Global Alpha And Beta Emitters Based Radiopharmaceuticals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

801.45 Million

USD

1,769.20 Million

2024

2032

USD

801.45 Million

USD

1,769.20 Million

2024

2032

| 2025 –2032 | |

| USD 801.45 Million | |

| USD 1,769.20 Million | |

|

|

|

|

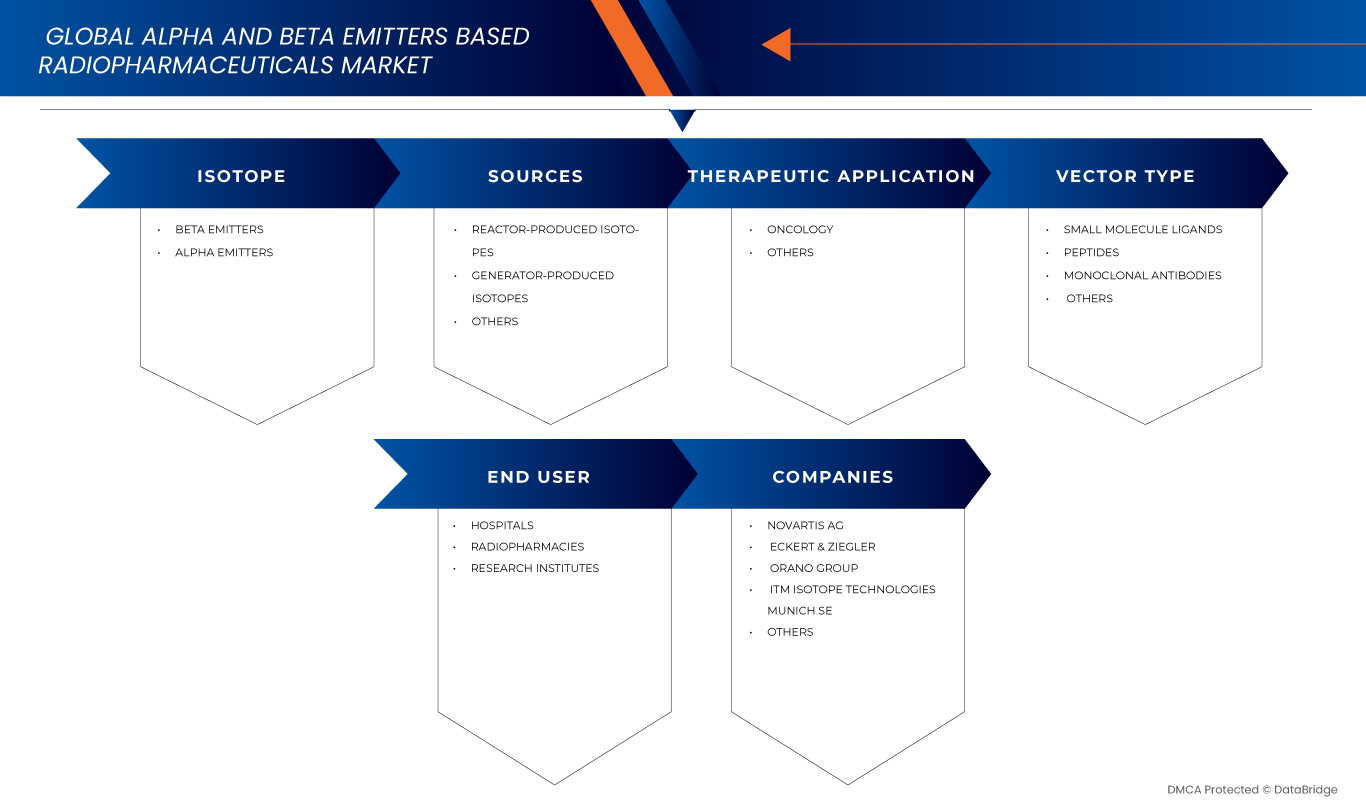

Segmentação do mercado global de radiofármacos baseados em emissores alfa e beta, por isótopo (emissores beta e emissores alfa), fontes (isótopos produzidos por reator, isótopos produzidos por gerador e outros), aplicação terapêutica (oncologia e outros), tipo de vetor (ligantes de pequenas moléculas, peptídeos, anticorpos monoclonais e outros), usuário final (hospitais, radiofarmácias e institutos de pesquisa) - Tendências do setor e previsão até 2032

