Europe Medical Cannabis Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.51 Billion

USD

35.59 Billion

2024

2032

USD

3.51 Billion

USD

35.59 Billion

2024

2032

| 2025 –2032 | |

| USD 3.51 Billion | |

| USD 35.59 Billion | |

|

|

|

|

Segmentação do mercado de cannabis medicinal na Europa, por produto (óleo, cannabis medicinal seca, cápsulas de cannabis medicinal, flor inteira, flor moída, caneta vape, cremes e hidratantes e outros), fonte (sintética e natural), espécies (cannabis indica, sativa e híbrida), derivados (canabidiol (CBD), tetrahidrocanabinol (THC) / delta-8-tetrahidrocanabinol e outros), aplicação (controle da dor, ansiedade, espasmos musculares, náuseas, perda de apetite, câncer, artrite, doença de Alzheimer/enxaquecas, epilepsia, depressão e distúrbios do sono, esclerose múltipla, autismo, condições de saúde mental, elevação do humor e outros), via de administração (soluções orais e cápsulas, tabagismo, vaporizadores, tópicos e outros), usuário final (indústria farmacêutica, centros de pesquisa e desenvolvimento, ambiente de assistência domiciliar, hospital, Centros de Reabilitação e Outros), Canal de Distribuição (B2B e B2C) - Tendências e Previsão do Setor até 2032

Tamanho do mercado de cannabis medicinal na Europa

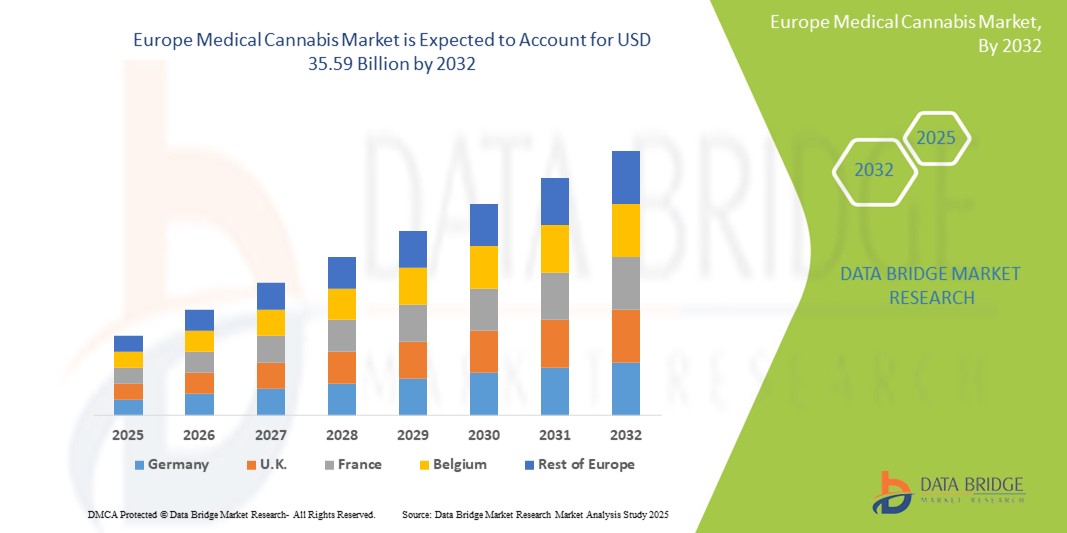

- O tamanho do mercado europeu de cannabis medicinal foi avaliado em US$ 3,51 bilhões em 2024 e deve atingir US$ 35,59 bilhões até 2032 , com um CAGR de 33,60% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção e progresso tecnológico em dispositivos domésticos conectados e tecnologia de casa inteligente, levando ao aumento da digitalização em ambientes residenciais e comerciais

- Além disso, a crescente demanda dos consumidores por soluções seguras, fáceis de usar e integradas para suas residências e empresas está consolidando as fechaduras inteligentes como o sistema moderno de controle de acesso preferido. Esses fatores convergentes estão acelerando a adoção de soluções de Cannabis Medicinal na Europa, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Cannabis Medicinal na Europa

- A cannabis medicinal, que abrange produtos de cannabis de grau farmacêutico usados para tratar uma variedade de condições, como dor crônica, epilepsia, esclerose múltipla e sintomas relacionados ao câncer, está testemunhando uma aceitação crescente em toda a Europa devido à evolução das estruturas regulatórias e à crescente validação clínica de seus benefícios terapêuticos.

- A procura por cannabis medicinal na Europa é impulsionada principalmente pela crescente prevalência de doenças crônicas, pelo crescimento da população geriátrica, por políticas governamentais de apoio e pelo aumento dos investimentos em pesquisa em terapias baseadas em canabinoides.

- A Alemanha dominou o mercado europeu de cannabis medicinal, com a maior participação na receita, de 27,9% em 2024, apoiada por uma estrutura de reembolso bem estabelecida, ampla adoção por médicos e forte demanda por pacientes. A liderança do país no desenvolvimento regulatório e seu ativo ecossistema de importação e produção doméstica continuam a impulsionar o crescimento do mercado.

- Espera-se que a Itália seja o país com crescimento mais rápido no mercado europeu de cannabis medicinal durante o período previsto, com um CAGR de 9,7% em 2024, impulsionado pela produção nacional por meio de instalações militares, aumento das importações e demanda consistente por tratamentos para dor crônica e cuidados paliativos.

- O segmento natural dominou o mercado europeu de cannabis medicinal, com uma participação de mercado de 69,3% em 2024, atribuída à crescente demanda por produtos terapêuticos orgânicos e derivados de plantas. Seu amplo uso é sustentado pela crescente preferência dos pacientes por tratamentos de origem natural e por posturas regulatórias favoráveis em países europeus importantes, como Alemanha, Itália e Holanda.

