.7.1 COMPANY OVERVIEW

5.7.2 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.7.3 SUPPLY CHAIN MANAGEMENT

5.7.4 RAW MATERIALS

5.7.5 PRODUCTION PROCESS

5.7.6 VALUE AND VOLUME ANALYSIS

5.7.7 COSTING ANALYSIS

5.7.8 STRATEGIC DEVELOPMENTS

5.8 GKN POWDER METALLURGY

5.8.1 COMPANY OVERVIEW

5.8.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.8.3 SUPPLY CHAIN MANAGEMENT

5.8.4 RAW MATERIALS

5.8.5 PRODUCTION PROCESS

5.8.6 VALUE AND VOLUME ANALYSIS

5.8.7 COSTING ANALYSIS

5.8.8 STRATEGIC DEVELOPMENTS

5.9 MITSUBISHI STEEL MFG. CO., LTD.

5.9.1 COMPANY OVERVIEW

5.9.2 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL - COBALT POWDER)

5.9.2.1 SUPPLY CHAIN MANAGEMENT

5.9.3 RAW MATERIALS

5.9.3.1 PRODUCTION PROCESS

5.9.3.2 VALUE AND VOLUME ANALYSIS

5.9.3.3 COSTING ANALYSIS

5.9.4 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.9.4.1 SUPPLY CHAIN MANAGEMENT

5.9.4.2 RAW MATERIALS

5.9.4.3 PRODUCTION PROCESS

5.9.4.4 VALUE AND VOLUME ANALYSIS

5.9.4.5 COSTING ANALYSIS

5.9.5 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.9.5.1 SUPPLY CHAIN MANAGEMENT

5.9.5.2 RAW MATERIALS

5.9.5.3 PRODUCTION PROCESS

5.9.5.4 VALUE AND VOLUME ANALYSIS

5.9.5.5 COSTING ANALYSIS

5.9.6 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY STEEL POWDER)

5.9.6.1 SUPPLY CHAIN MANAGEMENT

5.9.6.2 RAW MATERIALS

5.9.6.3 PRODUCTION PROCESS

5.9.6.4 VALUE AND VOLUME ANALYSIS

5.9.6.5 COSTING ANALYSIS

5.9.7 STRATEGIC DEVELOPMENTS

5.1 OC OERLIKON MANAGEMENT AG

5.10.1 COMPANY OVERVIEW

5.10.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.10.2.1 SUPPLY CHAIN MANAGEMENT

5.10.3 RAW MATERIALS

5.10.4 PRODUCTION PROCESS

5.10.5 VALUE AND VOLUME ANALYSIS

5.10.6 COSTING ANALYSIS

5.10.7 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL COBALT POWDERS)

5.10.7.1 SUPPLY CHAIN MANAGEMENT

5.10.7.2 RAW MATERIALS

5.10.7.3 PRODUCTION PROCESS

5.10.7.4 VALUE AND VOLUME ANALYSIS

5.10.8 COSTING ANALYSIS

5.10.9 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDERS)

5.10.9.1 SUPPLY CHAIN MANAGEMENT

5.10.9.2 RAW MATERIALS

5.10.9.3 PRODUCTION PROCESS

5.10.9.4 VALUE AND VOLUME ANALYSIS

5.10.10 COSTING ANALYSIS

5.10.11 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.10.11.1 SUPPLY CHAIN MANAGEMENT

5.10.11.2 RAW MATERIALS

5.10.11.3 PRODUCTION PROCESS

5.10.11.4 VALUE AND VOLUME ANALYSIS

5.10.12 COSTING ANALYSIS

5.10.13 STRATEGIC DEVELOPMENTS

5.11 RIO TINTO

5.11.1 COMPANY OVERVIEW

5.11.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.11.2.1 SUPPLY CHAIN MANAGEMENT

5.11.2.2 RAW MATERIALS

5.11.2.3 PRODUCTION PROCESS

5.11.2.4 VALUE AND VOLUME ANALYSIS

5.11.2.5 COSTING ANALYSIS

5.11.3 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.11.3.1 SUPPLY CHAIN MANAGEMENT