Tamanho do mercado de radiofármacos baseados em emissores alfa e beta

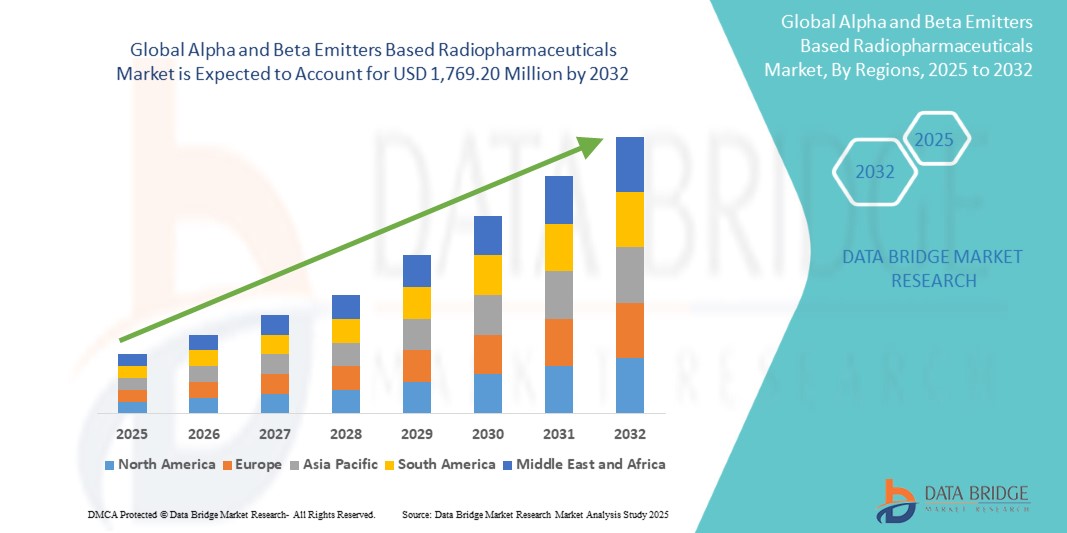

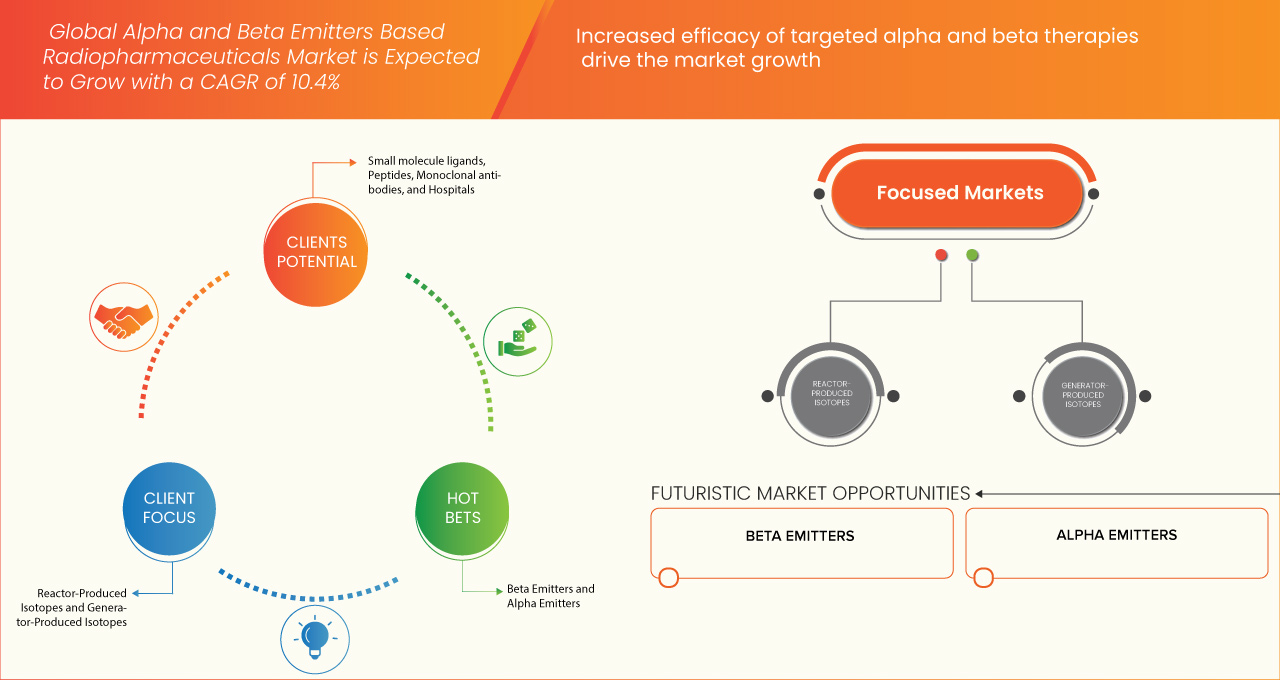

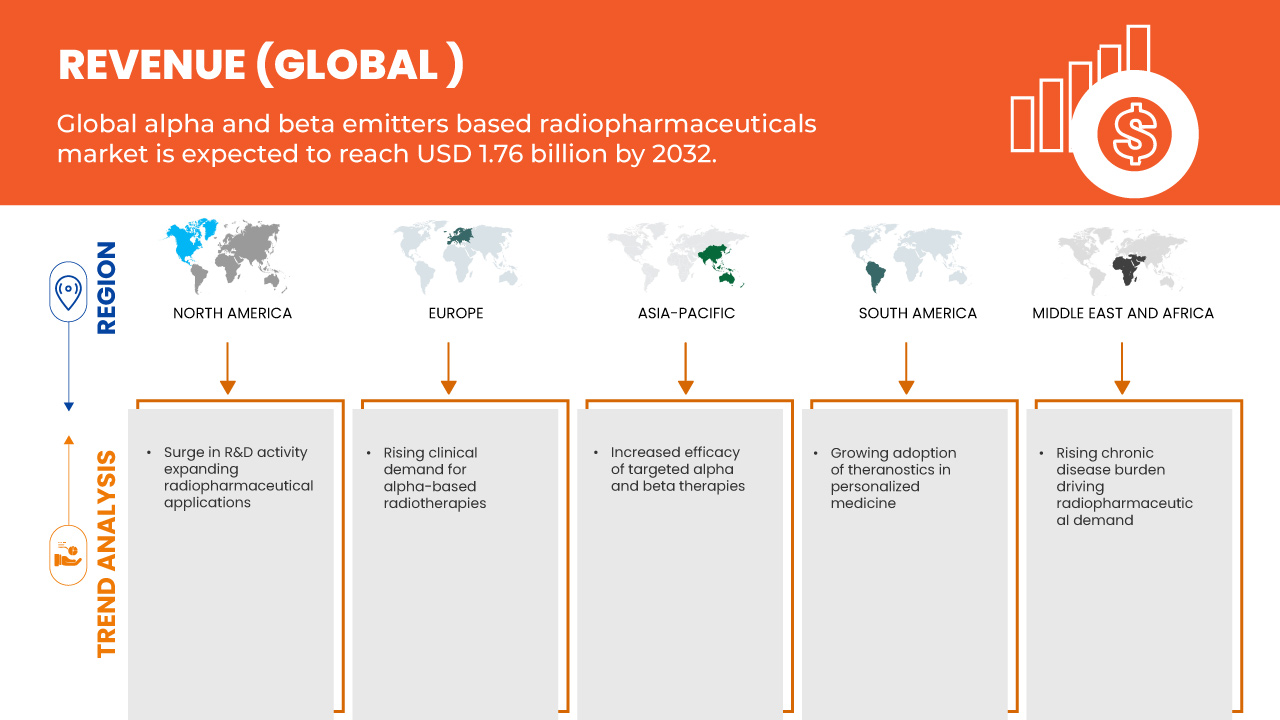

- O tamanho do mercado global de radiofármacos baseados em emissores alfa e beta foi avaliado em US$ 801,45 milhões em 2024 e deve atingir US$ 1.769,20 milhões até 2032 , com um CAGR de 10,4% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela maior eficácia das terapias alfa e beta direcionadas

- Além disso, a crescente adoção da teranóstica na medicina personalizada. Esses fatores convergentes estão acelerando a adoção de soluções radiofarmacêuticas baseadas em emissores alfa e beta, impulsionando significativamente o crescimento do setor.

Análise de Mercado de Radiofármacos Baseados em Emissores Alfa e Beta

- Os radiofármacos baseados em emissores alfa e beta são cada vez mais reconhecidos por sua precisão na terapia direcionada, especialmente em oncologia e medicina nuclear, fornecendo diagnóstico eficaz e opções de tratamento com efeitos colaterais mínimos.

- A crescente incidência de câncer em todo o mundo, juntamente com a crescente conscientização sobre medicina personalizada e os avanços na tecnologia radiofarmacêutica, está impulsionando a demanda global por radiofármacos baseados em emissores alfa e beta.

- A América do Norte detém uma participação significativa no mercado global de radiofármacos baseados em emissores alfa e beta, respondendo por aproximadamente 42,59% da receita em 2025, apoiada por infraestrutura avançada de saúde, extensas atividades de P&D e adoção antecipada de novas tecnologias terapêuticas.

- A região da América do Norte deverá ser o mercado de crescimento mais rápido para radiofármacos baseados em emissores alfa e beta durante o período previsto, impulsionado pela expansão da infraestrutura de saúde, aumento da prevalência do câncer e iniciativas governamentais para melhoria da saúde.

- Espera-se que o segmento de emissores beta domine o mercado com uma participação de 84,78% em 2025, impulsionado por sua alta eficácia na Terapia Alfa Direcionada (TAT), melhores resultados para os pacientes e crescente pesquisa focada em isótopos emissores de alfa como Actínio-225 e Rádio-223 para tratamento do câncer.

