Europe Cocoa Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.89 Billion

USD

16.24 Billion

2024

2032

USD

10.89 Billion

USD

16.24 Billion

2024

2032

| 2025 –2032 | |

| USD 10.89 Billion | |

| USD 16.24 Billion | |

|

|

|

|

Segmentação do mercado europeu de cacau por tipo de produto (cacau em pó e em barra, manteiga de cacau, grãos de cacau, licor e pasta de cacau, nibs de cacau e outros), natureza (convencional e orgânico), tipo de cacau (cacau Forastero, cacau Trinitario e cacau Criollo), canal de distribuição (direto e indireto), aplicação (suplementos alimentares, alimentos e bebidas, bebidas, produtos farmacêuticos e cosméticos) - Tendências e previsões do setor até 2032.

Tamanho do mercado de cacau na Europa

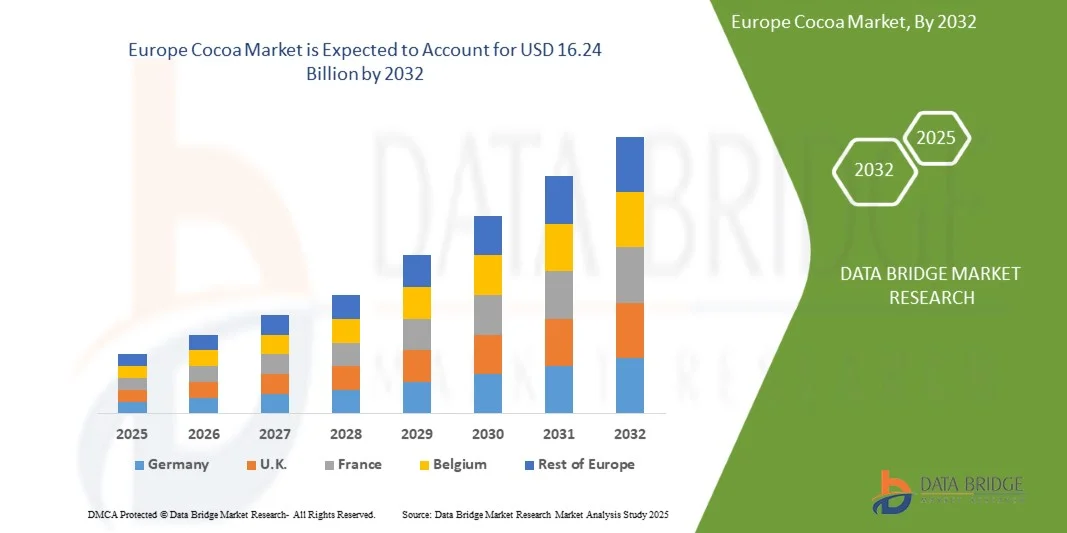

- O mercado europeu de cacau foi avaliado em US$ 10,89 bilhões em 2024 e espera-se que atinja US$ 16,24 bilhões até 2032, com uma taxa de crescimento anual composta (CAGR) de 5,2% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda do consumidor por produtos de cacau premium, orgânicos e de origem sustentável, motivada pela maior conscientização sobre os benefícios para a saúde associados ao chocolate amargo e ao cacau rico em flavonoides. A crescente preferência por ingredientes com rótulos limpos e produzidos de forma ética está incentivando os fabricantes a adotarem cadeias de suprimentos transparentes e rastreáveis, aumentando assim a confiança do consumidor e o valor da marca.

- Além disso, a expansão das aplicações do cacau em confeitaria, bebidas, cosméticos e nutracêuticos, juntamente com as inovações contínuas em formulações de produtos, como variantes de chocolate à base de plantas e com baixo teor de açúcar, estão acelerando a adoção pelo mercado. Esses fatores convergentes estão impulsionando significativamente o crescimento da indústria do cacau e posicionando-a como um segmento-chave no setor de alimentos e bebidas.

Análise do Mercado de Cacau na Europa

- O mercado europeu de cacau é impulsionado significativamente pela crescente demanda por chocolates e produtos de confeitaria em diversos segmentos de consumidores. O chocolate continua sendo um dos produtos de indulgência mais populares em todo o mundo, com o consumo aumentando constantemente tanto em economias desenvolvidas quanto emergentes. O cacau, sendo a principal matéria-prima para a produção de chocolate, experimenta um aumento direto na demanda em linha com o crescimento da indústria chocolateira. Fatores como a evolução dos estilos de vida dos consumidores, o aumento da renda disponível e a expansão dos segmentos de chocolates premium e artesanais estão impulsionando ainda mais essa tendência.

- As tendências emergentes incluem a crescente demanda por produtos veganos e à base de cacau de origem vegetal, a inovação em alimentos funcionais e fortificados à base de cacau e a crescente popularidade de variedades de cacau de origem única e especiais.

