Global Flexible Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

164.64 Billion

USD

266.37 Billion

2024

2032

USD

164.64 Billion

USD

266.37 Billion

2024

2032

| 2025 –2032 | |

| USD 164.64 Billion | |

| USD 266.37 Billion | |

|

|

|

|

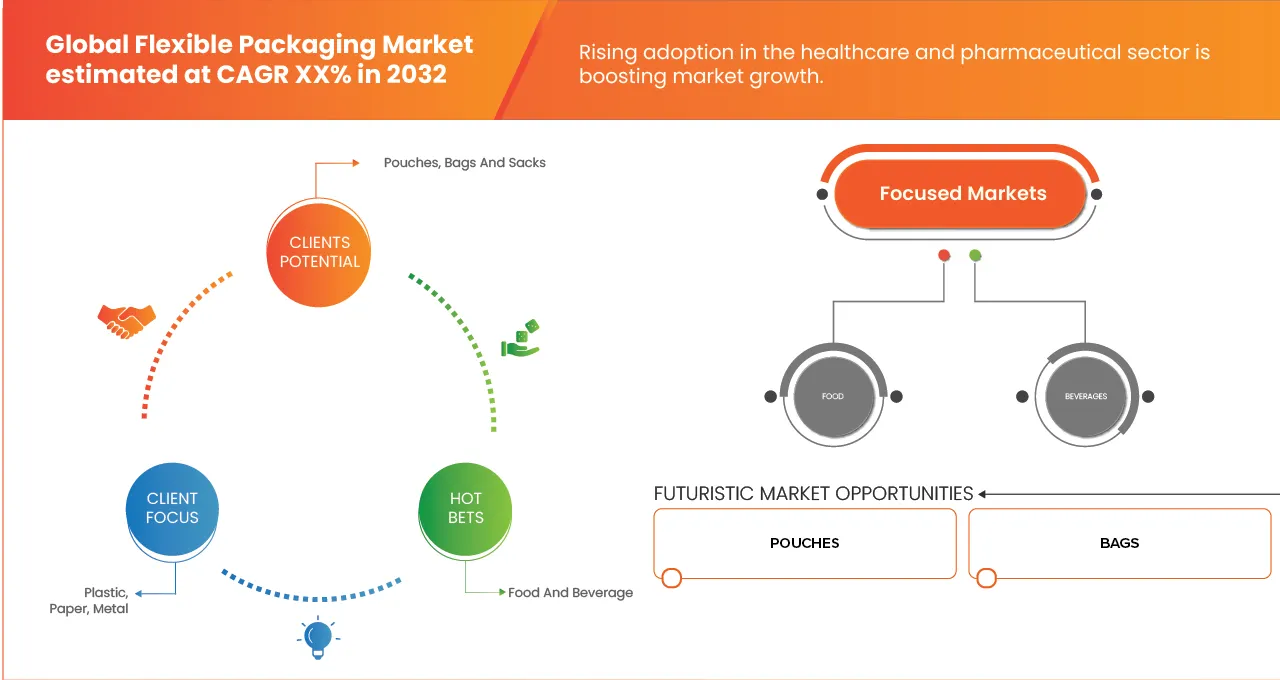

Segmentação do mercado global de embalagens flexíveis por produto (sacos, bolsas e sacos, tubos, revestimentos, sachês e embalagens adesivas, rótulos, fitas, filmes e invólucros), material (plástico, papel, metal, óxidos inorgânicos, adesivos e revestimentos, outros), uso final (alimentos e bebidas), tecnologia (flexografia, rotogravura, digital e outras), país (EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Turquia, Holanda, Luxemburgo, Suécia, Polônia, Suíça, Bélgica, restante da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Indonésia, Tailândia, Malásia, Singapura, Filipinas, restante da Ásia-Pacífico, Brasil, Argentina, restante da América do Sul, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel e restante do Oriente Médio e África), tendências do setor e previsão até 2032.

