Asia Pacific Plant Based Milk Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.91 Billion

USD

27.13 Billion

2024

2032

USD

10.91 Billion

USD

27.13 Billion

2024

2032

| 2025 –2032 | |

| USD 10.91 Billion | |

| USD 27.13 Billion | |

|

|

|

|

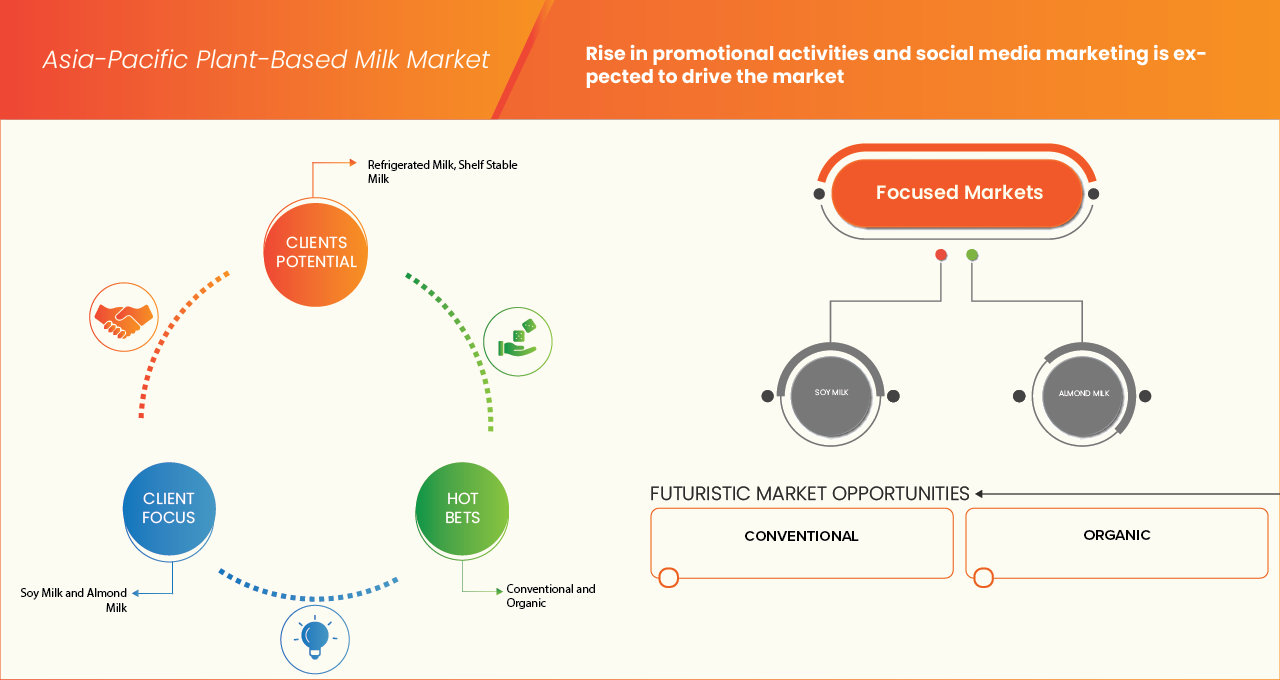

Segmentação do mercado de leites vegetais na região Ásia-Pacífico, por tipo de produto (leite de soja, leite de amêndoa, leite de coco, leite de aveia, leite de arroz, leite de castanha de caju, leite de noz, leite de avelã, leite de linhaça, leite de ervilha, leite de macadâmia, leite de cânhamo, leite de semente de abóbora e outros), tipo (leite refrigerado, leite de longa duração), origem (convencional e orgânico), forma (líquido e em pó), doçura (sem açúcar e adoçado), sabor (original/sem sabor e aromatizado), alegações (com alegação, sem alegação), prazo de validade (1 a 6 meses, 2 a 4 semanas, acima de 6 meses e 1 a 2 semanas), tipo de embalagem (Tetra Pak, garrafas, sachês, latas, potes, sachês individuais e outros), material da embalagem (vidro, plástico e metal), quantidade da embalagem (1000 ml, 250 ml, 500 ml, 110 ml, mais de 1000 ml e menos de 100 ml), preço (popular, premium, luxo), aplicação (doméstica e comercial), canal de distribuição (não baseado em lojas e baseado em lojas) - Tendências e previsões do setor até 2032

Tamanho do mercado de leite vegetal na região Ásia-Pacífico

- O mercado de leite vegetal na região Ásia-Pacífico foi avaliado em US$ 10,91 bilhões em 2024 e deverá atingir US$ 27,13 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 12,2% durante o período de previsão.

- A crescente preferência por dietas veganas e flexitarianas, juntamente com um foco maior na sustentabilidade, são os principais fatores que impulsionam a demanda em toda a região.

- A expansão das redes de varejo, a penetração do comércio eletrônico e as aplicações em serviços de alimentação, particularmente leites de aveia e amêndoa de qualidade barista, estão fortalecendo ainda mais o alcance de mercado.

Análise do mercado de leite vegetal na região Ásia-Pacífico

- O setor de leites vegetais é um componente crucial da indústria de alimentos e bebidas da região Ásia-Pacífico, atendendo à demanda do consumidor por alternativas mais saudáveis, sem lactose e sustentáveis. Abrange uma ampla gama de produtos, incluindo formulações à base de soja, amêndoa, aveia, coco, arroz e misturas, atendendo às necessidades alimentares tanto da população urbana quanto da rural. O crescimento do mercado é impulsionado pela crescente preocupação com a saúde, alergias a laticínios e pelo aumento de estilos de vida veganos e flexitarianos.

- A inovação de produtos está na vanguarda, com fabricantes desenvolvendo leites vegetais fortificados e enriquecidos com proteínas, cálcio e vitaminas para rivalizar com a nutrição dos laticínios. Características como formulações com rótulo limpo, teor reduzido de açúcar e embalagens ecologicamente sustentáveis estão moldando as preferências do consumidor. Nos segmentos de varejo e food service, a demanda está em alta por produtos versáteis, fáceis de preparar para baristas e de alta qualidade, que atendam a diversos paladares e necessidades funcionais.

- Prevê-se que a China seja o país dominante e de crescimento mais rápido no mercado de leites vegetais da região Ásia-Pacífico, impulsionada pela forte conscientização do consumidor, pela rápida urbanização e pelo investimento contínuo em tecnologias de proteínas alternativas. A presença de marcas nacionais líderes e a conformidade com os padrões de segurança alimentar em constante evolução posicionam a China como um mercado maduro e em rápida expansão. Sua ênfase na sustentabilidade e nos canais de varejo modernos impulsiona ainda mais a demanda.

