Europe Refinery Catalyst Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

920.00 Million

USD

1,360.00 Million

2024

2032

USD

920.00 Million

USD

1,360.00 Million

2024

2032

| 2025 –2032 | |

| USD 920.00 Million | |

| USD 1,360.00 Million | |

|

|

|

|

Segmentação do mercado de catalisadores para refinarias na Europa, por tipo (hidrotratamento, craqueamento catalítico fluidizado (FCC), craqueamento catalítico fluidizado de resíduos (RFCC), hidrocraqueamento e outros), catalisador (produtos químicos, zeólitas e metais), aplicação (diesel, querosene, desparafinação destilada e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de catalisadores de refinaria na Europa

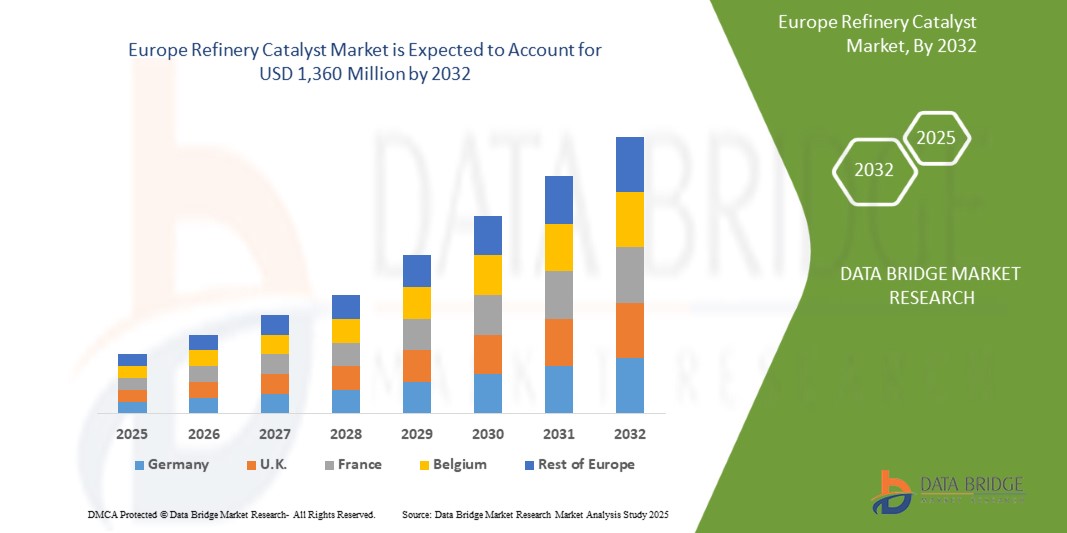

- O mercado europeu de catalisadores para refinarias foi avaliado em US$ 920 milhões em 2024 e deverá atingir US$ 1.360 milhões até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 5,08%, impulsionado principalmente pela crescente demanda por combustíveis mais limpos

- Este crescimento é impulsionado por fatores como a crescente procura por combustíveis mais limpos e regulamentações ambientais mais rigorosas

Análise do Mercado de Catalisadores de Refinaria na Europa

- O mercado de catalisadores para refinarias está em expansão global, impulsionado pela crescente demanda por combustíveis mais limpos e por regulamentações ambientais mais rigorosas. Os catalisadores para refinarias desempenham um papel crucial na melhoria da qualidade do combustível, na otimização das operações das refinarias e na redução de emissões.

- À medida que os governos impõem limites mais rigorosos ao teor de enxofre e metas de redução de carbono, as refinarias estão investindo cada vez mais em tecnologias catalíticas avançadas para atender à conformidade e melhorar a eficiência.

- A procura por catalisadores de refinaria é significativamente influenciada pela mudança global em direção a combustíveis com baixo teor de enxofre e ultrabaixo teor de enxofre, especialmente na produção de diesel e gasolina

- Esses catalisadores são vitais nos processos de hidroprocessamento, craqueamento catalítico fluido (FCC) e alquilação para atender aos padrões modernos de combustível e melhorar as margens das refinarias.