Tamanho do mercado de embalagens flexíveis

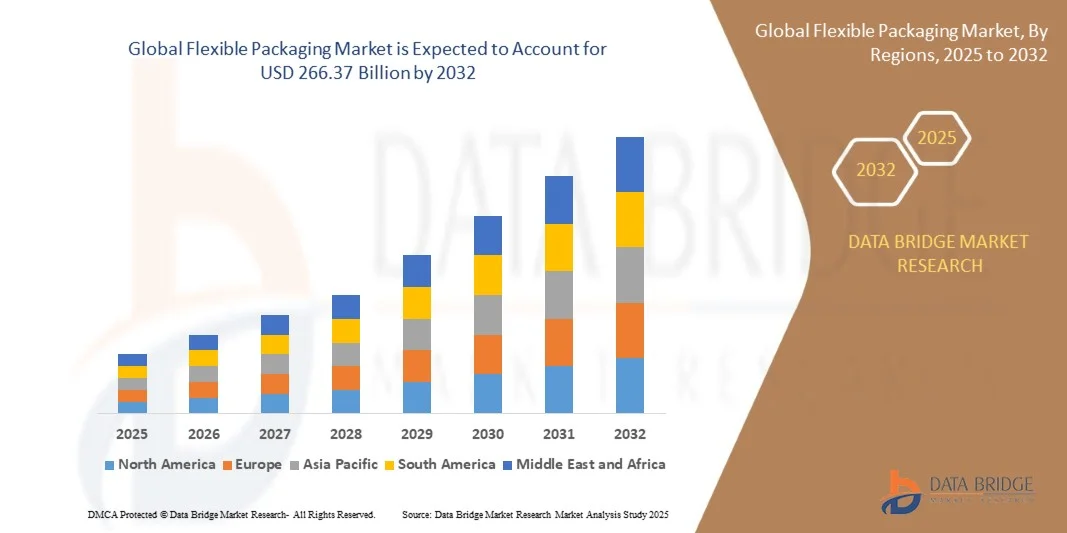

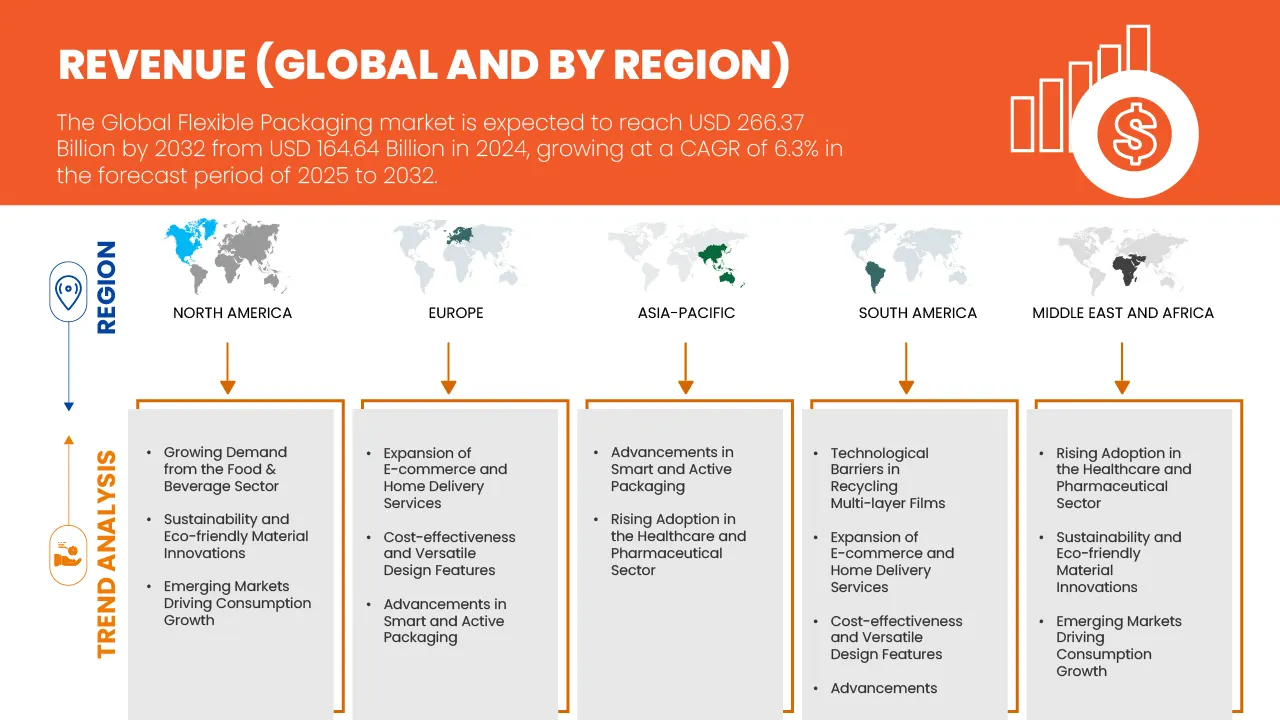

- O mercado de embalagens flexíveis foi avaliado em US$ 164,64 bilhões em 2024 e espera-se que alcance US$ 266,37 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 6,3% durante o período de previsão.

- A crescente demanda do setor de alimentos e bebidas é um dos principais fatores que impulsionam a demanda em toda a região.

- Os avanços em embalagens inteligentes e ativas, que melhoram a vida útil do produto e a experiência do consumidor, estão fortalecendo ainda mais o alcance de mercado.

Análise do mercado de embalagens flexíveis

- Embalagens flexíveis são embalagens feitas de materiais maleáveis, como filmes, folhas ou papel, que podem ser facilmente moldadas para proteger, armazenar e transportar produtos.

- O mercado de embalagens flexíveis é impulsionado principalmente pela crescente demanda por conveniência, design leve, maior vida útil, crescimento do comércio eletrônico, tendências de sustentabilidade, custo-benefício e inovações tecnológicas em materiais e impressão.

- A crescente demanda por embalagens flexíveis sustentáveis e recicláveis representa uma oportunidade de crescimento significativa, visto que consumidores e órgãos reguladores estão cada vez mais priorizando soluções ecológicas no setor de alimentos e bebidas.

- A região Ásia-Pacífico domina o mercado de embalagens flexíveis, impulsionada pela rápida urbanização e pelo aumento da renda disponível em países como China e Índia, o que aumenta a demanda por alimentos e bebidas embalados e, consequentemente, impulsiona o mercado de embalagens flexíveis.

- Em 2025, espera-se que o segmento de embalagens flexíveis domine o mercado com 43,73% de participação, devido ao seu design leve e com possibilidade de fechamento reutilizável, propriedades de barreira superiores, versatilidade para alimentos líquidos e sólidos, maior prazo de validade, portabilidade e praticidade para armazenamento, transporte e exposição no varejo. Sua capacidade de manter o frescor do produto e a facilidade de uso para o consumidor fazem delas a opção preferida em aplicações globais de embalagens para alimentos e bebidas.

- O mercado de embalagens flexíveis da região Ásia-Pacífico está preparado para crescer à taxa composta de crescimento anual (CAGR) mais rápida, de aproximadamente 6,7%, entre 2025 e 2032, impulsionado pela rápida urbanização, pelo aumento da renda disponível e pela crescente demanda por alimentos embalados e processados. O crescimento também é sustentado pela expansão do comércio eletrônico e dos canais de varejo, pela adoção de formatos de embalagens flexíveis leves, convenientes e sustentáveis, e pelos investimentos de fabricantes regionais em tecnologias inovadoras de impressão e barreira para atender às exigências dos consumidores e das regulamentações.

