Asia Pacific Textured Butter Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

364.21 Million

USD

465.27 Million

2024

2032

USD

364.21 Million

USD

465.27 Million

2024

2032

| 2025 –2032 | |

| USD 364.21 Million | |

| USD 465.27 Million | |

|

|

|

Asia-Pacific Textured Butter Market Segmentation, By Type (Unsalted Textured Butter and Salted Textured Butter), Product Type (Animal Based (Milk) Butter and Plant-Based Butter), Category (Organic and Conventional), Application (Bakery, Ice Crems, Sauces and Condiments, Confectionery, and Others)– Industry Trends and Forecast to 2032

Textured Butter Market Size

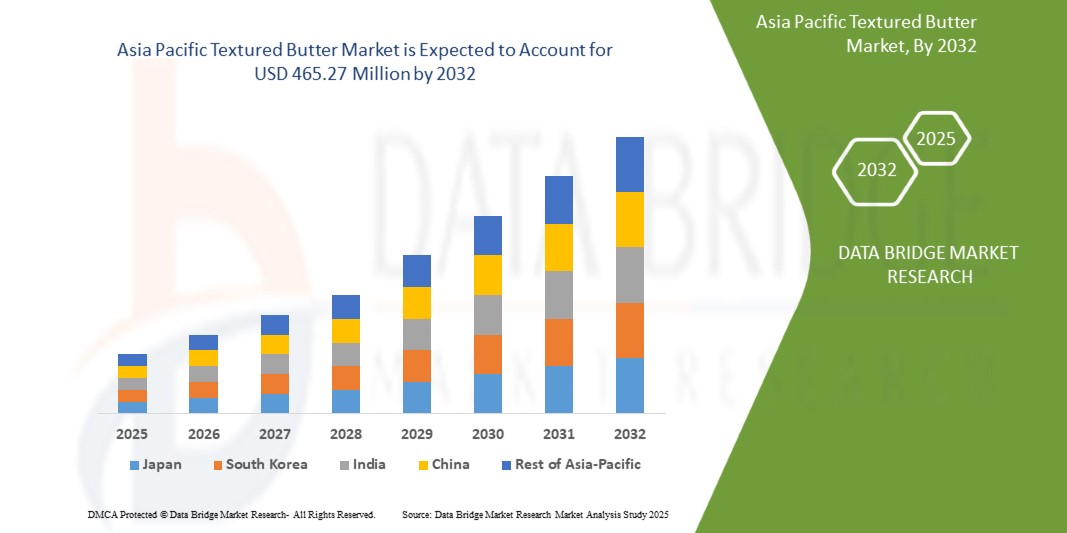

- The Asia-Pacific textured butter market was valued at USD 364.21 million in 2024 and is expected to reach USD 465.27 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.17%, primarily driven by rising consumer demand for enhanced sensory food experiences, clean label trends, and the growing preference for premium, spreadable butter options in both retail and foodservice sectors

- This growth is driven by factors such as rising demand for premium dairy products, increased consumer preference for clean-label and natural ingredients, and innovation in food processing and butter textures

Asia Pacific Textured Butter Market Analysis

- Rising consumer interest in artisanal and premium dairy products is driving the demand for textured butter. This trend is fueled by evolving taste preferences, health consciousness, and the appeal of rich, creamy textures in gourmet and home cooking applications, particularly in developed and urban markets

- Advancements in food processing technologies have enabled manufacturers to offer butter with improved texture, spreadability, and mouthfeel. These innovations cater to specific culinary uses, including baking and confectionery, boosting their appeal among both commercial food producers and household consumers

- The textured butter market is witnessing growth as consumers increasingly seek products with clean labels, organic certifications, and minimal processing. Butter, especially from grass-fed or organic sources, is perceived as a healthier fat option, boosting its popularity in both traditional and plant-based segments

- For instance, the resurgence of full-fat dairy products in the UK. Retailers like Marks & Spencer and Yeo Valley report rising sales of whole milk and butter, driven by consumer preference for creamier textures and skepticism toward low-fat, processed alternatives

- Textured butter is gaining popularity across various food segments such as bakery, confectionery, sauces, and ready-to-eat meals. Its versatility and ability to enhance flavor and consistency make it an essential ingredient in both domestic and industrial kitchens, expanding its market in Asia-Pacific region

Report Scope and Market Segmentation

|

Attributes |

Asia-Pacific Textured Butter Key Market Insights |

|

Segments Covered |

|

|

Países abrangidos |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquéritos aos consumidores, análises demográficas, análises da cadeia de abastecimento, análises da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulamentar. |

