Europe Aniline Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.77 Billion

USD

4.23 Billion

2025

2033

USD

2.77 Billion

USD

4.23 Billion

2025

2033

| 2026 –2033 | |

| USD 2.77 Billion | |

| USD 4.23 Billion | |

|

|

|

|

Segmentação do mercado europeu de anilina por processo de produção (hidrogenação de nitrobenzeno, nitração-hidrogenação integrada (benzeno para anilina), rotas de base biológica (piloto/emergentes), outras vias emergentes), grau e pureza (grau industrial padrão (≥99,5%), grau de alta pureza (≥99,9%) e sais e formulações), processo de fabricação (laminação a frio e recozimento, fiação por fusão, metalurgia do pó e outros), aplicação (produção de diisocianato de difenilmetano (MDI), produtos químicos para processamento de borracha, corantes e pigmentos, agroquímicos, produtos farmacêuticos e outros), usuário final (automotivo, móveis e eletrodomésticos, têxtil e couro, elétrico e eletrônico, construção e outros), canal de distribuição (direto, indireto) - tendências e previsões do setor até 2033.

Tamanho do mercado de anilina na Europa

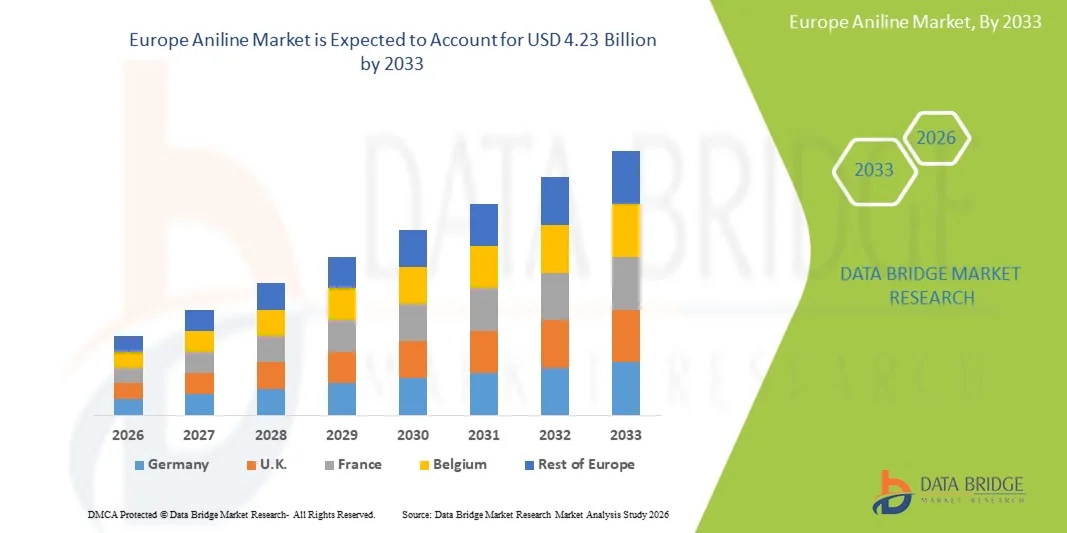

- O mercado europeu de anilina foi avaliado em US$ 2,77 bilhões em 2025 e deverá atingir US$ 4,23 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,6% durante o período de previsão.

- O crescimento do mercado europeu de anilina é impulsionado principalmente pela crescente demanda por MDI (diisocianato de difenilmetano) na produção de poliuretano, pela expansão de suas aplicações nas indústrias da construção civil, automotiva e moveleira, e pelo aumento da industrialização em economias emergentes, o que impulsiona a necessidade de materiais isolantes e revestimentos.

- Além disso, o mercado é impulsionado pelos avanços na fabricação de produtos químicos, pelo uso crescente de anilina em produtos farmacêuticos, corantes e produtos químicos para processamento de borracha, e pelos investimentos crescentes em tecnologias de produção sustentáveis. Esses fatores, em conjunto, aceleram a adoção pelo mercado e contribuem significativamente para a expansão geral do setor.

Análise do mercado europeu de anilina

- O mercado europeu de anilina abrange a produção, o processamento e a utilização de anilina em poliuretano, corantes e pigmentos, produtos químicos para processamento de borracha e intermediários farmacêuticos, impulsionado pelo rápido desenvolvimento da infraestrutura, pelo crescimento da fabricação automotiva e pela crescente demanda por materiais isolantes em projetos de construção e energia em toda a região.

- A crescente adoção da anilina é impulsionada pela expansão das aplicações de espuma de poliuretano, pelo aumento do investimento na fabricação de produtos químicos e pela mudança estratégica dos fabricantes em direção a derivados especiais de maior eficiência, visando atender às crescentes demandas regionais por revestimentos duráveis, polímeros avançados e soluções de espuma flexível nos setores industrial e de consumo.

- Prevê-se que a Alemanha domine o mercado europeu de anilina, com a maior quota de mercado de 17,49% em 2026, e também que registe a maior taxa de crescimento anual composta (CAGR) durante o período de previsão, impulsionada pelo rápido crescimento industrial em países como a China e a Índia, pelo aumento da procura de anilina em aplicações a jusante, como a produção de MDI, produtos químicos para o processamento da borracha e corantes e pigmentos, e pela presença de uma infraestrutura de fabrico de produtos químicos bem estabelecida na região.

- Espera-se que o segmento de hidrogenação de nitrobenzeno domine o mercado europeu de anilina, com a maior participação de mercado, de 68,91%, em 2026, principalmente devido à sua ampla adoção industrial, alta eficiência na produção de anilina e à preferência por tecnologias de hidrogenação consolidadas, como catalisadores de níquel Raney e paládio sobre carbono (Pd/C).

