Asia Pacific Unmanned Aerial Vehicle Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

11.92 Billion

USD

41.48 Billion

2025

2033

USD

11.92 Billion

USD

41.48 Billion

2025

2033

| 2026 –2033 | |

| USD 11.92 Billion | |

| USD 41.48 Billion | |

|

|

|

|

Segmentação do mercado de veículos aéreos não tripulados (VANTs) na Ásia-Pacífico, por tipo de produto (VANTs de asa rotativa, VANTs de asa fixa, VANTs híbridos, outros), por componente do sistema (plataforma, software e cibersegurança, enlace de dados, sistemas de lançamento e recuperação), por função (inteligência, vigilância e reconhecimento (ISR), mapeamento e levantamento topográfico, monitoramento e inspeção, entrega e logística, agricultura e agricultura de precisão, fotografia aérea, outros), por tipo de mobilidade (VANTs de asa rotativa, asa fixa, VANTs híbridos VTOL, helicópteros monorrotores, nanodrones/microdrones, outros), por usuário final (defesa e segurança, comercial, recreativo, civil, outros), por tipo de usuário (militar, operadores comerciais, governo e aplicação da lei, consumidor/entusiasta) e por canal de distribuição (indireto, direto) - Tendências e previsões do setor até 2033.

Tamanho do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

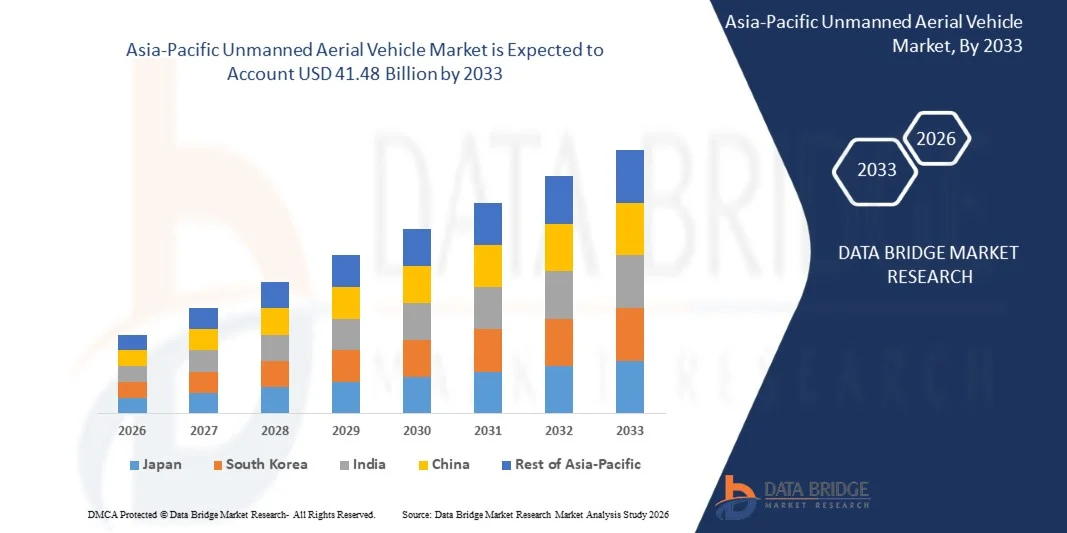

- O mercado de veículos aéreos não tripulados (VANTs) na região Ásia-Pacífico deverá atingir US$ 41,48 bilhões em 2033, partindo de US$ 11,92 milhões em 2025, crescendo a uma taxa composta de crescimento anual (CAGR) de 17,0% no período de previsão de 2026 a 2033.

- O mercado de drones na região Ásia-Pacífico está experimentando um rápido crescimento, impulsionado pela crescente adoção nos setores de defesa, agricultura, logística e indústria, com uma demanda cada vez maior por aplicações de vigilância, entrega e monitoramento.

- A integração de tecnologias avançadas de drones, incluindo navegação com inteligência artificial, sistemas de voo automatizados e análise de dados em tempo real, está acelerando a expansão do mercado, aprimorando a eficiência operacional e a precisão em diversas aplicações.

- Iniciativas governamentais, apoio regulatório e desenvolvimento de infraestrutura — como a modernização do espaço aéreo, políticas favoráveis a drones e investimentos em projetos de cidades inteligentes — estão impulsionando o crescimento do mercado e incentivando a implantação de drones tanto no setor privado quanto no comercial. A crescente tendência em direção a serviços de valor agregado, como soluções personalizadas de FIBC (Field Block Container), integração 3PL/4PL e armazenamento com temperatura controlada para produtos a granel sensíveis, está reforçando a posição da América do Norte como um mercado maduro com forte potencial de crescimento a longo prazo em soluções de embalagens a granel.

Análise do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

- O mercado de UAVs (Veículos Aéreos Não Tripulados) na região Ásia-Pacífico abrange a produção, distribuição e utilização de veículos aéreos não tripulados em setores como agricultura, logística, construção, defesa e aplicações industriais, impulsionado pela crescente demanda por soluções eficientes de monitoramento, entrega e coleta de dados.

- A China domina o mercado, representando 59,16%, impulsionada pela rápida industrialização, iniciativas governamentais, crescente adoção de tecnologias de drones e expansão das atividades de comércio eletrônico e logística.

- Os drones de asa rotativa representam o maior segmento, detendo 50,30% da participação de mercado, devido à sua versatilidade, manobrabilidade e adequação para aplicações de vigilância, entrega e agricultura.

- A crescente adoção de tecnologias avançadas de drones, incluindo navegação com inteligência artificial, sistemas de voo automatizados e análise de dados em tempo real, está aprimorando a eficiência operacional e impulsionando a expansão do mercado nos setores comercial e industrial.