- Em 2025, espera-se que o segmento de leite de soja domine o mercado com 38,71% de participação, devido à sua acessibilidade, familiaridade com o consumidor e alto teor proteico. As opções à base de soja continuam particularmente populares na China, Japão e Sudeste Asiático. Ao mesmo tempo, o leite de aveia e o leite de amêndoa estão ganhando força devido ao seu posicionamento premium, sabor atraente e crescente adoção na cultura de cafeterias.

- A expansão do mercado também é impulsionada pelo crescimento da classe média na região, pela crescente prevalência da intolerância à lactose e pelo aumento do apoio governamental à agricultura sustentável. Além disso, a mudança para dietas mais saudáveis, o aumento dos investimentos em inovação alimentar e o apoio regulatório a alternativas à base de plantas estão incentivando os fabricantes a expandir seus portfólios e fortalecer as cadeias de suprimentos em toda a região da Ásia-Pacífico.

Escopo do relatório e segmentação do mercado de leite vegetal na região Ásia-Pacífico

|

Atributos |

Principais informações sobre o mercado de leite vegetal na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do leite à base de plantas

“Integração de Tecnologias Inteligentes e Inovação Centrada no Consumidor”

- O mercado de leites vegetais na região Ásia-Pacífico está passando por uma forte transformação impulsionada pelos avanços nas tecnologias de processamento, incluindo o Processamento de Alta Pressão (HPP), o tratamento enzimático e as técnicas de fortificação. Essas inovações aprimoram o valor nutricional, o sabor e a vida útil, tornando o leite vegetal mais atraente para consumidores preocupados com a saúde e intolerantes à lactose.

- A interoperabilidade dos sistemas na cadeia de suprimentos está ganhando impulso, à medida que os produtores adotam ferramentas digitais para rastreabilidade, blockchain para transparência e verificações de qualidade baseadas em IA. Isso garante padrões consistentes em todo o processo de fornecimento, produção e distribuição em mercados regionais altamente diversos.

- A crescente demanda por linhas de produtos personalizáveis e escaláveis — desde leite de soja, aveia e amêndoa até bases de nicho como coco, arroz e ervilha — está moldando a inovação, com marcas oferecendo sabores localizados e variantes fortificadas para atender a preferências regionais específicas.

- A crescente preocupação com a acessibilidade para o consumidor está impulsionando o lançamento de embalagens fáceis de usar, formatos de porção única e opções sem lactose, sem glúten e com baixo teor de açúcar, atendendo a um amplo público, desde crianças até idosos.

- Análises baseadas em IA e insights preditivos do consumidor estão emergindo, permitindo que as marcas antecipem mudanças na demanda, personalizem o marketing e otimizem a distribuição. Isso é especialmente crítico na região Ásia-Pacífico, onde a diversidade cultural e os padrões alimentares variam amplamente entre os mercados.

Dinâmica do mercado de leite vegetal na região Ásia-Pacífico

Motorista

Crescimento da cultura vegana em todo o mundo

- A rápida ascensão da cultura vegana em todo o mundo tornou-se um fator-chave para o crescimento do mercado de leites vegetais na região Ásia-Pacífico. A mudança nas preferências do consumidor, especialmente entre os grupos mais jovens e urbanos, tem levado a uma redução no consumo de produtos de origem animal por motivos de saúde, meio ambiente e ética, e essa mudança cultural se traduz em maior demanda no varejo e em instituições por leites de aveia, soja, amêndoa e outros leites vegetais em toda a região Ásia-Pacífico.

- Autoridades públicas, organismos multilaterais e os principais meios de comunicação têm reconhecido e respondido cada vez mais a essas mudanças por meio de orientações, políticas de nutrição escolar, normas de rotulagem e investimentos públicos que, em conjunto, reduzem as barreiras para uma adoção mais ampla. Essas medidas políticas, somadas à ampla cobertura da mídia e às revisões científicas, aumentam a confiança do consumidor e aceleram o crescimento do mercado na região.

- Por exemplo, em janeiro de 2025, a Administração de Alimentos e Medicamentos dos EUA (FDA) informou que publicou uma minuta de diretrizes abordando a rotulagem de alternativas vegetais a alimentos de origem animal, concluindo que bebidas à base de plantas podem continuar a usar o termo "leite" quando claramente rotuladas com a origem vegetal, uma medida que reconheceu a crescente aceitação dos consumidores por leites não animais.

Oportunidade

Crescimento no lançamento de novos produtos e novas parcerias/aquisições

- O mercado de leite vegetal na região Ásia-Pacífico está se beneficiando de uma onda de inovação de produtos, parcerias estratégicas, expansões de capacidade e aquisições ocasionais entre os principais players, o que está criando uma dinâmica competitiva mais forte, portfólios de produtos mais amplos e maior penetração nos mercados.

- Novas variantes (misturas para barista, alto teor proteico, matérias-primas inovadoras), fábricas ampliadas e alianças regionais estão ajudando a solucionar tanto as restrições do lado da oferta (escala, custo, qualidade) quanto as necessidades do lado da demanda (sabor, funcionalidade, novidade). À medida que as empresas competem para atender às expectativas em constante evolução dos consumidores em relação à saúde, sustentabilidade, sabor e experiência, esses lançamentos e parcerias atuam como multiplicadores de força, permitindo uma difusão mais rápida dos leites vegetais no varejo, no setor de alimentação e nos canais online emergentes em toda a região da Ásia-Pacífico.

- Por exemplo, em novembro de 2021, o China Daily noticiou que a Oatly inaugurou sua primeira unidade de produção em Ma'anshan, província de Anhui, com capacidade para abastecer o mercado chinês com grandes volumes de bebidas à base de aveia, uma medida que expandiu significativamente a produção local e a disponibilidade de leite de aveia na Ásia.

Restrição/Desafio

Alto preço do leite vegetal em comparação com o leite de origem animal.

- Os leites vegetais geralmente requerem matérias-primas (como amêndoas, aveia e soja) que podem precisar ser importadas, tecnologias de processamento mais complexas ou que evitam o desperdício, embalagens especializadas, fortificação para corresponder aos perfis nutricionais e distribuição por meio de varejo moderno ou cadeia de frio, o que é mais caro.

- Em muitos países da região Ásia-Pacífico, onde o leite de vaca é fortemente subsidiado ou produzido localmente a baixo custo, o preço mais elevado das alternativas vegetais torna-se uma barreira significativa, especialmente nos segmentos de baixa e média renda. Consumidores sensíveis ao preço podem optar pelo leite de vaca ou evitar completamente o consumo de leite, em vez de comprar leite vegetal a um preço mais alto.

