Global 3d Scanner Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

5.10 Billion

USD

10.30 Billion

2024

2032

USD

5.10 Billion

USD

10.30 Billion

2024

2032

| 2025 –2032 | |

| USD 5.10 Billion | |

| USD 10.30 Billion | |

|

|

|

|

Global 3D Scanner Market Segmentation, By Type (Optical Scanner, Laser Scanner and Structured Light Scanner), Range (Short Range Scanner, Medium Range Scanner and Long Range Scanner), Offering (Hardware and Software and Aftermarket Service), Product (Tripod Mounted, Fixed CMM Based, Portable CMM Based and Desktop), Application (Reverse Engineering, Quality Control and Inspection and Virtual Simulation), End Users (Automotive, Healthcare, Aerospace and Defence, Architecture and Construction, Energy and Power, Tunnel and Mining and Artefact and Heritage Preservation Department), Distribution Channel (Direct Sales and Distributor Sales) - Industry Trends and Forecast to 2032

3D Scanner Market Size

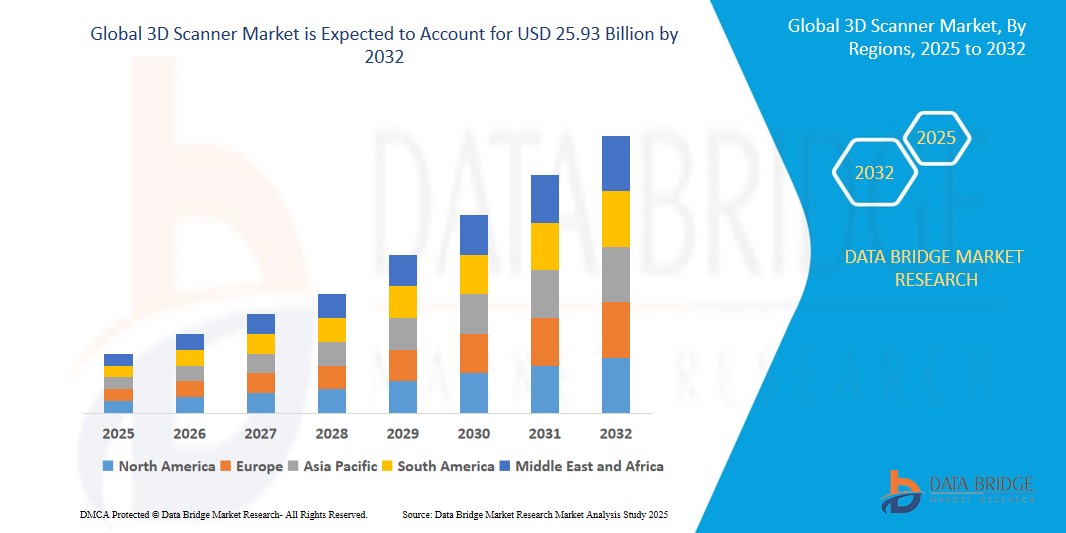

- The Global 3D Scanner Market size was valued atUSD 6.7 billion in 2024 and is expected to reachUSD 25.93 billion by 2032, at aCAGR of 7.80%during the forecast period

- This growth is driven by factors such as the Rising Adoption Across Industries, Advancements in Scanning Technology, and Growth of 3D Printing and Additive Manufacturing

3D Scanner Market Analysis

- A 3D scanner is a device that is used to capture the physical whereabouts such as weight and appearance of a physical object. 3D scanners are used in wide range of applications such as reverse engineering, quality control and inspection and virtual simulation. The collected data in turn is used to create 3D models for analysis and research purposes.

- Upsurge in the demand by the manufacturers for the technological solutions that help to maintain the product quality is inducing growth in the demand for 3D scanners. Growth and expansion of various end user verticals such as automotive, healthcare, aerospace and defence, architecture and construction, energy and power and others will directly and positively impact the demand for 3D scanners globally.

- North America is expected to dominate the 3D Scanners market due to rising demand for handheld scanning devices and increasing integration of 3D scanners by the various end user industries into machinery and other automated equipment

- Asia-Pacific is expected to be the fastest growing region in the 3D Scanner Market during the forecast period due to the deployment of 3D scanners in aerospace and defence industry.

