Europe Reverse Logistics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

33.10 Billion

USD

50.77 Billion

2025

2033

USD

33.10 Billion

USD

50.77 Billion

2025

2033

| 2026 –2033 | |

| USD 33.10 Billion | |

| USD 50.77 Billion | |

|

|

|

|

Mercado Europeu de Logística Reversa, por Tipo de Produto (Equipamentos Semicondutores e Eletrônicos, Componentes Automotivos e Equipamentos de Recarga para Veículos Elétricos, Equipamentos Médicos e de Saúde, Fontes de Alimentação Industriais, Equipamentos de Automação e Robótica), por Tipo de Serviço (Coleta, Reciclagem, Remanufatura, Revenda), por Canal de Distribuição (B2B, B2C), por País (Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Holanda, Polônia, Turquia, Suíça, Resto da Europa) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de logística reversa na Europa

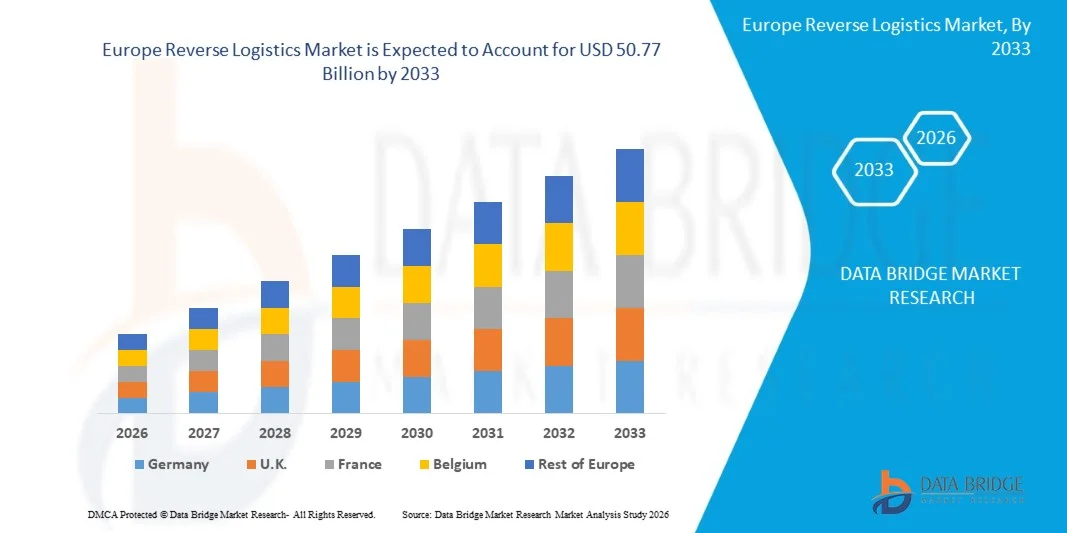

- O mercado europeu de logística reversa foi avaliado em US$ 33,10 bilhões em 2025 e espera-se que atinja aproximadamente US $ 50,77 bilhões até 2033.

- Durante o período de previsão de 2025 a 2032, espera-se que o mercado cresça a uma taxa composta de crescimento anual (CAGR) de 5,6% , impulsionado principalmente pela crescente conscientização sobre saúde mental, prevenção de doenças crônicas e pela adoção cada vez maior de soluções de bem-estar por parte dos empregadores.

- O mercado europeu de logística reversa concentra-se em fornecer soluções completas que otimizam a devolução, o reparo, a remanufatura e a reciclagem de produtos, aprimorando a eficiência e a sustentabilidade da cadeia de suprimentos.

Análise do mercado de logística reversa na Europa

- O mercado europeu de logística reversa está em expansão devido à forte transição da região para uma economia circular, às rigorosas regulamentações ambientais e ao elevado volume de devoluções de produtos impulsionado pelo comércio eletrônico. As operações de logística reversa — devoluções de produtos, remanufatura, reciclagem e reparo — estão se tornando essenciais para as estratégias da cadeia de suprimentos, à medida que as marcas buscam reduzir o desperdício, recuperar o valor dos ativos e cumprir as diretrizes de sustentabilidade da UE.

- O crescimento do mercado é fortemente influenciado por regulamentações da UE, como a Diretiva de Resíduos de Equipamentos Elétricos e Eletrônicos (REEE), a Responsabilidade Estendida do Produtor (REP) e as próximas revisões do Plano de Ação para a Economia Circular (PAEC). Essas políticas obrigam os fabricantes a gerenciar o descarte de produtos, aumentando a demanda por redes estruturadas de logística reversa nos setores de eletrônicos, automotivo, embalagens e bens de consumo.

- Em 2025, as devoluções do comércio eletrônico representarão a maior parcela da atividade de logística reversa na Europa, impulsionadas pelas altas taxas de devolução — frequentemente entre 25% e 40% nos setores de moda e varejo online — e pela rápida expansão das compras online transfronteiriças. Os varejistas estão investindo em centros de devolução automatizados, sistemas de inspeção baseados em inteligência artificial e instalações de remanufatura para reduzir o tempo de processamento e recuperar o valor dos produtos devolvidos.