Escopo do relatório e segmentação do mercado de anilina na Europa

|

Atributos |

Principais informações sobre o mercado de anilina na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de anilina na Europa

“ Forte demanda por poliuretano/MDI ”

- A crescente preferência industrial por sistemas de poliuretano de alto desempenho impulsiona fortemente o mercado europeu de anilina, visto que a anilina é o precursor essencial para a produção de MDI. Indústrias como a da construção civil, automotiva, de isolamento e de eletrodomésticos priorizam cada vez mais materiais que ofereçam durabilidade, eficiência térmica e leveza, aumentando diretamente o consumo de MDI e, consequentemente, de anilina.

- O crescimento da demanda incentiva os produtores de MDI e os fabricantes de produtos químicos integrados a expandir a capacidade produtiva, garantir o fornecimento de matérias-primas e investir em tecnologias catalíticas avançadas para melhorar a eficiência e o rendimento. Como resultado, os produtores de anilina ampliam suas operações, expandem sua rede de fornecimento e otimizam os processos para atender às necessidades de longo prazo do mercado de poliuretano.

- Em 2025, avaliações do setor da construção civil na Ásia e no Oriente Médio destacaram o desenvolvimento acelerado de infraestrutura e a crescente adoção de materiais de construção com eficiência energética, reforçando a necessidade de espuma rígida de poliuretano — uma das maiores aplicações subsequentes do MDI derivado da anilina.

- Em 2024, diversos relatórios sobre as perspectivas da indústria química sinalizaram um forte crescimento na produção automotiva, especialmente na fabricação de veículos elétricos, onde espumas e revestimentos de poliuretano são utilizados para redução de peso, isolamento acústico e conforto interno — ampliando ainda mais a demanda por MDI à base de anilina.

- Em 2025, os relatórios sobre inovação de materiais na Europa enfatizaram a mudança para materiais de isolamento e amortecimento sustentáveis e de alto desempenho, observando que as soluções de poliuretano continuam a dominar devido às suas propriedades térmicas, mecânicas e estruturais superiores. Essa orientação da indústria acelera a demanda por anilina como matéria-prima essencial para as cadeias de valor do poliuretano e do MDI.

Dinâmica do mercado de anilina na Europa

Motorista

“A crescente demanda por poliuretanos à base de MDI nos setores da construção civil, automotivo e de eletrodomésticos”

- O crescimento das inovações centradas no poliuretano nos setores da construção civil, automotivo e de eletrodomésticos atua como um dos principais impulsionadores da demanda no mercado europeu de anilina, visto que a anilina é a principal matéria-prima para o MDI, essencial na produção de espumas de poliuretano rígidas e flexíveis, revestimentos, adesivos e materiais isolantes. Os fabricantes nesses setores de uso final continuam priorizando materiais que ofereçam eficiência energética superior, resistência estrutural, leveza e durabilidade — necessidades que favorecem fortemente os poliuretanos à base de MDI. Essa mudança contínua acelera o consumo de anilina e estimula o investimento em sistemas de produção de MDI mais eficientes e com maior capacidade. Evidências das perspectivas do setor e das políticas de manufatura corroboram ainda mais a expansão contínua das cadeias de valor orientadas ao poliuretano nos setores da construção civil e da mobilidade.

- Em 2025, diversos produtores químicos europeus anunciaram expansões de capacidade em sistemas de MDI e poliuretano para atender à crescente demanda do setor da construção civil por espumas de isolamento rígidas, cada vez mais exigidas em normas de construção focadas em eficiência térmica e sustentabilidade. Essas expansões sinalizam uma forte demanda de longo prazo para a produção de anilina.

- Líderes do setor, como BASF, Huntsman, Wanhua e Covestro, estão aprimorando a eficiência dos processos, expandindo instalações integradas de anilina-MDI e desenvolvendo formulações especializadas de poliuretano para interiores automotivos de última geração, isolamento de baterias de veículos elétricos, espumas de conforto e componentes duráveis de eletrodomésticos. Esses aumentos de capacidade e inovações de produtos destacam como as aplicações de poliuretano de alto desempenho reforçam diretamente o crescimento do consumo de anilina.

- Ao mesmo tempo, as iniciativas europeias de sustentabilidade e eficiência energética — incluindo certificações de construção verde, normas de isolamento e políticas de redução de peso — estão criando condições favoráveis à adoção do poliuretano, aumentando assim a necessidade de MDI e seu precursor, a anilina. As regulamentações que promovem a construção energeticamente eficiente e veículos de baixa emissão reforçam significativamente a demanda por soluções de materiais à base de MDI.

- Em conjunto, esses desenvolvimentos ilustram como a convergência dos requisitos de desempenho funcional, das pressões regulatórias de sustentabilidade e da rápida inovação na tecnologia de poliuretano está impulsionando o crescimento contínuo, a diversificação e o investimento a montante no setor de anilina. O alinhamento estrutural entre a demanda por MDI e a expansão do mercado de poliuretano garante que a anilina permaneça um produto químico estrategicamente crítico na indústria manufatureira europeia.

Restrição/Desafio

“ Volatilidade do preço do benzeno e exposição às margens cíclicas dos aromáticos ”

- A volatilidade dos preços do benzeno funciona como uma grande restrição para o mercado europeu de anilina, pois o benzeno é a principal matéria-prima e as flutuações nos preços do petróleo bruto, nas operações de refinaria e nos ciclos de oferta e demanda de aromáticos influenciam diretamente os custos de produção e as margens de lucro da anilina. Produtores e fabricantes de MDI (injetores de dióxido de magnésio) enfrentam pressão constante sobre as margens quando os valores do benzeno oscilam de forma imprevisível, o que força ajustes operacionais, ciclos de planejamento mais curtos e estratégias de produção mais conservadoras. Essa dinâmica frequentemente limita a capacidade dos fornecedores de anilina de manter preços estáveis ou de firmar contratos de fornecimento de longo prazo, restringindo a confiança dos investidores em toda a cadeia de valor.