Escopo do relatório e segmentação do mercado de embalagens flexíveis

|

Atributos |

Principais informações sobre o mercado global de embalagens flexíveis |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análise de Porter, cobertura de matérias-primas, cenário de mudanças climáticas, estratégias de entrada no mercado, análise da cadeia de suprimentos, avanços tecnológicos, análise de preços, critérios de seleção de fornecedores, detalhamento da análise de custos e análise do ecossistema do setor. |

Tendências do mercado de embalagens flexíveis

“Embalagens flexíveis sustentáveis e recicláveis”

- No setor de alimentos e bebidas, observa-se uma forte tendência em direção a soluções de embalagens flexíveis que priorizam a sustentabilidade, a reciclabilidade e o pensamento de economia circular.

- As marcas estão utilizando cada vez mais filmes monomateriais (polímero único em vez de laminados multicamadas) para simplificar a reciclagem e reduzir a complexidade.

- Está a ser cada vez mais adotada a utilização de embalagens flexíveis de base biológica, compostáveis ou à base de papel, especialmente para alimentos secos e snacks, com o objetivo de reduzir a dependência de plásticos derivados de combustíveis fósseis.

- Pressão de marketing e regulamentação: os governos estão definindo metas (por exemplo, as embalagens de uso único devem ser recicláveis/compostáveis) e os consumidores esperam credenciais ecológicas.

- Embalagens leves e flexíveis reduzem o uso de materiais, o peso/volume do transporte e a pegada de carbono em comparação com alternativas rígidas, uma vantagem na logística de alimentos e bebidas. (embalagem interna)

- As embalagens flexíveis (como pouches stand-up e pouches com bico) predominam devido à sua praticidade e adaptabilidade, tornando as versões sustentáveis particularmente impactantes. Feeding Trends

- As melhorias no desempenho das barreiras (contra umidade, oxigênio e luz) estão sendo combinadas com escolhas sustentáveis, o que significa que as marcas não precisam sacrificar a vida útil ou a integridade do produto ao optarem por práticas mais ecológicas.

Dinâmica do mercado de embalagens flexíveis

Motorista

Crescente demanda do setor de alimentos e bebidas

- O setor de alimentos e bebidas continua a impulsionar uma demanda substancial por embalagens flexíveis devido às suas excelentes propriedades de barreira, maior vida útil e custo-benefício. O crescente consumo de refeições prontas, lanches e alimentos para consumo imediato, especialmente em economias emergentes como Índia, China e Brasil, está contribuindo para o crescimento do mercado. Formatos de embalagens flexíveis, como sachês, embalagens flexíveis e wraps, são preferidos por sua praticidade, design leve e menor uso de material em comparação com alternativas rígidas. Além disso, a expansão das entregas de supermercado online e a adoção de práticas de embalagens sustentáveis por marcas de alimentos estão acelerando a transição para materiais flexíveis recicláveis e de base biológica. Espera-se que essa crescente dependência de embalagens flexíveis continue impulsionando a expansão do mercado global nos próximos anos.

- Por exemplo, conforme destacado pelo Instituto de Fabricantes de Máquinas de Embalagem (PMMI, na sigla em inglês) em junho de 2025, 68% das empresas de bebidas preveem aumentos moderados a significativos nos investimentos em máquinas de embalagem, com quase 90% planejando novas aquisições. Esse impulso nos investimentos é impulsionado pela crescente demanda do consumidor por bebidas para consumo imediato e pelo aumento do uso de embalagens flexíveis.

- Em maio de 2025, a empresa indiana Jindal Poly Films Limited anunciou um investimento de US$ 84,34 milhões para expandir sua capacidade de produção de filmes BOPP, PET e CPP em sua unidade de Nashik, especificamente para apoiar o crescimento em setores-chave, incluindo embalagens flexíveis para alimentos e bebidas.

- A crescente demanda do setor de alimentos e bebidas é um fator-chave para o mercado de embalagens flexíveis para alimentos. A preferência cada vez maior do consumidor por conveniência, consumo em movimento e frescor do produto está levando os fabricantes a adotarem soluções de embalagem inovadoras e sustentáveis. Como resultado, a demanda por alimentos e bebidas não só impulsiona o crescimento do mercado, como também acelera o desenvolvimento de formatos flexíveis adaptados a diversos tipos de produtos e normas regulatórias.

Restrição/Desafio

Flutuação dos preços das matérias-primas

- A flutuação dos preços das matérias-primas continua sendo um desafio crítico para o mercado de embalagens flexíveis. Variações no custo de polímeros como polietileno, polipropileno e PET podem influenciar significativamente as despesas de produção, as margens de lucro e as estratégias de precificação. Essas flutuações são frequentemente impulsionadas por desequilíbrios globais entre oferta e demanda, volatilidade dos preços da energia e fatores geopolíticos, obrigando os fabricantes a adotarem estratégias de fornecimento, materiais alternativos e medidas de gestão de custos. Como resultado, a instabilidade dos preços das matérias-primas continua a moldar as decisões operacionais e a competitividade do setor.

- Por exemplo, em agosto de 2025, a Castrol Índia registrou um aumento de 5,1% no lucro do segundo trimestre, atingindo US$ 29.400, impulsionado pela demanda consistente por seus lubrificantes automotivos e industriais. A receita operacional cresceu 7,1%, para US$ 14,97 bilhões, sustentada por um aumento de quase 5% nas vendas de veículos no varejo na Índia durante o trimestre. No entanto, as despesas totais aumentaram 6,6%, principalmente devido a um aumento de 3,2% nos custos de matéria-prima, evidenciando o impacto da flutuação dos preços das matérias-primas nos custos de produção e nas margens de lucro.

