Global Automated Container Terminal Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.84 Billion

USD

19.16 Billion

2025

2033

USD

10.84 Billion

USD

19.16 Billion

2025

2033

| 2026 –2033 | |

| USD 10.84 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Segmentação global de terminais de contêineres automatizados, por grau de automação (terminais semiautomatizados, terminais totalmente automatizados), tipo de projeto (projetos Brownfield, projetos Greenfield), ofertas (equipamentos, software, serviços), usuário final (público, privado), canal de distribuição (canal direto e canal indireto) - Tendências e previsões do setor até 2033

Tamanho do mercado de terminais de contêineres automatizados

- O mercado global de terminais de contêineres automatizados foi avaliado em US$ 10,84 bilhões em 2025 e espera-se que atinja US$ 19,16 bilhões até 2033.

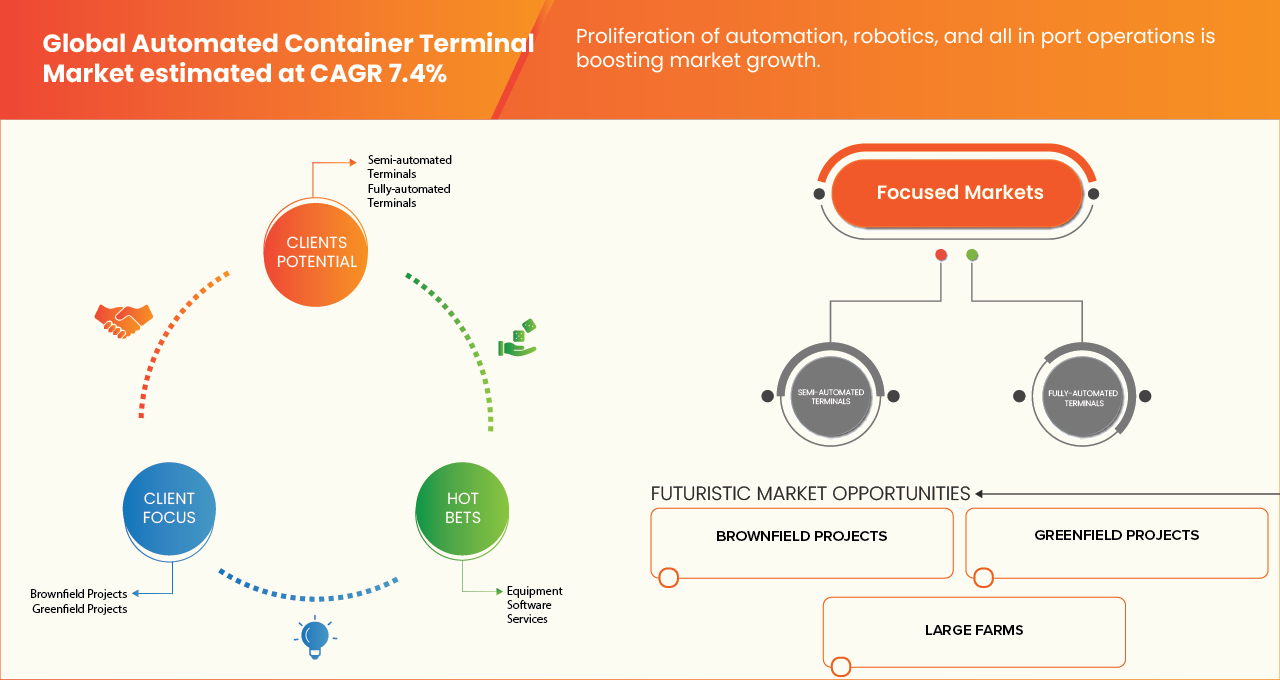

- Durante o período de previsão de 2026 a 2033, o mercado deverá crescer a uma taxa composta de crescimento anual (CAGR) de 7,4%, impulsionado principalmente pela necessidade de maior eficiência operacional e capacidade portuária.

- O crescimento do mercado de terminais de contêineres automatizados é impulsionado por fatores como o aumento do volume do comércio global, a crescente demanda por equipamentos de movimentação de contêineres de alto desempenho, os avanços tecnológicos em automação e inteligência artificial e a expansão dos setores de manufatura e transporte em todo o mundo.

Análise do mercado de terminais de contêineres automatizados

- Os terminais de contêineres automatizados são instalações portuárias avançadas que utilizam tecnologia e software automatizados para operar equipamentos de movimentação de contêineres, minimizando o trabalho manual, maximizando a produtividade e aumentando a segurança e a previsibilidade das operações de carga. Eles desempenham um papel crucial na cadeia de suprimentos global, atendendo às companhias de navegação, autoridades portuárias e redes logísticas, permitindo um retorno mais rápido dos navios ao porto e uma gestão otimizada do pátio.

- Uma das principais tecnologias em terminais de contêineres automatizados é o uso de guindastes de empilhamento automatizados (ASCs), que armazenam e recuperam contêineres no pátio de forma autônoma, otimizando o uso do espaço e reduzindo o tempo de movimentação. A crescente tendência de utilização de navios porta-contêineres maiores também impulsiona o desenvolvimento de softwares especializados e veículos guiados automaticamente (AGVs) projetados para coordenar a complexa movimentação de contêineres entre o cais e a pilha. Nas operações portuárias, essa automação é essencial para o processamento nos portões, o planejamento de navios e a manutenção de equipamentos, garantindo desempenho consistente e custos operacionais reduzidos.