- Dentro do ecossistema europeu de logística reversa, a reciclagem e a recuperação de materiais dominam a participação de mercado (≈40%+ na maioria dos países), impulsionadas pela alta demanda por materiais reciclados, pelos crescentes compromissos com a neutralidade de carbono e pelo aumento dos custos das matérias-primas. Os setores automotivo e eletrônico lideram esse segmento, apoiados por iniciativas de reciclagem de baterias, regulamentações sobre desmantelamento de veículos e modelos de manufatura em circuito fechado adotados por fabricantes de equipamentos originais (OEMs) globais.

Escopo do relatório e segmentação do mercado de logística reversa na Europa

|

Atributos |

Principais informações sobre o mercado europeu de máquinas de envase de líquidos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem rastreador de inovação e análise estratégica, avanços tecnológicos, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, critérios de seleção de fornecedores, análise PESTLE, análise de Porter, análise de patentes, análise do ecossistema da indústria, cobertura de matérias-primas, tarifas e seu impacto no mercado, cobertura regulatória, comportamento de compra do consumidor, perspectiva da marca, detalhamento da análise de custos e estrutura regulatória. |

Tendências do mercado de logística reversa na Europa

“Crescente necessidade de auditorias de sustentabilidade e consultoria em cadeias de suprimentos circulares”

- A crescente demanda por auditorias de sustentabilidade e consultoria em cadeias de suprimentos circulares representa uma oportunidade substancial para o mercado europeu de logística reversa. À medida que as empresas são obrigadas a rastrear e relatar os impactos ambientais, sociais e de governança (ESG) ao longo dos ciclos de vida dos produtos e cadeias de valor, elas necessitam cada vez mais de auditorias de terceiros, consultoria e suporte para integração de sistemas.

- Em abril de 2024, um artigo publicado na Reuters afirmou que a Diretiva de Due Diligence em Sustentabilidade Corporativa (CSDDD) foi aprovada pelo Parlamento Europeu, obrigando grandes empresas a auditar suas cadeias de suprimentos quanto aos impactos ambientais e de direitos humanos. Essa mudança regulatória abre oportunidades para consultoria e auditoria relacionadas a fluxos de logística reversa, recuperação de ativos, programas de logística reversa e investigações de ciclo de materiais.

- Em maio de 2025, um artigo da Intereconomics sobre a análise de políticas relativas à regulamentação da cadeia de suprimentos da UE afirmou que as empresas precisarão de "estruturas robustas de coleta de dados, transparência e garantia" em todas as cadeias de valor — o que implica uma demanda por serviços de consultoria que apoiem a rastreabilidade de devoluções, cadeias de reforma e logística de reutilização a jusante.

- Em agosto de 2025, a Comissão Europeia lançou a consulta pública para a futura Lei da Economia Circular, enfatizando o aumento do envolvimento das partes interessadas para identificar os gargalos e as oportunidades da economia circular. Essa iniciativa sinaliza a demanda por consultoria especializada e estruturas de auditoria baseadas em software em todas as redes de logística reversa.

Dinâmica do mercado de logística reversa na Europa

Motorista

“Explosão de devoluções no comércio eletrônico e varejo omnicanal”

- Em outubro de 2022, a Direção-Geral da Tributação e da União Aduaneira publicou um documento não oficial sobre as formalidades aduaneiras relacionadas com a devolução de mercadorias no contexto do comércio eletrónico, salientando que, após as alterações do IVA ao comércio eletrónico em 2021, as obrigações administrativas relativas às mercadorias devolvidas a países não pertencentes à UE aumentaram e que as alfândegas e as empresas estavam a enfrentar dificuldades. O documento descreve os procedimentos detalhados para as declarações de exportação, a invalidação das declarações de importação e o reembolso de direitos aduaneiros no caso de devoluções de vendas à distância, reconhecendo diretamente as devoluções em larga escala do comércio eletrónico como um desafio operacional específico para as alfândegas e as cadeias logísticas da UE.

- Em fevereiro de 2025, a Comissão Europeia adotou e apresentou a Comunicação “Um conjunto abrangente de ferramentas da UE para o comércio eletrónico seguro e sustentável”, acompanhada do artigo de notícias “Enfrentar os desafios das importações do comércio eletrónico”. A Comissão observou que, em 2024, cerca de 4,6 mil milhões de encomendas de baixo valor (com um valor igual ou inferior a 150 euros) entraram na UE, o dobro do registado em 2023 e o triplo do registado em 2022, e que cerca de 70% dos europeus fazem compras online regularmente, incluindo em plataformas fora da UE.

- Em janeiro de 2022, a análise temática do Índice de Economia e Sociedade Digitais (DESI) 2022 da Comissão Europeia deu especial ênfase ao comércio eletrônico. O relatório confirma que a adoção do comércio eletrônico pelas empresas europeias se tornou um indicador central da transformação digital, sinalizando volumes estruturalmente maiores de pedidos online e, consequentemente, maiores exigências em relação a fluxos de devolução organizados, gestão reversa de estoque e planejamento de logística reversa orientado por dados.

