Europe Lightweight Metals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

36.60 Billion

USD

303.51 Billion

2024

2052

USD

36.60 Billion

USD

303.51 Billion

2024

2052

| 2025 –2052 | |

| USD 36.60 Billion | |

| USD 303.51 Billion | |

|

|

|

|

Segmentação do mercado de metais leves na Europa, por tipo (alumínio e liga de alumínio, titânio e ligas de titânio, magnésio e liga de magnésio, berílio e liga de berílio, aço e ligas de aço e outros), aplicação (automotivo e transporte, aeroespacial e defesa, agricultura, eletrônicos e bens de consumo, marítimo e outros) - Tendências e previsões do setor até 2052

Tamanho do mercado de metais leves na Europa

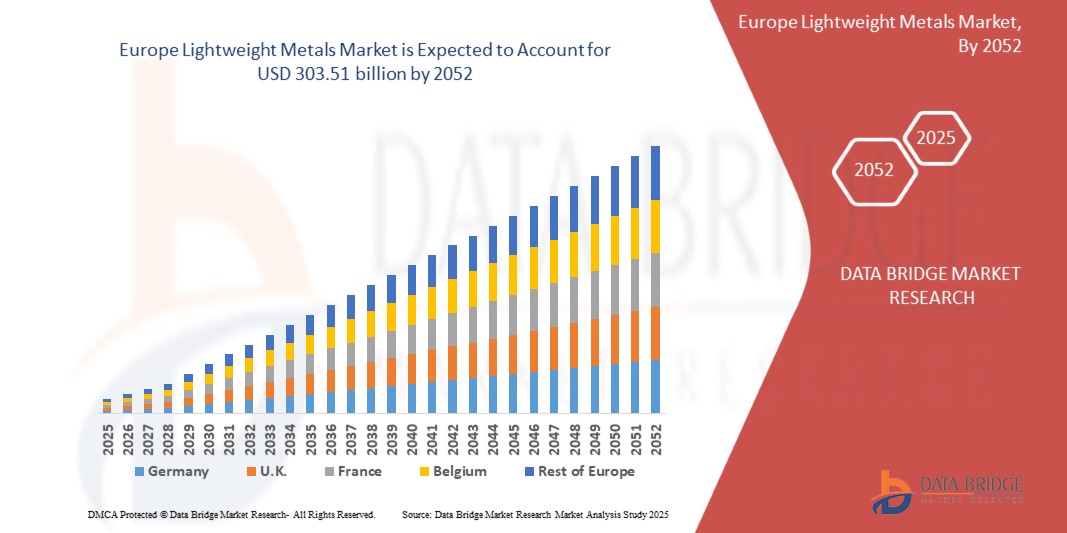

- O tamanho do mercado europeu de metais leves foi avaliado em US$ 36,60 bilhões em 2024 e deve atingir US$ 303,51 bilhões até 2052 , com um CAGR de 7,9% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda nos setores automotivo e aeroespacial

- Além disso, a adoção de metais leves em bens de consumo duráveis e eletrodomésticos está aumentando. Esses fatores convergentes estão acelerando a adoção de soluções em metais leves, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Metais Leves na Europa

- Os metais leves estão ganhando destaque devido ao seu papel essencial em indústrias como automotiva, aeroespacial, construção e eletrônica de consumo, onde a redução do peso dos componentes é crucial para melhorar a eficiência de combustível, o desempenho e a sustentabilidade.

- A crescente ênfase na eficiência de combustível, nas regulamentações de emissões de carbono e na transição da Europa para veículos elétricos (VEs) está impulsionando significativamente a demanda por metais leves, como alumínio, magnésio e titânio. Além disso, os avanços na metalurgia e nas tecnologias de processamento de metais estão permitindo a produção de materiais mais fortes, leves e resistentes à corrosão.

- A Alemanha domina o mercado europeu de metais leves, detendo a maior fatia de receita de 18,89% em 2024, atribuída às robustas indústrias aeroespacial e automotiva, à crescente adoção de veículos elétricos, à forte infraestrutura de fabricação e aos investimentos contínuos em tecnologias avançadas de materiais.

- A Alemanha deverá ser o país com crescimento mais rápido no mercado durante o período previsto, impulsionada por regulamentações ambientais rigorosas que promovem redução de peso, aumento da produção de veículos elétricos e híbridos e um forte foco em sustentabilidade e práticas de fabricação ecológicas.

- Espera-se que o segmento de alumínio e ligas de alumínio domine o mercado europeu de metais leves, com uma participação de mercado de 55,93% em 2025, devido à sua versatilidade, reciclabilidade e amplo uso em vários setores, incluindo automotivo, embalagens, aeroespacial e construção, apoiado ainda pela crescente demanda europeia por soluções sustentáveis e com eficiência energética.

