Global Fiber Reinforced Composites Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

114.28 Billion

USD

183.53 Billion

2025

2033

USD

114.28 Billion

USD

183.53 Billion

2025

2033

| 2026 –2033 | |

| USD 114.28 Billion | |

| USD 183.53 Billion | |

|

|

|

|

Global Fiber-Reinforced Composites Market Segmentation, By Resin Type (Polyester, Vinyl Ester, Epoxy, Polyurethane, Thermoplastic, and Others), Manufacturing Process (Compression & Injection Molding Process, Layup, Filament Winding, Pultrusion, Resin Transfer Molding (RTM), and Others), End-Use Industry (Wind Energy, Electrical & Electronics, Transportation, Pipes & Tanks, Construction & Infrastructure, Marine, Aerospace & Defense, and Others) - Industry Trends and Forecast to 2033

What is the Global Fiber-Reinforced Composites Market Size and Growth Rate?

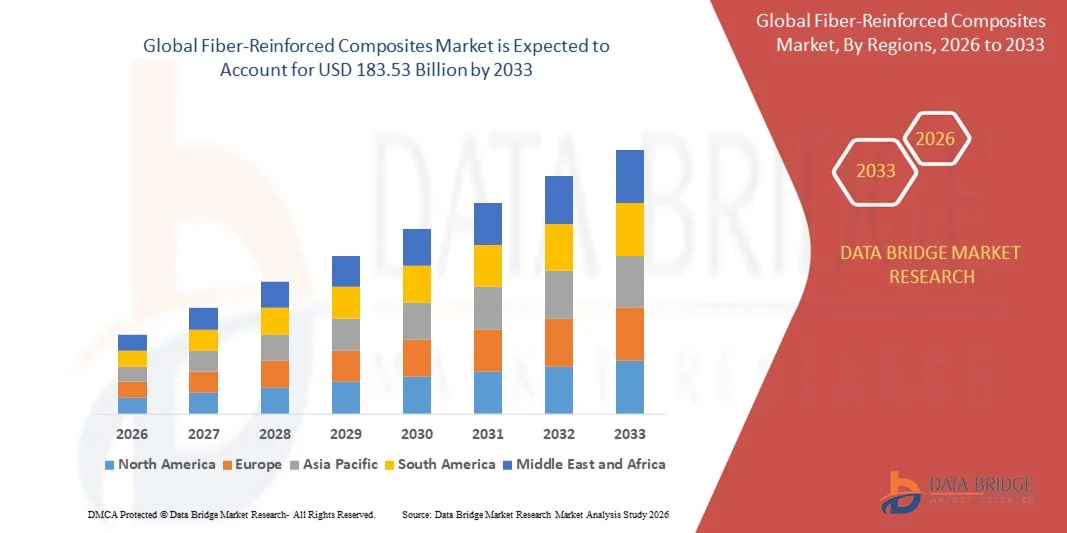

- The global fiber-reinforced composites market size was valued at USD 114.28 billion in 2025 and is expected to reach USD 183.53 billion by 2033, at a CAGR of6.1% during the forecast period

- The rise in the demand for the composites from the transportation, electrical & electronics, wind energy and pipes & tanks industries acts as one of the major factors driving the growth of fiber-reinforced composites market

- The increase in the number of wind energy capacity installations and growing usage of composite pipes in sewage & water management and oil & gas industry accelerate the fiber-reinforced composites market growth

What are the Major Takeaways of Fiber-Reinforced Composites Market?

- The rise in the rate of fiber-reinforced composites adoption in the transportation industry, and the recovery of the U.S. marine industry further influences the fiber-reinforced composites market

- In addition, growing use of composites in the construction & infrastructure industry, expansion of end user industries, rapid industrialization and surge in investment positively affect the fiber-reinforced composites market. Furthermore, increase in demand for these composites from emerging economies extends profitable opportunities to the fiber-reinforced composites market players

- North America dominated the fiber-reinforced composites market with a 39.8% revenue share in 2025, driven by strong demand from aerospace, wind energy, EV manufacturing, marine structures, and large-scale construction activities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rapid industrialization, strong automotive production, expanding wind energy installations, and large-scale construction activities across China, Japan, India, South Korea, and Southeast Asia

- The Polyester segment dominated the market with a 41.2% share in 2025, supported by its low cost, ease of processing, strong mechanical compatibility with glass fibers, and widespread use in construction, marine components, and industrial applications

Report Scope and Fiber-Reinforced Composites Market Segmentation

|

Attributes |

Fiber-Reinforced Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fiber-Reinforced Composites Market?

