Europe Cereals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

31.36 Billion

USD

59.11 Billion

2024

2032

USD

31.36 Billion

USD

59.11 Billion

2024

2032

| 2025 –2032 | |

| USD 31.36 Billion | |

| USD 59.11 Billion | |

|

|

|

|

Segmentação do mercado de cereais na Europa, por tipo de produto (trigo, arroz, milho, cevada, aveia, centeio, sorgo, painço, quinoa, trigo sarraceno, triticale, fonio, teff, amaranto, kamut e outros), forma do produto (grãos integrais, farinha, grãos em flocos, grãos laminados, grãos tufados, farinha moída, grãos quebrados, amido, farelo, gérmen e outros), nível de processamento (fortificado, descascado, polido, pré-cozido, misturado, instantâneo, germinado, torrado, extrusado, parcialmente cozido, micronizado, cru, totalmente cozido, cozido no vapor, temperado, adoçado, revestido e outros), formato de consumo (consumido com colher com leite/iogurte, barras para viagem, mingau, lanche seco, pacotes de lanche, pronto para cozinhar, pronto para aquecer, mix-in Ingrediente, Infusão de Bebida e Outros), Categoria do Produto (Ingredientes de Panificação (Misturas de Farinha/Grãos), Cereais Maternos, Matéria-Prima/Ração Animal, Snacks de Cereais, Misturas Instantâneas de Cereais, Cereais Infantis, Kits de Refeição à Base de Cereais, Insumos para Cervejaria/Destilaria e Outros), Natureza (Convencional e Orgânico), Categoria (À BASE DE OGM e Certificado NÃO OGM), Benefícios Funcionais (Fortificado com Vitaminas, Rico em Fibras, Baixo/Sem Açúcar, Rico em Proteínas, Sem Glúten, Saudável para o Coração, Enriquecido com Probióticos/Prebióticos, Redutor de Colesterol, Baixo Índice Glicêmico, Enriquecido com Ômega-3, Baixo em Gordura, Livre de Alérgenos, Rico em Ferro, Baixo/Sem Sal, Adequado para Paleolíticos, Adequado para Cetogênicos, Certificado Vegano e Outros) Validade (Longo Prazo (Estável em Temperatura Ambiente), Médio e Curto Prazo (Perecíveis)), Embalagem (Caixa, Bolsa, Saco, Sachê/Pacote Stick, Saco (A Granel), Pote, Tetra Pack/Caixa Asséptica, Lata, Tambor, Eco-Embalagem e Outros), Tamanho da Embalagem (Pacotes Pequenos (51G–250G), Pacotes Médios (251G–500G), Pacotes Grandes (501G–1KG), Pacotes Individuais (ABAIXO DE 50G), Pacotes Extra Grandes (1,1KG–2,5KG) e Pacotes a Granel (ACIMA DE 2,5KG)), Faixa de Preço (Econômica (ATÉ US$ 2,49), Média (US$ 2,50-6,99) e Premium (US$ 7,00 e ACIMA)), Canal de Distribuição (B2B e B2C) – Tendências e Previsão do Setor até 2032

Tamanho do mercado de cereais

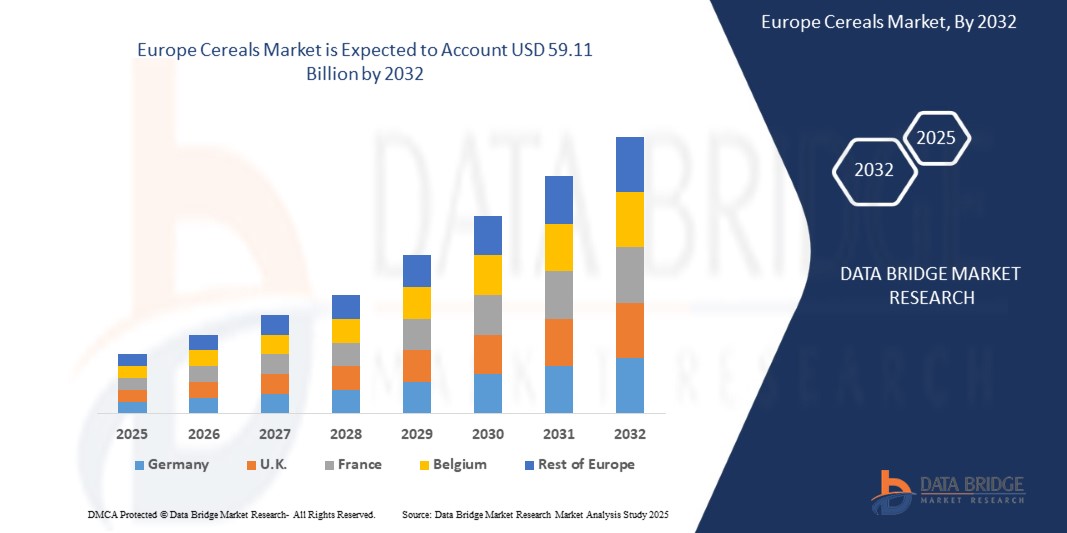

- O tamanho do mercado de cereais da Europa foi avaliado em US$ 31,36 bilhões em 2024 e deve atingir US$ 59,11 bilhões até 2032 , com um CAGR de 8,4% durante o período previsto.

- O crescimento do mercado é impulsionado por fatores como a crescente demanda por opções de café da manhã convenientes e nutritivas, a crescente conscientização sobre saúde entre os consumidores, a inovação em formulações de cereais e a expansão da disponibilidade por meio de canais de varejo online.

- Além disso, a evolução das preferências dos consumidores por alimentos nutritivos e funcionais, juntamente com a expansão da urbanização e a crescente penetração do varejo online, estão acelerando a adoção de produtos de cereais, impulsionando significativamente o crescimento da indústria.

Análise de Mercado de Cereais

- O mercado de cereais representa um segmento-chave na indústria alimentar e agrícola europeia, abrangendo produtos de cereais prontos para consumo e quentes. Esses produtos são amplamente consumidos como opções práticas e nutritivas para o café da manhã, adequadas aos estilos de vida modernos e agitados. O mercado inclui uma gama diversificada de produtos à base de trigo, aveia, milho, arroz e cevada, adaptados às diversas necessidades dos consumidores, incluindo preferências saudáveis, orgânicas e sem glúten.

