Europe Dietary Supplements Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

37.61 Billion

USD

61.31 Billion

2024

2032

USD

37.61 Billion

USD

61.31 Billion

2024

2032

| 2025 –2032 | |

| USD 37.61 Billion | |

| USD 61.31 Billion | |

|

|

|

|

Segmentação do mercado de suplementos alimentares na Europa, por tipo de produto (suplementos vitamínicos, suplementos minerais, suplementos de complexos/misturas de vitaminas e minerais, suplementos à base de proteínas, suplementos à base de ervas/plantas, suplementos probióticos, suplementos de ômega-3 e ácidos graxos essenciais, suplementos de aminoácidos, suplementos à base de fibras, suplementos prebióticos, suplementos simbióticos, queimadores de gordura e suplementos termogênicos e outros), natureza (convencional e orgânico), forma do produto (comprimidos, cápsulas, géis moles, pós, gomas e geleias, líquidos, pré-misturas e outros), função (suporte nutricional, fortalecimento do sistema imunológico, nutrição esportiva, saúde preventiva, saúde cardíaca, saúde digestiva, saúde cognitiva e mental, aprimoramento do desempenho, controle de peso, saúde intestinal, suporte ao envelhecimento, saúde da pele, saúde óssea e articular, saúde metabólica, manutenção da saúde, equilíbrio hormonal, saúde imunológica e outros), Tipo de embalagem (garrafas, bolsas e sachês, potes e recipientes, embalagens blister, latas e latas e outros), tamanho da embalagem (100 a 250 gramas, 250 a 500 gramas, menos de 100 gramas, 500 a 750 gramas, 750 a 1000 gramas e mais de 1000 gramas), demografia do consumidor (adultos (24 a 45 anos), idosos (acima de 45 anos), jovens (14 a 24 anos) e crianças (menores de 14 anos)), gênero (feminino, masculino e unissex), canal de distribuição (varejistas com lojas físicas e varejistas sem lojas físicas) - tendências e previsões do setor até 2032

Tamanho do mercado de suplementos alimentares na Europa

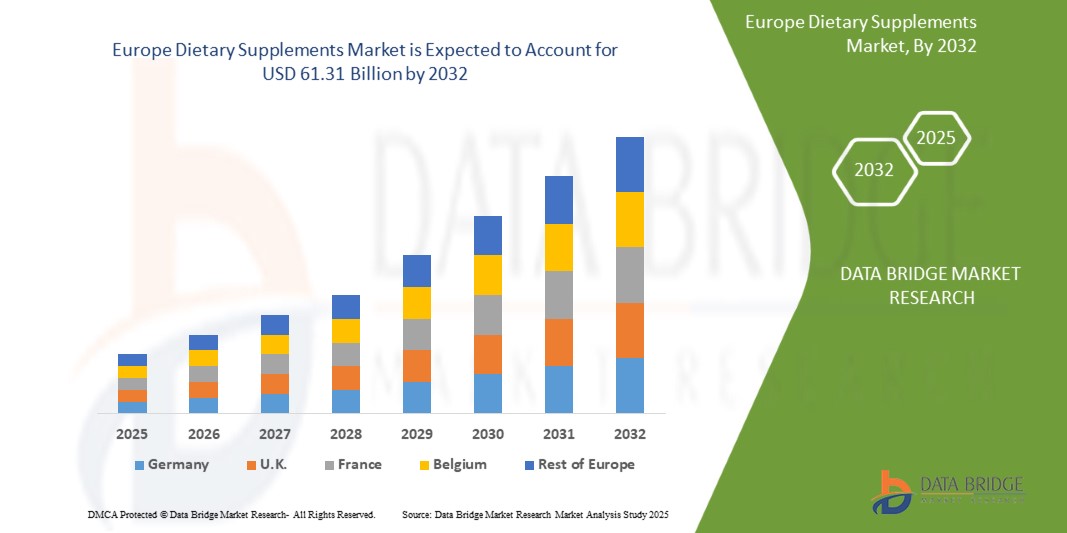

- O tamanho do mercado de suplementos alimentares da Europa foi avaliado em US$ 37,61 bilhões em 2024 e deve atingir US$ 61,31 bilhões até 2032 , com um CAGR de 6,4% durante o período previsto.