- Por exemplo, em 2024-2025, os mercados europeus de benzeno sofreram flutuações acentuadas devido a uma combinação de paradas em refinarias, mudanças na economia do reformado e taxas de operação variáveis de estireno e ciclohexano, o que apertou os equilíbrios de aromáticos e causou significativa instabilidade de custos para os fabricantes de anilina. Essas interrupções destacaram a sensibilidade da indústria de anilina a choques externos de matéria-prima e à rentabilidade cíclica dos aromáticos.

- Líderes do setor, como BASF, Covestro e Wanhua, relataram a necessidade de uma gestão cuidadosa de estoques, estratégias de hedge e otimização seletiva da taxa de produção durante fases de preços elevados do benzeno, demonstrando como a volatilidade nos mercados de aromáticos upstream força os produtores a alterar o comportamento operacional e adiar novos investimentos durante ciclos desfavoráveis.

- Em paralelo, as análises do setor químico europeu enfatizam que as cadeias de valor do benzeno-MDI estão cada vez mais expostas a recessões cíclicas impulsionadas por desacelerações macroeconômicas, redução da atividade da construção civil ou enfraquecimento da indústria automobilística, o que comprime as margens dos aromáticos e reduz a capacidade dos produtores de repassar os aumentos de custos. Essas recessões cíclicas amplificam os riscos financeiros e operacionais associados à produção de anilina derivada do benzeno.

- Em conjunto, essas condições ilustram como a convergência da volatilidade da matéria-prima, das margens cíclicas dos aromáticos e da sensibilidade macroeconômica representa um desafio estrutural contínuo para o setor de anilina, limitando a estabilidade das margens e influenciando as decisões de investimento, a utilização da capacidade e o planejamento de longo prazo nos mercados europeus de anilina-MDI .

Escopo do mercado de anilina na Europa

O mercado europeu de extratos de malte e concentrados de mosto para kvass está segmentado em seis categorias com base no processo de produção, grau e pureza, processo de fabricação, aplicação, usuário final e canal de distribuição.

- Por processo de produção

Com base no processo de produção, o mercado europeu de anilina é segmentado em hidrogenação de nitrobenzeno, nitração-hidrogenação integrada (benzeno para anilina), rotas de base biológica (piloto/emergentes) e outras vias emergentes. Em 2026, espera-se que o segmento de hidrogenação de nitrobenzeno domine o mercado, com uma participação de 68,91%, crescendo a uma taxa composta de crescimento anual (CAGR) de 5,7% no período de previsão de 2026 a 2033, principalmente porque essa rota continua sendo a tecnologia de produção de anilina mais consolidada, economicamente eficiente e escalável industrialmente. O processo se beneficia de projetos de reatores maduros, catalisadores bem otimizados e ampla disponibilidade de nitrobenzeno na Europa, permitindo que os fabricantes alcancem altos rendimentos, qualidade consistente do produto e produção confiável em grande volume. Além disso, a forte integração dos principais produtores de MDI com as cadeias de valor da anilina a partir de nitrobenzeno reforça ainda mais sua competitividade de custos, reduzindo a exposição a interrupções no fornecimento e aumentando a eficiência operacional.

- Por grau e pureza

Com base no grau de pureza, o mercado europeu de anilina é segmentado em Grau Industrial Padrão (≥99,5%), Grau de Alta Pureza (≥99,9%) e Sais e Formulações. Em 2026, espera-se que o segmento de Grau Industrial Padrão (≥99,5%) domine o mercado com uma participação de 69,32%, crescendo a uma taxa composta de crescimento anual (CAGR) de 5,8% no período de previsão de 2026 a 2033, principalmente porque esse nível de pureza atende aos requisitos de produção em larga escala das principais aplicações subsequentes — em particular, a produção de MDI para espumas de poliuretano utilizadas na construção civil, indústria automotiva e fabricação de eletrodomésticos. Esse grau de pureza oferece um equilíbrio ideal entre custo-benefício e desempenho, permitindo que os grandes produtores operem com eficiência, mantendo especificações químicas consistentes para processos industriais de alto volume.

- Por meio de aplicação

Com base na aplicação, o mercado europeu de anilina é segmentado em produção de diisocianato de difenilmetano (MDI), produtos químicos para processamento de borracha, corantes e pigmentos, agroquímicos, produtos farmacêuticos e outros. Em 2026, espera-se que o segmento de produção de MDI domine o mercado, com uma participação de 54,93%, crescendo a uma taxa composta de crescimento anual (CAGR) de 6,0% no período de previsão de 2026 a 2033, principalmente porque o MDI é a maior e mais importante aplicação da anilina em nível global. O MDI serve como componente fundamental para espumas de poliuretano, amplamente utilizadas em isolamento de construção, componentes automotivos, móveis, colchões, sistemas de refrigeração e diversos materiais industriais. A expansão contínua de projetos de infraestrutura, padrões de construção com eficiência energética, fabricação de automóveis leves e produção de eletrodomésticos duráveis reforçam a forte e sustentada demanda por MDI.