Escopo do Relatório e Segmentação do Mercado de Radiofármacos Baseados em Emissores Alfa e Beta

|

Atributos |

Principais insights de mercado sobre radiofármacos baseados em emissores alfa e beta |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Ásia-Pacífico

Europa

Ámérica do Sul

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de pipeline, análise de preços e estrutura regulatória. |

Tendências do mercado de radiofármacos baseados em emissores alfa e beta

“ Aumento da eficácia das terapias alfa e beta direcionadas ”

- Uma grande força motriz por trás do mercado global de radiofármacos baseados em emissores alfa e beta é a crescente adoção clínica de terapias com radionuclídeos direcionados, devido à sua eficácia comprovada no tratamento de cânceres avançados, como tumores neuroendócrinos e câncer de próstata metastático resistente à castração (mCRPC).

- Por exemplo, em maio de 2023, de acordo com o artigo publicado pelo NCBI, o regime aprovado [177Lu]Lu-PSMA-617 (7,4 GBq por ciclo a cada 6 semanas por até 6 ciclos) demonstrou forte segurança e eficácia antitumoral em uso real, com dosagem flexível (6 a 9,3 GBq) e intervalos de tratamento (4 a 10 semanas). Esse desempenho clínico consistente aumenta a confiança dos médicos e acelera a adoção pelo mercado.

- Radiofármacos como o Lu-177, particularmente quando usados na terapia com radionuclídeos receptores peptídicos (PRRT), demonstraram sucesso notável no tratamento de tumores neuroendócrinos, fornecendo radiação beta potente diretamente aos locais do tumor, preservando os tecidos saudáveis, o que leva a melhores resultados e aumento da demanda.

- Os avanços tecnológicos e a validação clínica de isótopos emissores de alfa, como o Ac-225, impulsionaram ainda mais o mercado. O Ac-225 demonstrou ser altamente eficaz no combate a células cancerígenas da próstata resistentes às terapias tradicionais, com efeitos colaterais mínimos e forte impacto terapêutico.