- Optical Scanner segment is expected to dominate the market with a market share of 44.21% due to its high precision, speed, and versatility across various industrial applications.

Report Scope and 3D Scanner Market Segmentation

|

Attributes |

3D Scanner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

3D Scanner Market Trends

“Increasing Use of 3D Scanning in Healthcare and Dentistry”

- One of the fastest-growing trends in the 3D scanner market is its adoption in the healthcare and dental industries. Medical professionals now use 3D scanners to create custom implants, dental crowns, prosthetics, and even surgical models. These tools allow for precise scanning of a patient's anatomy, making treatments faster and more accurate.

- The ability to produce 3D models from scans helps doctors plan complex surgeries or develop personalized medical devices. Dentistry has especially embraced this tech to eliminate traditional mold impressions, improving patient comfort and accuracy.

- This trend is also growing in developing countries, where affordable handheld scanners are making advanced healthcare more accessible.

- For instance, in 2024, Align Technology, the company behind Invisalign, introduced an upgraded iTero Element 5D Plus scanner. It improved intraoral scanning speed and imaging accuracy, helping dentists deliver faster and more customized orthodontic treatment to patients

3D Scanner Market Dynamics

Driver

“Growing Demand for Precision in Manufacturing”

- Industries like automotive, aerospace, and electronics are pushing for more precision than ever in their design and production processes.

- 3D scanners are playing a big role in this by providing extremely accurate measurements of parts and components. Instead of relying solely on blueprints or physical measurements, engineers use 3D scanning to reverse-engineer products, detect defects early, and speed up the quality control process.

- This not only saves time and reduces waste but also helps companies stay competitive by improving product performance and reliability

For instance,

- In 2024, Ford Motor Company integrated high-speed 3D laser scanners in their production line to inspect car body panels. This allowed them to detect millimeter-level defects instantly and reduced rework time by 30%.

Opportunity

“Integration of AI and Cloud Technologies”

- The use of artificial intelligence (AI) and cloud computing in 3D scanning is opening up new possibilities across industries. With AI, scanners can process data in real time, spot patterns, and even predict maintenance needs—helping businesses run more efficiently.

- Cloud integration allows teams to access and share 3D data instantly, improving collaboration across departments or locations.

- This trend is gaining momentum, with nearly half of businesses exploring AI-powered scanning, and many startups building products around these technologies.

For instance,

- In 2025, Niantic added a cutting-edge technique called Gaussian splatting to its Scaniverse app. This update lets users scan real-world objects using just their smartphones and turn them into detailed 3D models. Major tech players like Google and Meta are adopting this kind of innovation for everything from mapping to AR and VR experiences.

Restraint/Challenge

“High Initial Cost of 3D Scanning Equipment”

- One of the biggest challenges for the 3D scanner market is the high upfront cost of equipment. Advanced 3D scanners, especially those with high resolution and accuracy, can be quite expensive—sometimes costing tens of thousands of dollars.

- This makes it hard for small and mid-sized companies, especially in developing countries, to adopt the technology. Even though prices are gradually coming down, the cost of related software, training, and maintenance still adds to the overall investment.

- As a result, many businesses delay adopting 3D scanning despite knowing its long-term benefits.

For instance,

- In 2023, several small-scale manufacturers in Southeast Asia reported hesitancy to switch from traditional measurement tools to 3D scanning due to costs exceeding $25,000 per unit, limiting market penetration in the region

3D Scanner Market Scope

The 3D scanner market is segmented on the basis of type, range, offering, product, application and end users. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

Range |

|

|

Offering |

|

|

Product |

|

|

Application |

|

|

End Users |

|

In 2025, the Optical Scanner is projected to dominate the market with a largest share in Type segment

In 2025, the Optical Scanner segment is expected to lead the 3D scanner market, capturing the largest share of 44.21% in the type category. This growth is driven by its high accuracy, speed, and non-contact scanning capabilities, making it ideal for applications in healthcare, automotive, and cultural preservation. Optical scanners are especially preferred for capturing detailed surface textures and complex geometries, helping industries improve quality control, reverse engineering, and design processes efficiently.

The Laser Scanner is expected to account for the largest share during the forecast period in technology market

The Laser Scanner segment is projected to hold the largest share of 41.73% in the 3D scanner technology market during the forecast period. This dominance is mainly due to its exceptional precision, long-range capabilities, and speed, which make it ideal for large-scale applications like construction, mining, and infrastructure inspection. Laser scanners are widely used for creating accurate 3D models of complex environments, helping companies improve planning, maintenance, and safety.