Escopo do Relatório e Segmentação do Mercado de Metais Leves na Europa

|

Atributos |

Principais insights do mercado de metais leves |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de metais leves na Europa

Aumento da demanda nos setores automotivo e aeroespacial

- Uma grande força motriz por trás do mercado europeu de metais leves é o impulso crescente para eficiência de combustível, redução de emissões e otimização de desempenho, particularmente nas indústrias automotiva e aeroespacial, impulsionado por preocupações ambientais e mandatos regulatórios em todas as regiões

- Por exemplo, em maio de 2021, os pesquisadores Jovan Tan e Seeram Ramakrishna publicaram uma revisão abrangente destacando o apelo do magnésio em termos de engenharia, citando sua leveza, alta relação resistência-peso e excelente usinabilidade. Essas características o tornam ideal para aplicações automotivas e aeroespaciais focadas em eficiência energética e redução de emissões.

- No setor automotivo, a transição para veículos elétricos (VEs) aumentou significativamente a demanda por metais leves. As montadoras agora estão incorporando painéis de carroceria de alumínio, peças estruturais de magnésio e ligas metálicas em componentes essenciais como chassis, armações e sistemas de suspensão para compensar o peso da bateria e aumentar a autonomia do veículo.

- Enquanto isso, a indústria aeroespacial continua a adotar ligas avançadas de alumínio-lítio e componentes de titânio para reduzir o peso de decolagem, melhorar a economia de combustível e prolongar a vida útil das aeronaves. Com o aumento das viagens aéreas globais e da produção de veículos elétricos, espera-se que os metais leves permaneçam em alta demanda.

- De acordo com um comunicado à imprensa da Industry Outlook Manufacturing, o alumínio e o magnésio estão sendo rapidamente adotados no design de veículos, proporcionando uma melhoria de 6% a 8% na economia de combustível para cada 10% de redução no peso do veículo. Sua acessibilidade e desempenho estrutural os tornam especialmente adequados para veículos elétricos em comparação com o aço tradicional.

- A crescente demanda dos setores automotivo e aeroespacial, aliada aos avanços na manufatura aditiva e na inovação em ligas metálicas, está acelerando a adoção de metais leves em nível regional. À medida que as indústrias priorizam a mobilidade sustentável e as aeronaves de última geração, o papel do alumínio, magnésio e titânio continua a se expandir em aplicações tradicionais e emergentes.

Dinâmica do mercado de metais leves na Europa

Motorista

Adoção crescente de bens de consumo duráveis e eletrodomésticos

- A crescente demanda por metais leves é significativamente impulsionada pela crescente preferência do consumidor por aparelhos leves, duráveis e com baixo consumo de energia, que estejam alinhados às metas de sustentabilidade e às expectativas de desempenho no setor de bens de consumo duráveis.

- Por exemplo, uma publicação no blog da Associação Internacional de Magnésio enfatizou a crescente demanda por dispositivos compactos e transportáveis, com as ligas de magnésio substituindo cada vez mais os plásticos. O magnésio oferece leveza comparável, resistência significativamente maior, transferência de calor superior e proteção contra interferências eletromagnéticas e de radiofrequência, tornando-o ideal para aparelhos modernos.

- Metais leves como alumínio e magnésio são amplamente utilizados em geladeiras, máquinas de lavar, condicionadores de ar e eletrodomésticos de cozinha devido à sua resistência à corrosão, melhor gerenciamento térmico e flexibilidade de design. Esses benefícios facilitam o transporte e a instalação, reduzindo os custos gerais de envio e as emissões de carbono.

- Em uma publicação no blog da Magnum Austrália, o magnésio e outras ligas leves foram citados como alternativas superiores aos plásticos, graças à sua resistência, dissipação de calor e blindagem eletromagnética. A aplicação de magnésio pela Sony, em novembro de 2023, na estrutura interna da lente FE 300mm F2.8 GM OSS reforça ainda mais o papel crescente do metal em eletrônicos de consumo avançados.

- Além disso, Bleno destacou a crescente popularidade do alumínio em armários de cozinha modernos, onde é apreciado por sua aparência elegante, resistência e resistência à corrosão. Esses atributos o tornam um material ideal para projetos de cozinhas contemporâneas que exigem uma combinação de estética e funcionalidade.

- Além de aparelhos, as ligas de titânio também estão sendo cada vez mais adotadas em equipamentos biomédicos, conforme observado em um artigo publicado em dezembro de 2023 pela Biblioteca Nacional de Medicina. A excelente biocompatibilidade, resistência e resistência à corrosão do material impulsionaram seu uso em implantes ortopédicos, dispositivos odontológicos e aplicações cardiovasculares, com tecnologias de produção frequentemente sobrepondo-se às do mercado de bens de consumo duráveis de alto padrão.

- A crescente adoção de alumínio e magnésio em eletrodomésticos é ainda apoiada por iniciativas regulatórias e padrões voluntários como o ENERGY STAR, que pressionam os fabricantes a atingir padrões de eficiência mais elevados. À medida que a P&D em desenvolvimento de ligas e a inovação em design prosseguem, os metais leves estão se tornando essenciais para a criação de eletrodomésticos que atendem às demandas dos consumidores e aos padrões ambientais, reforçando seu papel no crescimento sustentado do mercado europeu de metais leves.

Oportunidade

Avanços na Reciclagem e Produção de Metais Verdes

- O foco crescente na sustentabilidade e na economia circular está impulsionando a demanda por metais leves produzidos por meio de métodos de baixa emissão e sistemas de reciclagem de circuito fechado.

