Europe Flexible Printed Circuit Fpc Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.21 Billion

USD

10.18 Billion

2024

2032

USD

4.21 Billion

USD

10.18 Billion

2024

2032

| 2025 –2032 | |

| USD 4.21 Billion | |

| USD 10.18 Billion | |

|

|

|

|

Segmentação do mercado europeu de circuitos impressos flexíveis (FPC), por tipo (multicamadas, dupla face, face única, circuito flexível rígido, acesso duplo, FPC esculpido e outros), processo de fabricação (processo subtrativo, processo aditivo, laminação com e sem adesivo), material (material base e material condutor), flexibilidade (flexibilidade estática (flexibilidade para instalação), flexibilidade dinâmica (flexibilidade para ajuste/movimentação) e enrolável/dobrável), formato (espessura padrão, ultrafino (200 µm)), usuário final (eletrônicos de consumo, automotivo, industrial e robótica, IoT e dispositivos inteligentes, dispositivos médicos, telecomunicações, aeroespacial e defesa e outros), canal de distribuição (vendas diretas e indiretas) - Tendências e previsões do setor até 2032.

Tamanho do mercado europeu de circuitos impressos flexíveis (FPC)

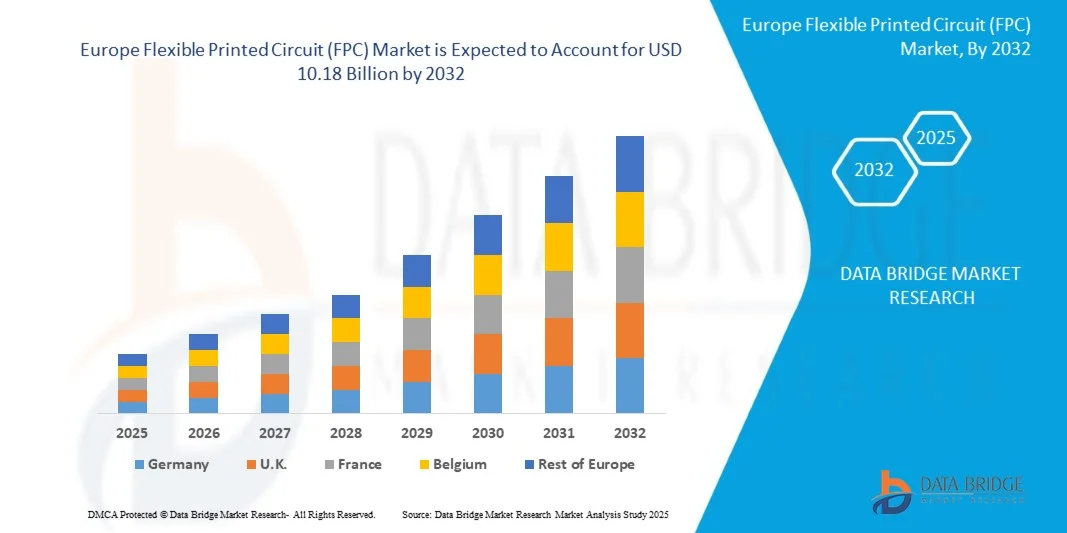

- O mercado europeu de circuitos impressos flexíveis (FPC) deverá atingir US$ 10,18 bilhões em 2032, partindo de US$ 4,21 bilhões em 2024, crescendo a uma taxa composta de crescimento anual (CAGR) substancial de 11,7% no período de previsão de 2025 a 2032.

- O crescimento do mercado europeu de circuitos impressos flexíveis (FPC) é significativamente influenciado pela crescente demanda por dispositivos eletrônicos compactos e leves em diversos setores, o que exige soluções de interconexão de alto desempenho e que economizem espaço.

- Essa expansão é ainda mais impulsionada pelo aumento dos investimentos nos setores de eletrônicos de consumo e automotivo na Europa, incluindo dispositivos vestíveis e veículos elétricos, que impulsionam a demanda por tecnologia FPC confiável e flexível. Além disso, há uma crescente disponibilidade e adoção de materiais e processos de fabricação avançados para FPCs, o que contribui para a acessibilidade ao mercado e o crescimento sustentado, oferecendo maior flexibilidade, durabilidade e integridade de sinal.

Análise do mercado europeu de circuitos impressos flexíveis (FPC)

- A crescente demanda por dispositivos eletrônicos compactos e de alto desempenho, impulsionada pela digitalização na Europa, pela integração da IoT e pela busca pela miniaturização, é uma das principais tendências que impulsionam a demanda por circuitos impressos flexíveis (FPCs) na região europeia. À medida que a funcionalidade eletrônica continua a aumentar, as placas de circuito impresso rígidas tradicionais enfrentam limitações em termos de flexibilidade e aproveitamento do espaço.

- Os circuitos impressos flexíveis, sendo a solução de interconexão crucial para a maioria dos dispositivos e módulos eletrônicos modernos, continuam sendo uma solução de infraestrutura essencial para a modernização da eletrônica de consumo, dando suporte a sistemas de infoentretenimento automotivo e permitindo uma integração perfeita em uma vasta área geográfica.