Restrição/Desafio

“Alta complexidade operacional e custo dos fluxos reversos”

- Em setembro de 2025, um comentário da IFA intitulado "Devoluções e Logística Reversa na Europa – do Custo à Velocidade Competitiva" afirmou que as operações de devolução, as rígidas estruturas de direitos do consumidor e os procedimentos alfandegários "podem tanto drenar a margem quanto desbloquear o valor da recuperação". Isso destaca que, sem uma infraestrutura adequada, as devoluções representam um dreno de custos.

- Em julho de 2025, o relatório da Landmark Global sobre insights logísticos, intitulado "Alta pressão sobre a logística reversa e aumento de devoluções em...", descreveu como os picos sazonais de devoluções, especialmente nos segmentos de moda e calçados, combinados com o aumento dos custos operacionais, criam "uma pressão crescente sobre uma parte já complexa da cadeia de suprimentos".

- Em janeiro de 2023, um estudo da MDPI intitulado "Uma Estrutura para Adotar uma Logística Reversa Sustentável..." concluiu que muitas cadeias de suprimentos em países desenvolvidos (incluindo a Europa) não possuem recursos suficientes para implementar soluções de logística reversa e que as deficiências em custos e qualidade de serviço dificultam fluxos de retorno sustentáveis.

- Em janeiro de 2025, o artigo “Logística Reversa: Resolvendo o Problema de Gestão de Devoluções na Europa” observou que estudos mostram que aproximadamente 30% das compras online na Europa são devolvidas (em comparação com uma porcentagem muito menor em lojas físicas) e que esse alto volume cria um “pesadelo logístico” para as empresas que gerenciam fluxos reversos.

Oportunidade

Crescimento nas plataformas de produtos de remanufatura, recompra e segunda vida.

A crescente demanda por soluções de envase automatizadas e assépticas em mercados emergentes representa uma oportunidade significativa para a indústria global de máquinas de envase de líquidos. A crescente conscientização do consumidor sobre higiene e segurança, aliada ao aumento do consumo de bebidas, laticínios e produtos farmacêuticos, está compelindo os fabricantes a adotarem tecnologias de envase avançadas que garantam a esterilidade e minimizem os riscos de contaminação. Sistemas automatizados e assépticos aumentam a eficiência da produção, minimizam a intervenção humana e facilitam o cumprimento de normas regulatórias rigorosas.

- Em janeiro de 2023, o governo holandês publicou o documento “Logística reversa para embalagens reutilizáveis”, que explora como a transição de sistemas de uso único para sistemas reutilizáveis (compartilhamento, caixas retornáveis) na Holanda exige redes de logística reversa e se alinha com plataformas mais amplas de segunda vida e reutilização.

- Em novembro de 2024, a Vanderlande anunciou a reabertura de seu Centro de Logística Reversa em Veghel (Holanda) com o objetivo explícito de "impulsionar a reutilização, a remanufatura e a reciclagem" de materiais devolvidos — sinalizando o investimento corporativo em infraestrutura de logística reversa para apoiar plataformas de segunda vida.

- Em março de 2023, a Avaliação de Impacto da Comissão Europeia, que apoiou o novo quadro legislativo de reparação e reutilização, observou que "a reutilização através da renovação... o seu potencial não está a ser suficientemente explorado" e apelou ao apoio político às plataformas de renovação e de mercado de segunda vida para desbloquear o valor dos retornos.

