Europe Silicon Carbide (SiC) Market, By Product (Black and Green), Application (Metallurgy, Abrasives, Refractory, Electrical & Electronics, and Other), End-Use (Automotive, Aerospace, Military & Defense, Heavy Engineering, Consumer Electronics, Healthcare, and Others), Country (UK, France, Russia, Turkey, Italy, Spain, Netherlands, Belgium, Switzerland, Rest of Europe) Industry Trends and Forecast to 2028.

Market Analysis and Insights: Europe Silicon Carbide Market

Market Analysis and Insights: Europe Silicon Carbide Market

Europe silicon carbide (SiC) market is expected to gain significant growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyzes that the market is growing at a CAGR of 11.0% in the forecast period of 2021 to 2028 and is expected to reach USD 309,250.40 thousand by 2028.

Silicon carbide elements are used in glass and non-ferrous metal melting, metal heat treating, float glass manufacturing, ceramic and electronic component manufacturing, and gas heater ignition flaming lighters. They are also used in refractory linings and heating elements for industrial furnaces in wear-resistant parts for pumps and rocket motors and semiconductor substrates for light-emitting diodes.

Increasing demand for silicon carbide (SiC) in the production of e-vehicles rise in adoption of fast-charging batteries have had a significant impact on the expansion of the market for Silicon carbide (SiC). Rapid increase in the number of R&D initiatives for improving battery chemistry, growing implementation of SiC devices in automotive and power devices, rising demand for efficient lithium-ion batteries in electric vehicles, and other consumer electronic devices are key determinants favoring the growth of the silicon carbide (SiC) market during the forecast period.

However, high cost of manufacturing silicon carbide products, and various challenges associated with the production of Li metal batteries, and inability to produce high quality graphene on a large scale at a low cost are expected to restrain the market growth. Whereas, availability of other substitutes, such as gallium nitride and rapid increase and degradation of silicon anodes are expected to challenge the growth of the Silicon carbide (SiC) market during the forecast period.

Many devices used in healthcare are based on semiconductor manufacturing technology. The devices have found many applications in areas such as clinical diagnosis and therapy, medical imaging, and wearable and home care. Solid-state equipment, such as magnetic resonance imaging (MRI) machines, pacemakers, blood pressure monitors, and others, play an important role in keeping patients out of hospitals and monitored in the comfort of their own homes. Highly specialized equipment also require SiC-based semiconductors which increases the efficiency of the devices and helps them to function smoothly.

Europe Silicon Carbide Scope and Market Size

Europe Silicon Carbide Scope and Market Size

Europe Silicon Carbide is segmented on the basis of product, application, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the Europe Silicon carbide (SiC) market is segmented into black and green. In 2021, the black segment is expected to dominate the market as black is cost effective product and has more application in the abrasive industry which increases its demand in Europe.

- On the basis of application, the Europe Silicon carbide (SiC) market is segmented into metallurgy, abrasives, refractory, electrical & electronics, and other. In 2021, the abrasives segment is expected to dominate the market as abrasives are mostly used in the automobile sector, which increases its demand in Europe.

- On the basis of end use, the Europe Silicon carbide (SiC) market is segmented into automotive, aerospace, military & defense, heavy engineering, consumer electronics, healthcare, and others. In 2021, automotive sector segment is expected to dominate the market due to increase in the production of e-vehicles in the region.

- On the basis of geography, the Europe silicon carbide market is segmented into Germany, the UK, Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, and Rest of Europe.