- Tecnologias avançadas — como a classificação de ligas orientada por IA, a fundição alimentada por energia solar e a recuperação de escória — estão permitindo a produção de alumínio e magnésio reciclados de alta pureza para uso nos setores automotivo, aeroespacial e de construção.

- Governos e corporações estão apoiando iniciativas de metais verdes por meio de incentivos políticos, compras focadas em ESG e investimentos em infraestrutura de baixo carbono.

- Em 2024, a Emirates Global Aluminium (EGA) tornou-se a primeira a produzir alumínio comercialmente usando energia solar (CelestiAL), reduzindo significativamente as emissões associadas aos processos tradicionais de fundição

- Em fevereiro de 2025, uma pesquisa publicada em Resources, Conservation & Recycling introduziu um sistema baseado em CNN com recursos SIFT e HOG para classificar sucata de liga de alumínio com mais de 90% de precisão, melhorando a eficiência da reciclagem

- O projeto RAD4AL, apoiado pela UE, desenvolveu a primeira linha de revestimento de bobinas de alumínio de cura por radiação da Europa, eliminando fornos a gás natural e solventes VOC, melhorando drasticamente a eficiência energética e reduzindo as emissões.

Restrição/Desafio

Altos custos de produção e processamento

- Os altos custos de produção e processamento associados à fabricação de metais leves, incluindo alumínio, titânio e magnésio, representam uma barreira significativa à expansão do mercado regional. Esses metais exigem métodos de extração e refino que consomem muita energia, como fundição em alta temperatura, eletrólise e destilação a vácuo, todos os quais demandam infraestrutura avançada e investimentos de capital substanciais.

- Por exemplo, em dezembro de 2023, um estudo intitulado "Titânio: Alto Desempenho, Alto Custo — Barreiras e Desafios para o Uso Amplo", realizado por pesquisadores do CNR-STEMS, na Itália, destacou o processo Kroll como um dos principais fatores que contribuem para o alto custo de produção do titânio. O estudo identificou as inúmeras etapas de extração, a reatividade do titânio com oxigênio e nitrogênio e a baixa usinabilidade devido à baixa condutividade térmica como os principais fatores de custo.

- Além disso, um estudo do MDPI de fevereiro de 2023 explorou as limitações do processo Kroll, enfatizando que a produção de apenas 1 kg de titânio requer aproximadamente 257,78 megajoules de energia. Apesar de ser o padrão da indústria, a ineficiência e as demandas energéticas do processo Kroll prejudicam severamente a escalabilidade e a acessibilidade da produção de titânio.

- A complexidade da produção de metais leves, especialmente em setores como aeroespacial e automotivo, também exige rigoroso controle de qualidade e usinagem de precisão, aumentando os custos de mão de obra e o tempo de processo. Esses fatores impedem a entrada de fabricantes menores e de economias emergentes no mercado e limitam a ampla adoção desses metais em aplicações com custo-benefício.

- Embora a P&D contínua em tecnologias de reciclagem, otimização de ligas e eficiência de fabricação seja promissora, as atuais restrições de energia e custos continuam a reduzir a competitividade, desencorajar investimentos e restringir a penetração no mercado, especialmente em regiões com fornecimento de energia instável ou caro.

- Até que alternativas economicamente viáveis e escaláveis a processos como Hall-Heroult para alumínio e Kroll para titânio se tornem comercialmente viáveis, a alta estrutura de custos continuará sendo uma restrição central no mercado europeu de metais leves. Superar esses desafios será essencial para desbloquear uma adoção mais ampla em diversos setores de uso final.

Escopo do mercado de metais leves na Europa

O mercado é segmentado com base no tipo e na aplicação.

- Por tipo

Com base no tipo, o mercado é segmentado em alumínio e ligas de alumínio, titânio e ligas de titânio, magnésio e ligas de magnésio, berílio e ligas de berílio, aço e ligas de aço, entre outros. Em 2025, o segmento de alumínio e ligas de alumínio dominará o mercado, com uma participação de mercado de 55,93%, impulsionada por sua ampla utilização nos setores automotivo, aeroespacial, de embalagens e construção civil. Os principais fatores incluem a leveza do alumínio, a resistência à corrosão, a alta reciclabilidade e a adaptabilidade para aplicações sustentáveis e com eficiência energética.

Prevê-se que o segmento de alumínio e ligas de alumínio apresente a maior taxa de crescimento, de 8,1%, entre 2025 e 2052, impulsionado por sua crescente adoção nos setores aeroespacial, de implantes médicos e de defesa, devido à alta relação resistência-peso, biocompatibilidade e resistência superior a ambientes extremos. Os avanços contínuos nas tecnologias de processamento e reciclagem de titânio também contribuem para o aumento da demanda.

- Por aplicação

Com base na aplicação, o mercado é segmentado em automotivo e transporte, aeroespacial e defesa, agricultura, eletrônicos e bens de consumo, marítimo e outros. Espera-se que o segmento automotivo e de transporte detenha a maior fatia de mercado, com 41,87% da receita em 2025, impulsionado pela ampla adoção de metais leves para aumentar a eficiência de combustível, reduzir as emissões e atender aos rigorosos padrões regulatórios. A crescente migração para veículos elétricos (VEs) e o uso crescente de materiais como alumínio e magnésio em estruturas de carroceria e componentes do trem de força impulsionaram ainda mais o crescimento do segmento.