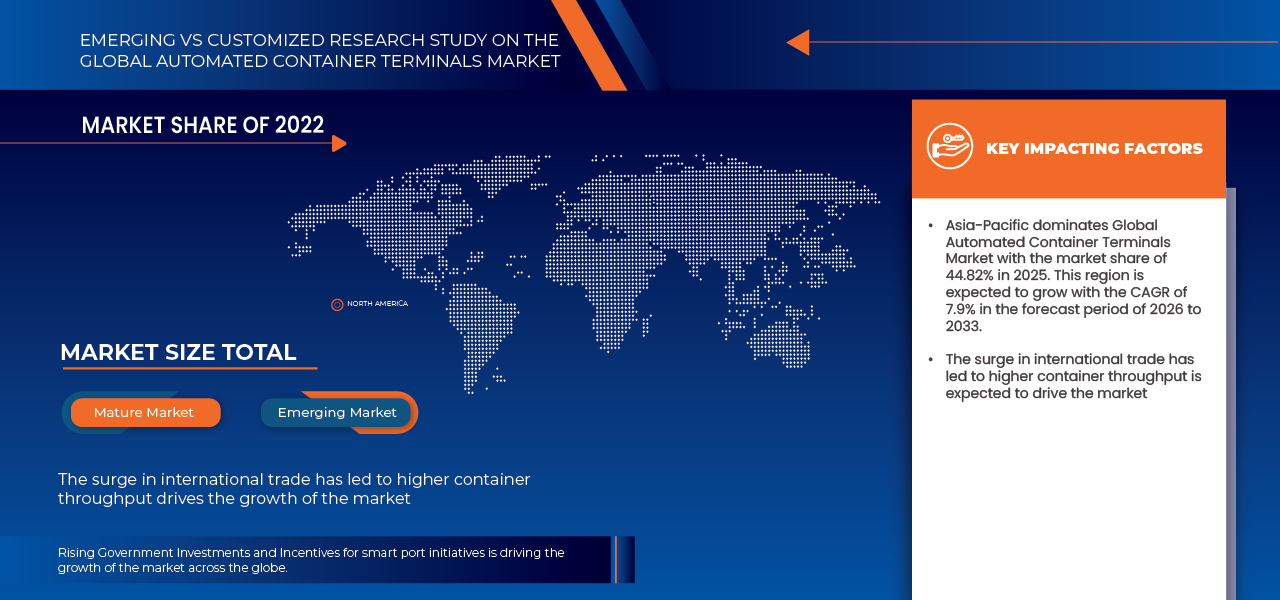

- A região Ásia-Pacífico deverá dominar o mercado de terminais de contêineres automatizados, com a maior participação na receita, de 45,02% em 2026, impulsionada pela rápida modernização da infraestrutura portuária, pelos fortes investimentos governamentais em iniciativas de portos inteligentes e pelo aumento do volume de comércio de contêineres em economias-chave como China, Japão, Coreia do Sul e Singapura. Além disso, o foco da região em automação, digitalização e sustentabilidade — por meio de tecnologias como operações de terminais orientadas por IA, guindastes autônomos e sistemas de rastreamento baseados em IoT — fortalece ainda mais sua liderança no mercado global.

- A região Ásia-Pacífico deverá ser a de crescimento mais rápido no mercado de terminais de contêineres automatizados durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 7,9%, impulsionada pela expansão do comércio marítimo, pela rápida adoção de tecnologias de automação e por investimentos em larga escala em projetos de desenvolvimento de portos inteligentes na China, Índia, Coreia do Sul e Sudeste Asiático. O crescente foco da região em aprimorar a eficiência portuária, reduzir o tempo de resposta e minimizar os custos de mão de obra — juntamente com iniciativas estratégicas como a Iniciativa Cinturão e Rota da China e o Programa Sagarmala da Índia — está impulsionando a implantação acelerada de sistemas automatizados de movimentação de contêineres.

- Em 2026, espera-se que o segmento de terminais semiautomatizados domine o mercado com uma participação de 53,93%, devido ao seu equilíbrio ideal entre investimento de capital e benefícios operacionais, oferecendo um caminho de transição de menor risco para os portos existentes, ganhos significativos de produtividade e maior flexibilidade operacional em comparação com sistemas totalmente automatizados.

Escopo do relatório e segmentação do mercado de terminais de contêineres automatizados

|

Atributos |

Principais informações de mercado sobre terminais automatizados de contêineres |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de terminais de contêineres automatizados

“Expansão de terminais automatizados em mercados emergentes”

- O rápido crescimento do volume de comércio e a crescente demanda por operações portuárias eficientes em mercados emergentes estão criando uma oportunidade significativa para os participantes do mercado de terminais de contêineres automatizados (ACT). Ao desenvolver terminais de contêineres automatizados, tanto em áreas novas quanto em áreas já existentes, essas regiões podem aumentar a eficiência portuária, acomodar navios maiores e fortalecer sua integração às cadeias de suprimentos globais.

- A expansão para mercados emergentes permite que fabricantes de equipamentos, fornecedores de software e integradores de serviços aproveitem as vantagens de pioneirismo, implementem tecnologias de automação modernas e alcancem maior escalabilidade operacional. Investimentos em guindastes avançados, veículos guiados automaticamente (AGVs), sistemas operacionais de terminais (TOS) e plataformas de logística digital estão transformando portos em centros modernos e eficientes, capazes de lidar com o crescente tráfego de contêineres, reduzindo custos e tempos de permanência.

- Em julho de 2025, segundo o Times of India, o Porto Internacional de Vizhinjam (Índia) iniciou suas operações utilizando inteligência artificial e guindastes automatizados, treinou as primeiras operadoras de guindastes automatizados da Índia e movimentou mais de 830.000 contêineres em seu primeiro ano.

- Em setembro de 2025, a Reuters noticiou que o Terminal Internacional Colombo Oeste (Sri Lanka), operado por um consórcio liderado pelo Grupo Adani, expandiu sua capacidade de terminal totalmente automatizado para movimentar até 3,2 milhões de contêineres anualmente, antes do previsto, fortalecendo as capacidades logísticas regionais.

- Assim, a expansão de terminais automatizados em mercados emergentes está consolidando essas regiões como importantes impulsionadoras do crescimento do mercado de terminais de carga. Ao implementar tecnologias avançadas de automação, os portos de mercados emergentes estão modernizando a infraestrutura, reduzindo gargalos operacionais e aprimorando a competitividade global, pavimentando o caminho para um crescimento sustentável do setor.