- Os fabricantes de cereais estão inovando cada vez mais com variantes ricas em proteínas, fortificadas e à base de plantas para se alinharem às tendências de saúde e às mudanças alimentares na Europa. Esses desenvolvimentos estão expandindo o alcance do mercado de cereais para categorias de alimentos funcionais, especialmente em regiões desenvolvidas, onde os consumidores priorizam rótulos limpos e valor nutricional. A tendência crescente de substituição de refeições e lanches para viagem impulsiona ainda mais o crescimento do mercado.

- A Alemanha dominou o mercado europeu de cereais e prevê-se que seja o país com crescimento mais rápido no mercado, devido aos fortes padrões de consumo, à fidelidade à marca e à presença de empresas consolidadas do setor, como Kellogg's, General Mills e Post Holdings. A região também se beneficia de uma infraestrutura de varejo consolidada e de uma alta conscientização do consumidor em relação à saúde e ao bem-estar.

- Espera-se que o segmento de trigo domine o mercado de cereais devido à sua conveniência, estabilidade na prateleira e ampla disponibilidade. Este segmento desempenha um papel crucial na formação dos hábitos de café da manhã dos consumidores e oferece valor por meio de opções fortificadas, ricas em sabor e específicas para cada dieta, que atendem a diversas necessidades nutricionais.

Escopo do Relatório e Segmentação do Mercado de Cereais

|

Atributos |

Principais insights do mercado de cereais |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do Mercado de Cereais

“Inovação em Cereais Funcionais e Nutrição Personalizada”

- O mercado de cereais da Europa está passando por uma mudança crucial com a crescente demanda por cereais funcionais e nutrição personalizada, adaptada às metas de saúde e preferências alimentares do consumidor.

- Essa tendência está levando os fabricantes a reformular os cereais tradicionais, incorporando ingredientes com benefícios específicos para a saúde, como alto teor de fibras, suporte à imunidade, saúde cardíaca e melhor digestão.

- Por exemplo, as principais marcas de cereais estão a introduzir produtos enriquecidos com superalimentos (sementes de chia, sementes de linhaça), probióticos, prebióticos e adaptógenos, como ashwagandha e maca, para atrair consumidores preocupados com o bem-estar.

- Esta mudança reflete a crescente conscientização em torno da saúde preventiva e a preferência por alimentos ricos em nutrientes e com rótulos limpos, posicionando os cereais funcionais como componentes essenciais das dietas modernas.

Dinâmica do Mercado de Cereais

Motorista

Aumento da demanda por opções alimentares convenientes e nutritivas

- Os estilos de vida urbanos estão se tornando cada vez mais agitados, gerando um aumento na demanda por soluções de café da manhã rápidas, nutritivas e fáceis de preparar.

- Os produtos de cereais atendem efetivamente a essa necessidade devido à sua conveniência, longa vida útil, diversos perfis nutricionais e ampla disponibilidade em canais de varejo modernos e tradicionais.

- As opções de cereais prontos para consumo e instantâneos permitem que os consumidores economizem tempo, garantindo uma ingestão equilibrada de nutrientes essenciais, como fibras, vitaminas e minerais

- Essa crescente preferência por opções alimentares práticas e saudáveis está impulsionando uma demanda constante por cereais em vários grupos demográficos, especialmente profissionais, estudantes e famílias preocupadas com a saúde.

- Em abril de 2024, de acordo com um relatório da FoodNavigator, a Kellogg's firmou parceria com uma empresa líder em ciência nutricional para alavancar dados de saúde do consumidor e ferramentas de IA para o desenvolvimento de misturas de cereais personalizadas. Ao analisar milhões de pontos de dados relacionados a hábitos alimentares, preferências e condições de saúde, a Kellogg's lançou uma linha de cereais personalizados, desenvolvidos para promover a saúde intestinal, o bem-estar cardíaco e os níveis de energia. Essa iniciativa reflete a crescente demanda por soluções de cereais funcionais e baseadas em dados, projetadas para nutrição personalizada.

- Essas inovações destacam como as marcas estão adotando a transformação digital e a análise de saúde para impulsionar a inovação de produtos e melhorar o envolvimento do consumidor, alimentando, em última análise, o crescimento sustentado do mercado nas categorias de cereais da Europa.

Restrição/Desafio

Preocupações com a saúde devido ao teor de açúcar em cereais matinais

- O custo substancial de aquisição de matérias-primas premium e desenvolvimento de cereais funcionais, orgânicos ou personalizados representa desafios significativos, especialmente para pequenos e médios fabricantes (PMEs)

- Esses custos incluem a aquisição de ingredientes especializados (por exemplo, superalimentos, probióticos), tecnologias avançadas de processamento, conformidade com padrões de rótulo limpo ou certificação de saúde e marketing para segmentos de saúde de nicho. Muitos produtores menores de cereais não têm recursos financeiros ou capacidade de P&D para competir com marcas europeias estabelecidas, o que leva a uma inovação mais lenta e a um alcance de mercado limitado.

- Em outubro de 2023, um relatório da AgriBusiness Review destacou que o custo de lançamento de linhas de produtos de cereais funcionais ou orgânicos vai muito além da obtenção de matérias-primas. Inclui investimentos em maquinário especializado, P&D para aprimoramento nutricional, inovação em embalagens, certificação (como orgânico ou sem glúten) e educação do consumidor. Essas despesas cumulativas costumam ser incontroláveis para pequenas marcas que buscam ingressar em segmentos de cereais voltados para a saúde.

- A capacidade financeira limitada e a infraestrutura tecnológica forçam muitos pequenos e médios produtores de cereais a adiar ou renunciar ao desenvolvimento desses produtos, restringindo sua capacidade de competir em categorias premium e funcionais. Esse obstáculo financeiro retarda significativamente a diversificação de mercado e a inovação em toda a indústria de cereais.