- A região Ásia-Pacífico se destaca como o mercado dominante para catalisadores de refinaria, impulsionada pela rápida industrialização, crescimento urbano e aumento da propriedade de veículos. Países como China e Índia estão investindo pesadamente em modernização e expansão de refinarias, impulsionando a demanda por soluções catalíticas.

- Globalmente, os catalisadores de hidroprocessamento lideram o mercado devido ao seu papel crucial na remoção de enxofre e na melhoria da estabilidade do combustível. Enquanto isso, os catalisadores FCC estão ganhando destaque, pois proporcionam maior rendimento de gasolina e ajudam as refinarias a se adaptarem às mudanças nos tipos de matéria-prima.

- O futuro do mercado parece promissor, com avanços na nanotecnologia e no processamento de matérias-primas renováveis abrindo caminho para a inovação de catalisadores de última geração

Escopo do Relatório e Segmentação do Mercado de Catalisadores de Refinaria na Europa

|

Atributos |

Principais insights do mercado de catalisadores de refinaria na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de catalisadores de refinaria na Europa

“Avanços Tecnológicos e Conformidade Ambiental”

- Uma tendência proeminente no mercado global de catalisadores de refinaria é a ênfase crescente em avanços tecnológicos e conformidade ambiental

- O setor está vivenciando um crescimento significativo, impulsionado pela crescente necessidade de combustíveis mais limpos e pela adesão a rigorosas regulamentações ambientais. Os catalisadores de refinaria são essenciais para aprimorar a qualidade do combustível, reduzir as emissões e garantir a conformidade regulatória em mercados globais.

- Por exemplo, em setembro de 2023, a BASF lançou um catalisador FCC de última geração, projetado para reduzir as emissões de enxofre e, ao mesmo tempo, maximizar o rendimento da gasolina. Essa inovação está alinhada às exigências ambientais globais e destaca a mudança do setor em direção a operações de refino sustentáveis.

- Os catalisadores modernos usados no hidroprocessamento e no craqueamento catalítico de fluidos estão cada vez mais incorporando nanotecnologia e materiais inteligentes para aumentar a eficiência, reduzir a formação de coque e prolongar a vida útil do catalisador.

- A crescente demanda por processos de refino ecologicamente corretos está impulsionando o mercado global de catalisadores de refinaria, alinhando-se às políticas governamentais que visam a descarbonização e a produção de energia mais limpa.

- Esta tendência está a fomentar o investimento em I&D, a expandir as oportunidades de mercado e a acelerar a transição para operações de refinaria mais sustentáveis em todo o mundo.

Dinâmica do Mercado de Catalisadores de Refinaria na Europa

Motorista

“Regulamentações ambientais rigorosas e demanda por combustíveis mais limpos”

- A busca global por energia mais limpa está impulsionando significativamente o mercado de catalisadores para refinarias. Regulamentações ambientais mais rigorosas, como mandatos de baixo teor de enxofre e metas de emissão de carbono, estão obrigando as refinarias a atualizar seus processos catalíticos.

- Os catalisadores desempenham um papel fundamental nas operações de refino, melhorando a eficiência do combustível, reduzindo as emissões e aprimorando a qualidade do rendimento. À medida que os países adotam políticas para reduzir a poluição do ar e fazer a transição para uma energia mais sustentável, a demanda por catalisadores avançados para refinarias está aumentando.

Por exemplo,

- Em 2023, a BASF lançou seu catalisador Fourtiva™ FCC, projetado para aumentar o rendimento do butileno e, ao mesmo tempo, minimizar a produção de gás seco e coque, alinhando-se às metas globais para uma produção de combustível mais limpa e impacto ambiental reduzido.