Europe Silicon Carbide (SiC) Market Country Level Analysis

Europe Silicon Carbide (SiC) Market Country Level Analysis

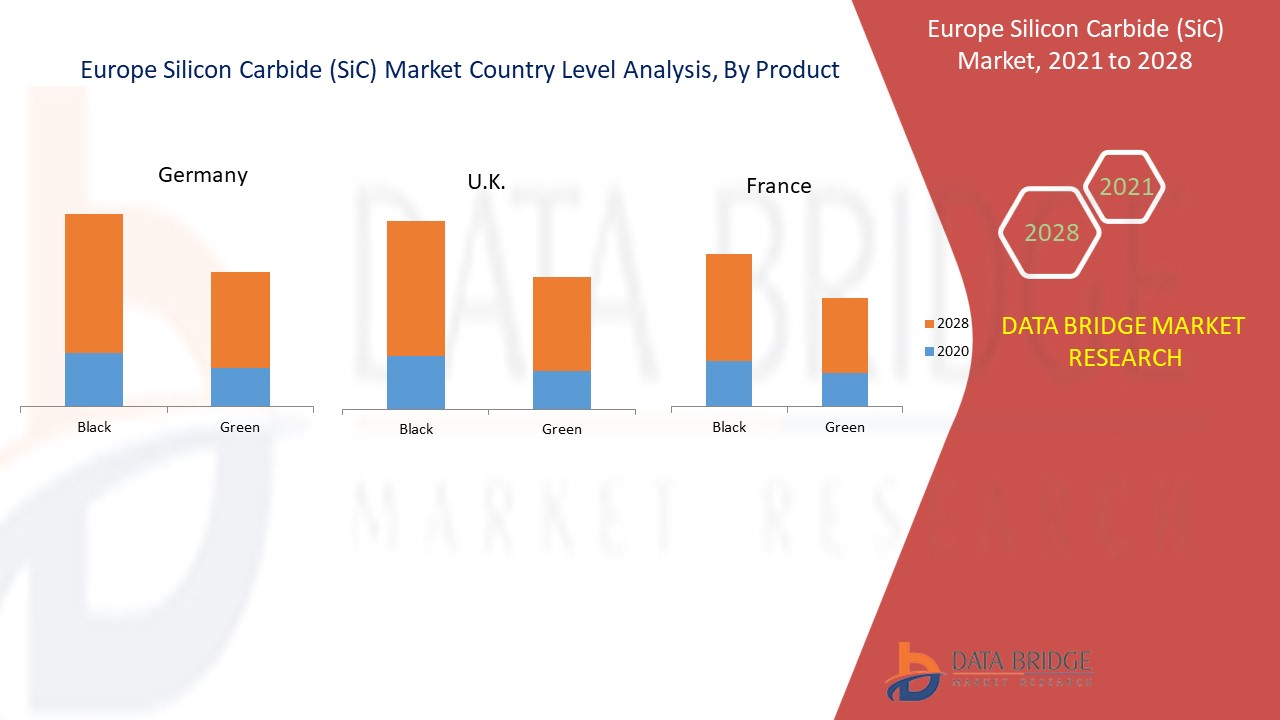

Europe silicon carbide is analyzed and market size information is provided by country, product, application, and end user.

The countries covered in the Europe Silicon carbide (SiC) market report are Germany, U.K, Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, and Rest of Europe.

- In Europe, Germany is the largest country in the manufacturing of silicon carbide (SiC) used for various applications, which increases the demand for silicon carbide (SiC) in automotive sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rise in demand from t electronics industry for various applications

Silicon carbide with higher silicon content can achieve good results, especially in the grating and refining of steel products. It can successfully expand the deoxidation rate of molten steel and improve the quality of steel in the process of steelmaking.

- In the aspect of casting, the primary silicon carbide has a good implantation effect, which can effectively promote the precipitation of the elements in the raw material for better chemical reaction, and also has a good spherical effect, and can effectively promote the formation of eutectic pellets.

Competitive Landscape and Silicon Carbide Share Analysis

Europe Silicon carbide (SiC) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus related to the Europe Silicon carbide (SiC) market equipment market.

Key players engaged in the Europe Silicon carbide (SiC) market are Infineon Technologies AG, Saint-Gobain, Entegris, CUMI EMD, ESD-SIC Bv, Ferrotec (USA) Corporation, WASHINGTON MILLS, Sublime Technologies, abrasivegrit, and SNAM Abrasives Pvt Ltd among others.

