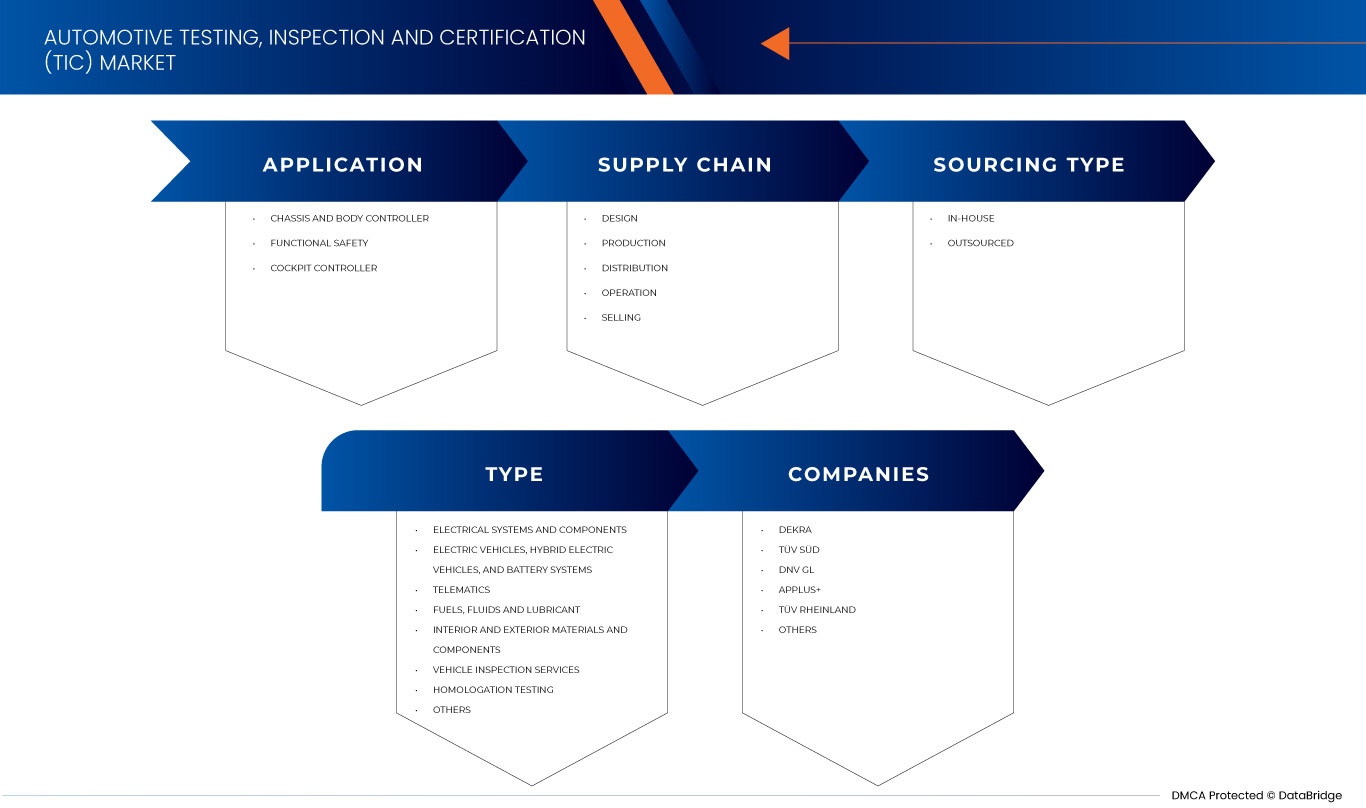

China Automotive Testing, Inspection and Certification (TIC) Market, By Application (Chassis and Body Controller, Cockpit Controller, and Functional Safety), Supply Chain (Design, Production, Distribution, Selling, and Operation), Sourcing Type (In-House and Outsourced), Type (Electrical Systems and Components, Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems, Telematics, Fuels, Fluids and Lubricant, Interior and Exterior Materials and Components, Vehicle Inspection Services, Homologation Testing, and Others) - Industry Trends and Forecast to 2030.