- Por usuário final

Com base no usuário final, o mercado europeu de anilina é segmentado em Automotivo, Móveis e Eletrodomésticos, Têxteis e Couro, Elétrico e Eletrônico, Construção e Outros. Em 2026, espera-se que o segmento automotivo domine o mercado com uma participação de 38,13%, crescendo a uma taxa composta de crescimento anual (CAGR) de 6,1% no período de previsão de 2026 a 2033, devido ao uso extensivo de extratos de malte e concentrados de mosto de kvass em formulações de bebidas alcoólicas e não alcoólicas. Sua capacidade de aprimorar o sabor, a doçura, a cor e a eficiência da fermentação, juntamente com a crescente demanda do consumidor por bebidas artesanais, funcionais e naturais, impulsiona fortemente o crescimento deste segmento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Venda Direta e Varejo. Em 2026, espera-se que o segmento de Venda Direta domine o mercado com uma participação de 71,92%, crescendo a uma taxa composta de crescimento anual (CAGR) de 5,8% no período de previsão de 2026 a 2033. Isso se deve principalmente ao fato de que grandes consumidores industriais, como fabricantes de MDI, produtores de poliuretano e empresas de intermediários químicos, preferem a compra direta de fornecedores para garantir um fornecimento consistente, grandes volumes e preços competitivos. As vendas diretas permitem uma logística simplificada, contratos de fornecimento de longo prazo e garantia de qualidade integrada, que são essenciais para manter a produção ininterrupta em processos downstream altamente especializados.

Análise Regional do Mercado Europeu de Anilina

- A Alemanha domina o mercado europeu de redes de fibra escura, representando 17,49% da participação total em 2026, impulsionada por uma demanda industrial consolidada e aplicações emergentes em isolamento de construção, componentes automotivos e produtos químicos especiais. A região também apresenta a maior taxa de crescimento anual composta (CAGR) de 6,9%, indicando um crescimento acelerado em comparação com outras regiões. A expansão é impulsionada pelo crescente desenvolvimento de infraestrutura, pela adoção de materiais de construção energeticamente eficientes e pelo aumento dos investimentos na fabricação de automóveis e eletrodomésticos que utilizam produtos de poliuretano derivados de MDI.

- A região beneficia da presença de importantes fabricantes de produtos químicos nacionais e regionais, de políticas comerciais favoráveis e de condições regulamentares e de preços vantajosas, o que facilita a penetração no mercado e garante um fornecimento consistente para os consumidores industriais. Além disso, as iniciativas para promover materiais sustentáveis e de alto desempenho nos setores da construção e da indústria automotiva reforçam as perspectivas de crescimento a longo prazo da anilina na Europa.

Análise do Mercado de Anilina na Alemanha e na Europa

O mercado de anilina na Alemanha e na Europa está preparado para um forte crescimento, impulsionado pela avançada cadeia de valor do poliuretano no país, pela crescente demanda por anilina em aplicações subsequentes, como a produção de MDI, produtos químicos para processamento de borracha e corantes e pigmentos, e pela presença de um ecossistema de fabricação química altamente desenvolvido. A sólida base industrial da Alemanha, a crescente adoção de materiais isolantes à base de poliuretano na construção civil, a expansão da produção automotiva e a liderança em especialidades químicas estão acelerando ainda mais o consumo de anilina no país.

Participação de mercado da anilina na Europa

A indústria da anilina é liderada principalmente por empresas consolidadas, incluindo:

- BASF (Alemanha)

- Covestro AG (Alemanha)

- Wanhua (EUA)

- US Risun Group Limited (EUA)

- Bondalti (Portugal)

- Sumitomo Chemical Co., Ltd. (Japão)

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (Índia)

- Merck & Co., Inc. (EUA)

- LANXESS (Alemanha)

- Panoli Intermediários Índia Unip. Ltd. (Índia)

- Huntsman International LLC (EUA)

- Tokyo Chemical Industry Co., Ltd. (Japão)

- JSK Chemicals (Índia)

- Henan Sinowin Chemical Industry Co., Ltd. (EUA)

Últimos desenvolvimentos no mercado europeu de anilina

- Em 2024, a Covestro inaugurou uma planta piloto em Leverkusen, na Alemanha, para produzir anilina de base biológica a partir de biomassa vegetal. Essa iniciativa representou um marco significativo na fabricação de produtos químicos sustentáveis, demonstrando a viabilidade técnica da produção de anilina inteiramente a partir de fontes renováveis, utilizando uma combinação de fermentação e conversão catalítica. A anilina de base biológica é utilizada principalmente na produção de MDI (diisocianato de difenilmetano), um componente essencial em espumas de poliuretano para isolamento, mobiliário e aplicações automotivas. Ao ampliar essa tecnologia, a Covestro está reduzindo a dependência de matérias-primas derivadas do petróleo e impulsionando o movimento europeu em direção a processos químicos ecologicamente corretos.

- Em abril de 2024, a empresa francesa de biotecnologia Pili industrializou com sucesso a produção de um derivado de anilina de base biológica, especificamente o ácido antranílico, utilizando fermentação microbiana. A empresa produziu várias toneladas em escala comercial, permitindo que o material seja utilizado em corantes, pigmentos e outros produtos químicos finos. A conquista da Pili destaca como a biotecnologia pode oferecer alternativas escaláveis e renováveis às rotas petroquímicas tradicionais, reduzindo o impacto ambiental. Também demonstra a crescente aceitação de intermediários de base biológica no mercado em indústrias que dependem fortemente de compostos aromáticos.