Escopo do mercado de logística reversa na Europa

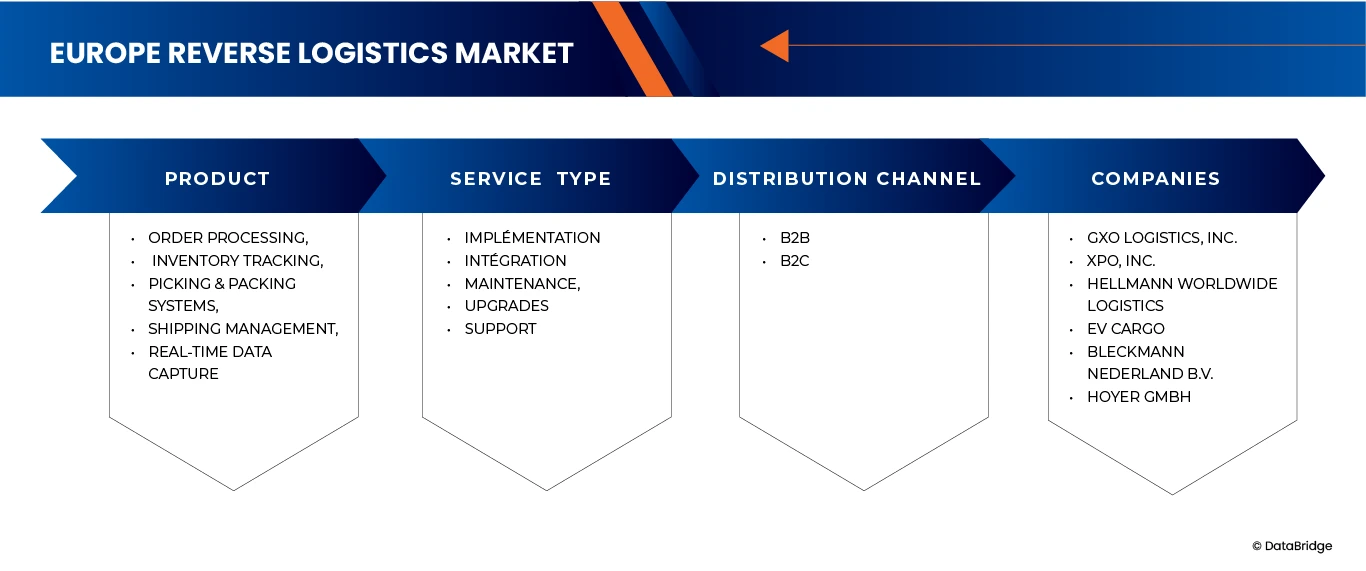

O mercado europeu de logística reversa está segmentado em três segmentos principais com base no tipo de produto, tipo de serviço e canal de distribuição.

• Por tipo de produto

Com base no tipo de produto, o mercado europeu de logística reversa foi segmentado em semicondutores e equipamentos eletrônicos, componentes automotivos e equipamentos de carregamento de veículos elétricos, equipamentos médicos e de saúde, fontes de alimentação industriais e equipamentos de automação e robótica. Em 2026, o segmento de semicondutores e equipamentos eletrônicos deverá dominar o mercado europeu de logística reversa, com uma participação de 29,24%, e espera-se que atinja US$ 14.180.222,38 mil até 2033, crescendo a uma taxa composta de crescimento anual (CAGR) de 4,9%, devido ao crescente volume de devoluções de produtos eletrônicos, às rápidas atualizações tecnológicas e à crescente pressão regulatória para a gestão responsável de resíduos eletrônicos. O segmento se beneficia de altos ciclos de retorno, oportunidades de recuperação de componentes e forte demanda por reforma e reciclagem de dispositivos eletrônicos em toda a Europa.

• Por tipo de serviço

Com base no tipo de serviço, o mercado europeu de logística reversa é segmentado em coleta, reciclagem, reforma e revenda. Em 2026, espera-se que o segmento de coleta domine o mercado europeu de logística reversa, com 35,85% de participação, e que alcance US$ 17.402.815,14 mil até 2033, crescendo a uma taxa composta de crescimento anual (CAGR) de 4,9%, devido à crescente necessidade de recuperação eficiente de produtos devolvidos, danificados ou em fim de vida útil. A expansão do comércio eletrônico, o aumento dos recalls de produtos e as regulamentações mais rigorosas da UE sobre gestão de resíduos estão impulsionando investimentos em redes de coleta organizadas, permitindo fluxos reversos mais rápidos e econômicos em diversos setores.

- Por canal de distribuição

Com base no canal de distribuição, o mercado europeu de logística reversa é segmentado em B2B e B2C. Em 2026, espera-se que o segmento B2B domine o mercado europeu de logística reversa, com uma participação de 81,73%, e que atinja USD 41.359.939,65 mil até 2033, crescendo a uma taxa composta de crescimento anual (CAGR) de 5,5%, devido ao alto volume de devoluções industriais, programas de recuperação de componentes e serviços contratuais de logística reversa entre fabricantes, distribuidores e prestadores de serviços. As empresas dependem cada vez mais de fluxos de retorno estruturados, parcerias de reforma e sistemas de recuperação de ativos para reduzir o desperdício, recuperar valor e atingir metas de sustentabilidade em toda a cadeia de suprimentos.

Análise Regional do Mercado de Logística Reversa na Europa

- A Europa ocupa uma posição de destaque no mercado europeu de logística reversa, impulsionada por seu sólido arcabouço regulatório, ecossistema de reciclagem consolidado e alto volume de devoluções gerado por setores como eletrônicos, automotivo, varejo e saúde.

- A região beneficia de uma infraestrutura de coleta e processamento bem estabelecida, de investimentos crescentes em iniciativas de economia circular e de diretivas rigorosas da UE que exigem gestão responsável de resíduos, programas de recolhimento de produtos e descarte sustentável.

- A crescente conscientização do consumidor, a rápida expansão do comércio eletrônico e o aumento das taxas de devolução de produtos em categorias como vestuário, eletrônicos e bens de consumo embalados estão acelerando ainda mais o crescimento do mercado em toda a Europa.

- As empresas europeias estão adotando cada vez mais sistemas automatizados de triagem, plataformas de rastreamento digital e soluções de logística reversa habilitadas para IoT (Internet das Coisas) para melhorar a rastreabilidade, aumentar o valor da recuperação e otimizar a eficiência da cadeia de suprimentos reversa.

- Além disso, o forte foco na redução de carbono, na otimização de recursos e em operações de reciclagem com eficiência energética está alinhado com as metas de sustentabilidade da Europa, incentivando fabricantes e provedores de logística a implementar práticas de logística reversa mais ecológicas e impulsionadas pela tecnologia.