Tendências do mercado de manteiga texturizada na Ásia-Pacífico

“Crescente procura por produtos lácteos artesanais premium”

- O mercado de manteiga texturizada da Ásia-Pacífico está a ser moldado pela crescente procura dos consumidores por produtos gourmet e artesanais. À medida que as pessoas migram para experiências alimentares premium, a manteiga texturizada — com o seu sabor rico e apelo visual — está a ganhar popularidade tanto nas cozinhas domésticas como nos estabelecimentos culinários de alto nível, especialmente nos mercados urbanos e desenvolvidos, onde a qualidade e a estética influenciam as decisões de compra.

- Os consumidores preocupados com a saúde estão a impulsionar o crescimento do mercado da manteiga texturizada, com uma preferência notável por opções orgânicas e de rótulo limpo. Rica em gorduras naturais e frequentemente minimamente processada, a manteiga texturada está alinhada com as tendências nutricionais atuais que privilegiam os alimentos integrais em detrimento de alternativas com baixo teor de gordura, reforçando a sua inclusão em dietas equilibradas e de elevada qualidade.

- O aumento da panificação e da cozinha caseira, acelerado pelas mudanças no estilo de vida pós-pandemia, aumentou a procura de ingredientes especiais, como a manteiga texturizada. O seu sabor e consistência melhorados tornam-no uma escolha preferencial para produtos de panificação, molhos e pastas, contribuindo para a diversificação da utilização em todas as categorias de alimentos

- Por exemplo, a crescente preferência dos consumidores por produtos artesanais e produzidos localmente, indicando uma tendência mais ampla para a comida gourmet, incluindo a manteiga texturizada

- Os fabricantes estão a inovar no mercado da manteiga texturizada ao introduzir alternativas à base de plantas e sem lactose para servir os consumidores veganos e intolerantes à lactose. Estas inovações de produtos, combinadas com iniciativas de embalagens e fornecimento sustentáveis, estão a expandir a base de consumidores e a apoiar o crescimento do mercado a longo prazo.

Dinâmica do mercado de manteiga texturizada na Ásia-Pacífico

Motoristas

“ Aumento da procura de produtos lácteos premium ”

- Os consumidores de hoje estão mais conscientes sobre os ingredientes e métodos de processamento utilizados nos seus alimentos, o que leva a um aumento da procura de produtos lácteos premium que oferecem sabor, textura e benefícios nutricionais superiores.

- A manteiga texturizada, conhecida pela sua melhor espalhabilidade, suavidade e consistência, está a tornar-se a escolha preferida entre cozinheiros domésticos e chefs profissionais. A ascensão dos setores da restauração de luxo, padarias e pastelarias impulsionou ainda mais esta tendência, uma vez que a manteiga texturizada melhora a qualidade dos doces, sobremesas e alimentos premium. Além disso, os consumidores preocupados com a saúde estão a optar por alternativas de manteiga de alta qualidade que contêm menos aditivos e conservantes, mas mantêm a riqueza natural

- Por exemplo, em outubro de 2024, a Danone anunciou um investimento de 21,60 milhões de dólares para expandir as suas operações no Punjab, capitalizando a crescente procura de produtos lácteos premium na Índia. À medida que os consumidores procuram cada vez mais opções de produtos lácteos mais saudáveis e de alta qualidade, a Danone pretende aumentar a sua quota de mercado, competindo com concorrentes estabelecidos como a Amul

- Em agosto de 2024, o edairynews publicou um artigo afirmando que a procura por produtos lácteos premium na Índia aumentou à medida que os consumidores preocupados com a saúde deram prioridade à qualidade em detrimento do custo. Impulsionado por uma crescente consciencialização sobre ingredientes naturais, orgânicos, alimentados com erva e opções sem hormonas, o mercado está a assistir a uma preferência crescente do consumidor por produtos que oferecem um sabor superior e benefícios para a saúde, remodelando o setor dos produtos lácteos

- O crescimento de produtos lácteos biológicos e alimentados com erva contribuiu para a crescente procura de variedades de manteiga premium. Os consumidores estão dispostos a pagar mais por produtos de origem ética, ecológicos e isentos de ingredientes artificiais. Como resultado, os fabricantes de produtos lácteos estão a inovar com diferentes texturas, sabores e certificações orgânicas para atender a este segmento de mercado em expansão, impulsionando ainda mais o crescimento do mercado da manteiga texturizada.