- A flutuação dos preços das matérias-primas continua a representar um desafio significativo para a indústria de embalagens flexíveis, afetando diretamente os custos de produção, as margens de lucro e as estratégias de precificação. A variabilidade nos custos de polímeros, papel e outros insumos essenciais obriga os fabricantes a implementar o fornecimento estratégico, adotar materiais alternativos e otimizar as cadeias de suprimentos. Essas flutuações não apenas influenciam a lucratividade a curto prazo, mas também moldam as decisões operacionais e de investimento a longo prazo, enfatizando a necessidade de resiliência e gestão proativa de custos em um mercado global dinâmico.

Escopo do mercado de embalagens flexíveis

O mercado é segmentado com base no produto, material, setor de uso final e tecnologia.

Por produto

Com base no produto, o mercado é segmentado em embalagens flexíveis, incluindo sachês, sacos, tubos, revestimentos, embalagens tipo stick, rótulos, fitas adesivas, filmes e invólucros. Em 2025, as embalagens flexíveis dominarão o mercado de embalagens flexíveis com uma participação de 43,73%, devido ao seu design leve e resselável, propriedades de barreira superiores, versatilidade para alimentos líquidos e sólidos, maior prazo de validade, portabilidade e conveniência para armazenamento, transporte e exposição no varejo. Sua capacidade de manter o frescor do produto e a facilidade de uso para o consumidor as tornam a escolha preferida em aplicações globais de embalagens para alimentos e bebidas.

Além disso, prevê-se que este segmento registre a maior taxa de crescimento anual composta (CAGR) de 6,6% durante o período de previsão de 2025 a 2032, devido à crescente demanda por refeições individuais prontas para consumo e lanches para viagem, à urbanização crescente, aos estilos de vida focados na conveniência, às necessidades de embalagens para comércio eletrônico, aos designs inovadores de embalagens flexíveis e à adoção por marcas de alimentos emergentes por soluções de embalagem econômicas, sustentáveis e visualmente atraentes.

Por material

Com base no material, o mercado é segmentado em plástico, papel, metal, óxidos inorgânicos, adesivos e revestimentos, e outros. Em 2025, o plástico dominará o mercado global com uma participação de 69,37%, devido à sua durabilidade, flexibilidade, leveza, custo-benefício, propriedades superiores de barreira contra umidade e oxigênio, compatibilidade com diversas tecnologias de impressão e laminação, e capacidade de preservar a qualidade, o prazo de validade e a aparência do produto em diferentes aplicações de alimentos e bebidas em todo o mundo.

Além disso, prevê-se que o segmento de papel registre a maior taxa de crescimento anual composta (CAGR) de 6,7% durante o período de previsão de 2025 a 2032. Esse alto crescimento deve-se principalmente às crescentes tendências de sustentabilidade, à preferência do consumidor por materiais recicláveis ou biodegradáveis, às regulamentações governamentais sobre plásticos de uso único, à crescente adoção de embalagens e invólucros à base de papel e ao aumento das iniciativas de embalagens ecologicamente conscientes por parte de marcas globais de alimentos e bebidas.

Por setor de uso final

Com base no setor de uso final, o mercado é segmentado em alimentos e bebidas. Em 2025, o setor de alimentos dominará o mercado com uma participação de 83,78%, devido ao alto consumo global de alimentos embalados, à crescente demanda por conveniência e produtos prontos para consumo, aos estilos de vida urbanos, à necessidade de maior prazo de validade, ao aumento da distribuição no varejo e à preferência por embalagens seguras, higiênicas e visualmente atraentes.

Além disso, espera-se que este segmento registre o crescimento mais rápido, de 6,4%, durante o período de previsão, devido à expansão dos mercados de alimentos processados e embalados, ao aumento da renda disponível, à adoção de formatos de porção única e lanches, ao aumento das vendas de alimentos no comércio eletrônico, à crescente conscientização sobre a conservação de alimentos e à necessidade de soluções de embalagens sustentáveis, convenientes e portáteis.

Por meio da tecnologia

Com base na tecnologia, o mercado é segmentado em flexografia, rotogravura, digital e outras. Em 2025, a flexografia dominará o mercado de embalagens flexíveis com uma participação de 46,61%, pois oferece impressão de alta velocidade e baixo custo em diversos substratos, qualidade de cor consistente, adaptabilidade a filmes flexíveis, escalabilidade para grandes tiragens de produção, adesão superior da tinta, tempo de preparação mínimo e capacidade de fornecer designs vibrantes e de alta resolução para branding e atratividade do produto.

Além disso, prevê-se que este segmento apresente o crescimento mais rápido, de 6,6%, durante o período de previsão. O crescimento deste segmento deve-se principalmente aos avanços na automação, às tecnologias aprimoradas de produção de chapas, à integração híbrida digital, à demanda por impressões de alta qualidade em tiragens curtas, às inovações em tintas sustentáveis, à capacidade de personalizar embalagens rapidamente e à crescente adoção por marcas que buscam soluções de impressão visualmente atraentes, eficientes e econômicas.

Análise Regional do Mercado de Embalagens Flexíveis

- A região Ásia-Pacífico dominou o mercado de embalagens flexíveis com uma participação de 41,34% na receita, impulsionada pela rápida urbanização e pelo aumento da renda disponível em países como China e Índia, que estão elevando a demanda por alimentos e bebidas embalados e, consequentemente, impulsionando o mercado de embalagens flexíveis.

- A expansão do comércio eletrônico e dos canais de varejo modernos na região da Ásia-Pacífico está impulsionando a adoção de soluções de embalagens flexíveis convenientes, leves e duráveis.