Espera-se que o segmento automotivo e de transporte testemunhe o CAGR mais rápido de 8,3% entre 2025 e 2052, impulsionado pela crescente demanda por aeronaves de última geração, maiores esforços de modernização militar e uso de titânio e ligas de alumínio-lítio para reduzir o peso das aeronaves, melhorar o desempenho e melhorar a eficiência de combustível.

Análise regional do mercado europeu de metais leves

- A Europa é o segundo maior mercado de metais leves, detendo uma participação substancial na receita em 2025 e está projetada para crescer a um CAGR robusto de 7,9% de 2025 a 2052. O crescimento da região é impulsionado por regulamentações rigorosas de emissões, crescente adoção da mobilidade elétrica e maiores investimentos em tecnologias leves nos setores automotivo, aeroespacial e de bens de consumo.

- A Europa se beneficia de estruturas políticas sólidas, como o Pacto Ecológico Europeu e o pacote Fit for 55, que incentivam a redução do peso dos veículos e a eficiência energética. Além disso, colaborações entre fabricantes de equipamentos originais (OEMs) e inovadores em ciência de materiais, bem como programas de P&D apoiados pelo governo, estão impulsionando avanços tecnológicos em aplicações de alumínio, titânio e magnésio.

- Países como a Alemanha, a França e o Reino Unido lideram a região com a adoção em larga escala de materiais leves em indústrias-chave e infraestruturas de produção robustas

Visão do mercado de metais leves na Alemanha e na Europa

Espera-se que a Alemanha detenha a maior fatia de mercado de 19,44% na receita da Europa em 2025, devido à sua liderança na fabricação automotiva, forte presença de fornecedores aeroespaciais de primeiro nível e investimentos contínuos em P&D de materiais avançados.

Visão geral do mercado de metais leves na França e Europa

A França deverá registrar um CAGR notável de 8,0% entre 2025 e 2052, impulsionado pelos setores aeroespacial e de defesa, especialmente pela presença de players globais como a Airbus. Iniciativas apoiadas pelo governo para aviação sustentável, pesquisa de materiais leves e a promoção de práticas de economia circular estão impulsionando a demanda por ligas e compósitos de alto desempenho.

Visão geral do mercado de metais leves do Reino Unido e da Europa

O Reino Unido está emergindo como um importante contribuinte para o Mercado Europeu de Metais Leves, apoiado por programas de eletrificação automotiva, centros de inovação em materiais sustentáveis e parcerias público-privadas. Com financiamento significativo para veículos de energia limpa e modernização da defesa, o Reino Unido está promovendo a crescente adoção de compósitos de alumínio, magnésio e híbridos em aplicações estruturais e de desempenho crítico.

Participação no mercado de metais leves na Europa

A indústria de metais leves é liderada principalmente por empresas bem estabelecidas, incluindo:

- China Hongqiao Group Limited (China)

- Hindalco Industries Ltd. (Índia)

- thyssenkrupp Steel Europe (Alemanha)

- AMETEK Inc. (EUA)

- Vedanta Limited (Índia)

- Norsk Hydro ASA (Noruega)

- AMAG Austria Metall AG (Áustria)

- SSAB (Suécia)

- Costellium (França)

- ArcelorMittal (Luxemburgo)

- Luxfer Holdings PLC (Reino Unido)

Últimos desenvolvimentos no mercado europeu de metais leves

- Em janeiro de 2025, a filial de Alumina Second em Hongqiao implementou protocolos avançados de testes para aprimorar significativamente a qualidade e a eficiência de seus processos de produção. A iniciativa se concentra em controles de qualidade mais rigorosos, análise de dados mais rápida e calibração aprimorada de equipamentos. Como resultado, a filial alcançou maior consistência nos padrões dos produtos e minimizou os defeitos. Essa mudança reflete o compromisso de Hongqiao com alto desempenho, segurança operacional e satisfação do cliente. Treinamento contínuo e instalações laboratoriais modernizadas também contribuem significativamente para essa melhoria.

- Em junho de 2025, a Hindalco adquiriu a AluChem Companies, Inc., com sede nos Estados Unidos, por US$ 125 milhões por meio de sua subsidiária, Aditya Holdings LLC. A AluChem, produtora de alumina de alta pureza, agrega valor estratégico à expansão global da Hindalco no segmento de alumina de alta tecnologia. Essa aquisição fortalece o foco da Hindalco em produtos de valor agregado, impulsionado pelo forte crescimento e lucratividade de seu negócio atual de alumina especial.

- Em outubro de 2024, a thyssenkrupp Steel aprimorou seu Bluemint Steel, produzindo aço com baixo teor de CO₂ a partir de sucata em altos-fornos. Isso ajuda tanto a empresa quanto seus clientes a reduzir a pegada de carbono. Aços de alto desempenho e ultra-alta resistência também estão sendo desenvolvidos, permitindo veículos mais leves e seguros, com melhor eficiência de combustível e desempenho.

