Global Antiviral Api Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.18 Billion

USD

2.33 Billion

2025

2033

USD

1.18 Billion

USD

2.33 Billion

2025

2033

| 2026 –2033 | |

| USD 1.18 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Global Antiviral API Market Segmentation, ByTypeNucleoside Analogues, Protease Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Integrase Inhibitors, and OthersApplicationHIV, Hepatitis B & C, Influenza, COVID-19, Herpes, and Others), End UserPharmaceutical Companies, Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), Hospitals, and Research Institutes) - Industry Trends and Forecast to 2033

Antiviral API Market Size

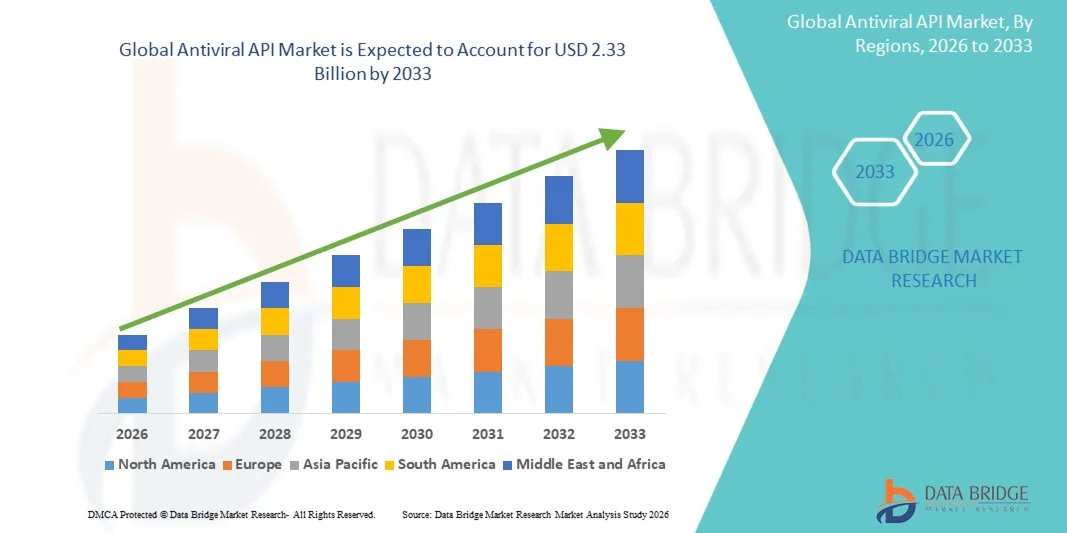

- The global antiviral API market size was valued at USD 1.18 billion in 2025 and is expected to reach USD 2.33 billion by 2033, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of viral infections, rising demand for effective antiviral therapies, and continuous technological advancements in antiviral drug development, leading to higher adoption of antiviral active pharmaceutical ingredients (APIs) across pharmaceutical manufacturing

- Furthermore, growing investments in R&D, expansion of pharmaceutical production capacities, and the rising focus on pandemic preparedness and personalized medicine are establishing antiviral APIs as essential components of modern therapeutic solutions. These converging factors are accelerating the uptake of Antiviral API solutions, thereby significantly boosting the industry’s growth

Antiviral API Market Analysis

- Antiviral APIs, serving as the active pharmaceutical ingredients in therapies for viral infections such as HIV, Hepatitis, Influenza, COVID-19, and Herpes, are increasingly vital components of modern pharmaceutical manufacturing due to their critical role in effective antiviral drug development and therapeutic outcomes

- The escalating demand for antiviral APIs is primarily fueled by the rising prevalence of viral infections, growing focus on pandemic preparedness, increasing investments in R&D, and the expansion of pharmaceutical production capacities worldwide, driving the adoption of high-quality antiviral APIs

- North America dominated the antiviral API market with the largest revenue share of approximately 39.2% in 2025, supported by advanced pharmaceutical infrastructure, strong regulatory frameworks, high demand for antiviral therapies, and the presence of key pharmaceutical manufacturers, with the U.S. contributing the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the antiviral API market during the forecast period, driven by increasing healthcare investments, expanding API manufacturing capabilities in China and India, supportive government policies, and rising demand for controlled therapeutic drugs

- The HIV segment accounted for the largest market revenue share of 41.2% in 2025, driven by sustained demand for antiretroviral therapy and inclusion in national HIV programs

Report Scope and Antiviral API Market Segmentation

|

Attributes |

Antiviral API Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Antiviral API Market Trends

