Europe Biomarkers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

18.18 Billion

USD

50.41 Billion

2024

2032

USD

18.18 Billion

USD

50.41 Billion

2024

2032

| 2025 –2032 | |

| USD 18.18 Billion | |

| USD 50.41 Billion | |

|

|

|

|

Europe Biomarkers Market Segmentation, By Type (Safety Biomarkers, Efficacy Biomarkers, and Validation Biomarker), Product (Consumables, Services, Software, and Growth Hormone Therapy), Mechanism (Genetic, Epigenetic, Proteomic, Lipidomic, and Other Mechanisms), Application (Diagnostics Development, Drug Discovery and Development, Personalized Medicine, Disease Risk Assessment, and Others), Disease Indication (Cancer, Cardiovascular Disorders, Neurological Disorders, Immunological Disorders, and Others) - Industry Trends and Forecast to 2032

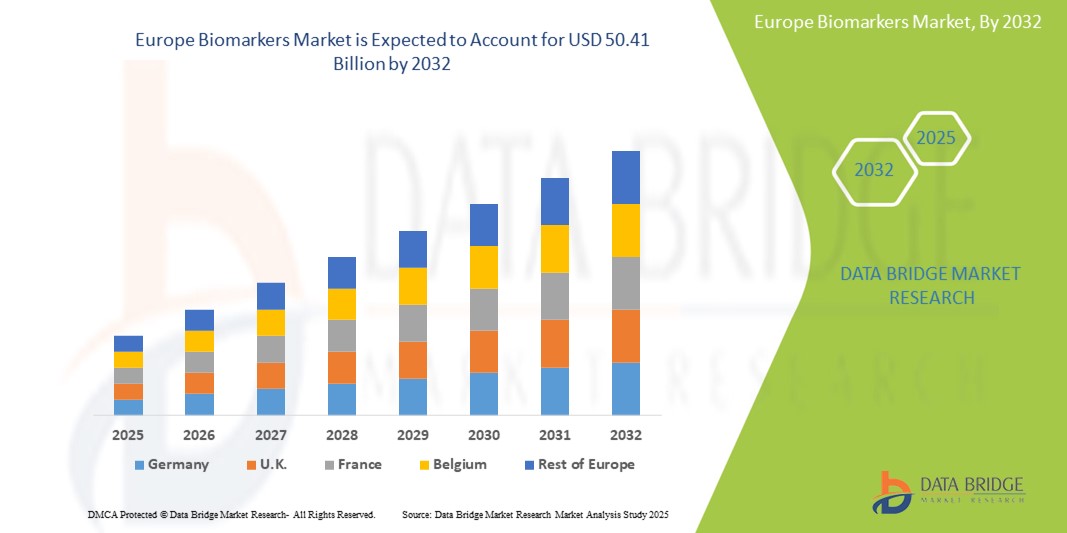

Europe Biomarkers Market Size

- The Europe biomarkers market size was valued atUSD 18.18 billion in 2024and is expected to reachUSD 50.41 billion by 2032, at aCAGR of 13.60%during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, advancements in personalized medicine, the growing demand for early diagnosis, the rising use of biomarkers in drug development and clinical trials, and the expansion of biotechnology and pharmaceutical industries

Europe Biomarkers Market Analysis

- The Europe biomarkers market is witnessing significant growth due to the rising demand for precise diagnostics, with biomarkers playing a critical role in early detection and monitoring of various diseases

- Technological advancements in biomarker discovery are revolutionizing the market, with innovative platforms accelerating the identification of novel biomarkers for different therapeutic areas

- Germany is expected to dominate the biomarkers market with 12.3% market share due to its robust healthcare system facilitates the adoption of innovative diagnostic technologies, including biomarkers, into clinical practice

- France is expected to be the fastest growing region in the Europe biomarkers market with 11.6% market share during the forecast period due to the increasing demand for personalized medicine, advancements in diagnostic technologies, and a growing emphasis on early disease detection

- The safety biomarkers segment is expected to dominate the Europe biomarkers market with the largest share of 49.05% in 2025 due to its critical role in assessing drug safety during development. These biomarkers help identify potential adverse effects early, reducing the risk of late-stage clinical trial failures. Their application enhances patient safety by predicting toxicological responses, leading to more effective and safer therapeutic interventions. The increasing prevalence of chronic diseases and the demand for personalized medicine further drive the adoption of safety biomarkers

Report Scope and Europe Biomarkers Market Segmentation

|

Attributes |

Europe Biomarkers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Biomarkers Market Trends

"Growth of Personalized Medicine in Biomarkers Market"