Dinâmica do mercado de radiofármacos baseados em emissores alfa e beta

Motorista

“Adoção crescente de teranósticos na medicina personalizada”

- A crescente adoção de radiofármacos teranósticos emissores alfa e beta — como Lutécio-177 (Lu-177) e Térbio-161 (Tb-161) — é um importante impulsionador do mercado global de radiofármacos. Ao combinar diagnóstico por imagem com terapia direcionada em um único fluxo de trabalho clínico, esses agentes proporcionam um tratamento preciso e específico para o paciente, melhorando os resultados e agilizando o planejamento do tratamento.

- Por exemplo, em julho de 2023, uma revisão publicada no NCBI relatou o aumento do uso clínico de regimes teranósticos baseados em Lu-177 (por exemplo, ¹⁷⁷Lu-DOTATATE para tumores neuroendócrinos e ¹⁷⁷Lu-PSMA para câncer de próstata). As aprovações da FDA para esses agentes validaram sua segurança e eficácia, acelerando a adoção e destacando a poderosa sinergia de pares diagnóstico-terapêuticos combinados.

- A crescente conscientização entre oncologistas e especialistas em medicina nuclear sobre a eficiência do fluxo de trabalho, a precisão do tratamento e a toxicidade reduzida associadas às abordagens teranósticas está impulsionando a demanda, à medida que os médicos buscam ferramentas confiáveis para o gerenciamento personalizado do câncer.

- Além disso, à medida que os sistemas de saúde enfrentam pressões crescentes para melhorar as taxas de sobrevivência e controlar os custos, as soluções integradas de terapia de imagem como Lu-177 e Tb-161 reduzem o tempo de tratamento, evitam intervenções ineficazes e melhoram a qualidade de vida, consolidando sua proposta de valor.

- A crescente preferência pela oncologia de precisão, aliada à P&D contínua em isótopos de última geração, como Tb-149, Tb-152/155 e Ac-225, posiciona os radiofármacos teranósticos como a pedra angular do tratamento moderno do câncer e um importante motor de crescimento para o mercado global.

Restrição/Desafio

“ Desafios da cadeia de suprimentos e escalabilidade devido às meias-vidas curtas dos isótopos ”

- A curta meia-vida dos radionuclídeos como o Chumbo-212 (~10,6 horas) cria grandes obstáculos logísticos e operacionais: a produção deve ocorrer perto dos locais de tratamento, as janelas de transporte são de apenas algumas horas e são necessárias cadeias de abastecimento “just-in-time” altamente coordenadas, restringindo coletivamente a produção em larga escala e o alcance do mercado.

- Por exemplo, em abril de 2025, a LEK Consulting observou que a meia-vida de 10,6 horas do Pb-212 força a produção descentralizada, próxima ao paciente, e a infraestrutura do gerador no local, limitando as economias de escala e complicando a logística de distribuição.

- Além disso, os complexos sistemas geradores necessários para extrair Pb-212 (e outros isótopos de curta duração) acrescentam camadas de conformidade regulamentar, requisitos de segurança contra radiação e despesas de capital, dificultando a ampla implementação em hospitais e radiofarmácias.

- Embora os avanços em geradores compactos, métodos de purificação mais rápidos e centros de produção regionais possam eventualmente aliviar essas pressões, a natureza fundamentalmente sensível ao tempo dos isótopos de vida curta continua sendo uma restrição significativa à ampla adoção e ao crescimento do mercado de radiofármacos.

Escopo do mercado de radiofármacos baseados em emissores alfa e beta

O mercado é segmentado com base em isótopo, fontes, aplicação terapêutica, tipo de vetor e usuário final.

- Por Isótopo

Com base no tipo de isótopo, o mercado é segmentado em emissores beta e emissores alfa. Em 2025, espera-se que o segmento de emissores beta domine o mercado, com uma participação de mercado de 84,78%, devido à ampla adoção clínica de isótopos como lutécio-177 (Lu-177) e ítrio-90 (Y-90) para o tratamento de tumores neuroendócrinos, câncer de fígado e câncer de próstata. Os emissores beta são preferidos por suas meias-vidas relativamente mais longas, perfis de segurança estabelecidos e compatibilidade com os fluxos de trabalho clínicos existentes.

O segmento de emissores beta deverá apresentar a taxa de crescimento mais rápida, de 9,1%, entre 2025 e 2032, impulsionado pelo uso crescente de Actínio-225 (Ac-225) e Chumbo-212 (Pb-212) em tratamentos de câncer avançado. Os emissores alfa oferecem alta transferência linear de energia (LET) e maior eficácia na eliminação de tumores com danos colaterais mínimos, tornando-os altamente adequados para cânceres resistentes e metastáticos.

- Por fontes

Com base nas fontes, o mercado é categorizado em isótopos produzidos em reatores, isótopos produzidos em geradores e outros. Em 2025, os isótopos produzidos em reatores liderarão o mercado devido ao alto volume de fornecimento e à ampla disponibilidade de emissores beta importantes, como Lu-177 e Iodo-131.

No entanto, espera-se que os isótopos produzidos em reatores sejam o segmento de crescimento mais rápido, impulsionado pela crescente demanda por isótopos como Pb-212 e Ra-223, que exigem produção descentralizada e próxima ao paciente. O aumento de geradores locais também se alinha ao crescente interesse em terapias alfa e radiofármacos de curta duração.