- Por exemplo, em maio de 2023, o jornal The Guardian relatou que os leites vegetais custavam, em média, o dobro do leite de vaca nos mercados analisados, fazendo com que alguns consumidores voltassem a optar por laticínios devido ao preço.

Escopo do mercado de leite vegetal na região Ásia-Pacífico

O mercado de leite vegetal na região Ásia-Pacífico é categorizado em quatorze segmentos principais, com base em tipo de produto, natureza, forma, sabor, doçura, prazo de validade, alegação, material de embalagem, tipo de embalagem, quantidade de embalagem, preço, aplicação e canal de distribuição.

• Por tipo de produto

Com base no tipo de produto, o mercado de leites vegetais da Ásia-Pacífico é segmentado em leite de soja, leite de amêndoa, leite de coco, leite de aveia, leite de arroz, leite de castanha de caju, leite de noz, leite de avelã, leite de linhaça, leite de ervilha, leite de macadâmia, leite de cânhamo, leite de semente de abóbora e outros. Em 2025, espera-se que o segmento de leite de soja domine o mercado com 38,71% de participação, devido à sua ampla aceitação cultural, preço acessível e alto teor de proteína em comparação com outras alternativas vegetais.

O segmento de leite de soja deverá apresentar o maior crescimento anual composto (CAGR) de 13,5% no período de previsão de 2025 a 2032, devido ao seu amplo consumo tanto como bebida tradicional quanto como alternativa moderna aos laticínios. Sua versatilidade de aplicações, desde o consumo direto até o uso culinário, em bebidas e alimentos processados, fortaleceu ainda mais sua posição no mercado.

Por tipo

Com base no tipo, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em leite refrigerado e leite de longa duração. Em 2025, espera-se que o segmento de leite refrigerado domine o mercado com 86,53% de participação, devido à percepção de frescor, sabor superior e crescente preferência entre os consumidores urbanos preocupados com a saúde.

O segmento de leite refrigerado deverá crescer com a maior taxa composta de crescimento anual (CAGR) de 12,4% no período de previsão de 2025 a 2032, visto que os formatos refrigerados são frequentemente associados a maior qualidade e processamento mínimo, tornando-os particularmente atraentes em canais de varejo premium e entre o público mais jovem que busca alternativas lácteas mais saudáveis.

Por natureza

Com base na natureza, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em convencional e orgânico. Em 2025, espera-se que o segmento convencional domine o mercado com 71,83% de participação, devido à sua acessibilidade, ampla disponibilidade e forte familiaridade do consumidor em diversos segmentos demográficos.

O segmento convencional deverá apresentar o maior crescimento anual composto (CAGR) de 12,5% no período de previsão de 2025 a 2032, visto que as variantes convencionais de leite de soja, coco e arroz fazem parte da dieta tradicional em países como China, Japão e Sudeste Asiático, tornando-as mais acessíveis em comparação com as alternativas orgânicas ou fortificadas. Seus preços competitivos e ampla distribuição em supermercados, lojas de conveniência e varejistas locais reforçam ainda mais sua posição dominante, principalmente em mercados sensíveis a preços em toda a região.

Por formulário

Com base na forma, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em líquido e em pó. Em 2025, espera-se que o segmento líquido domine o mercado com 89,56% de participação, devido à sua conveniência, ampla disponibilidade e forte preferência do consumidor por formatos prontos para consumo.

Prevê-se que o segmento de bebidas líquidas apresente o maior crescimento anual composto (CAGR) de 12,3% no período de previsão de 2025 a 2032, uma vez que os leites vegetais líquidos, como os de soja, aveia, amêndoa e coco, são amplamente consumidos como alternativas diretas aos laticínios e fazem parte integrante das dietas diárias em toda a região, particularmente nos centros urbanos, onde o consumo em movimento e a cultura de cafés estão em rápida expansão.

Por Doçura

Com base no grau de doçura, o mercado de leites vegetais da região Ásia-Pacífico é segmentado em não adoçado e adoçado. Em 2025, espera-se que o segmento não adoçado domine o mercado com 78,18% de participação, devido à crescente conscientização sobre saúde, à demanda cada vez maior por dietas com baixo teor de açúcar e ao foco crescente em produtos com rótulos limpos.

O segmento de produtos sem açúcar deverá apresentar o maior crescimento anual composto (CAGR) de 12,5% no período de previsão de 2025 a 2032, à medida que os consumidores em toda a região se tornam mais conscientes de condições de saúde relacionadas ao estilo de vida, como obesidade e diabetes. Assim, as variantes sem açúcar de leite de soja, aveia e amêndoa estão ganhando popularidade como alternativas mais saudáveis tanto ao leite de vaca quanto às opções vegetais adoçadas.

Por sabor

Com base no sabor, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em original/sem sabor e com sabor. Em 2025, espera-se que o segmento original/sem sabor domine o mercado com 54,49% de participação, devido à sua versatilidade, ampla aceitação pelo consumidor e adequação a diversas aplicações.

Espera-se que o segmento de produtos originais ou sem sabor apresente o maior crescimento anual composto (CAGR) de 12,9% no período de previsão de 2025 a 2032, visto que as variantes originais ou sem sabor de leite de soja, aveia, coco e amêndoa são comumente utilizadas em culinária, panificação, cereais, café e smoothies, pois oferecem um perfil de sabor neutro que não altera o sabor das receitas.

Por meio de reivindicações

Com base nas alegações, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em produtos com alegações e produtos sem alegações. Em 2025, espera-se que o segmento de produtos com alegações domine o mercado, com uma participação de 64,16%, devido à crescente confiança do consumidor em produtos que destacam benefícios específicos para a saúde, nutrição e sustentabilidade.

O segmento de produtos com alegações nutricionais deverá crescer com a maior taxa composta de crescimento anual (CAGR) de 12,7% no período de previsão de 2025 a 2032, à medida que os leites vegetais rotulados com alegações como "rico em proteínas", "fortificado com cálcio", "sem lactose", "não transgênico" ou "ambientalmente sustentável" ganham forte popularidade, principalmente entre as populações urbanas preocupadas com a saúde e os jovens que buscam transparência em suas escolhas alimentares.

Por prazo de validade

Com base no prazo de validade, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em 1 a 6 meses, 2 a 4 semanas, acima de 6 meses e 1 a 2 semanas. Em 2025, espera-se que o segmento de 1 a 6 meses domine o mercado com 42,81% de participação, devido ao seu equilíbrio entre frescor, conveniência e adequação às cadeias de suprimentos do varejo moderno.