- A crescente conscientização sobre segurança alimentar, os requisitos de maior prazo de validade e o aumento do consumo de alimentos prontos para consumo e processados estão impulsionando ainda mais o crescimento do mercado, contribuindo para a grande participação da região na receita.

Análise do Mercado de Embalagens Flexíveis nos EUA

O mercado de embalagens flexíveis dos EUA representou uma parcela significativa da América do Norte em 2024, devido à forte demanda do consumidor por alimentos práticos, à crescente adoção de produtos prontos para consumo e para levar, e às crescentes exigências de embalagens no comércio eletrônico. Além disso, os avanços em soluções de embalagens sustentáveis e recicláveis, juntamente com os altos investimentos de fabricantes líderes em formatos flexíveis inovadores, reforçaram a dominância do mercado e sustentaram um crescimento consistente nos segmentos de alimentos, bebidas e cuidados pessoais.

Análise do Mercado Europeu de Embalagens Flexíveis

O mercado europeu de embalagens flexíveis deverá crescer de forma constante durante o período de previsão, impulsionado pela crescente conscientização do consumidor sobre sustentabilidade, pelas regulamentações governamentais sobre plásticos de uso único e pela crescente demanda por soluções de embalagens recicláveis e ecológicas. O crescimento é ainda sustentado pela expansão dos setores de alimentos e bebidas embalados, pelos avanços tecnológicos em impressão e filmes de barreira e pela crescente adoção de formatos flexíveis convenientes, como sachês, embalagens flexíveis e invólucros.

Análise do Mercado de Embalagens Flexíveis no Reino Unido

O mercado de embalagens flexíveis do Reino Unido deverá registrar um crescimento constante durante o período de previsão, impulsionado pela crescente demanda por soluções de embalagens práticas e leves nos setores de alimentos, bebidas e cuidados pessoais. A preferência do consumidor por materiais sustentáveis, recicláveis e biodegradáveis, juntamente com as crescentes exigências de embalagens no comércio eletrônico e no varejo, está impulsionando a adoção. Inovações tecnológicas em filmes flexíveis, barreiras e soluções de impressão aprimoram ainda mais a diferenciação de produtos e a competitividade no mercado.

Análise do Mercado de Embalagens Flexíveis na Alemanha

Prevê-se que o mercado alemão de embalagens flexíveis cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pela crescente preferência dos consumidores por formatos de embalagens sustentáveis e recicláveis. O crescimento é impulsionado por um setor de alimentos e bebidas robusto, pelo apoio regulatório a embalagens ecológicas e pela crescente adoção de filmes flexíveis avançados com propriedades de barreira e impressão aprimoradas. Os fabricantes estão investindo em inovação e automação para atender à demanda por soluções de embalagens convenientes e de alta qualidade.

Análise do Mercado de Embalagens Flexíveis na Ásia-Pacífico

O mercado de embalagens flexíveis da região Ásia-Pacífico está preparado para crescer à taxa composta de crescimento anual (CAGR) mais rápida, de aproximadamente 6,7%, entre 2025 e 2032, impulsionado pela rápida urbanização, pelo aumento da renda disponível e pela crescente demanda por alimentos embalados e processados. O crescimento também é sustentado pela expansão do comércio eletrônico e dos canais de varejo, pela adoção de formatos de embalagens flexíveis leves, convenientes e sustentáveis, e pelos investimentos de fabricantes regionais em tecnologias inovadoras de impressão e barreira para atender às exigências dos consumidores e das regulamentações.

Análise do Mercado de Embalagens Flexíveis na China

Em 2024, a China detinha a maior participação no mercado de embalagens flexíveis da região Ásia-Pacífico, devido ao seu rápido crescimento populacional, à crescente urbanização e à demanda cada vez maior por alimentos e bebidas embalados. A expansão dos canais modernos de varejo e comércio eletrônico, as iniciativas governamentais que promovem embalagens sustentáveis e os crescentes investimentos de fabricantes nacionais e internacionais em formatos flexíveis avançados e tecnologias de impressão fortaleceram a posição dominante da China, possibilitando a ampla adoção em diversos setores de uso final.

Análise do Mercado Japonês de Embalagens Flexíveis

O mercado japonês de embalagens flexíveis está crescendo de forma constante, impulsionado pela preferência do consumidor por produtos alimentícios convenientes, com porções controladas e prontos para consumo. O crescimento é ainda sustentado pela crescente demanda por soluções de embalagens sustentáveis e recicláveis, pelos avanços tecnológicos em filmes flexíveis e pela presença de setores de fabricação de alimentos e bebidas bem estabelecidos. Os fabricantes estão focando em designs de embalagens inovadores, materiais de alta barreira e estética premium para atender tanto ao mercado interno quanto ao de exportação.

Os principais líderes de mercado que atuam no setor são:

- PROAMPAC (EUA)

- AMCOR PLC (Suíça)

- GOGLIO SPA (Itália)

- EMPRESA DE EMBALAGENS GRÁFICAS (EUA)

- CONSTANTIA FLEXIBLES (Áustria)

- ALTANA (Alemanha)

- SONOCO PRODUCTS COMPANY (EUA)

- FLAIR FLEXIBLE PACKAGING CORPORATION (EUA)

- MONDI (Reino Unido)

- WESTROCK COMPANY (EUA)

- TRANSCONTINENTAL INC. (Canadá)

- GRUPO WIPAK (Finlândia)

- AR SEALIZADO (EUA)

- BBC CELLPACK EMBALAGEM (Suíça)

- SCHUR FLEXÍVEIS (Áustria)

- COVERIS (Áustria)

- HUHTAMÄKI (Finlândia)

- BISCHOF + KLEIN SE & CO. KG (Alemanha)

- SÜDPAC (Alemanha)

Últimos desenvolvimentos no mercado global de embalagens flexíveis

- Em setembro, a Sealed Air lançou a máquina de ensacamento híbrida AUTOBAG 850HB, projetada para operações de logística que utilizam embalagens de papel ou de polietileno. A máquina oferece flexibilidade para trabalhar com ambos os tipos de substrato, ajudando os clientes a otimizar suas necessidades de equipamentos e a atender aos formatos recicláveis para coleta seletiva.