5.11.3.2 RAW MATERIALS

5.11.3.3 PRODUCTION PROCESS

5.11.3.4 VALUE AND VOLUME ANALYSIS

5.11.3.5 COSTING ANALYSIS

5.11.4 STRATEGIC DEVELOPMENTS

5.12 TRONOX HOLDINGS PLC

5.12.1 COMPANY OVERVIEW

5.12.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.12.2.1 SUPPLY CHAIN MANAGEMENT

5.12.2.2 RAW MATERIALS

5.12.2.3 PRODUCTION PROCESS

5.12.2.4 VALUE AND VOLUME ANALYSIS

5.12.2.5 COSTING ANALYSIS

5.12.3 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.12.3.1 SUPPLY CHAIN MANAGEMENT

5.12.3.2 RAW MATERIALS

5.12.3.3 PRODUCTION PROCESS

5.12.3.4 VALUE AND VOLUME ANALYSIS

5.12.4 COSTING ANALYSIS

5.12.5 STRATEGIC DEVELOPMENTS

6 TARIFFS & IMPACT ON THE MARKET

6.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

6.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

6.3 VENDOR SELECTION CRITERIA DYNAMICS

6.4 IMPACT ON SUPPLY CHAIN

6.4.1 RAW MATERIAL PROCUREMENT

6.4.2 MANUFACTURING AND PRODUCTION

6.4.3 LOGISTICS AND DISTRIBUTION

6.4.4 PRICE PITCHING AND POSITION OF MARKET

6.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

6.5.1 SUPPLY CHAIN OPTIMIZATION

6.5.2 JOINT VENTURE ESTABLISHMENTS

6.6 IMPACT ON PRICES

6.7 REGULATORY INCLINATION

6.7.1 GEOPOLITICAL SITUATION

6.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

6.7.2.1 FREE TRADE AGREEMENTS

6.7.2.2 ALLIANCE ESTABLISHMENTS

6.7.3 STATUS ACCREDITATION (INCLUDING MFN)

6.7.4 DOMESTIC COURSE OF CORRECTION

6.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

6.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

7 REGULATION COVERAGE

7.1 INTRODUCTION

7.2 PRODUCT CODES

7.3 CERTIFIED STANDARDS

7.4 SAFETY STANDARDS

7.4.1 MATERIAL HANDLING & STORAGE

7.4.2 TRANSPORT & PRECAUTIONS

7.4.3 HAZARD IDENTIFICATION

7.5 CONCLUSION

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 GROWING ADOPTION OF 316L AND 17-4PH MIM POWDERS IN MEDICAL AND SURGICAL DEVICES

8.1.2 AUTOMOTIVE AND EV COMPONENT MINIATURIZATION INCREASING DEMAND FOR COMPLEX MIM PARTS

8.1.3 ADVANCEMENTS IN BINDER AND DEBINDING TECHNOLOGIES IMPROVING PRODUCTION EFFICIENCY

8.1.4 COST-EFFECTIVE MASS PRODUCTION CAPABILITY OF MIM FOR TIGHT-TOLERANCE COMPONENTS

8.2 RESTRAINTS

8.2.1 VOLATILE NICKEL, COBALT, AND TITANIUM PRICES IMPACTING POWDER COST STABILITY.

8.2.2 EXTENDED QUALIFICATION TIMELINES IN REGULATED END-USE INDUSTRIES

8.3 OPPORTUNITY

8.3.1 INCREASING DEMAND FOR TITANIUM AND SPECIALTY ALLOY FEEDSTOCKS IN HIGH VALUE APPLICATIONS

8.3.2 LOCALIZATION OF POWDER AND FEEDSTOCK MANUFACTURING TO STRENGTHEN SUPPLY CHAINS

8.3.3 EXPANSION OF VALUE-ADDED SERVICES SUCH AS POWDER CHARACTERIZATION AND PROCESS SUPPORT

8.4 CHALLENGES

8.4.1 MAINTAINING CONSISTENT PARTICLE SIZE DISTRIBUTION AND POWDER QUALITY AT SCALE

8.4.2 STRICT CONTAMINATION CONTROL REQUIREMENTS IN MEDICAL AND AEROSPACE APPLICATIONS

9 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE

9.1 OVERVIEW

9.2 STAINLESS STEEL POWDERS

9.3 LOW ALLOY STEEL POWDERS

9.4 NICKEL & COBALT BASED POWDERS

9.5 TITANIUM POWDERS

9.6 OTHERS

9.7 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (TONS)