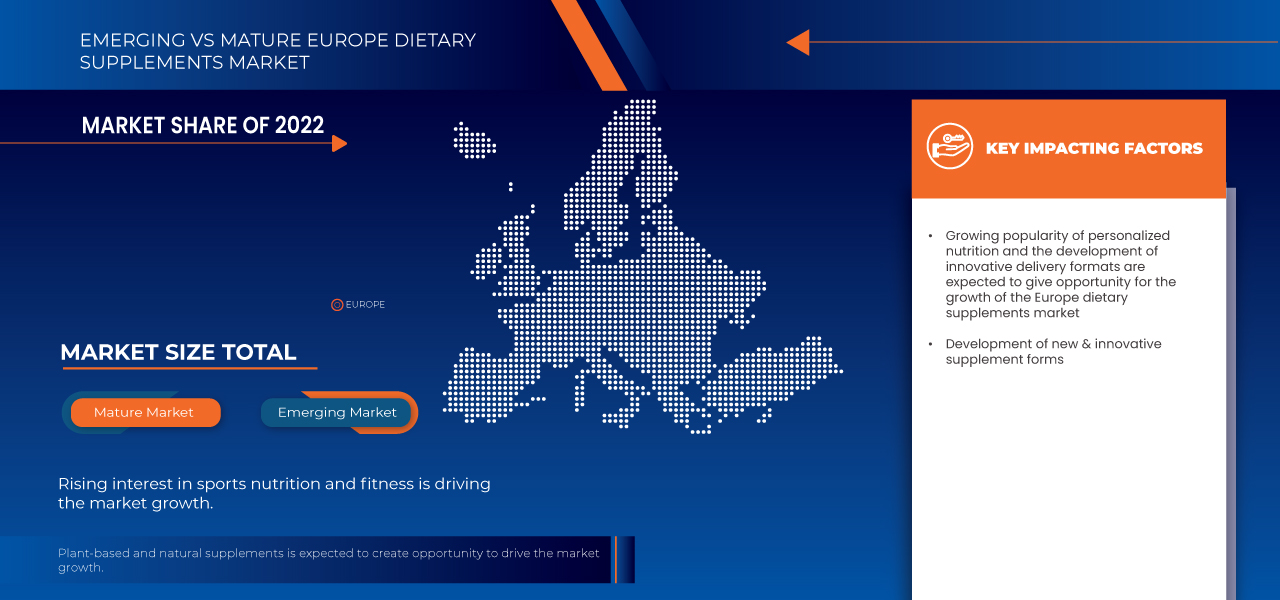

- O crescimento do mercado na Europa é amplamente impulsionado pela crescente conscientização regional sobre cuidados de saúde preventivos e nutrição, juntamente com avanços significativos em tecnologias de formulação de produtos e abordagens de nutrição personalizadas, levando a um melhor envolvimento do consumidor e resultados de saúde.

- Além disso, a crescente demanda de pacientes e consumidores em toda a região por soluções de suplementos mais eficazes, acessíveis e com base científica para o gerenciamento de condições relacionadas ao estilo de vida e a melhoria do bem-estar geral está consolidando suplementos funcionais, misturas botânicas e produtos enriquecidos com probióticos como o padrão moderno de suporte alimentar. Esses fatores convergentes estão acelerando a adoção de suplementos alimentares na Europa, impulsionando significativamente o crescimento regional do setor.

Análise do Mercado de Suplementos Alimentares na Europa

- O mercado europeu de suplementos alimentares, caracterizado por sua crescente ênfase na saúde preventiva e no bem-estar, é uma área de foco cada vez mais vital nos cuidados de saúde modernos devido ao seu papel significativo no aumento da imunidade, no gerenciamento de condições crônicas e na melhoria da qualidade geral de vida, frequentemente usado como um complemento às terapias convencionais ou para tratar deficiências de nutrientes.

- A crescente demanda por suplementos alimentares é alimentada principalmente pela crescente conscientização sobre a saúde entre os consumidores, pelo envelhecimento populacional crescente, pela prevalência crescente de distúrbios relacionados ao estilo de vida e pelos avanços contínuos em formulações de suplementos e sistemas de administração, incluindo gomas, comprimidos efervescentes e plataformas de nutrição personalizadas.

- A Itália detém uma posição dominante no mercado europeu de suplementos alimentares, sendo responsável por uma parcela substancial da receita, caracterizada por estruturas regulatórias rigorosas que garantem a qualidade do produto, ampla adoção de práticas de autocuidado, alto poder de compra do consumidor e forte presença de empresas nutracêuticas globais e regionais.

- Espera-se que a Itália seja a região com crescimento mais rápido no mercado europeu de suplementos alimentares durante o período previsto, devido ao aumento da renda disponível e à mudança de atitude do consumidor em relação aos produtos naturais para a saúde.