- O aumento da conformidade ambiental e das iniciativas de combustíveis mais limpos é um importante impulsionador do mercado global de catalisadores para refinarias. Seu alinhamento com as metas de sustentabilidade, emissões mais limpas e estratégias de transição energética torna os catalisadores indispensáveis. À medida que governos e indústrias em todo o mundo priorizam o refino ecologicamente correto, os catalisadores desempenham um papel fundamental na modernização das operações e na garantia de uma infraestrutura energética preparada para o futuro.

Oportunidade

“Inovação em Formulações de Catalisadores”

- A inovação em formulações de catalisadores representa uma oportunidade de crescimento significativa para o mercado de catalisadores de refinaria, permitindo que as empresas melhorem a eficiência, reduzam o impacto ambiental e atendam a regulamentações cada vez mais rigorosas.

- Ao desenvolver catalisadores avançados com maior seletividade, maior vida útil e melhor estabilidade térmica, as refinarias podem otimizar seus processos para obter a produção máxima, minimizando custos e emissões.

- Além disso, a introdução de catalisadores sustentáveis e ecológicos estará alinhada com o crescente foco global na responsabilidade ambiental

Por exemplo,

- De acordo com um relatório da World Refining, o mercado de catalisadores para refinarias testemunhou inovações significativas com o desenvolvimento de catalisadores de base biológica que são mais eficientes em termos energéticos e produzem menos poluentes, abordando preocupações económicas e ambientais.

- Um artigo recente da Chemicals Today destacou a introdução de uma nova geração de catalisadores avançados à base de zeólita, projetados para aprimorar os processos de craqueamento e reforma em refinarias. Esses catalisadores não apenas melhoram o rendimento do produto, mas também reduzem o consumo de energia, representando uma grande oportunidade para as refinarias que buscam atender às demandas regulatórias e de mercado.

- A inovação em formulações de catalisadores oferece oportunidades substanciais, melhorando a eficiência operacional, reduzindo custos, alinhando-se às metas de sustentabilidade ambiental e aprimorando a qualidade do produto. Os operadores de refinarias podem aproveitar esses avanços para se manterem competitivos, atender às demandas regulatórias e contribuir para os esforços globais de sustentabilidade, impulsionando assim o crescimento do mercado de catalisadores para refinarias.

Restrição/Desafio

“Altos custos de matérias-primas na produção de catalisadores”

- O mercado de catalisadores de refinaria depende fortemente de matérias-primas raras e de alto custo, como zeólitas, metais de terras raras e alumina, que estão sujeitas a flutuações globais de preços e restrições na cadeia de suprimentos.

- Esses altos custos impactam diretamente as despesas de produção, representando um desafio tanto para os fabricantes de catalisadores quanto para os usuários finais. Os produtores menores, em particular, têm dificuldade para absorver o aumento dos custos, o que pode afetar a competitividade, as estratégias de preços e a disponibilidade dos produtos.

- Além disso, fatores geopolíticos, regulamentações ambientais e fontes limitadas de mineração contribuem para a volatilidade desses materiais, complicando o planejamento e o investimento de longo prazo.

Por exemplo,

- Em novembro de 2023, o ICIS News relatou um aumento significativo no preço de elementos de terras raras, especialmente lantânio e cério, devido a restrições à exportação e interrupções na cadeia de suprimentos nos principais países produtores. Esses metais são essenciais na produção de catalisadores de FCC (craqueamento catalítico fluido), tornando o aumento de custo um desafio substancial para os fabricantes de catalisadores.

- Um artigo de março de 2024 da Chemical & Engineering News destacou a alta nos preços da alumina devido ao aumento dos custos de energia e à escassez de matéria-prima. Como a alumina serve como um material de suporte essencial em muitos catalisadores de refinaria, esse aumento de preço pressionou os fabricantes a absorver os custos ou repassá-los às refinarias, resultando em margens mais estreitas e potenciais reduções nos gastos com P&D.

- Os altos custos das matérias-primas atuam como um grande entrave, elevando os custos de produção, reduzindo as margens de lucro e limitando a inovação. Esses desafios são particularmente graves para produtores menores, que não têm escala para negociar termos de aquisição favoráveis.