Increasing Shift Toward High-Performance, Lightweight, and Multi-Functional Composite Materials

- The fiber-reinforced composites market is witnessing rapid adoption of lightweight, corrosion-resistant, and high-strength composite materials driven by automotive lightweighting, aerospace modernization, and renewable energy projects

- Manufacturers are introducing high-modulus fibers, hybrid composites, and thermoplastic composites that deliver improved durability, recyclability, and faster processing cycles

- Growing demand for energy-efficient, sustainable, and multi-functional materials is accelerating usage across wind turbines, EV components, construction, marine structures, and industrial equipment

- For instance, companies such as PPG Industries, Owens Corning, Jushi Group, Saint-Gobain, and AGY have advanced their composite portfolios with high-strength glass fibers, carbon-glass hybrids, and performance-enhanced resins to support next-generation industrial applications

- Rising need for lightweight structural components, higher fatigue resistance, and improved thermal stability is fueling the shift toward advanced fiber-reinforced composites

- As industries transition toward sustainable and efficient materials, Fiber-Reinforced Composites will remain critical for high-performance engineering, design flexibility, and next-gen manufacturing

What are the Key Drivers of Fiber-Reinforced Composites Market?

- Increasing demand for lightweight, strong, and durable materials to support automotive, aerospace, electronics, construction, and energy sector expansion

- For instance, in 2025, companies such as Saint-Gobain, Celanese, Owens Corning, and Jiangsu Jiuding expanded their composite offerings with high-tensile fibers, thermoplastic matrices, and improved resin systems to enhance strength-to-weight ratios

- Growing adoption of EVs, wind energy installations, modular construction, and industrial automation is pushing demand for fiber-reinforced composite components across the U.S., Europe, and Asia-Pacific

- Advancements in fiber manufacturing, resin chemistry, compression molding, pultrusion, and automated lay-up technologies have improved productivity and material performance

- Rising use of high-modulus fibers, impact-resistant laminates, and corrosion-proof solutions is creating demand for engineered composite systems

- Supported by increasing investments in sustainable materials, lightweight manufacturing, and structural innovation, the Fiber-Reinforced Composites market is expected to experience strong long-term growth

Which Factor is Challenging the Growth of the Fiber-Reinforced Composites Market?

- High costs associated with premium fibers (carbon, aramid), advanced resin systems, and automated production equipment limit adoption among small manufacturers and price-sensitive end-users

- For instance, during 2024–2025, fluctuations in raw material prices (resins, fibers), supply-chain disruptions, and higher energy costs increased manufacturing expenses for several global composite producers

- Complexity in design optimization, structural analysis, and multi-material integration increases the need for skilled engineers and specialized manufacturing expertise

- Limited awareness in emerging markets regarding composite processing technologies, performance benefits, and life-cycle advantages slows adoption

- Competition from metals, low-cost plastics, and hybrid material alternatives creates price pressure and challenges differentiation

- To address these issues, companies are focusing on cost-optimized fiber systems, recyclable composites, automated production, and enhanced R&D to increase global adoption of Fiber-Reinforced Composites

How is the Fiber-Reinforced Composites Market Segmented?

The market is segmented on the basis of resin type, manufacturing process, and end-use industry.

- By Resin Type

The fiber-reinforced composites market is segmented into Polyester, Vinyl Ester, Epoxy, Polyurethane, Thermoplastic, and Others. The Polyester segment dominated the market with a 41.2% share in 2025, supported by its low cost, ease of processing, strong mechanical compatibility with glass fibers, and widespread use in construction, marine components, and industrial applications. Polyester resins offer excellent corrosion resistance, making them ideal for pipes, tanks, panels, and infrastructure parts.