Análise do Mercado de Logística Reversa na Alemanha

A Alemanha continua sendo o maior mercado devido à forte penetração do comércio eletrônico e às rigorosas políticas de reciclagem. As altas taxas de devolução nos setores de moda e eletrônicos incentivaram as empresas a investir em centros de logística reversa dedicados. Por exemplo, grandes varejistas online operam centros de devolução automatizados no norte da Alemanha, onde a inteligência artificial é usada para categorizar os itens para revenda, reforma ou reciclagem.

Empresas alemãs estão investindo fortemente em tecnologias de triagem automatizada, sistemas de inspeção com inteligência artificial e plataformas digitais de rastreamento para aumentar a velocidade, a precisão e a transparência nos processos de logística reversa.

A transição para a recuperação sustentável de materiais, o rigoroso cumprimento das diretivas da UE, como as regulamentações sobre REEE (Resíduos de Equipamentos Elétricos e Eletrônicos), ELV (Veículos em Fim de Vida) e resíduos de embalagens, e a pesquisa e desenvolvimento contínuos em robótica e automação estão acelerando ainda mais a sofisticação do mercado. Os principais players nacionais e globais que operam na Alemanha estão expandindo ativamente suas capacidades em recuperação de componentes, processamento de lixo eletrônico e reforma com valor agregado para apoiar cadeias de suprimentos de ciclo fechado e melhorar a eficiência no uso de recursos.

Análise do Mercado de Logística Reversa no Reino Unido

O Reino Unido tem experimentado um crescimento significativo na logística reversa, impulsionado pelo alto volume de compras online e por políticas de devolução generosas. As devoluções de vestuário representam uma grande parcela dos fluxos reversos, e diversas varejistas firmaram parcerias com operadores terceirizados para lidar com a consolidação, classificação e processamento de reembolsos. Os polos logísticos na região central da Inglaterra se tornaram centros essenciais para o processamento de devoluções.

No Reino Unido, as empresas estão priorizando a digitalização, a automação e modelos flexíveis de gestão de devoluções para lidar com fluxos imprevisíveis de forma eficiente. A crescente busca por sustentabilidade acelerou os investimentos em infraestrutura de reciclagem, automação de armazéns e práticas de recuperação de produtos ecologicamente corretas.

Iniciativas governamentais que promovem modelos de economia circular e compromissos de redução de carbono estão incentivando empresas a implantar plataformas avançadas de logística reversa, incluindo ferramentas de monitoramento inteligente, sistemas de otimização baseados em dados e tecnologias de manutenção preditiva. Os principais participantes do setor no Reino Unido estão utilizando robótica, análises em tempo real e sistemas de gerenciamento de devoluções baseados em nuvem para melhorar a produtividade operacional e reduzir os custos de manuseio.

Participação de mercado na logística reversa na Europa

O panorama competitivo do mercado europeu de logística reversa oferece informações detalhadas sobre os principais participantes do setor que atuam na região. As informações incluem visão geral da empresa, presença regional e global, desempenho financeiro, contribuição da receita proveniente das operações de logística reversa, potencial de mercado, investimentos em infraestrutura de reciclagem e remanufatura, e novas iniciativas voltadas para o fortalecimento das práticas de economia circular.

Os principais líderes de mercado que atuam no setor são:

- DB Schenker (Alemanha)

- DHL Supply Chain / Deutsche Post DHL (Alemanha)

- Kuehne + Nagel (Suíça)

- GEODIS (França)

- Rhenus Logistics SE & Co. KG (Alemanha)

- LOGISTEED, Ltda. (Japão)

- XPO, Inc. (EUA)

- GXO Logistics, Inc. (EUA)

- United Parcel Service of America, Inc. (EUA)

- Hellmann Worldwide Logistics (Alemanha)

- HOYER GmbH (Alemanha)

- Bleckmann Nederland BV (Países Baixos)

- Asapreverse (Países Baixos)

- Ambrogio Trasporti SPA (Itália)

- Moduslink Corporation (EUA)

- EV Cargo (Reino Unido)

- Grupo de Logística Reversa (RLG) (Alemanha)

- Nordlogway (Alemanha)

- Interzero (Alemanha)

- Taracell AG (Suíça)

Novidades no mercado de logística reversa na Europa

- Em outubro, a UPS anunciou a aquisição da Happy Returns, empresa conhecida por seu sistema de devolução simplificado e baseado em software, que permite aos clientes realizar devoluções sem caixa e sem etiqueta em pontos de coleta designados. Com a incorporação da Happy Returns, a UPS planeja expandir significativamente essa rede de devoluções para mais de 12.000 locais, utilizando tanto sua própria infraestrutura logística de pequenos pacotes quanto a extensa rede de lojas UPS Store. A medida fortalece a posição da UPS na logística reversa, tornando as devoluções mais fáceis para os consumidores e mais eficientes para os varejistas.

- Em janeiro, a Ambrogio Intermodal fez um investimento significativo em 650 carrocerias intercambiáveis e chassis de contêineres encomendados à Kässbohrer. A empresa depende fortemente de uma frota capaz de transportar diversos tipos de carga, incluindo materiais em fim de vida útil e resíduos, de forma econômica e sustentável. Os veículos mais leves permitem transportar mais carga por viagem, o que reduz o número de viagens necessárias e, consequentemente, as emissões por unidade transportada.