- A volatilidade nos preços das matérias-primas também pode levar a flutuações nos preços dos catalisadores, afetando os orçamentos operacionais e as decisões de investimento das refinarias, influenciando, em última análise, a trajetória geral de crescimento do mercado de catalisadores para refinarias.

Escopo do mercado de catalisadores de refinaria na Europa

O mercado é segmentado com base no tipo, catalisador e aplicação.

|

Segmentação |

Sub-segmentação |

|

Tipo |

|

|

Catalisador |

|

|

Aplicativo |

|

- Análise regional do mercado de catalisadores de refinaria

“A Alemanha é o país dominante no mercado de catalisadores de refinaria”

- Espera-se que a Alemanha domine o mercado de catalisadores de refinaria, impulsionada pela rápida industrialização, expansão da capacidade de refino e forte presença de importantes participantes do mercado

- Fatores como o aumento da demanda de energia, o apoio governamental à produção de combustível mais limpo, o aumento do consumo de combustível e a modernização das refinarias existentes contribuem para a liderança da região

“A Alemanha deverá registar a maior taxa de crescimento”

- Espera-se que a região da Alemanha testemunhe a maior taxa de crescimento no mercado de catalisadores de refinaria, impulsionada pela crescente demanda de energia, regulamentações ambientais e iniciativas de modernização de refinarias

- A Alemanha domina devido ao seu enorme setor de refino, fortes iniciativas governamentais para a produção de combustível com teor ultrabaixo de enxofre, avanços tecnológicos e pesquisa e desenvolvimento robustos de catalisadores.

Participação de mercado de catalisadores de refinaria

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Corporação de Petróleo e Química da China (China)

- Exxon Mobil Corporation (EUA)

- Shell (Holanda)

- Antenchem (China)

- Ketjen (EUA)

- Gazpromneft - Lubrificantes Ltda. (Rússia)

- Honeywell International Inc. (EUA)

- Axens (França)

- BASF (Alemanha)

- Johnson Matthey (Reino Unido)

- Clariant (Suíça)

- Arkema (França)

- JGC HOLDINGS CORPORATION (Japão)

- Dow (EUA)

Últimos desenvolvimentos no mercado europeu de catalisadores de refinaria

- Em dezembro de 2024, a Shell Catalysts & Technologies e a Yilkins firmaram uma parceria para aprimorar a produção de Combustível Sustentável para Aviação (SAF). Essa colaboração visa aprimorar a eficiência e a sustentabilidade da produção de SAF por meio de tecnologias catalíticas avançadas. A parceria alavancará a expertise da Shell em catalisadores, juntamente com as soluções inovadoras da Yilkins, para apoiar a transição da indústria da aviação para alternativas de combustível mais sustentáveis.

- Em dezembro de 2023, a Johnson Matthey firmou uma parceria com a Basecamp Research para acelerar a adoção de soluções de biocatálise. Essa colaboração combina a expertise da Johnson Matthey em catálise com o mapeamento genético da biodiversidade habilitado por IA da Basecamp para atender à crescente demanda nas indústrias farmacêutica e química. A parceria visa expandir as soluções de biocatálise, reduzindo o consumo de energia e o desperdício nos setores farmacêutico e agroquímico.

- Em março de 2022, a ExxonMobil Catalysts and Licensing LLC e a KBR anunciaram uma colaboração para aprimorar a tecnologia de desidrogenação de propano (PDH), integrando o catalisador proprietário da ExxonMobil com a tecnologia K-PRO PDH da KBR, com o objetivo de converter propano em propileno de forma mais eficiente. Espera-se que essa solução combinada ofereça economia financeira e reduza o consumo de energia em comparação com as tecnologias PDH existentes. A parceria aproveita mais de 50 anos de experiência de ambas as empresas no desenvolvimento de catalisadores e projetos de plantas. Doug Kelly, Presidente de Tecnologia da KBR, destacou os benefícios potenciais para clientes K-PRO novos e existentes, enquanto James Ritchie, Presidente da ExxonMobil Catalysts and Licensing LLC, enfatizou o papel da colaboração na aceleração da comercialização de seu catalisador de próxima geração.