Prevê-se que o segmento de 1 a 6 meses de validade apresente a maior taxa de crescimento anual composta (CAGR) de 13,0% no período de previsão de 2025 a 2032, uma vez que os produtos desta categoria, normalmente embalados em caixas assépticas ou formatos refrigerados, proporcionam aos consumidores uma percepção de maior qualidade e segurança em comparação com as opções de prazo de validade ultracurto, mantendo-se acessíveis em supermercados, hipermercados e lojas de conveniência.

Por tipo de embalagem

Com base no tipo de embalagem, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em embalagens Tetra Pak, garrafas, sachês, latas, potes, sachês individuais e outras. Em 2025, espera-se que o segmento de embalagens Tetra Pak domine o mercado com 55,42% de participação, devido à sua durabilidade, praticidade e capacidade de prolongar a vida útil do produto sem comprometer a qualidade.

O segmento de embalagens Tetra Pak deverá apresentar o maior crescimento anual composto (CAGR) de 12,7% no período de previsão de 2025 a 2032, visto que as embalagens Tetra Pak são leves, portáteis e fáceis de armazenar, tornando-as altamente adequadas para os canais de distribuição de varejo e comércio eletrônico em expansão na região. Sua tecnologia de embalagem asséptica ajuda a preservar o frescor e o valor nutricional por vários meses, atendendo às necessidades dos consumidores urbanos e rurais, onde a infraestrutura de cadeia de frio pode ser limitada.

Por material de embalagem

Com base no material de embalagem, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em vidro, plástico e metal. Em 2025, espera-se que o segmento de vidro domine o mercado com 51,45% de participação, devido ao seu apelo premium, imagem ecológica e forte associação do consumidor com pureza e qualidade.

O segmento de embalagens de vidro deverá apresentar o maior crescimento anual composto (CAGR) de 12,6% no período de previsão de 2025 a 2032, visto que o vidro é frequentemente preferido em nichos de mercado e mercados urbanos, onde consumidores preocupados com a saúde e o meio ambiente estão dispostos a pagar mais por embalagens sustentáveis e reutilizáveis. Sua capacidade de preservar o sabor natural e a integridade nutricional de leites vegetais, como soja, aveia e amêndoa, aumenta ainda mais seu atrativo no segmento de produtos premium.

Por quantidade de embalagem

Com base na quantidade de embalagem, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em 1000 ml, 250 ml, 500 ml, 110 ml, mais de 1000 ml e menos de 100 ml. Em 2025, espera-se que o segmento de 1000 ml domine o mercado com 53,55% de participação, devido ao maior consumo doméstico, à relação custo-benefício por litro, à preferência por embalagens tamanho família e à crescente disponibilidade no varejo, atendendo ao uso diário regular.

O segmento de 1000 ml deverá apresentar o maior crescimento anual composto (CAGR) de 12,7% no período de previsão de 2025 a 2032, devido ao crescente estilo de vida urbano, ao aumento da renda da classe média e à preferência do consumidor por embalagens sustentáveis e em maior quantidade, o que impulsiona ainda mais a demanda, tornando a embalagem de 1000 ml a opção mais conveniente e econômica para os lares.

Por preço

Com base no preço, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em popular, premium e de luxo. Em 2025, espera-se que o segmento popular domine o mercado com 53,48% de participação, devido à sua acessibilidade, preço baixo e apelo junto à grande base de consumidores da região, sensível a preços.

Prevê-se que o segmento de mercado de massa apresente o maior crescimento anual composto (CAGR) de 12,6% no período de previsão de 2025 a 2032, visto que os leites vegetais com preços acessíveis, particularmente as variantes de soja, arroz e coco, são amplamente consumidos tanto em áreas urbanas quanto rurais, tornando-os a opção mais popular para o consumo diário. Seus preços competitivos permitem uma adoção mais ampla entre as famílias de renda média, garantindo que o leite vegetal continue sendo uma alternativa atraente aos laticínios para o consumo regular.

Por meio de aplicação

Com base na aplicação, o mercado de leites vegetais na região Ásia-Pacífico é segmentado em comercial e doméstico. Em 2025, espera-se que o segmento doméstico domine o mercado com 71,03% de participação, à medida que as alternativas vegetais se tornam cada vez mais parte da dieta diária em toda a região. As famílias estão adotando leite de soja, aveia, amêndoa e coco como substitutos do leite de vaca em usos cotidianos, como beber, cozinhar, assar, em cereais e smoothies.

Prevê-se que o segmento de consumo doméstico apresente o maior crescimento anual composto (CAGR) de 12,5% no período de previsão de 2025 a 2032, uma vez que a versatilidade do leite vegetal, aliada à crescente conscientização sobre saúde, à prevalência da intolerância à lactose e à mudança para dietas com baixo teor de açúcar e mais sustentáveis, posicionou os domicílios como o principal segmento de consumidores finais na região Ásia-Pacífico.

Por canal de distribuição

Com base no canal de distribuição, o mercado de leite vegetal na região Ásia-Pacífico é segmentado em vendas fora do ambiente de lojas físicas e vendas em lojas físicas. Em 2025, espera-se que o segmento de vendas fora do ambiente de lojas físicas domine o mercado com 76,72% de participação, devido à rápida expansão das plataformas de comércio eletrônico, aplicativos de supermercado online e modelos de entrega direta ao consumidor (D2C).

O segmento de vendas online (fora das lojas físicas) deverá apresentar o maior crescimento anual composto (CAGR) de 12,4% no período de previsão de 2025 a 2032, devido ao estilo de vida urbano agitado e à crescente adoção digital, que incentivaram os consumidores a comprar leite de soja, aveia, amêndoa e coco online pela conveniência da entrega em domicílio, maior variedade de produtos e descontos atrativos. Serviços de assinatura e opções de entrega no mesmo dia reforçam ainda mais a fidelização do cliente, tornando os canais online a escolha preferida para o consumo doméstico regular.

Análise Regional do Mercado de Leites Vegetais na Ásia-Pacífico

- O mercado de leites vegetais na região Ásia-Pacífico está em rápida expansão, impulsionado pela crescente conscientização sobre saúde, pela prevalência cada vez maior de intolerância à lactose e pela forte aceitação cultural de alternativas à base de soja e outros laticínios. Países como China, Índia, Japão e Austrália estão testemunhando uma demanda crescente, sustentada pela urbanização, pela disponibilidade de produtos premium e pela penetração do comércio eletrônico. Inovação em sabores, fortificação com vitaminas e minerais e ofertas de produtos localizados são os principais fatores de crescimento. Além disso, o leite vegetal está sendo cada vez mais adotado por consumidores mais jovens e por grupos demográficos preocupados com a saúde e o bem-estar que buscam opções sustentáveis e livres de crueldade animal.