- O mercado europeu de circuitos impressos flexíveis é impulsionado principalmente pela necessidade crítica de interconectividade avançada e miniaturização em eletrônicos de consumo, automotivo e dispositivos médicos, bem como pela alta taxa de utilização de componentes flexíveis em setores como smartphones, wearables e tecnologias avançadas de displays. O mercado é influenciado pelo ritmo da inovação tecnológica na ciência dos materiais e pelo ambiente regulatório para o projeto de dispositivos eletrônicos, incluindo as normas europeias e os ciclos de desenvolvimento de produtos, que afetam a adoção geral.

- A Alemanha deverá ser o país dominante e de crescimento mais rápido no mercado europeu de circuitos impressos flexíveis (FPC), impulsionada pelos avanços contínuos na ciência dos materiais e por investimentos industriais significativos em eletrônica inteligente. O foco regional na melhoria do desempenho dos dispositivos e na otimização do design de produtos em um ambiente altamente competitivo está impulsionando ainda mais a demanda por soluções de FPC de alta qualidade, como parte essencial da gestão eletrônica avançada e das estratégias de desenvolvimento sustentável.

- O segmento multicamadas é o tipo dominante no mercado europeu de circuitos impressos flexíveis, com uma participação de mercado de 36,60% em 2025. Isso reflete o forte crescimento de dispositivos eletrônicos compactos e econômicos, o que exige a implantação contínua e estratégica do segmento multicamadas para simplificar a interconectividade e reduzir a complexidade de fabricação, posicionando esses materiais como um componente vital no futuro da eletrônica e dos dispositivos portáteis na região.

Escopo do relatório e segmentação do mercado europeu de circuitos impressos flexíveis (FPC)

|

Atributos |

Principais informações sobre o mercado europeu de circuitos impressos flexíveis (FPC) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de déficits na cadeia de suprimentos e demanda. |

Tendências do mercado europeu de circuitos impressos flexíveis (FPC)

“Crescente demanda por circuitos flexíveis em veículos elétricos e híbridos”

- A crescente transição para a produção de veículos elétricos e híbridos representa um importante fator de crescimento para o mercado europeu de circuitos impressos flexíveis (FPC). À medida que os fabricantes de equipamentos originais (OEMs) e fornecedores de nível 1 reestruturam as arquiteturas dos veículos para acomodar sistemas de baterias, assistência avançada ao condutor, sistemas de infoentretenimento aprimorados e a necessidade de redução de peso, a demanda por soluções de fiação e interconexão altamente integradas, mais finas e mais adaptáveis aumenta.

- Os circuitos impressos flexíveis oferecem uma combinação atraente de massa reduzida, formato compacto e alta densidade de roteamento, ideal para o ecossistema da mobilidade elétrica. O crescente reconhecimento dessas necessidades por governos e indústria, por meio de programas e investimentos direcionados, reforça ainda mais a trajetória ascendente da adoção de circuitos impressos flexíveis em aplicações automotivas.

- Por exemplo, em abril de 2024, a Ennovi apresentou um novo processo de produção de circuitos flexíveis para conectividade de baixa tensão em sistemas de contato de células de baterias de veículos elétricos, definindo explicitamente a tecnologia como uma alternativa sustentável e com tamanho otimizado aos circuitos impressos flexíveis convencionais.

- A crescente transição para veículos elétricos e híbridos é um catalisador fundamental para o mercado europeu de circuitos impressos flexíveis (FPC). À medida que as montadoras integram sistemas avançados de baterias, tecnologias de assistência ao motorista e arquiteturas de veículos definidas por software, a demanda por soluções de interconexão leves, de alta densidade e adaptáveis aumenta substancialmente.

- Os circuitos impressos flexíveis estão numa posição única para atender a esses requisitos, oferecendo massa reduzida, formato compacto e capacidades de roteamento aprimoradas. Apoiados por iniciativas governamentais, programas de pesquisa e investimentos da indústria.

Dinâmica do mercado europeu de circuitos impressos flexíveis (FPC)

Motorista

“Expansão da adoção de FPC em eletrônica automotiva e médica”

- A crescente adoção de circuitos impressos flexíveis (FPCs) em eletrônica automotiva e médica constitui um importante impulsionador do mercado europeu de FPCs. No setor automotivo, a eletrificação de veículos, os sistemas avançados de assistência ao condutor e o aumento da funcionalidade interna estão levando as montadoras e os fornecedores a especificarem interconexões mais finas, leves e confortáveis, que reduzem a complexidade dos chicotes elétricos e permitem maior densidade de integração – requisitos que a tecnologia FPC atende.

- Na área da eletrônica médica, o crescimento de monitores vestíveis, sensores implantáveis e plataformas de diagnóstico minimamente invasivas está acelerando a demanda por interconexões flexíveis e biocompatíveis, bem como por conjuntos de sensores integrados. Órgãos reguladores e agências de financiamento estão reforçando essa trajetória por meio de diretrizes específicas e programas de inovação.

- Programas de inovação dos setores público e privado que financiam eletrônica híbrida flexível e apoiam a resiliência da cadeia de suprimentos reduzem ainda mais as barreiras técnicas e comerciais à escalabilidade, convertendo assim a demanda em nível de aplicação em volumes disponíveis para fornecedores de FPC (Flexible Computer).