“Enhanced Importance of Advanced Antiviral Therapies”

- A significant and accelerating trend in the global Antiviral API market is the increasing development and production of high-efficacy antiviral agents, including broad-spectrum and targeted therapies, aimed at tackling emerging viral infections worldwide. This trend reflects the growing demand for rapid-response therapeutics and pandemic preparedness

- For instance, in March 2023, Gilead Sciences expanded its antiviral API manufacturing facility in Ireland to scale up production for investigational broad-spectrum antiviral compounds, addressing global supply needs

- Manufacturers are also focusing on biotechnologically derived APIs, such as recombinant proteins and nucleoside analogs, to improve therapeutic efficacy, reduce side effects, and support advanced formulations. For example, in July 2022, Merck launched a new nucleoside-based antiviral API for use in both oral and injectable treatments

- The market is witnessing a shift towards high-purity, GMP-compliant antiviral APIs to meet regulatory requirements and ensure consistent product quality. In 2021, Lonza upgraded its Swiss production facility to produce high-purity antiviral APIs, supporting both clinical trials and commercial supply

- This trend towards more efficient, safe, and scalable antiviral APIs is fundamentally reshaping pharmaceutical R&D priorities and production strategies

- The increasing emphasis on advanced antiviral therapies is driving innovation, collaboration, and investments across the pharmaceutical industry, as companies aim to meet global healthcare demands

Antiviral API Market Dynamics

Driver

“Rising Burden of Viral Diseases and Pandemic Preparedness”

- The growing prevalence of viral infections worldwide, including HIV, hepatitis, influenza, and emerging zoonotic viruses, has created an urgent need for high-quality antiviral APIs. Governments, healthcare institutions, and pharmaceutical companies are prioritizing antiviral API development to strengthen healthcare preparedness and improve therapeutic outcomes globally

- For instance, in 2022, the WHO reported significant influenza outbreaks in Southeast Asia, prompting both governments and private manufacturers to ramp up production of antiviral APIs for emergency stockpiles and treatment availability

- Pharmaceutical companies are increasingly investing in novel APIs capable of addressing resistant viral strains, multi-drug therapies, and faster therapeutic response times. This is driving innovations in antiviral chemistry, process optimization, and biotechnological production methods

- The demand for pandemic-ready antiviral APIs is not limited to developed countries; emerging economies such as India, Brazil, and South Africa are also investing in local production capacities to ensure self-sufficiency, which is further accelerating market growth

- Global collaborations between governments, academic institutions, and biotech firms are facilitating faster API development, licensing, and distribution. These initiatives aim to ensure that high-quality antiviral drugs are accessible during outbreaks, reinforcing the market’s resilience and expansion

- Overall, the combination of rising viral disease prevalence, global health security priorities, and technological innovation in API production is a major driver for the Antiviral API market, making it one of the most dynamic segments in pharmaceutical manufacturing

Restraint/Challenge

“High Production Costs and Stringent Regulatory Requirements”

- The production of antiviral APIs, especially biotechnologically derived compounds such as nucleoside analogues and recombinant proteins, involves complex chemical processes, specialized equipment, and strict quality control. These factors significantly increase manufacturing costs, which can impede smaller players from entering the market

- For instance, in May 2022, an Indian API manufacturer postponed the commercial launch of a newly developed antiviral API due to the high costs required for upgrading its facility to meet stringent GMP standards and international regulatory compliance

- In addition to capital investment, manufacturers must adhere to rigorous safety, purity, and consistency standards mandated by global regulatory agencies like the US FDA, EMA, and PMDA (Japan). This often involves multi-stage validation, extensive documentation, and repeated quality testing, all of which add to operational expenses

- High production costs can limit the affordability of antiviral APIs in low- and middle-income countries, slowing widespread adoption despite growing therapeutic demand. This can create regional disparities in access to critical antiviral treatments during outbreaks

- Furthermore, fluctuating raw material prices, dependency on specific precursor chemicals, and complex supply chains make continuous API production challenging, especially during global emergencies or geopolitical disruptions

- Overall, the combination of high capital requirements, regulatory compliance burden, and complex production processes remains a significant restraint for the Antiviral API market, impacting both new entrants and established manufacturers seeking to expand capacity globally

Antiviral API Market Scope

The market is segmented on the basis of type, application, and end user.