- Em maio de 2022, a Arkema e a Nippon Shokubai anunciaram uma parceria estratégica para fortalecer sua colaboração em materiais especiais inovadores. Essa aliança visa aprimorar o desenvolvimento de produtos e expandir as oportunidades de mercado, especialmente em soluções sustentáveis e de alto desempenho.

- Em maio de 2020, os desenvolvimentos da Honeywell International Inc. em catalisadores concentraram-se em aprimorar os processos de refino, melhorando a eficiência e a qualidade do produto. Essas inovações visam otimizar a conversão de petróleo bruto em combustíveis e produtos químicos valiosos, contribuindo para operações de refino mais limpas e sustentáveis.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.4.1 PROCUREMENT:

4.4.2 MANUFACTURING:

4.4.3 MARKETING & DISTRIBUTION:

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY OF SUPPLY

4.5.2 RELIABILITY AND TIMELINESS

4.5.3 COST COMPETITIVENESS

4.5.4 TECHNICAL CAPABILITY AND INNOVATION

4.5.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.5.6 FINANCIAL STABILITY

4.5.7 CUSTOMER SERVICE AND SUPPORT

4.6 CLIMATE CHANGE SCENARIO

4.6.1 IMPACT OF REGULATORY PRESSURE AND FUEL STANDARDS

4.6.2 CATALYST INNOVATION IN RESPONSE TO CLIMATE GOALS

4.6.3 CORPORATE CLIMATE COMMITMENTS AND SUSTAINABILITY INTEGRATION

4.6.4 CLIMATE CHANGE AND THE AVAILABILITY OF RAW MATERIALS

4.6.5 RENEWABLE ENERGY TRANSITION AND IMPACT ON DEMAND

4.6.6 CONCLUSION

4.7 PRODUCTION CAPACITY OVERVIEW

4.7.1 OVERVIEW

4.7.2 REGIONAL CAPACITY DISTRIBUTION

4.7.3 KEY PLAYERS & FACILITY FOOTPRINT

4.7.4 EXPANSION PLANS & INVESTMENTS

4.7.5 SUPPLY-DEMAND DYNAMICS

4.7.6 CHALLENGES & FUTURE OUTLOOK

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.8.1 ZEOLITES

4.8.2 TRANSITION METALS

4.8.3 RARE EARTH ELEMENTS (REES)

4.8.4 ALTERNATIVE AND RENEWABLE FEEDSTOCKS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL SOURCING

4.9.3 MANUFACTURING & PROCESSING

4.9.4 LOGISTICS & DISTRIBUTION

4.9.5 END-USE & MARKET DEMAND

4.9.6 CHALLENGES & FUTURE OUTLOOK

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.10.7.2.1 FREE TRADE AGREEMENTS

4.10.7.3 ALLIANCES ESTABLISHMENTS

4.10.7.4 STATUS ACCREDITATION (INCLUDING MFTN)

4.10.7.5 DOMESTIC COURSE OF CORRECTION

4.10.7.5.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.7.5.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.11 TECHNOLOGICAL INNOVATIONS ADVANCEMENT BY MANUFACTURERS