Escopo do Relatório e Segmentação do Mercado de Cannabis Medicinal na Europa

|

Atributos |

Principais insights do mercado de cannabis medicinal na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de cannabis medicinal na Europa

“ Crescente Personalização e Digitalização da Terapia com Cannabis Medicinal ”

- Uma tendência significativa e crescente no mercado europeu de cannabis medicinal é a integração de abordagens de tratamento personalizadas por meio de plataformas digitais de saúde e tecnologias de monitoramento de pacientes. Este modelo em evolução aprimora o engajamento do paciente, a precisão da dosagem e a supervisão médica, permitindo melhores resultados terapêuticos.

- Por exemplo, diversas startups europeias estão em parceria com plataformas de saúde digital para oferecer aplicativos de rastreamento de dosagem de cannabis baseados em IA e consultas por telemedicina, melhorando o acesso e o atendimento individualizado. Essas plataformas orientam os pacientes sobre os cronogramas de titulação, monitoram os sintomas e ajustam as cepas com base em feedback em tempo real.

- A integração digital também permite o monitoramento remoto de pacientes, especialmente no tratamento de doenças crônicas como dor, ansiedade e epilepsia. Os médicos podem monitorar o progresso do tratamento, os efeitos colaterais e a adesão remotamente, agilizando a tomada de decisões e aumentando a segurança do paciente.

- Esse engajamento digital contínuo entre dispositivos, aplicativos e portais de pacientes cria um ecossistema terapêutico conectado, onde a cannabis medicinal deixa de ser isolada e passa a fazer parte de uma jornada de cuidado digital mais ampla. Isso permite a coordenação entre médicos, farmácias e pacientes para uma prestação de cuidados mais eficiente.

- Empresas como a SOMAÍ Pharmaceuticals e a Cellen Health na Europa estão desenvolvendo ativamente plataformas de tele-cannabis, combinando atendimento virtual com atendimento de produtos e análise de dados para oferecer programas de tratamento de cannabis medicinal escaláveis e compatíveis em diferentes cenários regulatórios europeus.

- A demanda por terapia com cannabis, digitalmente integrada e centrada no paciente, está crescendo rapidamente em toda a região, especialmente entre populações mais jovens, com conhecimento tecnológico e portadores de doenças crônicas. À medida que essa tendência ganha força, ela está reformulando as expectativas em relação à distribuição, ao suporte e ao monitoramento da eficácia da cannabis medicinal.

Dinâmica do mercado europeu de cannabis medicinal

Motorista

“Necessidade crescente devido ao aumento da carga de doenças crônicas e à adoção da cannabis terapêutica”

- A prevalência crescente de doenças crônicas, como câncer, epilepsia, esclerose múltipla e dor crônica, juntamente com a legalização acelerada da cannabis para uso médico em vários países europeus, é um fator significativo para o aumento da demanda por produtos de cannabis medicinal.

- Por exemplo, em abril de 2024, a STENOCARE A/S (Dinamarca) anunciou planos para expandir sua linha de produtos com o lançamento de novas formulações de cannabis medicinal à base de óleo, visando melhorar os resultados do tratamento de dor crônica e neurologia. Espera-se que tais estratégias, por parte de empresas-chave, impulsionem o crescimento do setor de cannabis medicinal na Europa no período previsto.

- À medida que pacientes e profissionais de saúde se tornam mais conscientes dos benefícios clínicos e dos menores efeitos colaterais da cannabis medicinal em comparação aos produtos farmacêuticos tradicionais, a demanda por terapias derivadas da cannabis continua a crescer. Esses produtos oferecem alternativas atraentes em áreas como controle da dor, cuidados paliativos e saúde mental.

- Além disso, o crescente apoio dos governos europeus por meio de reformas regulatórias, programas piloto e aprovações de importação está tornando a cannabis medicinal mais acessível aos pacientes, acelerando assim sua integração nos principais sistemas de saúde.

- A conveniência de diversas formas farmacêuticas, como óleos, cápsulas e sprays, juntamente com a expansão dos serviços de prescrição eletrônica e a distribuição em farmácias, são fatores-chave que impulsionam a adoção da cannabis medicinal nos setores de internação e ambulatorial. A tendência para terapias à base de plantas e a crescente aceitação da medicina alternativa também contribuem significativamente para o crescimento do mercado.

Restrição/Desafio

“ Preocupações com a complexidade regulatória e os altos custos de tratamento ”

- As preocupações em torno do cenário regulatório fragmentado e em constante evolução em toda a Europa representam um desafio significativo para uma penetração mais ampla no mercado. Leis, estruturas de licenciamento e restrições de importação/exportação variáveis entre os países dificultam a operação integrada de fabricantes e distribuidores na região.

- Por exemplo, enquanto países como a Alemanha e o Reino Unido têm estruturas bem estabelecidas para a cannabis medicinal, outros ainda estão navegando na implementação de políticas em estágio inicial, causando atrasos e incertezas para investidores e provedores de saúde.

- Superar essas barreiras regulatórias por meio de legislação harmonizada em toda a UE, diretrizes padronizadas de qualidade dos produtos e procedimentos de licenciamento transparentes é crucial para a construção de uma indústria robusta e escalável. Empresas como a Aurora Cannabis e a Tilray Brands estão trabalhando ativamente com reguladores para expandir o acesso e agilizar a conformidade.

- Além disso, o custo relativamente alto do tratamento com cannabis medicinal, especialmente para produtos importados ou com certificação GMP, pode ser uma barreira à adoção por pacientes sem plano de saúde ou com restrições de custo. Embora alguns países ofereçam reembolso parcial, o acesso ainda é limitado em muitas regiões.