China Automotive Testing, Inspection and Certification (TIC) Market Analysis and Size

The market for automotive vehicles is growing rapidly in China, especially for passenger vehicles. China's auto market seems to be the world's biggest, with intelligent functions like internet connectivity and autonomous driving. This is expected to drive sales to increase by 30% by 2025. Although with the growing automotive sales in the country, there is an increase in traffic incidents. The main reason for traffic incidents in China are actions against traffic regulations, including over freight and speed, fatigue driving, and vehicle malfunctions. In recent years, the government has been strengthening large-scale inspections of safety measures during long-distance passenger transportation rush periods, thus containing frequent heavy traffic accidents and effectively controlling the rise in the death toll claimed by traffic accidents. However, in another aspect, with the increase in vehicle population, the death toll caused by accidents or vehicle collisions has increased.

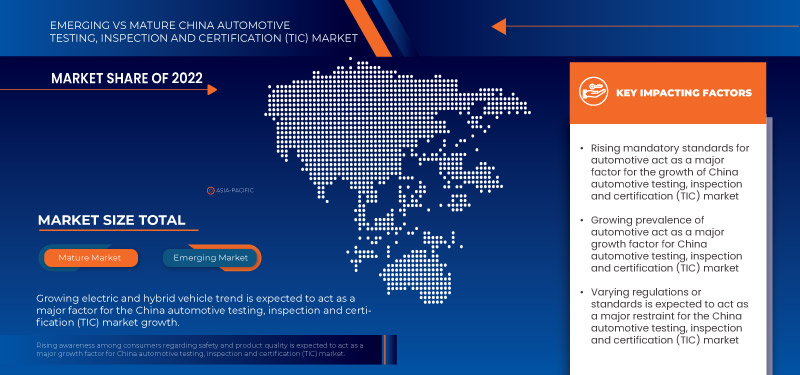

Data Bridge Market Research analyses that the China automotive testing, inspection and certification (TIC) market is expected to grow at a CAGR of 4.8% from 2023 to 2030. Government to implement strict and mandatory safety standards to be followed by vehicle manufacturers, which has been increasing over the years.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Application (Chassis and Body Controller, Cockpit Controller, and Functional Safety), Supply Chain (Design, Production, Distribution, Selling, and Operation), Sourcing Type (In-House and Outsourced), Type (Electrical Systems and Components, Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems, Telematics, Fuels, Fluids and Lubricant, Interior and Exterior Materials and Components, Vehicle Inspection Services, Homologation Testing, Others) |

|

Countries Covered |

China |

|

Market Players Covered |

Nemko, DEKRA, RINA S.p.A., NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific, and HQTS Group Ltd. among others |

Market Definition

The automotive testing, inspection, and certification (TIC) market is a specialized sector within the automotive industry that provides essential services to ensure the safety, quality, and compliance of vehicles and automotive components. This market encompasses a range of activities, including testing, inspection, and certification services that play a crucial role in enhancing product reliability, mitigating risks, and meeting regulatory requirements.

In the TIC market, testing services involve comprehensive evaluations of automotive products, systems, and materials to assess their performance, durability, and adherence to industry standards. This includes inspections of manufacturing plants, supply chain audits, quality control checks, and pre-shipment inspections. Additionally, certification services involve the issuance of official certifications and approvals that validate the compliance of automotive products and processes with relevant regulations and standards.

China Automotive Testing, Inspection and Certification (TIC) Market Dynamics

This section deals with understanding the drivers, restraints, challenges, and weaknesses. All of this is discussed in detail below:

Drivers

- Increasing focus of the government on imposing mandatory safety standards for automotive

The market for automotive vehicles is growing rapidly in China, especially for passenger vehicles. China's auto market seems to be the world's biggest, with intelligent functions such as internet connectivity and autonomous driving. This is expected to drive sales to increase by 30% by 2025.