- Em outubro, a parceria entre a Hellmann e a SkyNet abrange a gestão de devoluções como parte de sua solução completa de comércio eletrônico transfronteiriço. A gestão de devoluções é uma função essencial da logística reversa, que envolve o manuseio de mercadorias devolvidas pelos clientes, seu processamento (por exemplo, classificação, reembalagem, reembolso de impostos) e sua reintegração à cadeia de suprimentos. A Hellmann oferece inclusive um portal de devoluções de marca branca e suporte ao reembolso de impostos ("Duty Drawback") para itens devolvidos.

- Em novembro de 2024, a H&M selecionou a Bleckmann para apoiar o lançamento online de sua coleção Pre‑Loved Archive. A Bleckmann realizou um processo de renovação que incluiu classificação, limpeza, reparos invisíveis, gestão de estoque e fotografia de peças usadas/seminovas em seu centro de distribuição em Almelo. Essa restauração de itens de segunda vida e sua preparação para revenda é uma atividade essencial da logística reversa. A Bleckmann também utilizou SKUs serializados para rastrear o histórico de reparos e o status de cada item, proporcionando transparência e controle sobre o estoque em fluxo reverso.

- Em janeiro, a DHL Supply Chain adquiriu a Inmar Supply Chain Solutions, adicionando 14 centros de devolução e cerca de 800 funcionários, tornando-se a maior provedora de logística reversa na América do Norte.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 SECONDARY SOURCES