- Por aplicação terapêutica

Em termos de aplicação terapêutica, o mercado está segmentado em oncologia e outras áreas. Em 2025, a oncologia dominará o mercado, com os radiofármacos desempenhando um papel central em terapias direcionadas para câncer de próstata, tumores neuroendócrinos e linfoma. O crescente sucesso das terapias direcionadas ao PSMA e baseadas em PRRT reforça a liderança da oncologia nesse segmento.

O segmento de oncologia inclui distúrbios cardiovasculares, endócrinos e neurológicos e espera-se que testemunhe um crescimento constante com o desenvolvimento de novos radioligantes e expansão para indicações não oncológicas.

- Por tipo de vetor

Com base no tipo de vetor, o mercado é segmentado em ligantes de pequenas moléculas, peptídeos, anticorpos monoclonais e outros. Em 2025, espera-se que os ligantes de pequenas moléculas detenham a maior fatia de mercado devido à sua rápida penetração nos tecidos e amplo uso em terapias direcionadas a PSMA e somatostatina.

Ligantes de pequenas moléculas estão prestes a apresentar um crescimento significativo durante o período previsto devido aos avanços nas tecnologias de conjugação e à sua capacidade de oferecer maior seletividade tumoral, tempos de circulação mais longos e maior eficiência de ligação. Esses vetores são especialmente críticos para terapias com emissores alfa, onde a precisão é fundamental.

- Por usuário final

Com base nisso, o mercado é segmentado por usuário final em hospitais, radiofarmácias e institutos de pesquisa. Em 2025, os hospitais representarão a maior fatia, impulsionados pelo aumento do acesso dos pacientes à medicina nuclear, pelo crescimento dos departamentos de teranóstico e por fortes estruturas de reembolso em países desenvolvidos.

Espera-se que o segmento de radiofármacos cresça rapidamente devido à crescente demanda por composição centralizada e descentralizada de radiofármacos, especialmente aqueles com meias-vidas curtas. Os institutos de pesquisa continuarão a desempenhar um papel vital na inovação e nos ensaios clínicos, particularmente para isótopos de próxima geração, como o Térbio-161 e o Actínio-225.

Análise regional do mercado de radiofármacos baseados em emissores alfa e beta

- A América do Norte domina o mercado de radiofármacos baseados em emissores alfa e beta com a maior participação na receita de 42,59% em 2025 e projeta-se que se expanda a um CAGR robusto até 2032.

- Sustentada por profundos pipelines oncológicos, rápida absorção teranóstica e uma densa rede de instalações de PET/SPECT e radiofarmácia, o forte financiamento federal da região para pesquisa em medicina nuclear, o reembolso favorável para terapia com radioligantes e os investimentos contínuos dos produtores de Lu-177 e Ac-225 estabelecem uma cadeia de suprimentos doméstica resiliente e sustentam a liderança de mercado.

- Grandes economias, como os Estados Unidos e o Canadá, alavancam a infraestrutura madura de produção de isótopos, a extensa atividade de ensaios clínicos e as parcerias público-privadas para escalar a produção e permitir o acesso rápido dos pacientes

Visão do mercado de radiofármacos baseados em emissores alfa e beta dos EUA

Os EUA deterão a maior parte da receita da América do Norte em 2025, impulsionada por um ecossistema de saúde avançado, aprovações antecipadas da FDA (por exemplo, Lu-177 PSMA-617) e expansões contínuas de capacidade por fornecedores como PharmaLogic e SHINE.

Visão geral do mercado de radiofármacos baseados em emissores alfa e beta do Canadá

O Canadá registra crescimento de dois dígitos à medida que novas atualizações de cíclotrons e reatores dão suporte à produção doméstica de Lu-177, enquanto uma rede crescente de centros teranósticos ambulatoriais atende à crescente demanda por oncologia de precisão.

Visão do mercado de radiofármacos baseados em emissores alfa e beta da Ásia-Pacífico

A região da Ásia-Pacífico é a que mais cresce, capturando uma parcela significativa da receita global em 2025, impulsionada pelo aumento da incidência de câncer, pelo grande número de pacientes e pelo investimento governamental agressivo em capacidade de medicina nuclear. Programas nacionais de controle do câncer, a expansão das frotas de cíclotrons e a localização da produção de Lu-177 e Ac-225 sustentam o impulso da região, enquanto a melhoria do reembolso amplia o acesso dos pacientes. As principais economias, China, Índia, Japão e Coreia do Sul, estão expandindo rapidamente a fabricação de radiofármacos por meio de iniciativas estatais e colaborações com fornecedores globais de isótopos.

Visão geral do mercado de radiofármacos baseados em emissores alfa e beta da China

A China comandará a maior fatia da Ásia-Pacífico em 2025, impulsionada por um foco estratégico na autossuficiência nacional de isótopos e joint ventures (por exemplo, terapia de prótons da IBA e colaborações de isótopos com a CGN) que reforçam a segurança da cadeia de suprimentos.

Visão do mercado de radiofármacos baseados em emissores alfa e beta da Índia

A Índia registra o ritmo de crescimento mais rápido da região graças aos programas do Departamento de Energia Atômica que escalaram a produção nativa de Lu-177 e ligante PSMA no BARC, reduzindo drasticamente a dependência de importação e aumentando os volumes de terapia.