- Em julho de 2025, o presidente do Grupo Tata, N. Chandrasekaran, marcou o lançamento da pedra fundamental do novo Forno a Arco Elétrico (FEA) da Tata Steel UK em Port Talbot. Este projeto de aço verde de US$ 2,25 bilhões, apoiado por £ 500 milhões do Governo do Reino Unido, visa reduzir as emissões de carbono em 90% e garantir 5.000 empregos. O FEA será um dos maiores do mundo, produzindo 3 milhões de toneladas de aço de baixo carbono anualmente. A iniciativa marca um passo importante na estratégia de descarbonização e transformação industrial da Tata no Reino Unido.

- Em abril de 2024, a Vedanta Aluminium sediou o conclave Auto-Edge para promover o uso do alumínio na indústria automotiva. O evento reuniu as principais empresas automotivas para discutir o futuro da mobilidade e o papel dos metais leves. A Vedanta apresentou sua diversificada gama de produtos, incluindo ligas de alumínio para a fabricação de veículos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 VALUE CHAIN ANALYSIS: EUROPE LIGHTWEIGHT METALS MARKET

4.3.1 PROCUREMENT:

4.3.2 MANUFACTURING:

4.3.3 MARKETING & DISTRIBUTION:

4.4 VENDOR SELECTION CRITERIA

4.4.1 QUALITY AND CONSISTENCY OF SUPPLY

4.4.2 RELIABILITY AND TIMELINESS

4.4.3 COST COMPETITIVENESS

4.4.4 TECHNICAL CAPABILITY AND INNOVATION

4.4.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.4.6 FINANCIAL STABILITY

4.4.7 CUSTOMER SERVICE AND SUPPORT

4.5 BRAND OUTLOOK

4.5.1 BRAND COMPETITIVE ANALYSIS OF THE EUROPE LIGHTWEIGHT METALS MARKET

4.5.2 PRODUCT VS BRAND OVERVIEW

4.5.3 PRODUCT OVERVIEW

4.5.4 BRAND OVERVIEW

4.5.5 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIALS

4.7.2 ENERGY CONSUMPTION

4.7.3 LABOR AND OPERATIONAL COSTS

4.7.4 RESEARCH AND DEVELOPMENT

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM-SIZE COMPANIES

4.8.3 END USERS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.10.4 ANALYST RECOMMENDATIONS

4.11 CONSUMER BUYING BEHAVIOUR

4.12 PROFIT MARGINS SCENARIO

4.12.1 MARGIN RANGE BY PRODUCT TYPE

4.12.2 KEY FACTORS INFLUENCING MARGINS

4.12.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.13 RAW MATERIAL SOURCING ANALYSIS ON THE EUROPE LIGHTWEIGHT METALS MARKET

4.13.1 ALUMINUM

4.13.2 MAGNESIUM

4.13.3 TITANIUM

4.13.4 BERYLLIUM

4.13.5 CARBON AND METAL MATRIX COMPOSITES (ADDITIVES)

4.13.6 CONCLUSION

4.14 TECHNOLOGIES ADVANCEMENTS

4.14.1 OVERVIEW

4.14.2 ADVANCED ALLOY DEVELOPMENT

4.14.3 METALLURGICAL PROCESS INNOVATIONS

4.14.4 SURFACE ENGINEERING AND COATINGS

4.14.5 RECYCLING AND CIRCULAR MANUFACTURING TECHNOLOGIES

4.14.6 INTEGRATED LIGHTWEIGHT DESIGN AND SIMULATION TOOLS

4.15 TARIFFS AND THEIR IMPACT ON MARKET

4.15.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.15.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.15.3 VENDOR SELECTION CRITERIA DYNAMICS

4.15.4 IMPACT ON SUPPLY CHAIN

4.15.4.1 RAW MATERIAL PROCUREMENT

4.15.4.2 MANUFACTURING AND PRODUCTION

4.15.4.3 LOGISTICS AND DISTRIBUTION

4.15.4.4 PRICE PITCHING AND POSITION OF MARKET

4.15.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.15.5.1 SUPPLY CHAIN OPTIMIZATION

4.15.5.2 JOINT VENTURE ESTABLISHMENTS

4.15.6 IMPACT ON PRICES

4.15.7 REGULATORY INCLINATION

4.15.7.1 GEOPOLITICAL SITUATION

4.15.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.15.7.2.1 FREE TRADE AGREEMENTS

4.15.7.2.2 ALLIANCE ESTABLISHMENTS

4.15.7.2.3 STATUS ACCREDITATION (INCLUDING MFN)

4.15.7.3 DOMESTIC COURSE OF CORRECTION

4.15.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.15.7.3.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE AND AEROSPACE SECTORS