Dinâmica do mercado de terminais de contêineres automatizados

Motorista

“ O aumento do comércio internacional levou a uma maior movimentação de contêineres .”

- A expansão contínua do comércio global aumentou significativamente o volume de carga conteinerizada que atravessa fronteiras internacionais, impulsionando a demanda por soluções automatizadas e eficientes para a movimentação de contêineres. Como o transporte marítimo continua sendo a espinha dorsal do comércio global, os portos em todo o mundo estão sob crescente pressão para aumentar a capacidade de movimentação, reduzir o tempo de permanência dos navios no porto e melhorar a eficiência geral do terminal. Os Terminais de Contêineres Automatizados (ACTs) surgiram como uma solução vital para atender a essas demandas operacionais, aproveitando a robótica, a inteligência artificial e as tecnologias logísticas avançadas.

- A crescente globalização, aliada ao crescimento do comércio eletrônico e das cadeias de suprimentos transfronteiriças, está acelerando ainda mais a necessidade de automação nas operações portuárias. Guindastes automatizados, veículos autônomos e sistemas digitais de gestão portuária estão sendo cada vez mais utilizados para movimentar grandes volumes de contêineres com precisão e mínima intervenção humana.

- Em outubro de 2024, segundo a Conferência das Nações Unidas sobre Comércio e Desenvolvimento (UNCTAD, 2024), o volume do comércio marítimo global cresceu 2,4% em relação a 2023, com o comércio de contêineres representando mais de 60% da carga marítima, o que destaca a necessidade crítica de infraestrutura portuária automatizada.

- Em novembro de 2024, um relatório da Hamburg Port Consulting destacou que a automação e a digitalização estão se tornando essenciais para as operações portuárias modernas, visto que o aumento do volume de cargas exige maior eficiência.

- Além disso, a crescente complexidade das redes logísticas globais e a expansão das zonas de livre comércio estão obrigando os portos a adotarem sistemas automatizados de última geração para se manterem competitivos. A automação não só permite uma maior movimentação de contêineres, como também garante maior precisão operacional, sustentabilidade e adaptabilidade às flutuações da demanda comercial. Com o crescimento contínuo do comércio marítimo internacional, tecnologias de automação como AGVs (Veículos Guiados Automaticamente), guindastes de empilhamento automatizados e sistemas de monitoramento baseados em gêmeos digitais estão se tornando indispensáveis para otimizar o desempenho e reduzir gargalos operacionais.

- Assim, o aumento nos volumes do comércio internacional e a crescente necessidade de movimentação eficiente de contêineres estão impulsionando a adoção de terminais de contêineres automatizados em todo o mundo, consolidando a automação como um pilar fundamental para operações portuárias preparadas para o futuro, resilientes e de alto desempenho.

Restrição/Desafio

“Altos custos iniciais de investimento e instalação”

Apesar da crescente adoção de tecnologias de automação em portos globais, os altos custos iniciais de investimento e instalação continuam sendo um fator restritivo significativo para o mercado de terminais de contêineres automatizados. O desenvolvimento de terminais totalmente ou semiautomatizados exige capital substancial para maquinário avançado, como Veículos Guiados Automaticamente (AGVs), Guindastes de Empilhamento Automatizados (ASCs) e Sistemas Operacionais de Terminal (TOS) sofisticados, bem como para a integração de infraestrutura digital e sistemas de energia de suporte. Essas despesas frequentemente ultrapassam centenas de milhões de dólares, representando uma grande restrição, principalmente para portos de pequeno e médio porte com orçamentos limitados ou fluxo de carga incerto.

- Além disso, os projetos de automação normalmente envolvem adaptações complexas e longos prazos de instalação, o que pode interromper as operações em andamento e prolongar os períodos de retorno do investimento (ROI). Embora a automação prometa eficiência operacional e economia de mão de obra a longo prazo, o alto investimento inicial (CAPEX) e os riscos de integração muitas vezes impedem que os operadores de terminais adotem soluções de automação em larga escala. Consequentemente, muitos portos optam por modelos de automação faseados ou híbridos em vez de reformas completas.

- Em janeiro de 2024, a Port Technology International relatou que 62% dos profissionais de terminais identificaram os altos requisitos de investimento inicial como a principal barreira para a implantação da automação em terminais de contêineres.

- Em junho de 2023, a PortEconomics destacou que as adaptações de automação em terminais existentes frequentemente enfrentam problemas complexos de integração, aumentando ainda mais os custos do projeto e limitando a flexibilidade após a instalação.

- Assim, embora a automação de terminais prometa benefícios a longo prazo, como aumento da produtividade, otimização da mão de obra e sustentabilidade, o significativo ônus financeiro inicial e os complexos processos de instalação continuam sendo os principais entraves para o crescimento do mercado. Superar esses desafios dependerá da adoção de mecanismos de financiamento inovadores, modelos de automação faseados e maior colaboração público-privada para tornar a automação financeiramente viável para portos de todos os portes nos próximos anos.

Escopo do mercado de terminais de contêineres automatizados

O mercado é segmentado com base no grau de automação, tipo de projeto, oferta, usuário final e canal de distribuição.

- Por grau de automação

Com base no grau de automação, o mercado é segmentado em terminais semiautomatizados e terminais totalmente automatizados. Em 2026, espera-se que o segmento de terminais semiautomatizados domine o mercado com uma participação de 53,93%, impulsionado por sua relação custo-benefício, flexibilidade operacional, integração gradual da automação com supervisão manual e a crescente adoção de guindastes de empilhamento automatizados (ASCs) e equipamentos de pátio controlados remotamente, que aumentam a eficiência, a segurança e a produtividade, minimizando os riscos de transição e os custos de implementação.