- Embora os preços estejam gradualmente se tornando mais competitivos devido ao aumento da produção local, a percepção da cannabis como um tratamento premium ou experimental continua a dificultar a adoção generalizada em comunidades médicas conservadoras.

- Superar esses desafios por meio do alinhamento regulatório, treinamento de médicos, educação pública e desenvolvimento de produtos de cannabis medicinal mais acessíveis e com base em evidências será vital para o crescimento sustentado do mercado europeu de cannabis medicinal.

Escopo do mercado de cannabis medicinal na Europa

O mercado é segmentado com base no produto, fonte, espécie, derivados, aplicação, via de administração, usuário final e canal de distribuição.

• Por produto

Com base no produto, o mercado europeu de cannabis medicinal é segmentado em óleo, cannabis medicinal seca, cápsulas de cannabis medicinal, flor inteira, flor moída, caneta vaporizadora, cremes e hidratantes, entre outros. O segmento de óleo dominou a maior fatia de mercado, com 34,6% da receita em 2024, devido à sua dosagem precisa, facilidade de administração e preferência em tratamentos de doenças crônicas.

Espera-se que o segmento de cápsulas de cannabis medicinal testemunhe a taxa de crescimento mais rápida, com um CAGR de 22,9% de 2025 a 2032, devido à melhor adesão do paciente e à expansão da prescrição para distúrbios neurológicos e relacionados à dor.

• Por fonte

Com base na origem, o mercado europeu de cannabis medicinal é segmentado em sintético e natural. O segmento natural representou a maior fatia da receita, 69,3% em 2024, impulsionado pela crescente demanda por produtos terapêuticos orgânicos e derivados de plantas.

Espera-se que o segmento sintético registre o CAGR mais rápido de 20,4% entre 2025 e 2032, devido aos avanços nas formulações de canabinoides projetados em laboratório.

• Por Espécie

Com base nas espécies, o mercado europeu de cannabis medicinal é segmentado em Cannabis Indica, Sativa e Híbrida. O segmento de Cannabis Indica detinha a maior participação de mercado, com 41,7% em 2024, sendo amplamente utilizado por suas propriedades sedativas no controle da dor e da insônia.

Espera-se que o segmento Híbrido testemunhe o CAGR mais rápido de 21,3% entre 2025 e 2032, favorecido por seus efeitos terapêuticos equilibrados.

• Por Derivativos

Com base em derivados, o mercado europeu de cannabis medicinal é segmentado em Canabidiol (CBD), Tetraidrocanabinol (THC) / Delta-8-Tetraidrocanabinol e outros. O segmento de Canabidiol (CBD) foi responsável pela maior fatia da receita, 57,8%, em 2024, devido à sua natureza não psicoativa e amplo potencial terapêutico.

O segmento de tetrahidrocanabinol (THC) deverá crescer na taxa composta de crescimento anual (CAGR) mais rápida, de 23,1%, de 2025 a 2032, impulsionado pela crescente legalização e aceitação do tratamento da dor e náusea em oncologia e cuidados paliativos.

• Por aplicação

Com base na aplicação, o mercado europeu de cannabis medicinal é segmentado em: tratamento da dor, ansiedade, espasmos musculares, náuseas, perda de apetite, câncer, artrite, doença de Alzheimer/enxaquecas, epilepsia, depressão e distúrbios do sono, esclerose múltipla, autismo, problemas de saúde mental, elevação do humor, entre outros. O segmento de tratamento da dor dominou, com uma participação de receita de 38,5% em 2024, seguido por aplicações relacionadas ao câncer, com 14,2%.

Espera-se que o segmento de epilepsia registre o CAGR mais rápido de 22,6% entre 2025 e 2032, impulsionado pelo aumento de evidências clínicas que apoiam a eficácia dos canabinoides no controle de convulsões.

• Por via de administração

Com base na via de administração, o mercado europeu de cannabis medicinal é segmentado em soluções e cápsulas orais, cigarros, vaporizadores, tópicos e outros. O segmento de soluções e cápsulas orais detinha a maior participação de mercado, 36,8% em 2024, impulsionado pela facilidade de uso e precisão da dose.

O segmento de vaporizadores deverá registrar o CAGR mais rápido de 21,5% entre 2025 e 2032, preferido por seu rápido início de ação e uso crescente entre grupos demográficos mais jovens.

• Por Usuário Final

Com base no consumidor final, o mercado europeu de cannabis medicinal é segmentado em indústria farmacêutica, centros de pesquisa e desenvolvimento, ambientes de atendimento domiciliar, hospitais, centros de reabilitação e outros. O segmento da indústria farmacêutica obteve a maior fatia da receita, de 32,4% em 2024, impulsionado pelo aumento dos ensaios clínicos e do desenvolvimento de medicamentos.

Espera-se que o segmento de atendimento domiciliar cresça na taxa composta de crescimento anual (CAGR) mais rápida, de 22,7%, entre 2025 e 2032, devido à crescente demanda por tratamentos de cannabis centrados no paciente e em casa.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado é segmentado em B2B e B2C. O segmento B2B deteve a maior participação na receita, 60,1% em 2024, impulsionado pela compra a granel por farmácias e hospitais.

Espera-se que o segmento B2C cresça a uma CAGR mais rápida, de 24,2%, entre 2025 e 2032, devido ao aumento de farmácias eletrônicas e plataformas de venda direta ao consumidor em toda a Europa.

Análise regional do mercado europeu de cannabis medicinal

- A Alemanha dominou o mercado europeu de cannabis medicinal, com a maior participação na receita, de 27,9% em 2024, impulsionada por sua estrutura regulatória estabelecida, ampla adoção por médicos e receitas médicas cobertas por planos de saúde. A forte capacidade de importação do país e a expansão da produção doméstica estão impulsionando ainda mais o acesso dos pacientes e sustentando a liderança de mercado a longo prazo.