- Políticas governamentais favoráveis, desenvolvimento de infraestrutura e investimentos em projetos de cidades inteligentes estão impulsionando ainda mais o crescimento do mercado, incentivando a implantação de drones nos setores privado e comercial e fortalecendo o potencial de longo prazo do setor.

Escopo do relatório e segmentação do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

|

Atributos |

Análise do Mercado de Veículos Aéreos Não Tripulados na Região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

“ Integração com projetos de cidades inteligentes, automação de armazéns e logística de comércio eletrônico ”

- Os drones estão sendo utilizados para monitoramento de tráfego, planejamento urbano e segurança pública, aprimorando a tomada de decisões baseada em dados em iniciativas de cidades inteligentes.

- Os drones facilitam a gestão de inventário, o monitoramento de estoque em tempo real e o manuseio automatizado de materiais, melhorando a eficiência operacional em armazéns.

- Os drones são cada vez mais utilizados para entregas de última milha, processamento rápido de pedidos e otimização da cadeia de suprimentos, impulsionando o crescimento das plataformas de comércio eletrônico.

Por exemplo,

- Em janeiro de 2025, os veículos aéreos não tripulados (VANTs) já fazem parte de sistemas de logística inteligentes que integram inteligência artificial (IA), redes 5G e robótica para tornar o transporte de cargas e as entregas mais rápidas e seguras, demonstrando como a tecnologia de VANTs está se tornando um componente essencial da infraestrutura logística de cidades inteligentes de próxima geração.

- Um recente panorama do setor destaca o rápido crescimento de soluções de entrega autônomas, incluindo sistemas de entrega por drones, à medida que o comércio eletrônico se expande, apontando para uma adoção logística mais ampla além dos métodos tradicionais.

Dinâmica do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

Motorista

“ Aumento das necessidades de modernização da defesa e de ISR (Inteligência, Vigilância e Reconhecimento) militar ”

- O setor de defesa da região Ásia-Pacífico está passando por uma rápida aceleração na aquisição e integração operacional de veículos aéreos não tripulados (VANTs), impulsionada pela evolução e crescente complexidade das necessidades de inteligência, vigilância, reconhecimento (ISR) e proteção de forças. As forças armadas em todo o mundo estão priorizando os VANTs como ativos essenciais para uma gama de missões, desde ISR persistente e vigilância de fronteiras até inteligência eletrônica (ELINT) e operações de ataque de precisão. À medida que as estratégias militares evoluem para enfrentar novas ameaças, há uma demanda crescente por plataformas de VANTs capazes de voos de longa duração, execução autônoma de missões e links de comunicação seguros para permitir a transferência de dados em tempo real.

- O crescente foco em UAVs (Veículos Aéreos Não Tripulados) nas iniciativas de modernização da defesa criou um ambiente dinâmico para que os fornecedores inovem, resultando em avanços na modularidade da plataforma, autonomia e subsistemas como propulsão, sensores e links de dados seguros. Em resposta a essa demanda, as empresas contratadas pela defesa estão investindo fortemente no desenvolvimento de soluções versáteis de UAVs que possam ser facilmente adaptadas a diversos perfis de missão, seja para ISR (Inteligência, Vigilância e Reconhecimento), apoio tático ou operações ofensivas.

- Essas inovações são impulsionadas pelas necessidades operacionais das forças armadas modernas, que exigem plataformas adaptáveis e multifuncionais capazes de operar em ambientes diversos e frequentemente hostis. À medida que os ministérios da defesa continuam a priorizar a integração de VANTs (Veículos Aéreos Não Tripulados) em suas estruturas de força, esse ímpeto de aquisição não apenas influencia os investimentos dos fornecedores, mas também remodela as capacidades militares da região Ásia-Pacífico, reforçando o papel dos VANTs como componentes centrais da guerra moderna.

Por exemplo

- Em setembro de 2023, de acordo com um artigo do Centro para Segurança e Tecnologias Emergentes, o Departamento de Defesa dos EUA anunciou a "Iniciativa Replicadora", com o objetivo de implantar rapidamente milhares de sistemas autônomos e não tripulados, incluindo drones aéreos, para combater ameaças emergentes por meio de processos acelerados de aquisição e implantação.

- Em fevereiro de 2024, um artigo publicado pela Crown afirmava que o Ministério da Defesa do Reino Unido reafirmou os sistemas não tripulados e autônomos como prioridades centrais em sua agenda de modernização da defesa, destacando a integração de UAVs para ISR (Inteligência, Vigilância e Reconhecimento), apoio a ataques e resiliência operacional nos domínios aéreo e terrestre.

- Em fevereiro de 2025, a Agência Europeia de Defesa (EDA) delineou os esforços multinacionais em curso para melhorar as capacidades de ISR (Inteligência, Vigilância e Reconhecimento) de aeronaves não tripuladas, apoiando a aquisição conjunta, a interoperabilidade e a harmonização de capacidades entre os Estados-Membros da UE.

Restrição/Desafio

“Falta de regulamentações harmonizadas na região Ásia-Pacífico para operações com drones”

- A falta de regulamentações harmonizadas na região Ásia-Pacífico para operações com veículos aéreos não tripulados (VANTs) representa um desafio significativo para o mercado de VANTs na região, uma vez que os marcos regulatórios variam muito entre países e regiões.

- As autoridades de aviação civil aplicam regras diferentes para acesso ao espaço aéreo, licenciamento de pilotos, certificação de plataformas, proteção de dados e aprovações operacionais, como voos além da linha de visão visual (BVLOS). Essa fragmentação regulatória força os fabricantes e operadores de drones a personalizar plataformas, softwares e procedimentos operacionais para cada jurisdição, aumentando os custos de conformidade e prolongando o tempo de lançamento no mercado.

- Como resultado, as empresas enfrentam dificuldades para expandir as operações com drones internacionalmente, principalmente para serviços transfronteiriços como logística, mapeamento e inspeção de infraestrutura.