9.7.1 STAINLESS STEEL POWDERS

9.7.2 LOW ALLOY STEEL POWDERS

9.7.3 NICKEL & COBALT BASED POWDERS

9.7.4 TITANIUM POWDERS

9.7.5 OTHERS

9.8 ASIA-PACIFIC STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 316L

9.8.2 17-4 PH

9.8.3 304 / 304L

9.8.4 440C

9.8.5 OTHER

9.9 ASIA-PACIFIC STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 ASIA-PACIFIC LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 4140

9.10.2 4340

9.10.3 8620

9.10.4 4605

9.10.5 OTHERS

9.11 ASIA-PACIFIC LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 ASIA-PACIFIC NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 INCONEL 718

9.12.2 INCONEL 625

9.12.3 CO–CR ALLOY

9.12.4 OTHERS

9.13 ASIA-PACIFIC NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 NORTH AMERICA

9.13.3 EUROPE

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 ASIA-PACIFIC TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.14.1 GRADE 5

9.14.2 GRADE 1

9.14.3 GRADE 2

9.14.4 GRADE 3

9.14.5 OTHERS

9.15 ASIA-PACIFIC TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.15.1 ASIA-PACIFIC

9.15.2 NORTH AMERICA

9.15.3 EUROPE

9.15.4 SOUTH AMERICA

9.15.5 MIDDLE EAST & AFRICA

9.16 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

10 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD

10.1 OVERVIEW

10.2 GAS ATOMIZED

10.3 WATER ATOMIZED

10.4 MECHANICAL ALLOYING

10.5 OTHER METHODS (PLASMA, ULTRASONIC)

10.6 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

10.6.1 GAS ATOMIZED

10.6.2 WATER ATOMIZED

10.6.3 MECHANICAL ALLOYING

10.6.4 OTHER METHODS (PLASMA, ULTRASONIC)

10.7 ASIA-PACIFIC GAS ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 ASIA-PACIFIC WATER ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 ASIA-PACIFIC MECHANICAL ALLOYING IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 ASIA-PACIFIC OTHER METHODS (PLASMA, ULTRASONIC) IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 AUTOMOTIVE

11.1.2 MEDICAL & DENTAL

11.1.3 INDUSTRIAL MACHINERY

11.1.4 CONSUMER ELECTRONICS

11.1.5 AEROSPACE

11.1.6 FIREARMS & DEFENSE

11.1.7 OTHERS

11.2 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

11.2.1 AUTOMOTIVE

11.2.2 MEDICAL & DENTAL

11.2.3 INDUSTRIAL MACHINERY

11.2.4 CONSUMER ELECTRONICS

11.2.5 AEROSPACE

11.2.6 FIREARMS & DEFENSE

11.2.7 OTHERS

11.3 ASIA-PACIFIC AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 ENGINE COMPONENTS

11.3.2 TRANSMISSION COMPONENTS

11.4 ASIA-PACIFIC ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 TURBOCHARGER PARTS

11.4.2 FUEL INJECTORS

11.4.3 SENSORS & ACTUATORS

11.5 ASIA-PACIFIC AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 ASIA-PACIFIC MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SURGICAL INSTRUMENTS

11.6.2 ORTHOPEDIC IMPLANTS

11.7 ASIA-PACIFIC MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 NORTH AMERICA

11.7.3 EUROPE

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 ASIA-PACIFIC INDUSTRIAL MACHINERY IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 SOUTH AMERICA