4.11.1 PRODUCT INNOVATIONS

4.11.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE IN CATALYST DESIGN

4.11.3 SUSTAINABLE AND ENVIRONMENTALLY FRIENDLY CATALYSTS

4.11.4 ADVANCES UTILIZATION OF NANOTECHNOLOGY

4.11.5 INNOVATIONS DEVELOPMENT OF SOLID ACID CATALYSTS

4.11.6 INNOVATIONS DEVELOPMENT OF SOLID ACID CATALYSTS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CLEANER FUELS

6.1.2 EXPANSION OF REFINERY CAPACITY IN EMERGING MARKETS

6.1.3 STRINGENT ENVIRONMENTAL REGULATIONS

6.1.4 GROWING DEMAND FOR HIGH-OCTANE FUELS

6.2 RESTRAINTS

6.2.1 HIGH COST OF ADVANCED CATALYSTS

6.2.2 VOLATILITY IN RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN CATALYST FORMULATIONS

6.3.2 GROWTH IN BIO-REFINERIES AND RENEWABLE FUELS

6.3.3 ADVANCEMENTS IN CATALYST REGENERATION AND RECYCLING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 FLUCTUATING CRUDE OIL PRICES

6.4.2 HIGH R&D COSTS FOR NEW CATALYST DEVELOPMENT

7 EUROPE REFINERY CATALYST MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROTREATING

7.3 FLUIDIZED CATALYTIC CRACKING (FCC)

7.4 RESIDUE FLUIDIZED CATALYTIC CRACKING (RFCC)

7.5 HYDROCRACKING

7.6 OTHERS

8 EUROPE REFINERY CATALYST MARKET, BY CATALYST

8.1 OVERVIEW

8.2 CHEMICALS

8.3 ZEOLITES

8.4 METALS

9 EUROPE REFINERY CATALYST MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DIESEL

9.3 KEROSENE

9.4 DISTILLATE DEWAX

9.5 OTHERS

10 EUROPE REFINERY CATALYST MARKET BY REGION

10.2 EUROPE

10.2.1 GERMANY

10.2.2 U.K.

10.2.3 BELGIUM

10.2.4 ITALY

10.2.5 FRANCE

10.2.6 NETHERLANDS

10.2.7 SWITZERLAND

10.2.8 SPAIN

10.2.9 TURKEY

10.2.10 RUSSIA

10.2.11 SWEDEN

10.2.12 FINLAND

10.2.13 NORWAY

10.2.14 DENMARK

10.2.15 BELARUS

10.2.16 AZERBAIJAN

10.2.17 REST OF EUROPE

11 EUROPE REFINING CATALYST MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 BASF

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 EXXON MOBIL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SHELL

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 HONEYWELL INTERNATIONAL INC.

13.4.1 COMPANY SNAPSHOTS

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 JOHNSON MATTHEY

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ANTENCHEM

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARKEMA

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 AXENS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CHINA PETROLEUM & CHEMICAL CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 CLARIANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT/NEWS

13.11 DOW

13.11.1 COMPANY SNAPSHOTS

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT/NEWS

13.12 GAZPROMNEFT – SM LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JGC HOLDINGS CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 KETJEN

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 KUWAIT CATALYST COMPANY

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 4 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 6 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 8 EUROPE FLUIDIZED CATALYTIC CRACKING (FCC) IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE FLUIDIZED CATALYTIC CRACKING (FCC) IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 EUROPE RESIDUE FLUIDIZED CATALYTIC CRACKING (RFCC) IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE RESIDUE FLUIDIZED CATALYTIC CRACKING (RFCC) IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 EUROPE HYDROCRACKING IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE HYDROCRACKING IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 EUROPE OTHERS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE OTHERS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 EUROPE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 18 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 22 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 24 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 26 EUROPE METALS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE METALS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 28 EUROPE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 30 EUROPE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 32 EUROPE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 34 EUROPE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 36 EUROPE DIESEL IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE DIESEL IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 38 EUROPE KEROSENE IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE KEROSENE IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 40 EUROPE DISTILLATE DEWAX IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE DISTILLATE DEWAX IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 42 EUROPE OTHERS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE OTHERS IN REFINERY CATALYST MARKET, BY REGION, 2018-2032 (TONS)