Oportunidades

“ Mudar a inclinação do consumidor para produtos de origem sustentável e ética ”

- Os consumidores estão cada vez mais a migrar para a manteiga texturizada sustentável e de origem ética, criando oportunidades significativas para o mercado. Com a crescente consciencialização sobre o impacto ambiental e a agricultura ética, os compradores preferem a manteiga feita a partir de produtos lácteos de origem responsável. Procuram certificações como biológica, comércio justo e alimentação com erva, garantindo que o produto está alinhado com os seus valores

- O fornecimento sustentável envolve práticas agrícolas ecológicas que protegem os recursos naturais, reduzem a pegada de carbono e apoiam a biodiversidade. O fornecimento ético garante salários justos aos agricultores e tratamento humano aos animais. Muitas marcas estão agora a adotar cadeias de abastecimento transparentes para satisfazer estas expectativas dos consumidores

- The growing demand for such products encourages manufacturers to invest in responsible sourcing and sustainable production methods. Companies that focus on eco-friendly packaging, reduced waste, and ethical ingredient sourcing can gain a competitive edge in the Asia Pacific textured butter market. As consumer preferences continue to evolve, businesses that align with sustainability and ethical standards will likely experience increased brand loyalty and market growth. This trend presents a lucrative opportunity for manufacturers to expand their product range while meeting the demand for responsible food choices

For instance,

- In January 2023, a study published on Sustainably Produced Butter: The Effect of Product Knowledge, interest in Sustainability, and Consumer Characteristics on Purchase Frequency highlights that consumer knowledge, interest in sustainability, and product certifications such as organic and fair trade significantly influence the purchase frequency and preferences for ethically sourced butter. This trend emphasizes the growing demand for responsibly produced dairy products

- In August 2024, an article published by Ethical Consumer Research Association Ltd highlights that consumers are increasingly opting for butter and spreads with ethical certifications such as fair-trade and organic, prioritizing sustainability and responsible sourcing in their purchasing decisions

- An article published by the World Wildlife Fund states that sustainable agriculture practices, including eco-friendly dairy farming methods and responsible sourcing, are crucial for protecting natural resources, reducing carbon footprints, and promoting biodiversity

Consumers are increasingly demanding sustainably and ethically sourced textured butter, driving market opportunities. With rising awareness of environmental impact and ethical farming, brands focusing on responsible sourcing, eco-friendly packaging, and transparent supply chains gain a competitive edge. This trend boosts market growth, encouraging manufacturers to align with sustainability and ethical standards.

Restraints/Challenges

“High Production Costs Of Textured Butter”

- Textured butter, due to its specialized production process, requires more advanced technology and higher-quality raw materials, such as organic or grass-fed cream. These factors contribute to its increased cost compared to regular butter. The need for precise manufacturing techniques to achieve the desired consistency and texture further drives up production expenses

- For manufacturers, the higher costs associated with sourcing premium ingredients, maintaining quality control, and investing in specialized equipment can limit the scalability and affordability of textured butter, especially in price-sensitive markets. This, in turn, can restrict its widespread adoption, particularly among small and medium-sized businesses in the food industry that may struggle to absorb the added costs

For instance,

- Em dezembro de 2024, um relatório da Fast Company destacou o aumento dos preços da manteiga devido a perturbações na cadeia de abastecimento, escassez de mão-de-obra e aumento dos custos de produção. Estes factores, especialmente no caso da manteiga texturada, têm colocado pressão sobre os chefs e os consumidores, aumentando ainda mais os preços da manteiga e das matérias-primas de alta qualidade.

- Em Abril de 2024, a William Reed Ltd salientou que o aumento dos preços da manteiga é atribuído a factores como o clima extremo, a instabilidade política e o aumento dos custos energéticos, que estão a fazer subir os preços dos produtos lácteos e, consequentemente, a aumentar os custos de produção da manteiga. Prevê-se que este aumento se mantenha devido à procura sustentada

A sensibilidade dos consumidores ao preço, especialmente nos mercados em desenvolvimento, pode prejudicar a procura de manteiga texturada, uma vez que os consumidores podem optar por alternativas mais acessíveis. Como resultado, o crescimento do mercado da manteiga texturizada enfrenta desafios, particularmente na competição com gorduras e óleos mais baratos na indústria alimentar em geral.