- Em 2025, a BASF anunciou planos para expandir sua capacidade de produção de MDI em Xangai, nos EUA, e, como parte de sua estratégia “Winning Ways”, a empresa está modernizando sua unidade de nitrobenzeno/anilina para operar por mais tempo a cada ano (de aproximadamente 7.500 para aproximadamente 8.000 horas). Como a anilina é um precursor fundamental do MDI, a expansão naturalmente aumenta a demanda por anilina, viabilizando o crescimento adicional da capacidade. Essa medida fortalece ainda mais a cadeia de valor integrada da BASF na Europa, aprimorando a segurança do fornecimento a longo prazo tanto de intermediários quanto de produtos de poliuretano derivados.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.3.1 MATERIAL SOURCING AND QUALITY

4.3.2 MANUFACTURING CAPABILITIES

4.3.3 COST COMPETITIVENESS

4.3.4 FLEXIBLITY AND COLLABORATIONS

4.3.5 SUPPLY CHAIN RELIABILITY

4.3.6 SUSTAINABILITY PRACTICES

4.4 BRAND OUTLOOK

4.4.1 COMPANY VS BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO – EUROPE ANILINE MARKET

4.5.1 INTRODUCTION

4.5.2 ENVIRONMENTAL CONCERNS

4.5.3 INDUSTRY RESPONSE

4.5.4 GOVERNMENT’S ROLE

4.5.5 ANALYST RECOMMENDATIONS

4.5.6 CONCLUSION

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.6.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.6.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.6.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.6.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.6.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.7 COST ANALYSIS BREAKDOWN — EUROPE ANILINE MARKET