- A Alemanha deverá dominar o mercado europeu de cacau, detendo a maior quota de mercado, de 24,63%, em 2025, devido à crescente procura por produtos veganos e à base de cacau de origem vegetal.

- Prevê-se que a Alemanha seja o país com o crescimento mais rápido no mercado europeu de cacau durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 5,7%, impulsionada pela crescente popularidade de bebidas à base de cacau e pela ampla gama de produtos, incluindo chocolate quente tradicional, bebidas de cacau prontas para beber, leite aromatizado, shakes de proteína e bebidas funcionais para o bem-estar.

- O segmento de cacau em pó e bolos deverá dominar o mercado europeu de cacau, com uma participação de mercado de 35,06% em 2025, devido à crescente aplicação do cacau em cosméticos e produtos de higiene pessoal.

Escopo do relatório e segmentação do mercado de cacau na Europa

|

Atributos |

Principais informações sobre o mercado de cacau |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de cacau na Europa

“Aumento da demanda por chocolates e produtos de confeitaria”

- Uma tendência proeminente no mercado europeu de cacau é impulsionada significativamente pela crescente demanda por chocolates e produtos de confeitaria em diversos segmentos de consumidores.

- O cacau, principal matéria-prima para a produção de chocolate, experimenta um aumento direto na demanda em linha com o crescimento da indústria chocolateira. Fatores como a evolução dos estilos de vida dos consumidores, o aumento da renda disponível e a expansão dos segmentos de chocolates premium e artesanais impulsionam ainda mais essa tendência.

- A inovação de produtos por parte dos fabricantes de confeitaria, incluindo a introdução de sabores exóticos, chocolates funcionais com benefícios para a saúde e alegações de fornecimento sustentável, ampliou o apelo ao consumidor.

Dinâmica do Mercado de Cacau na Europa

Motorista

“Crescente conscientização sobre os benefícios do cacau para a saúde e suas propriedades antioxidantes”

- Uma das principais tendências que impulsionam o mercado europeu de cacau é a crescente conscientização sobre as propriedades benéficas do cacau para a saúde, que se tornou um forte fator de crescimento para o mercado.

- O cacau é naturalmente rico em flavonoides, polifenóis e outros antioxidantes que estão associados a diversos benefícios para a saúde, incluindo a melhoria da saúde cardiovascular, melhor circulação sanguínea e redução do risco de doenças crônicas.

- Por exemplo, em novembro de 2024, pesquisadores da Universidade de Birmingham revelaram que o consumo de cacau rico em flavonóis após uma refeição rica em gordura aumentou significativamente o fluxo sanguíneo e o desempenho vascular por até 90 minutos, mesmo durante estresse mental, sugerindo um papel protetor para a saúde cardiovascular em condições alimentares desafiadoras.

- A tendência de bem-estar, aliada ao crescimento da saúde preventiva, está expandindo as aplicações do cacau para categorias como bebidas à base de cacau, proteínas em pó e produtos de beleza de dentro para fora. À medida que os consumidores se tornam mais informados sobre o valor nutricional do cacau, espera-se que o mercado se beneficie de uma demanda sustentada, criando novas oportunidades de crescimento em diversos setores além da tradicional fabricação de chocolate.

- Os fabricantes estão capitalizando sobre essa conscientização, promovendo produtos de "chocolate amargo" e "alto teor de cacau", que contêm níveis mais elevados de compostos benéficos em comparação com o chocolate ao leite.

Oportunidades

“Crescente demanda por produtos veganos e à base de cacau de origem vegetal”

- A crescente adoção de estilos de vida veganos e à base de plantas, impulsionada por fatores éticos, ambientais e de saúde, está aumentando a demanda por produtos à base de cacau sem laticínios.

- O cacau, por ser naturalmente derivado de plantas, alinha-se bem com as tendências veganas nas indústrias de confeitaria, panificação e bebidas.

- Inovações em produtos como chocolates amargos sem lactose, bebidas de cacau à base de plantas e cremes de cacau veganos estão ganhando popularidade.

- O crescimento das alternativas de leite à base de plantas (leite de amêndoa, aveia e soja) impulsiona o desenvolvimento de bebidas cremosas e saborosas à base de cacau, sem laticínios.

- Em 2023, a Barry Callebaut relatou uma forte adesão às marcas de chocolate vegano que utilizam manteiga de cacau e leites vegetais, atraindo consumidores preocupados com a saúde e a sustentabilidade.

- Marcas premium estão oferecendo produtos de cacau veganos, orgânicos, de origem ética e com embalagens sustentáveis, com grande sucesso principalmente na Europa.