- Por exemplo, em abril de 2024, um comunicado de imprensa da Comissão Europeia destacou a iniciativa BAYFLEX (através da base de dados CORDIS da Comissão Europeia), que relatou o desenvolvimento de sensores eletrônicos orgânicos flexíveis, projetados em substratos dobráveis, para detecção e classificação de sinais eletrofisiológicos.

- A crescente integração de circuitos impressos flexíveis (FPCs) em eletrônica automotiva e médica representa uma força crucial que molda o mercado europeu de FPCs. Em aplicações automotivas, a transição para a eletrificação, sistemas inteligentes de assistência ao condutor e digitalização aprimorada da cabine continuam a impulsionar a demanda por soluções de interconexão leves, adaptáveis e compactas, que otimizem o desempenho e reduzam a complexidade da fiação.

Restrição/Desafio

“Dependência da fabricação de FPC em materiais caros como poliimida e cobre”

- O mercado europeu de circuitos impressos flexíveis (FPC) depende fortemente de materiais de alto custo, como filmes de poliimida e folhas de cobre. Esses materiais desempenham um papel fundamental para alcançar a durabilidade à flexão, o alto desempenho térmico e elétrico e a capacidade de miniaturização exigidos pelos FPCs modernos.

- Custos elevados e voláteis de matérias-primas, juntamente com gargalos na cadeia de suprimentos de substratos de poliimida e cobre, aumentam os custos de produção, reduzem a flexibilidade de margem e elevam as barreiras para novos entrantes e compradores sensíveis ao volume.

- Consequentemente, o custo elevado dos materiais pode retardar a adoção em segmentos sensíveis a preços e limitar a competitividade de preços dos FPCs em relação às soluções tradicionais de interconexão rígida ou semirrígida.

- Por exemplo, em maio de 2023, um artigo da EC Electronics afirmou que, segundo comentários da indústria de fabricação eletrônica, os produtores de PCBs enfrentam interrupções na cadeia de suprimentos e volatilidade nos custos de matérias-primas, como folhas de cobre, resinas e tecidos de vidro, componentes essenciais para soluções de interconexão flexíveis e rígido-flexíveis.

- O mercado europeu de circuitos impressos flexíveis (FPC) é significativamente limitado pela sua dependência de materiais de alto custo, particularmente filmes de poliimida e folhas de cobre. Esses materiais são essenciais para garantir estabilidade térmica, desempenho elétrico e flexibilidade mecânica, mas seus preços elevados e voláteis criam pressões substanciais sobre os custos para os fabricantes.

Escopo do mercado europeu de circuitos impressos flexíveis (FPC)

O mercado europeu de circuitos impressos flexíveis (FPC) está segmentado em sete segmentos principais: tipo, processo de fabricação, material, flexibilidade, formato, usuário final e canal de distribuição.

- Por tipo

Com base no tipo, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em multicamadas, dupla face, face única, circuitos rígido-flexíveis, acesso duplo, FPC esculpidos e outros. Em 2025, espera-se que o segmento multicamadas domine o mercado com 33,60% de participação, visto que esses circuitos oferecem maior flexibilidade de projeto e alta densidade de circuitos em uma estrutura compacta. Além disso, permitem a interconexão eficiente de componentes eletrônicos complexos, mantendo desempenho e confiabilidade superiores.

Espera-se que o segmento de interfaces unilaterais apresente o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 12,6%, impulsionado pela crescente demanda por interconexões de alta densidade e funcionalidades aprimoradas em dispositivos eletrônicos compactos, incluindo smartphones, wearables e implantes médicos.

- Por processo de fabricação

Com base no processo de fabricação, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em processo subtrativo, processo aditivo, laminação com adesivo e laminação sem adesivo. Em 2025, espera-se que o segmento de processo subtrativo domine o mercado com 80,39% de participação, devido à sua ampla disponibilidade e custo-benefício em comparação com outros processos de fabricação, tornando-se a escolha preferencial para a produção de circuitos flexíveis em larga escala.

Prevê-se que o segmento de processos aditivos seja o de crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 12,0%, devido à sua capacidade de criar linhas e espaços mais finos, reduzir o desperdício de material e permitir projetos de FPC (circuito impresso flexível) mais complexos e personalizados, que são essenciais para aplicações avançadas em dispositivos médicos e comunicação de alta frequência.

- Por material

Com base no material, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em material base e material condutor. Em 2025, espera-se que o segmento de material base domine o mercado com 63,04% de participação, devido à sua estabilidade térmica, flexibilidade e confiabilidade superiores, que permitem um desempenho eficiente e durabilidade do circuito sob diversas condições ambientais.

Prevê-se que o segmento de materiais básicos seja o de crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 12,2%, devido à crescente demanda por maior integridade de sinal, maior capacidade de condução de corrente e melhor gerenciamento térmico em FPCs (circuitos flexíveis de placa), que são essenciais para transmissão de dados em alta velocidade e aplicações de energia.

- Por Flexibilidade

Com base na flexibilidade, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em flexível estático (flexível para instalação), flexível dinâmico (flexível para ajuste/movimentação) e enrolável/dobrável. Em 2025, espera-se que o segmento de flexível estático (flexível para instalação) domine o mercado com 62,03% de participação, devido ao seu uso generalizado em aplicações onde o FPC é dobrado ou moldado uma única vez durante a montagem e permanece em uma posição fixa. Sua relação custo-benefício e confiabilidade para tais aplicações, comuns em eletrônicos de consumo e módulos automotivos, o tornam a escolha preferencial para a integração de componentes em espaços reduzidos.