- The Europe biomarkers market is growing significantly due to the rising demand for personalized medicine, which customizes treatments based on individual genetic profiles. This trend is improving the effectiveness of treatments and reducing adverse reactions for patients

- Advancements in technologies such as next-generation sequencing and liquid biopsies are enhancing biomarker discovery. These innovations allow for more accurate and less invasive methods of detecting biomarkers associated with various diseases, contributing to better diagnosis

- Regulatory support for personalized medicine is a key factor in the market’s expansion. Authorities are encouraging the development of companion diagnostics, ensuring that targeted therapies can be used safely and effectively in personalized treatment plans

- The growing focus on patient-centered care is also fueling the biomarkers market. Healthcare systems are increasingly adopting personalized approaches, emphasizing the need for specific biomarkers to better understand and treat individual patient conditions

- For instance, artificial intelligence is being integrated into the biomarker discovery process. This technology is improving the speed and accuracy of identifying new biomarkers, accelerating the development of more precise and effective personalized treatments

- In conclusion, overall, the growing emphasis on personalized medicine and technological advancements is driving the expansion of the biomarkers market

Europe Biomarkers Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases”

- The rising prevalence of chronic diseases in Europe, including cancer, cardiovascular diseases, and diabetes, is accelerating the demand for biomarkers. The aging population and lifestyle changes are contributing to the growing need for early diagnosis and personalized treatments

- Biomarkers are becoming essential for early detection and monitoring of chronic diseases. For example, cancer biomarkers are used to identify tumor types, enabling doctors to select the most effective treatment strategies

- Personalized medicine, guided by biomarkers, is improving treatment outcomes by offering more tailored solutions. Biomarkers help to minimize adverse reactions by matching patients with the most appropriate therapies based on their unique genetic profiles

- The increasing demand for early detection is fueling the growth of biomarker-based diagnostics. For instance, biomarkers are vital in screening for cancers, allowing for earlier intervention and improved survival rates

- As awareness of chronic diseases grows, more healthcare providers are integrating biomarkers into their diagnostic and treatment processes. This is leading to greater investment in biomarker research and development across Europe

Opportunity

“Integration of Artificial Intelligence in Biomarker Discovery”

- Artificial intelligence is transforming biomarker discovery by efficiently analyzing vast clinical datasets and genetic information to identify new biomarkers. This allows for more accurate and faster identification compared to traditional methods

- AI's capability to process complex data enables the discovery of rare biomarkers, especially for diseases such as cancer and neurological disorders. This increases the such aslihood of detecting previously overlooked patterns

- Machine learning tools driven by AI are enhancing personalized medicine by predicting how patients will respond to specific treatments. This ensures patients receive the most effective and tailored therapy

- For instance, AI is used in precision oncology to match patients with treatments based on their genetic profiles, improving treatment outcomes and reducing unnecessary therapies

- The increasing adoption of AI technologies in healthcare provides a major opportunity for further advancements in biomarker research. As AI tools evolve, they will drive innovation in diagnostics and treatment options

- In conclusion, overall, the integration of AI in biomarker discovery is set to revolutionize healthcare by accelerating diagnostics and improving patient care

Restraint/Challenge

“High Cost of Biomarker Development”

- The high cost of developing and commercializing biomarkers is a major challenge in the market, requiring significant investments in research, clinical trials, and technology. The process of discovering and validating biomarkers can take years and involves substantial financial resources

- Extensive testing, data analysis, and clinical validation make the development of reliable biomarkers an expensive process. This burden is particularly heavy for smaller biotech companies with limited funding, making it difficult to compete with larger, more resource-rich organizations

- Regulatory hurdles for biomarker-based products also contribute to high costs, as stringent approval processes require additional investments. These delays in market entry further increase the financial burden on companies developing biomarker-based diagnostics

- The cost of biomarker development is often passed onto healthcare systems and patients, which can limit the adoption of biomarker-based diagnostics. This is particularly problematic in low- and middle-income regions, where access to advanced diagnostics may be limited

Europe Biomarkers Market Scope

The market is segmented on the basis of type, product, mechanism, application, and disease indication.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Mechanism |

|

|

By Application

|

|

|

By Disease Indication |

|

In 2025, the safety biomarkers segment is projected to dominate the market with a largest share in type segment

The safety biomarkers segment is expected to dominate the Europe biomarkers market with the largest share of 49.05% in 2025 due to its critical role in assessing drug safety during development. These biomarkers help identify potential adverse effects early, reducing the risk of late-stage clinical trial failures. Their application enhances patient safety by predicting toxicological responses, leading to more effective and safer therapeutic interventions. The increasing prevalence of chronic diseases and the demand for personalized medicine further drive the adoption of safety biomarkers.