Restrição/Desafio

“Crescente concorrência de ingredientes alternativos na produção de confeitaria”

- Um dos principais fatores que restringem o mercado europeu de cacau é a crescente concorrência de ingredientes alternativos utilizados na produção de confeitaria. O aumento dos preços do cacau, aliado às incertezas de abastecimento causadas pelas mudanças climáticas e doenças nas plantações, tem incentivado os fabricantes a explorar substitutos economicamente viáveis.

- Ingredientes como a alfarroba, aromas sintéticos de cacau e outras alternativas de origem vegetal estão sendo cada vez mais adotados para substituir parcial ou totalmente o cacau em aplicações de chocolate, panificação e bebidas.

- A tecnologia alimentar avançada possibilitou o desenvolvimento de imitadores de sabor de cacau e misturas que utilizam menos cacau, mantendo o sabor e a textura. Essa mudança é particularmente notável entre as marcas de confeitaria do mercado de massa que buscam manter preços competitivos sem comprometer o apelo ao consumidor.

- Embora essas alternativas possam não reproduzir completamente as qualidades premium do cacau, sua crescente aceitação em certos segmentos de consumidores representa um desafio para a demanda por cacau.

Escopo do mercado de cacau na Europa

O mercado europeu de cacau está segmentado por tipo de produto, natureza, tipos de cacau, canal de distribuição e aplicação.

- Tipo de produto

Com base no tipo de produto, o mercado é segmentado em cacau em pó e em barra, manteiga de cacau, grãos de cacau, licor e pasta de cacau, nibs de cacau e outros. Em 2025, espera-se que o segmento de cacau em pó e em barra domine o mercado, com uma participação de 35,06%. O domínio desse segmento pode ser atribuído ao seu uso generalizado na fabricação de chocolate, em produtos de panificação e na formulação de bebidas. Sua facilidade de armazenamento, longa vida útil e compatibilidade com processos de produção em larga escala o tornam altamente preferido entre os processadores de alimentos.

Prevê-se que o segmento de grãos de cacau apresente o maior crescimento anual composto (CAGR) de 6,1% durante o período de previsão, devido à crescente demanda por chocolates premium e de origem única, ao aumento do uso de cacau cru em aplicações artesanais e à crescente preferência do consumidor por ingredientes naturais e minimamente processados.

- Natureza

Com base na natureza, o mercado é segmentado em convencional e orgânico. Em 2025, espera-se que o segmento convencional domine o mercado com uma participação de 93,07%. O domínio do segmento convencional deve-se principalmente à sua relação custo-benefício, cadeias de suprimentos estabelecidas e capacidade de produção em larga escala. O cacau convencional oferece qualidade consistente, tornando-o ideal para fabricantes que visam aplicações no mercado de massa.

Prevê-se que o segmento de produtos orgânicos apresente a maior taxa de crescimento anual composta (CAGR) de 5,9% durante o período de previsão, devido à crescente conscientização do consumidor sobre saúde e bem-estar.

- Tipo de cacau

Com base no tipo de cacau, o mercado é segmentado em cacau forastero, cacau trinitário e cacau criollo. Em 2025, espera-se que o segmento de cacau forastero domine o mercado, com uma participação de 82,91%. O domínio do cacau forastero pode ser atribuído à sua resiliência, qualidade consistente e adequação à produção em massa. Sua ampla distribuição regional de cultivo favorece economias de escala e atende às demandas dos grandes produtores de chocolate. Sua robustez também o torna menos suscetível a doenças, garantindo um fornecimento estável e preços acessíveis, o que impulsiona sua rápida adoção e o crescimento consistente do mercado.

O cacau Forastero apresentou o maior crescimento anual composto (CAGR) de 5,3% durante o período de previsão, devido ao seu alto rendimento, menor custo de produção e cultivo generalizado.

- Canal de Distribuição

Com base no canal de distribuição, o mercado é segmentado em indireto e direto. Em 2025, espera-se que o segmento indireto domine o mercado, com uma participação de 77,34%. O domínio do segmento indireto é sustentado pela presença de redes consolidadas de varejo, atacado e distribuição, que facilitam o acesso a produtos de cacau tanto em mercados desenvolvidos quanto emergentes. Os canais indiretos oferecem melhor logística, maior cobertura geográfica e economias de escala, especialmente para fabricantes que distribuem por meio de supermercados, atacadistas e fornecedores de serviços de alimentação, impulsionando sua rápida adoção e crescimento consistente do mercado.

Prevê-se que o segmento indireto cresça com a maior taxa composta de crescimento anual (CAGR) de 5,7% durante o período de previsão, impulsionado pela rápida expansão das plataformas de comércio eletrônico e pelo aumento da demanda por conveniência.