Âmbito do mercado de cereais

O mercado de cereais da Europa é segmentado em treze segmentos notáveis com base no tipo de produto, forma do produto, nível de processamento, formato de consumo, categoria do produto, natureza, categoria, benefícios funcionais, prazo de validade, embalagem, tamanho da embalagem, faixa de preço, canal de distribuição

- Por tipo de produto

Com base no tipo de produto, o mercado de cereais é segmentado em trigo, arroz, milho, cevada, aveia, centeio, sorgo, milheto, quinoa, trigo sarraceno, triticale, fônio, teff, amaranto, kamut e outros. Espera-se que o trigo e o milho dominem a participação de mercado em 2025 e sejam os segmentos de crescimento mais rápido devido à sua disponibilidade na Europa, preço acessível e ampla utilização nas indústrias de alimentos e rações. A crescente demanda por grãos ancestrais, como quinoa e amaranto, deverá impulsionar o crescimento nos segmentos de cereais especiais e saudáveis durante o período previsto.

- Por forma de produto

Com base no formato do produto, o mercado de cereais é segmentado em grãos integrais, farinha, grãos em flocos, grãos laminados, grãos tufados, farinha moída, grãos quebrados, amido, farelo, gérmen e outros. Espera-se que os grãos integrais dominem a participação de mercado em 2025 e sejam o segmento de crescimento mais rápido, impulsionado pela crescente conscientização sobre dietas ricas em fibras e preferências por rótulos limpos. Espera-se que farinha e farelo apresentem crescimento constante devido ao seu uso em panificação e alimentos saudáveis.

- Por nível de processamento

Com base no nível de processamento, o mercado de cereais é segmentado em fortificados, descascados, polidos, pré-cozidos, misturados, instantâneos, germinados, torrados, extrusados, parcialmente cozidos, micronizados, crus, totalmente cozidos, cozidos no vapor, temperados, adoçados, revestidos e outros. Espera-se que os cereais fortificados dominem a fatia de mercado em 2025 e sejam o segmento de crescimento mais rápido devido aos seus benefícios nutricionais adicionais, enquanto os formatos instantâneos e pré-cozidos estão impulsionando a demanda entre as populações urbanas por soluções de refeições que economizem tempo.

- Por formato de consumo

Com base no formato de consumo, o mercado de cereais é segmentado em: cereais para consumo com leite/iogurte, barras para viagem, mingaus, lanches secos, pacotes de lanche, prontos para cozinhar, prontos para aquecer, ingredientes para misturar, com infusão em bebidas, entre outros. Espera-se que os cereais para consumo com colher dominem a fatia de mercado em 2025 e sejam o segmento de crescimento mais rápido devido ao seu uso convencional, enquanto os cereais prontos para cozinhar e os pacotes de lanche devem apresentar rápido crescimento devido à sua portabilidade e conveniência.

- Por categoria de produto

Com base na categoria de produto, o mercado de cereais é segmentado em ingredientes para panificação (misturas de farinha/grãos), cereais matinais, ração animal, snacks de cereais, misturas instantâneas para cereais, cereais infantis, kits de refeição à base de cereais, insumos para cervejaria/destilaria, entre outros. Espera-se que o café da manhã domine a fatia de mercado em 2025 e seja o segmento de crescimento mais rápido devido ao seu amplo consumo, enquanto snacks de cereais e cereais infantis devem crescer rapidamente devido às mudanças nos padrões alimentares e à criação de filhos com foco na saúde.

- Por natureza

Com base na natureza, o mercado de cereais é segmentado em convencionais e orgânicos. Os cereais convencionais dominam em volume devido à acessibilidade e às cadeias de suprimentos estabelecidas.

A projeção é que os cereais orgânicos apresentem o crescimento mais rápido entre 2025 e 2032, impulsionados pela crescente demanda dos consumidores por produtos sem pesticidas e com rótulos limpos.

- Por categoria

Com base na categoria, o mercado de cereais é segmentado em cereais à base de OGM e cereais com certificação não OGM. Espera-se que o segmento com certificação não OGM domine a participação de mercado em 2025 e seja o segmento de crescimento mais rápido devido à crescente conscientização e preferência do consumidor por grãos de origem natural, especialmente na Europa.

- Por Benefícios Funcionais

Com base nos benefícios funcionais, o mercado de cereais é segmentado em: enriquecidos com vitaminas, ricos em fibras, com baixo ou nenhum teor de açúcar, ricos em proteínas, sem glúten, saudáveis para o coração, enriquecidos com probióticos/prebióticos, redutores de colesterol, com baixo índice glicêmico, enriquecidos com ômega-3, com baixo teor de gordura, sem alérgenos, ricos em ferro, com baixo ou nenhum teor de sal, adequados para a dieta paleolítica, adequados para a dieta cetogênica, com certificação vegana, entre outros. Espera-se que os cereais ricos em fibras e saudáveis para o coração dominem a fatia de mercado em 2025 e sejam o segmento de crescimento mais rápido no mercado devido ao foco crescente em saúde preventiva e controle de peso.

- Por prazo de validade

Com base na vida útil, o mercado de cereais é segmentado em longo prazo (estáveis em temperatura ambiente), médio prazo e curto prazo (perecíveis). Espera-se que os cereais estáveis em temperatura ambiente dominem a fatia de mercado em 2025 e sejam o segmento de crescimento mais rápido devido à sua durabilidade e vantagens logísticas, especialmente nos mercados varejista e de exportação.

- Por embalagem

Com base na embalagem, o mercado de cereais é segmentado em caixa, bolsa, saco, sachê/stick pack, saco (a granel), pote, Tetra Pack/cartão asséptico, lata, tambor, embalagens ecológicas e outros. Espera-se que caixas e bolsas dominem a participação de mercado em 2025 e sejam o segmento de crescimento mais rápido no varejo, enquanto as embalagens ecológicas devem apresentar rápido crescimento devido a iniciativas de sustentabilidade e soluções de embalagem com boa relação custo-benefício. A preferência do consumidor por formatos resseláveis, leves e ecológicos impulsiona o crescimento, especialmente nos setores de alimentos, cuidados pessoais e comércio eletrônico, com foco em frescor e redução de desperdício.