- Em setembro de 2025, a Graphic Packaging, juntamente com a Henkel Adhesive Technologies e a Kraton Corporation, firmaram uma parceria estratégica para desenvolver soluções de embalagens sustentáveis de última geração. Essa colaboração tem como foco alinhar a inovação aos princípios da economia circular, acelerando a transição para materiais mais sustentáveis e de alto desempenho. A parceria visa impulsionar o progresso sustentável na indústria de embalagens por meio da combinação de conhecimento especializado e recursos.

- Em julho, a BBC Cellpack Packaging aprimorou sua capacidade de produção em Lauterecken (Alemanha) com a instalação de uma impressora flexográfica BOBST EXPERT CI com onze unidades de impressão. O investimento possibilita trocas de trabalho mais rápidas, redução de desperdício e maior versatilidade em embalagens flexíveis recicláveis e sustentáveis, fortalecendo a presença da empresa nos segmentos de confeitaria, alimentos secos e cuidados pessoais.

- Em agosto de 2024, a ACTEGA lançou a plataforma tecnológica YUNICO, uma solução de revestimento à base de água projetada para aprimorar a sustentabilidade das embalagens de alimentos. Essa plataforma permite a dispersão de compostos altamente personalizáveis, proporcionando propriedades de barreira, reciclabilidade e adesão em materiais de embalagem. A YUNICO está alinhada ao compromisso da ALTANA com soluções de embalagens sustentáveis.

- Em agosto de 2023, a Amcor adquiriu a Phoenix Flexibles, uma empresa sediada em Gujarat que gera aproximadamente US$ 20 milhões em receita anual com soluções de embalagens flexíveis para os setores de alimentos, produtos de limpeza doméstica e cuidados pessoais. Essa aquisição amplia a capacidade da Amcor no mercado indiano, de alto crescimento, e introduz tecnologias avançadas de filmes, possibilitando a produção local de soluções de embalagens sustentáveis.

- Em abril, a Huhtamaki expandiu seu portfólio de embalagens flexíveis com o lançamento de sua nova geração de filmes monomateriais sob a plataforma blueloop. A nova linha, feita de PE e PP, oferece total reciclabilidade e alta proteção ao produto, atendendo à demanda por soluções flexíveis sustentáveis nos mercados de alimentos e cuidados pessoais. Essa inovação reflete o foco da Huhtamaki em soluções de embalagens circulares e seu compromisso de longo prazo com a redução do desperdício de plástico por meio da inovação em materiais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLEXIBLE PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TIMELINE CURVE

2.1 MARKET END USE INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATIONS

4.4 RAW MATERIAL COVERAGE

4.4.1 POLYETHYLENE (PE)

4.4.2 POLYPROPYLENE (PP)

4.4.3 POLYETHYLENE TEREPHTHALATE (PET)

4.4.4 ALUMINUM FOIL

4.4.5 PAPER & CELLULOSIC MATERIALS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTICS COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 PRODUCTION CAPACITY OVERVIEW OF THE FLEXIBLE PACKAGING MARKET

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7.1 HIGH-PERFORMANCE BARRIER FILMS AND NANOCOMPOSITE STRUCTURES

4.7.2 MONO-MATERIAL INNOVATIONS FOR CIRCULARITY

4.7.3 DIGITAL PRINTING AND SMART CONVERTING TECHNOLOGIES

4.7.4 BIO-BASED AND COMPOSTABLE POLYMER DEVELOPMENT

4.7.5 SMART AND FUNCTIONAL PACKAGING INTEGRATION

4.7.6 ADVANCED SEALING AND FORMING MECHANISMS

4.7.7 AUTOMATION, ROBOTICS, AND AI-ENABLED MANUFACTURING

4.7.8 RECYCLING-COMPATIBLE ADHESIVES AND COATINGS

4.7.9 DATA-DRIVEN DESIGN AND LIFECYCLE ANALYTICS

4.7.10 TOWARD A SMART, CIRCULAR FUTURE

4.8 VENDOR SELECTION CRITERIA

4.8.1 MATERIAL AND PRODUCT PORTFOLIO BREADTH

4.8.2 TECHNOLOGICAL CAPABILITY AND INNOVATION READINESS

4.8.3 SUSTAINABILITY AND REGULATORY COMPLIANCE

4.8.4 MANUFACTURING CAPACITY AND GLOBAL FOOTPRINT

4.8.5 QUALITY ASSURANCE AND CERTIFICATION STANDARDS

4.8.6 CUSTOMIZATION AND DESIGN FLEXIBILITY

4.8.7 SUPPLY CHAIN TRANSPARENCY AND TRACEABILITY

4.8.8 COST COMPETITIVENESS AND TOTAL VALUE PROPOSITION

4.8.9 DIGITAL INTEGRATION AND AFTER-SALES SUPPORT

4.8.10 REPUTATION, STRATEGIC PARTNERSHIPS, AND MARKET ENDORSEMENT

4.8.11 SUMMARY

4.9 PRICING ANALYSIS

5 REGULATION COVERAGE

5.1 PRODUCT CODE

5.1.1 INDIAN STANDARD (IS) CODES

5.1.2 INTERNATIONAL STANDARD CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HARAD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FROM THE FOOD & BEVERAGE SECTOR