Visão do mercado de radiofármacos baseados em emissores alfa e beta da Coreia do Sul

O roteiro do Ministério da Ciência da Coreia do Sul para fomentar uma indústria de exportação de radiofármacos até 2035 — incluindo a produção nacional de Lu-177 — posiciona o país para um alto crescimento de médio prazo e status de centro de fornecimento regional.

Visão geral do mercado de radiofármacos baseados em emissores alfa e beta na Europa

A Europa representa pouco mais de um quarto da receita global (≈ 25%) em 2025 e projeta-se que cresça a uma taxa composta de crescimento anual (CAGR) constante até 2032, apoiada por rigorosas regulamentações ambientais e de qualidade que favorecem a geração interna de isótopos e a ampla adoção de teranósticos. Consórcios de pesquisa financiados pela UE, ensaios pan-europeus de compostos Ac-225 e Tb-161 e a rápida expansão de radiofarmácias centralizadas impulsionam o crescimento regional, enquanto a estrutura EURATOM da UE garante o fornecimento de isótopos provenientes de reatores.

Economias como Alemanha, França e Reino Unido lideram em instalações teranósticas, linhas de produção de GMP e redes de pesquisa clínica.

Visão geral do mercado de radiofármacos baseados em emissores alfa e beta na Alemanha

A Alemanha lidera as receitas europeias em 2025, impulsionada por sua densa rede de clínicas de medicina nuclear, incentivos de investimento para plantas GMP Lu-177 e crescimento contínuo de centros de terapia por imagem, elevando o valor de mercado para US$ 39,29 milhões até 2024.

Visão geral do mercado de radiofármacos baseados em emissores alfa e beta da França

A França mostra uma expansão sólida, já que a política de saúde resiliente ao clima incentiva terapias de baixa dosagem e alta eficácia, e os grupos em torno de Orano e CEA canalizam o financiamento para programas de emissores alfa de próxima geração e implantação de geradores descentralizados.

Participação no mercado de radiofármacos baseados em emissores alfa e beta

O mercado de radiofármacos baseados em emissores alfa e beta é liderado principalmente por empresas bem estabelecidas, incluindo:

- Novartis AG (Suíça)

- Eckert & Ziegler Alemanha)

- ITM Isotope Technologies Munique SE (Alemanha)

- SHINE Technologies, LLC (EUA)

- Actinium Pharmaceuticals, Inc. (EUA)

- Alpha Tau Medical Ltda. (Israel)

- ARICEUM THERAPEUTICS (Alemanha)

- Bayer AG (Alemanha)

- Cúrio (EUA)

- IONETIX Corporation (EUA)

- Isotopia (Israel)

- Lantheus (EUA)

- Lilly (EUA)

- Niowave (EUA)

- RMN (EUA)

- Oncoinvent (Noruega)

- Grupo Orano (Paris)

- Radiopharm Theranostics Limited (Austrália)

- Telix Pharmaceuticals Limited (Austrália)

- Terthera (Holanda)

Últimos desenvolvimentos no mercado de radiofármacos baseados em emissores alfa e beta

- Em maio de 2025, a ITM Isotope Technologies Munich SE e a Radiopharm Theranostics anunciaram um acordo de fornecimento para Lutécio-177 (nca 177Lu) sem adição de carreador. A parceria apoia o desenvolvimento clínico da Radiopharm de terapias baseadas em Lu-177, incluindo RAD 204, RAD 202 e RV01, garantindo acesso a isótopos de alta qualidade para tratamento radiofarmacêutico direcionado de tumores sólidos em ensaios clínicos em andamento e futuros.

- Em março de 2025, a FDA aprovou o Pluvicto (Lu-177 vipivotida tetraxetana) da Novartis para uso precoce em câncer de próstata metastático resistente à castração com PSMA positivo, permitindo a administração após uma ARPI e antes da quimioterapia. Com base nos resultados do ensaio clínico de Fase III PSMAfore, o Pluvicto reduziu o risco de progressão ou morte em 59%, dobrando a sobrevida livre de progressão radiográfica mediana, mantendo um perfil de segurança favorável e expandindo significativamente o acesso dos pacientes.

- Em março de 2025, a Eckert & Ziegler e a AtomVie Global Radiopharma assinaram um acordo global de fornecimento para Lutécio-177 (Theralugand) sem adição de carreador. A parceria garante um fornecimento estável e de alta qualidade de Lu-177 para as operações radiofarmacêuticas em CDMO da AtomVie, apoiando o desenvolvimento em estágios iniciais e finais em todo o mundo e aprimorando as capacidades de ambas as empresas em inovação radiofarmacêutica, conformidade regulatória e soluções de medicina nuclear centradas no paciente.

- Em março de 2025, a Eckert & Ziegler e a Actinium Pharmaceuticals assinaram um acordo de fornecimento para Actinium-225 (Ac-225) de alta pureza. A parceria garante uma fonte confiável de Ac-225 para apoiar o desenvolvimento do Actimab-A e de outros candidatos radioterápicos direcionados à LMA e tumores sólidos, fortalecendo o pipeline clínico da Actinium e abordando os desafios globais de fornecimento de isótopos em terapia radiofarmacêutica de precisão.