Além disso, prevê-se que este segmento registre a maior taxa de crescimento anual composta (CAGR) durante o período de previsão de 2026 a 2033, devido à crescente preferência dos operadores portuários por estratégias de automação faseada, menores requisitos de capital inicial, facilidade de modernização de terminais existentes, menor resistência da mão de obra, retorno mais rápido do investimento e implantação crescente de sistemas de controle inteligentes em projetos portuários já existentes.

- Por tipo de projeto

Com base no tipo de projeto, o mercado é segmentado em projetos brownfield e projetos greenfield. Em 2026, espera-se que o segmento brownfield domine o mercado com uma participação de 64,59%, impulsionado pela modernização e atualização da infraestrutura portuária existente, pela integração de tecnologias avançadas de automação em terminais operacionais, pela relação custo-benefício em comparação com a construção de novos terminais e pela necessidade de aumentar a eficiência, reduzir o tempo de permanência dos navios no porto e atender à crescente demanda por movimentação de contêineres.

O segmento Greenfield é o que apresenta o crescimento mais rápido no mercado, com uma taxa de crescimento anual composta (CAGR) de 7,9%, impulsionado pelo desenvolvimento de novos terminais de última geração equipados com tecnologias avançadas de automação, pelo aumento do volume do comércio internacional, pelo forte apoio governamental à expansão da infraestrutura portuária e pela necessidade de operações portuárias eficientes, escaláveis e sustentáveis.

- Ao oferecer

Com base na oferta, o mercado global de terminais de contêineres automatizados é segmentado em equipamentos, software e serviços. Em 2026, espera-se que o segmento de equipamentos domine o mercado com 54,58% de participação, impulsionado pela crescente implantação de guindastes de empilhamento automatizados (ASCs), veículos guiados automaticamente (AGVs), equipamentos de pátio controlados remotamente e guindastes de cais, bem como pelo aumento dos investimentos em modernização portuária, pelo crescimento do volume de contêineres e pela demanda por maior eficiência operacional e segurança nas operações dos terminais.

O segmento de software é o que apresenta o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 8,3% no mercado, impulsionado pela crescente adoção de sistemas operacionais de terminais (TOS) avançados, análise de dados em tempo real, soluções habilitadas para IA e IoT, e pela crescente necessidade de gerenciamento eficiente de cargas, manutenção preditiva e integração perfeita com a comunidade portuária.

- Por usuário final

Com base no usuário final, o mercado é segmentado em público e privado. Em 2026, espera-se que o segmento público domine o mercado com 56,28% de participação, impulsionado pelas autoridades portuárias governamentais, investimentos em infraestrutura em larga escala, iniciativas nacionais de facilitação do comércio, modernização de portos estratégicos, adoção de automação para melhorar a eficiência e a segurança, estabilidade de financiamento a longo prazo e apoio político voltado para o aprimoramento da conectividade global e do crescimento econômico.

O segmento privado é o que apresenta o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 7,6% no mercado, impulsionado pelo aumento das concessões de terminais privados, parcerias público-privadas, demanda por eficiência operacional, tomada de decisões mais rápida, foco no retorno do investimento, adoção de tecnologias avançadas de automação, pressão competitiva para reduzir custos, melhorar a produtividade e oferecer maior confiabilidade nos serviços.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em canal direto e canal indireto. Em 2026, espera-se que o segmento de canal direto domine o mercado com 68,65% de participação, impulsionado pelos fortes relacionamentos entre operadores de terminais e fornecedores de soluções de automação, requisitos de integração de sistemas personalizados, custos de aquisição reduzidos, suporte técnico direto, contratos de serviço de longo prazo e a necessidade de implementação perfeita de soluções de automação complexas e de alto valor.

Análise Regional do Mercado de Terminais de Contêineres Automatizados

- A região Ásia-Pacífico deverá dominar o mercado de terminais de contêineres automatizados, com a maior participação na receita, de 45,02% em 2026, impulsionada pelo forte crescimento comercial da região, pelos extensos projetos de expansão portuária e pela crescente adoção de tecnologias digitais e de automação avançadas. Economias-chave como China, Japão, Coreia do Sul e Singapura estão na vanguarda da integração de sistemas de gerenciamento de terminais baseados em inteligência artificial, veículos guiados automaticamente (AGVs) e guindastes controlados remotamente para aprimorar a eficiência operacional. Além disso, iniciativas de portos inteligentes apoiadas pelo governo, juntamente com investimentos crescentes de operadores portuários globais como PSA International, Hutchison Ports e DP World, continuam a reforçar a dominância da Ásia-Pacífico no mercado global.

- A região Ásia-Pacífico deverá ser a de crescimento mais rápido no mercado de terminais de contêineres automatizados durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 7,9%, impulsionada pela expansão do comércio marítimo, pela rápida adoção de tecnologias de automação e por investimentos em larga escala em projetos de desenvolvimento de portos inteligentes na China, Índia, Coreia do Sul e Sudeste Asiático. O crescente foco da região em aprimorar a eficiência portuária, reduzir o tempo de resposta e minimizar os custos de mão de obra — juntamente com iniciativas estratégicas como a Iniciativa Cinturão e Rota da China e o Programa Sagarmala da Índia — está impulsionando a implantação acelerada de sistemas automatizados de movimentação de contêineres.

Análise do Mercado Europeu de Terminais Automatizados de Contêineres

O mercado europeu de terminais de contêineres automatizados é impulsionado pela adoção precoce de tecnologias de automação de terminais, infraestrutura portuária consolidada e forte presença de fornecedores líderes em soluções de automação, como Konecranes, ABB e Kalmar. Portos europeus, incluindo Rotterdam (Holanda), Hamburgo (Alemanha) e Antuérpia (Bélgica), foram pioneiros na implementação de operações de terminais totalmente automatizadas, motivados pelo foco na melhoria da eficiência operacional, redução de emissões e otimização de custos de mão de obra. Além disso, as rigorosas regulamentações ambientais da região e a crescente ênfase em sistemas logísticos sustentáveis e digitalizados fortaleceram ainda mais sua liderança no mercado global.