4.7.1 RAW MATERIAL COSTS

4.7.2 UTILITIES AND ENERGY CONSUMPTION

4.7.3 LABOUR, WORKFORCE CAPABILITIES, AND STAFFING COSTS

4.7.4 PROCESS TECHNOLOGY, EQUIPMENT, AND MAINTENANCE COSTS

4.7.5 ENVIRONMENTAL COMPLIANCE AND SAFETY MANAGEMENT COSTS

4.7.6 PACKAGING AND PRODUCT HANDLING COSTS

4.7.7 LOGISTICS, TRANSPORTATION, AND STORAGE COSTS

4.7.8 OVERHEADS, ADMINISTRATIVE, AND SUPPORT COSTS

4.7.9 CONCLUSION

4.8 INDUSTRY ECOSYSTEM ANALYSIS — EUROPE ANILINE MARKET

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM-SIZED COMPANIES

4.8.4 END USERS

4.8.5 CONCLUSION

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS — EUROPE ANILINE MARKET

4.9.1.1 Joint Ventures

4.9.1.2 Mergers and Acquisitions

4.9.1.3 Licensing and Partnership

4.9.1.4 Technology Collaborations

4.9.1.5 Strategic Divestments

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 EGION PATENT LANDSCAPE

4.10.3 IP STRATEGY AND MANAGEMENT

4.10.4 PATENT FAMILIES

4.10.5 LICENSING & COLLABORATION

4.11 PROFIT MARGINS SCENARIO — EUROPE ANILINE MARKET

4.11.1 FEEDSTOCK VOLATILITY AND MARGIN SENSITIVITY

4.11.2 OPERATIONAL EFFICIENCY AND COST-POSITIONING MARGINS

4.11.3 ENVIRONMENTAL COMPLIANCE, SAFETY INVESTMENTS, AND MARGIN PRESSURE

4.11.4 DOWNSTREAM DEMAND CYCLES AND MARGIN REALIZATION

4.11.5 REGIONAL COMPETITIVENESS AND MARGIN DIVERGENCE

4.11.6 COMPETITIVE INTENSITY AND MARGIN EROSION RISK

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

4.12.1 NITROBENZENE

4.12.2 BENZENE

4.12.3 HYDROGEN

4.12.4 CATALYST

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 INTRODUCTION

4.13.2 RAW MATERIAL SOURCING & PROCUREMENT

4.13.2.1 Feedstock Acquisition

4.13.2.2 Supplier Qualification & Quality Assurance

4.13.2.3 Risk Mitigation & Sustainability

4.13.3 PROCESSING & MANUFACTURING (CHEMICAL SYNTHESIS)

4.13.3.1 Nitration of Benzene

4.13.3.2 Hydrogenation to Aniline

4.13.3.3 Purification & Finishing

4.13.3.4 By-product and Waste Management

4.13.3.5 Occupational Safety & Process Safety

4.13.4 LOGISTICS, PACKAGING & DISTRIBUTION

4.13.4.1 Packaging for Transport

4.13.4.2 Storage and Warehousing

4.13.4.3 Transportation & Regulatory Compliance

4.13.4.4 Risk Management in Transit

4.13.5 COMMERCIAL CHANNELS & END-USE DISTRIBUTION

4.13.5.1 Primary End-Use Markets

4.13.5.2 Sales & Contracting Models

4.13.5.3 Value-Added Services

4.13.5.4 Logistics Alignment with Demand Patterns

4.13.6 QUALITY MANAGEMENT, TRACEABILITY & REGULATORY COMPLIANCE

4.13.6.1 Quality Assurance & Control

4.13.6.2 Regulatory Governance

4.13.6.3 Documentation Systems & Information Flow

4.13.7 RISK MANAGEMENT ACROSS THE SUPPLY CHAIN

4.13.7.1 Supply Risk

4.13.7.2 Process Safety Risk

4.13.7.3 Logistical Risk

4.13.7.4 Regulatory & Compliance Risk

4.13.7.5 Quality Risk

4.13.8 SUSTAINABILITY AND FUTURE TRENDS

4.13.8.1 Environmental Footprint Reduction

4.13.8.2 Circular Economy Initiatives

4.13.8.3 Regulatory & Policy Drivers

4.13.8.4 Technology Innovation

4.13.9 CONCLUSION

4.14 TECHNOLOGICAL ADVANCEMENT

4.14.1 ADVANCED CATALYTIC HYDROGENATION SYSTEMS

4.14.2 CLEANER AND SAFER NITRATION TECHNOLOGIES

4.14.3 BIO-BASED AND RENEWABLE-FEEDSTOCK ANILINE DEVELOPMENT

4.14.4 DIGITALIZATION, AUTOMATION, AND INDUSTRY 4.0 IN ANILINE PRODUCTION

4.14.5 EFFLUENT TREATMENT, EMISSION CONTROL, AND ENVIRONMENTAL TECHNOLOGIES

4.14.6 ENERGY EFFICIENCY AND HEAT-RECOVERY INNOVATIONS

4.14.7 WASTE MINIMIZATION, BY-PRODUCT UTILIZATION, AND CIRCULAR-ECONOMY APPROACHES

4.14.8 APPLICATION-SPECIFIC INNOVATION IN ANILINE DERIVATIVES

4.14.9 CONCLUSION

4.15 VALUE CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING & PRODUCTION

4.15.2 PROCESSING & MANUFACTURING

4.15.3 DISTRIBUTION & LOGISTICS

4.15.4 SALES & MARKETING

4.15.5 BUYERS / END USERS

4.15.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN MARKET

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 IMPACT ON PRICES

5.5.1 DIRECT IMPACT ON LANDED COSTS

5.5.2 IMPACT ON DOMESTIC PRODUCER PRICING POWER

5.6 CONCLUSION

6 REGULATION COVERAGE — EUROPE ANILINE MARKET

6.1 INTRODUCTION:

6.2 PRODUCT CODES

6.2.1 CHEMICAL IDENTIFIERS

6.2.2 HARMONIZED SYSTEM AND TARIFF CODES

6.2.3 INDEX AND INVENTORY LISTINGS

6.3 CERTIFIED STANDARDS

6.3.1 INTERNATIONAL STANDARDS AND QUALITY SYSTEMS

6.3.2 PACKAGING AND CERTIFICATION FOR TRADE

6.3.3 ANALYTICAL AND ENVIRONMENTAL TESTING STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES

7.1.2 GROWTH IN RUBBER PROCESSING AND TIRE MANUFACTURING

7.1.3 HIGH DEMAND OF DYES, PIGMENTS & SPECIALTY CHEMICALS

7.1.4 RISING DEMAND FROM PHARMACEUTICALS AND AGROCHEMICALS

7.2 RESTRAINTS

7.2.1 BENZENE PRICE VOLATILITY AND EXPOSURE TO CYCLICAL AROMATICS MARGINS

7.2.2 STRINGENT ENVIRONMENTAL, HEALTH, AND SAFETY REGULATIONS FOR TOXIC AND HAZARDOUS SUBSTANCES

7.3 OPPORTUNITIES

7.3.1 BIO-BASED ANILINE DEVELOPMENT

7.3.2 CATALYST AND PROCESS INTENSIFICATION FOR ENERGY EFFICIENCY AND LOWER EMISSIONS

7.3.3 CAPACITY EXPANSIONS ACROSS ASIA-PACIFIC AND INTEGRATED UPSTREAM BENZENE ADVANTAGES

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH REACH/TSCA AND OCCUPATIONAL EXPOSURE LIMITS ACROSS REGIONS

7.4.2 LOGISTICS AND HANDLING CONSTRAINTS FOR HAZARDOUS MATERIALS IN BULK SHIPMENTS

8 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS

8.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

8.2 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.3 NITROBENZENE HYDROGENATION

8.4 INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE)

8.5 BIO-BASED ROUTES (PILOT/EMERGING)

8.6 OTHER EMERGING PATHWAYS

8.7 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.7.1 FIXED-BED TRICKLE FLOW REACTORS

8.7.2 SLURRY-PHASE REACTORS

8.7.3 OTHERS

8.8 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

8.8.1 RANEY NICKEL

8.8.2 PALLADIUM ON CARBON (PD/C)

8.8.3 COPPER-CHROMITE

8.8.4 PLATINUM ON CARBON (PT/C)

8.8.5 OTHERS

8.9 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

8.10.1 MIXED ACID ROUTE (HNO₃/H₂SO₄)

8.10.2 ORGANIC NITRATION ROUTE

8.10.3 OTHERS

8.11 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

8.11.1 CONTINUOUS

8.11.2 BATCH

8.12 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA PACIFIC

8.12.2 EUROPE

8.12.3 NORTH AMERICA

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

8.13.1 BIO-BASED NITROBENZENE PRECURSORS

8.13.2 FERMENTATION-DERIVED INTERMEDIATES

8.13.3 OTHERS

8.14 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 CATALYTIC AMINATION OF PHENOL/CHLOROBENZENE

8.15.2 ELECTROCATALYTIC / LOW-CARBON PROCESSES

8.15.3 DIRECT AMINATION OF BENZENE VIA NOVEL CATALYST SYSTEMS

8.15.4 PLASMA-ASSISTED NITRATION & HYDROGENATION

8.15.5 CO₂-DERIVED AROMATIC INTERMEDIATES (CARBON-UTILIZATION)

8.15.6 OTHERS

8.16 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA PACIFIC

8.16.2 EUROPE

8.16.3 NORTH AMERICA

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

9 EUROPE ANILINE MARKET, BY GRADE & PURITY

9.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

9.2 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

9.3 STANDARD INDUSTRIAL GRADE (≥99.5%)

9.4 HIGH PURITY GRADE (≥99.9%)

9.5 SALTS AND FORMULATIONS

9.6 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

9.6.1 ISO TANKS

9.6.2 DRUMS

9.6.3 IBC

9.6.4 OTHERS

9.7 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

9.8.1 PHARMACEUTICAL INTERMEDIATES

9.8.2 SPECIALTY DYES & PIGMENTS

9.8.3 OTHERS

9.9 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA PACIFIC

9.9.2 EUROPE

9.9.3 NORTH AMERICA

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 ANILINE HYDROCHLORIDE

9.10.2 BLENDED GRADES FOR RUBBER CHEMICALS

9.10.3 ANILINE SULFATE

9.10.4 STABILIZED ANILINE SOLUTIONS

9.10.5 CUSTOM SALT FORMULATIONS

9.10.6 ANILINE ACETATE

9.10.7 OTHERS

9.11 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

10 EUROPE ANILINE MARKET, BY APPLICATION

10.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

10.2 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION

10.4 RUBBER PROCESSING CHEMICALS

10.5 DYES & PIGMENTS

10.6 AGROCHEMICALS

10.7 PHARMACEUTICALS

10.8 OTHERS

10.9 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 RIGID FOAMS

10.9.2 FLEXIBLE FOAMS

10.9.3 OTHERS

10.1 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.10.1 BUILDING INSULATION PANELS