For instance,

- In October, 2021, Infineon Technologies AG collaborated with PIONIERKRAFT for enabling self-produced solar energy among the different households. This collaboration has in turn helped the company to adapt innovative solutions for energy generation and thus improving its position among the local consumers.

- In October, 2021, Saint-Gobain invested nearly €10 thousand to acquire the largest low-carbon electric furnace in Europe (for ductile iron pipes) in France. This investment was made in order to reduce environmental impact, inherent to industrial production.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE SILICON CARBIDE (SIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OPPORTUNITIES FOR SILICON CARBIDE IN ELECTRICAL & ELECTRONICS SECTORS

4.2 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, PRICE ANALYSIS

4.2.1 OVERVIEW

5 ME, INDIA AND EUROPE SILICON CARBIDE (SIC) MARKET, REGIONAL AND COUNTRY SUMMARY

5.1 EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FROM THE STEEL INDUSTRY FOR VARIOUS APPLICATIONS

6.1.2 INCREASE IN IMPLEMENTATION OF SIC DEVICES IN AUTOMOTIVE AND POWER DEVICES

6.1.3 GROW IN DEMAND FOR SMART CONSUMER ELECTRONICS

6.1.4 POSITIVE OUTLOOK OF SILICON CARBIDE (SIC) TOWARDS SEMICONDUCTOR INDUSTRY

6.2 RESTRAINT

6.2.1 HIGH COST FOR MANUFACTURING SILICON CARBIDE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 HUGE ADOPTION OF SILICON CARBIDE (SIC) IN THE HEALTH SECTOR

6.3.2 GROW IN DEMAND FOR SMALL DEVICES TO ENABLE SIZE-REDUCTION

6.3.3 RISE IN DEMAND FOR HYBRID AND ELECTRIC CARS

6.4 CHALLENGE

6.4.1 AVAILABILITY OF OTHER SUBSTITUTES SUCH AS GALLIUM NITRIDE, GRAPHENE, AND PEROVSKITES

7 IMPACT OF COVID-19 ON THE MIDDLE EAST, INDIA, AND EUROPE SILICON CARBIDE (SIC) MARKET

7.1 AFTERMATH OF COVID-19, BY SEGMENT

7.1.1 METALLURGY

7.1.2 ABRASIVES

7.1.3 REFRACTORIES

7.2 STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID-19 TO GET COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BLACK

8.3 GREEN

9 EUROPE SILICON CARBIDE (SIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ABRASIVES

9.3 ELECTRICAL & ELECTRONICS

9.4 METALLURGY

9.5 REFRACTORY

9.6 OTHERS

10 EUROPE SILICON CARBIDE (SIC) MARKET, BY END-USER

10.1 OVERVIEW

10.2 AUTOMOTIVE

10.3 HEAVY ENGINEERING

10.4 CONSUMER ELECTRONICS

10.5 AEROSPACE

10.6 MILITARY & DEFENSE

10.7 HEALTHCARE

10.8 OTHERS

11 EUROPE SILICON CARBIDE (SIC) MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 NETHERLANDS

11.1.7 BELGIUM

11.1.8 RUSSIA

11.1.9 TURKEY

11.1.10 SWITZERLAND

11.1.11 REST OF EUROPE

12 EUROPE SILICON CARBIDE (SIC) MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 MERGER & ACQUISITIONS, COLLABORATIONS

12.3 EXPANSION

12.4 NEW PRODUCT DEVELOPMENTS

13 SWOT

14 COMPANY PROFILES

14.1 SAINT-GOBAIN

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 INFINEON TECHNOLOGIES AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 ENTEGRIS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 CUMI EMD

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATE

14.5 WASHINGTON MILLS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 ESD-SIC BV

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 ABRASIVEGRIT

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 FERROTEC (USA) CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 SNAM ABRASIVES PVT LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 SUBLIME TECHNOLOGIES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF CARBIDES OF SILICON, WHETHER OR NOT CHEMICALLY DEFINED, HS CODE - 284920 (USD THOUSAND)