Informações sobre leite vegetal na China

Em 2025, espera-se que a China domine o mercado com 31,22% de participação, devido à sua longa tradição de consumo de leite de soja e à crescente preferência por alternativas modernas aos laticínios. A rápida urbanização, o crescimento da classe média e a demanda cada vez maior por bebidas saudáveis e funcionais impulsionam o crescimento do mercado. A inovação em sabores, embalagens e produtos lácteos vegetais fortificados está expandindo a adoção pelos consumidores para além da soja tradicional. Grandes empresas nacionais, como Vitasoy e Yili, juntamente com marcas internacionais, competem para conquistar a fidelidade do consumidor. O foco do governo na sustentabilidade e na segurança alimentar está alinhado com o crescimento das opções à base de plantas, especialmente à medida que os consumidores se tornam mais conscientes do meio ambiente. Com sua forte base cultural para bebidas não lácteas e a crescente demanda moderna, a China se posiciona como o maior e mais influente mercado de leite vegetal da região.

Participação de mercado de leite vegetal na região Ásia-Pacífico

O mercado de leite à base de plantas é liderado principalmente por empresas já consolidadas, incluindo:

- Otsuka Foods Co., Ltd. (Japão)

- Corporação Kikkoman (Japão)

- Mondelēz International (EUA)

- Danone (França)

- General Mills Inc. (EUA)

- Produtores de Diamante Azul (EUA)

- Empresa de Saúde e Bem-Estar Sanitarium (Austrália)

- Marusan-Ai Co., Ltd. (Japão)

- Vitasoy International Holdings (Hong Kong)

- Yeo Hiap Seng Ltda. (Singapura)

- Hershey's (EUA)

- Oatly (Suécia)

- PureHarvest (Austrália)

- Fazendas Califia (EUA)

- Divertida Mente (Austrália)

- Produtos Nutritivos (Austrália)

- Milklab (Austrália)

- Prensagem de matérias-primas (Índia)

- Tão bom (Austrália)

- A Austrália (Austrália)

- Arla Foods amba (Dinamarca)

- Ulu Hye (Austrália)

- Epigamia (Índia)

- Bebidas Sunsip (Índia)

- Adicionar Joi (EUA)

- WhatIf F&I Pte Ltd (Singapura)

- Apenas a Terra (Índia)

Novidades no mercado de leite vegetal na região Ásia-Pacífico

- Em janeiro de 2023, a Califia Farms expandiu sua premiada linha de produtos sem laticínios com o lançamento de aveia orgânica certificada pelo USDA e leite de amêndoas. Os novos produtos da empresa foram criados para atender às demandas dos clientes que buscam produtos com menos ingredientes e estão disponíveis no Kroger Co., Whole Foods Market, Sprouts Farmers Market e outros varejistas em todo o país.

- Em setembro de 2021, a Sanitarium e a Life Education anunciaram uma nova colaboração. A parceria criou e implementou um novo módulo de nutrição para alunos do ensino fundamental II, que também inclui ferramentas para professores e pais ensinarem as crianças a fazer escolhas alimentares mais saudáveis. Por meio dessa colaboração, a empresa conseguiu atrair uma nova base de consumidores.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE

4.1.5 INDUSTRY RIVALRY

4.2 PRICING ANALYSIS

4.3 COST ANALYSIS BREAKDOWN

4.3.1 RAW MATERIAL COSTS

4.3.2 PROCESSING & MANUFACTURING

4.3.3 PACKAGING COSTS

4.3.4 DISTRIBUTION & LOGISTICS COSTS

4.3.5 MARKETING & BRANDING COSTS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 CONSUMPTION ANALYSIS

4.6 ASIA-PACIFIC PLANT-BASED MILK MARKET

4.6.1 RAW MATERIAL IMPACT ON MARGINS

4.6.2 MANUFACTURING & PROCESSING MARGINS

4.6.3 DISTRIBUTION & RETAIL MARGINS

4.6.4 PREMIUMIZATION & VALUE-ADDED MARGINS

4.7 IMPORT-EXPORT ANALYSIS

4.7.1 IMPORT ANALYSIS

4.8 EXPORT ANALYSIS

4.9 IMPORT EXPORT SCENARIO

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 PATENT FAMILIES

4.10.3 LICENSING AND COLLABORATIONS

4.10.4 REGION PATENT LANDSCAPE

4.10.5 IP STRATEGY AND MANAGEMENT

4.11 VALUE CHAIN ANALYSIS

4.11.1 RAW MATERIAL PROCUREMENT

4.11.2 MANUFACTURING & PROCESSING

4.11.3 PACKAGING & STORAGE

4.11.4 DISTRIBUTION & LOGISTICS

4.11.5 END-USE INDUSTRIES

4.12 VENDOR SELECTION CRITERIA

4.12.1 QUALITY AND CONSISTENCY

4.12.2 TECHNICAL EXPERTISE

4.12.3 SUPPLY CHAIN RELIABILITY

4.12.4 COMPLIANCE AND SUSTAINABILITY

4.12.5 COST AND PRICING STRUCTURE

4.12.6 FINANCIAL STABILITY

4.12.7 FLEXIBILITY AND CUSTOMIZATION

4.12.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.13 BRAND OUTLOOK

4.13.1 BRAND COMPARATIVE ANALYSIS OF ASIA-PACIFIC PLANT-BASED MILK MARKET

4.13.2 PRODUCT VS BRAND OVERVIEW

4.13.3 PRODUCT OVERVIEW

4.13.4 BRAND OVERVIEW

4.14 CLIMATE CHANGE SCENARIO

4.14.1 ENVIRONMENTAL CONCERNS

4.14.2 INDUSTRY RESPONSE

4.14.3 GOVERNMENT’S ROLE

4.14.4 ANALYST RECOMMENDATIONS

4.15 CONSUMERS BUYING BEHAVIOUR

4.15.1 HEALTH & WELLNESS ORIENTATION

4.15.2 PRICE SENSITIVITY & AFFORDABILITY

4.15.3 CULTURAL & TASTE PREFERENCES

4.15.4 CONVENIENCE & CHANNEL PREFERENCE

4.16 INDUSTRY ECO-SYSTEM ANALYSIS

4.16.1 PROMINENT COMPANIES

4.16.2 SMALL & MEDIUM-SIZED COMPANIES

4.16.3 END USERS

4.17 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.17.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.17.1.1 JOINT VENTURES