Por exemplo,

- No final de novembro de 2025, de acordo com uma publicação no LinkedIn, diversas autoridades locais na Índia (por exemplo, Mumbai, Uttarakhand e Varanasi) emitiram ordens temporárias de exclusão aérea para drones em torno de eventos e áreas aeroportuárias, com cada jurisdição estabelecendo diferentes restrições espaciais e temporais. Essa variedade de regras locais ilustra a fragmentação regulatória dentro de um mesmo país e representa um desafio para os operadores, que precisam lidar com diferentes requisitos regulatórios mesmo dentro de uma mesma nação.

- Em maio de 2025, segundo o Times of India, a polícia de Nashik, na Índia, declarou toda a cidade uma zona de exclusão aérea para drones, em meio a amplas preocupações com a segurança, apesar da existência simultânea de estruturas nacionais de espaço aéreo digital, como a Plataforma Digital Sky da Índia. A proibição local generalizada, que ia além das diretrizes nacionais para drones, causou desafios operacionais para operadores de drones civis e comerciais, que tiveram que solicitar permissão explícita para quaisquer voos durante o período de proibição.

Escopo do mercado de veículos aéreos não tripulados na região Ásia-Pacífico

O mercado de veículos aéreos não tripulados (VANTs) na região Ásia-Pacífico é categorizado em sete segmentos principais, com base em tipo de produto, componente, função, tipo de mobilidade, usuário final, tipo de usuário e canal de distribuição.

Por tipo de produto

Com base no tipo de produto, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em VANTs de asa rotativa, VANTs de asa fixa, VANTs híbridos e outros.

O segmento de drones de asa rotativa deverá dominar o mercado devido à sua versatilidade, manobrabilidade e facilidade de operação superiores em comparação com plataformas de asa fixa. Esses drones podem decolar e pousar verticalmente, pairar com precisão e operar com eficácia em ambientes confinados ou urbanos sem a necessidade de pistas de pouso. Tais capacidades os tornam ideais para aplicações como fotografia aérea, vigilância, inspeção de infraestrutura, mapeamento, agricultura e segurança pública. Os drones de asa rotativa também são amplamente adotados por agências militares e policiais para missões táticas e de inteligência de curto alcance. Além disso, os custos de aquisição mais baixos, a facilidade de implantação e os rápidos avanços tecnológicos em projetos multirrotores continuam a impulsionar sua ampla adoção na região da Ásia-Pacífico.

Por componente do sistema

Com relação aos componentes do sistema, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em plataforma, software e cibersegurança, enlace de dados e sistemas de lançamento e recuperação.

Espera-se que o segmento de Plataformas domine o mercado, pois representa o sistema físico central que determina o desempenho, a capacidade e a adequação à missão. As plataformas de UAVs (Veículos Aéreos Não Tripulados) representam a maior parcela do custo total do sistema, abrangendo fuselagens, unidades de propulsão, sistemas de controle de voo e componentes estruturais. A crescente demanda das forças de defesa por UAVs táticos avançados, MALE (Médio, Longa, Longa e Longa Duração) e HALE (Alto, Longa e Longa Duração), juntamente com a crescente adoção comercial de drones multirrotores e de asa fixa, impulsiona significativamente as vendas de plataformas. Além disso, a expansão frequente da frota, os ciclos de substituição e a personalização para aplicações específicas, como vigilância, entrega e inspeção, reforçam ainda mais a liderança do segmento de plataformas no mercado.

• Por função

Com base na função, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em Inteligência, Vigilância e Reconhecimento (ISR), Mapeamento e Levantamento Topográfico, Monitoramento e Inspeção, Entrega e Logística, Agricultura e Agricultura de Precisão, Fotografia Aérea e Outros.

Espera-se que o segmento de Inteligência domine o mercado devido à crescente ênfase na região Ásia-Pacífico em inteligência, vigilância e reconhecimento (ISR) em operações de defesa e segurança. Governos e forças militares dependem cada vez mais de drones para obter consciência situacional em tempo real, monitoramento de fronteiras, contraterrorismo e inteligência no campo de batalha, sem colocar vidas humanas em risco. Os sistemas de inteligência baseados em drones oferecem monitoramento contínuo, imagens de alta resolução e transmissão rápida de dados a custos operacionais mais baixos em comparação com aeronaves tripuladas. Além disso, o aumento das tensões geopolíticas, a guerra assimétrica e a integração de sensores avançados, análises baseadas em IA e sistemas de comunicação seguros estão fortalecendo ainda mais a demanda por soluções de drones focadas em inteligência em todo o mundo.

Por tipo de mobilidade

Com base no tipo de mobilidade, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em VANTs de asa rotativa, asa fixa, híbridos VTOL, helicópteros de rotor único, nanodrones/microdrones e outros.

Espera-se que o segmento de drones de asa rotativa domine o mercado devido à sua flexibilidade operacional superior e versatilidade em uma ampla gama de aplicações. Os drones de asa rotativa podem decolar e pousar verticalmente, pairar no ar e operar com eficácia em ambientes confinados ou urbanos, onde os drones de asa fixa têm limitações. Essas capacidades os tornam ideais para vigilância, inspeção, mapeamento, resposta a emergências e missões militares. Sua capacidade de transportar diversas cargas úteis, como câmeras, LiDAR, sensores e equipamentos de comunicação, aumenta ainda mais sua adoção. Além disso, a forte demanda dos setores de defesa, segurança pública, monitoramento de infraestrutura e fotografia comercial continua impulsionando a ampla implantação de drones de asa rotativa na região da Ásia-Pacífico.

Por usuário final

Com base no usuário final, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em Defesa e Segurança, Comercial, Recreativo, Civil e Outros.