The Thermoplastic segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for recyclable, impact-resistant, and high-toughness composite materials. Thermoplastic composites support rapid manufacturing cycles, lightweighting, and high structural performance, fueling adoption in automotive, aerospace, and consumer electronics. Increasing focus on sustainability, high-volume production, and improved energy absorption capabilities further accelerates thermoplastic penetration across global composite manufacturing.

- By Manufacturing Process

The market is segmented into Compression & Injection Molding, Layup, Filament Winding, Pultrusion, Resin Transfer Molding (RTM), and Others. The Compression & Injection Molding segment dominated the market with a 33.7% share in 2025, driven by its suitability for mass production of lightweight, high-strength composite parts used in automotive, electronics housings, consumer goods, and industrial components. The process offers high repeatability, shorter cycle times, and strong compatibility with both thermoset and thermoplastic resins.

The Resin Transfer Molding (RTM) segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for precision-engineered, high-quality parts in aerospace, EVs, and industrial equipment. RTM enables tighter dimensional control, smoother surface finishes, and reduced waste, making it ideal for producing complex structural components. Growing deployment of automated RTM systems further enhances scalability and performance across advanced composite manufacturing.

- By End-Use Industry

The fiber-reinforced composites market is segmented into Wind Energy, Electrical & Electronics, Transportation, Pipes & Tanks, Construction & Infrastructure, Marine, Aerospace & Defense, and Others. The Transportation segment dominated the market with a 29.8% share in 2025, driven by rising demand for lightweight materials in EVs, rail components, commercial vehicles, and structural automotive parts. Fiber composites help improve fuel efficiency, enhance crash performance, and reduce lifecycle maintenance.

The Wind Energy segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by global expansion of wind turbine installations and increasing rotor blade length requirements. Fiber-reinforced composites—especially glass and carbon fiber-based systems—offer exceptional fatigue resistance, stiffness, and weather durability essential for next-generation turbine blades. Increasing renewable energy investments across the U.S., Europe, China, and India further accelerate composite adoption in wind energy infrastructure.

Which Region Holds the Largest Share of the Fiber-Reinforced Composites Market?

- North America dominated the fiber-reinforced composites market with a 39.8% revenue share in 2025, driven by strong demand from aerospace, wind energy, EV manufacturing, marine structures, and large-scale construction activities across the U.S. and Canada. The region’s focus on lightweight materials, corrosion-resistant composites, and high-performance fiber systems supports widespread adoption across both industrial and defence applications

- Leading companies in North America are investing in advanced glass and carbon fiber technologies, high-modulus composites, and automated molding processes to support next-generation aircraft, automotive platforms, renewable energy systems, and infrastructure. Growing investments in sustainability, composite recycling, and high-strength thermoplastic systems further strengthen regional dominance

- High engineering capabilities, mature manufacturing infrastructure, and strong aerospace and automotive clusters reinforce North America’s leadership position in the global Fiber-Reinforced Composites market

U.S. Fiber-Reinforced Composites Market Insight

The U.S. is the largest contributor to the North American market, supported by extensive adoption of fiber-reinforced composites in aerospace, defense, EV manufacturing, wind turbine production, and high-performance industrial applications. Advanced material research programs, strong OEM presence, and growing investments in lightweight structural components accelerate composite usage across aircraft parts, automotive body panels, blades, pipes, tanks, and marine systems. Increasing demand for energy-efficient materials, high-strength laminates, and durable corrosion-resistant solutions further strengthens the U.S. market outlook.

Canada Fiber-Reinforced Composites Market Insight

Canada contributes significantly to regional demand due to its expanding wind energy sector, rising construction activities, and growing use of composite materials in transportation, marine components, and industrial infrastructure. Universities, R&D centers, and manufacturing clusters are increasingly adopting fiber-reinforced composites for advanced structural applications. Government-supported clean energy programs, aerospace investments, and focus on sustainable materials continue to enhance composite adoption across the country.

Asia-Pacific Fiber-Reinforced Composites Market

Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rapid industrialization, strong automotive production, expanding wind energy installations, and large-scale construction activities across China, Japan, India, South Korea, and Southeast Asia. High-volume manufacturing of composite parts, rising demand for lightweight vehicles, and strong growth in marine, electronics, and renewable energy sectors are driving regional market expansion. Increasing investments in carbon fiber production, advanced molding processes, and large composite facilities further accelerate market adoption.