- Aplicativo

Com base na aplicação, o mercado é segmentado em suplementos alimentares, alimentos e bebidas, bebidas, produtos farmacêuticos, cuidados pessoais e cosméticos. Em 2025, prevê-se que o segmento de suplementos alimentares domine o mercado, com uma participação de 37,53%. A dominância do segmento de suplementos alimentares deve-se ao crescente reconhecimento dos benefícios do cacau para a saúde, incluindo suas propriedades antioxidantes, efeitos na melhora do humor e suporte cardiovascular. Os suplementos à base de cacau estão sendo cada vez mais integrados a dietas saudáveis e produtos de nutrição funcional, principalmente em mercados desenvolvidos, onde o bem-estar preventivo é uma tendência importante, impulsionando sua rápida adoção e crescimento consistente do mercado.

Espera-se que o segmento de alimentos e bebidas cresça com a maior taxa composta de crescimento anual (CAGR) de 5,9% durante o período de previsão, impulsionado pelo aumento da demanda por snacks à base de cacau, produtos de panificação e alternativas lácteas.

Análise Regional do Mercado de Cacau na Europa

- A Alemanha deverá dominar o mercado europeu de cacau, detendo a maior quota de receita, com 24,63% em 2025, devido à crescente procura por produtos veganos e à base de cacau de origem vegetal.

- Prevê-se que a Alemanha seja o país com o crescimento mais rápido no mercado durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 5,7%, impulsionada pela crescente popularidade de bebidas à base de cacau e pela ampla gama de produtos, incluindo chocolate quente tradicional, bebidas de cacau prontas para consumo, leite aromatizado, shakes de proteína e bebidas funcionais para o bem-estar.

- O mercado europeu de cacau está experimentando um crescimento constante devido a diversos fatores-chave. Um dos principais impulsionadores é a crescente demanda por produtos à base de cacau, como chocolates, doces e itens de panificação, alimentada pelo aumento da população urbana e da renda disponível. À medida que as preferências do consumidor se voltam para dietas ao estilo ocidental e alimentos indulgentes, o consumo de chocolate e produtos com cacau está se tornando mais difundido, principalmente nos centros urbanos da região. Além disso, a expansão da indústria de alimentos e bebidas, juntamente com o crescente interesse em alimentos funcionais e suplementos alimentares, está impulsionando ainda mais o uso do cacau em diversas aplicações. A região também está testemunhando um aumento no consumo de cacau orgânico e de origem ética, impulsionado pela crescente conscientização sobre saúde e preocupações com a sustentabilidade entre os consumidores. Ademais, os avanços na infraestrutura da cadeia de suprimentos e o aumento dos investimentos em instalações locais de processamento de cacau estão apoiando o crescimento do mercado, melhorando a disponibilidade do produto e reduzindo a dependência de importações.

Análise do Mercado Europeu de Cacau

Prevê-se que a Europa cresça a uma taxa composta de crescimento anual (CAGR) de 5,2% entre 2025 e 2032, impulsionada principalmente pela elevada e consistente procura dos consumidores por chocolate e produtos à base de cacau, sustentada por uma cultura do chocolate profundamente enraizada e uma indústria de processamento de alimentos altamente desenvolvida.

Análise do Mercado de Cacau na Alemanha e na Europa

A Alemanha continua a dominar o mercado devido ao seu elevado consumo per capita de chocolate e à sua consolidada indústria de confeitaria. O país abriga alguns dos maiores fabricantes de chocolate da Europa e funciona como um importante centro de processamento e distribuição. Prevê-se que a Alemanha seja o mercado de crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 5,7% entre 2025 e 2032, impulsionada pela crescente procura por produtos de cacau orgânicos, de comércio justo e de origem sustentável. Os consumidores alemães estão cada vez mais preocupados com a origem ética dos produtos, a sustentabilidade ambiental e o impacto social do cultivo do cacau.

Análise do Mercado de Cacau na Holanda e na Europa

A Holanda continua sendo um ator fundamental no mercado europeu de cacau, devido à sua posição como o maior importador e processador de grãos de cacau do mundo. O Porto de Amsterdã serve como uma porta de entrada crucial para as importações de cacau na Europa, tornando o país um importante centro para o comércio, armazenamento e processamento de cacau. Espera-se que a Holanda registre um crescimento constante, com uma taxa de crescimento anual composta (CAGR) de 5,5% de 2025 a 2032, impulsionado por investimentos crescentes em fornecimento sustentável de cacau, inovação em ingredientes à base de cacau e forte demanda de fabricantes de alimentos e bebidas em toda a Europa. As empresas holandesas estão liderando os esforços globais em rastreabilidade e fornecimento ético, alinhando-se às preferências do consumidor por transparência, comércio justo e responsabilidade ambiental.