2.8 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 TREND ANALYSIS

3.1.1 BY PRODUCT

3.1.1.1 INDUSTRIAL POWER SUPPLIES

3.1.1.2 AUTOMATION & ROBOTICS EQUIPMENT

3.1.1.3 SEMICONDUCTOR & ELECTRONICS EQUIPMENT

3.1.1.4 MEDICAL & HEALTHCARE EQUIPMENT

3.1.1.5 AUTOMOTIVE COMPONENTS & EV CHARGING EQUIPMENT

3.1.2 BY SERVICE TYPE

3.1.2.1 COLLECTION

3.1.2.2 REFURBISHMENT

3.1.2.3 RECYCLING

3.1.2.4 RESALE

3.1.3 BY DISTRIBUTION CHANNEL

3.1.3.1 B2B

3.1.3.2 B2C

3.1.4 BY REGION

3.1.4.1 GERMANY

3.1.4.2 FRANCE

3.1.4.3 U.K.

3.1.4.4 POLAND

3.1.4.5 ITALY

3.1.4.6 SPAIN

3.1.4.7 RUSSIA

3.1.4.8 TURKEY

3.1.4.9 NETHERLANDS

3.1.4.10 SWITZERLAND

3.1.4.11 REST OF EUROPE

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 LIST OF KEY CONSUMERS IN THE EUROPE REVERSE LOGISTICS MARKET

4.2.1 ANALYST RECOMMENDATION – EUROPE REVERSE LOGISTICS MARKET

4.2.2 TRANSFORM REVERSE LOGISTICS INTO A VALUE-CREATION FUNCTION

4.2.3 INVEST IN DIGITAL VISIBILITY AND DATA-DRIVEN RETURNS MANAGEMENT

4.2.4 REIMAGINE RETURN POLICIES FOR PROFITABILITY AND LOYALTY

4.2.5 ALIGN WITH EU CIRCULAR ECONOMY DIRECTIVES AND REGULATORY COMPLIANCE

4.2.6 ACCELERATE GREEN REVERSE LOGISTICS AND LOW-CARBON RETURN NETWORKS

4.2.7 FORGE STRATEGIC ALLIANCES FOR SCALE AND SPECIALIZATION

4.2.8 STRATEGIC OUTLOOK

4.3 GO-TO-MARKET (GTM) STRATEGY

4.3.1 GO-TO-MARKET (GTM) STRATEGY MODEL

4.3.2 PENETRATION (NEW PRODUCT → NEW CONSUMER)

4.3.3 EXPANSION (NEW PRODUCT → EXISTING CONSUMER)

4.3.4 INNOVATION (EXISTING PRODUCT → NEW CONSUMER)

4.3.5 AGGRESSION (NEW PRODUCT → NEW CONSUMER)

4.4 COMPANY EVALUATION QUADRANT

4.5 CUSTOMERS OF REFURBISHED GOODS

4.5.1 B2C CONSUMER SEGMENTS

4.5.1.1 ECO-DRIVEN MILLENNIALS AND GENERATION Z

4.5.2 PRICE-CONSCIOUS FAMILIES SEEKING AFFORDABLE OPTIONS

4.5.2.1 FASHION-CONSCIOUS BARGAIN HUNTERS AND LUXURY RESALE CONSUMERS

4.5.3 B2B CUSTOMER SEGMENTS

4.5.3.1 WHOLESALERS PURCHASING BULK LOTS

4.5.3.2 CORPORATE BUYERS SOURCING REFURBISHED IT EQUIPMENT

4.5.3.3 RETAILERS OFFERING PRE-OWNED PRODUCT CATEGORIES

4.5.4 EXPORT BUYERS FROM AFRICA, THE MIDDLE EAST, AND EASTERN EUROPE

4.6 DEMAND & SUPPLY DRIVERS

4.6.1 GERMANY

4.6.2 FRANCE

4.6.3 UNITED KINGDOM (UK)

4.6.4 OTHERS

4.6.5 END-TO-END RETURNS MANAGEMENT PROCESS

4.6.6 STEP 1: SOURCES OF RETURNED GOODS

4.6.7 STEP 2: COLLECTION AND AGGREGATION

4.6.8 STEP 3: INSPECTION & SORTING

4.6.9 STEP 4: REFURBISHMENT AND REPAIR

4.6.10 STEP 5: REDISTRIBUTION

4.6.11 STEP 6: END CONSUMER

4.6.12 CONCLUSION

4.7 GEOGRAPHICAL FOOTPRINT

4.7.1 DOMESTIC EUROPEAN MARKETS

4.7.2 INTERNATIONAL EXPORT ROUTES

4.7.3 ROLE OF ONLINE PLATFORM IN DISTRIBUTION

4.8 MARKET ENTRY STRATEGIES

4.8.1 PARTNERSHIP-LED ENTRY WITH RETAILERS, OEMS & 3PLS–

4.8.2 BUILD A CENTRALIZED REFURBISHMENT & VALUE-RECOVERY HUB –

4.8.3 TECHNOLOGY-LED DIFFERENTIATION (AI-BASED REVERSE LOGISTICS PLATFORM)–

4.8.4 REGULATORY-LED ENTRY (COMPLIANCE-AS-A-SERVICE)–

4.8.5 SECONDARY MARKETPLACE & VALUE-RECOVERY INTEGRATION–

4.8.6 CONCLUSION

4.9 EUROPE REVERSE LOGISTICS MARKET: INDUSTRY CONTEXT AND EVOLUTION

4.9.1 INTRODUCTION:

4.9.2 REGULATORY ALIGNMENT WITH THE CIRCULAR ECONOMY FRAMEWORK

4.9.3 GROWTH OF RECOMMERCE AND CHANGING CONSUMER PERCEPTIONS

4.9.4 KEY MARKET DRIVERS

4.9.4.1 RISING E-COMMERCE RETURN VOLUMES

4.9.4.2 SUSTAINABILITY AND CARBON-NEUTRAL COMMITMENTS

4.9.4.3 EVOLVING CONSUMER ACCEPTANCE OF PRE-OWNED AND REFURBISHED GOODS

4.9.4.4 STRENGTHENING REGULATORY AND COMPLIANCE REQUIREMENTS

4.9.4.5 ECONOMIC INCENTIVES AND COST RECOVERY OPPORTUNITIES

4.9.5 REGIONAL DYNAMICS AND MAJOR MARKETS

4.9.6 CONCLUSION

4.1 INDUSTRY DYNAMICS — EUROPE REVERSE LOGISTICS MARKET

4.10.1 OVERVIEW

4.10.2 REGULATORY LANDSCAPE

4.10.3 STRUCTURAL AND OPERATIONAL DYNAMICS

4.10.4 REVERSE FLOWS TYPICALLY INCLUDE:

4.10.5 TECHNOLOGY AND DIGITALIZATION

4.10.6 COUNTRY-LEVEL DYNAMICS

4.10.7 CONCLUSION

4.11 ROI

4.12 VALUE CHAIN ANALYSIS

4.12.1 END CONSUMER (RETURN INITIATION):

4.12.2 RETURN SHIPPING

4.12.3 RETURN PROCESSED

4.12.4 MOVEMENT TO DISPOSITION

4.12.5 RECYCLE / REFURB

4.12.6 RESALE

4.12.7 END CONSUMER

4.12.8 CONCLUSION

4.13 TECHNOLOGICAL TRENDS — EUROPE REVERSE LOGISTICS MARKET

5 REGULATORY STANDARDS AND FRAMEWORK

5.1 GERMANY

5.2 FRANCE

5.3 SPAIN

5.4 ITALY

5.5 UNITED KINGDOM (UK)

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 EXPLOSION OF E-COMMERCE RETURNS AND OMNI-CHANNEL RETAILING

6.1.2 ADVANCEMENT IN REVERSE LOGISTICS SOFTWARE ECOSYSTEMS

6.1.3 RISE OF PRODUCT-AS-A-SERVICE (PAAS) AND LEASING MODELS

6.1.4 EU SUSTAINABILITY MANDATES ACCELERATING REVERSE-LOGISTICS DEPLOYMENT

6.2 RESTRAINT

6.2.1 HIGH OPERATIONAL COMPLEXITY AND COST OF REVERSE FLOWS

6.2.2 INADEQUATE DATA VISIBILITY ACROSS REVERSE-LOGISTICS NETWORKS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN REFURBISHMENT, RE-COMMERCE, AND SECOND-LIFE PRODUCT PLATFORMS