TABLE 2 EXPORT DATA CARBIDES OF SILICON, WHETHER OR NOT CHEMICALLY DEFINED, HS CODE - 284920 (USD THOUSAND)

TABLE 3 ALLOY CONTENT IN STEEL MANUFACTURING

TABLE 4 EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 5 EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 6 EUROPE SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 7 EUROPE SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 8 EUROPE SILICON CARBIDE (SIC) MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 9 EUROPE SILICON CARBIDE (SIC) MARKET, BY COUNTRY, 2019-2028 (TONS)

TABLE 10 EUROPE SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 11 EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 12 EUROPE SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 13 EUROPE SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 14 GERMANY SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 15 GERMANY SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 16 GERMANY SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 17 GERMANY SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 18 U.K. SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 19 U.K. SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 20 U.K. SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 21 U.K. SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 22 FRANCE SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 23 FRANCE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 24 FRANCE SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 25 FRANCE SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 26 ITALY SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 27 ITALY SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 28 ITALY SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 29 ITALY SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 30 SPAIN SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 31 SPAIN SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 32 SPAIN SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 33 SPAIN SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 34 NETHERLANDS SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 35 NETHERLANDS SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 36 NETHERLANDS SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 37 NETHERLANDS SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 38 BELGIUM SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 39 BELGIUM SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 40 BELGIUM SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 41 BELGIUM SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 42 RUSSIA SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 43 RUSSIA SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 44 RUSSIA SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 45 RUSSIA SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 46 TURKEY SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 47 TURKEY SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 48 TURKEY SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 49 TURKEY SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 50 SWITZERLAND SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 51 SWITZERLAND SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 52 SWITZERLAND SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 SWITZERLAND SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 54 REST OF EUROPE SILICON CARBIDE (SIC )MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 55 REST OF EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

Lista de Figura

FIGURE 1 EUROPE SILICON CARBIDE (SIC) MARKET: SEGMENTATION

FIGURE 2 EUROPE SILICON CARBIDE(SIC) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SILICON CARBIDE(SIC) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SILICON CARBIDE(SIC) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 EUROPE SILICON CARBIDE(SIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SILICON CARBIDE(SIC) MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE SILICON CARBIDE(SIC) MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE SILICON CARBIDE(SIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE SILICON CARBIDE(SIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE SILICON CARBIDE(SIC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE SILICON CARBIDE(SIC) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE SILICON CARBIDE(SIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE SILICON CARBIDE(SIC) MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE EUROPE SILICON CARBIDE (SIC) MARKET AND WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 THE GROWING IMPLEMENTATION OF SIC DEVICES IN AUTOMOTIVE AND POWER DEVICES IS EXPECTED TO DRIVE THE EUROPE SILICON CARBIDE (SIC) MARKET FROM 2021 TO 2028

FIGURE 16 THE BLACK SIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SILICON CARBIDE(SIC) MARKET IN 2021 & 2028

FIGURE 17 GLOBAL SEMICONDUCTOR INDUSTRY SALES (USD BILLION) (2019-2020)

FIGURE 18 PRICE OF SILICON CARBIDE (SIC) IN SAUDI ARABIA, 2019-2020 (TONS)

FIGURE 19 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF EUROPE SILICON CARBIDE (SIC) MARKET

FIGURE 20 EFFICIENCY CURVE OF SIC BASED SEMICONDUCTORS (%)

FIGURE 21 U.K. EV SIC DEVICE DEMAND (USD MILLIONS)

FIGURE 22 EUROPE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2020

FIGURE 23 EUROPE SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2020

FIGURE 24 EUROPE SILICON CARBIDE (SIC) MARKET, BY END-USER, 2020

FIGURE 25 EUROPE SILICON CARBIDE (SIC) MARKET: SNAPSHOT (2020)

FIGURE 26 EUROPE SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2020)

FIGURE 27 EUROPE SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 28 EUROPE SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 29 EUROPE SILICON CARBIDE (SIC) MARKET: BY PRODUCT (2021-2028)

FIGURE 30 EUROPE SILICON CARBIDE (SIC) MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.