Although with the growing automotive sales in the country, there is an increase in traffic incidents. The main reason for traffic incidents in China are actions against traffic regulations, including over freight and speed, fatigue driving, and vehicle malfunctions. In recent years, the government has been strengthening large-scale inspections of safety measures. This was during rush periods of long-distance passenger transportation. Thus, having contained frequent heavy traffic accidents and effectively controlled the rise in death toll claimed by traffic accidents. However, in another aspect, the death toll caused by accidents or vehicle collisions has increased with the increase in vehicle population.

- Growing prevalence of automotive

The production and consumption of automobiles are mainly centered on the passenger segment automobiles in China. This has been a major driving factor for the increase in the automobile industry since the 21st century. The growth of the Chinese economy, the vehicle population, especially passenger vehicles with private cars as the mainstay, has been increasing rapidly.

China continues to be the world's largest vehicle market by annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. Commercial vehicle sales reached 4.79 million units, down 6.6% from 2020.

Moreover, there is a growing importance for electric vehicles across the globe. Electric vehicles (EVs) are designed to be a promising technology to achieve sustainable transportation with zero carbon emissions, low noise, and high efficiency. Electric vehicles are highly embedded with automotive software and have various benefits concentrated by various countries. This has resulted in formulation regulation, policies, testing, inspection, and certification process to boost electric vehicle quality as it helps control carbon emissions and avoid China warming.

Opportunity

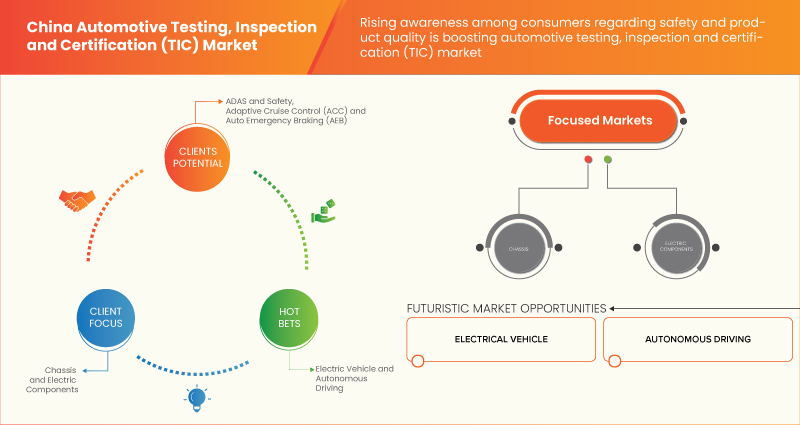

- Growing trend of electric and ADAS vehicles

Electric vehicles (EVs) are designed to be a promising technology for sustainable transportation with zero carbon emissions, low noise, and high efficiency. Moreover, electric vehicles evolved in the 19th century, but due to a lack of technological advancement, internal combustion engines had a huge demand compared to electric vehicles. During the 20th century, technological advancement was boosted yearly, resulting in developments and innovations that helped reshape electric vehicles.

Moreover, electric vehicles are the key technology to decarbonize road transport. Recent years have seen exponential growth in the sale of electric vehicles with improved range, wider model availability, and increased performance. Passenger electric cars are surging in popularity. In addition, the government of China is supporting the usage of electric vehicles. Governments are providing various policies and formulating rules to promote electric vehicle usage.

Restraint/Challenge

- Varying standards across different regions/countries

Automotive emissions are one of the leading contributors to air pollution. The various exhaust gases from an automobile tailpipe, such as NOx, CO2, and CO, are the primary reasons for polluting the atmosphere and environment, which further leads to cause respiratory and skin diseases in humans. This has made many countries formulate stringent rules and regulations to reduce emissions.

Furthermore, different countries and regions have implemented norms and have set different standards. Several large state-owned automobile enterprises, such as Beijing Automotive Industry Corp, Brilliance China Automotive Holdings, and many others in China, tried to partner with foreign auto manufacturers. These joint ventures are formed to increase their capacity and enhance their technical capabilities.

However, companies from other countries have different vehicle standards and norms than China. This will create variations in the features of the automobile along with the pricing. Moreover, the government of China is changing the norms and standards frequently.

Recent Developments

- In November 2022, Nemko acquired the remaining shares of Nemko Norlab, making them the company's sole owner. This acquisition aims to enhance collaboration and meet customer needs more effectively, leveraging the market synergies and opportunities observed since the initial share acquisition in June.