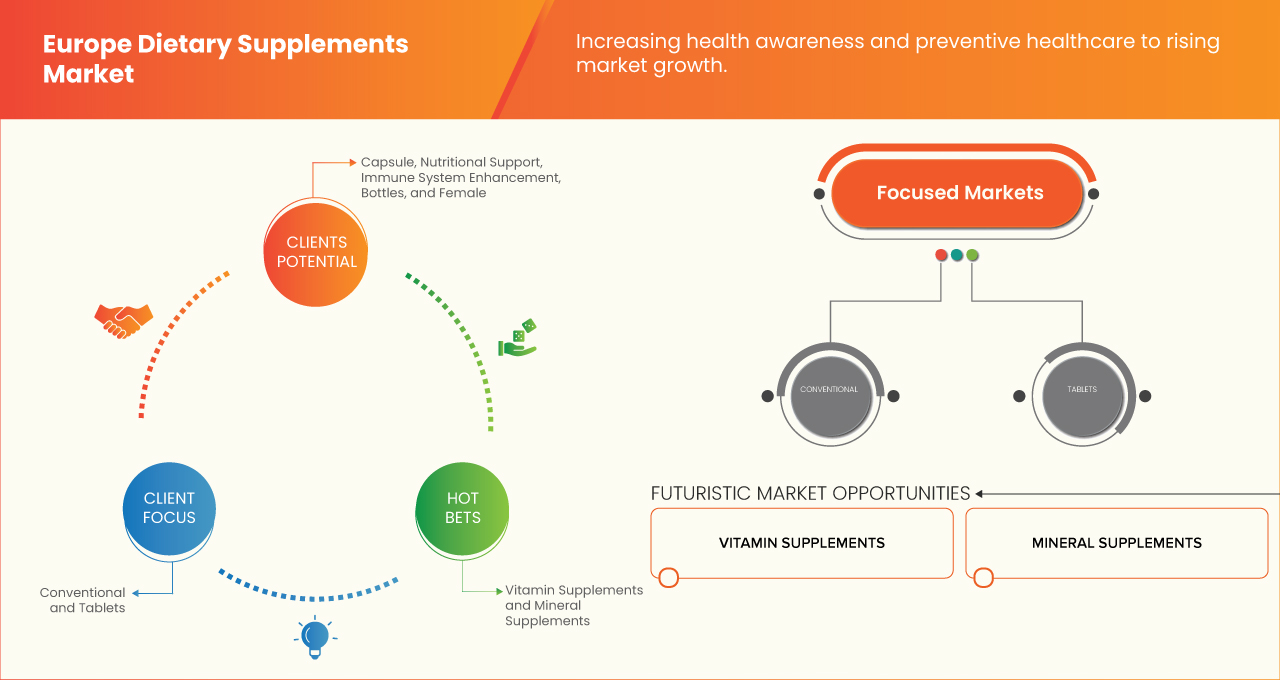

- Espera-se que o segmento de suplementos vitamínicos domine o mercado europeu de suplementos alimentares, impulsionado por sua reputação consolidada no suporte à saúde imunológica, à força óssea e à vitalidade geral, sua ampla disponibilidade em vários canais de distribuição e inovações contínuas em formulações com biodisponibilidade aprimorada e soluções de saúde personalizadas que atendam às necessidades demográficas específicas.

Escopo do Relatório e Segmentação do Mercado de Suplementos Alimentares na Europa

|

Atributos |

Principais insights do mercado de suplementos alimentares na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de suplementos alimentares na Europa

Bem-estar aprimorado do consumidor por meio de IA e integração digital

- Uma tendência significativa e crescente no mercado europeu de suplementos alimentares é o aprofundamento da integração com inteligência artificial (IA) e plataformas digitais de saúde, abrangendo aplicativos de nutrição personalizados, monitoramento de saúde em tempo real e mecanismos inteligentes de recomendação de suplementos. Essa fusão de tecnologias está aprimorando significativamente o engajamento do consumidor, a personalização de produtos e a eficácia da ingestão de suplementos em diversos segmentos da população.

- Por exemplo, em fevereiro de 2024, a Orthomol iniciou uma joint venture para construir um centro logístico e de distribuição em Leverkusen, Alemanha. Esta instalação otimiza a eficiência da cadeia de suprimentos em toda a UE, reduz os prazos de entrega e apoia a expansão da distribuição de produtos. A joint venture aumenta a capacidade da Orthomol de atender à crescente demanda por suplementos de micronutrientes por parte dos consumidores.

- A integração de IA em suplementos alimentares permite recursos como a análise de dados de biomarcadores e estilo de vida para sugerir regimes de suplementação personalizados, ajustar dosagens com base no feedback do usuário e prever deficiências antes do surgimento dos sintomas. Por exemplo, diversas startups europeias estão desenvolvendo plataformas baseadas em IA que combinam dados genômicos e do microbioma com informações sobre estilo de vida para gerar kits de suplementos hiperpersonalizados, enviados diretamente aos consumidores. Além disso, tecnologias de embalagens inteligentes e lembretes baseados em aplicativos estão melhorando a adesão e o rastreamento, promovendo melhores resultados de saúde.

- A integração perfeita de ferramentas de monitoramento de suplementos com ecossistemas digitais de saúde mais amplos facilita a gestão centralizada do bem-estar. Por meio de uma única interface, os usuários podem monitorar a ingestão de nutrientes, acompanhar metas de saúde, reordenar produtos e receber orientações em tempo real de nutricionistas certificados, oferecendo uma experiência coesa e proativa ao consumidor.

- Essa tendência em direção a sistemas de gestão de suplementos mais inteligentes, intuitivos e interconectados está remodelando fundamentalmente as expectativas dos consumidores no setor de saúde e bem-estar europeu. Consequentemente, as empresas estão investindo em mecanismos de personalização com tecnologia de IA, diagnósticos digitais e modelos de entrega habilitados para dispositivos móveis que oferecem suporte completo, desde a avaliação até a ingestão de suplementos.

- A demanda por soluções de suplementos alimentares que ofereçam IA e integração digital perfeitas está crescendo rapidamente em todos os grupos demográficos, especialmente entre a geração Y, que entende de tecnologia, e idosos preocupados com a saúde, já que tanto consumidores quanto profissionais de bem-estar priorizam cada vez mais a precisão, a conveniência e a melhoria holística da saúde.

Dinâmica do mercado de suplementos alimentares na Europa

Motorista

Aumentando a conscientização sobre saúde e cuidados preventivos de saúde

- A crescente conscientização dos consumidores em relação à saúde preventiva e ao bem-estar, aliada à crescente prevalência de condições relacionadas ao estilo de vida, como obesidade, problemas cardiovasculares e distúrbios digestivos, é um importante impulsionador da crescente demanda por suplementos alimentares em toda a Europa. Essa tendência é ainda mais reforçada pelos avanços nas tecnologias de nutrição personalizada e pelo maior interesse público por produtos de saúde naturais e funcionais.

- Por exemplo, de acordo com a Food Supplements Europe, mais de 80% dos adultos europeus relatam tomar suplementos alimentares para manutenção da saúde, sendo o suporte imunológico, a energia e a digestão as principais prioridades, demonstrando uma forte e crescente demanda por soluções de suplementos adaptadas a necessidades e estilos de vida específicos.