Espera-se que o segmento de Defesa e Segurança domine o mercado devido aos investimentos militares contínuos na região Ásia-Pacífico em plataformas de inteligência, vigilância, reconhecimento e prontas para combate. As forças armadas dependem cada vez mais de drones para monitoramento de fronteiras, detecção de ameaças, aquisição de alvos e ataques de precisão, pois reduzem o risco operacional para o pessoal e oferecem maior autonomia a custos mais baixos do que aeronaves tripuladas. O aumento das tensões geopolíticas, a guerra assimétrica e a necessidade de inteligência em tempo real no campo de batalha reforçam ainda mais a demanda. Além disso, os programas de drones para defesa se beneficiam de contratos de aquisição de longo prazo, atualizações contínuas e integrações de cargas úteis de alto valor agregado, resultando em uma contribuição de receita significativamente maior em comparação com as aplicações comerciais e civis de drones.

Por tipo de usuário

Com base no tipo de usuário, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em Militar, Operadores Comerciais, Governo e Forças da Lei, e Consumidores/Entusiastas.

Espera-se que o segmento militar domine o mercado devido aos gastos contínuos com defesa e à importância estratégica dos sistemas não tripulados na guerra moderna. As forças armadas dependem cada vez mais de drones para missões de inteligência, vigilância, reconhecimento, monitoramento de fronteiras e ataques de precisão, pois reduzem os riscos para o pessoal e aumentam a eficácia operacional. Os drones militares têm custos unitários significativamente mais altos e contratos de serviço de longo prazo em comparação com drones comerciais, contribuindo com mais receita por plataforma. As tensões geopolíticas contínuas, a modernização das forças de defesa, a demanda por drones de longa duração e capacidade de combate, e os investimentos em andamento em sistemas autônomos e com inteligência artificial reforçam ainda mais a posição de liderança do segmento militar no mercado de drones da região Ásia-Pacífico.

Por canal de distribuição

Com base no canal de distribuição, o mercado de veículos aéreos não tripulados (VANTs) da região Ásia-Pacífico é segmentado em indireto e direto.

Espera-se que o segmento indireto domine o mercado devido à sua capacidade de fornecer soluções abrangentes que vão além da fabricação de drones, incluindo software, análise de dados, manutenção, treinamento, integração e serviços gerenciados. Muitos usuários finais preferem soluções indiretas, pois elas reduzem a complexidade operacional, a carga regulatória e o investimento inicial de capital. Agências de defesa e empresas terceirizam cada vez mais as operações de UAVs, o processamento de dados e o gerenciamento de frotas para provedores de serviços especializados, a fim de aumentar a eficiência e se concentrar em suas atividades principais. Além disso, as receitas recorrentes de serviços, atualizações e contratos de longo prazo geram um valor maior e mais estável em comparação com as vendas únicas de hardware, fortalecendo a dominância do segmento indireto.

Análise Regional do Mercado de Veículos Aéreos Não Tripulados na Ásia-Pacífico

- A região Ásia-Pacífico é o maior mercado de drones, representando 37,80% da demanda da região. Com uma taxa de crescimento anual composta (CAGR) projetada de 17%, o crescimento é impulsionado pela rápida industrialização, apoio governamental, expansão do comércio eletrônico e das operações logísticas, e crescente adoção de drones nos setores agrícola, de construção e de vigilância.

- A região se beneficia da melhoria da infraestrutura, de políticas regulatórias favoráveis e do aumento do investimento em iniciativas de cidades inteligentes e tecnologia de drones. O crescimento das aplicações finais na agricultura, inspeção industrial e logística sustenta uma forte penetração de mercado e um potencial de crescimento a longo prazo na região da Ásia-Pacífico.

Análise do Mercado de Veículos Aéreos Não Tripulados na China

O mercado de drones na China está em rápida expansão, impulsionado pelo apoio governamental, inovação tecnológica e adoção nos setores de agricultura, logística, vigilância e comércio eletrônico. A forte capacidade de produção, o desenvolvimento de infraestrutura e o investimento em drones com inteligência artificial aprimoram a eficiência operacional, posicionando a China como um mercado líder de drones na região Ásia-Pacífico, com significativo potencial de crescimento.

Análise do Mercado de Veículos Aéreos Não Tripulados na Índia

O mercado de drones na Índia está testemunhando um crescimento robusto, impulsionado pela modernização da defesa, monitoramento agrícola, inspeção industrial e aplicações logísticas. Iniciativas governamentais de apoio à tecnologia de drones, a crescente adoção de drones de asa rotativa e a integração de IA e IoT aumentam a eficiência, tornando a Índia um mercado emergente de rápido crescimento na região da Ásia-Pacífico.

Participação de mercado de veículos aéreos não tripulados na região Ásia-Pacífico

O setor de Veículos Aéreos Não Tripulados é liderado principalmente por empresas consolidadas, incluindo:

- DJI (China)

- Northrop Grumman Corporation (EUA)

- Lockheed Martin Corporation (EUA)

- General Atomics Aeronautical Systems (EUA)

- BAE Systems (Reino Unido)

- Grupo Thales (França)

- Leonardo SPA (Itália)

- Teledyne FLIR LLC (EUA)

- Insitu (uma empresa Boeing) (EUA)

- Robótica Autel (China)

- Ehang Holdings (China)

- Parrot SA (França)

Últimos desenvolvimentos no mercado de veículos aéreos não tripulados na região Ásia-Pacífico

- Em novembro de 2025, a BAE Systems e a Turkish Aerospace assinaram um Memorando de Entendimento para formar uma aliança estratégica focada no desenvolvimento de sistemas aéreos não tripulados. A colaboração reúne a expertise da BAE Systems em aeronaves de combate da FalconWorks e as comprovadas capacidades da Turkish Aerospace em UAS (Sistemas Aéreos Não Tripulados) para explorar conjuntamente a inovação, acelerar o desenvolvimento e desbloquear novas oportunidades de mercado na região Ásia-Pacífico por meio de soluções economicamente viáveis.