- Em maio de 2024, a Novartis AG anunciou seu acordo para adquirir a Mariana Oncology por US$ 1 bilhão à vista e até US$ 750 milhões em pagamentos de marcos. A aquisição fortalece o pipeline de terapia com radioligantes (RLT) da Novartis com ativos pré-clínicos direcionados a tumores sólidos, incluindo o candidato à base de actínio MC-339 para câncer de pulmão de pequenas células, e aprimora suas capacidades de pesquisa, fornecimento e inovação em RLT.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 END USER MARKET COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PIPELINE

4.4 SUPPLY CHAIN ECOSYSTEM

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.5 INDUSTRY INSIGHTS:

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 KEY PRICING STRATEGIES

4.6 MARKETED DRUG ANALYSIS

4.6.1 DRUG

4.6.1.1 BRAND NAME

4.6.1.2 GENERIC NAME

4.6.2 THERAPEUTIC INDICATION

4.6.3 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.4 DRUG PRIMARY INDICATION

4.6.5 MARKET STATUS

4.6.6 MEDICATION TYPE

4.6.7 DRUG DOSAGE FORM

4.6.8 DOSAGES AVAILABILITY

4.6.9 PACKAGING TYPE

4.6.10 DRUG ROUTE OF ADMINISTRATION

4.6.11 DOSING FREQUENCY

4.6.12 DRUG INSIGHT

4.6.13 OVERVIEW OF DRUG DEVELOPMENT ACTIVITIES

4.6.13.1 FORECAST MARKET OUTLOOK

4.6.13.2 CROSS COMPETITION

4.6.13.3 THERAPEUTIC PORTFOLIO

4.6.13.4 CURRENT DEVELOPMENT SCENARIO

4.7 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.7.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

4.7.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.7.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

4.7.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.7.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.7.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

4.8 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.8.1.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.1.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.8.1.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

4.8.2 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.8.2.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

4.8.2.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.2.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.9 EPIDEMIOLOGY OVERVIEW

4.9.1 INCIDENCE OF ALL CANCERS BY GENDER

4.9.2 TREATMENT RATE

4.9.3 MORTALITY RATE

4.9.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.9.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY FRAMEWORK

5.1 REGULATORY FRAMEWORK OVERVIEW FOR THE NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.1.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.1.2 REGULATORY APPROVAL PATHWAYS

5.1.3 LICENSING AND REGISTRATION

5.1.4 POST-MARKETING SURVEILLANCE

5.1.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.2 REGULATORY FRAMEWORK OVERVIEW FOR THE SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.2.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.2.2 REGULATORY APPROVAL PATHWAYS

5.2.3 LICENSING AND REGISTRATION

5.2.4 POST-MARKETING SURVEILLANCE

5.2.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.3 REGULATORY FRAMEWORK OVERVIEW FOR THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.3.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.3.2 REGULATORY APPROVAL PATHWAYS

5.3.3 LICENSING AND REGISTRATION

5.3.4 POST-MARKETING SURVEILLANCE

5.3.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.4 REGULATORY FRAMEWORK OVERVIEW FOR THE ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.4.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.4.2 REGULATORY APPROVAL PATHWAYS

5.4.3 LICENSING AND REGISTRATION

5.4.4 POST-MARKETING SURVEILLANCE

5.4.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.5 REGULATORY FRAMEWORK OVERVIEW FOR THE MIDDLE EAST AND AFRICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.5.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.5.2 REGULATORY APPROVAL PATHWAYS