participação de mercado do cacau na Europa

A indústria do cacau é liderada principalmente por empresas consolidadas, incluindo :

- Neogric Limitada (Reino Unido)

- Fábrica de chocolate Macofa (Índia)

- Toutan SA (França)

- Olam International Limited (Singapura)

- Blommer Chocolate Company (EUA)

- Cacau Deprama (Indonésia)

- PT GRAND KAKAO INDONÉSIA (Indonésia)

- Jaya Saliem Industri (Indonésia)

- INDCRE SA (Espanha)

- PT ANDW NGENSOWIDJAJA (Indonésia)

- INDOCOCOA (PT KENDO AGRI NUSANTARA) (Indonésia)

- Guan Chong Berhad (Malásia)

- ECUAKAO GROUP LTD (Equador)

- CocoaCraft (Índia)

- Sucden (França)

- Cargill, Incorporated (EUA)

- Empresa de Processamento de Cacau Limitada (CPC) (Gana)

- Cacau incomum (EUA)

- Puratos (Bélgica)

- ECOM Agroindustrial Corp. Limitada (Suíça)

- Kokoa Kamili (Tanzânia)

- Barry Callebaut (Suíça)

- JB Cacau (Malásia)

- Centro de Cacau (Reino Unido)

- Duc d'O (Parte do grupo Baronie.com) (Bélgica)

- Natra (Espanha)

- MONER COCOA, SA (Espanha)

- Chocolate Pacari (Equador)

- Icam Spa (Itália)

- ALTINMARKA (Turquia)

Últimos desenvolvimentos no mercado de cacau na Europa

- Em outubro de 2024, a ICAM Cioccolato lançou uma loja virtual reformulada, construída na plataforma Shopify, que oferece uma experiência de compra intuitiva, segura e otimizada para dispositivos móveis. A plataforma apresenta os produtos da ICAM, Vanini e Otto, com ênfase em sustentabilidade e inclusão. Com recursos de perfil de clientes para marketing personalizado, o projeto foi desenvolvido em parceria com a Ecommerce School e apoiado por campanhas promocionais para impulsionar a visibilidade e as vendas online.

- Em junho de 2025, a Kokoa Kamili, que opera no Vale de Kilombero, na Tanzânia, desde 2013, reafirmou sua missão de posicionar o país como líder europeu em cacau de sabor fino. O cofundador Siman Bindra enfatizou que, embora a Tanzânia produza apenas cerca de 14.000 toneladas anualmente — muito abaixo de grandes produtores como a Costa do Marfim e Gana —, a força da nação reside em sua genética, clima e qualidade. A Kokoa Kamili trabalha em parceria com 1.500 agricultores com certificação orgânica, distribuiu mais de 600.000 mudas e está desenvolvendo programas de enxertia a partir de árvores de alto rendimento e sabor excepcional. A empresa conquistou o prêmio Cocoa of Excellence três vezes e busca o reconhecimento da Organização Internacional do Cacau (OIC) por seu status de cacau de sabor fino para garantir preços mais altos para todo o cacau tanzaniano. Diante dos desafios das mudanças climáticas, a Kokoa Kamili explora a irrigação movida a energia solar e defende que as estratégias nacionais de irrigação incluam o cacau. Bindra também pretende desmistificar a ideia de que a África produz apenas cacau em grande quantidade e de baixa qualidade, destacando a comprovada excelência da Tanzânia nos mercados premium.

- Em março de 2025, a Natra Cacao SL lançou um projeto, apoiado pelo Fundo Europeu de Desenvolvimento Regional (FEDER) e pela Agência Valenciana de Inovação, para desenvolver produtos fermentados análogos ao cacau para a produção de chocolate. A iniciativa explora matérias-primas vegetais alternativas com o mesmo perfil organoléptico e funcionalidade do cacau fermentado, visando criar produtos de valor agregado com benefícios para a saúde, cadeias de suprimentos mais curtas e resilientes e menor dependência dos voláteis mercados europeus de cacau. O projeto também busca reduzir a pegada de carbono, mitigar os riscos de desmatamento e impulsionar a inovação em toda a cadeia de valor do grupo Natra.