- Em julho de 2025, a BAE Systems demonstrou com sucesso uma capacidade de ataque de baixo custo, lançando munições guiadas com precisão a partir de um sistema aéreo não tripulado multirrotor durante testes nos EUA. Utilizando uma plataforma TRV-150 equipada com APKWS®, os testes destruíram alvos aéreos e terrestres, apresentando uma solução UAS multifuncional e acessível para operações modernas em campo de batalha.

- Em dezembro de 2025, na I/ITSEC 2025, a Thales apresentou uma nova capacidade de treinamento com drones que integra drones em simulações militares reais. Compatível com diversos tipos de drones, o sistema permite treinamento realista tanto para cenários com drones aliados quanto inimigos. Ele aprimora a prontidão operacional ao simular a neutralização de drones, o uso de munições de ataque de precisão e fornece análises baseadas em dados, preparando as forças armadas para as ameaças aéreas em constante evolução no campo de batalha moderno.

- Em junho de 2025, a Leonardo e a Baykar estabeleceram uma joint venture 50/50, a LBA Systems, com sede na Itália, para desenvolver tecnologias não tripuladas. Anunciada no Paris Airshow 2025, a parceria combina as plataformas avançadas de UAS da Baykar com a expertise da Leonardo em eletrônica, certificação e sistemas multidomínio, visando projetar, produzir e manter conjuntamente sistemas aéreos não tripulados de última geração para os mercados europeu e da Ásia-Pacífico.

- Em junho de 2025, a Leonardo e a Baykar estabeleceram uma joint venture 50/50, a LBA Systems, com sede na Itália, para desenvolver tecnologias não tripuladas. Anunciada no Paris Airshow 2025, a parceria combina as plataformas avançadas de UAS da Baykar com a expertise da Leonardo em eletrônica, certificação e sistemas multidomínio, visando projetar, produzir e manter conjuntamente sistemas aéreos não tripulados de última geração para os mercados europeu e da Ásia-Pacífico.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 OVERVIEW

4.2.2 LOGISTIC COST SCENARIO

4.2.2.1 INBOUND LOGISTICS FOR COMPONENTS AND SUBSYSTEMS

4.2.2.2 DOMESTIC DISTRIBUTION AND SYSTEM DEPLOYMENT

4.2.2.3 EXPORT LOGISTICS AND ASIA-PACIFIC DEPLOYMENT

4.2.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.2.3.1 SPECIALIZED HANDLING AND SECURITY

4.2.3.2 SUPPLY CHAIN COORDINATION AND NETWORK DESIGN

4.2.3.3 REGULATORY COMPLIANCE AND EXPORT MANAGEMENT

4.2.3.4 RISK MITIGATION AND SUPPLY CHAIN RESILIENCE

4.2.3.5 SUPPORT FOR AFTERMARKET AND CUSTOMER SERVICE

4.2.4 CONCLUSION

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL AND COMPONENT SUPPLIERS: ENABLING PERFORMANCE AND RELIABILITY

4.3.2 TECHNOLOGY AND SOFTWARE PROVIDERS: POWERING AUTONOMY AND INTELLIGENCE

4.3.3 MANUFACTURERS AND FORMULATORS: CONVERTING DATA INTO CUSTOMIZED PRODUCTS

4.3.4 MANUFACTURERS AND SYSTEM INTEGRATORS: CONVERTING TECHNOLOGY INTO MISSION-READY UAVS

4.3.5 GROUND CONTROL, SUPPORT EQUIPMENT, AND PAYLOAD PROVIDERS: EXPANDING OPERATIONAL CAPABILITY

4.3.6 END USERS AND SERVICE OPERATORS: DRIVING DEMAND THROUGH MISSION REQUIREMENTS

4.3.7 REGULATORY AUTHORITIES AND STANDARDS BODIES

4.3.8 SUSTAINABILITY AND INNOVATION DRIVERS

4.4 VENDOR SELECTION CRITERIA

4.4.1 TECHNICAL CAPABILITY & PRODUCT PERFORMANCE

4.4.2 MANUFACTURING & INTEGRATION CAPABILITIES

4.4.3 SUPPLY CHAIN RELIABILITY & AFTER‑SALES SUPPORT

4.4.4 COST & COMMERCIAL COMPETITIVENESS

4.4.5 REGULATORY, SAFETY & SUSTAINABILITY PRACTICES

4.4.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 ADVANCED SENSORS AND IMAGING SYSTEMS

4.5.2 ARTIFICIAL INTELLIGENCE (AI) AND AUTONOMOUS NAVIGATION

4.5.3 EXTENDED FLIGHT TIME AND BATTERY TECHNOLOGY

4.5.4 LIGHTWEIGHT AND ADVANCED MATERIALS

4.5.5 ANTI-COLLISION AND OBSTACLE AVOIDANCE SYSTEMS

4.5.6 MODULAR PAYLOAD SYSTEMS

4.6 COMPANY EVALUATION QUADRANT

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARATIVE ANALYSIS

4.7.2 COMPANY VS BRAND OVERVIEW

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 GROUP 1 DEFENSE & MILITARY USERS

4.8.2 GROUP 2 GOVERNMENT & PUBLIC SAFETY AGENCIES

4.8.3 GROUP 3 COMMERCIAL & ENTERPRISE USERS

4.8.4 GROUP 4 INDUSTRIAL INSPECTION & ENERGY SECTOR USERS

4.8.5 GROUP 5 AGRICULTURE & ENVIRONMENTAL MONITORING USERS

4.8.6 GROUP 6 CONSUMER & PROSUMER USERS

4.9 COST ANALYSIS BREAKDOWN

4.9.1 HARDWARE COSTS

4.9.2 R&D, SOFTWARE, SENSORS, AND IP COSTS

4.9.3 MANUFACTURING, CONTRACT ASSEMBLY, AND PROCUREMENT

4.9.4 TESTING, CERTIFICATION, AND REGULATORY COMPLIANCE

4.9.5 LOGISTICS, DISTRIBUTION, SALES & MARKETING

4.9.6 AFTER-SALES, SUSTAINMENT, TRAINING, AND DATA SERVICES

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND STRATEGIC PARTNERSHIPS

4.10.2 TECHNOLOGY COLLABORATIONS

4.10.3 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.4 STAGE OF DEVELOPMENT