5.5.3 LICENSING AND REGISTRATION

5.5.4 POST-MARKETING SURVEILLANCE

5.5.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED EFFICACY OF TARGETED ALPHA AND BETA THERAPIES

6.1.2 GROWING ADOPTION OF THERANOSTICS IN PERSONALIZED MEDICINE

6.1.3 RISING CLINICAL DEMAND FOR ALPHA-BASED RADIOTHERAPIES

6.1.4 RISING CHRONIC DISEASE BURDEN DRIVING RADIOPHARMACEUTICAL DEMAND

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN AND SCALABILITY CHALLENGES FROM SHORT ISOTOPE HALF-LIVES

6.2.2 STRINGENT REGULATORY LANDSCAPE LIMITING MARKET FLEXIBILITY

6.2.3 SAFETY AND EXPOSURE RISKS IN RADIOPHARMACEUTICAL USE

6.3 OPPORTUNITIES

6.3.1 SURGE IN R&D ACTIVITY EXPANDING RADIOPHARMACEUTICAL APPLICATIONS

6.3.2 EXPANSION OF LU-177-PSMA THERAPY IN PROSTATE CANCER TREATMENT

6.3.3 STRATEGIC COLLABORATIONS DRIVING RADIOPHARMACEUTICAL INNOVATION

6.4 CHALLENGES

6.4.1 HIGH COST OF DEVELOPMENT AND IMPLEMENTATION OF RADIOPHARMACEUTICALS

6.4.2 SHORTAGE OF SKILLED WORKFORCE IN NUCLEAR MEDICINE AND RADIOCHEMISTRY

7 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE

7.1 OVERVIEW

7.2 BETA EMITTERS

7.2.1 LUTETIUM-177

7.2.2 TERBIUM-161

7.3 ALPHA EMITTERS

7.3.1 ACTINIUM-225

7.3.2 LEAD -212

8 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES

8.1 OVERVIEW

8.2 REACTOR-PRODUCED ISOTOPES

8.3 GENERATOR-PRODUCED ISOTOPES

8.4 OTHERS

9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 PROSTATE CANCER

9.2.2 NEUROENDOCRINE TUMORS

9.2.3 LIVER CANCER

9.2.4 BRAIN TUMORS

9.2.5 BREAST CANCER

9.2.6 LEUKEMIA

9.3 OTHERS

10 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULE LIGANDS

10.3 PEPTIDES

10.4 MONOCLONAL ANTIBODIES

10.5 OTHERS

11 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ONCOLOGY CENTERS

11.2.2 NUCLEAR MEDICINE DEPARTMENTS

11.3 RADIOPHARMACIES

11.4 RESEARCH INSTITUTES

12 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 FRANCE

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 POLAND

12.3.7 RUSSIA

12.3.8 NORWAY

12.3.9 TURKEY

12.3.10 AUSTRIA

12.3.11 IRELAND

12.3.12 NETHERLANDS

12.3.13 SWITZERLAND

12.3.14 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.2 AUSTRALIA

12.4.3 JAPAN

12.4.4 SOUTH KOREA

12.4.5 SINGAPORE

12.4.6 INDIA

12.4.7 INDONESIA

12.4.8 PHILIPPINES

12.4.9 THAILAND

12.4.10 MALAYSIA

12.4.11 VIETNAM

12.4.12 TAIWAN

12.4.13 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 CHILE

12.5.4 PERU

12.5.5 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 U.A.E.

12.6.5 KUWAIT

12.6.6 ISRAEL

12.6.7 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NOVARTIS AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ECKERT & ZIEGLER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ITM ISOTOPE TECHNOLOGIES MUNICH SE

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SHINE TECHNOLOGIES, LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ACTINIUM PHARMACEUTICALS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PIPELINE PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALPHA TAU MEDICAL LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PIPELINE PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARICEUM THERAPEUTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PIPELINE PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAYER AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PIPELINE PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CURIUM

15.9.1 COMPANY SNAPSHOT

15.9.2 PIPELINE PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IONETIX CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PIPELINE PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ISOTOPIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PIPELINE PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 LANTHEUS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PIPELINE PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LILLY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PIPELINE PRODUCT PORTFOLIO

15.14 NIOWAVE

15.14.1 COMPANY SNAPSHOT

15.14.2 PIPELINE PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NMR

15.15.1 COMPANY SNAPSHOT

15.15.2 PIPELINE PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ONCOINVENT

15.16.1 COMPANY SNAPSHOT

15.16.2 PIPELINE PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ORANO GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PIPELINE PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 RADIOPHARM THERANOSTICS LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 PIPELINE PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TELIX PHARMACEUTICALS LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PIPELINE PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TERTHERA

15.20.1 COMPANY SNAPSHOT

15.20.2 PIPELINE PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 5 PENETRATION AND GROWTH PROSPECT MAPPING

TABLE 6 INCIDENCE OF CANCER BY GENDER

TABLE 7 CANCER MORTALITY RATE

TABLE 8 CANCER TREATMENT SUCCESS RATE

TABLE 9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL REACTOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL GENERATOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL SMALL MOLECULE LIGANDS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL PEPTIDES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL MONOCLONAL ANTIBODIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL RADIOPHARMACIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL RESEARCH INSTITUTES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 65 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.K. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.K. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 U.K. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 102 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 FRANCE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 106 FRANCE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 108 ITALY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 117 SPAIN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SPAIN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 120 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 SPAIN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 124 SPAIN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 126 POLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 POLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 129 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 POLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 133 POLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 135 RUSSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 RUSSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 RUSSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORWAY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORWAY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 147 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 NORWAY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 NORWAY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 153 TURKEY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 TURKEY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 156 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 TURKEY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 160 TURKEY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 165 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 AUSTRIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 169 AUSTRIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 171 IRELAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 IRELAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 174 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 IRELAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 178 IRELAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 NETHERLANDS HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 189 SWITZERLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SWITZERLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 192 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 SWITZERLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 196 SWITZERLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 REST OF EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 207 ASIA-PACIFIC HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 216 CHINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 218 AUSTRALIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 AUSTRALIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 221 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 AUSTRALIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 225 AUSTRALIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 227 JAPAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 JAPAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 230 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 JAPAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 234 JAPAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 245 SINGAPORE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SINGAPORE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 248 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 SINGAPORE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 252 SINGAPORE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 254 INDIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 INDIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 257 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 INDIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 261 INDIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 263 INDONESIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 INDONESIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 266 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 INDONESIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 270 INDONESIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 272 PHILIPPINES BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 PHILIPPINES ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 275 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 PHILIPPINES ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 279 PHILIPPINES HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 281 THAILAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 THAILAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 284 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 THAILAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 288 THAILAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 290 MALAYSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 MALAYSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 293 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 MALAYSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 297 MALAYSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 299 VIETNAM BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 VIETNAM ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 302 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 303 VIETNAM ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 306 VIETNAM HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 308 TAIWAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 TAIWAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 311 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 312 TAIWAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 315 TAIWAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 REST OF ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 319 SOUTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SOUTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 328 BRAZIL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BRAZIL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 331 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 BRAZIL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 335 BRAZIL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 337 ARGENTINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ARGENTINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 340 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 341 ARGENTINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 344 ARGENTINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 346 CHILE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 CHILE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 349 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 350 CHILE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 353 CHILE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 PERU ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 355 PERU BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 PERU ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 PERU ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 358 PERU ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 359 PERU ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 PERU ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 PERU ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)