- Em junho de 2025, a Touton demonstra como a colaboração, a inteligência operacional e a inovação direcionada impulsionaram resultados significativos na proteção florestal, na produção sustentável e no envolvimento da comunidade na safra de 2023-2024. O relatório destaca conquistas como a distribuição de centenas de milhares de mudas melhoradas de cacau e de plantas multiuso em Gana e na Costa do Marfim, e o treinamento de mais de 112.000 agricultores em práticas climáticas inteligentes.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 SOURCE: DBMR ANALYSIS

4.7.2 PRODUCT QUALITY AND CERTIFICATION

4.7.3 SOURCING AND TRACEABILITY

4.7.4 PRICING AND COST COMPETITIVENESS

4.7.5 SUSTAINABILITY AND ETHICAL PRACTICES

4.7.6 PRODUCTION CAPACITY AND RELIABILITY

4.7.7 COMPLIANCE WITH REGULATIONS

4.7.8 LOGISTICS AND SUPPLY CHAIN EFFICIENCY

4.7.9 REPUTATION AND REFERENCES

4.8 BRAND OUTLOOK

4.8.1 MARKET ROLES & POSITIONING (WHO PLAYS WHICH ROLE?)

4.8.2 PRODUCT & PACKAGING DIFFERENCES

4.8.3 SUSTAINABILITY & FARMER PROGRAMS (CRITICAL FOR REPUTATION & SUPPLY SECURITY)

4.8.4 STRENGTHS, COMPETITIVE EDGES, AND CUSTOMER FIT

4.8.5 RISKS & MARKET PRESSURES (INDUSTRY-WIDE)

4.8.6 STRATEGIC TAKEAWAYS FOR REPORT READERS

4.8.7 WHY THIS LAYOUT?

4.8.8 BARRY CALLEBAUT — FULL-SPECTRUM CHOCOLATE LEADER

4.8.9 CARGILL — CUSTOM SOLUTIONS + INDUSTRY SCALE

4.8.10 OLAM — ORIGINATION & PROCESSING BACKBONE

4.8.11 GUAN CHONG (GCB) — EFFICIENT PROCESSOR

4.8.12 BLOMMER — NORTH AMERICA PROCESSOR & SERVICE

4.9 CONSUMER BUYING BEHAVIOUR

4.9.1 PROBLEM RECOGNITION AND AWARENESS

4.9.2 INFORMATION SEARCH

4.9.3 EVALUATION OF ALTERNATIVES

4.9.4 PURCHASE DECISION

4.9.5 POST-PURCHASE BEHAVIOUR

4.9.6 DEMOGRAPHIC INSIGHTS

4.9.7 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 INITIAL INVESTMENT AND CAPITAL EXPENDITURE (CAPEX)

4.10.2 INSTALLATION AND INFRASTRUCTURE ADAPTATION

4.10.3 ENERGY CONSUMPTION AND OPERATIONAL COST (OPEX)

4.10.4 MAINTENANCE AND SERVICING

4.10.5 OVERHEAD AND INDIRECT COSTS

4.10.6 STRATEGIC INVESTMENT CONSIDERATIONS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGINS SCENARIO

4.12.1 FACTORS INFLUENCING PROFITABILITY

4.12.2 VALUE ADDITION:

4.12.3 QUALITY & CERTIFICATION:

4.12.4 MARKET DEMAND:

4.12.5 BUSINESS MODEL:

4.13 RAW MATERIAL COVERAGE

4.13.1 COCOA BEANS (PRIMARY RAW MATERIAL)

4.13.2 SUGAR (SWEETENING AGENT)

4.13.3 COCOA BUTTER (FAT COMPONENT)

4.13.4 MILK POWDER (DAIRY INGREDIENT)

4.13.5 LECITHIN (EMULSIFIER)

4.14 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.14.1 ADVANCED COCOA BEAN ROASTING TECHNOLOGIES

4.14.2 AUTOMATED COCOA PROCESSING AND PRODUCTION SYSTEMS

4.14.3 AI-DRIVEN QUALITY CONTROL AND DEFECT DETECTION

4.14.4 ENERGY-EFFICIENT GRINDING AND CONCHING EQUIPMENT

4.14.5 SMART PACKAGING AND SHELF-LIFE EXTENSION SOLUTIONS

4.14.6 DIGITAL SUPPLY CHAIN AND TRACEABILITY INTEGRATION

4.15 PATENT ANALYSIS –

4.15.1 PATENT QUALITY AND STRENGTH

4.15.2 PATENT FAMILIES

4.15.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.15.4 REGION PATENT LANDSCAPE

4.15.5 IP STRATEGY AND MANAGEMENT

4.15.6 PATENT ANALYSIS – TOP APPLICANTS

5 TARIFFS & IMPACT ON THE EUROPE COCOA MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 BEANS AND RATIOS FOR HISTORY AND FORECAST AND WITH CONCRETE DATA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS

8.1.2 GROWING AWARENESS OF COCOA’S HEALTH AND ANTIOXIDANT BENEFITS

8.1.3 EXPANDING USE OF COCOA IN COSMETICS AND PERSONAL CARE

8.1.4 GROWTH IN COCOA-BASED BEVERAGES

8.2 RESTRAINTS

8.2.1 GROWING COMPETITION FROM ALTERNATIVE INGREDIENTS IN CONFECTIONERY PRODUCTION

8.2.2 STRINGENT REGULATORY STANDARDS FOR COCOA QUALITY AND SAFETY COMPLIANCE

8.3 OPPORTUNITIES

8.3.1 RISING DEMAND FOR VEGAN AND PLANT-BASED COCOA-BASED PRODUCTS

8.3.2 INNOVATION IN COCOA-BASED FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

8.3.3 INCREASING POPULARITY OF SINGLE-ORIGIN AND SPECIALTY COCOA VARIETIES

8.4 CHALLENGE

8.5 CLIMATE CHANGE REDUCING COCOA YIELDS AND AFFECTING QUALITY

8.5.1 LIMITED FARMER ACCESS TO MODERN FARMING TOOLS AND TRAINING

9 EUROPE COCOA MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 COCOA POWDER & CAKE

9.3 COCOA BUTTER

9.4 COCOA BEANS

9.5 COCOA LIQUOR & PASTE

9.6 COCOA NIBS

9.7 OTHERS

10 EUROPE COCOA MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 EUROPE COCOA MARKET, BY TYPE OF COCOA

11.1 OVERVIEW

11.2 FORASTERO COCOA

11.3 TRINITARIO COCOA

11.4 CRIOLLO COCOA

12 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.3 DIRECT

13 EUROPE COCOA MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 DIETARY SUPPLEMENTS

13.3 FOOD AND BEVERAGE

13.4 BEVERAGE

13.5 PHARMACEUTICALS

13.6 PERSONAL CARE AND COSMETICS

14 EUROPE COCOA MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 NETHERLANDS

14.1.3 FRANCE

14.1.4 U.K.

14.1.5 BELGIUM

14.1.6 ITALY

14.1.7 SWITZERLAND

14.1.8 SPAIN

14.1.9 POLAND

14.1.10 RUSSIA

14.1.11 TURKEY

14.1.12 SWEDEN

14.1.13 DENMARK

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

15 EUROPE COCOA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 OLAM GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 BARRY CALLEBAUT

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ECOM AGROINDUSTRIAL CORP. LIMITED.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS/NEWS

17.4 PURATOS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 GUAN CHONG BERHAD (GCB)

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS/NEWS

17.6 JB COCOA

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 RECENT DEVELOPMENT

17.7 ALTINMARKA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 BLOMMER CHOCOLATE COMPANY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CARGILL, INCORPORATED.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 COCOA HUB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS/NEWS

17.11 COCOA PROCESSING COMPANY LIMITED (CPC)

17.11.1 COMPANY SNAPSHOT

17.11.2 RECENT FINANCIALS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 COCOACRAFT

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS/NEWS

17.13 DEPRAMA COCOA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 DUC D’O

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS/NEWS

17.15 ECUAKAO GROUP LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS/NEWS

17.16 ICAM SPA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 INDCRE S.A

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATES

17.18 INDOCOCOA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS/NEWS

17.19 JAYA SALIEM INDUSTRI

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KOKOA KAMILI

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS/NEWS

17.21 MACOFA CHOCOLATE FACTORY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MONER COCOA, S.A.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 NATRA

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS/NEWS

17.24 NEOGRIC LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 PACARI

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT UPDATES

17.26 PT ANDOW NGENSOWIDJAJA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS/NEWS

17.27 PT GRAND KAKAO INDONESIA

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TOUTON S.A.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 UNCOMMON CACOA .

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 FIGURE 2. COMPANY VS BRAND OVERVIEW

TABLE 3 NUMBER OF PATENTS PER YEAR

TABLE 4 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 5 TOP PATENT APPLICANTS.

TABLE 6 REGULATORY COVERAGE

TABLE 7 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 9 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 10 EUROPE COCOA BUTTER IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (TONS)

TABLE 13 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (PRICE USD/KG)

TABLE 14 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (TONS)

TABLE 16 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (PRICE USD/KG)

TABLE 17 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 18 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (TONS)

TABLE 19 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (PRICE USD/KG)

TABLE 20 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE BEVERAGES IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (TONS)

TABLE 35 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (PRICE USD/KG)