Prevê-se que o segmento de dispositivos enroláveis/dobráveis apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 13,4%, devido à crescente demanda por compósitos flexíveis de plástico (FPCs) que suportem dobras e movimentos repetidos ao longo de sua vida útil, características essenciais para aplicações como celulares flip, dispositivos vestíveis e braços robóticos.

- Por fator de forma

Com base no formato, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em espessura padrão, ultrafinos (<50 µm) e espessos (>200 µm). Em 2025, espera-se que o segmento de espessura padrão domine o mercado com 67,26% de participação, devido ao seu uso generalizado e ao equilíbrio entre flexibilidade, durabilidade e custo-benefício para uma ampla gama de dispositivos eletrônicos. Sua adequação aos processos de fabricação convencionais faz dele a escolha preferencial para aplicações de FPC de uso geral nas indústrias de eletrônicos de consumo e automotiva.

Prevê-se que o segmento ultrafino (<50 µm) cresça com a taxa composta de crescimento anual (CAGR) mais rápida, de 12,4%, devido à crescente demanda por miniaturização extrema e dispositivos eletrônicos altamente compactos, particularmente em wearables, implantes médicos e tecnologias avançadas de exibição.

- Por usuário final

Com base no usuário final, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em eletrônicos de consumo, automotivo, industrial e robótica, IoT e dispositivos inteligentes, dispositivos médicos, telecomunicações, aeroespacial e defesa, e outros. Em 2025, espera-se que o segmento de eletrônicos de consumo domine o mercado com 42,65% de participação, devido à alta produção de smartphones, tablets, laptops e outros dispositivos eletrônicos pessoais que utilizam amplamente FPCs para design compacto e funcionalidades avançadas.

Prevê-se que o segmento automotivo seja o de crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 13,5%, devido ao crescimento exponencial de dispositivos interconectados, eletrodomésticos inteligentes e diversos sensores que exigem interconexões flexíveis, miniaturizadas e robustas. Esse crescimento também é impulsionado pela necessidade de circuitos integrados flexíveis (FPCs) em dispositivos vestíveis, sensores inteligentes e sistemas de monitoramento remoto, que demandam altos níveis de integração em um formato compacto. Além disso, a crescente adoção da tecnologia 5G e a expansão das iniciativas de cidades inteligentes podem acelerar o crescimento desse segmento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado europeu de circuitos impressos flexíveis (FPC) é segmentado em vendas diretas e vendas indiretas. Em 2025, espera-se que o segmento de vendas diretas domine o mercado com 70,57% de participação, devido à forte presença de redes de distribuição consolidadas e à crescente demanda por canais de fornecimento diretos e eficientes que garantam a disponibilidade do produto e entregas mais rápidas em todos os setores de uso final.

O segmento de vendas diretas deverá apresentar o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) projetada de 11,9%, impulsionado pela crescente preferência do consumidor por experiências de compra personalizadas e convenientes. Esse crescimento é alimentado pela capacidade das marcas de interagirem diretamente com os clientes, oferecerem promoções sob medida e manterem relacionamentos mais sólidos sem intermediários.

Análise Regional do Mercado Europeu de Circuitos Impressos Flexíveis (FPC)

- A região da Europa é reconhecida como um mercado significativo para circuitos impressos flexíveis (FPCs), impulsionada pela alta e crescente prevalência de eletrônica automotiva avançada, pelo crescimento massivo na fabricação de dispositivos médicos e pela expansão da automação industrial e das aplicações de IoT, tornando o material um componente essencial das estratégias de inovação e conectividade de alta confiabilidade do continente.

- O ritmo crescente de adoção de dispositivos eletrônicos e a modernização industrial, aliados à necessidade de designs mais compactos e melhor integridade de sinal em diversas economias europeias, são um importante catalisador para a adoção essencial e crescente de FPCs na região.

A expansão e modernização constantes da infraestrutura de fabricação e comunicação eletrônica, especialmente nos principais centros industriais e polos tecnológicos, e a grande necessidade de garantir a transmissão de dados contínua e a operação eficiente dos dispositivos, estão impulsionando ainda mais a demanda por soluções FPC potentes e de alta densidade na Europa.

Análise do Mercado Europeu de Circuitos Impressos Flexíveis (FPC)

O mercado europeu de circuitos impressos flexíveis (FPC) está preparado para um crescimento robusto de 11,7% no período de previsão de 2025 a 2032, impulsionado pela crescente demanda nos setores automotivo, industrial, médico e de eletrônicos de consumo. À medida que os fabricantes europeus aceleram a adoção de veículos elétricos, sistemas de automação e dispositivos habilitados para IoT, os FPCs são cada vez mais preferidos por sua flexibilidade, interconexões de alta densidade e formato compacto. Em particular, países como Alemanha, França e Reino Unido lideram a região devido às suas fortes bases de fabricação nos setores de eletrônica industrial, automotivo e eletrônico, complementadas por rigorosos padrões de qualidade e foco em sustentabilidade. Os tipos de FPC multicamadas e rígido-flexíveis estão ganhando força, impulsionados pela demanda por circuitos duráveis, miniaturizados e de alto desempenho em veículos elétricos, dispositivos médicos, automação industrial e hardware de telecomunicações 5G. Esses padrões posicionam a Europa como uma região líder em soluções de materiais magnéticos macios de alta qualidade e eficiência energética.