11.8.5 MIDDLE EAST & AFRICA

11.9 ASIA-PACIFIC CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

11.9.1 SMARTPHONE PARTS

11.9.2 CONNECTORS & HOUSINGS

11.1 ASIA-PACIFIC CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 ASIA-PACIFIC AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 ASIA-PACIFIC FIREARMS & DEFENSE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 NORTH AMERICA

11.13.3 EUROPE

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

12 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER

12.1 OVERVIEW

12.2 ELECTRONICS & ELECTRICAL

12.3 AUTOMOTIVE OEMS

12.4 MEDICAL DEVICES

12.5 INDUSTRIAL EQUIPMENT

12.6 DEFENSE & AEROSPACE

12.7 OTHERS

12.8 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

12.8.1 ELECTRONICS & ELECTRICAL

12.8.2 AUTOMOTIVE OEMS

12.8.3 MEDICAL DEVICES

12.8.4 INDUSTRIAL EQUIPMENT

12.8.5 DEFENSE & AEROSPACE

12.8.6 OTHERS

12.9 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 NORTH AMERICA

12.9.3 EUROPE

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 ASIA-PACIFIC AUTOMOTIVE OEMS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 ASIA-PACIFIC MEDICAL DEVICES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 NORTH AMERICA

12.11.3 EUROPE

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 ASIA-PACIFIC INDUSTRIAL EQUIPMENT IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 ASIA-PACIFIC DEFENSE & AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.13.1 ASIA-PACIFIC

12.13.2 NORTH AMERICA

12.13.3 EUROPE

12.13.4 SOUTH AMERICA

12.13.5 MIDDLE EAST & AFRICA

12.14 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.15.1 DIRECT SALES

12.15.2 DISTRIBUTORS

12.16 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

13 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 DISTRIBUTORS

13.4 ASIA-PACIFIC DIRECT SALES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 ASIA-PACIFIC DISTRIBUTORS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION

14.1 ASIA PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 AUSTRALIA

14.1.5 SINGAPORE

14.1.6 THAILAND

14.1.7 INDONESIA

14.1.8 MALAYSIA

14.1.9 NEW ZEALAND

14.1.10 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMAPANY PROFILES

17.1 LINDE PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVEOPMENT

17.2 BASF

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVEOPMENT

17.3 EPSON ATMIX CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVEOPMENT

17.4 SANDVIK AB

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVEOPMENT

17.5 CRS HOLDINGS, LLC (CARPENTER TECHNOLOGY)

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVEOPMENT

17.6 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 AMETEK INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 COMPANY SHARE ANALYSIS

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENT

17.8 CNPC POWDER

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVEOPMENT

17.9 HOGANAS AB

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVEOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 KEY TECHNICAL AND COMMERCIAL PARAMETERS: MIM VS. AM POWDERS

TABLE 2 THE FOLLOWING TABLE ILLUSTRATES HOW MAJOR SUPPLIERS ALIGN WITH KEY MIM MATERIAL CATEGORIES WITHIN THE SCOPE OF THIS STUDY.

TABLE 3 INDICATIVE PRICING RANGE (2025)

TABLE 4 KEY SUPPLIERS IN THE MIM INDUSTRY:

TABLE 5 CAPITAL EXPENDITURE BREAKDOWN – LAND & INFRASTRUCTURE

TABLE 6 CAPITAL EXPENDITURE ALLOCATION – CORE PROCESS EQUIPMENT

TABLE 7 CAPITAL EXPENDITURE DISTRIBUTION – UTILITIES & ANCILLARY SYSTEMS

TABLE 8 CAPITAL EXPENDITURE ALLOCATION – INDIRECT & SOFT COSTS

TABLE 9 OPERATING COST STRUCTURE – RAW MATERIALS

TABLE 10 OPERATING COST STRUCTURE – UTILITIES & ENERGY CONSUMPTION

TABLE 11 OPERATING COST STRUCTURE – LABOR & ADMINISTRATION

TABLE 12 OPERATING COST STRUCTURE – MAINTENANCE

TABLE 13 OPERATING COST STRUCTURE – CONSUMABLES & PACKAGING

TABLE 14 OPERATING COST STRUCTURE – OVERHEADS & MISCELLANEOUS

TABLE 15 FINANCIAL PERFORMANCE BENCHMARKS – PAYBACK ANALYSIS

TABLE 16 INDICATIVE POWDER AND FEEDSTOCK PRICING RANGES (RELATIVE INDEX)