6.3.2 GROWING NEED FOR SUSTAINABILITY AUDITING AND CIRCULAR SUPPLY CHAIN CONSULTING

6.3.3 SERVICE DIFFERENTIATION FOR 3PL/4PL AND PARCEL INTEGRATORS

6.4 CHALLENGES

6.4.1 CAPACITY AND CAPABILITY GAPS IN RECYCLING AND REPAIR INFRASTRUCTURE

6.4.2 MANAGING FRAUDULENT OR AVOIDABLE RETURNS IN E-COMMERCE

7 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SEMICONDUCTOR & ELECTRONICS EQUIPMENT

7.3 AUTOMOTIVE COMPONENTS & EV CHARGING EQUIPMENT

7.4 MEDICAL & HEALTHCARE EQUIPMENT

7.5 INDUSTRIAL POWER SUPPLIES

7.6 AUTOMATION & ROBOTICS EQUIPMENT

8 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 COLLECTION

8.3 RECYCLING

8.4 REFURBISHMENT

8.5 RESALE

9 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 B2B

9.3 B2C

10 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY

10.1 OVERVIEW

10.2 EUROPE

10.2.1 GERMANY

10.2.2 U.K.

10.2.3 FRANCE

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 NETHERLANDS

10.2.8 POLAND

10.2.9 TURKEY

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

11 EUROPE REVERSE LOGISTICS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ASAPREVERSE

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENTS

13.2 AMBROGIO TRASPORTI S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 BLECKMANN NEDERLAND BV

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 DHL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 DB SCHENKER

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 EV CARGO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 GEODIS.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 GXO LOGISTICS, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 HOYER GMBH

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 HELLMANN WORLDWIDE LOGISTICS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 INTERZERO.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 KUEHNE+NAGEL

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 LOGISTEED, LTD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MODUSLINK CORPORATION (SUBSIDIARY OF STEEL PARTNERS HOLDINGS L.P.)

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 NORDLOGWAY, S.L

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 RHENUS LOGISTICS SE & CO..

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 RLG.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 TARACELL AG

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 UNITED PARCEL SERVICE OF AMERICA, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 XPO, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 RELATED REPORTS

Lista de Tabela

TABLE 1 INNOVATION TYPES

TABLE 2 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 4 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 7 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (THOUSAND UNITS)

TABLE 8 EUROPE REVERSE LOGISTICS MARKET, BY COUNTRY, 2019-2033 (ASP/UNIT)

TABLE 9 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 10 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 11 EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 12 EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 13 EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 14 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 15 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 16 GERMANY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 17 GERMANY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 18 GERMANY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 19 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 20 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 21 U.K. REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 22 U.K. REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 23 U.K. REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 24 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 25 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 26 FRANCE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 27 FRANCE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 28 FRANCE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 29 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 30 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 31 ITALY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 32 ITALY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 ITALY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 34 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 35 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 36 SPAIN REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 37 SPAIN REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 38 SPAIN REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 39 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 40 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 41 RUSSIA REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 42 RUSSIA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 43 RUSSIA REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 44 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 45 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 46 NETHERLANDS REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 47 NETHERLANDS REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 NETHERLANDS REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 49 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 50 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 51 POLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 52 POLAND REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 53 POLAND REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 54 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 55 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 56 TURKEY REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 57 TURKEY REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 58 TURKEY REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 59 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 60 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 61 SWITZERLAND REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 62 SWITZERLAND REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 SWITZERLAND REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

TABLE 64 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (USD THOUSAND)

TABLE 65 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (THOUSAND UNITS)

TABLE 66 REST OF EUROPE REVERSE LOGISTICS MARKET, BY PRODUCT, 2019-2033 (ASP/UNIT)

TABLE 67 REST OF EUROPE REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2019-2033 (USD THOUSAND)

TABLE 68 REST OF EUROPE REVERSE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2033 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL EUROPE REVERSE LOGISTICS MARKET

FIGURE 2 EUROPE REVERSE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REVERSE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REVERSE LOGISTICS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REVERSE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REVERSE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GO-TO-MARKET (GTM) STRATEGY MODEL

FIGURE 8 GO TO MARKET STRATEGY GROWTH MATRIX

FIGURE 9 COMPANY EVALUATION QUADRANT

FIGURE 10 REGIONAL BREAKDOWN OF PRODUCT CATEGORIES

FIGURE 11 REVERSE LOGISTICS SUPPLY CHAIN

FIGURE 12 THE EEA VISION FOR A CIRCULAR ECONOMY IN EUROPE

FIGURE 13 TREND IN ESG RATINGS OF COMPANIES OF THE EU STOXX 50 FROM 2019 TO 2024

FIGURE 14 KEY MATERIAL FLOW INDICATORS IN THE EU-27

FIGURE 15 EUROPE REVERSE LOGISTICS MARKET: BY PRODUCT TYPE, 2025

FIGURE 16 EUROPE REVERSE LOGISTICS MARKET: BY SERVICE TYPE, 2025

FIGURE 17 EUROPE REVERSE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 18 EUROPE REVERSE LOGISTICS MARKET: SNAPSHOT, 2025

FIGURE 19 EUROPE REVERSE LOGISTICS MARKET: COMPANY SHARE 2025 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.