Análise do Mercado de Circuitos Impressos Flexíveis (FPC) na Alemanha

O mercado de FPC (circuitos flexíveis) da Alemanha está em rápida expansão e crescimento, com a maior taxa de crescimento anual composta (CAGR) de 13,2% no período de previsão de 2025 a 2032, impulsionado pela forte demanda dos setores automotivo, de eletrônica industrial e de eletrônicos de consumo. A crescente adoção de veículos elétricos (VEs), sistemas avançados de assistência ao condutor (ADAS), automação industrial e equipamentos 5G/telecomunicações está impulsionando a necessidade de circuitos flexíveis compactos, leves e de alta densidade. À medida que fabricantes e OEMs nacionais buscam miniaturização e designs com uso eficiente do espaço, os FPCs multicamadas e rígido-flexíveis estão se tornando cada vez mais preferidos. Combinado com o robusto ecossistema de manufatura de precisão da Alemanha, regulamentações de sustentabilidade e inovação em P&D de eletrônica flexível, o segmento de FPC está preparado para um crescimento sustentado nos próximos anos.

Análise do Mercado de Circuitos Impressos Flexíveis (FPC) na França

O mercado francês de FPCs (circuitos flexíveis com placas) tem se expandido rapidamente, impulsionado pela crescente demanda dos setores automotivo, aeroespacial, de telecomunicações, de eletrônica industrial e de eletrônicos de consumo. Com a crescente popularidade de veículos elétricos, infraestrutura 5G e automação avançada, os FPCs multicamadas e rígido-flexíveis são cada vez mais adotados devido à sua compacidade, leveza e confiabilidade sob vibração ou estresse térmico. Polos de manufatura nacionais e um forte ecossistema de P&D em eletrônica apoiam a inovação em circuitos flexíveis de alta densidade e alto desempenho. Com a crescente necessidade de dispositivos miniaturizados e energeticamente eficientes, como unidades de controle de veículos elétricos, hardware de telecomunicações e módulos médicos/industriais vestíveis, espera-se que o mercado francês de FPCs mantenha um crescimento robusto nos próximos anos.

Participação de mercado de circuitos impressos flexíveis (FPC)

O setor de circuitos impressos flexíveis (FPC) é liderado principalmente por empresas consolidadas, incluindo:

- NOK CORPORATION (Japão)

- Zhen Ding Tech. Group Technology Holding Limited (China)

- Nitto Denko Corporation (Japão)

- Fujikura Printed Circuits Ltd. (Subsidiária da Fujikura Ltd.) (Japão)

- Sumitomo Electric Industries, Ltd. (Japão)

- Flexium Interconnect.Inc (Taiwan)

- Amphenol Corporation (EUA)

- IBIDEN (Japão)

- MFLEX (EUA)

- Würth Elektronik eiSos GmbH & Co. KG (Alemanha)

- TTM Technologies Inc. (EUA)

- Interflex co.,ltd. (Coreia do Sul)

- Grupo Cicor (Suíça)

- Tecnologia MFS (Singapura)

- Cirexx Internacional (EUA)

- AS&R Circuits India Pvt. Ltd. (Índia)

- Alimentação PCB (EUA)

- AdvancedPCB (EUA)

- QDOS (Malásia)

- MEKTEC Manufacturing Co. (Taiwan)

- FPCWAY (China)

- Tate Circuit Industries Ltd (Reino Unido)

- Millennium Circuits Limited (EUA)

- Circuito flexível (EUA)

- Shah Circuitech (Índia)

Novidades no mercado europeu de circuitos impressos flexíveis (FPC)

- Em outubro de 2025, a Zhen Ding Technology apresentou seu plano estratégico “One ZDT” na TPCA Show 2025, integrando tecnologias de semicondutores, embalagens avançadas e PCBs sob um modelo de crescimento unificado. A empresa enfatizou seu papel na viabilização de aplicações de IA e computação de alto desempenho, exibindo substratos de circuitos integrados de última geração e PCBs de ponta. Essa iniciativa reforça a posição da Zhen Ding no ecossistema de IA em constante evolução, aproveitando a integração heterogênea para aprimorar o desempenho computacional e consolidar uma presença mais forte nos mercados de embalagens eletrônicas avançadas.

- Em março de 2025, a Nitto Denko Corporation foi selecionada entre as "100 principais empresas inovadoras da Europa em 2025 pela Clarivate", em reconhecimento à sua excelência em capacidades de pesquisa e desenvolvimento e à sua sólida estratégia de propriedade intelectual.

- Em setembro de 2025, a Zhen Ding Technology apresentou seus avanços em integração heterogênea de circuitos integrados e embalagens avançadas no Fórum de Manufatura Inteligente de Alta Tecnologia da SEMICON Taiwan. A empresa enfatizou seu papel na promoção da transformação digital impulsionada por IA, alinhando as tecnologias de PCB com as tendências de integração de semicondutores. Ao aproveitar as embalagens avançadas e a integração heterogênea, a Zhen Ding visa superar as limitações da Lei de Moore e expandir seu ecossistema nos setores de IA e computação de alto desempenho.