China Fiber-Reinforced Composites Market Insight

China is the largest contributor to the Asia-Pacific region, supported by massive manufacturing capacity, rapid expansion of wind energy projects, and strong demand for composites in automotive, electronics, marine, and industrial applications. Government-backed infrastructure programs and large composite blade manufacturing operations drive significant consumption of glass and carbon fibers. Competitive costs and advanced production capabilities further strengthen China’s position as a global composite leader.

Japan Fiber-Reinforced Composites Market Insight

Japan shows steady growth driven by advanced automotive engineering, aerospace materials development, and strong emphasis on high-quality composite components. The country’s leadership in precision manufacturing, robotics, and high-performance industrial equipment drives demand for reliable, lightweight, and high-modulus fiber-reinforced materials. Continuous R&D in carbon fiber technologies further enhances Japan’s market footprint.

India Fiber-Reinforced Composites Market Insight

India is emerging as a rapidly growing market, supported by infrastructure development, renewable energy expansions, rising automotive production, and government-backed manufacturing initiatives. Increasing adoption of fiber composites in wind blades, railway components, pipes, tanks, and lightweight automotive parts is strengthening market penetration. Growing industrialization and investments in material innovation further boost demand.

South Korea Fiber-Reinforced Composites Market Insight

South Korea contributes strongly through its advanced automotive, electronics, defense, and shipbuilding industries. Increasing development of high-performance vehicles, marine vessels, and renewable energy systems drives demand for high-strength, lightweight, and corrosion-resistant composites. Continuous investments in automation, carbon fiber production, and advanced molding technologies support long-term industry expansion.

Which are the Top Companies in Fiber-Reinforced Composites Market?

The fiber-reinforced composites industry is primarily led by well-established companies, including:

- PPG Industries Inc. (U.S.)

- Owens Corning (U.S.)

- Johns Manville (U.S.)

- Yuntianhua Group Co. Ltd. (China)

- Jushi Group (China)

- Saint-Gobain (France)

- ASAHI FIBER GLASS Co. Ltd. (Japan)

- Nippon Sheet Glass Co. Ltd. (Japan)

- AGY (U.S.)

- CTG Group (China)

- Nitto Boseki Co. Ltd. (Japan)

- Braj Binani Group (India)

- China Beihai Fiberglass Co. Ltd. (China)

- BGF Industries Inc. (U.S.)

- SAERTEX GmbH & Co. KG (Germany)

- Jiangsu Jiuding New Materials Co. Ltd. (China)

- Celanese Corporation (U.S.)

- Quantum Composites (U.S.)

- Reliance Industries Limited (India)

- PFG FIBER GLASS CORPORATION (Taiwan)

- Advanced Composites Inc. (U.S.)

What are the Recent Developments in Global Fiber-Reinforced Composites Market?

- In May 2025, Hexcel and Specialty Materials jointly developed a next-generation carbon-fiber composite that integrates boron and carbon fibers using Hexcel’s advanced resin technology, enhancing overall structural performance. This innovation strengthens both companies’ portfolios in high-strength composite materials

- In May 2024, Hexcel Corporation entered a 10-year sustainability-focused agreement with Fairmat to recycle carbon fiber composite materials, supported by Fairmat’s newly opened large-scale recycling facility near Hexcel’s Salt Lake City operations. This long-term collaboration reinforces their commitment to circular composite material management

- In December 2024, Toray Advanced Composites acquired the assets of Gordon Plastics to expand its production capacity for continuous fiber-reinforced thermoplastic tapes, improving manufacturing efficiency and output. This acquisition supports Toray’s strategic goal of strengthening its global thermoplastic composites capabilities

- In October 2023, Mitsubishi Chemical Group Corporation completed the acquisition of CPC, an Italian manufacturer specializing in carbon fiber reinforced plastic (CFRP) automotive components, broadening its capabilities within the composite supply chain. This strategic move enhances Mitsubishi Chemical’s competitive presence in advanced carbon fiber automotive applications

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.