TABLE 17 MIM POWDER COST RANGES

TABLE 18 POWDER TYPE OVERVIEW

TABLE 19 PRODUCT CATEGORY-WISE KEY PLAYERS

TABLE 20 ESTIMATED COST STRUCTURE FOR LOW ALLOY STEEL POWDERS

TABLE 21 COST STRUCTURE

TABLE 22 COST STRUCTURE OF IRON POWDER AND COPPER POWDER

TABLE 23 COMPLIANCE OVERVIEW OF MIM POWDERS AND FEEDSTOCK – STANDARDS, SAFETY CODES, AND APPLICATIONS

TABLE 24 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (TONS)

TABLE 26 ASIA-PACIFIC STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 30 ASIA-PACIFIC NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 32 ASIA-PACIFIC TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 34 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 35 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 37 ASIA-PACIFIC GAS ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 38 ASIA-PACIFIC WATER ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 39 ASIA-PACIFIC MECHANICAL ALLOYING IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 40 ASIA-PACIFIC OTHER METHODS (PLASMA, ULTRASONIC) IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 41 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 43 ASIA-PACIFIC AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 46 ASIA-PACIFIC MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 48 ASIA-PACIFIC INDUSTRIAL MACHINERY IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 49 ASIA-PACIFIC CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 50 ASIA-PACIFIC CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 51 ASIA-PACIFIC AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 52 ASIA-PACIFIC FIREARMS & DEFENSE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 53 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 54 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 56 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 57 ASIA-PACIFIC AUTOMOTIVE OEMS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 58 ASIA-PACIFIC MEDICAL DEVICES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 59 ASIA-PACIFIC INDUSTRIAL EQUIPMENT IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 60 ASIA-PACIFIC DEFENSE & AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 61 ASIA-PACIFIC OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 62 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 64 ASIA-PACIFIC DIRECT SALES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 65 ASIA-PACIFIC DISTRIBUTORS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 66 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 68 USD THOUSAND

TABLE 69 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 71 ASIA-PACIFIC STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 77 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 79 ASIA-PACIFIC AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 83 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 85 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 87 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 89 CHINA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 CHINA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 CHINA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 CHINA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 94 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 95 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 96 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 97 CHINA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 CHINA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 CHINA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 CHINA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 101 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 102 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 103 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 CHINA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 105 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 107 JAPAN STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 JAPAN LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 JAPAN NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 JAPAN TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 112 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 113 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 114 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 115 JAPAN AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 JAPAN ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 JAPAN MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 JAPAN CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 119 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 120 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 121 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 122 JAPAN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 123

TABLE 124 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 126 SOUTH KOREA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 SOUTH KOREA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 SOUTH KOREA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 SOUTH KOREA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 131 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 132 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 133 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 134 SOUTH KOREA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 SOUTH KOREA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 SOUTH KOREA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 SOUTH KOREA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 138 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 139 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 140 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 141 SOUTH KOREA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 142 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 144 INDIA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 INDIA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 INDIA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 INDIA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 149 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 150 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 151 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 152 INDIA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 INDIA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 INDIA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDIA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 156 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 158 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 159 INDIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 160 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 162 AUSTRALIA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 AUSTRALIA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 AUSTRALIA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 AUSTRALIA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 167 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 168 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 169 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 170 AUSTRALIA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 AUSTRALIA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 AUSTRALIA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 AUSTRALIA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 174 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 175 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 176 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 AUSTRALIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 178 SINGAPORE METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 SINGAPORE METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 180 SINGAPORE STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 SINGAPORE LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 SINGAPORE NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 SINGAPORE TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 SINGAPORE METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 185 SINGAPORE METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)