Âmbito do mercado de manteiga texturizada na Ásia-Pacífico

O mercado é segmentado com base no tipo, tipo de produto, categoria e aplicação.

|

Segmentação |

Sub-segmentação |

|

Por tipo |

|

|

Por tipo de produto |

|

|

Por categoria |

|

|

Por aplicação |

|

Análise regional do mercado de manteiga texturizada da Ásia-Pacífico

“A China é o país dominante no mercado de manteiga texturizada da Ásia-Pacífico”

- A China está pronta para dominar o mercado da manteiga texturizada devido à crescente procura dos consumidores por produtos lácteos, impulsionada pela adopção de dietas ocidentais e de uma classe média em crescimento. Esta mudança levou a um aumento significativo das importações de manteiga, principalmente da Nova Zelândia e da União Europeia, para cumprir os padrões de qualidade exigidos pelas padarias e processadores de alimentos premium. Além disso, a expansão dos sectores nacionais de panificação e confeitaria impulsionou ainda mais a procura de manteiga de alta qualidade.

“ A China deverá registar a maior taxa de crescimento”

- A China deverá registar a maior taxa de crescimento no mercado da manteiga texturizada devido à crescente procura dos consumidores por produtos lácteos, impulsionada pela adopção de dietas ocidentais e de uma classe média em crescimento. Esta tendência levou a um aumento significativo das importações de manteiga, principalmente da Nova Zelândia e da União Europeia, para cumprir os padrões de qualidade exigidos pelas padarias e processadores de alimentos premium. Além disso, a expansão dos sectores nacionais de panificação e confeitaria impulsionou ainda mais a procura de manteiga de alta qualidade.

Participação no mercado de manteiga texturizada

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença regional, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de manteiga texturizada da Ásia-Pacífico que operam no mercado são:

- Flechard SAS (França)

- FrieslandCampina Professional (Holanda)

- Royal VIVBuisman (Holanda)

- Ingredientes Uelzena (Alemanha)

- LACTALIS (França)

- NUMIDIA BV (Holanda)

- Lakeland Dairies (Irlanda)

- CORMAN (Bélgica)

Últimos desenvolvimentos no mercado de manteiga texturizada da Ásia-Pacífico

- Em janeiro, a Lactalis Ingredients está a lançar uma nova identidade gráfica para a embalagem da sua linha de manteigas. Esta atualização faz parte dos esforços contínuos da empresa para aumentar a visibilidade da marca e modernizar a apresentação dos seus produtos. O novo design pretende refletir o compromisso da Lactalis com a qualidade, inovação e sustentabilidade, ao mesmo tempo que torna a embalagem mais atrativa para os consumidores. Este desenvolvimento ajuda a Lactalis Ingredients a fortalecer a notoriedade da marca, a melhorar o apelo ao consumidor e a reforçar o seu compromisso com a qualidade, a inovação e a sustentabilidade.

- Em março, a Lakeland Dairies concluiu a aquisição da De Brandt Dairy International NV, uma empresa belga de gordura láctea , com o objetivo de aumentar as suas capacidades de valor acrescentado e expandir a sua presença no mercado europeu. E reforçou a sua posição no mercado europeu da manteiga, abrindo novos mercados e categorias de produtos. Espera-se que esta mudança estratégica proporcione retornos mais fortes às suas famílias agrícolas e desenvolva ainda mais as suas ofertas de produtos de classe mundial para os clientes atuais e futuros.

- Em Fevereiro, a FrieslandCampina anunciou a sua intenção de transferir a produção de manteiga para Lochem, na Holanda, como parte dos esforços para aumentar a eficiência e a sustentabilidade. Esta mudança inclui o encerramento planeado da unidade de Den Bosch no início de 2025, impactando cerca de 90 colaboradores, para os quais a empresa irá fornecer apoio e oportunidades alternativas de emprego. A deslocalização visa otimizar os processos de produção e, ao mesmo tempo, garantir melhorias operacionais a longo prazo. A FrieslandCampina sublinha que a decisão ainda está sujeita a consultas com os funcionários e aprovações regulamentares antes da implementação final

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 VIETNAM

11.1.12 INDONESIA

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 129 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 131 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 146 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 148 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 150 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 165 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 167 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 169 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 184 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 186 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 188 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 203 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 205 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 207 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 222 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 224 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 239 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 241 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 243 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 245 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 260 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 262 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 264 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 279 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 281 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 283 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 REST OF ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 2 ASIA-PACIFIC TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 21 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.