4.17.1.2 MERGERS AND ACQUISITIONS

4.17.1.3 LICENSING AND PARTNERSHIP

4.17.1.4 TECHNOLOGY COLLABORATIONS

4.17.1.5 STRATEGIC DIVESTMENTS

4.17.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.17.3 STAGE OF DEVELOPMENT

4.17.4 TIMELINES AND MILESTONES

4.17.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.17.6 RISK ASSESSMENT AND MITIGATION

4.17.7 FUTURE OUTLOOK

4.18 MARKET ENTRY STRATEGIES

4.18.1 STRATEGIC PARTNERSHIPS & ALLIANCES

4.18.2 JOINT VENTURES

4.18.3 ACQUISITION OF LOCAL PLAYERS

4.18.4 CONTRACT MANUFACTURING

4.18.5 PARTICIPATION IN EUROPEAN TRADE FAIRS

4.18.6 DIGITAL & E-COMMERCE SALES CHANNELS

4.18.7 COMPLIANCE WITH EU STANDARDS

4.18.8 CUSTOMIZATION FOR LOCAL PREFERENCES

4.18.9 PRICING STRATEGY ADAPTATION

4.19 RAW MATERIAL COVERAGE

4.19.1 PRIMARY FEEDSTOCKS

4.19.1.1 SOY

4.19.1.2 ALMOND

4.19.1.3 OAT

4.19.1.4 RICE

4.19.1.5 COCONUT

4.19.1.6 PEA / FABA / OTHER LEGUMES

4.19.1.7 NUTS & SEEDS (CASHEW, HEMP, SESAME)

4.19.2 SECONDARY INGREDIENTS

4.19.2.1 EMULSIFIERS

4.19.2.2 STABILIZERS / THICKENERS

4.19.2.3 FORTIFICATION AGENTS

4.19.2.4 SWEETENERS & FLAVORS

4.19.2.5 OILS & MOUTHFEEL AGENTS

4.19.2.6 PRESERVATIVES / ACIDITY REGULATORS

4.2 SUPPLY CHAIN ANALYSIS

4.20.1 OVERVIEW

4.20.2 LOGISTICS COST SCENARIO

4.20.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21 TECHNOLOGICAL ADVANCEMENTS

4.21.1 PRODUCT INNOVATION AND SENSORY ENHANCEMENT

4.21.2 PROCESSING AND FORTIFICATION TECHNOLOGIES

4.21.3 SUSTAINABLE AND EFFICIENT PRODUCTION METHODS

4.21.4 RESEARCH AND DEVELOPMENT INITIATIVES

4.21.5 CONSUMER-CENTRIC PRODUCT FORMATS

5 ASIA-PACIFIC PLANT-BASED MILK MARKET — TARIFFS & MARKET IMPACT

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.8 GEOPOLITICAL SITUATION

5.9 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.1 ALLIANCES ESTABLISHMENTS STATUS

5.11 ACCREDITATION (INCLUDING MFTN)

5.12 DOMESTIC COURSE OF CORRECTION

5.13 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.14 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN VEGAN CULTURE AROUND THE GLOBE