- Os consumidores nos principais países europeus estão cada vez mais recorrendo à cannabis medicinal para dores crônicas, distúrbios neurológicos, sintomas relacionados ao câncer e suporte à saúde mental, favorecendo produtos regulamentados, como óleos, flores secas e cápsulas, por sua segurança, eficácia e acesso mediante prescrição médica.

- A crescente conscientização sobre tratamentos derivados da cannabis, o aumento da prevalência de doenças crônicas e as reformas progressivas na legislação sobre cannabis estão acelerando a demanda em todo o continente. Países como Reino Unido, França e Itália estão testemunhando um aumento na adesão de pacientes em programas de acesso à cannabis e ensaios clínicos.

Visão geral do mercado de cannabis medicinal no Reino Unido e na Europa

O mercado de cannabis medicinal do Reino Unido e da Europa obteve uma participação de 18,6% na receita do mercado europeu de cannabis medicinal em 2024, impulsionado pelo número crescente de clínicas privadas de cannabis, pela crescente conscientização e pela disposição dos pacientes em buscar tratamento fora do Serviço Nacional de Saúde (NHS). Espera-se um forte crescimento com a expansão das plataformas digitais de prescrição e maior clareza regulatória.

Visão geral do mercado de cannabis medicinal na França e na Europa

O mercado francês de cannabis medicinal representou 11,3% do mercado europeu de cannabis medicinal em 2024, apoiado por seu programa piloto nacional de cannabis medicinal e pelo crescente apoio governamental. Espera-se que a entrada total no mercado após a fase de testes impulsione significativamente o crescimento durante o período previsto.

Visão geral do mercado de cannabis medicinal na Itália e na Europa

Espera-se que o mercado italiano de cannabis medicinal na Europa apresente o maior CAGR de 9,7% em 2024, impulsionado pela produção doméstica por meio de instalações militares, pelo aumento das importações e pela demanda consistente por tratamentos para dor crônica e cuidados paliativos. A estrutura regulatória madura do país sustenta a estabilidade contínua do mercado.

Participação no mercado de cannabis medicinal na Europa

A indústria europeia de cannabis medicinal é liderada principalmente por empresas bem estabelecidas, incluindo:

- Aurora Cannabis Inc. (Canadá)

- Canopy Growth Corporation (Canadá)

- Tilray Brands, Inc. (Canadá)

- Jazz Pharmaceuticals Inc. (Irlanda)

- STENOCARE A/S (Dinamarca)

- Demecan GmbH (Alemanha)

- Wayland Group Corp. (Alemanha)

- Cannamedical Pharma GmbH (Alemanha)

- Bedrocan International BV (Holanda)

- Panaxia Pharmaceutical Industries Ltd. (Israel)

- IM Cannabis Corp. (Israel)

- Little Green Pharma Ltd. (Austrália)

- PharmaCielo Ltd. (Canadá)

- Khiron Life Sciences Corp. (Colômbia)

- Althea Group Holdings Ltd. (Austrália)

Últimos desenvolvimentos no mercado europeu de cannabis medicinal

- Em maio de 2024 , a Lei da Cannabis da Alemanha entrou em vigor, reclassificando a cannabis de narcótico para medicamento reconhecido. Essa mudança regulatória possibilitou consultas por telemedicina, receitas simplificadas e a legalidade do cultivo e porte pessoal, catalisando o rápido crescimento do mercado. O número de pacientes na Alemanha disparou de 250.000 em abril de 2024 para quase 900.000 em maio de 2025, com a projeção de que o mercado ultrapassará EUR 1 bilhão (~USD 1,1 bilhão) em vendas durante todo o ano.

- Em janeiro de 2025 , a Aurora Cannabis anunciou o lançamento de sua primeira cannabis medicinal cultivada na Alemanha sob sua marca IndiMed, sinalizando crescente integração vertical e estratégias de fornecimento local no mercado europeu

- Em junho de 2024 , a Glass Pharms tornou-se o primeiro produtor sediado no Reino Unido a entregar flores de cannabis cultivadas localmente e licenciadas pela MHRA via correio, marcando um marco nas capacidades de produção e distribuição nacionais da Europa.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe MEDICAL CANNABIS market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- PRODUCT LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market application coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- EUROPE MEDICAL CANNABIS MARKET: REGULATIONS

- UNITED STATES

- CANADA

- AUSTRALIA

- THAILAND

- EUROPE MEDICAL CANNABIS MARKET: SUPPLY CHAIN ANALYSIS

- CULTIVATORS AND GROWERS

- MANUFACTURER AND PRODUCER

- TESTERS

- WHOLESALE AND DISTRIBUTORS

- RETAILERS

- Market Overview

- DRIVERS

- INCREASED MEDICINAL USE

- LEGALIZATION OF CANNABIS

- INITIATIVES TAKEN BY MANUFACTURERS

- INCREASED USAGE OF CANNABIS SEEDS IN COSMETIC PRODUCTS

- FUNCTIONAL PROPERTIES OF CANNABIS AND THEIR INCREASED USE IN DIFFERENT INDUSTRIES

- RESTRAINTS

- COMPLEX REGULATORY STRUCTURE FOR USAGE OF CANNABIS

- LONG TERM USE CAN CAUSE ADVERSE EFFECTS

- HIGH COST

- OPPORTUNITIES

- NOVEL PRODUCT DEVELOPMENT WITH INCREASING R & D ACTIVITIES

- INCREASED ADOPTION OF CANNABIS FOR RECREATIONAL PURPOSE

- GROWING GERIATRIC POPULATION

- INCREASING PREVALENCE OF CHRONIC DISEASES

- CHALLENGES

- RISE OF MARIJUANA BLACK MARKET

- SIDE EFFECTS RELATED TO THE USE OF CANNABIS

- SHORTAGE OF PERSONNEL

- IMPACT OF COVID-19 ON EUROPE MEDICAL CANNABIS MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY

- KEY INITIATIVES BY MARKET PLAYER DURING COVID 19

- CONCLUSION:

- EUROPE MEDICAL CANNABIS MARKET, BY product

- overview

- oil

- By Type

- CBD Oil Concentrates

- CBD Vape Oil

- CBD Tinctures

- By Source

- Marijuana Based

- Hemp Based

- By Species

- Sativa

- Hybrid

- Cannabis Indica

- Dried Medical cannabis

- Cannabis Indica

- Sativa

- Hybrid

- medical cannabis capsules

- By Type

- Oil Based Cannabis Capsules

- Power Based Cannabis Capsules

- Others

- By Concentrates

- High CBD Capsules Digital

- High THC Capsule

- THC/CBD balanced capsule

- CBD Isolate Capsule

- By Species

- Sativa

- Hybrid

- Cannabis Indica

- vape pen

- Cannabis Indica

- Sativa

- Hybrid

- whole flower

- Sativa

- Hybrid

- Cannabis Indica

- CREAMS & MOISTURIZER

- Ground Flower

- Sativa

- Cannabis Indica

- Hybrid

- patch

- mask & serum

- cleanser

- others

- EUROPE MEDICAL CANNABIS MARKET, BY application

- overview

- pain management

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Patch

- Ground Flower

- Creams & Moisturizer

- Vape Pen

- Whole Flower

- Masks & Serum

- Cleanser

- Others

- anxiety

- Oil

- Dried Medical Cannabis

- Medical cannabis and capsules

- Ground Flower

- Vape Pen

- Whole Flower

- Others

- muscle spasms

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Patch

- Creams & Moisturizer

- Ground Flower

- Vape Pen

- Whole Flower

- Masks & Serum

- Cleanser

- Others

- nausea

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Ground Flower

- Creams & Moisturizer

- Patch

- Vape Pen

- Whole Flower

- Masks & Serum

- Cleanser

- Others

- appetite loss

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Ground Flower

- Whole Flower

- Vape Pen

- Patch

- Others

- cancer

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Patch

- Ground Flower

- Vape Pen

- Whole Flower

- Others

- arthritis

- Oil

- Medical cannabis and capsules

- Dried Medical Cannabis

- Patch

- Ground Flower

- Creams & Moisturizer

- Masks & Serum

- Whole Flower

- Vape Pen

- Cleanser

- Others

- alzheimer’s disease/Migranes

- Oil

- Dried Medical Cannabis

- Medical cannabis and capsules

- Patch

- Ground Flower

- Vape Pen

- Whole Flower

- Others

- epilepsy

- Oil

- Medical cannabis and capsules

- Others

- depression and sleep disorders

- Oil

- Dried Medical Cannabis

- Medical cannabis and capsules

- Patch

- Creams & Moisturizer

- Others

- multiple sclerosis

- Oil

- Dried Medical Cannabis

- Medical cannabis and capsules

- Patch

- Ground Flower

- Vape Pen

- Whole Flower

- Others

- autism

- Oil

- Medical cannabis and capsules

- Others

- mental health conditions

- Oil

- Medical cannabis and capsules

- Others

- elevate Mood

- Oil

- Dried Medical Cannabis

- Medical cannabis and capsules

- Patch

- Creams & Moisturizer

- Masks & Serum

- Cleanser

- Others

- others

- EUROPE MEDICAL CANNABIS MARKET, BY derivatives

- overview

- CANNABIDIOL (CBD)

- Oil

- Medical Cannabis Capsules

- Ground Flower

- Patch

- Creams & Moisturizer

- Vape Pen

- Whole Flower

- Masks & Serum

- Cleanser

- Others

- tetrahydrocannabinol (thc)/Delta-8-TETRAHYDROCANNABINOL

- Oil

- Medical Cannabis Capsules

- Dried Medical Cannabis

- Ground Flower

- Patch

- Creams & Moisturizer

- Whole Flower

- Vape Pen

- Masks & Serum

- Cleanser

- Others

- CANNABIGEROL (CBG)

- Oil

- Whole Flower

- Medical cannabis and capsules

- Cleanser

- cannabinol (CBN)

- others

- EUROPE MEDICAL CANNABIS MARKET, BY source

- overview

- natural

- synthetic

- EUROPE MEDICAL CANNABIS MARKET, BY species

- overview

- sativa

- hybrid

- cannabis indica

- EUROPE MEDICAL CANNABIS MARKET, BY route of administration

- overview

- oral solutions and capsules

- smoking

- topicals

- vaporizers

- others

- EUROPE MEDICAL CANNABIS MARKET, BY end user

- overview

- homecare setting

- hospital

- rehab centers

- PHARMACEUTICAL INDUSTRY

- research and development centers

- others

- EUROPE MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL

- overview

- B2C

- Pharmacies

- Conventional Stores

- Online Stores

- Others

- B2B

- Europe medical cannabis MARKET by geography

- europe

- germany

- italy

- u.k.