Análise do Mercado de Terminais Automatizados de Contêineres na Alemanha

O mercado de terminais de contêineres automatizados da Alemanha detinha a maior participação de receita em 2026 na região da Europa, impulsionado pela infraestrutura portuária avançada do país, forte foco na integração da Indústria 4.0 e adoção precoce de tecnologias de automação e digitalização na logística marítima. Grandes portos como Hamburgo e Bremerhaven implementaram guindastes automatizados, sistemas operacionais de terminais (TOS) e veículos de transporte autônomos para melhorar a eficiência e reduzir os custos operacionais. Além disso, iniciativas governamentais de apoio à logística inteligente, juntamente com investimentos de grandes operadores como a HHLA (Hamburger Hafen und Logistik AG) e a Eurogate, aceleraram a liderança da Alemanha no mercado europeu de terminais de contêineres automatizados.

Análise do Mercado de Terminais Automatizados de Contêineres na América do Norte

O mercado de terminais de contêineres automatizados na América do Norte é impulsionado pelo aumento do volume de comércio de contêineres, pelos crescentes investimentos em modernização portuária e pela necessidade cada vez maior de eficiência operacional e redução do tempo de resposta. Grandes portos como Los Angeles, Long Beach e Vancouver estão na vanguarda da adoção de sistemas de terminais semiautomatizados e totalmente automatizados, apoiados por logística avançada baseada em inteligência artificial, robótica e análise de dados. Além disso, a ênfase da região em sustentabilidade, otimização da mão de obra e transformação digital — juntamente com investimentos de operadores importantes como SSA Marine, DP World e APM Terminals — fortaleceu ainda mais a posição de liderança da América do Norte no mercado global de terminais de contêineres automatizados.

Análise do Mercado de Terminais de Contêineres Automatizados nos EUA

O mercado de terminais de contêineres automatizados dos EUA detinha a maior participação na receita em 2026 na região da América do Norte, impulsionado por investimentos significativos em automação portuária, infraestrutura digital e sistemas de logística inteligentes. Grandes portos como Los Angeles, Long Beach e Nova York/Nova Jersey adotaram guindastes de empilhamento automatizados, veículos guiados automaticamente (AGVs) e sistemas operacionais de terminais (TOS) avançados para aumentar a produtividade e reduzir o congestionamento. Além disso, o forte apoio de iniciativas federais e estaduais voltadas para a melhoria da resiliência e sustentabilidade da cadeia de suprimentos, juntamente com a presença de importantes operadores portuários globais como APM Terminals, SSA Marine e DP World, fortaleceu ainda mais a posição dos EUA como líder no desenvolvimento de terminais de contêineres automatizados na América do Norte.

Análise do Mercado de Terminais de Contêineres Automatizados na China

O mercado de terminais de contêineres automatizados da China detinha a maior participação de receita na região Ásia-Pacífico em 2026, impulsionado por investimentos maciços em automação portuária, transformação digital e infraestrutura logística inteligente. A China abriga alguns dos portos automatizados mais avançados do mundo, como o Porto de Águas Profundas de Yangshan (Xangai), o Porto de Qingdao e o Porto de Tianjin, que utilizam sistemas de controle baseados em inteligência artificial, conectividade 5G, veículos autônomos e guindastes automatizados para alcançar alta eficiência operacional. Iniciativas governamentais no âmbito da Iniciativa Cinturão e Rota (BRI) e da estratégia Made in China 2025 aceleraram ainda mais a adoção da automação, promovendo inovação tecnológica, eficiência e sustentabilidade nas operações portuárias. Além disso, colaborações com fornecedores de tecnologia líderes, como Huawei, ZPMC e Shanghai International Port Group (SIPG), reforçaram a posição dominante da China no mercado regional de terminais de contêineres automatizados.

Análise do Mercado de Terminais de Contêineres Automatizados no Japão

O mercado japonês de terminais de contêineres automatizados é impulsionado pela adoção precoce de tecnologias de automação pelo país, pelo forte apoio governamental a iniciativas de portos inteligentes e pela modernização contínua da infraestrutura marítima. Portos líderes como Yokohama, Tóquio e Kobe integraram guindastes de empilhamento automatizados, sistemas operacionais de terminais (TOS) inteligentes e plataformas logísticas baseadas em inteligência artificial para aumentar a produtividade e a eficiência operacional. Além disso, o compromisso do Japão com a sustentabilidade, a eficiência da mão de obra e a transformação digital, apoiado por iniciativas do Ministério da Terra, Infraestrutura, Transporte e Turismo (MLIT) e parcerias com fornecedores de tecnologia como Mitsui OSK Lines, NEC e Hitachi, fortaleceu significativamente sua liderança no mercado regional de terminais de contêineres automatizados.

Análise do Mercado de Terminais Automatizados de Contêineres na África do Sul

O mercado de terminais de contêineres automatizados da África do Sul deverá crescer de forma constante, impulsionado pelas iniciativas de modernização em curso da Transnet Port Terminals (TPT), pela adoção de guindastes de empilhamento automatizados (ASCs) e guindastes de cais controlados remotamente, pela implementação de tecnologias portuárias inteligentes e soluções de manutenção preditiva, por investimentos em infraestrutura logística digital e por parcerias estratégicas com fornecedores globais de automação, como Kalmar, ABB e Siemens. Portos importantes, incluindo o Porto de Durban, o Porto de Ngqura e o Terminal de Contêineres da Cidade do Cabo, estão liderando essa transformação para aumentar a eficiência, reduzir o tempo de permanência dos navios no porto e dar suporte ao crescente volume de comércio da região.