10.10.2 REFRIGERATION INSULATION

10.10.3 OTHERS

10.11 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE & BEDDING

10.11.2 AUTOMOTIVE SEATING

10.11.3 OTHERS

10.12 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA PACIFIC

10.12.2 EUROPE

10.12.3 NORTH AMERICA

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 ANTIOXIDANTS (PPDS)

10.13.2 ACCELERATORS & OTHER INTERMEDIATES

10.13.3 OTHERS

10.14 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA PACIFIC

10.14.2 EUROPE

10.14.3 NORTH AMERICA

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST & AFRICA

10.15 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.15.1 AZO DYES INTERMEDIATES

10.15.2 SULFUR DYES INTERMEDIATES

10.15.3 OTHERS

10.16 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.16.1 ASIA PACIFIC

10.16.2 EUROPE

10.16.3 NORTH AMERICA

10.16.4 SOUTH AMERICA

10.16.5 MIDDLE EAST & AFRICA

10.17 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.17.1 HERBICIDE INTERMEDIATES

10.17.2 OTHER CROP PROTECTION INTERMEDIATES

10.18 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA PACIFIC

10.18.2 EUROPE

10.18.3 NORTH AMERICA

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 API INTERMEDIATES

10.19.2 PROCESSING AIDS

10.2 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.20.1 ASIA PACIFIC

10.20.2 EUROPE

10.20.3 NORTH AMERICA

10.20.4 SOUTH AMERICA

10.20.5 MIDDLE EAST & AFRICA

10.21 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.21.1 ASIA PACIFIC

10.21.2 EUROPE

10.21.3 NORTH AMERICA

10.21.4 SOUTH AMERICA

10.21.5 MIDDLE EAST & AFRICA

11 EUROPE ANILINE MARKET, BY END USER

11.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

11.2 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.3 AUTOMOTIVE

11.4 FURNITURE & APPLIANCES

11.5 TEXTILES & LEATHER

11.6 ELECTRICAL & ELECTRONICS

11.7 CONSTRUCTION

11.8 OTHERS

11.9 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 OEM APPLICATIONS

11.9.2 AFTERMARKET APPLICATIONS

11.1 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA PACIFIC

11.10.2 EUROPE

11.10.3 NORTH AMERICA

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 BEDDING & UPHOLSTERY

11.11.2 REFRIGERATION & HVAC

11.11.3 OTHERS

11.12 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA PACIFIC

11.12.2 EUROPE

11.12.3 NORTH AMERICA

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 DYEING

11.13.2 FINISHING

11.13.3 OTHERS

11.14 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.14.1 ASIA PACIFIC

11.14.2 EUROPE

11.14.3 NORTH AMERICA

11.14.4 SOUTH AMERICA

11.14.5 MIDDLE EAST & AFRICA

11.15 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.15.1 INSULATION FOAMS

11.15.2 ENCAPSULATION MATERIALS

11.15.3 OTHERS

11.16 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.16.1 ASIA PACIFIC

11.16.2 EUROPE

11.16.3 NORTH AMERICA

11.16.4 SOUTH AMERICA

11.16.5 MIDDLE EAST & AFRICA

11.17 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.17.1 RESIDENTIAL

11.17.2 COMMERCIAL & INDUSTRIAL

11.17.3 OTHERS

11.18 EUROPE CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.18.1 ASIA PACIFIC

11.18.2 EUROPE

11.18.3 NORTH AMERICA

11.18.4 SOUTH AMERICA

11.18.5 MIDDLE EAST & AFRICA

11.19 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.19.1 ASIA PACIFIC

11.19.2 EUROPE

11.19.3 NORTH AMERICA

11.19.4 SOUTH AMERICA

11.19.5 MIDDLE EAST & AFRICA

12 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL

12.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

12.2 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.3 DIRECT

12.4 INDIRECT

12.5 EUROPE DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 EUROPE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.6.1 ONLINE

12.6.2 OFFLINE

12.7 EUROPE INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 EUROPE ANILINE MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 RUSSIA

13.1.3 U.K.

13.1.4 ITALY

13.1.5 FRANCE

13.1.6 SPAIN

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 BELGIUM

13.1.10 SWITZERLAND

13.1.11 SWEDEN

13.1.12 DENMARK

13.1.13 NORWAY

13.1.14 FINLAND

13.1.15 REST OF EUROPE

14 EUROPE ANILINE MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 DISTRIBUTORS COMPANY PROFILE

16.1 AZELIS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 KESSLER CHEMICAL, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRADE SYNDICATE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 UNIVAR SOLUTIONS LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 MANUFACTURERS COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 COVESTRO AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CHINA RISUN GROUP LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 WANHUA CHEMICAL GROUP CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 BONDALTI

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HUNTSMAN CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.9 JSK CHEMICALS AHMEDABAD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LANXESS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 MERCK (SIGMA-ALDRICH)

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PANOLI INTERMEDIATES INDIA PVT.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SUMITOMO CHEMICAL CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 KEY PERFORMANCE INDICATORS (KPIS) & METRICS FOR CLIMATE-CHANGE READINESS