6.1.2 GROWING ADOPTION OF CONSUMER DURABLES AND APPLIANCES

6.1.3 GROWING DEMAND FOR FUEL-EFFICIENT VEHICLES GLOBALLY

6.1.4 REGULATORY INITIATIVES SUPPORTING LIGHTWEIGHT DESIGN

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PROCESSING COSTS

6.2.2 CORROS.ION SENSITIVITY AND ALLOY LIMITATIONS

6.3 OPPORTUNITIES

6.3.1 RISING PENETRATION OF ELECTRIC VEHICLES WORLDWIDE

6.3.2 ADVANCEMENTS IN RECYCLING AND GREEN METAL PRODUCTION

6.3.3 MARINE INDUSTRY SHIFTING TOWARD WEIGHT-OPTIMIZED DESIGNS

6.4 CHALLENGES

6.4.1 RAW MATERIAL AVAILABILITY AND GEOPOLITICAL DEPENDENCY

6.4.2 COMPATIBILITY ISSUES WITH TRADITIONAL MANUFACTURING EQUIPMENT

7 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 ALUMINUM AND ALUMINUM ALLOY

7.3 TITANIUM AND TITANIUM ALLOYS

7.4 MAGNESIUM AND MAGNESIUM ALLOY

7.5 STEEL AND STEEL ALLOYS

7.6 BERYLLIUM AND BERYLLIUM ALLOY

7.7 OTHERS

8 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.3 AEROSPACE & DEFENSE

8.4 ELECTRONICS & CONSUMER GOODS

8.5 MARINE

8.6 AGRICULTURE

8.7 OTHERS

9 EUROPE LIGHTWEIGHT METALS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 FRANCE

9.1.3 U.K.

9.1.4 SPAIN

9.1.5 ITALY

9.1.6 NETHERLANDS

9.1.7 RUSSIA

9.1.8 SWEDEN

9.1.9 BELGIUM

9.1.10 SWITZERLAND

9.1.11 POLAND

9.1.12 DENMARK

9.1.13 FINLAND

9.1.14 TURKEY

9.1.15 NORWAY

9.1.16 LUXEMBOURG

9.1.17 REST OF EUROPE

10 EUROPE LIGHTWEIGHT METALS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CHINA HONGQIAO GROUP LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 RECENT FINANCIALS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HINDALCO INDUSTRIES LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 THYSSENKRUPP STEEL EUROPE

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AMETEK INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 RECENT FINANCIALS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 VEDANTA LIMITED

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ALCOA CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT/NEWS

12.7 ARCELORMITTAL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 AMAG AUSTRIA METALL AG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 AMETEK SPECIALTY METAL PRODUCTS (AMETEK INC.)

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 ATI, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 ATLAS STEELS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS/NEWS

12.12 BAVARIA STAHL UND METALL IMPORT/EXPORT GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS/NEWS

12.13 COSTELLIUM

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 CLINTON ALUMINUM

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 CORPORATION VSMPO-AVISMA

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 DWA ALUMINUM COMPOSITES USA, INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 EMIRATES EUROPE ALUMINIUM PJSC