4.10.5 TIMELINES AND MILESTONES

4.10.6 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.7 RISK ASSESSMENT AND MITIGATION

4.10.8 FUTURE OUTLOOK

4.11 PRICING ANALYSIS

4.11.1 PRICING BY UAV TYPE

4.11.2 PRICING BY APPLICATION

4.11.3 COST STRUCTURE DRIVERS

4.11.4 REGIONAL PRICING VARIATIONS

4.11.5 IMPACT OF TARIFFS AND LOCALIZATION

4.11.6 PRICING MODELS AND COMMERCIAL STRATEGIES

4.11.7 PRICING TREND AND FUTURE OUTLOOK

4.12 PROFIT MARGIN SCENARIO

4.12.1 MILITARY SEGMENT

4.12.2 COMMERCIAL SEGMENT

4.12.3 REGIONAL VARIATIONS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEFENSE MODERNIZATION AND MILITARY ISR (INTELLIGENCE, SURVEILLANCE, RECONNAISSANCE) REQUIREMENTS

7.1.2 RISING ADOPTION OF UAVS FOR BORDER SECURITY AND HOMELAND SURVEILLANCE

7.1.3 GROWING COMMERCIAL USE IN AGRICULTURE, INFRASTRUCTURE INSPECTION, MINING, AND CONSTRUCTION

7.1.4 EXPANSION OF UAV APPLICATIONS IN LOGISTICS AND LAST-MILE DELIVERY

7.2 RESTRAINTS

7.2.1 STRINGENT AIRSPACE REGULATIONS AND COMPLEX CERTIFICATION PROCESSES

7.2.2 LIMITED BATTERY LIFE AND PAYLOAD CAPACITY

7.3 OPPORTUNITIES

7.3.1 INCREASING DEMAND FOR UAVS IN DISASTER MANAGEMENT AND EMERGENCY RESPONSE

7.3.2 EXPANSION OF UAV-BASED MAPPING, SURVEYING, AND AERIAL IMAGING SERVICES

7.3.3 INTEGRATION OF UAVS WITH 5G, SATELLITE COMMUNICATIONS, AND CLOUD PLATFORMS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZED ASIA-PACIFIC REGULATIONS FOR UAV OPERATIONS

7.4.2 SAFE INTEGRATION INTO CIVILIAN AIR TRAFFIC MANAGEMENT SYSTEMS

8 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ROTARY-WING UAVS

8.3 FIXED-WING UAVS

8.4 HYBRID UAVS

8.5 OTHERS

8.6 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 MULTI-ROTOR (QUADCOPTER, HEXACOPTER, ETC.)

8.6.2 SINGLE ROTOR

8.7 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.7.1 REMOTE PILOTED

8.7.2 AUTONOMOUS

8.8 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 CONVENTIONAL FIXED-WING

8.8.2 HYBRID FIXED-WING

8.9 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

8.9.1 MEDIUM RANGE

8.9.2 LONG RANGE

8.9.3 SHORT RANGE

8.1 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.10.1 REMOTE PILOTED

8.10.2 AUTONOMOUS

8.11 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 VTOL (VERTICAL TAKE-OFF AND LANDING)

8.11.2 TILT-WING

8.12 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

8.12.1 DEFENSE VTOL

8.12.2 COMMERCIAL VTOL

8.12.3 OTHERS

8.13 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.13.1 REMOTE PILOTED

8.13.2 AUTONOMOUS

8.14 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 NORTH AMERICA

8.14.3 EUROPE

8.14.4 MIDDLE EAST AND AFRICA

8.14.5 SOUTH AMERICA

8.15 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 NORTH AMERICA

8.15.3 EUROPE

8.15.4 MIDDLE EAST AND AFRICA

8.15.5 SOUTH AMERICA

8.16 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 MIDDLE EAST AND AFRICA