- Em março de 2025, a Fujikura Printed Circuits Ltd anunciou o desenvolvimento de um FPC com estrutura kirigami/origami em pesquisa conjunta com a Universidade de Waseda, permitindo expansão/contração e adaptabilidade a superfícies curvas, mantendo o plano de montagem.

- Em agosto de 2025, a Amphenol anunciou um acordo definitivo para adquirir a CommScope Connectivity and Cable Solutions (CCS) por US$ 10,5 bilhões em dinheiro, ampliando significativamente as capacidades de interconexão e conectividade de fibra óptica da Amphenol nos mercados de redes de TI/dados e comunicações.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS: EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.1.1 INTRODUCTION:

4.1.2 INTENSITY OF COMPETITIVE RIVALRY (MODERATE TO HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTES (LOW)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.1.6 BARGAINING POWER OF BUYERS (HIGH)

4.1.7 CONCLUSION

4.2 VALUE CHAIN ANALYSIS — EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.2.1 INTRODUCTION

4.2.2 RAW MATERIAL AND COMPONENT SUPPLY

4.2.3 MATERIAL INPUTS

4.2.4 SUPPLIER ROLES AND COLLABORATION

4.2.5 CHALLENGES AND RISKS

4.2.6 MANUFACTURING AND ASSEMBLY

4.2.7 DISTRIBUTION AND LOGISTICS

4.2.8 INTEGRATION AND SYSTEM ASSEMBLY

4.2.9 END-USE APPLICATIONS AND AFTERMARKET

4.2.10 CROSS-STAGE STRATEGIC CONSIDERATIONS

4.3 REGULATORY STANDARDS GOVERNING THE EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.3.1 MATERIAL AND DESIGN STANDARDS

4.3.2 ELECTRICAL AND MECHANICAL RELIABILITY TESTING

4.3.3 ENVIRONMENTAL AND SUSTAINABILITY COMPLIANCE

4.3.4 QUALITY MANAGEMENT AND MANUFACTURING PROCESS STANDARDS

4.3.5 SECTOR-SPECIFIC REGULATORY FRAMEWORKS

4.3.6 EMERGING STANDARDS AND INDUSTRY ADAPTATION

4.3.7 CONCLUSION

4.4 PENETRATION AND GROWTH PROSPECT MAPPING — EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.4.1 INTRODUCTION

4.4.2 FRAMEWORK AND METHODOLOGY (SUMMARY)

4.4.3 CURRENT PENETRATION ANALYSIS

4.4.3.1 GEOGRAPHIC PENETRATION

4.4.3.2 VERTICAL / APPLICATION PENETRATION

4.4.3.3 TECHNOLOGY & PRODUCT PENETRATION

4.4.4 GROWTH-PROSPECT MAPPING: DRIVERS AND ENABLERS

4.4.4.1 TECHNOLOGY AND PRODUCT DRIVERS

4.4.4.2 COMMERCIAL AND SUPPLY-CHAIN ENABLERS

4.4.4.3 POLICY & ECOSYSTEM ENABLERS

4.4.5 GROWTH LIMITATIONS AND CONSTRAINTS

4.4.5.1 TECHNICAL CONSTRAINTS

4.4.5.2 SUPPLY AND COST CONSTRAINTS

4.4.5.3 MARKET & COMMERCIAL CONSTRAINTS

4.4.6 MAPPING GROWTH PROSPECTS BY SCENARIO

4.4.7 STRATEGIC IMPLICATIONS AND PRIORITIZED ACTIONS

4.4.7.1 FOR FABRICATORS AND EQUIPMENT SUPPLIERS

4.4.7.2 FOR OEMS AND INTEGRATORS

4.4.7.3 FOR INVESTORS AND POLICYMAKERS

4.4.8 MEASURABLE KPIS FOR TRACKING PENETRATION AND GROWTH

4.5 NEW BUSINESS & EMERGING REVENUE OPPORTUNITIES — FUTURE OUTLOOK EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.5.1 INTRODUCTION