7.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

7.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

7.2 RESTRAINTS

7.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

7.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

7.3 OPPORTUNITIES

7.3.1 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS / ACQUISITIONS

7.3.2 RAPID GROWTH OF OAT & PREMIUM VARIANTS

7.3.3 E-COMMERCE & RETAIL EXPANSION

7.4 CHALLENGES

7.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

7.4.2 REGULATORY & LABELLING RESTRICTIONS

8 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SOY MILK

8.3 ALMOND MILK

8.4 COCONUT MILK

8.5 OAT MILK

8.6 RICE MILK

8.7 CASHEW MILK

8.8 WALNUT MILK

8.9 HAZELNUT MILK

8.1 FLAX MILK

8.11 PEA MILK

8.12 MACADAMIA MILK

8.13 HEMP MILK

8.14 PUMPKIN MILK

8.15 OTHERS

9 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY TYPE

9.1 OVERVIEW

9.2 REFRIGERATED MILK

9.3 SHELF STABLE MILK

10 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SWEETNESS

12.1 OVERVIEW

12.2 UNSWEETENED

12.3 SWEETENED

13 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 ORIGINAL/UNFLAVOURED

13.3 FLAVOURED

14 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY CLAIMS

14.1 OVERVIEW

14.2 WITH CLAIMS

14.3 WITHOUT CLAIMS

15 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SHELF LIFE

15.1 OVERVIEW

15.2 1-6 MONTHS

15.3 2-4 WEEKS

15.4 ABOVE 6 MONTHS

15.5 1-2 WEEKS

16 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 TETRA PACKS

16.3 BOTTLES

16.4 POUCHES

16.5 CANS

16.6 JARS

16.7 SACHETS

16.8 OTHERS

17 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL

17.1 OVERVIEW

17.2 GLASS

17.3 PLASTIC

17.4 METALS

18 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY

18.1 OVERVIEW

18.2 1000 ML

18.3 250 ML

18.4 500 ML

18.5 110 ML

18.6 MORE THAN 1000 ML

18.7 LESS THAN 100 ML

19 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRICE

19.1 OVERVIEW

19.2 MASS

19.3 PREMIUM

19.4 LUXURY

20 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 HOUSEHOLD

20.3 COMMERCIAL

21 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 NON-STORE BASED

21.3 STORE BASED

22 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY

22.1 ASIA-PACIFIC

22.1.1 CHINA

22.1.2 JAPAN

22.1.3 SOUTH KOREA

22.1.4 INDIA

22.1.5 AUSTRALIA

22.1.6 THAILAND

22.1.7 INDONESIA

22.1.8 MALAYSIA

22.1.9 PHILIPPINES

22.1.10 TAIWAN

22.1.11 SINGAPORE

22.1.12 NEW ZEALAND

22.1.13 HONG KONG

22.1.14 REST OF ASIA-PACIFIC

23 ASIA-PACIFIC PLANT-BASED MILK MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC DISTRIBUTORS

23.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC MANUFACTURER

24 SWOT ANALYSIS

25 COMPANY PROFILES

25.1 OTSUKA FOODS CO. LTD.

25.1.1 COMPANY SNAPSHOT

25.1.2 PRODUCT PORTFOLIO

25.1.3 RECENT DEVELOPMENT

25.2 KIKKOMAN CORPORATION

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENT

25.3 MONDELĒZ INTERNATIONAL

25.3.1 COMPANY SNAPSHOT

25.3.2 REVENUE ANALYSIS

25.3.3 PRODUCT PORTFOLIO

25.3.4 RECENT DEVELOPMENT

25.4 DANONE

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENT

25.5 GENERAL MILLS INC.

25.5.1 COMPANY SNAPSHOT

25.5.2 REVENUE ANALYSIS

25.5.3 PRODUCT PORTFOLIO

25.5.4 RECENT DEVELOPMENT

25.6 ARLA FOODS AMBA

25.6.1 COMPANY SNAPSHOT

25.6.2 REVENUE ANALYSIS

25.6.3 PRODUCT PORTFOLIO

25.6.4 RECENT DEVELOPMENT

25.7 AUSTRALIA'S OWN

25.7.1 COMPANY SNAPSHOT

25.7.2 PRODUCT PORTFOLIO

25.7.3 RECENT DEVELOPMENTS

25.8 BLUE DIAMOND GROWERS

25.8.1 COMPANY SNAPSHOT

25.8.2 PRODUCT PORTFOLIO

25.8.3 RECENT DEVELOPMENT

25.9 CALIFIA FARMS, LLC.

25.9.1 COMPANY SNAPSHOT

25.9.2 PRODUCT PORTFOLIO

25.9.3 RECENT DEVELOPMENT

25.1 EPIGAMIA

25.10.1 COMPANY SNAPSHOT

25.10.2 PRODUCT PORTFOLIO

25.10.3 RECENT DEVELOPMENT

25.11 HERSHEY INDIA PRIVATE LIMITED

25.11.1 COMPANY SNAPSHOT

25.11.2 PRODUCT PORTFOLIO

25.11.3 RECENT DEVELOPMENT

25.12 INSIDE OUT NUTRITIOUS GOODS

25.12.1 COMPANY SNAPSHOT

25.12.2 PRODUCT PORTFOLIO

25.12.3 RECENT DEVELOPMENT

25.13 JOI

25.13.1 COMPANY SNAPSHOT

25.13.2 PRODUCT PORTFOLIO

25.13.3 RECENT DEVELOPMENT

25.14 MARUSAN-AI CO., LTD.

25.14.1 COMPANY SNAPSHOT

25.14.2 REVENUE ANALYSIS

25.14.3 PRODUCT PORTFOLIO

25.14.4 RECENT DEVELOPMENT

25.15 MILKLAB

25.15.1 COMPANY SNAPSHOT

25.15.2 PRODUCT PORTFOLIO

25.15.3 RECENT DEVELOPMENT

25.16 OATLY GROUP AB

25.16.1 COMPANY SNAPSHOT

25.16.2 REVENUE ANALYSIS

25.16.3 PRODUCT PORTFOLIO

25.16.4 RECENT DEVELOPMENT

25.17 ONLY EARTH

25.17.1 COMPANY SNAPSHOT

25.17.2 PRODUCT PORTFOLIO

25.17.3 RECENT DEVELOPMENT

25.18 PUREHARVEST

25.18.1 COMPANY SNAPSHOT

25.18.2 PRODUCT PORTFOLIO

25.18.3 RECENT DEVELOPMENT

25.19 RAWPRESSERY

25.19.1 COMPANY SNAPSHOT

25.19.2 PRODUCT PORTFOLIO

25.19.3 RECENT DEVELOPMENT

25.2 SANITARIUM

25.20.1 COMPANY SNAPSHOT

25.20.2 PRODUCT PORTFOLIO

25.20.3 RECENT DEVELOPMENT

25.21 SO GOOD (LIFE HEALTH FOODS)

25.21.1 COMPANY SNAPSHOT

25.21.2 PRODUCT PORTFOLIO

25.21.3 RECENT DEVELOPMENT

25.22 SUNSIP BEVERAGES VIETNAM

25.22.1 COMPANY SNAPSHOT

25.22.2 PRODUCT PORTFOLIO

25.22.3 RECENT DEVELOPMENTS

25.23 ULU HYE

25.23.1 COMPANY SNAPSHOT

25.23.2 PRODUCT PORTFOLIO

25.23.3 RECENT DEVELOPMENT

25.24 VINASOY CORP.

25.24.1 COMPANY SNAPSHOT

25.24.2 PRODUCT PORTFOLIO

25.24.3 RECENT DEVELOPMENT

25.25 VITASOY INTERNATIONAL HOLDINGS LTD.

25.25.1 COMPANY SNAPSHOT

25.25.2 REVENUE ANALYSIS

25.25.3 PRODUCT PORTFOLIO

25.25.4 RECENT DEVELOPMENT

25.26 WHAT IF F&I PTE LTD

25.26.1 COMPANY SNAPSHOT

25.26.2 PRODUCT PORTFOLIO

25.26.3 RECENT DEVELOPMENT

25.27 YEO HIAP SENG LTD. ALL

25.27.1 COMPANY SNAPSHOT

25.27.2 REVENUE ANALYSIS

25.27.3 PRODUCT PORTFOLIO

25.27.4 RECENT DEVELOPMENT

25.28 FRESHDI GLOBAL INC

25.28.1 COMPANY SNAPSHOT

25.28.2 PRODUCT PORTFOLIO

25.28.3 RECENT DEVELOPMENT

25.29 KAISER FOODS

25.29.1 COMPANY SNAPSHOT

25.29.2 PRODUCT PORTFOLIO

25.29.3 RECENT DEVELOPMENT

26 QUESTIONNAIRE

27 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 3 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITRES)

TABLE 4 ASIA-PACIFIC SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 5 ASIA-PACIFIC ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 9 ASIA-PACIFIC CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 12 ASIA-PACIFIC FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 14 ASIA-PACIFIC MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 16 ASIA-PACIFIC PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 19 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY, 2018-2032 (MILLION LITERS)