TABLE 36 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 38 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 40 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 41 EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 44 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 45 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 47 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 48 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 50 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 51 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 56 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 69 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 70 GERMANY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 72 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 73 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 74 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 76 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 77 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 79 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 80 GERMANY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 84 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 85 GERMANY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 98 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 99 NETHERLANDS COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 101 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 102 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 103 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 104 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 105 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 106 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 108 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 109 NETHERLANDS INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 113 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 114 NETHERLANDS FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NETHERLANDS PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 128 FRANCE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 131 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 132 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 134 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 135 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 137 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 138 FRANCE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 142 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 143 FRANCE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 FRANCE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 156 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 157 U.K. COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 160 U.K. COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 161 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 162 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 163 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 164 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 166 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 167 U.K. INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.K. OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 172 U.K. FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.K. BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.K. CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.K. CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.K. CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 U.K. WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.K. DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.K. PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 U.K. BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.K. DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.K. PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 185 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 186 BELGIUM COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 188 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 189 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 190 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 192 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 193 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 195 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 196 BELGIUM INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 200 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 201 BELGIUM FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 BELGIUM BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 BELGIUM CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BELGIUM CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BELGIUM CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 206 BELGIUM WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 BELGIUM DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BELGIUM PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 BELGIUM BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 BELGIUM DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 BELGIUM PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 214 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 215 ITALY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 ITALY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 217 ITALY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 218 ITALY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 219 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 221 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 222 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 224 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 225 ITALY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 229 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 230 ITALY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ITALY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 ITALY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 ITALY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ITALY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 235 ITALY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ITALY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ITALY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 ITALY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ITALY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 ITALY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 243 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 244 SWITZERLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 246 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 247 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 248 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 250 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 251 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 253 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 254 SWITZERLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 258 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 259 SWITZERLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 264 SWITZERLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWITZERLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWITZERLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 272 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 273 SPAIN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 276 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 277 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 279 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 280 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 282 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 283 SPAIN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 287 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 288 SPAIN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SPAIN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SPAIN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SPAIN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SPAIN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 301 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 302 POLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 POLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 304 POLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 305 POLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 306 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 307 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 308 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 309 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 311 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 312 POLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 POLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 316 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 317 POLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 330 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 331 RUSSIA COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 333 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 334 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 335 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 336 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 337 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 338 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 339 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 340 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 341 RUSSIA INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 RUSSIA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 344 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 345 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 346 RUSSIA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 RUSSIA BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 RUSSIA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 RUSSIA CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 RUSSIA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 351 RUSSIA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 RUSSIA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 RUSSIA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 RUSSIA BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 RUSSIA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 RUSSIA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 359 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 360 TURKEY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 362 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 363 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 364 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 365 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 366 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 367 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 368 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 369 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 370 TURKEY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 TURKEY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 373 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 374 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 375 TURKEY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 TURKEY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 TURKEY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 TURKEY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 TURKEY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 380 TURKEY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 TURKEY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 TURKEY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 TURKEY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 TURKEY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 TURKEY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 388 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 389 SWEDEN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 391 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 392 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 393 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 394 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 395 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 396 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 397 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 398 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 399 SWEDEN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 SWEDEN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 402 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 403 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 404 SWEDEN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 SWEDEN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 SWEDEN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 SWEDEN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 SWEDEN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 409 SWEDEN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 SWEDEN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 SWEDEN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 SWEDEN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 SWEDEN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 SWEDEN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 417 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 418 DENMARK COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 420 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 421 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 422 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 423 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 424 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 425 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 426 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 427 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 428 DENMARK INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 DENMARK OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 431 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 432 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 433 DENMARK FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 DENMARK BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 DENMARK CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 DENMARK CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 DENMARK CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 438 DENMARK WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 DENMARK DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 DENMARK PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 DENMARK BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 DENMARK DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 DENMARK PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 446 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 447 NORWAY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 449 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 450 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 451 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 452 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 453 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 454 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 455 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 456 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 457 NORWAY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 NORWAY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 460 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 461 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 462 NORWAY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 NORWAY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 NORWAY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 465 NORWAY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 466 NORWAY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 467 NORWAY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 468 NORWAY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 NORWAY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 NORWAY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 NORWAY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 NORWAY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 474 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 475 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 476 FINLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 477 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 478 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 479 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 480 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 481 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 482 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 483 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 484 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 485 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 486 FINLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 FINLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 489 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 490 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 491 FINLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 FINLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 493 FINLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 FINLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 FINLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 496 FINLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 FINLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 FINLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 FINLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 FINLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 501 FINLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 502 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 503 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 504 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 505 REST OF EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 506 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 507 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 508 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 509 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 510 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 511 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 512 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 513 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 514 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 515 REST OF EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 516 REST OF EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 517 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 518 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 519 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 520 REST OF EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 521 REST OF EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 522 REST OF EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 523 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 524 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 525 REST OF EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 526 REST OF EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 527 REST OF EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 528 REST OF EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 529 REST OF EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 530 REST OF EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 EUROPE COCOA MARKET

FIGURE 2 EUROPE COCOA MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE COCOA MARKET: DROC ANALYSIS

FIGURE 4 EUROPE COCOA MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE COCOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE COCOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE COCOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE COCOA MARKET: DBMR MARKET POSITION GRID