3D Scanner Market Regional Analysis

“North America Holds the Largest Share in the 3D Scanner Market”

- North America is currently the leading region in the global 3D scanner market, holding a dominant market share of 53.78%. This strong position is largely due to the widespread adoption of advanced technologies across industries like aerospace, automotive, healthcare, and manufacturing.

- The region benefits from a highly developed infrastructure, strong R&D capabilities, and the presence of major 3D scanning companies and software developers. In addition, U.S. companies are heavily investing in automation and quality control, where 3D scanners play a critical role.

- Educational institutions and research labs are also increasingly using this technology for innovation and product development. Furthermore, demand for 3D scanning in cultural heritage preservation and medical imaging continues to grow.

- Supportive government funding and rapid integration of AI and cloud solutions are also fueling market expansion. These factors together make North America a technological hub for 3D scanning. As a result, the region continues to set global standards and drive future trends in the market.

“Asia-Pacific is Projected to Register the Highest CAGR in the 3D Scanner Market”

- The Asia-Pacific region is expected to experience the highest growth rate in the global 3D scanner market, with a projected CAGR of 8.45%. This rapid growth is fueled by the increasing adoption of 3D scanning technology across key industries like automotive, electronics, construction, and healthcare.

- Countries like China, Japan, and India are seeing significant investments in manufacturing and infrastructure, where 3D scanning is crucial for improving product design, quality control, and automation processes. The region’s strong focus on technological advancements, particularly in AI and robotics, is further driving market expansion.

- Additionally, the rise of e-commerce and the need for digitalization in various sectors are contributing to the demand for 3D scanning solutions. The increasing number of small and medium-sized enterprises (SMEs) adopting these technologies for cost-effective prototyping and product development is also a key factor.

- With growing industrialization and the need for precision, Asia-Pacific is positioning itself as a major player in the global 3D scanner market. This trend is expected to continue as more companies embrace digital transformation.

3D Scanner Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- KEYENCE CORPORATION.,

- JENOPTIK AG,

- Metrologic Group.,

- Hexagon AB,

- FARO,

- CREAFORM.,

- Perceptron, Inc.,

- Nikon Metrology NV,

- Trimble Inc.,

- ZEISS,

- TOPCON CORPORATION,

- RIEGL Laser Measurement Systems GmbH,

- Artec Europe.,

- Surphaser.,

- DeWalt Corporation,

- WENZEL Group,

- NextEngine, Inc.,

- SGM Lightwave, LLC,

- Precise Visual Technologies,

- Technics Group.,

- CyberOptics,

- IMAG’ING

- McKim & Creed, Inc

Latest Developments in Global 3D Scanner Market

- In January 2025, FARO Technologies introduced the FARO Leap ST®, a versatile handheld 3D scanner designed for high-speed, high-accuracy metrology. It features five scanning modes, including ultra-fast scanning and photogrammetry, making it suitable for various manufacturing applications. The launch was accompanied by an update to FARO's CAM2® software, enhancing the scanning process and integration capabilities. This move strengthens FARO's position in the portable 3D metrology sector.

- Nikon released the Lasermeister SB100 in April 2024, a 3D scanner developed to complement its Lasermeister LM300A metal additive manufacturing system. The SB100 enables automated scanning of workpieces, generating tool path data for 3D printing processes. This integration supports applications such as turbine blade and mold repairs, enhancing factory automation and precision in industrial settings.

- ZEISS launched the INSPECT Optical 3D 2025 software, introducing several enhancements to streamline 3D surface inspection tasks. Key features include improved surface defect workflows, support for the latest GD&T standards, and sensor fusion capabilities for handling data from multiple sensors. These updates aim to increase productivity and measurement accuracy across various industries.

- In February 2025, FARO acquired Opto-Tech SRL and its subsidiary Open Technologies SRL, both Italian companies specializing in compact 3D structured light scanning solutions. This acquisition expands FARO's portfolio in dental and orthopedic applications, enabling the creation of custom crowns, implants, and prosthetics. The move aligns with FARO's strategy to enhance its presence in the medical and industrial sectors.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.