- NETHERLANDS

- switzerland

- france

- russia

- spain

- belgium

- rest of europe

- Europe Medical Cannabis market: COMPANY landscape

- company share analysis: Europe

- Swot analysis

- company profile

- MEDIPHARM LABS INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- APHRIA INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- tilray

- COMPANY SNAPSHOT

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Zenabis Europe Ltd.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AURORA CANNABIS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- gw pharmaceuticals plc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Althea Company Pty Ltd (A subsidiary of Althea Group)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Apothecanna

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- bARNEY’S FARM

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Bioactive solutions, inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- bol pharma

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CANNABIS SEEDS USA

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- canopy growth corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Cresco Labs

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Crop King Seeds

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- discover health llc

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- EcoGen Biosciences

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Elixinol Europe limited

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- endoca

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- EXTRACTAS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- FOLIUM BIOSCIENCES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GREENWICH BIOSCIENCES, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HARMONY

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HUMBOLDT SEED COMPANY

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- IDT AUSTRALIA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- kiehl’s (a subsidiary of L'Oréal)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- mary’s nutritionals, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- medical marijuana, inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MEDIFARM

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- pacific roots

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- pharmahemp

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- pure ratios

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PEACE NATURALS PROJECT INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- seed Cellar

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SEEDS FOR ME

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- THC EUROPE GROUP LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- upstate elevator supply co.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- vermont hemp health

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

Lista de Tabela

TABLE 1 Annual Cost of Cultivation:

TABLE 2 Annual Cost of Manufacturing:

TABLE 3 NEUROLOGICAL CONDITIONS FOR WHICH CANNABIS-BASED TREATMENTS HAVE BEEN EMPLOYED

TABLE 26 Europe MEDICAL CANNABIS market, By application, 2019-2028 (USD million)

TABLE 27 EUROPE PAIN MANAGEMENT IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 28 Europe Pain Management in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 29 EUROPE PAIN MANAGEMENT IN MEDICAL CANNABIS market, by anxiety, By Region, 2021-2028 (USD Million)

TABLE 30 Europe Pain Management in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 31 EUROPE muscle spasms IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 32 Europe muscle spasms in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 33 EUROPE nausea IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 34 Europe nausea in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 35 EUROPE appetite loss IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 36 Europe appetite loss in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 37 EUROPE cancer IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 38 Europe cancer in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 39 EUROPE arthritis IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 40 Europe arthritis in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 41 EUROPE ALZHEIMER’S DISEASE/MIGRANES IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 42 Europe ALZHEIMER’S DISEASE/MIGRANES in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 43 EUROPE epilepsy IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 44 Europe epilepsy in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 45 EUROPE depression and sleep disorders IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 46 Europe depression and sleep disorders in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 47 EUROPE multiple sclerosis IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 48 Europe multiple sclerosis in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 49 EUROPE autism IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 50 Europe autism in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 51 EUROPE mental health conditions IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 52 Europe mental health conditions in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 53 EUROPE elevate mood IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 54 Europe elevate mood in Medical Cannabis Market , By Application, 2019-2028 (USD Million)

TABLE 55 EUROPE others IN MEDICAL CANNABIS market, by PAIN MANAGEMENT, By Region, 2021-2028 (USD Million)

TABLE 65 Europe medical cannabis Market, BY source, 2019-2028 (USD MILLION)

TABLE 66 Europe natural in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 67 Europe synthetic in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 68 Europe medical cannabis Market, By Species, 2019-2028 (USD Million)

TABLE 69 Europe sativa in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 70 Europe hybrid in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 71 Europe cannabis indica in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 72 Europe medical cannabis Market, By route of administration, 2019-2028 (USD Million)

TABLE 73 Europe oral solutions and capsules in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 74 Europe smoking in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 75 Europe topicals in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 76 Europe vaporizers in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 77 Europe others in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 78 Europe medical cannabis Market, BY end user, 2019-2028 (USD MILLION)

TABLE 79 Europe homecare setting in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 80 Europe hospital in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 81 Europe rehab centers in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 82 Europe pharmaceutical industry in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 83 Europe research and development centers in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 84 Europe others in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 85 Europe medical cannabis Market, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 86 Europe b2c in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 87 Europe b2C in medical cannabis Market, By distribution channel, 2019-2028 (USD Million)

TABLE 88 Europe b2b in medical cannabis Market, By Region, 2019-2028 (USD Million)

TABLE 89 europe medical cannabis Market, By COUNTRY, 2021-2028 (USD million)