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 ICL

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS/NEWS

12.19 KAISER ALUMINUM

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 LUXFER HOLDINGS PLC

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

12.21 METALWERKS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS/NEWS

12.22 MATERION CORPORATION

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENTS/NEWS

12.23 MSKS IP INC.

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 NUCOR CORPORATION

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENTS

12.25 NORSK HYDRO ASA

12.25.1 COMPANY SNAPSHOT

12.25.2 PRODUCT PORTFOLIO

12.25.3 RECENT DEVELOPMENT/NEWS

12.26 PRECISION CASTPARTS CORP.

12.26.1 COMPANY SNAPSHOT

12.26.2 PRODUCT PORTFOLIO

12.26.3 RECENT DEVELOPMENT

12.27 POSCO

12.27.1 COMPANY SNAPSHOT

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENTS/NEWS

12.28 RUSAL

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENT

12.29 RIO TINTO

12.29.1 COMPANY SNAPSHOT

12.29.2 REVENUE ANALYSIS

12.29.3 PRODUCT PORTFOLIO

12.29.4 RECENT DEVELOPMENT

12.3 RELIANCE, INC.

12.30.1 COMPANY SNAPSHOT

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT

12.31 RYERSON HOLDING CORPORATION

12.31.1 COMPANY SNAPSHOT

12.31.2 REVENUE ANALYSIS

12.31.3 PRODUCT PORTFOLIO

12.31.4 RECENT DEVELOPMENTS

12.32 SCOPE METALS GROUP LTD.

12.32.1 COMPANY SNAPSHOT

12.32.2 REVENUE ANALYSIS

12.32.3 PRODUCT PORTFOLIO

12.32.4 RECENT DEVELOPMENT

12.33 SSAB

12.33.1 COMPANY SNAPSHOT

12.33.2 REVENUE ANALYSIS

12.33.3 PRODUCT PORTFOLIO

12.33.4 RECENT DEVELOPMENT

12.34 SMITHS METAL CENTRES LIMITED

12.34.1 COMPANY SNAPSHOT

12.34.2 PRODUCT PORTFOLIO

12.34.3 RECENT DEVELOPMENT

12.35 TW METALS, LLC.

12.35.1 COMPANY SNAPSHOT

12.35.2 PRODUCT PORTFOLIO

12.35.3 RECENT DEVELOPMENT

12.36 TATA STEEL

12.36.1 COMPANY SNAPSHOT

12.36.2 RECENT FINANCIALS

12.36.3 PRODUCT PORTFOLIO

12.36.4 RECENT DEVELOPMENT

12.37 THYSSENKRUPP MATERIALS NA, INC.

12.37.1 COMPANY SNAPSHOT

12.37.2 PRODUCT PORTFOLIO

12.37.3 RECENT DEVELOPMENT

12.38 TOHO TITANIUM CO., LTD.

12.38.1 COMPANY SNAPSHOT

12.38.2 REVENUE ANALYSIS

12.38.3 PRODUCT PORTFOLIO

12.38.4 RECENT DEVELOPMENT

12.39 US MAGNESIUM LLC

12.39.1 COMPANY SNAPSHOT

12.39.2 PRODUCT PORTFOLIO

12.39.3 RECENT DEVELOPMENT

12.4 VULCAN INC.

12.40.1 COMPANY SNAPSHOT

12.40.2 PRODUCT PORTFOLIO

12.40.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ELECTRIC VEHICLE (EV) SALES AND MARKET SHARE (2023–2024)

TABLE 4 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM WELD PLATES (PER 100 PIECES)

TABLE 5 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM COVER PLATE (PER 100 PIECES)

TABLE 6 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 7 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 8 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 9 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND

TABLE 10 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 11 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 12 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 13 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 14 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 15 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 16 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 17 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 18 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 19 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 20 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 21 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 22 EUROPE OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 23 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 24 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 25 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 26 EUROPE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 27 EUROPE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 28 EUROPE LIGHT COMMERCIAL VEHICLES (LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 29 EUROPE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 30 EUROPE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 31 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 32 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 33 EUROPE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 34 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 35 EUROPE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 36 EUROPE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 37 EUROPE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 38 EUROPE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 39 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 40 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 41 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 42 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 43 EUROPE OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 44 EUROPE LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (USD THOUSAND)

TABLE 45 EUROPE LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (TONS)