- Por tamanho da embalagem

Com base no tamanho da embalagem, o mercado de cereais é segmentado em embalagens pequenas (51 g a 250 g), embalagens médias (251 g a 500 g), embalagens grandes (501 g a 1 kg), embalagens individuais (abaixo de 50 g), embalagens extragrandes (1,1 kg a 2,5 kg) e embalagens a granel (acima de 2,5 kg). Espera-se que as embalagens pequenas e médias dominem a participação de mercado em 2025 e sejam o segmento de crescimento mais rápido devido à sua acessibilidade e adequação a domicílios individuais, enquanto as embalagens a granel são comuns em vendas B2B e institucionais.

- Por faixa de preço

Com base na faixa de preço, o mercado de cereais é segmentado em econômico (até US$ 2,49), médio (US$ 2,50 a US$ 6,99) e premium (US$ 7,00 ou mais). Espera-se que o segmento médio domine a participação de mercado em 2025 e seja o segmento de crescimento mais rápido devido ao seu equilíbrio entre preço acessível e qualidade, enquanto os cereais premium estão ganhando força nos mercados urbanos com o aumento da renda disponível.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de cereais é segmentado em B2B e B2C. Espera-se que o B2C domine a participação de mercado em 2025 e seja o segmento de crescimento mais rápido, devido à maioria das vendas serem feitas por meio de supermercados, lojas de conveniência e plataformas online, enquanto o segmento B2B é impulsionado por serviços de alimentação, fornecimento institucional e uso industrial.

Análise Regional do Mercado de Cereais

- O mercado de cereais da Europa teve uma participação de receita de 24,23% em 2025, impulsionado pelo alto consumo de cereais prontos para consumo, forte presença da marca e ampla disponibilidade em formatos de varejo modernos

- A região se beneficia de uma indústria de processamento de alimentos madura, da crescente demanda por cereais orgânicos e fortificados e da inovação contínua de players importantes como Kellogg's, General Mills e Post Holdings. Além disso, a crescente preferência do consumidor por opções de café da manhã práticas e saudáveis consolida ainda mais a liderança de mercado na Europa.

Visão do mercado de cereais na Alemanha

O mercado de cereais da Alemanha capturou a maior fatia de receita da Europa, acima de 14,00%, em 2024, impulsionado pelo alto consumo per capita de cereais, fidelidade à marca e uma rede de varejo bem estabelecida. Grandes players como General Mills, Kellogg's, Post Holdings e Quaker (PepsiCo) dominam o mercado com uma ampla gama de cereais prontos para consumo e funcionais. A demanda por cereais orgânicos, ricos em fibras e proteínas continua crescendo, refletindo a evolução das tendências de saúde e bem-estar.

Visão geral do mercado de cereais do Reino Unido

O mercado de cereais do Reino Unido capturou a maior fatia de receita, acima de 12,40%, na Europa em 2024, impulsionado pela crescente conscientização sobre saúde, pela demanda por opções práticas de café da manhã e pela popularidade de produtos ricos em fibras, com baixo teor de açúcar e à base de plantas. A inovação em sabores, embalagens e ingredientes funcionais também sustenta o crescimento contínuo do mercado.

Participação no Mercado de Cereais

O mercado de cereais é liderado principalmente por empresas bem estabelecidas, incluindo:

- Weetabix (Reino Unido)

- Associated British Foods plc (Reino Unido)

- B&G Foods, Inc. (EUA)

- bio-familia AG (Suíça)

- Rude Health (Reino Unido)

- Clextral (França)

- Dr. Oetker (Alemanha)

- Seitenbacher (Alemanha)

Últimos desenvolvimentos no mercado de cereais da Europa

- Em março de 2025 , a General Mills lançou uma nova linha de cereais matinais ricos em proteína sob a marca "Nature Valley", voltada para consumidores preocupados com a saúde e entusiastas do fitness. O produto inclui variantes fortificadas com proteína de soro de leite, fibras e zero adição de açúcar, em linha com a crescente demanda por alimentos funcionais.

- Em janeiro de 2025 , a Kellogg's anunciou sua expansão estratégica para o Sudeste Asiático com uma nova unidade fabril no Vietnã para atender à crescente demanda regional por soluções práticas para o café da manhã. A fábrica produzirá uma variedade de cereais adaptados às preferências locais, incluindo opções com baixo teor de açúcar e à base de plantas.

- Em outubro de 2024 , a Nestlé firmou parceria com a Danone e uma startup de tecnologia da saúde para desenvolver em conjunto uma plataforma de nutrição personalizada. A plataforma utiliza dados alimentares dos consumidores para recomendar cereais ricos em nutrientes específicos, como ômega-3, fibras e ferro, inaugurando uma nova era de nutrição de precisão na categoria de café da manhã.

- Em abril de 2025 , a Post Holdings lançou embalagens sustentáveis para sua linha de cereais "Honey Bunches of Oats". As novas embalagens recicláveis e biodegradáveis reforçam o compromisso da empresa de reduzir o uso de plástico em 50% até 2030 e atender consumidores ecoconscientes.