4.5.2 DEMAND PULL: APPLICATION-LED REVENUE POOLS

4.5.2.1 AUTOMOTIVE & EV ARCHITECTURES

4.5.2.2 WEARABLES, TEXTILE ELECTRONICS & CONSUMER IOT

4.5.2.3 MEDICAL & BIO-INTEGRATED DEVICES

4.5.2.4 AEROSPACE, SPACE & INDUSTRIAL ROBOTICS

4.5.3 ECHNOLOGY-DRIVEN BUSINESS MODELS & SERVICES

4.5.3.1 DESIGN-AS-A-SERVICE AND RAPID PROTOTYPING

4.5.3.2 MANUFACTURING-AS-A-SERVICE (MAAS) / FLEXIBLE CAPACITY LEASING

4.5.3.3 ADDITIVE & PRINTED ELECTRONICS LICENSING

4.5.3.4 SYSTEM INTEGRATION & MODULE SUPPLY

4.5.3.5 SUBSCRIPTION & DATA-DRIVEN SERVICES

4.5.4 MANUFACTURING & PROCESS INNOVATION — REVENUE LEVERS

4.5.4.1 ROLL-TO-ROLL AND HIGH-THROUGHPUT FABRICATION

4.5.4.2 ADVANCED SUBSTRATES & HIGH-RELIABILITY MATERIALS

4.5.4.3 HYBRID PRODUCTION (ADDITIVE + SUBTRACTIVE)

4.5.4.4 IN-PROCESS INSPECTION & DIGITAL TRACEABILITY

4.5.5 SUPPLY-CHAIN & LOCALIZATION OPPORTUNITIES

4.5.5.1 ON-SHORING AND REGIONAL HUBS

4.5.5.2 TIERED SUPPLIER ECOSYSTEMS

4.5.5.3 LOGISTICS AND VALUE-ADDED DISTRIBUTION

4.5.6 AFTERMARKET, RECYCLING & CIRCULAR ECONOMY REVENUE STREAMS

4.5.6.1 COMPONENT RECOVERY & MATERIAL REUSE

4.5.6.2 SERVICE & REPAIR PROGRAMS

4.5.7 BARRIERS, RISKS & MITIGATIONS (BUSINESS-LEVEL CONSIDERATIONS)

4.5.8 STRATEGIC RECOMMENDATIONS FOR NEW & EMERGING BUSINESSES

4.5.9 FUTURE OUTLOOK (5–10 YEAR HORIZON)

4.5.10 CONCLUSION

4.6 TECHNOLOGY MATRIX ANALYSIS–EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.7 COMPANY COMPARATIVE ANALYSIS – EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.8 COMPANY SERVICE PLATFORM MATRIX – EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.9 EMERGING PRODUCTION PROCESSES SHAPING THE FPC AND FHE INDUSTRIES

4.1 KEY INSIGHTS ON TECHNOLOGICAL ADVANCEMENTS

4.10.1 KEY TECHNOLOGICAL BREAKTHROUGHS IN FPC MANUFACTURING

4.10.1.1 ADHESIVELESS LAMINATION TECHNOLOGY

4.10.1.2 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP)

4.10.1.3 LASER DIRECT IMAGING (LDI) & UV LASER MICROVIA DRILLING

4.10.2 MARKET IMPACT & STRATEGIC IMPLICATIONS

4.10.3 MATERIAL INNOVATION IN COPPER FOILS & POLYIMIDE FILMS — STRATEGIC DRIVER FOR FPC MARKET LEADERSHIP

4.10.4 SUPPLY CHAIN & STRATEGIC IMPLICATIONS OF FPC MATERIAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 EXPANDING FPC ADOPTION IN AUTOMOTIVE AND MEDICAL ELECTRONICS.

5.1.2 RISING DEMAND FOR COMPACT AND LIGHTWEIGHT ELECTRONIC DEVICES

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN FPC DESIGN AND MATERIALS

5.1.4 GROWING DEMAND FOR FLEXIBLE CIRCUITS IN ELECTRIC AND HYBRID VEHICLES

5.2 RESTRAINTS

5.2.1 DEPENDENCE OF FPC MANUFACTURING ON COSTLY POLYIMIDE AND COPPER MATERIALS

5.2.2 HIGH DEFECT RATES DURING PRECISION BENDING OPERATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF FPC CIRCUIT IN AEROSPACE AND DEFENSE SYSTEMS.

5.3.2 EXPANDING FPC APPLICATIONS IN NEXT-GENERATION FOLDABLE PHONES

5.3.3 STRATEGIC PARTNERSHIPS FOR ADVANCED RIGID-FLEX PRODUCT DEVELOPMENT

5.4 CHALLENGES

5.4.1 CONTINUOUS PRESSURE TO REDUCE COSTS WHILE SUSTAINING QUALITY STANDARDS

5.4.2 RAPID TECHNOLOGICAL CHANGES DEMANDING CONTINUOUS INNOVATION INVESTMENT

6 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE

6.1 OVERVIEW

6.2 MULTI-LAYER

6.3 DOUBLE SIDED

6.4 SINGLE SIDED

6.5 RIGID FLEXIBLE CIRCUIT

6.6 DUAL ACCESS

6.7 SCULPTURED FPC

6.8 OTHERS

7 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 SUBTRACTIVE PROCESS

7.3 ADDITIVE PROCESS

7.4 ADHESIVE AND ADHESIVELESS LAMINATION

8 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 BASE MATERIAL

8.3 CONDUCTOR MATERIAL

9 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 STATIC FLEX (FLEX-TO-INSTALL)

9.3 DYNAMIC FLEX (FLEX-TO-FIT/MOVE)

9.4 ROLLABLE / FOLDABLE

10 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR

10.1 OVERVIEW

10.2 STANDARD THICKNESS

10.3 ULTRA-THIN (<50 µM)

10.4 THICK (>200 µM)

11 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.3 AUTOMOTIVE

11.4 INDUSTRIAL & ROBOTICS

11.5 IOT & SMART DEVICES

11.6 MEDICAL DEVICES

11.7 TELECOMMUNICATION

11.8 AEROSPACE & DEFENSE

11.9 OTHERS

12 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 IN-DIRECT SALES

13 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 UNITED KINGDOM

13.1.4 ITALY

13.1.5 SWEDEN

13.1.6 NETHERLANDS

13.1.7 SWITZERLAND

13.1.8 SPAIN

13.1.9 FINLAND

13.1.10 NORWAY

13.1.11 DENMARK

13.1.12 TURKEY

13.1.13 BELGIUM

13.1.14 RUSSIA

13.1.15 REST OF EUROPE

14 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NOK CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 NITTO DENKO CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 FUJIKURA PRINTED CIRCUITS LTD. (SUBSIDIARY OF FUJIKURA LTD.)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 SUMITOMO ELECTRIC INDUSTRIES, LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCED PCB

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMPHENOL CORPORATION..