TABLE 90 EUROPE medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 91 EUROPE type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 92 EUROPE source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 93 EUROPE species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 94 EUROPE dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 95 EUROPE type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 96 EUROPE concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 97 EUROPE species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 98 EUROPE vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 99 EUROPE whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 100 EUROPE ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 101 EUROPE medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 102 EUROPE medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 103 EUROPE medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 104 EUROPE cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 105 EUROPE tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 106 EUROPE cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 107 EUROPE medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 108 EUROPE pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 109 EUROPE anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 110 EUROPE muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 111 EUROPE nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 112 EUROPE appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 113 EUROPE cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 114 EUROPE arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 115 EUROPE alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 116 EUROPE epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 117 EUROPE depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 118 EUROPE multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 119 EUROPE autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 120 EUROPE mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 121 EUROPE elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 122 EUROPE medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 123 EUROPE medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 124 EUROPE medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 125 EUROPE B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 126 GERMANY medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 127 GERMANY type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 128 GERMANY source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 129 GERMANY species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 130 GERMANY dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 131 GERMANY type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 132 GERMANY concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 133 GERMANY species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 134 GERMANY vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 135 GERMANY whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 136 GERMANY ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 137 GERMANY medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 138 GERMANY medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 139 GERMANY medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 140 GERMANY cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 141 GERMANY tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 142 GERMANY cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 143 GERMANY medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 144 GERMANY pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 145 GERMANY anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 146 GERMANY muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 147 GERMANY nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 148 GERMANY appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 149 GERMANY cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 150 GERMANY arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 151 GERMANY alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 152 GERMANY epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 153 GERMANY depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 154 GERMANY multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 155 GERMANY autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 156 GERMANY mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 157 GERMANY elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 158 GERMANY medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 159 GERMANY medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 160 GERMANY medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 161 GERMANY B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 162 ITALY medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 163 ITALY type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 164 ITALY source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 165 ITALY species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 166 ITALY dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 167 ITALY type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 168 ITALY concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 169 ITALY species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 170 ITALY vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 171 ITALY whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 172 ITALY ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 173 ITALY medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 174 ITALY medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 175 ITALY medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 176 ITALY cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 177 ITALY tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 178 ITALY cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 179 ITALY medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 180 ITALY pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 181 ITALY anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 182 ITALY muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 183 ITALY nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 184 ITALY appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 185 ITALY cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 186 ITALY arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 187 ITALY alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 188 ITALY epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 189 ITALY depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 190 ITALY multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 191 ITALY autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 192 ITALY mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 193 ITALY elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 194 ITALY medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 195 ITALY medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 196 ITALY medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 197 ITALY B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 198 U.K. medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 199 U.K. type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 200 U.K. source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 201 U.K. species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 202 U.K. dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 203 U.K. type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 204 U.K. concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 205 U.K. species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 206 U.K. vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 207 U.K. whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 208 U.K. ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 209 U.K. medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 210 U.K. medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 211 U.K. medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 212 U.K. cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 213 U.K. tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 214 U.K. cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 215 U.K. medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 216 U.K. pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 217 U.K. anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 218 U.K. muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 219 U.K. nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 220 U.K. appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 221 U.K. cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 222 U.K. arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 223 U.K. alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 224 U.K. epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 225 U.K. depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 226 U.K. multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 227 U.K. autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 228 U.K. mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 229 U.K. elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 230 U.K. medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 231 U.K. medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 232 U.K. medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 233 U.K. B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 234 NETHERLANDS medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 235 NETHERLANDS type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 236 NETHERLANDS source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 237 NETHERLANDS species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 238 NETHERLANDS dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 239 NETHERLANDS type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 240 NETHERLANDS concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 241 NETHERLANDS species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 242 NETHERLANDS vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 243 NETHERLANDS whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 244 NETHERLANDS ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 245 NETHERLANDS medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 246 NETHERLANDS medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 247 NETHERLANDS medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 248 NETHERLANDS cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 249 NETHERLANDS tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 250 NETHERLANDS cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 251 NETHERLANDS medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 252 NETHERLANDS pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 253 NETHERLANDS anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 254 NETHERLANDS muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 255 NETHERLANDS nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 256 NETHERLANDS appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 257 NETHERLANDS cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 258 NETHERLANDS arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 259 NETHERLANDS alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 260 NETHERLANDS epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 261 NETHERLANDS depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 262 NETHERLANDS multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 263 NETHERLANDS autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 264 NETHERLANDS mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 265 NETHERLANDS elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 266 NETHERLANDS medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 267 NETHERLANDS medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 268 NETHERLANDS medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 269 NETHERLANDS B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 270 SWITZERLAND medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 271 SWITZERLAND type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 272 SWITZERLAND source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 273 SWITZERLAND species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 274 SWITZERLAND dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 275 SWITZERLAND type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 276 SWITZERLAND concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 277 SWITZERLAND species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 278 SWITZERLAND vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 279 SWITZERLAND whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 280 SWITZERLAND ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 281 SWITZERLAND medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 282 SWITZERLAND medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 283 SWITZERLAND medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 284 SWITZERLAND cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 285 SWITZERLAND tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 286 SWITZERLAND cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 287 SWITZERLAND medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 288 SWITZERLAND pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 289 SWITZERLAND anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 290 SWITZERLAND muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 291 SWITZERLAND nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 292 SWITZERLAND appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 293 SWITZERLAND cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 294 SWITZERLAND arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 295 SWITZERLAND alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 296 SWITZERLAND epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 297 SWITZERLAND depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 298 SWITZERLAND multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 299 SWITZERLAND autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 300 SWITZERLAND mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 301 SWITZERLAND elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 302 SWITZERLAND medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 303 SWITZERLAND medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 304 SWITZERLAND medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 305 SWITZERLAND B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 306 FRANCE medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 307 FRANCE type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 308 FRANCE source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 309 FRANCE species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 310 FRANCE dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 311 FRANCE type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 312 FRANCE concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 313 FRANCE species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 314 FRANCE vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 315 FRANCE whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 316 FRANCE ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 317 FRANCE medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 318 FRANCE medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 319 FRANCE medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 320 FRANCE cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 321 FRANCE tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 322 FRANCE cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 323 FRANCE medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 324 FRANCE pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 325 FRANCE anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 326 FRANCE muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 327 FRANCE nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 328 FRANCE appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 329 FRANCE cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 330 FRANCE arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 331 FRANCE alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 332 FRANCE epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 333 FRANCE depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 334 FRANCE multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 335 FRANCE autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 336 FRANCE mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 337 FRANCE elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 338 FRANCE medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 339 FRANCE medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 340 FRANCE medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 341 FRANCE B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 342 RUSSIA medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 343 RUSSIA type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 344 RUSSIA source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 345 RUSSIA species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 346 RUSSIA dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 347 RUSSIA type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 348 RUSSIA concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 349 RUSSIA species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 350 RUSSIA vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 351 RUSSIA whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 352 RUSSIA ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 353 RUSSIA medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 354 RUSSIA medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 355 RUSSIA medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 356 RUSSIA cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 357 RUSSIA tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 358 RUSSIA cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 359 RUSSIA medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 360 RUSSIA pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 361 RUSSIA anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 362 RUSSIA muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 363 RUSSIA nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 364 RUSSIA appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 365 RUSSIA cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 366 RUSSIA arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 367 RUSSIA alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 368 RUSSIA epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 369 RUSSIA depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 370 RUSSIA multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 371 RUSSIA autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 372 RUSSIA mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 373 RUSSIA elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 374 RUSSIA medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 375 RUSSIA medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 376 RUSSIA medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 377 RUSSIA B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 378 SPAIN medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 379 SPAIN type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 380 SPAIN source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 381 SPAIN species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 382 SPAIN dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 383 SPAIN type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 384 SPAIN concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 385 SPAIN species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 386 SPAIN vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 387 SPAIN whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 388 SPAIN ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 389 SPAIN medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 390 SPAIN medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 391 SPAIN medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 392 SPAIN cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 393 SPAIN tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 394 SPAIN cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 395 SPAIN medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 396 SPAIN pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 397 SPAIN anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 398 SPAIN muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 399 SPAIN nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 400 SPAIN appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 401 SPAIN cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 402 SPAIN arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 403 SPAIN alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 404 SPAIN epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 405 SPAIN depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 406 SPAIN multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 407 SPAIN autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 408 SPAIN mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 409 SPAIN elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 410 SPAIN medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 411 SPAIN medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 412 SPAIN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 413 SPAIN B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 414 BELGIUM medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 415 BELGIUM type in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 416 BELGIUM source in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 417 BELGIUM species in oil in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 418 BELGIUM dried medical cannabs in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 419 BELGIUM type in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 420 BELGIUM concentrates in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 421 BELGIUM species in medical cannabis capsules in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 422 BELGIUM vape pen in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 423 BELGIUM whole flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 424 BELGIUM ground flower in medical cannabis Market, By product, 2021-2028 (USD million)