6.1.2 SUSTAINABILITY AND ECO-FRIENDLY MATERIAL INNOVATIONS

6.1.3 COST-EFFECTIVENESS AND VERSATILE DESIGN FEATURES

6.1.4 EXPANSION OF E-COMMERCE AND HOME DELIVERY SERVICES

6.2 RESTRAINS

6.2.1 FLUCTUATING RAW MATERIAL PRICES AFFECTING PRODUCTION COSTS AND PROFIT MARGINS

6.2.2 LIMITED RECYCLING INFRASTRUCTURE HINDERING CIRCULAR ECONOMY AND SUSTAINABILITY GOALS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN SMART AND ACTIVE PACKAGING ENHANCING PRODUCT SHELF LIFE AND CONSUMER EXPERIENCE

6.3.2 RISING ADOPTION IN THE HEALTHCARE AND PHARMACEUTICAL SECTOR

6.3.3 EMERGING MARKETS DRIVING CONSUMPTION GROWTH THROUGH RISING DISPOSABLE INCOME AND CHANGING CONSUMER PREFERENCES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL AND REGULATORY PRESSURES SHAPING PACKAGING DESIGN AND SUSTAINABILITY PRACTICES

6.4.2 TECHNOLOGICAL BARRIERS IN RECYCLING MULTI-LAYER FILMS

7 GLOBAL FLEXIBLE PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POUCHES

7.3 BAGS AND SACKS

7.4 FILMS AND WRAPS

7.5 TUBES

7.6 SACHETS & STICK PACKS

7.7 LINERS

7.8 LABELS

7.9 TAPES

8 GLOBAL FLEXIBLE PACKAGING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 METAL

8.5 ADHESIVE AND COATINGS

8.6 INORGANIC OXIDES

8.7 OTHERS

9 GLOBAL FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 FLEXOGRAPHY

9.3 ROTOGRAVURE

9.4 DIGITAL

9.5 OTHERS

10 GLOBAL FLEXIBLE PACKAGING MARKET, BY END USE

10.1 OVERVIEW

10.2 FOOD

10.3 BEVERAGE

11 GLOBAL FLEXIBLE PACKAGING MARKET BY REGIONS

11.1 OVERVIEW

11.2 ASIA PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 AUSTRALIA & NEW ZEALAND

11.2.5 SOUTH KOREA

11.2.6 INDONESIA

11.2.7 THAILAND

11.2.8 MALAYSIA

11.2.9 PHILIPPINES

11.2.10 SINGAPORE

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 U.K.

11.4.4 ITALY

11.4.5 SPAIN

11.4.6 RUSSIA

11.4.7 TURKEY

11.4.8 NETHERLANDS

11.4.9 BELGIUM

11.4.10 SWITZERLAND

11.4.11 LUXEMBOURG

11.4.12 REST OF EUROPE

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 SAUDI ARABIA

11.6.2 UAE

11.6.3 SOUTH AFRICA

11.6.4 EGYPT

11.6.5 ISRAEL

11.6.6 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL FLEXIBLE PACKAGING MARKET: COMPANY LANDSCAPE

12.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: EUROPE

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 AMCOR PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 GRAPHIC PACKAGING INTERNATIONAL, LLC (SUBSIDIARY OF A. R. PACKAGING SOLUTIONS)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 SEALED AIR

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HUHTAMÄKI OYJ

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ALTANA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BBC CELLPACK PACKAGING

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BISCHOF+KLEIN SE & CO. KG

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTANTIA FLEXIBLES

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 COVERIS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GOGLIO SPA

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PROAMPAC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SCHUR