- À medida que os consumidores europeus se tornam mais proativos na gestão da sua saúde, o papel dos suplementos passou de um suporte reativo para um cuidado preventivo contínuo. Tecnologias como avaliações nutricionais baseadas em IA, testes genéticos e análise do microbioma estão permitindo o desenvolvimento de planos de suplementação altamente personalizados, proporcionando aos usuários maior controle sobre suas escolhas de saúde com confiança e respaldo em dados.

- Além disso, o aumento do comércio eletrônico e dos aplicativos móveis de saúde está oferecendo acesso conveniente a uma ampla gama de opções de suplementos, recursos educacionais e consultoria especializada, facilitando a tomada de decisões informadas pelos consumidores. Isso, aliado à crescente preferência por formulações de rótulos limpos, orgânicas e à base de plantas, reflete uma mudança mais ampla em direção a soluções de bem-estar sustentáveis e transparentes.

- O apelo da intervenção nutricional precoce, aliado a ferramentas digitais para monitorar e otimizar a ingestão, está aumentando a adesão aos suplementos e os resultados de bem-estar a longo prazo. Além disso, inovações em formas de administração — como gomas, pós e sachês diários personalizados — estão impulsionando um maior engajamento do consumidor, tornando os suplementos mais acessíveis e prazerosos, especialmente para populações mais jovens e mais velhas.

Restrição/Desafio

Regulamentos rigorosos e complexos

- Preocupações com inconsistências regulatórias em todos os países europeus, aliadas ao crescente ceticismo dos consumidores quanto à eficácia, qualidade e segurança de certos suplementos alimentares, representam um desafio significativo para o crescimento sustentável do mercado. A variabilidade nas alegações de saúde permitidas, nos padrões de rotulagem e nos processos de aprovação sob as regulamentações da UE e de cada país frequentemente complica o desenvolvimento, a comercialização e a distribuição internacional de produtos.

- Por exemplo, embora a Autoridade Europeia para a Segurança Alimentar (EFSA) tenha aprovado um número limitado de alegações de saúde, muitos suplementos comercializados na Europa estão sujeitos a restrições quanto às alegações que podem fazer, o que leva à confusão do consumidor e à redução da confiança nos benefícios do produto, especialmente quando comparado com mercados globais menos regulamentados.

- Abordar essas preocupações exige maior harmonização regulatória, validação científica transparente e fiscalização mais rigorosa contra alegações enganosas ou infundadas. Além disso, casos de suplementos adulterados ou mal formulados vendidos online contribuíram para o aumento das preocupações com a segurança, gerando apelos por um controle de qualidade mais rigoroso, especialmente no canal de comércio eletrônico.

- O preço relativamente alto de suplementos premium, de rótulo limpo e personalizados também pode ser uma barreira à adoção, especialmente em grupos demográficos de baixa renda ou em regiões onde os gastos com saúde preventiva não são amplamente priorizados. Além disso, a orientação inconsistente de profissionais de saúde em relação à suplementação

Escopo do mercado de suplementos alimentares na Europa

O mercado é categorizado em nove segmentos notáveis que são baseados no tipo de produto, natureza, forma do produto, função, tipo de embalagem, tamanho da embalagem, demografia do consumidor, gênero e canal de distribuição.

- Tipo de produto

Com base no tipo de produto, o mercado é segmentado em suplementos vitamínicos, suplementos minerais, suplementos/misturas de vitaminas e minerais, suplementos à base de proteínas, suplementos à base de ervas/plantas, suplementos probióticos, suplementos de ômega-3 e ácidos graxos essenciais, suplementos de aminoácidos, suplementos à base de fibras, suplementos prebióticos, suplementos simbióticos, queimadores de gordura e suplementos termogênicos, entre outros. Em 2025, o segmento de suplementos vitamínicos dominará a maior fatia de receita do mercado, com 22,07%, impulsionado por sua ampla confiança do consumidor, amplo uso para manutenção da saúde geral e papel essencial no suporte à imunidade, metabolismo e energia. Produtos como vitamina D, vitamina C e misturas multivitamínicas são amplamente adotados em todas as faixas etárias. O crescente foco na saúde imunológica pós-pandemia impulsionou ainda mais sua relevância no mercado.

Prevê-se que o segmento de suplementos probióticos apresente a maior taxa de crescimento, com um CAGR de 7,9% durante o período previsto, impulsionado pela crescente demanda dos consumidores por produtos que promovam a saúde intestinal, soluções naturais e produtos de rótulo limpo. Inovações em formulações probióticas específicas para cada cepa e misturas de ervas para alívio do estresse, equilíbrio hormonal e digestão estão ganhando popularidade, principalmente entre consumidores mais jovens e do sexo feminino.

- Natureza

Com base na natureza, o mercado é segmentado em convencional e orgânico. Em 2025, o segmento convencional deterá a maior fatia de mercado, com 81,99%, devido à sua ampla disponibilidade, menor custo e presença de marca de longa data em farmácias, supermercados e plataformas online.

O segmento convencional deverá crescer em ritmo acelerado, com CAGR de 6,5%, impulsionado pela crescente conscientização sobre saúde, preferência por rótulos limpos e demanda por produtos livres de produtos químicos e de origem sustentável. Consumidores que buscam estilos de vida naturais e transparência na origem estão migrando ativamente para suplementos orgânicos.

- Formulário do produto

Com base na forma do produto, o mercado é segmentado em comprimidos, cápsulas, cápsulas gelatinosas moles, pós, gomas e geleias, líquidos, pré-misturas e outros. Em 2025, o segmento de comprimidos dominará o mercado com 25,70% devido à sua precisão de dosagem, longa vida útil e facilidade de consumo. Essas formas são preferidas para uma ampla gama de suplementos, incluindo multivitamínicos, minerais e extratos de ervas.