TABLE 425 BELGIUM medical cannabis Market, By source, 2021-2028 (USD million)

TABLE 426 BELGIUM medical cannabis Market, By species, 2021-2028 (USD million)

TABLE 427 BELGIUM medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 428 BELGIUM cannabidiol (cbd) medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 429 BELGIUM tetrahydrocannabinol (thc)/delt-8-tethydrocannabinol in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 430 BELGIUM cannabigerol (cbg) in medical cannabis Market, By derivatives, 2021-2028 (USD million)

TABLE 431 BELGIUM medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 432 BELGIUM pain management in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 433 BELGIUM anxiety in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 434 BELGIUM muscle spasms in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 435 BELGIUM nausea in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 436 BELGIUM appetite loss in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 437 BELGIUM cancer in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 438 BELGIUM arthritis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 439 BELGIUM alzheimer’s disease/migranes in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 440 BELGIUM epilepsy in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 441 BELGIUM depression and sleep disroder in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 442 BELGIUM multiple sclerosis in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 443 BELGIUM autism in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 444 BELGIUM mental health conditions in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 445 BELGIUM elevate mood in medical cannabis Market, By application, 2021-2028 (USD million)

TABLE 446 BELGIUM medical cannabis Market, By route of administration, 2021-2028 (USD million)

TABLE 447 BELGIUM medical cannabis Market, By end user, 2021-2028 (USD million)

TABLE 448 BELGIUM medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 449 BELGIUM B2C IN medical cannabis Market, By distribution channel, 2021-2028 (USD million)

TABLE 450 rest of europe medical cannabis Market, By product, 2021-2028 (USD million)

Lista de Figura

FIGURE 1 Europe medical cannabis market: segmentation

FIGURE 2 Europe medical cannabis market: data triangulation

FIGURE 3 Europe medical cannabis market: DROC ANALYSIS

FIGURE 4 Europe medical cannabis market : Europe vs REGIONAL MARKET ANALYSIS

FIGURE 5 Europe medical cannabis market : COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe medical cannabis market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe medical cannabis market: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE medical cannabis MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 Europe medical cannabis market: vendor share analysis

FIGURE 10 Europe medical cannabis market: SEGMENTATION

FIGURE 11 increasing medicinal use and legalization of medical cannabis are expected to drive THE Europe medical cannabis market IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 oil segment is expected to account for the largest share of the Europe medical cananbis market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE MEDICAL CANNABIS MARKET

FIGURE 14 Europe MEDICAL CANNABIS market: BY product, 2020

FIGURE 15 Europe MEDICAL CANNABIS market: BY product, 2021-2028 (USD Million)

FIGURE 16 Europe MEDICAL CANNABIS market: BY product, CAGR (2021-2028)

FIGURE 17 Europe MEDICAL CANNABIS market: BY product, LIFELINE CURVE

FIGURE 18 Europe MEDICAL CANNABIS market: BY application, 2020

FIGURE 19 Europe MEDICAL CANNABIS market: BY application, 2021-2028 (USD Million)

FIGURE 20 Europe MEDICAL CANNABIS market: BY application, CAGR (2021-2028)

FIGURE 21 Europe MEDICAL CANNABIS market: BY application, LIFELINE CURVE

FIGURE 22 Europe MEDICAL CANNABIS market: BY DERIVATIVES, 2020

FIGURE 23 Europe MEDICAL CANNABIS market: BY DERIVATIVES, 2021-2028 (USD Million)

FIGURE 24 Europe MEDICAL CANNABIS market: BY DERIVATIVES, CAGR (2021-2028)

FIGURE 25 Europe MEDICAL CANNABIS market: BY DERIVATIVES, LIFELINE CURVE

FIGURE 26 Europe MEDICAL CANNABIS market: BY source, 2020

FIGURE 27 Europe MEDICAL CANNABIS market: BY source, 2021-2028 (USD Million)

FIGURE 28 Europe MEDICAL CANNABIS market: BY source, CAGR (2021-2028)

FIGURE 29 Europe MEDICAL CANNABIS market: BY source, LIFELINE CURVE

FIGURE 30 Europe MEDICAL CANNABIS market: BY species, 2020