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SONOCO PRODUCTS COMPANY

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 SÜDPACK

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 WIPAK

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 GLOBAL POUCHES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 GLOBAL BAGS AND SACKS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 4 GLOBAL FILMS AND WRAPS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 5 GLOBAL TUBES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 GLOBAL SACHETS & STICK PACKS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 GLOBAL LINERS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 GLOBAL LABELS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 9 GLOBAL TAPES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 10 GLOBAL FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 11 GLOBAL PLASTIC IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 GLOBAL PAPER IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 GLOBAL METAL IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 GLOBAL ADHESIVE AND COATINGS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 GLOBAL INORGANIC OXIDES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 GLOBAL OTHERS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 GLOBAL FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 19 GLOBAL FOOD IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 GLOBAL FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 GLOBAL BEVERAGE IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 GLOBAL FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 GLOBAL FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 24 GLOBAL FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 25 GLOBAL FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 26 GLOBAL FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 GLOBAL FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 34 CHINA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 35 CHINA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 36 CHINA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 37 CHINA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 CHINA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 39 INDIA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 40 INDIA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 41 INDIA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 42 INDIA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 INDIA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 44 JAPAN FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 45 JAPAN FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 46 JAPAN FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 47 JAPAN FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 JAPAN FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 49 AUSTRALIA & NEW ZEALAND FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 AUSTRALIA & NEW ZEALAND FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 51 AUSTRALIA & NEW ZEALAND FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 52 AUSTRALIA & NEW ZEALAND FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 AUSTRALIA & NEW ZEALAND FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 54 SOUTH KOREA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 55 SOUTH KOREA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 56 SOUTH KOREA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 57 SOUTH KOREA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 SOUTH KOREA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 59 INDONESIA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 60 INDONESIA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 61 INDONESIA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 62 INDONESIA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 INDONESIA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 64 THAILAND FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 65 THAILAND FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 66 THAILAND FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 67 THAILAND FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 THAILAND FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 69 MALAYSIA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 70 MALAYSIA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 71 MALAYSIA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 72 MALAYSIA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 MALAYSIA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 74 PHILIPPINES FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 75 PHILIPPINES FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 76 PHILIPPINES FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 77 PHILIPPINES FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 PHILIPPINES FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 79 SINGAPORE FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 SINGAPORE FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 81 SINGAPORE FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 82 SINGAPORE FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 SINGAPORE FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 84 REST OF ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 85 REST OF ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 86 REST OF ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 87 REST OF ASIA-PACIFIC FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 88 REST OF ASIA-PACIFIC FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 95 U.S. FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 96 U.S. FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 97 U.S. FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 98 U.S. FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 U.S. FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 100 CANADA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 101 CANADA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 102 CANADA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 103 CANADA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 CANADA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 105 MEXICO FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 106 MEXICO FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 107 MEXICO FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 108 MEXICO FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 MEXICO FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 110 EUROPE FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 111 EUROPE FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 112 EUROPE FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 113 EUROPE FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 114 EUROPE FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 EUROPE FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 116 GERMANY FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 117 GERMANY FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 118 GERMANY FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 119 GERMANY FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 GERMANY FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 121 FRANCE FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 122 FRANCE FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 123 FRANCE FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 124 FRANCE FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 FRANCE FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 126 U.K. FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 127 U.K. FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 128 U.K. FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 129 U.K. FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 U.K. FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 131 ITALY FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 132 ITALY FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 133 ITALY FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 134 ITALY FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 ITALY FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 136 SPAIN FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 137 SPAIN FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 138 SPAIN FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 139 SPAIN FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 140 SPAIN FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 141 RUSSIA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 142 RUSSIA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 143 RUSSIA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 144 RUSSIA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 RUSSIA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 146 TURKEY FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 147 TURKEY FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 148 TURKEY FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 149 TURKEY FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 150 TURKEY FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 151 NETHERLANDS FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 152 NETHERLANDS FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 153 NETHERLANDS FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 154 NETHERLANDS FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NETHERLANDS FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 156 BELGIUM FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 157 BELGIUM FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 158 BELGIUM FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 159 BELGIUM FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 BELGIUM FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 161 SWITZERLAND FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 162 SWITZERLAND FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 163 SWITZERLAND FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 164 SWITZERLAND FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 SWITZERLAND FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 166 LUXEMBOURG FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 167 LUXEMBOURG FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 168 LUXEMBOURG FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 169 LUXEMBOURG FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 LUXEMBOURG FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 171 REST OF EUROPE FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 172 REST OF EUROPE FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 173 REST OF EUROPE FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 174 REST OF EUROPE FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 175 REST OF EUROPE FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 176 SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 177 SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 178 SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 179 SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 180 SOUTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 182 BRAZIL FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 183 BRAZIL FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 184 BRAZIL FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 185 BRAZIL FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 BRAZIL FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 187 ARGENTINA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 188 ARGENTINA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 189 ARGENTINA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 190 ARGENTINA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 ARGENTINA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 193 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 194 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 195 REST OF SOUTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 197 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 198 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 199 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 203 SAUDI ARABIA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 204 SAUDI ARABIA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 205 SAUDI ARABIA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 206 SAUDI ARABIA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 207 SAUDI ARABIA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 208 UAE FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 209 UAE FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 210 UAE FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 211 UAE FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 UAE FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 213 SOUTH AFRICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 214 SOUTH AFRICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 215 SOUTH AFRICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 216 SOUTH AFRICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 SOUTH AFRICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 218 EGYPT FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 219 EGYPT FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 220 EGYPT FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 221 EGYPT FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 222 EGYPT FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 223 ISRAEL FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 224 ISRAEL FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 225 ISRAEL FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 226 ISRAEL FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 227 ISRAEL FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 228 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 229 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST AND AFRICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

Lista de Figura

FIGURE 1 GLOBAL FLEXIBLE PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL FLEXIBLE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL FLEXIBLE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL FLEXIBLE PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL FLEXIBLE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL FLEXIBLE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL FLEXIBLE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL FLEXIBLE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL FLEXIBLE PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 GLOBAL FLEXIBLE PACKAGING MARKET: MATERIAL TIMELINE CURVE

FIGURE 11 GLOBAL FLEXIBLE PACKAGING MARKET: END USE INDUSTRY COVERAGE GRID

FIGURE 12 GLOBAL FLEXIBLE PACKAGING MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE GLOBAL FLEXIBLE PACKAGING MARKET, BY END USE INDUSTRY (2024)

FIGURE 14 GLOBAL FLEXIBLE PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING DEMAND IN FODD & BEVERAGE SECTOR IS EXPECTED TO DRIVE THE GLOBAL FLEXIBLE PACKAGING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 END USE INDUSTRY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL FLEXIBLE PACKAGING MARKET IN 2025 & 2032

FIGURE 18 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE GLOBAL FLEXIBLE PACKAGING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 19 ASIA PACIFIC IS THE FASTEST-GROWING REGION FOR THE GLOBAL FLEXIBLE PACKAGING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 20 PESTEL ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 GLOBAL FLEXIBLE PACKAGING MARKET, 2024-2040, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 DROC ANALYSIS

FIGURE 24 GLOBAL FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2024

FIGURE 25 GLOBAL FLEXIBLE PACKAGING MARKET: BY MATERIAL, 2024

FIGURE 26 GLOBAL FLEXIBLE PACKAGING MARKET: BY TECHNOLOGY, 2024

FIGURE 27 GLOBAL FLEXIBLE PACKAGING MARKET: BY END USE, 2024

FIGURE 28 GLOBAL FLEXIBLE PACKAGING MARKET SNAPSHOT

FIGURE 29 GLOBAL FLEXIBLE PACKAGING MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 EUROPE FLEXIBLE PACKAGING MARKET: COMPANY SHARE 2024 (%)

FIGURE 31 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET: COMPANY SHARE 2024 (%)

FIGURE 32 NORTH AMERICA FLEXIBLE PACKAGING MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.