O segmento de gomas e geleias apresenta o crescimento mais rápido, especialmente entre crianças, jovens adultos e idosos. Seu sabor atraente, facilidade de ingestão e crescente aplicação em vitaminas e probióticos as tornam uma alternativa preferencial aos comprimidos tradicionais.

- Função

Com base na função, o mercado é segmentado em suporte nutricional, fortalecimento do sistema imunológico, nutrição esportiva, saúde preventiva, saúde cardíaca, saúde digestiva, saúde cognitiva e mental, aprimoramento do desempenho, controle de peso, saúde intestinal, suporte ao envelhecimento, saúde da pele, saúde óssea e articular, saúde metabólica, manutenção da saúde, equilíbrio hormonal, saúde imunológica, entre outros. Em 2025, o suporte nutricional é o segmento dominante, com 35,65% de participação de mercado, refletindo o crescente interesse do consumidor em saúde preventiva e no controle de doenças crônicas. Multivitamínicos diários e formulações que fortalecem o sistema imunológico, como vitamina C, D e zinco, são muito procurados.

- Tipo de embalagem

Com base no tipo de embalagem, o mercado é segmentado em garrafas, sachês e sachês, potes e recipientes, blisters, latas e latas, entre outros. Em 2025, o segmento de garrafas liderará o mercado com 31,85% de participação devido à sua durabilidade, reutilização e conveniência para armazenar cápsulas, comprimidos e gomas. São um produto essencial tanto em lojas físicas quanto online.

O segmento de frascos está emergindo como um segmento de alto crescimento, especialmente para pós, pré-misturas e suplementos de dose única. Sua portabilidade e apelo ecológico atraem consumidores em movimento e compradores preocupados com a sustentabilidade.

- Tamanho da embalagem

Com base no tamanho da embalagem, o mercado é segmentado em menos de 100 gramas, 100 a 250 gramas, 250 a 500 gramas, 500 a 750 gramas, 750 a 1000 gramas e mais de 1000 gramas. Em 2025, o segmento de 100 a 250 gramas dominará o mercado, oferecendo um equilíbrio entre quantidade e preço acessível, ideal para uso mensal ou de curto prazo. É amplamente adotado em multivitamínicos, proteínas em pó e misturas de ervas.

- Demografia do consumidor

Com base na demografia do consumidor, o mercado é segmentado em crianças (menores de 14 anos), jovens (14 a 24 anos), adultos (24 a 45 anos) e idosos (acima de 45 anos). Em 2025, o segmento de adultos (24 a 45 anos) representará o maior segmento de consumidores, investindo ativamente em suplementos para imunidade, energia, condicionamento físico e controle do estresse. Eles constituem o principal público-alvo da maioria das inovações de produtos e integrações digitais de bem-estar.

Análise regional do mercado de suplementos alimentares na Europa

- A Itália domina o mercado europeu de suplementos alimentares com uma participação substancial na receita, impulsionada por um alto nível de conscientização sobre saúde, forte demanda por soluções preventivas de bem-estar e uma estrutura nutracêutica bem regulamentada nas principais economias.

- Os consumidores e os profissionais de saúde da região valorizam muito os suplementos de alta qualidade, com respaldo científico, apoiados por regulamentações rigorosas de autoridades como a Autoridade Europeia para a Segurança Alimentar (EFSA), que garantem a segurança, eficácia e transparência dos produtos.

- Essa forte presença no mercado é ainda mais reforçada pelo envelhecimento populacional, pela crescente adoção de formulações de rótulos limpos e à base de plantas e pela ampla disponibilidade de suplementos alimentares tanto no varejo tradicional quanto nos canais de comércio eletrônico em rápida expansão. Esses fatores, em conjunto, posicionam a Europa como um polo maduro e inovador para o consumo de suplementos e o desenvolvimento de produtos.

Visão geral do mercado de suplementos alimentares na Alemanha e na Europa

O mercado alemão de suplementos alimentares na Europa conquistou um tamanho de mercado significativo na Europa, muitas vezes representando mais de US$ 10,38 bilhões em 2025, impulsionado por sua reputação de formulações cientificamente validadas, preferência do consumidor por saúde preventiva e forte adesão às diretrizes da EFSA.

Além disso, a integração de suplementos alimentares em farmácias e ambientes de cuidados naturopáticos, juntamente com a inovação robusta em misturas probióticas e à base de plantas, continua a aumentar a adoção e apoia o crescimento do mercado a longo prazo.

Visão geral do mercado de suplementos alimentares na França e Europa

O mercado francês de suplementos alimentares na Europa conquistou uma fatia significativa do mercado europeu, apoiado por uma cultura consolidada de suplementos fitoterápicos e homeopáticos e pela crescente ênfase no bem-estar holístico. Os consumidores franceses estão cada vez mais recorrendo a suplementos para alívio do estresse, saúde da pele e equilíbrio metabólico.

Além disso, campanhas apoiadas pelo governo que promovem a conscientização sobre micronutrientes e a crescente penetração de marcas especializadas no comércio eletrônico estão fortalecendo a acessibilidade do mercado e a adesão do consumidor a regimes regulares de suplementação.