TABLE 44 EUROPE REFINERY CATALYST MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE REFINERY CATALYST MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 46 EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 48 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 50 EUROPE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 52 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 54 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 56 EUROPE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 58 EUROPE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 60 EUROPE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 EUROPE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 64 GERMANY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 66 GERMANY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 68 GERMANY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 69 GERMANY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 70 GERMANY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 72 GERMANY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 GERMANY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 74 GERMANY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 GERMANY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 GERMANY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 78 GERMANY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 GERMANY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 80 GERMANY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 82 U.K. REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.K. REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 84 U.K. HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.K. HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 86 U.K. REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 87 U.K. REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 88 U.K. CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.K. CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 90 U.K. ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.K. ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 92 U.K. METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 94 U.K. TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 96 U.K. PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 98 U.K. REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 U.K. REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 100 BELGIUM REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 BELGIUM REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 102 BELGIUM HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 BELGIUM HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 104 BELGIUM REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 105 BELGIUM REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 106 BELGIUM CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 BELGIUM CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 108 BELGIUM ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 BELGIUM ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 110 BELGIUM METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 BELGIUM METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 112 BELGIUM TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 BELGIUM TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 114 BELGIUM PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 BELGIUM PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 116 BELGIUM REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 BELGIUM REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 118 ITALY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 ITALY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 120 ITALY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 ITALY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 122 ITALY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 124 ITALY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 126 ITALY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 128 ITALY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 130 ITALY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 132 ITALY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 ITALY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 134 ITALY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 ITALY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 136 FRANCE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 138 FRANCE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 140 FRANCE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 142 FRANCE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 FRANCE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 146 FRANCE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 148 FRANCE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 150 FRANCE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 152 FRANCE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 154 NETHERLANDS REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 NETHERLANDS REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 156 NETHERLANDS HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NETHERLANDS HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 158 NETHERLANDS REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 159 NETHERLANDS REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 160 NETHERLANDS CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NETHERLANDS CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 162 NETHERLANDS ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 NETHERLANDS ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 164 NETHERLANDS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 NETHERLANDS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 166 NETHERLANDS TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 NETHERLANDS TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 168 NETHERLANDS PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 NETHERLANDS PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 170 NETHERLANDS REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 NETHERLANDS REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 172 SWITZERLAND REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SWITZERLAND REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 174 SWITZERLAND HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SWITZERLAND HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 176 SWITZERLAND REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 177 SWITZERLAND REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 178 SWITZERLAND CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SWITZERLAND CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 180 SWITZERLAND ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SWITZERLAND ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SWITZERLAND METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SWITZERLAND METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 184 SWITZERLAND TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SWITZERLAND TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 186 SWITZERLAND PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SWITZERLAND PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 188 SWITZERLAND REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 SWITZERLAND REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 190 SPAIN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 192 SPAIN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 194 SPAIN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 196 SPAIN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 198 SPAIN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 200 SPAIN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 202 SPAIN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 SPAIN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 206 SPAIN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 208 TURKEY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 TURKEY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 210 TURKEY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 TURKEY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 212 TURKEY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 213 TURKEY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 214 TURKEY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 TURKEY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 216 TURKEY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 TURKEY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 218 TURKEY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 TURKEY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 TURKEY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 TURKEY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 222 TURKEY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 TURKEY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 224 TURKEY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 TURKEY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 RUSSIA REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 RUSSIA REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 228 RUSSIA HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 RUSSIA HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 230 RUSSIA REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 231 RUSSIA REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 232 RUSSIA CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 RUSSIA CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 234 RUSSIA ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 RUSSIA ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 236 RUSSIA METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 238 RUSSIA TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 240 RUSSIA PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 RUSSIA PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 242 RUSSIA REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 243 RUSSIA REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 244 SWEDEN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SWEDEN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 246 SWEDEN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SWEDEN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 248 SWEDEN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 249 SWEDEN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 250 SWEDEN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SWEDEN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 252 SWEDEN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 SWEDEN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 254 SWEDEN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWEDEN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 256 SWEDEN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 SWEDEN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 SWEDEN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SWEDEN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 260 SWEDEN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 SWEDEN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 262 FINLAND REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 FINLAND REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 264 FINLAND HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 FINLAND HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 266 FINLAND REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 267 FINLAND REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 268 FINLAND CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 FINLAND CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 270 FINLAND ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 FINLAND ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 272 FINLAND METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 FINLAND METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 274 FINLAND TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 FINLAND TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 276 FINLAND PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 FINLAND PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 278 FINLAND REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 279 FINLAND REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 280 NORWAY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 NORWAY REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 282 NORWAY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 NORWAY HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 284 NORWAY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 285 NORWAY REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 286 NORWAY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 NORWAY CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 288 NORWAY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 NORWAY ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 290 NORWAY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 NORWAY METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 292 NORWAY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 NORWAY TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 294 NORWAY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 NORWAY PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 296 NORWAY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 297 NORWAY REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 298 DENMARK REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 DENMARK REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 300 DENMARK HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 DENMARK HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 302 DENMARK REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 303 DENMARK REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 304 DENMARK CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 DENMARK CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 306 DENMARK ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 DENMARK ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 308 DENMARK METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 DENMARK METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 310 DENMARK TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 DENMARK TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 312 DENMARK PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 DENMARK PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 314 DENMARK REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 DENMARK REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 316 BELARUS REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 BELARUS REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 318 BELARUS HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 BELARUS HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 320 BELARUS REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 321 BELARUS REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 322 BELARUS CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 BELARUS CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 324 BELARUS ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 BELARUS ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 326 BELARUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BELARUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 328 BELARUS TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BELARUS TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 330 BELARUS PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 BELARUS PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 332 BELARUS REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 333 BELARUS REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 334 AZERBAIJAN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 AZERBAIJAN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 336 AZERBAIJAN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 AZERBAIJAN HYDROTREATING IN REFINERY CATALYST MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 338 AZERBAIJAN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (USD THOUSAND)