• By Type

On the basis of type, the Antiviral API market is segmented into Nucleoside Analogues, Protease Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Integrase Inhibitors, and Others. The Nucleoside Analogues segment dominated the largest market revenue share of approximately 38.6% in 2025, driven by their well-established efficacy against HIV, Hepatitis B & C, and COVID-19. These APIs are widely used in combination therapies and are preferred due to broad-spectrum antiviral activity, predictable pharmacokinetics, and high compatibility with other antiviral agents. Strong adoption by pharmaceutical companies, hospitals, and research institutes, along with continuous R&D investment and favorable regulatory frameworks, supports dominance. The availability of generic formulations, government-backed antiviral programs, and global patient demand further enhance market leadership. Increasing production capacity and strategic collaborations among major manufacturers continue to strengthen this segment.

The Integrase Inhibitors segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by increasing use in HIV therapy and rising inclusion in combination regimens. These APIs are highly effective in blocking viral replication, particularly in resistant HIV strains. The segment benefits from ongoing clinical trials, government funding, and growing adoption in emerging markets. Expanding pipeline drugs, increased demand for targeted therapies, and global investments in gene-based antivirals contribute to rapid market expansion. Rising awareness among healthcare providers and patients, coupled with improved access in developing regions, further accelerates growth.

• By Application

On the basis of application, the Antiviral API market is segmented into HIV, Hepatitis B & C, Influenza, COVID-19, Herpes, and Others. The HIV segment accounted for the largest market revenue share of 41.2% in 2025, driven by sustained demand for antiretroviral therapy and inclusion in national HIV programs. Combination therapies using Nucleoside Analogues, Protease Inhibitors, and NNRTIs strengthen this segment. Increasing awareness, favorable reimbursement policies, and continued investments by pharmaceutical companies further reinforce dominance. Strong pipeline development, high patient compliance, and the availability of treatment centers globally maintain market leadership. The segment benefits from global partnerships and growing focus on long-acting antiretroviral formulations.

The COVID-19 segment is projected to witness the fastest CAGR of 22.4% from 2026 to 2033, fueled by high demand for antiviral APIs targeting SARS-CoV-2, emergency treatment protocols, and new drug development. Ongoing clinical trials, accelerated regulatory approvals, and investment in pandemic preparedness are driving growth. Expansion of contract manufacturing, increasing hospital adoption, and rising need for combination therapies contribute to rapid market uptake. Increased production of antiviral drugs, government stockpiling, and global research collaborations further enhance market growth.

• By End User

On the basis of end user, the Antiviral API market is segmented into Pharmaceutical Companies, Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), Hospitals, and Research Institutes. Pharmaceutical Companies dominated the market with a revenue share of 45.7% in 2025, leveraging in-house production, strong pipelines, and global distribution networks. Large-scale manufacturing, strategic collaborations, and investments in R&D strengthen leadership. Government incentives, supportive policies, and expansion into emerging markets further consolidate dominance. The segment benefits from increasing prevalence of viral diseases and higher patient accessibility to advanced antivirals.

The CDMOs segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by outsourcing of antiviral API production, rising demand for high-quality contract manufacturing, and expansion of global CDMO capacity. Pharmaceutical companies increasingly partner with CDMOs for cost-effective production, rapid scale-up, and access to specialized expertise. Expansion in emerging markets, increasing contract agreements, and supportive government initiatives further accelerate growth. Rising demand for precision manufacturing and customized antiviral solutions also boosts segment adoption globally.

Antiviral API Market Regional Analysis

- North America dominated the antiviral API market with the largest revenue share of approximately 39.2% in 2025, supported by advanced pharmaceutical infrastructure, strong regulatory frameworks, high demand for antiviral therapies, and the presence of key pharmaceutical manufacturers

- The region benefits from robust R&D investments, a technologically advanced supply chain, and high healthcare spending, enabling efficient production and distribution of antiviral APIs

- Strategic collaborations between biotech and pharma companies, government funding, and integration of innovative manufacturing technologies further strengthen the market position

U.S. Antiviral API Market Insight

The U.S. antiviral API market captured the largest revenue share within North America in 2025, driven by rapid adoption of innovative antiviral formulations, growing prevalence of viral diseases, and strong government support for pharmaceutical research. High demand for advanced antiviral therapies in hospitals, research institutes, and pharmaceutical companies further boosts market growth. The U.S. benefits from a well-established pharmaceutical manufacturing base, cutting-edge clinical trials infrastructure, and continuous product launches. Moreover, rising exports of antiviral APIs and strategic partnerships with CDMOs reinforce its leadership position in the regional market.