- In October 2023, Nemko Germany obtained accreditation from DAkkS in Functional Safety. This development has enabled them to test and assess equipment/systems' functional safety in compliance with international standards and regulations, ensuring the control of hazards and minimizing risks for the safety of individuals, facilities, and the environment. Such recognition helps the company to gain customer attention Chinaly.

China Automotive Testing, Inspection and Certification (TIC) Market Scope

China automotive testing, inspection and certification (TIC) market is segmented into four notable segments based on application, supply chain, sourcing type, and type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Application

- Chassis and Body Controller

- Cockpit Controller

- Functional Safety

On the basis of application, the China automotive testing, inspection and certification (TIC) market is segmented into chassis and body controller, cockpit controller and functional safety.

Supply Chain

- Design

- Production

- Distribution

- Selling

- Operation

On the basis of supply chain, the China automotive testing, inspection and certification (TIC) market is segmented into design, production, distribution, selling and operation.

Sourcing Type

- In-House

- Outsourced

On the basis of sourcing type, the China automotive testing, inspection and certification (TIC) market is segmented into in-house and outsourced.

Type

- Electrical Systems and Components

- Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems

- Telematics

- Fuels, Fluids and Lubricant

- Interior and Exterior Materials and Components

- Vehicle Inspection Services

- Homologation Testing

- Others

On the basis of type, the China automotive testing, inspection and certification (TIC) market is segmented into electrical systems and components, electric vehicles, hybrid electric vehicles, and battery systems, telematics, fuels, fluids and lubricant, interior and exterior materials and components, vehicle inspection services, homologation testing, and others.

Competitive Landscape and China Automotive Testing, Inspection and Certification (TIC) Market Share Analysis

The China automotive testing, inspection and certification (TIC) market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points only relate to the companies focusing on the market.

Some of the major players operating in the China automotive testing, inspection and certification (TIC) market are Nemko, DEKRA, RINA S.p.A., NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific, and HQTS Group Ltd. among others among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 APPLICATION CURVE

2.8 MARKET END-USER COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING FOCUS OF THE GOVERNMENT ON IMPOSING MANDATORY SAFETY STANDARDS FOR AUTOMOTIVE

5.1.2 GROWING PREVALENCE OF AUTOMOTIVE

5.2 RESTRAINTS

5.2.1 VARYING STANDARDS ACROSS DIFFERENT REGIONS/COUNTRIES

5.2.2 LENGTHY PROCESS AND LEAD TIME FOR QUALIFICATION TESTS

5.3 OPPORTUNITIES

5.3.1 GROWING TREND OF ELECTRIC AND ADAS VEHICLES

5.3.2 INCREASE IN THE USAGE OF ELECTRONIC SYSTEMS IN VEHICLES

5.3.3 RISING AWARENESS REGARDING SAFETY AND PRODUCT QUALITY AMONG CONSUMERS

5.4 CHALLENGES

5.4.1 RISK AVERSION AND NEW TECHNOLOGY RELUCTANCE

5.4.2 LACK OF SKILLED PROFESSIONALS

6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 CHASSIS AND BODY CONTROLLER