The diagnostics development segment is expected to account for the largest share during the forecast period in application segment

In 2025, the diagnostics development segment is expected to dominate the market with the largest market share of 38.05% due to the escalating demand for early and precise disease detection, particularly for conditions such as cancer and neurological disorders. Advancements in diagnostic technologies, including next-generation sequencing (NGS), polymerase chain reaction (PCR), and mass spectrometry, have significantly enhanced the sensitivity and specificity of biomarker-based tests, facilitating more accurate diagnoses. The integration of artificial intelligence (AI) and machine learning (ML) in biomarker discovery has further streamlined data analysis, enabling the identification of complex biomarker patterns and supporting personalized diagnostic approaches.

Europe Biomarkers Market Regional Analysis

“Germany Holds the Largest Share in the Europe Biomarkers Market”

- Germany's robust healthcare system facilitates the adoption of innovative diagnostic technologies, including biomarkers, into clinical practice

- The country hosts a vast network of research institutions, such as the German Cancer Research Center (DKFZ), fostering advancements in genomics and personalized medicine with 12.3% market share

- Government-backed initiatives such as the National Genome Research Network (NGFN) support large-scale genomic projects, enhancing biomarker development

- Germany's regulatory environment, governed by agencies such as the European Medicines Agency (EMA) and the Federal Institute for Drugs and Medical Devices (BfArM), expedites the approval of innovative biomarker-based therapies and diagnostics

- These factors collectively position Germany at the forefront of the personalized medicine biomarkers market in Europe

“France is Projected to Register the Highest CAGR in the Europe Biomarkers Market”

- The France market expansion is due to the increasing demand for personalized medicine, advancements in diagnostic technologies, and a growing emphasis on early disease detection

- Key segments contributing to this growth include safety biomarkers, with efficacy biomarkers emerging as the fastest-growing segment with 11.6% market share during the forecast period

- France's strong healthcare infrastructure, coupled with substantial investments in research and development, supports the rapid adoption of biomarker-based diagnostics and therapies

- The country's regulatory environment facilitates the development and commercialization of innovative biomarker technologies, further accelerating market growth

- Collaborations between pharmaceutical, biotechnology, and diagnostic companies enhance innovation and market growth

Europe Biomarkers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- QIAGEN (Germany)

- PerkinElmer, Inc. (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Enzo Biochem, Inc. (U.S.)

- Charles River Laboratories International, Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Agilent Technologies, Inc. (U.S.)

- Bruker (U.S.)

- Siemens (U.S.)

- Epigenomics AG (Germany)

- General Electric (U.S.)

- bioMérieux SA (France)

- Oxford BioDynamics Plc (U.K.)

- Proteome Sciences plc (U.K.)

- Abcam plc (U.K.)

- BiognostiX AG (Switzerland)

Latest Developments in Europe Biomarkers Market

- In May 2024, Genialis introduced a machine learning-based biomarker tool called Genialis krasID, designed to help identify patients most likely to benefit from KRAS inhibitors. This innovative tool also offers an in-depth analysis of response rates and the extent of effectiveness, helping personalize cancer treatment strategies and improve patient outcomes

- In April 2024, Owlstone Medical received a significant grant of USD 1.5 million from the Bill & Melinda Gates Foundation. The funding aims to advance their development of breath-based diagnostics, focusing on the identification of breath biomarkers for diseases such as tuberculosis and human immunodeficiency virus (HIV). This project holds the potential to revolutionize diagnostic approaches for these infectious diseases by providing non-invasive, rapid, and highly accurate testing methods

- In April 2024, Bio-Rad Laboratories launched the ddPLEX ESR1 mutation detection kit, an ultrasensitive and multiplexed digital PCR assay. This kit is designed to detect ESR1 mutations in breast cancer during clinical research, enabling more precise detection and monitoring of treatment efficacy. The advancement of this kit could contribute to more effective management of breast cancer by helping clinicians track mutations that influence treatment decisions

- In March 2024, Koneksa, a company focused on developing evidence-based biomarkers, announced a partnership with Merck through its Data Syndication Partnership Program. The collaboration aims to accelerate the development of digital biomarkers for neurodegenerative disorders such as Alzheimer’s and Parkinson’s disease. This initiative is expected to help create innovative tools for early detection, monitoring disease progression, and optimizing treatment strategies, ultimately improving patient care in neurodegenerative diseases

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.