TABLE 339 AZERBAIJAN REFINERY CATALYST MARKET, BY CATALYST, 2018-2032 (TONS)

TABLE 340 AZERBAIJAN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 AZERBAIJAN CHEMICALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 342 AZERBAIJAN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 AZERBAIJAN ZEOLITES IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 344 AZERBAIJAN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 AZERBAIJAN METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 346 AZERBAIJAN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 AZERBAIJAN TRANSITION AND BASE METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 348 AZERBAIJAN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 AZERBAIJAN PRECIOUS METALS IN REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 350 AZERBAIJAN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 351 AZERBAIJAN REFINERY CATALYST MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 352 REST OF EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 REST OF EUROPE REFINERY CATALYST MARKET, BY TYPE, 2018-2032 (TONS)

Lista de Figura

FIGURE 1 EUROPE REFINERY CATALYST MARKET

FIGURE 2 EUROPE REFINERY CATALYST MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFINERY CATALYST MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFINERY CATALYST MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFINERY CATALYST MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFINERY CATALYST MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE REFINERY CATALYST MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE REFINERY CATALYST MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE REFINERY CATALYST MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REFINERY CATALYST MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR CLEANER FUELS IS EXPECTED TO DRIVE THE EUROPE REFINERY CATALYST MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 THE HYDROTREATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFINERY CATALYST MARKET IN 2025 AND 2032

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 FIVE SEGMENTS COMPRISE THE EUROPE REFINERY CATALYST MARKET, BY TYPE (2024)

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 EUROPE REFINERY CATALYST MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 VALUE CHAIN ANALYSIS OF THE EUROPE REFINERY CATALYST MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE REFINERY CATALYST MARKET

FIGURE 22 DECLINE IN OIL PRICE

FIGURE 26 EUROPE REFINERY CATALYST MARKET: SNAPSHOT (2024)

FIGURE 27 EUROPE REFINING CATALYST MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.