Visão geral do mercado de suplementos alimentares no Reino Unido e na Europa

O mercado de suplementos alimentares do Reino Unido para a Europa conquistou uma fatia significativa do mercado europeu, impulsionado pela crescente conscientização sobre saúde, forte infraestrutura de varejo digital e demanda por nutrição personalizada. Os consumidores do Reino Unido valorizam cada vez mais suplementos que aprimoram a imunidade, a função cognitiva e o equilíbrio hormonal, especialmente entre mulheres e idosos.

Além disso, a crescente influência de startups de tecnologia de saúde e serviços de assinatura de suplementos baseados em IA, juntamente com a regulamentação confiável dos padrões alinhados pela MHRA e pela EFSA, está acelerando a expansão do mercado e a inovação de produtos.

Participação no mercado de suplementos alimentares na Europa

A indústria europeia de suplementos alimentares é liderada principalmente por empresas bem estabelecidas, incluindo:

- Nestlé (Suíça)

- Abbott (EUA)

- Amway Corp. (EUA)

- Grupo de Empresas Haleon (Reino Unido)

- Herbalife International of America, Inc. (EUA)

- Orkla (Noruega)

- FitLife Brands, Inc. (EUA)

- Glanbia PLC (Irlanda)

- BioGaia (Suécia)

- Procter & Gamble (EUA)

- Sanofi (França)

- Evonik Industries AG (Alemanha)

- Arkopharma (França)

- Pharma Nord Inc. (Dinamarca)

- Pileje (França)

- Probi (Suécia)

- Nature's Sunshine Products, Inc. (EUA)

- Himalaya Wellness Company (Índia)

- Perrigo Company plc. (Irlanda)

- Bio-Tech Pharmacal (EUA)

- Wörwag Pharma (Alemanha)

Últimos desenvolvimentos no mercado europeu de suplementos alimentares

- Em abril de 2025, a Abbott vivenciará um desenvolvimento de mercado significativo, já que dados demográficos favoráveis impulsionam o crescimento em nutrição adulta. Esse desenvolvimento destaca a crescente demanda por produtos nutricionais, impulsionada pelo envelhecimento da população global e pela crescente conscientização sobre saúde. O impacto é o crescimento dos negócios da Abbott, expandindo sua participação no mercado de nutrição adulta. Isso permite que a empresa alavanque ainda mais suas marcas consolidadas, como Ensure e Glucerna, atendendo às crescentes necessidades de saúde de adultos em todo o mundo.

- Em dezembro de 2024, cientistas da Nestlé realizaram um avanço significativo ao identificar nutrientes bioativos específicos, incluindo compostos relacionados à vitamina B e polifenóis da azeitona, que atuam nos mecanismos celulares do declínio muscular relacionado à idade. Essa descoberta, baseada na compreensão da sarcopenia, permite a criação de soluções nutricionais inovadoras. O impacto é profundo: abre caminho para novos produtos que promovem a regeneração muscular mais rápida, aumentam a energia celular e melhoram o desempenho físico, contribuindo, em última análise, para uma longevidade mais saudável e uma melhor qualidade de vida para uma população global em envelhecimento.

- Em setembro de 2023, a Nestlé fechou um acordo com a Advent International para adquirir uma participação majoritária no Grupo CRM, empresa brasileira de chocolates premium. O negócio, com previsão de conclusão para 2024, fortalece a presença da Nestlé no mercado brasileiro de confeitos de alta qualidade.

- Em janeiro de 2025, o Haleon Group investiu significativamente em sua presença global em P&D, notadamente com uma recente modernização de US$ 54 milhões em seu centro de P&D em Richmond, EUA, complementando seu substancial orçamento anual de P&D. Este desenvolvimento visa acelerar a inovação de novos produtos em categorias como OTC e VMS. O impacto é o aumento da capacidade de desenvolver soluções baseadas na ciência, fomentar um pipeline de talentos e impulsionar o crescimento sustentável, oferecendo inovações de marca disruptivas e localmente relevantes para consumidores em todo o mundo.

- Em outubro de 2024, o Haleon Group of Companies desenvolveu uma ferramenta de "Triagem de Inclusão em Saúde" com tecnologia de IA para revolucionar a publicidade, aprimorando sua acessibilidade, simplicidade e representatividade. O desenvolvimento envolve IA e aprendizado de máquina para analisar ativos de marketing digital em termos de legibilidade, legibilidade do texto, legendas e representação demográfica diversificada (idade, gênero, tom de pele). O impacto dessa ferramenta inovadora é significativo: ela ajuda a Haleon a criar campanhas mais inclusivas que repercutem em um público mais amplo, incluindo grupos vulneráveis, melhorando assim a compreensão do consumidor, o desempenho da marca e, em última análise, contribuindo para melhores resultados de saúde em todo o mundo.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE DIETARY SUPPLEMENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.3.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.3.1.1 JOINT VENTURES

4.3.1.2 MERGERS AND ACQUISITIONS

4.3.1.3 LICENSING AND PARTNERSHIP

4.3.1.4 TECHNOLOGY COLLABORATIONS

4.3.1.5 STRATEGIC DIVESTMENTS

4.3.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.3.3 STAGE OF DEVELOPMENT

4.3.4 TIMELINES AND MILESTONES

4.3.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.3.6 RISK ASSESSMENT AND MITIGATION