Os principais líderes de mercado que atuam no setor são:

- TOTAL SOFT BANK LTDA. (Coreia do Sul)

- INFORM SOFTWARE (Alemanha)

- Logstar ERP (Índia)

- infyz.com (Índia)

- Tideworks (EUA)

- Loginno Logistic Innovation Ltda. (Israel)

- World Crane Services FZE (EAU)

- SISTEMAS STARCOMM (Reino Unido)

- Kalmar Corporation (Finlândia)

- Cargotec Corporation (Finlândia)

- Konecranes Plc (Finlândia)

- Shanghai Zhenhua Heavy Industries Co., Ltd. (China)

- Grupo LIEBHERR (Suíça)

- ABB Ltda. (Suíça)

- HAPAG LLOYD (Alemanha)

- Terminais APM (Países Baixos)

- BECKHOFF AUTOMATION GMBH & CO. KG (Alemanha)

- Künz GmbH (Áustria)

- CyberLogitec Co., Ltd. (Coreia)

- Camco Technologies NV (Bélgica)

- IDENTEC SOLUTIONS AG (Áustria)

- ORBCOMM Inc. (EUA)

- A ORBITA PORTS & TERMINALS foi adquirida pela TMEIC PORT TECHNOLOGIES, SL (Japão).

- PACECO Corp. (EUA)

Últimos desenvolvimentos em terminais de contêineres automatizados globais

- Em outubro de 2025, a Hapag-Lloyd e a DP World renovaram sua parceria de longo prazo no Porto de Santos, no Brasil. Essa extensão garante a colaboração para a próxima década e inclui uma grande expansão do terminal, aumentando o comprimento do cais e a capacidade anual de movimentação de cargas, o que permitirá à Hapag-Lloyd atender navios maiores e oferecer novos serviços aos clientes.

- Em setembro de 2025, a Hiab Corporation firmou uma parceria com a Forterra para acelerar o desenvolvimento de soluções autônomas para caminhões e movimentação de cargas. O objetivo é aprimorar as capacidades de direção autônoma, aumentando a sustentabilidade e a segurança nos fluxos de trabalho logísticos.

- Em setembro de 2025, a Liebherr e a TPT firmaram um acordo de parceria estratégica de 10 anos com o objetivo de modernizar e aumentar a eficiência das operações portuárias na África do Sul. O acordo inclui o fornecimento de quatro guindastes STS de grande porte para o Porto de Durban e 48 guindastes pórticos sobre pneus (RTG) para os terminais de Durban e da Cidade do Cabo, além de um programa de gestão de ativos de 20 anos para garantir a confiabilidade dos equipamentos a longo prazo.

- Em novembro de 2024, a Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) firmou um acordo de cooperação estratégica com a Cavotec SA, marcando um passo significativo para o avanço da sustentabilidade e inovação na infraestrutura portuária e de terminais em todo o mundo. Essa parceria combina a expertise da ZPMC na fabricação de equipamentos portuários de grande porte com as tecnologias especializadas da Cavotec em automação e eletrificação. Juntas, elas visam desenvolver soluções de ponta que aprimorem a eficiência e o desempenho ambiental dos portos, como a redução de emissões por meio de equipamentos eletrificados e o aumento da automação operacional. Ao aproveitar os pontos fortes de ambas as empresas, a colaboração busca apoiar a transição da indústria marítima global para operações portuárias mais ecológicas, inteligentes e sustentáveis.

- Em dezembro de 2024, a Konecranes concluiu a aquisição da Peinemann Port Services BV e da Peinemann Container Handling BV, ambas sediadas em Roterdã, após aprovação da autoridade holandesa de defesa da concorrência. A aquisição, cujo valor não foi divulgado, adicionou aproximadamente 100 funcionários e fortaleceu a posição da Konecranes na Holanda, particularmente na região de Roterdã.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 COMPETITOR KEY PRICING STRATEGIES (PROMINENT PLAYERS)

4.4 TECHNOLOGY ANALYSIS – GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

4.5 COMPANY PROFILING

4.5.1 HAPAG-LLOYD AG

4.5.1.1 LIST OF ACQUISITION

4.5.1.2 SHAREHOLDING PATTERN

4.5.1.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.1.4 BUSINESS MODEL

4.5.1.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.1.5.1 COMPANY CUSTOMER SEGMENTS

4.5.1.5.2 COMPANY VALUE PROPOSITIONS

4.5.1.5.3 COMPANY CHANNELS

4.5.1.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.1.5.5 COMPANY REVENUE STREAMS

4.5.1.5.6 COMPANY KEY RESOURCES

4.5.1.5.7 COMPANY KEY ACTIVITIES

4.5.1.5.8 COMPANY KEY PARTNERS

4.5.1.5.9 COMPANY A COST STRUCTURE

4.5.1.5.10 COMPANY SWOT ANALYSIS

4.5.2 KONECRANES

4.5.2.1 LIST OF ACQUISITION

4.5.2.2 SHAREHOLDING PATTERN

4.5.2.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.2.4 BUSINESS MODEL

4.5.2.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.2.5.1 COMPANY CUSTOMER SEGMENTS

4.5.2.5.2 COMPANY VALUE PROPOSITIONS

4.5.2.5.3 COMPANY CHANNELS

4.5.2.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.2.5.5 COMPANY REVENUE STREAMS

4.5.2.5.6 COMPANY KEY RESOURCES

4.5.2.5.7 COMPANY KEY ACTIVITIES

4.5.2.5.8 COMPANY KEY PARTNERS

4.5.2.5.9 COMPANY A COST STRUCTURE

4.5.2.5.10 COMPANY SWOT ANALYSIS

4.6 COMPETITIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT

5.1.2 PROLIFERATION OF AUTOMATION, ROBOTICS, AND AI IN PORT OPERATIONS

5.1.3 SUSTAINABILITY INITIATIVES PROMOTING ENERGY-EFFICIENT AND LOW-EMISSION TERMINALS

5.1.4 RISING GOVERNMENT INVESTMENTS AND INCENTIVES FOR SMART PORT INITIATIVES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT INVESTMENT AND INSTALLATION COSTS