8.16.5 SOUTH AMERICA

8.17 ASIA-PACIFIC OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 MIDDLE EAST AND AFRICA

8.17.5 SOUTH AMERICA

9 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT

9.1 OVERVIEW

9.2 PLATFORM

9.3 SOFTWARE & CYBERSECURITY

9.4 DATA LINK

9.5 LAUNCH & RECOVERY SYSTEMS

9.6 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 AVIONICS

9.6.2 AIRFRAME

9.6.3 PROPULSION SYSTEM

9.6.4 GROUND CONTROL STATION

9.7 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 FLIGHT CONTROL SYSTEMS

9.7.2 SENSORS & PAYLOADS

9.7.3 NAVIGATION SYSTEMS

9.7.4 COMMUNICATION SYSTEMS

9.8 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 IMAGING PAYLOAD

9.8.2 LIDAR/RADAR MODULES

9.8.3 HYPERSPECTRAL SENSORS

9.9 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 MIDDLE EAST AND AFRICA

9.9.5 SOUTH AMERICA

9.1 ASIA-PACIFIC SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.10.1 ASIA-PACIFIC

9.10.2 NORTH AMERICA

9.10.3 EUROPE

9.10.4 MIDDLE EAST AND AFRICA

9.10.5 SOUTH AMERICA

9.11 ASIA-PACIFIC DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 MIDDLE EAST AND AFRICA

9.11.5 SOUTH AMERICA

9.12 ASIA-PACIFIC LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.12.1 ASIA-PACIFIC

9.12.2 NORTH AMERICA

9.12.3 EUROPE

9.12.4 MIDDLE EAST AND AFRICA

9.12.5 SOUTH AMERICA

10 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

10.3 MAPPING & SURVEYING

10.4 MONITORING & INSPECTION

10.5 DELIVERY & LOGISTICS

10.6 AGRICULTURE & PRECISION FARMING

10.7 AERIAL PHOTOGRAPHY

10.8 OTHERS

10.9 ASIA-PACIFIC INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 MIDDLE EAST AND AFRICA

10.9.5 SOUTH AMERICA

10.1 ASIA-PACIFIC MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 MIDDLE EAST AND AFRICA

10.10.5 SOUTH AMERICA

10.11 ASIA-PACIFIC MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.11.1 ASIA-PACIFIC

10.11.2 NORTH AMERICA

10.11.3 EUROPE

10.11.4 MIDDLE EAST AND AFRICA

10.11.5 SOUTH AMERICA

10.12 ASIA-PACIFIC DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 MIDDLE EAST AND AFRICA

10.12.5 SOUTH AMERICA

10.13 ASIA-PACIFIC AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 MIDDLE EAST AND AFRICA

10.13.5 SOUTH AMERICA

10.14 ASIA-PACIFIC AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA-PACIFIC

10.14.2 NORTH AMERICA

10.14.3 EUROPE

10.14.4 MIDDLE EAST AND AFRICA

10.14.5 SOUTH AMERICA

10.15 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 MIDDLE EAST AND AFRICA

10.15.5 SOUTH AMERICA

11 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE

11.1 OVERVIEW

11.2 ROTARY-WING

11.3 FIXED-WING

11.4 HYBRID VTOL

11.5 SINGLE-ROTOR HELICOPTER UAVS

11.6 NANO / MICRO DRONES

11.7 OTHERS

11.8 ASIA-PACIFIC ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 MIDDLE EAST AND AFRICA

11.8.5 SOUTH AMERICA

11.9 ASIA-PACIFIC FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.9.1 ASIA-PACIFIC

11.9.2 NORTH AMERICA

11.9.3 EUROPE

11.9.4 MIDDLE EAST AND AFRICA

11.9.5 SOUTH AMERICA

11.1 ASIA-PACIFIC HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 MIDDLE EAST AND AFRICA

11.10.5 SOUTH AMERICA

11.11 ASIA-PACIFIC SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 MIDDLE EAST AND AFRICA

11.11.5 SOUTH AMERICA

11.12 ASIA-PACIFIC NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 MIDDLE EAST AND AFRICA

11.12.5 SOUTH AMERICA

11.13 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 NORTH AMERICA

11.13.3 EUROPE

11.13.4 MIDDLE EAST AND AFRICA

11.13.5 SOUTH AMERICA

12 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER

12.1 OVERVIEW

12.2 DEFENSE & SECURITY

12.3 COMMERCIAL

12.4 RECREATIONAL

12.5 CIVIL

12.6 OTHERS

12.7 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

12.7.1 DEFENSE & SECURITY

12.7.2 COMMERCIAL

12.7.3 RECREATIONAL

12.7.4 CIVIL

12.7.5 OTHERS

12.8 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.8.1 COMBAT OPERATIONS

12.8.2 BORDER PATROL

12.8.3 SEARCH & RESCUE

12.9 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.9.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.9.2 MONITORING & INSPECTION

12.9.3 DELIVERY & LOGISTICS

12.9.4 MAPPING & SURVEYING

12.9.5 AERIAL PHOTOGRAPHY

12.9.6 AGRICULTURE & PRECISION FARMING

12.9.7 OTHERS

12.1 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.10.1 AERIAL PHOTOGRAPHY

12.10.2 MAPPING & SURVEYING

12.10.3 AGRICULTURE & PRECISION FARMING

12.10.4 MONITORING & INSPECTION

12.10.5 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.10.6 DELIVERY & LOGISTICS

12.10.7 OTHERS

12.11 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.11.1 AERIAL PHOTOGRAPHY

12.11.2 MAPPING & SURVEYING

12.11.3 MONITORING & INSPECTION

12.11.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.11.5 DELIVERY & LOGISTICS

12.11.6 AGRICULTURE & PRECISION FARMING

12.11.7 OTHERS

12.12 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.12.1 ENVIRONMENTAL MONITORING

12.12.2 DISASTER MANAGEMENT

12.12.3 RESEARCH AND EDUCATION

12.13 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.13.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.13.2 MAPPING & SURVEYING

12.13.3 DELIVERY & LOGISTICS

12.13.4 AGRICULTURE & PRECISION FARMING

12.13.5 AERIAL PHOTOGRAPHY

12.13.6 MONITORING & INSPECTION

12.13.7 OTHERS

12.14 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.14.1 AERIAL PHOTOGRAPHY

12.14.2 MAPPING & SURVEYING

12.14.3 MONITORING & INSPECTION

12.14.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.14.5 DELIVERY & LOGISTICS

12.14.6 AGRICULTURE & PRECISION FARMING

12.14.7 OTHERS

12.15 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.15.1 ASIA-PACIFIC

12.15.2 NORTH AMERICA

12.15.3 EUROPE

12.15.4 MIDDLE EAST AND AFRICA

12.15.5 SOUTH AMERICA

12.16 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 MIDDLE EAST AND AFRICA

12.16.5 SOUTH AMERICA

12.17 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.17.1 ASIA-PACIFIC

12.17.2 NORTH AMERICA

12.17.3 EUROPE

12.17.4 MIDDLE EAST AND AFRICA

12.17.5 SOUTH AMERICA

12.18 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 MIDDLE EAST AND AFRICA