4.4 FUTURE OUTLOOK

4.4.1 PERSONALIZED NUTRITION

4.4.2 TECHNOLOGICAL INTEGRATION

4.4.3 SHIFTING CONSUMER PREFERENCES

4.4.4 AGING POPULATION

4.4.5 REGULATORY LANDSCAPE

4.4.6 ECONOMIC FACTORS

4.4.7 REGULATION COVERAGE

4.4.7.1 PRODUCT CODES

4.4.7.2 CERTIFIED STANDARDS

4.4.7.3 SAFETY STANDARDS

4.4.7.3.1 MATERIAL HANDLING & STORAGE

4.4.7.3.2 TRANSPORT & PRECAUTIONS

4.4.7.3.3 HAZARD IDENTIFICATION

4.5 PRICING ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM SIZE COMPANIES

4.8.3 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 BRAND COMPARATIVE ANALYSIS

4.11 COMPANY VS BRAND OVERVIEW

4.12 CONSUMER BUYING BEHAVIOUR

4.13 VENDOR SELECTION CRITERIA

4.14 TECHNOLOGICAL ADVANCEMENTS

4.15 COST ANALYSIS

4.16 PROFIT MARGIN ANALYSIS

5 TARIFFS & IMPACT

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING HEALTH AWARENESS AND PREVENTIVE HEALTHCARE

6.1.2 EXPANSION OF E-COMMERCE PLATFORMS

6.1.3 RISING INTEREST IN SPORTS NUTRITION AND FITNESS

6.1.4 1.1.4 DEVELOPMENT OF NEW & INNOVATIVE SUPPLEMENT FORMS

6.2 RESTRAINTS

6.2.1 COMPETITION FROM PHARMACEUTICALS AND NATURAL FOOD-BASED NUTRITION

6.2.2 STRINGENT AND COMPLEX REGULATIONS

6.3 OPPORTUNITIES

6.3.1 PLANT-BASED AND NATURAL SUPPLEMENTS

6.3.2 INNOVATIONS IN NUTRACEUTICALS

6.3.3 COLLABORATION AND MERGERS & ACQUISITIONS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN SUBSTANTIATING HEALTH CLAIMS

6.4.2 MAINTAINING QUALITY AND SAFETY STANDARDS

7 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 VITAMIN SUPPLEMENTS

7.3 MINERAL SUPPLEMENTS

7.4 VITAMIN AND MINERAL COMPLEXES/BLENDS SUPPLEMENTS

7.5 PROTEIN-BASED SUPPLEMENTS

7.6 HERBAL/PLANT-BASED SUPPLEMENTS

7.7 PROBIOTIC SUPPLEMENTS

7.8 OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS

7.9 AMINO ACID SUPPLEMENTS

7.1 FIBER-BASED SUPPLEMENTS

7.11 PREBIOTIC SUPPLEMENTS

7.12 SYNBIOTIC SUPPLEMENTS

7.13 FAT BURNERS AND THERMOGENIC SUPPLEMENTS

7.14 OTHERS

8 EUROPE DIETARY SUPPLEMENTS MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 TABLETS

9.3 CAPSULE

9.4 SOFT GELS

9.5 POWDERS

9.6 GUMMIES & JELLIES

9.7 LIQUIDS

9.8 PREMIXES

9.9 OTHERS

10 EUROPE DIETARY SUPPLEMENTS MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 NUTRITIONAL SUPPORT

10.3 IMMUNE SYSTEM ENHANCEMENT

10.4 SPORTS NUTRITION

10.5 PREVENTIVE HEALTH

10.6 HEART HEALTH

10.7 DIGESTIVE HEALTH

10.8 COGNITIVE AND MENTAL HEALTH

10.9 PERFORMANCE ENHANCEMENT

10.1 WEIGHT MANAGEMENT

10.11 GUT HEALTH

10.12 AGING SUPPORT

10.13 SKIN HEALTH

10.14 BONE AND JOINT HEALTH

10.15 METABOLIC HEALTH

10.16 HEALTH MAINTENANCE

10.17 HORMONAL BALANCE

10.18 IMMUNE HEALTH

10.19 OTHERS

11 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE

11.1 OVERVIEW

11.2 BOTTLES

11.3 POUCHES AND SACHETS

11.4 JARS AND CONTAINERS

11.5 BLISTER PACKS

11.6 CANS AND TINS

11.7 OTHERS

12 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE

12.1 OVERVIEW

12.2 100 TO 250 GRAMS

12.3 250 TO 500 GRAMS

12.4 LESS THAN 100 GRAMS

12.5 500 TO 750 GRAMS

12.6 750 TO 1000 GRAMS

12.7 MORE THAN 1000 GRAMS

13 EUROPE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY

13.1 OVERVIEW

13.2 ADULTS (24 TO 45 YEARS)

13.3 SENIORS (ABOVE 45 YEARS)

13.4 YOUNGS (14 TO 24 YEARS)

13.5 KIDS (UNDER 14 YEARS)

14 EUROPE DIETARY SUPPLEMENTS MARKET, BY GENDER

14.1 OVERVIEW

14.2 FEMALE

14.3 MALE

14.4 UNI-SEX

15 EUROPE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE BASED RETAILERS

15.3 NON-STORE BASED RETAILERS

15.4 EUROPE

15.4.1 ITALY

15.4.2 GERMANY

15.4.3 FRANCE

15.4.4 U.K

15.4.5 SPAIN

15.4.6 NETHERLANDS

15.4.7 RUSSIA

15.4.8 SWITZERLAND

15.4.9 BELGIUM

15.4.10 SWEDEN

15.4.11 POLAND

15.4.12 DENMARK

15.4.13 FINLAND

15.4.14 TURKEY

15.4.15 REST OF EUROPE

16 EUROPE DIETARY SUPPLEMENTS MARKET

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 NESTLÉ

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 ABBOTT

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 AMWAY CORP

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 HALEON GROUP OF COMPANIES

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 BRAND PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 HERBALIFE LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ARKOPHARMA