TABLE 4 INDIAN AUTOMOBILE PRODUCTION TRENDS:

TABLE 5 PRODUCER PRICE INDEX BY INDUSTRY: SYNTHETIC DYE AND PIGMENT MANUFACTURING:

TABLE 6 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 7 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 8 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 EUROPE CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 EUROPE DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 EUROPE INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE ANILINE MARKET, 2018-2033 (USD THOUSAND)

TABLE 54 EUROPE ANILINE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 55 EUROPE

TABLE 56 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 60 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 62 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 66 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 EUROPE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 GERMANY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 GERMANY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 85 GERMANY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GERMANY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 87 GERMANY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 88 GERMANY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 89 GERMANY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 GERMANY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 91 GERMANY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 92 GERMANY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 GERMANY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 GERMANY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 GERMANY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 GERMANY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 GERMANY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 GERMANY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 GERMANY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 GERMANY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 GERMANY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 103 GERMANY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 GERMANY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 GERMANY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 GERMANY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 GERMANY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 GERMANY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 GERMANY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 RUSSIA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 111 RUSSIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 112 RUSSIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 RUSSIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 114 RUSSIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 115 RUSSIA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 116 RUSSIA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 RUSSIA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 118 RUSSIA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 119 RUSSIA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 120 RUSSIA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 RUSSIA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 RUSSIA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 RUSSIA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 RUSSIA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 RUSSIA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 RUSSIA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 RUSSIA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 RUSSIA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 130 RUSSIA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 RUSSIA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 RUSSIA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 RUSSIA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 RUSSIA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 RUSSIA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 RUSSIA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 U.K. ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 138 U.K. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 139 U.K. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 U.K. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 141 U.K. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 142 U.K. BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 143 U.K. OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 U.K. ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 145 U.K. STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 146 U.K. HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 U.K. SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 U.K. ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 U.K. RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 U.K. FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 U.K. RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 U.K. DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 U.K. AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 U.K. PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 U.K. ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 U.K. AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 U.K. FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 U.K. TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 U.K. ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 U.K. CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 U.K. ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 U.K. INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 ITALY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 165 ITALY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 166 ITALY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 ITALY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 168 ITALY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 169 ITALY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 170 ITALY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 ITALY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 172 ITALY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 173 ITALY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 ITALY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 ITALY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 ITALY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 ITALY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 ITALY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 ITALY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 ITALY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 ITALY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 ITALY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 184 ITALY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 ITALY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 ITALY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 ITALY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 ITALY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 ITALY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 190 ITALY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 FRANCE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 192 FRANCE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 193 FRANCE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 FRANCE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 195 FRANCE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 196 FRANCE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 197 FRANCE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 FRANCE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 199 FRANCE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 200 FRANCE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 201 FRANCE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 FRANCE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 FRANCE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 FRANCE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 FRANCE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 FRANCE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 FRANCE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 FRANCE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 FRANCE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 FRANCE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 211 FRANCE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 FRANCE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 FRANCE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 FRANCE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 FRANCE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 FRANCE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 FRANCE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 SPAIN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 219 SPAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 220 SPAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 SPAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 222 SPAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 223 SPAIN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 224 SPAIN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SPAIN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 226 SPAIN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 227 SPAIN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 SPAIN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SPAIN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 SPAIN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 SPAIN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 SPAIN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 SPAIN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 SPAIN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 SPAIN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 SPAIN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 238 SPAIN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 SPAIN FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 SPAIN TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 SPAIN ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 SPAIN CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 SPAIN ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 244 SPAIN INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 TURKEY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 246 TURKEY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 247 TURKEY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 TURKEY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 249 TURKEY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 250 TURKEY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 251 TURKEY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 TURKEY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 253 TURKEY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 254 TURKEY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 255 TURKEY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 TURKEY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 TURKEY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 TURKEY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 TURKEY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 TURKEY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 TURKEY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 TURKEY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 TURKEY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 TURKEY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 265 TURKEY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 TURKEY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 TURKEY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 TURKEY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 TURKEY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 TURKEY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 271 TURKEY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 NETHERLANDS ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 273 NETHERLANDS NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 274 NETHERLANDS NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 NETHERLANDS INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 276 NETHERLANDS INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 277 NETHERLANDS BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 278 NETHERLANDS OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 NETHERLANDS ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 280 NETHERLANDS STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 281 NETHERLANDS HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 282 NETHERLANDS SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 NETHERLANDS ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 284 NETHERLANDS METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 NETHERLANDS RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 NETHERLANDS FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 NETHERLANDS RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 NETHERLANDS DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 NETHERLANDS AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 NETHERLANDS PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 NETHERLANDS ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 292 NETHERLANDS AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 NETHERLANDS FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 NETHERLANDS TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 295 NETHERLANDS ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 NETHERLANDS CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 NETHERLANDS ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 298 NETHERLANDS INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 BELGIUM ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 300 BELGIUM NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 301 BELGIUM NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 BELGIUM INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 303 BELGIUM INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 304 BELGIUM BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 305 BELGIUM OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 BELGIUM ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 307 BELGIUM STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 308 BELGIUM HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 309 BELGIUM SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 BELGIUM ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 BELGIUM METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 BELGIUM RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 BELGIUM FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 BELGIUM RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 315 BELGIUM DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 BELGIUM AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 BELGIUM PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 BELGIUM ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 319 BELGIUM AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 BELGIUM FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 BELGIUM TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 BELGIUM ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 BELGIUM CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 324 BELGIUM ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 325 BELGIUM INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 SWITZERLAND ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 327 SWITZERLAND NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 328 SWITZERLAND NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 SWITZERLAND INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 330 SWITZERLAND INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 331 SWITZERLAND BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)