Europe Antiviral API Market Insight

The Europe antiviral API market is expected to expand at a substantial CAGR during the forecast period, fueled by stringent regulatory oversight, increasing demand for effective antiviral therapies, and the emphasis on precision medicine. The U.K. dominated the European market with the largest revenue share in 2025, supported by well-established clinical research infrastructure, government funding for life sciences, and strong adoption of gene and cell therapies. Increasing investments by pharmaceutical companies in antiviral API production, advanced research initiatives, and growing focus on pandemic preparedness contribute to market leadership.

Germany Antiviral API Market Insight

The Germany antiviral API market is expected to witness the fastest CAGR of approximately 15.8% from 2026 to 2033, driven by rising biotechnology and pharmaceutical investments, expansion of clinical trials, and increasing demand for high-quality antiviral APIs. Strong focus on innovation, regulatory support for advanced therapeutics, and collaborations with CDMOs accelerate growth. The country’s precision medicine initiatives and high-quality research infrastructure make it an attractive hub for antiviral API development.

Asia-Pacific Antiviral API Market Insight

The Asia-Pacific antiviral API market is expected to be the fastest-growing region, with a projected CAGR of approximately 24% from 2026 to 2033, driven by increasing healthcare investments, expanding API manufacturing capabilities in China and India, supportive government policies, and rising demand for controlled therapeutic drugs. Rapid urbanization, growing middle-class populations, and rising prevalence of viral diseases support market expansion.

China Antiviral API Market Insight

The China antiviral API market accounted for the largest market revenue share in the region in 2025, fueled by domestic manufacturing capabilities, favorable government policies, and strong R&D investment by local pharmaceutical companies. China has become a key hub for antiviral API production, supported by large-scale clinical trials and cost-efficient manufacturing.

India Antiviral API Market Insight

The India antiviral API market is expected to witness robust growth, supported by rising clinical research, increasing outsourcing of antiviral API manufacturing, and government initiatives promoting biotechnology and pharmaceutical innovation. Favorable regulatory frameworks, cost-effective production, and a growing pharmaceutical export market further accelerate growth.

Antiviral API Market Share

The Antiviral API industry is primarily led by well-established companies, including:

- Gilead Sciences (U.S.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- GSK (U.K.)

- Roche Holding AG (Switzerland)

- Johnson & Johnson (U.S.)

- AbbVie Inc. (U.S.)

- Bristol-Myers Squibb (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Aurobindo Pharma (India)

- Cipla Ltd. (India)

- Hetero Labs Ltd. (India)

- Dr. Reddy’s Laboratories (India)

- Zhejiang Huahai Pharmaceutical (China)

- CSPC Pharmaceutical Group (China)

- Shanghai Fosun Pharmaceutical (China)

- Sun Pharmaceutical Industries Ltd. (India)

- Lupin Limited (India)

- Chugai Pharmaceutical Co., Ltd. (Japan)

- Boehringer Ingelheim (Germany)

Latest Developments in Global Antiviral API Market

- In March 2024, Cipla announced the acquisition of a mid‑sized antiviral API manufacturing facility in India to boost production of valacyclovir HCl API and secure supply for its generic antiviral portfolio. This acquisition helps the company expand capacity and improve supply chain resilience for treatment of herpes and related viral infections, reflecting growing demand and manufacturing consolidation in the antiviral API space

- In May 2024, Sandoz announced a strategic partnership with Lupin to co‑develop and manufacture valacyclovir API for global markets, aimed at expanding production and reducing lead times for this widely used antiviral ingredient. The collaboration underscores increasing industry focus on expanding capacity and improving access to essential antiviral APIs

- In June 2024, Sun Pharmaceutical Industries launched a high‑purity valacyclovir HCl API intended for U.S. and EU markets, signaling a move toward specialty antiviral API offerings and meeting quality standards demanded by advanced healthcare systems. This launch supports broader availability of antiviral therapies for viral infections including herpes

- In December 2024, Zydus Cadila announced the acquisition of a specialty API manufacturer to expand its antiviral API capacity, including ganciclovir API production. This acquisition strengthens Zydus’s position in the antiviral API market and enhances its ability to serve global demand for treatment of cytomegalovirus and other viral diseases

- In February 2025, Fresenius Kabi secured a major contract to supply ganciclovir API to a European hospital network, marking a significant expansion of its antiviral API commercial footprint and reinforcing supply chain links between manufacturers and healthcare institutions

- In March 2025, Cipla announced a strategic collaboration with Hetero Labs to expand entecavir API manufacturing capacity and secure long‑term global supply, reflecting ongoing efforts to strengthen production of key antiviral APIs for hepatitis B treatment

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.