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AS&R CIRCUITS INDIA PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CIREXX INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CICOR GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 FLEXIBLE CIRCUIT

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FPCWAY

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FLEXIUM INTERCONNECT.INC

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 INTERFLEX CO.,LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 IBIDEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MILLENNIUM CIRCUITS LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MFS TECHNOLOGY

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MEKTEC MANUFACTURING CO.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MFLEX

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PCB POWER

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QDOS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHAH CRICUITECH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 TATE CIRCUIT INDUSTRIES LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TTM TECHNOLOGIES INC

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 WÜRTH ELEKTRONIK EISOS GMBH & CO. KG

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPANY COMPARATIVE ANALYSIS

TABLE 4 COMPANY SERVICE PLATFORM MATRIX

TABLE 5 STRATEGIC IMPLICATIONS FOR OEMS, FPC MANUFACTURERS & INVESTORS

TABLE 6 TECHNOLOGY MAP

TABLE 7 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP) PARAMETERS

TABLE 8 COPPER FOIL ADVANCEMENTS — ROLLED ANNEALED (RA) VS. ELECTRODEPOSITED (ED) VS. NEXT-GENERATION HIGH-FREQUENCY COPPER

TABLE 9 POLYIMIDE FILM EVOLUTION — FROM STANDARD PI TO TRANSPARENT & LOW-DK FLEX SUBSTRATES

TABLE 10 WHO IS INVESTING AND WHY IT MATTERS?

TABLE 11 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 EUROPE MULTI LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE MULTI LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE SINGLE SIDED IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE RIGID FLEXIBLE CIRCUIT IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE DUAL ACCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE SCULPTURED FPC IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 22 EUROPE SUBTRACTIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ADDITIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE ADHESIVE AND ADHESIVELESS LAMINATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE STATIC FLEX (FLEX-TO-INSTALL) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE DYNAMIC FLEX (FLEX-TO-FIT/MOVE) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ROLLABLE / FOLDABLE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE STANDARD THICKNESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE ULTRA-THIN (<50 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE THICK (>200 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE AEROSPACE & DEFENCE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 67 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 69 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 71 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 95 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 97 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 121 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 123 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 FRANCE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 FRANCE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED KINGDOM PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 147 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 149 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED KINGDOM BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED KINGDOM CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 153 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 154 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 155 UNITED KINGDOM CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 UNITED KINGDOM CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 UNITED KINGDOM AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 UNITED KINGDOM AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 UNITED KINGDOM INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 UNITED KINGDOM INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 UNITED KINGDOM IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 UNITED KINGDOM IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 UNITED KINGDOM MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 UNITED KINGDOM MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 UNITED KINGDOM TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 UNITED KINGDOM TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 UNITED KINGDOM AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 UNITED KINGDOM AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 170 UNITED KINGDOM IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 ITALY PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 173 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 175 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ITALY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 ITALY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ITALY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 ITALY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 ITALY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 196 ITALY IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SWEDEN PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 199 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 200 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 201 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 202 SWEDEN BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SWEDEN CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 205 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 206 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 SWEDEN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SWEDEN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SWEDEN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SWEDEN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SWEDEN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SWEDEN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SWEDEN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SWEDEN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SWEDEN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SWEDEN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SWEDEN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SWEDEN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SWEDEN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SWEDEN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 222 SWEDEN IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 NETHERLANDS PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 225 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 226 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 227 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 228 NETHERLANDS BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NETHERLANDS CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 231 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 232 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 NETHERLANDS AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 NETHERLANDS AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 NETHERLANDS IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SWITZERLAND PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 251 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 253 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 254 SWITZERLAND BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 258 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 259 SWITZERLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWITZERLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SWITZERLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWITZERLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWITZERLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SWITZERLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SWITZERLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SWITZERLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 SWITZERLAND IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 SPAIN PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 277 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 279 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 280 SPAIN BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 283 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SPAIN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SPAIN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SPAIN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SPAIN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SPAIN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SPAIN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 300 SPAIN IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FINLAND PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 303 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 304 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 305 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 306 FINLAND BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FINLAND CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 309 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 310 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 311 FINLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 FINLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 FINLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 FINLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 FINLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 FINLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 FINLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 FINLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 FINLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 FINLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 FINLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 FINLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 FINLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 FINLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 326 FINLAND IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 NORWAY PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 329 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 330 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 331 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 332 NORWAY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 NORWAY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 335 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 336 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 337 NORWAY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 NORWAY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 NORWAY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 NORWAY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 NORWAY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 NORWAY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 NORWAY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 NORWAY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 NORWAY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 NORWAY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 NORWAY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 NORWAY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 NORWAY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 NORWAY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)