- Em fevereiro de 2025 , a marca “Saffola” da Marico lançou cereais à base de milheto na linha “Healthy Crunch” na Índia. O lançamento está alinhado à iniciativa do Ano Internacional do Milheto e aborda a crescente popularidade de grãos ancestrais em fórmulas modernas de café da manhã.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES:-

4.1.1 INTENSITY OF COMPETITIVE RIVALRY (HIGH)

4.1.2 BARGAINING POWER OF BUYERS/CONSUMERS (HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTE PRODUCTS (MODERATE TO HIGH)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.2 BRAND OUTLOOK

4.2.1 COMPARATIVE BRAND ANALYSIS

4.2.2 PRODUCT AND BRAND OVERVIEW

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS:

4.4 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.5 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.5.1 IMPACT ON PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.6 REGULATORY FRAMEWORK AND GUIDELINES

4.7 VALUE CHAIN

4.7.1 EUROPE CEREALS MARKET VALUE CHAIN

4.7.2 PRODUCTION:

4.7.3 PROCESSING:

4.7.4 MARKETING/DISTRIBUTION:

4.7.5 BUYERS:

4.8 SUPPLY CHAIN ANALYSIS

4.9 COST ANALYSIS BREAKDOWN

4.1 PROFIT MARGINS SCENARIO

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.12 PRICING ANALYSIS

4.13 PATENT ANALYSIS

4.13.1 PATENT QUALITY AND STRENGTH

4.13.2 PATENT FAMILIES

4.13.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.13.4 LICENSING AND COLLABORATIONS

4.13.5 COMPANY PATENT LANDSCAPE

4.13.6 REGION PATENT LANDSCAPE

4.14 IP STRATEGY AND MANAGEMENT

4.14.1 PATENT ANALYSIS

4.14.2 PROFIT MARGINS SCENARIO

4.15 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE CEREALS MARKET

4.15.1 IMPACT ON PRICES

4.15.2 IMPACT ON SUPPLY CHAIN

4.15.3 IMPACT ON SHIPMENT

4.15.4 IMPACT ON DEMAND

4.15.5 IMPACT ON STRATEGIC DECISIONS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 TYPES OF LOGISTICS COSTS INVOLVED

4.16.3 FACTORS INFLUENCING EACH COST TYPE

4.16.4 STRATEGIES TO MINIMIZE LOGISTIC COSTS

4.16.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.17.1 PROMINENT COMPANIES

4.17.2 SMALL & MEDIUM SIZE COMPANIES

4.17.3 END USERS

4.18 PRODUCTION CONSUMPTION ANALYSIS

4.19 RAW MATERIAL SOURCING ANALYSIS (EUROPE CEREALS MARKET)

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.20.1 OVERVIEW:

4.21 TARIFFS & IMPACT ON THE MARKET

4.21.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.21.3 VENDOR SELECTION CRITERIA DYNAMICS

4.21.4 IMPACT ON SUPPLY CHAIN

4.21.4.1 RAW MATERIAL PROCUREMENT

4.21.4.2 MANUFACTURING AND PRODUCTION

4.21.4.3 LOGISTICS AND DISTRIBUTION

4.21.4.4 PRICE PITCHING AND POSITION OF MARKET

4.21.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.5.1 SUPPLY CHAIN OPTIMIZATION

4.21.5.2 JOINT VENTURE ESTABLISHMENTS

4.21.6 IMPACT ON PRICES

4.21.7 REGULATORY INCLINATION

4.21.7.1 GEOPOLITICAL SITUATION

4.21.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.21.8 FREE TRADE AGREEMENTS

4.21.9 ALLIANCES ESTABLISHMENTS

4.21.10 STATUS ACCREDITATION (INCLUDING MFTN)

4.21.11 DOMESTIC COURSE OF CORRECTION

4.21.12 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.21.13 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR NUTRITIONAL AND FUNCTIONAL FOODS

5.1.2 URBANIZATION AND CHANGING LIFESTYLES BOOSTING READY-TO-EAT CEREALS

5.1.3 SURGE OF PLANT‑BASED AND FUNCTIONAL INGREDIENTS DRIVEN BY HEALTH & ENVIRONMENTAL CONCERNS

5.2 RESTRAINTS

5.2.1 FLUCTUATING RAW MATERIAL PRICES AND CLIMATE RISKS

5.2.2 GROWING CRITICISM OVER ADDED SUGAR AND PROCESSING

5.3 OPPORTUNITIES

5.3.1 CONSUMERS ARE INCREASINGLY CHOOSING HIGH-FIBER, LOW-SUGAR, AND ORGANIC CEREALS

5.3.2 THE RISING SHIFT TOWARD PLANT-BASED DIETARY PATTERNS INFLUENCING CONSUMER PREFERENCES.

5.3.3 ONLINE GROCERY ENABLING CEREAL BRANDS TO SELL DIRECTLY, GATHER CONSUMER DATA, AND OFFER SUBSCRIPTIONS

5.4 CHALLENGES

5.4.1 SIGNIFICANT HURDLES FOR SUPPLY CHAINS DUE TO LOGISTICS DISRUPTIONS, COMPLEX REGULATIONS, AND INEFFICIENT DISTRIBUTION NETWORKS

5.4.2 INCREASED COMPETITION FROM ALTERNATIVES LIKE GRANOLA, PROTEIN BARS, SMOOTHIES, YOGURT, AND ETHNIC BREAKFASTS

6 EUROPE CEREALS MARKET, BY CEREAL TYPE

6.1 OVERVIEW

6.2 WHEAT

6.2.1 WHEAT, BY TYPE

6.3 RICE

6.3.1 RICE, BY TYPE

6.4 MAIZE(CORN)

6.4.1 MAIZE(CORN), BY TYPE

6.5 BARLEY

6.5.1 BARLEY, BY TYPE

6.6 OATS

6.6.1 OATS, BY TYPE

6.7 RYE

6.7.1 RYE, BY TYPE

6.8 SORGHUM

6.8.1 SORGHUM, BY TYPE

6.9 MILLET

6.9.1 MILLET, BY TYPE

6.1 QUINOA

6.10.1 QUINOA, BY TYPE

6.11 BUCKWHEAT

6.12 TRITICALE

6.13 FONIO

6.14 TEFF

6.15 AMARANTH

6.16 KAMUT

6.17 OTHERS

7 EUROPE CEREALS MARKET, PRODUCT FORM

7.1 OVERVIEW

7.2 WHOLE GRAINS

7.3 FLOUR

7.4 FLAKED GRAINS

7.5 ROLLED GRAINS

7.6 PUFFED GRAINS

7.7 GROUND MEAL

7.8 CRACKED GRAINS

7.9 STARCH

7.1 BRAN

7.11 GERM

7.12 OTHERS

8 EUROPE CEREALS MARKET, BY PROCESSING LEVEL

8.1 OVERVIEW

8.2 FORTIFIED

8.3 DEHUSKED

8.4 POLISHED

8.5 PRE-COOKED

8.6 BLENDED

8.7 INSTANT

8.8 SPROUTED

8.9 ROASTED

8.1 EXTRUDED

8.11 PARTIALLY COOKED

8.12 MICRONIZED

8.13 RAW

8.14 FULLY COOKED

8.15 STEAMED

8.16 SEASONED

8.17 SWEETENED

8.18 COATED

8.19 OTHERS

9 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT

9.1 OVERVIEW

9.2 SPOON-EATEN WITH MILK/YOGURT

9.3 ON-THE-GO BARS

9.4 PORRIDGE

9.5 DRY SNACK

9.6 SNACK PACKS

9.7 READY-TO-COOK

9.8 READY-TO-HEAT

9.9 MIX-IN INGREDIENT

9.1 BEVERAGE-INFUSED

9.11 OTHERS

10 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS)