TABLE 44 CHINA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 45 CHINA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 46 CHINA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 47 CHINA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 48 CHINA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 49 CHINA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 50 CHINA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 51 CHINA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 52 CHINA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 53 CHINA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 54 CHINA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 55 CHINA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 56 CHINA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 57 CHINA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 58 CHINA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 59 CHINA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 60 CHINA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 CHINA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 62 CHINA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 63 CHINA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 64 CHINA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 65 CHINA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 66 CHINA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 67 CHINA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 CHINA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 69 CHINA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 70 CHINA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 CHINA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 CHINA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 73 CHINA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 CHINA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 CHINA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 76 CHINA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 77 CHINA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 78 CHINA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 CHINA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 CHINA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 CHINA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 82 CHINA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 CHINA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 JAPAN PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 85 JAPAN PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 86 JAPAN SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 87 JAPAN ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 88 JAPAN COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 89 JAPAN OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 90 JAPAN RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 91 JAPAN CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 92 JAPAN WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 93 JAPAN HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 94 JAPAN FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 95 JAPAN PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 96 JAPAN MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 97 JAPAN HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 98 JAPAN PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 99 JAPAN OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 100 JAPAN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 101 JAPAN PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 102 JAPAN PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 103 JAPAN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 104 JAPAN PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 105 JAPAN FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 JAPAN PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 107 JAPAN WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 JAPAN PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 109 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 110 JAPAN TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 JAPAN SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 113 JAPAN PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 JAPAN METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 116 JAPAN PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 117 JAPAN PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 118 JAPAN COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 119 JAPAN RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 JAPAN INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 JAPAN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 122 JAPAN NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 JAPAN STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 125 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 126 SOUTH KOREA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 127 SOUTH KOREA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 128 SOUTH KOREA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 129 SOUTH KOREA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 130 SOUTH KOREA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 131 SOUTH KOREA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 132 SOUTH KOREA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 133 SOUTH KOREA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 134 SOUTH KOREA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 135 SOUTH KOREA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 136 SOUTH KOREA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 137 SOUTH KOREA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 138 SOUTH KOREA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 139 SOUTH KOREA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 140 SOUTH KOREA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 SOUTH KOREA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 142 SOUTH KOREA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 143 SOUTH KOREA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 144 SOUTH KOREA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 145 SOUTH KOREA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 SOUTH KOREA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 147 SOUTH KOREA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 148 SOUTH KOREA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 149 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 150 SOUTH KOREA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 SOUTH KOREA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 153 SOUTH KOREA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 SOUTH KOREA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 156 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 157 SOUTH KOREA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 158 SOUTH KOREA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 SOUTH KOREA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 SOUTH KOREA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 SOUTH KOREA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 162 SOUTH KOREA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 SOUTH KOREA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 INDIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 165 INDIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 166 INDIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 167 INDIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 168 INDIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 169 INDIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 170 INDIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 171 INDIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 172 INDIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 173 INDIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 174 INDIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 175 INDIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 176 INDIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 177 INDIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 178 INDIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 179 INDIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 180 INDIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 INDIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 182 INDIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 183 INDIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 184 INDIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 185 INDIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 INDIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 187 INDIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 INDIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 189 INDIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 190 INDIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 INDIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 INDIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 193 INDIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 INDIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 INDIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 196 INDIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 197 INDIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 INDIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 INDIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 INDIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 INDIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 INDIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 INDIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 204 AUSTRALIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 205 AUSTRALIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 206 AUSTRALIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 207 AUSTRALIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 208 AUSTRALIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 209 AUSTRALIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 210 AUSTRALIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 211 AUSTRALIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 212 AUSTRALIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 213 AUSTRALIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 214 AUSTRALIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 215 AUSTRALIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 216 AUSTRALIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 217 AUSTRALIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 218 AUSTRALIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 219 AUSTRALIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 220 AUSTRALIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 AUSTRALIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 222 AUSTRALIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 223 AUSTRALIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 224 AUSTRALIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 225 AUSTRALIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 AUSTRALIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 227 AUSTRALIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 AUSTRALIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 229 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 230 AUSTRALIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 231 AUSTRALIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 233 AUSTRALIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 AUSTRALIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 236 AUSTRALIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 237 AUSTRALIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 AUSTRALIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 AUSTRALIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 AUSTRALIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 AUSTRALIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 242 AUSTRALIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 AUSTRALIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 THAILAND PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 245 THAILAND PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 246 THAILAND SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 247 THAILAND ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 248 THAILAND COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 249 THAILAND OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 250 THAILAND RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 251 THAILAND CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 252 THAILAND WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 253 THAILAND HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 254 THAILAND FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 255 THAILAND PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 256 THAILAND MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 257 THAILAND HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 258 THAILAND PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 259 THAILAND OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 260 THAILAND PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 THAILAND PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 262 THAILAND PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 263 THAILAND PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 264 THAILAND PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 THAILAND PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 267 THAILAND WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 THAILAND PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 269 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 270 THAILAND TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 THAILAND SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 273 THAILAND PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 THAILAND METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 276 THAILAND PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 277 THAILAND PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 278 THAILAND COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 THAILAND RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 THAILAND INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 THAILAND PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 282 THAILAND NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 THAILAND STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 284 INDONESIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 285 INDONESIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 286 INDONESIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 287 INDONESIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 288 INDONESIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 289 INDONESIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 290 INDONESIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 291 INDONESIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 292 INDONESIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 293 INDONESIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 294 INDONESIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 295 INDONESIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 296 INDONESIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 297 INDONESIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 298 INDONESIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 299 INDONESIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 300 INDONESIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 INDONESIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 302 INDONESIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 303 INDONESIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 304 INDONESIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 305 INDONESIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 INDONESIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 307 INDONESIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 308 INDONESIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 309 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 310 INDONESIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 INDONESIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 313 INDONESIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 314 INDONESIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 316 INDONESIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 317 INDONESIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 318 INDONESIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 INDONESIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 320 INDONESIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 321 INDONESIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 322 INDONESIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 INDONESIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 MALAYSIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 325 MALAYSIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 326 MALAYSIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 327 MALAYSIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 328 MALAYSIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 329 MALAYSIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 330 MALAYSIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 331 MALAYSIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 332 MALAYSIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 333 MALAYSIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 334 MALAYSIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 335 MALAYSIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 336 MALAYSIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 337 MALAYSIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 338 MALAYSIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 339 MALAYSIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 340 MALAYSIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 341 MALAYSIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 342 MALAYSIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 343 MALAYSIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 344 MALAYSIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 345 MALAYSIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 MALAYSIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 347 MALAYSIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 MALAYSIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 349 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 350 MALAYSIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 MALAYSIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 353 MALAYSIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 MALAYSIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 356 MALAYSIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 357 MALAYSIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 358 MALAYSIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 MALAYSIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 MALAYSIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 MALAYSIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 362 MALAYSIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 MALAYSIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 PHILIPPINES PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 365 PHILIPPINES PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 366 PHILIPPINES SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 367 PHILIPPINES ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 368 PHILIPPINES COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 369 PHILIPPINES OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 370 PHILIPPINES RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 371 PHILIPPINES CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 372 PHILIPPINES WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 373 PHILIPPINES HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 374 PHILIPPINES FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 375 PHILIPPINES PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 376 PHILIPPINES MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 377 PHILIPPINES HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 378 PHILIPPINES PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 379 PHILIPPINES OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 380 PHILIPPINES PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 381 PHILIPPINES PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 382 PHILIPPINES PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 383 PHILIPPINES PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 384 PHILIPPINES PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)