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BIOGAIA

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 BIO-TECH PHARMACAL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 EVONIK INDUSTRIES AG

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 FITLIFE BRANDS, INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GLANBIA PLC

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 GNC HOLDINGS, LLC

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 HIMALAYA WELLNESS COMPANY

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 NATURE'S SUNSHINE PRODUCTS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 NOW FOODS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 ORKLA

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PERRIGO COMPANY PLC

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 PHARMA NORD INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PILEJE

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 PROBI

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 PROCTER & GAMBLE

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 BRAND PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SANOFI

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SWANSON

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 VITABIOTICS LTD.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 VITACO

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 WÖRWAG PHARMA

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 ZEIN PHARMA

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 RECENT DEVELOPMENTS, HIGHLIGHTING NEW PRODUCT LAUNCHES, INNOVATIONS, AND TRENDS

TABLE 2 TIMELINES AND MILESTONES IN THE EUROPEAN DIETARY SUPPLEMENTS INDUSTRY

TABLE 3 BRAND COMPARATIVE ANALYSIS

TABLE 4 COMPANY V/S BRAND OVERVIEW

TABLE 5 CONSUMER BUYING BEHAVIOUR

TABLE 6 VENDOR SELECTION CRITERIA

TABLE 7 TECHNOLOGICAL ADVANCEMENTS

TABLE 8 COST ANALYSIS

TABLE 9 PROFIT MARGIN ANALYSIS

TABLE 10 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 12 EUROPE VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE FAT BURNERS AND THERMOGENIC SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE NON-STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRIES, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRIES, 2018-2032 (THOUSAND UNITS)

TABLE 46 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 48 ITALY VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ITALY VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ITALY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ITALY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 52 ITALY PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ITALY HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ITALY CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ITALY PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ITALY BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ITALY LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ITALY BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ITALY LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ITALY NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ITALY BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ITALY FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ITALY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 ITALY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 65 ITALY AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ITALY FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ITALY PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ITALY FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 72 ITALY DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ITALY BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ITALY DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 77 ITALY DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 ITALY STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 82 GERMANY VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 116 FRANCE VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 138 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 FRANCE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 150 U.K. VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.K. BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.K. LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.K. NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.K. BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 U.K. FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.K. OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 U.K. OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 167 U.K. AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.K. FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.K. PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.K. FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 U.K. DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 172 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 173 U.K. DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 174 U.K. DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.K. BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.K. DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 U.K. DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 178 U.K. DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 179 U.K. DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 180 U.K. STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.K. NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 184 SPAIN VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SPAIN VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SPAIN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SPAIN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 188 SPAIN PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SPAIN HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SPAIN CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SPAIN BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SPAIN BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SPAIN NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 200 SPAIN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 SPAIN STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SPAIN NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 218 NETHERLANDS VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 NETHERLANDS VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 NETHERLANDS MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 NETHERLANDS MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 222 NETHERLANDS PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 NETHERLANDS HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 NETHERLANDS CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 NETHERLANDS PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 NETHERLANDS BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 NETHERLANDS LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 NETHERLANDS BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NETHERLANDS LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NETHERLANDS NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 NETHERLANDS BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 NETHERLANDS FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 245 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 246 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 247 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 NETHERLANDS STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 NETHERLANDS NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 252 RUSSIA VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 RUSSIA BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 RUSSIA FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 RUSSIA OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 268 RUSSIA OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 269 RUSSIA AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 RUSSIA FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 RUSSIA PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 280 RUSSIA DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 281 RUSSIA DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 282 RUSSIA STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 RUSSIA NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 286 SWITZERLAND VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SWITZERLAND VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SWITZERLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SWITZERLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 290 SWITZERLAND PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SWITZERLAND HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SWITZERLAND CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SWITZERLAND PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 320 BELGIUM VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 BELGIUM VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 BELGIUM MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 BELGIUM MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 324 BELGIUM PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 BELGIUM HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 BELGIUM CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BELGIUM PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 BELGIUM BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BELGIUM LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BELGIUM BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 BELGIUM LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 BELGIUM NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 BELGIUM BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 BELGIUM FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 BELGIUM OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 336 BELGIUM OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 337 BELGIUM AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 BELGIUM FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 BELGIUM PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 BELGIUM FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 BELGIUM DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 342 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 343 BELGIUM DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 344 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 BELGIUM BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 347 BELGIUM DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 348 BELGIUM DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 349 BELGIUM DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 350 BELGIUM STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 BELGIUM NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 354 SWEDEN VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 SWEDEN VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SWEDEN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 SWEDEN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 358 SWEDEN PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 SWEDEN HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SWEDEN CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SWEDEN PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SWEDEN BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SWEDEN LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SWEDEN BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SWEDEN LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 SWEDEN NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 SWEDEN BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 SWEDEN FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SWEDEN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 370 SWEDEN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 371 SWEDEN AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 SWEDEN FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SWEDEN PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SWEDEN FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SWEDEN DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 376 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 377 SWEDEN DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 378 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 SWEDEN BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 381 SWEDEN DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 382 SWEDEN DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 383 SWEDEN DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 384 SWEDEN STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 SWEDEN NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 POLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 POLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 388 POLAND VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 POLAND VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 POLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 POLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 392 POLAND PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 POLAND HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 POLAND CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 POLAND PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 POLAND BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 POLAND LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 POLAND BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)