10.3 BREAKFAST CEREALS

10.3.1 BREAKFAST CEREALS, BY TYPE

10.3.1.1 Ready-To-Eat (RTE), By Type

10.3.1.2 Hot Cereals, By Type

10.4 FEEDSTOCK/ANIMAL FEED

10.5 CEREAL SNACKS

10.5.1 CEREAL SNACKS, BY TYPE

10.6 INSTANT CEREAL MIXES

10.7 INFANT CEREALS

10.7.1 INFANT CEREALS, BY TYPE

10.8 CEREAL-BASED MEAL KITS

10.9 BREWING/DISTILLING INPUTS

10.1 OTHERS

11 EUROPE CEREALS MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 EUROPE CEREALS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 GMO-BASED

12.3 NON-GMO CERTIFIED

13 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS

13.1 OVERVIEW

13.2 VITAMIN-FORTIFIED

13.3 HIGH-FIBER

13.4 LOW/NO SUGAR

13.5 HIGH-PROTEIN

13.6 GLUTEN-FREE

13.7 HEART-HEALTHY

13.8 PROBIOTIC/PREBIOTIC ENHANCED

13.9 CHOLESTEROL-LOWERING

13.1 LOW GLYCEMIC INDEX

13.11 OMEGA-3 ENRICHED

13.12 LOW FAT

13.13 ALLERGEN-FREE

13.14 HIGH-IRON

13.15 LOW/NO SALT

13.16 PALEO-FRIENDLY

13.17 KETO-FRIENDLY

13.18 VEGAN-CERTIFIED

13.19 OTHERS

14 EUROPE CEREALS MARKET, BY SHELF LIFE

14.1 OVERVIEW

14.2 LONG-TERM (AMBIENT SHELF-STABLE)

14.3 MEDIUM-TERM

14.4 SHORT-TERM (PERISHABLE)

15 EUROPE CEREALS MARKET, BY PACKAGING

15.1 OVERVIEW

15.2 BOX

15.2.1 BOX, BY TYPE

15.3 POUCH

15.3.1 POUCH, BY TYPE

15.4 BAG

15.4.1 BAG, BY TYPE

15.5 SACHET/STICK PACK

15.6 SACK (BULK)

15.7 JAR

15.7.1 JAR, BY TYPE

15.8 TETRA PACK / ASEPTIC CARTON

15.9 CANISTER

15.1 DRUM

15.11 ECO-PACKAGING

15.11.1 ECO-PACKAGING, BY TYPE

15.12 OTHERS

16 EUROPE CEREALS MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 SMALL PACKS (51G–250G)

16.3 MEDIUM PACKS (251G–500G)

16.4 LARGE PACKS (501G–1KG)

16.5 SINGLE SERVE PACKS (BELOW 50G)

16.6 EXTRA LARGE PACKS (1.1KG–2.5KG)

16.7 BULK PACKS (ABOVE 2.5KG)

17 EUROPE CEREALS MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 ECONOMY (UPTO USD 2.49)

17.3 MID-RANGE (USD 2.50-6.99)

17.4 PREMIUM (USD 7.00 AND ABOVE)

18 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 B2B

18.3 B2C

18.3.1 B2C, BY TYPE

18.3.2 ONLINE, BY TYPE

18.3.3 OFFLINE, BY TYPE

19 EUROPE CEREALS MARKET, BY REGION

19.1 EUROPE

19.1.1 GERMANY

19.1.2 U.K.

19.1.3 FRANCE

19.1.4 ITALY

19.1.5 SPAIN

19.1.6 NETHERLANDS

19.1.7 POLAND

19.1.8 RUSSIA

19.1.9 BELGIUM

19.1.10 SWITZERLAND

19.1.11 TURKEY

19.1.12 SWEDEN

19.1.13 NORWAY

19.1.14 DENMARK

19.1.15 FINLAND

19.1.16 REST OF EUROPE

20 EUROPE CEREALS MARKET

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 NESTLÉ

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 BRAND PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 ASSOCIATED BRITISH FOODS PLC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 BUSINESS PORTFOLIO

22.2.5 RECENT NEWS

22.3 GENERAL MILLS INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 BRAND PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 POST HOLDINGS, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 BRAND PORTFOLIO

22.4.5 RECENT DEVELOPMENT

22.5 WK KELLOGG CO

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 BRAND PORTFOLIO

22.5.5 RECENT DEVELOPMENT

22.6 BAGRRY'S

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS/NEWS

22.7 B&G FOODS, INC.

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENT

22.8 BARBARA'S BAKERY

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 BIO-FAMILIA EN

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 BOB’S RED MILL NATURAL FOODS

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 CÉRÉAL BIO

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 CLEXTRAL

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 DR. OETKER

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS/NEWS

22.14 HERO GROUP

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENTS/NEWS

22.15 KASHI LLC

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 KWALITY

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 LIMAGRAIN - INGRÉDIENTS

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 MARICO

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 BRAND PORTFOLIO

22.18.4 RECENT DEVELOPMENTS/NEWS

22.19 MULDER BREAKFAST CEREALS

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 NATURE'S PATH

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 PEPSICO

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 RUDE HEALTH

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 SANITARIUM

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 SEITENBACHER

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 SEVEN SUNDAYS

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENTS/NEWS

22.26 SURREAL UK

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 THE HAIN CELESTIAL GROUP, INC.