5.2.2 COMPLIANCE WITH STRINGENT REGIONAL REGULATIONS AND SAFETY STANDARDS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF AUTOMATED TERMINALS IN EMERGING MARKETS

5.3.2 INTEGRATION WITH SMART LOGISTICS SOLUTIONS AND PORT COMMUNITY SYSTEMS

5.3.3 GROWING ADOPTION OF ELECTRIC AND HYBRID AUTOMATED EQUIPMENT FOR SUSTAINABILITY

5.4 CHALLENGES

5.4.1 CYBERSECURITY RISKS ASSOCIATED WITH DIGITAL PORT INFRASTRUCTURE

5.4.2 SYSTEM INTEROPERABILITY WITH LEGACY EQUIPMENT AND MULTI-VENDOR SOLUTIONS

6 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION

6.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

6.1.1 SEMI-AUTOMATED TERMINALS

6.1.2 FULLY AUTOMATED TERMINALS

7 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

7.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

7.1.1 BROWNFIELD PROJECTS

7.1.1.1 BROWNFIELD PROJECTS, BY TYPE

7.1.1.1.1 END-TO-END BROWNFIELD PROJECTS TERMINAL AUTOMATION

7.1.1.1.2 YARD-ONLY AUTOMATION RETROFITS

7.1.1.1.3 LANDSIDE / GATE AUTOMATION UPGRADES

7.1.1.1.4 QUAY CRANE AUTOMATION RETROFITS

7.1.2 GREENFIELD PROJECTS

7.1.2.1 GREENFIELD PROJECTS, BY TYPE

7.1.2.1.1 FULLY AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.2 SEMI-AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.3 PHASED GREENFIELD PROJECTS AUTOMATION

8 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING

8.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

8.1.1 EQUIPMENT

8.1.1.1 EQUIPMENT, BY TYPE

8.1.1.1.1 AUTOMATED & REMOTE-CONTROLLED CRANES

8.1.1.1.2 AUTOMATED HORIZONTAL TRANSPORT

8.1.1.1.3 GATE & LANDSIDE AUTOMATION EQUIPMENT

8.1.1.1.4 OTHERS

8.1.2 SOFTWARE

8.1.2.1 SOFTWARE, BY TYPE

8.1.2.1.1 EQUIPMENT CONTROL SYSTEMS (ECS) & FLEET MANAGEMENT

8.1.2.1.2 TERMINAL OPERATING SYSTEMS (TOS)

8.1.2.1.3 AUTOMATION & ORCHESTRATION PLATFORMS

8.1.2.1.4 DIGITAL TWIN & SIMULATION TOOLS

8.1.2.1.5 GATE & COMMUNITY PLATFORMS

8.1.2.1.6 OTHERS

8.1.3 SERVICES

8.1.3.1 SERVICE, BY TYPE

8.1.3.1.1 PROFESSIONAL SERVICES

8.1.3.1.2 MANAGED SERVICES

9 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER

9.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

9.1.1 PUBLIC

9.1.1.1 PUBLIC, BY APPLICATION

9.1.1.1.1 PORT INFRASTRUCTURE MODERNIZATION

9.1.1.1.2 TRADE FACILITATION & CUSTOMS AUTOMATION

9.1.1.1.3 SAFETY & COMPLIANCE AUTOMATION

9.1.1.1.4 SMART NATIONAL LOGISTICS CORRIDORS

9.1.1.1.5 PUBLIC–PRIVATE PARTNERSHIP (PPP) CO-MANAGED TERMINALS

9.1.1.1.6 OTHERS

9.1.2 PRIVATE

9.1.2.1 PRIVATE, BY APPLICATION

9.1.2.1.1 HIGH-VOLUME AUTOMATED CONTAINER HANDLING

9.1.2.1.2 AUTOMATED LOGISTICS & INTERMODAL HUBS

9.1.2.1.3 CARRIER-OWNED SMART TERMINALS

9.1.2.1.4 SUBSCRIPTION & MANAGED TERMINAL AUTOMATION SERVICES

10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL

10.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

10.1.1 DIRECT CHANNEL

10.1.2 INDIRECT CHANNEL

10.1.2.1 INDIRECT CHANNEL, BY TYPE

10.1.2.1.1 SYSTEM INTEGRATORS

10.1.2.1.2 VALUE-ADDED RESELLERS (VAR)

10.1.2.1.3 OTHERS

11 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 SINGAPORE

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 INDIA

11.2.6 AUSTRALIA

11.2.7 MALAYSIA (

11.2.8 INDONESIA

11.2.9 THAILAND

11.2.10 PHILIPPINES (

11.2.11 REST OF ASIA PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 NETHERLANDS

11.3.3 BELGIUM

11.3.4 UNITED KINGDOM

11.3.5 FRANCE

11.3.6 ITALY

11.3.7 SPAIN

11.3.8 RUSSIA

11.3.9 TURKEY

11.3.10 SWITZERLAND

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 CHILE

11.5.3 COLOMBIA

11.5.4 PERU

11.5.5 ARGENTINA

11.5.6 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 U.A.E

11.6.2 SAUDI ARABIA

11.6.3 SOUTH AFRICA

11.6.4 EGYPT

11.6.5 ISRAEL

11.6.6 REST OF MIDDLE EAST & AFRICA

12 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIEBHERR

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BECKHOFF AUTOMATION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 SHANGHAI ZHENHUA HEAVY INDUSTRIES CO., LTD.