12.18.5 SOUTH AMERICA

12.19 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.19.1 ASIA-PACIFIC

12.19.2 NORTH AMERICA

12.19.3 EUROPE

12.19.4 MIDDLE EAST AND AFRICA

12.19.5 SOUTH AMERICA

13 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE

13.1 OVERVIEW

13.2 MILITARY

13.3 COMMERCIAL OPERATORS

13.4 GOVERNMENT & LAW ENFORCEMENT

13.5 CONSUMER / ENTHUSIAST

13.6 ASIA-PACIFIC MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 NORTH AMERICA

13.6.3 EUROPE

13.6.4 MIDDLE EAST AND AFRICA

13.6.5 SOUTH AMERICA

13.7 ASIA-PACIFIC COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 NORTH AMERICA

13.7.3 EUROPE

13.7.4 MIDDLE EAST AND AFRICA

13.7.5 SOUTH AMERICA

13.8 ASIA-PACIFIC GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.8.1 ASIA-PACIFIC

13.8.2 NORTH AMERICA

13.8.3 EUROPE

13.8.4 MIDDLE EAST AND AFRICA

13.8.5 SOUTH AMERICA

13.9 ASIA-PACIFIC CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 NORTH AMERICA

13.9.3 EUROPE

13.9.4 MIDDLE EAST AND AFRICA

13.9.5 SOUTH AMERICA

14 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.3 DIRECT

14.4 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

14.4.1 DISTRIBUTORS & AUTHORIZED DEALERS

14.4.2 SYSTEM INTEGRATORS

14.4.3 VALUE-ADDED RESELLERS (VARS)

14.5 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.5.1 ASIA-PACIFIC

14.5.2 NORTH AMERICA

14.5.3 EUROPE

14.5.4 MIDDLE EAST AND AFRICA

14.5.5 SOUTH AMERICA

14.6 ASIA-PACIFIC DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.6.1 ASIA-PACIFIC

14.6.2 NORTH AMERICA

14.6.3 EUROPE

14.6.4 MIDDLE EAST AND AFRICA

14.6.5 SOUTH AMERICA

15 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY REGION

15.1 ASIA PACIFIC

15.1.1 CHINA

15.1.2 INDIA

15.1.3 JAPAN

15.1.4 SOUTH KOREA

15.1.5 AUSTRALIA

15.1.6 SINGAPORE

15.1.7 THAILAND

15.1.8 INDONESIA

15.1.9 MALAYSIA

15.1.10 PHILIPPINES

15.1.11 TAIWAN

15.1.12 HONG KONG

15.1.13 NEW ZEALAND

15.1.14 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 DJI

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 NORTHROP GRUMMAN

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 LOCKHEED MARTIN CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 GENERAL ATOMICS

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 BAE SYSTEMS

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ACTION DRONE, INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROVIRONMENT, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 AIROBOTICS LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 AUTEL ROBOTICS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 EHANG

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 ELBIT SYSTEMS LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 HOLY STONE

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INSITU (SUBSIDIARY OF THE BOEING COMPANY)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 LEONARDO S.P.A.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MICRODRONES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PARROT DRONES SAS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 QUANTUM-SYSTEMS GMBH

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SKYDIO, INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 TELEDYNE FLIR DEFENSE INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 TERRA DRONE CORP.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 THALES

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 WINGCOPTER

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 YUNEEC

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 ZIPLINE

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 39 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD UNITS)

TABLE 62 ASIA-PACIFIC

TABLE 63 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 80 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 CHINA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 CHINA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 CHINA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 93 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 95 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 96 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 98 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 99 CHINA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 100 CHINA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 CHINA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 CHINA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 CHINA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 104 CHINA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 CHINA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 106 CHINA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 107 CHINA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 CHINA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 109 CHINA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 110 CHINA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 111 CHINA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 CHINA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 113 CHINA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 114 CHINA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 CHINA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 CHINA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 INDIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 INDIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 120 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 122 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 123 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 125 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 126 INDIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 127 INDIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 INDIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 INDIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 INDIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 131 INDIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 INDIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 133 INDIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 134 INDIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 INDIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 136 INDIA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 137 INDIA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 138 INDIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 INDIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 140 INDIA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 141 INDIA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 INDIA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 143 INDIA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 JAPAN ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 JAPAN ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 147 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 149 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 150 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 152 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 153 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 154 JAPAN PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 JAPAN AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 JAPAN SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 158 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 160 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 161 JAPAN DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 JAPAN DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 163 JAPAN COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 164 JAPAN RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 165 JAPAN CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 JAPAN CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 167 JAPAN OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 168 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 170 JAPAN INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 SOUTH KOREA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 SOUTH KOREA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 174 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 176 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 177 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 179 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 180 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 181 SOUTH KOREA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 SOUTH KOREA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 SOUTH KOREA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 185 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 187 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 188 SOUTH KOREA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SOUTH KOREA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 190 SOUTH KOREA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 191 SOUTH KOREA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 192 SOUTH KOREA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SOUTH KOREA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 194 SOUTH KOREA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 195 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 197 SOUTH KOREA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 AUSTRALIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 AUSTRALIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 201 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 203 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 204 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 206 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 207 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 208 AUSTRALIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 AUSTRALIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 AUSTRALIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 212 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 214 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 215 AUSTRALIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 AUSTRALIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 217 AUSTRALIA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 218 AUSTRALIA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 219 AUSTRALIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 AUSTRALIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 221 AUSTRALIA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 222 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 224 AUSTRALIA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 SINGAPORE ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 SINGAPORE ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 228 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 230 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 231 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 233 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 234 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 235 SINGAPORE PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 SINGAPORE AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 SINGAPORE SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 239 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 241 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 242 SINGAPORE DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 SINGAPORE DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 244 SINGAPORE COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 245 SINGAPORE RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 246 SINGAPORE CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 SINGAPORE CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 248 SINGAPORE OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 249 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 251 SINGAPORE INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 THAILAND ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 THAILAND ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 255 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 257 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 258 THAILAND HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 THAILAND HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)