22.27.1 COMPANY SNAPSHOT

22.27.2 REVENUE ANALYSIS

22.27.3 BRAND PORTFOLIO

22.27.4 RECENT DEVELOPMENTS/NEWS

22.28 THE QUAKER OATS COMPANY

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 THE SILVER PALATE

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 WEETABIX

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENTS/NEWS

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tabela

TABLE 1 SUMMARY OF COMPETITIVE POSITIONING:

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 EXPORT

TABLE 4 IMPORT

TABLE 5 COST FOR KEY EQUIPMENT AND THE OVERALL CEREALS PROCESSING PLANTS

TABLE 6 PROFIT MARGIN SCENARIOS

TABLE 7 CONSUMER BUYING BEHAVIOUR

TABLE 8 PRODUCTION

TABLE 9 CONSUMPTION

TABLE 10 CONSUMER BUYING BEHAVIOUR

TABLE 11 CEREAL IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 12 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 13 REGULATORY INCLINATION

TABLE 14 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 15 ALLIANCES ESTABLISHMENTS

TABLE 16 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 17 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 19 EUROPE WHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE RICE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE BARLEY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OATS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE RYE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE SORGHUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE MILLET IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE QUINOA IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE BUCKWHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE TRITICALE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE FONIO IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE TEFF IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE AMARANTH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE WHOLE GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE FLOUR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE FLAKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE ROLLED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE PUFFED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE GROUND MEAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE CRACKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE STARCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE BRAN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE GERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE FORTIFIEDIN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE DEHUSKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE POLISHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE PRE-COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE BLENDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE INSTANT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE SPROUTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE ROASTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE EXTRUDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE PARTIALLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE MICRONIZED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE RAW IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE FULLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE STEAMED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE SEASONED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE SWEETENED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE COATED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE SPOON-EATEN WITH MILK/YOGURT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ON-THE-GO BARS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE PORRIDGE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE DRY SNACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE SNACK PACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE READY-TO-COOK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE READY-TO-HEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE MIX-IN INGREDIENT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE BEVERAGE-INFUSED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE FEEDSTOCK/ANIMAL FEED CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 EUROPE INSTANT CEREAL MIXES IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 EUROPE INFANT CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 EUROPE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 EUROPE CEREAL-BASED MEAL KITS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 EUROPE BREWING/DISTILLING INPUTS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 100 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 101 EUROPE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 102 EUROPE CONVENTIONAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 103 EUROPE ORGANIC IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 EUROPE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 105 EUROPE GMO-BASED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 EUROPE NON-GMO CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 107 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 108 EUROPE VITAMIN-FORTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 EUROPE HIGH-FIBER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 EUROPE LOW/NO SUGAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 EUROPE HIGH-PROTEIN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 EUROPE GLUTEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 EUROPE HEART-HEALTHY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 EUROPE PROBIOTIC/PREBIOTIC ENHANCED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 EUROPE CHOLESTEROL-LOWERING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 EUROPE LOW GLYCEMIC INDEX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 EUROPE OMEGA-3 ENRICHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 EUROPE LOW FAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 EUROPE ALLERGEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 EUROPE HIGH-IRON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 EUROPE LOW/NO SALT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 EUROPE PALEO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 EUROPE KETO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 EUROPE VEGAN-CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 EUROPE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 127 EUROPE LONG-TERM (AMBIENT SHELF-STABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 EUROPE MEDIUM-TERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 EUROPE SHORT-TERM (PERISHABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 EUROPE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 131 EUROPE BOX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 EUROPE BOX IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 EUROPE POUCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 EUROPE POUCH IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 EUROPE BAG IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 EUROPE BAG IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 EUROPE SACHET/STICK PACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 EUROPE SACK (BULK) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 EUROPE JAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 140 EUROPE JAR IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 EUROPE TETRA PACK / ASEPTIC CARTON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 EUROPE CANISTER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 EUROPE DRUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 144 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 145 EUROPE ECO-PACKAGING IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 147 EUROPE CEREALS MARKET, BY PACKAGING-SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 EUROPE SMALL PACKS (51G–250G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 149 EUROPE MEDIUM PACKS (251G–500G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 150 EUROPE LARGE PACKS (501G–1KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 151 EUROPE SINGLE SERVE PACKS (BELOW 50G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 152 EUROPE EXTRA LARGE PACKS (1.1KG–2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 153 EUROPE BULK PACKS (ABOVE 2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 154 EUROPE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 155 EUROPE ECONOMY (UPTO USD 2.49) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 156 EUROPE MID-RANGE (USD 2.50-6.99) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 157 EUROPE PREMIUM (USD 7.00 AND ABOVE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 158 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 159 EUROPE B2B IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 160 EUROPE B2C IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 161 EUROPE B2C IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 EUROPE ONLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 EUROPE OFFLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EUROPE CEREALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 165 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 167 EUROPE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EUROPE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EUROPE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EUROPE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 EUROPE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EUROPE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EUROPE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EUROPE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EUROPE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 177 EUROPE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 178 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 179 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 180 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 EUROPE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 EUROPE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 EUROPE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 EUROPE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 186 EUROPE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 188 EUROPE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 189 EUROPE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 190 EUROPE BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 EUROPE POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 EUROPE BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 EUROPE JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 EUROPE CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 EUROPE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 197 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 198 EUROPE B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 EUROPE ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 EUROPE OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 GERMANY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 GERMANY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 203 GERMANY WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 GERMANY RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 GERMANY MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 GERMANY BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 GERMANY OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 GERMANY RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 GERMANY SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 GERMANY MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 GERMANY QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 GERMANY CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 213 GERMANY CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 214 GERMANY CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 215 GERMANY CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 216 GERMANY BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 GERMANY READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 GERMANY HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 GERMANY CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 GERMANY INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 GERMANY CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 222 GERMANY CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 GERMANY CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 224 GERMANY CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 225 GERMANY CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 226 GERMANY BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 GERMANY POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 GERMANY BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 GERMANY JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 GERMANY ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 GERMANY CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 232 GERMANY CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 233 GERMANY CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 234 GERMANY B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 GERMANY ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 GERMANY OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 U.K. CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.K. CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 239 U.K. WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 U.K. RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 U.K. MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.K. BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.K. OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.K. RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 U.K. SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 U.K. MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 U.K. QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 U.K. CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 249 U.K. CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 250 U.K. CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 251 U.K. CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 252 U.K. BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 U.K. READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 U.K. HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 U.K. CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 U.K. INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 U.K. CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 258 U.K. CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 259 U.K. CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 260 U.K. CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 261 U.K. CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 262 U.K. BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 U.K. POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 U.K. BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 U.K. JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 U.K. ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 U.K. CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 268 U.K. CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 269 U.K. CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 270 U.K. B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 U.K. ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 U.K. OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 FRANCE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 FRANCE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 275 FRANCE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 FRANCE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 FRANCE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 FRANCE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 FRANCE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 FRANCE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 FRANCE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 FRANCE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 FRANCE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 FRANCE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 285 FRANCE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 286 FRANCE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 287 FRANCE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 288 FRANCE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 FRANCE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 FRANCE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 FRANCE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 FRANCE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 FRANCE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 294 FRANCE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 295 FRANCE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 296 FRANCE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 297 FRANCE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 298 FRANCE BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 FRANCE POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 FRANCE BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 FRANCE JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FRANCE ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 FRANCE CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 304 FRANCE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 305 FRANCE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 306 FRANCE B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FRANCE ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 FRANCE OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ITALY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 ITALY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 311 ITALY WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 ITALY RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 ITALY MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 ITALY BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ITALY OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ITALY RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 ITALY SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 ITALY MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 ITALY QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 ITALY CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 321 ITALY CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 322 ITALY CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 323 ITALY CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 324 ITALY BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ITALY READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ITALY HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ITALY CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ITALY INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ITALY CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 330 ITALY CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 331 ITALY CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 332 ITALY CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 333 ITALY CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 334 ITALY BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 ITALY POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 ITALY BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 ITALY JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ITALY ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 ITALY CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 340 ITALY CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 341 ITALY CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 342 ITALY B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 ITALY ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 ITALY OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SPAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SPAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 347 SPAIN WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 SPAIN RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 SPAIN MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 SPAIN BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 SPAIN OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SPAIN RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 SPAIN SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 SPAIN MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 SPAIN QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SPAIN CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 357 SPAIN CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 358 SPAIN CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 359 SPAIN CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 360 SPAIN BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SPAIN READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SPAIN HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SPAIN CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SPAIN INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SPAIN CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 366 SPAIN CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 367 SPAIN CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 368 SPAIN CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 369 SPAIN CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 370 SPAIN BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 SPAIN POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 SPAIN BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SPAIN JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SPAIN ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SPAIN CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 376 SPAIN CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 377 SPAIN CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 SPAIN B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 SPAIN ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 SPAIN OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 NETHERLANDS CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 NETHERLANDS CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 383 NETHERLANDS WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 NETHERLANDS RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 NETHERLANDS MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 NETHERLANDS BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 NETHERLANDS OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 NETHERLANDS RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 NETHERLANDS SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 NETHERLANDS MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 NETHERLANDS QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 NETHERLANDS CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 393 NETHERLANDS CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 394 NETHERLANDS CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 395 NETHERLANDS CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 396 NETHERLANDS BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 NETHERLANDS READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 NETHERLANDS HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 NETHERLANDS CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 NETHERLANDS INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 NETHERLANDS CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 402 NETHERLANDS CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 403 NETHERLANDS CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 404 NETHERLANDS CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 405 NETHERLANDS CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 406 NETHERLANDS BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 NETHERLANDS POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 NETHERLANDS BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 NETHERLANDS JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 NETHERLANDS ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 NETHERLANDS CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 412 NETHERLANDS CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 413 NETHERLANDS CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 414 NETHERLANDS B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 NETHERLANDS ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 NETHERLANDS OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 POLAND CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 POLAND CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 419 POLAND WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 POLAND RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 POLAND MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 POLAND BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 POLAND OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 POLAND RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 POLAND SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 POLAND MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 POLAND QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 POLAND CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 429 POLAND CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 430 POLAND CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 431 POLAND CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 432 POLAND BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 POLAND READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 POLAND HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 POLAND CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 POLAND INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 POLAND CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 438 POLAND CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 439 POLAND CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 440 POLAND CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 441 POLAND CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 442 POLAND BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 POLAND POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 POLAND BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 POLAND JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 POLAND ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 POLAND CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 448 POLAND CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 449 POLAND CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 450 POLAND B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 451 POLAND ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 452 POLAND OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 453 RUSSIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 454 RUSSIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 455 RUSSIA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 456 RUSSIA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 457 RUSSIA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 RUSSIA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 RUSSIA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 RUSSIA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 RUSSIA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 462 RUSSIA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 RUSSIA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 RUSSIA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 465 RUSSIA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 466 RUSSIA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 467 RUSSIA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 468 RUSSIA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 RUSSIA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 RUSSIA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 RUSSIA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 RUSSIA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 RUSSIA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 474 RUSSIA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 475 RUSSIA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 476 RUSSIA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 477 RUSSIA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 478 RUSSIA BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 479 RUSSIA POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 480 RUSSIA BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 481 RUSSIA JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 482 RUSSIA ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 483 RUSSIA CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 484 RUSSIA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 485 RUSSIA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 486 RUSSIA B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 RUSSIA ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 RUSSIA OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 489 BELGIUM CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 490 BELGIUM CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 491 BELGIUM WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 BELGIUM RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 493 BELGIUM MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 BELGIUM BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 BELGIUM OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 496 BELGIUM RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 BELGIUM SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 BELGIUM MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 BELGIUM QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 BELGIUM CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 501 BELGIUM CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 502 BELGIUM CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 503 BELGIUM CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 504 BELGIUM BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)