14.3.1 COMPANY SNAPSHOTS

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 KONECRANES

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 KALMAR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APM TERMINALS

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CAMCO TECHNOLOGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CLT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HIAB CORPORATION (SUBSIDIARY OF CARGOTEC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 HAPAG-LLOYD AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 INFYZ.COM.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INFORM SOFTWARE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 IDENTEC SOLUTIONS AG

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KÜNZ GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LOGSTAR ERP.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 LOGINNO LOGISTIC INNOVATION LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORBCOMM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PACECO CORP.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STARCOM GPS GLOBAL SOLUTIONS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 ECENT DEVELOPMENT

14.21 TMEIC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TIDEWORKS.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 TOTAL SOFT BANK LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.24 WCS CONSULTANCY

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 INDUSTRY ANALYSIS AND FUTURISTIC SCENARIO OF THE GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

TABLE 2 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL SEMI-AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 GLOBAL FULLY AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL DIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 CHINA (USD THOUSAND)

TABLE 44 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 45 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 CHINA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 CHINA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 49 CHINA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 CHINA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 CHINA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 CHINA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 54 CHINA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 CHINA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 CHINA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 SINGAPORE (USD THOUSAND)

TABLE 59 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 60 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 SINGAPORE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 SINGAPORE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 64 SINGAPORE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SINGAPORE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SINGAPORE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SINGAPORE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 69 SINGAPORE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 70 SINGAPORE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 71 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 SINGAPORE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH KOREA (USD THOUSAND)

TABLE 74 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 75 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 SOUTH KOREA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 SOUTH KOREA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 79 SOUTH KOREA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 SOUTH KOREA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 SOUTH KOREA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 SOUTH KOREA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 84 SOUTH KOREA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 85 SOUTH KOREA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 86 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 87 SOUTH KOREA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 JAPAN (USD THOUSAND)

TABLE 89 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 90 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 JAPAN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 JAPAN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 94 JAPAN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 JAPAN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 JAPAN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 JAPAN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 99 JAPAN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 100 JAPAN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 101 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 102 JAPAN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 INDIA (USD THOUSAND)

TABLE 104 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 105 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 INDIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 INDIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 109 INDIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 INDIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 INDIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 INDIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 114 INDIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 115 INDIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 AUSTRALIA (USD THOUSAND)

TABLE 119 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 120 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 AUSTRALIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 AUSTRALIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 132 AUSTRALIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 MALAYSIA (USD THOUSAND)

TABLE 134 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 135 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 MALAYSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MALAYSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 139 MALAYSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 MALAYSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 MALAYSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 MALAYSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 144 MALAYSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 MALAYSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 146 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 147 MALAYSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 INDONESIA (USD THOUSAND)

TABLE 149 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 150 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDONESIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 INDONESIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 154 INDONESIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDONESIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 INDONESIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 INDONESIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 159 INDONESIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 160 INDONESIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 161 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 162 INDONESIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 THAILAND (USD THOUSAND)

TABLE 164 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 165 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 THAILAND BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 THAILAND GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 169 THAILAND EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 THAILAND SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 THAILAND SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 THAILAND PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 174 THAILAND PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 175 THAILAND PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 176 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 THAILAND INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 PHILIPPINES (USD THOUSAND)

TABLE 179 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 180 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 PHILIPPINES BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 PHILIPPINES GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 184 PHILIPPINES EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 PHILIPPINES SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 PHILIPPINES SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 PHILIPPINES PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 189 PHILIPPINES PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 190 PHILIPPINES PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 191 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 192 PHILIPPINES INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 REST OF ASIA PACIFIC (USD THOUSAND)

TABLE 194 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 195 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 REST OF ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 REST OF ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 REST OF ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 204 REST OF ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 205 REST OF ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 206 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 REST OF ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 209 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 210 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 EUROPE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 EUROPE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 214 EUROPE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 EUROPE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 EUROPE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 EUROPE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 219 EUROPE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 220 EUROPE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 221 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 222 EUROPE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 GERMANY (USD THOUSAND)

TABLE 224 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 225 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 GERMANY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 GERMANY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 229 GERMANY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 GERMANY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 GERMANY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 GERMANY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 234 GERMANY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 235 GERMANY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 236 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 237 GERMANY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 NETHERLANDS (USD THOUSAND)

TABLE 239 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 240 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 NETHERLANDS BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 NETHERLANDS GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 244 NETHERLANDS EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 NETHERLANDS SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 NETHERLANDS SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 NETHERLANDS PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 249 NETHERLANDS PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 250 NETHERLANDS PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 251 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 252 NETHERLANDS INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 BELGIUM (USD THOUSAND)

TABLE 254 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 255 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 BELGIUM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 BELGIUM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 259 BELGIUM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 BELGIUM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 BELGIUM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 BELGIUM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 264 BELGIUM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 265 BELGIUM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 266 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 267 BELGIUM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 UNITED KINGDOM (USD THOUSAND)

TABLE 269 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 270 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 UNITED KINGDOM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 UNITED KINGDOM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 274 UNITED KINGDOM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 UNITED KINGDOM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 UNITED KINGDOM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 UNITED KINGDOM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 279 UNITED KINGDOM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 280 UNITED KINGDOM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 281 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 282 UNITED KINGDOM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 FRANCE (USD THOUSAND)

TABLE 284 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 285 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 FRANCE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 FRANCE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 289 FRANCE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 FRANCE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 FRANCE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 FRANCE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 294 FRANCE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 295 FRANCE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 296 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 297 FRANCE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 ITALY (USD THOUSAND)

TABLE 299 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 300 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 ITALY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 ITALY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 304 ITALY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 ITALY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 ITALY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 ITALY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 309 ITALY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 310 ITALY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 311 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 312 ITALY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 SPAIN (USD THOUSAND)

TABLE 314 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 315 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 SPAIN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 SPAIN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 319 SPAIN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 SPAIN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 SPAIN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 SPAIN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 324 SPAIN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 SPAIN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 326 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 327 SPAIN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 RUSSIA (USD THOUSAND)

TABLE 329 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 330 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 RUSSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 RUSSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 334 RUSSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 RUSSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 RUSSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 RUSSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 339 RUSSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 340 RUSSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 341 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 342 RUSSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 343 TURKEY (USD THOUSAND)

TABLE 344 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 345 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 TURKEY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 347 TURKEY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)