6.3 FUNCTIONAL SAFETY

6.3.1 ADAS AND SAFETY

6.3.2 ADAPTIVE CRUISE CONTROL (ACC)

6.3.3 AUTO EMERGENCY BRAKING (AEB)

6.3.4 LANE DEPARTURE WARNING SYSTEM (LDWS)

6.3.5 TIRE PRESSURE MONITORING SYSTEM (TPMS)

6.3.6 AUTOMATIC PARKING

6.3.7 PEDESTRIAN WARNING/PROTECTION SYSTEM

6.3.8 AUTOMOTIVE NIGHT VISION

6.3.9 TRAFFIC SIGN RECOGNITION

6.3.10 DRIVER DROWSINESS DETECTION

6.3.11 BLIND SPOT DETECTION

6.3.12 OTHER ADAS AND SAFETY CONTROLLERS

6.4 COCKPIT CONTROLLER

6.4.1 HUMAN-MACHINE INTERFACE (HMI)

6.4.2 HEADS-UP DISPLAY (HUD)

6.4.3 OTHER

7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN

7.1 OVERVIEW

7.2 DESIGN

7.3 PRODUCTION

7.4 DISTRIBUTION

7.5 OPERATION

7.6 SELLING

8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE

9.1 OVERVIEW

9.2 ELECTRICAL SYSTEMS AND COMPONENTS

9.2.1 IN-HOUSE

9.2.2 OUTSOURCED

9.3 ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS

9.3.1 IN-HOUSE

9.3.2 OUTSOURCED

9.4 TELEMATICS

9.4.1 IN-HOUSE

9.4.2 OUTSOURCED

9.5 FUELS, FLUIDS AND LUBRICANT

9.5.1 IN-HOUSE

9.5.2 OUTSOURCED

9.6 INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS

9.6.1 IN-HOUSE

9.6.2 OUTSOURCED

9.7 VEHICLE INSPECTION SERVICES

9.7.1 IN-HOUSE

9.7.2 OUTSOURCED

9.8 HOMOLOGATION TESTING

9.8.1 IN-HOUSE

9.8.2 OUTSOURCED

9.9 OTHERS

10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 DEKRA

12.1.1 COMPANY SNAPSHOT

12.1.2 SERVICE PORTFOLIO

12.1.3 RECENT DEVELOPMENTS

12.2 TÜV SÜD

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 DNV GL

12.3.1 COMPANY SNAPSHOT

12.3.2 SERVICE PORTFOLIO

12.3.3 RECENT DEVELOPMENTS

12.4 APPLUS+

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 SERVICE PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 TÜV RHEINLAND

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASIA QUALITY FOCUS

12.6.1 COMPANY SNAPSHOT

12.6.2 SERVICE PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHINA CERTIFICATION AND INSPECTION (GROUP) CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ELEMENT MATERIALS TECHNOLOGY

12.8.1 COMPANY SNAPSHOT

12.8.2 SERVICE PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EUROFINS SCIENTIFIC

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SERVICE PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HQTS GROUP LTD

12.10.1 COMPANY SNAPSHOT

12.10.2 SERVICE PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INTERTEK GROUP PLC

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 SERVICE PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 MISTRAS GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 SERVICE PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 NEMKO

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 NSF

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 RINA S.P.A.

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 SERVICE PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 THE BRITISH STANDARDS INSTITUTION

12.17.1 COMPANY SNAPSHOT

12.17.2 SERVICE PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TÜV NORD GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SERVICE PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 VERITELL INSPECTION CERTIFICATION CO., LTD

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 2 CHINA FUNCTIONAL SAFETY IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 CHINA COCKPIT CONTROLLER IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN, 2021-2030 (USD MILLION)

TABLE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 CHINA ELECTRICAL SYSTEMS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 8 CHINA ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 9 CHINA TELEMATICS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 10 CHINA FUELS, FLUIDS AND LUBRICANT IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 11 CHINA INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 12 CHINA VEHICLE INSPECTION SERVICES IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 13 CHINA HOMOLOGATION TESTING IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 2 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DATA TRIANGULATION

FIGURE 3 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DROC ANALYSIS

FIGURE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET: APPLICATION CURVE

FIGURE 8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 12 UPSURGE OF ADOPTION OF ADVANCED FEATURES FOR VEHICLES IS EXPECTED TO DRIVE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET IN THE FORECAST PERIOD

FIGURE 13 CHASSIS AND BODY CONTROLLER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET FROM 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF GLOBAL SYNCHRONOUS CONDENSER MARKET

FIGURE 15 GROWTH RATE OF ADOPTION OF ELECTRONIC SYSTEMS IN VARIOUS APPLICATIONS (CAGR)

FIGURE 16 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY APPLICATION, 2022

FIGURE 17 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SUPPLY CHAIN, 2022

FIGURE 18 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SOURCING TYPE, 2022

FIGURE 19 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY TYPE, 2022

FIGURE 20 THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY SHARE 2022(%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.