TABLE 46 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 47 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 48 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 49 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 50 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 51 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 52 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 53 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 54 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 55 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 56 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 57 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 58 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 59 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 60 EUROPE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 61 EUROPE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 62 EUROPE LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 63 EUROPE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 64 EUROPE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 65 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 66 EUROPE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 67 EUROPE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 68 EUROPE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 69 EUROPE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 70 EUROPE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 71 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 72 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 73 GERMANY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 74 GERMANY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 75 GERMANY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 76 GERMANY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 77 GERMANY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 78 GERMANY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 79 GERMANY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 80 GERMANY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 81 GERMANY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 82 GERMANY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 83 GERMANY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 84 GERMANY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 85 GERMANY LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 86 GERMANY AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 87 GERMANY PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 88 GERMANY ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 89 GERMANY LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 90 GERMANY HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 91 GERMANY TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 92 GERMANY AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 93 GERMANY ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 94 GERMANY CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 95 GERMANY PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 96 GERMANY AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 97 GERMANY HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 98 GERMANY MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 99 GERMANY AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 100 FRANCE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 101 FRANCE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 102 FRANCE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 103 FRANCE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 104 FRANCE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 105 FRANCE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 106 FRANCE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 107 FRANCE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 108 FRANCE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 109 FRANCE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 110 FRANCE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 111 FRANCE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 112 FRANCE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 113 FRANCE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 114 FRANCE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 115 FRANCE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 116 FRANCE LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 117 FRANCE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 118 FRANCE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 119 FRANCE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 120 FRANCE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 121 FRANCE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 122 FRANCE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 123 FRANCE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 124 FRANCE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 125 FRANCE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 126 FRANCE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 127 U.K. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 128 U.K. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 129 U.K. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 130 U.K. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 131 U.K. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 132 U.K. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 133 U.K. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 134 U.K. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 135 U.K. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 136 U.K. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 137 U.K. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 138 U.K. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 139 U.K. LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 140 U.K. AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 141 U.K. PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 142 U.K. ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 143 U.K. LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 144 U.K. HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 145 U.K. TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 146 U.K. AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 147 U.K. ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 148 U.K. CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 149 U.K. PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 150 U.K. AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 151 U.K. HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 152 U.K. MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 153 U.K. AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 154 SPAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 155 SPAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 156 SPAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 157 SPAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 158 SPAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 159 SPAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 160 SPAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 161 SPAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 162 SPAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 163 SPAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 164 SPAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 165 SPAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 166 SPAIN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 167 SPAIN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 168 SPAIN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 169 SPAIN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 170 SPAIN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 171 SPAIN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 172 SPAIN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 173 SPAIN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 174 SPAIN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 175 SPAIN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 176 SPAIN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 177 SPAIN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 178 SPAIN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 179 SPAIN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 180 SPAIN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 181 ITALY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 182 ITALY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 183 ITALY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 184 ITALY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 185 ITALY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 186 ITALY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 187 ITALY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 188 ITALY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 189 ITALY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 190 ITALY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 191 ITALY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 192 ITALY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 193 ITALY LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 194 ITALY AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 195 ITALY PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 196 ITALY ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 197 ITALY LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 198 ITALY HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 199 ITALY TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 200 ITALY AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 201 ITALY ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 202 ITALY CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 203 ITALY PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 204 ITALY AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 205 ITALY HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 206 ITALY MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 207 ITALY AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 208 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 209 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 210 NETHERLANDS ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 211 NETHERLANDS ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 212 NETHERLANDS TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 213 NETHERLANDS TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 214 NETHERLANDS MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 215 NETHERLANDS MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 216 NETHERLANDS STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 217 NETHERLANDS STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 218 NETHERLANDS BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 219 NETHERLANDS BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 220 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 221 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 222 NETHERLANDS PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 223 NETHERLANDS ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 224 NETHERLANDS LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 225 NETHERLANDS HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 226 NETHERLANDS TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 227 NETHERLANDS AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 228 NETHERLANDS ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 229 NETHERLANDS CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 230 NETHERLANDS PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 231 NETHERLANDS AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 232 NETHERLANDS HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 233 NETHERLANDS MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 234 NETHERLANDS AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 235 RUSSIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 236 RUSSIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 237 RUSSIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 238 RUSSIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 239 RUSSIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 240 RUSSIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 241 RUSSIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 242 RUSSIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 243 RUSSIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 244 RUSSIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 245 RUSSIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 246 RUSSIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 247 RUSSIA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 248 RUSSIA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 249 RUSSIA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 250 RUSSIA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 251 RUSSIA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 252 RUSSIA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 253 RUSSIA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 254 RUSSIA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 255 RUSSIA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 256 RUSSIA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 257 RUSSIA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 258 RUSSIA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 259 RUSSIA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 260 RUSSIA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 261 RUSSIA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 262 SWEDEN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 263 SWEDEN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 264 SWEDEN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 265 SWEDEN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 266 SWEDEN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 267 SWEDEN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 268 SWEDEN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 269 SWEDEN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 270 SWEDEN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 271 SWEDEN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 272 SWEDEN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 273 SWEDEN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 274 SWEDEN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 275 SWEDEN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 276 SWEDEN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 277 SWEDEN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 278 SWEDEN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 279 SWEDEN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 280 SWEDEN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 281 SWEDEN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 282 SWEDEN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 283 SWEDEN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 284 SWEDEN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 285 SWEDEN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 286 SWEDEN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 287 SWEDEN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 288 SWEDEN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 289 BELGIUM LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 290 BELGIUM LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 291 BELGIUM ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 292 BELGIUM ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 293 BELGIUM TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 294 BELGIUM TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 295 BELGIUM MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 296 BELGIUM MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 297 BELGIUM STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 298 BELGIUM STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 299 BELGIUM BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 300 BELGIUM BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 301 BELGIUM LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 302 BELGIUM AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 303 BELGIUM PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 304 BELGIUM ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 305 BELGIUM LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 306 BELGIUM HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 307 BELGIUM TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 308 BELGIUM AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 309 BELGIUM ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 310 BELGIUM CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 311 BELGIUM PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 312 BELGIUM AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 313 BELGIUM HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 314 BELGIUM MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 315 BELGIUM AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 316 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 317 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 318 SWITZERLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 319 SWITZERLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 320 SWITZERLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 321 SWITZERLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 322 SWITZERLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 323 SWITZERLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 324 SWITZERLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 325 SWITZERLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 326 SWITZERLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 327 SWITZERLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 328 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 329 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 330 SWITZERLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 331 SWITZERLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 332 SWITZERLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 333 SWITZERLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 334 SWITZERLAND TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 335 SWITZERLAND AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 336 SWITZERLAND ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 337 SWITZERLAND CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 338 SWITZERLAND PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 339 SWITZERLAND AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 340 SWITZERLAND HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 341 SWITZERLAND MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 342 SWITZERLAND AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 343 POLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 344 POLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 345 POLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 346 POLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 347 POLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 348 POLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 349 POLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 350 POLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 351 POLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 352 POLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 353 POLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 354 POLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 355 POLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 356 POLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 357 POLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 358 POLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 359 POLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 360 POLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 361 POLAND TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 362 POLAND AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 363 POLAND ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 364 POLAND CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 365 POLAND PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 366 POLAND AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 367 POLAND HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 368 POLAND MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 369 POLAND AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 370 DENMARK LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 371 DENMARK LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 372 DENMARK ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 373 DENMARK ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 374 DENMARK TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 375 DENMARK TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 376 DENMARK MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 377 DENMARK MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 378 DENMARK STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 379 DENMARK STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 380 DENMARK BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 381 DENMARK BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 382 DENMARK LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 383 DENMARK AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 384 DENMARK PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 385 DENMARK ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 386 DENMARK LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 387 DENMARK HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 388 DENMARK TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 389 DENMARK AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 390 DENMARK ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 391 DENMARK CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 392 DENMARK PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 393 DENMARK AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 394 DENMARK HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 395 DENMARK MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 396 DENMARK AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 397 FINLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 398 FINLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 399 FINLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 400 FINLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 401 FINLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 402 FINLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 403 FINLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 404 FINLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 405 FINLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 406 FINLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 407 FINLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 408 FINLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 409 FINLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 410 FINLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 411 FINLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 412 FINLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 413 FINLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 414 FINLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)