Global Flow Wrap Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

26.90 Billion

USD

40.66 Billion

2025

2033

USD

26.90 Billion

USD

40.66 Billion

2025

2033

| 2026 –2033 | |

| USD 26.90 Billion | |

| USD 40.66 Billion | |

|

|

|

|

Global Flow Wrap Packaging Market Segmentation, By Material (Plastic, Paper, and Aluminum Foil), Application (Packaged Snacks, Chocolate & Confectionary, Bakery Products, Medical Devices, and Personal Hygiene Products), End-use (Food & Beverages, Medical & Pharma, Cosmetics & Personal Care, Industrial Goods, Household Products, Pet Food & Supplies, and Tobacco Products) - Industry Trends and Forecast to 2033

Flow Wrap Packaging Market Size

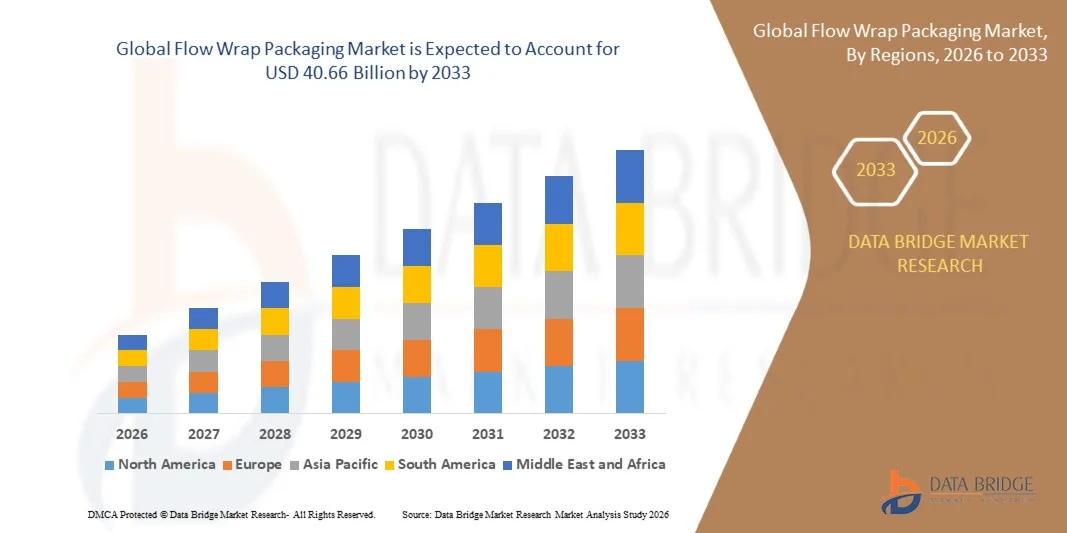

- The global flow wrap packaging market size was valued at USD 26.90 billion in 2025 and is expected to reach USD 40.66 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely driven by the expanding demand for flexible packaging solutions across food, confectionery, bakery, dairy, and personal care sectors, supported by advancements in high-speed packaging machinery and material innovation that improve efficiency, shelf life, and product protection

- Furthermore, increasing emphasis on cost-effective packaging, rising consumption of packaged and on-the-go products, and growing adoption of recyclable and downgauged materials are reinforcing flow wrap packaging as a preferred format. These combined factors are accelerating market penetration across both developed and emerging economies, thereby strengthening overall industry growth

Flow Wrap Packaging Market Analysis

- Flow wrap packaging is a flexible packaging format in which products are wrapped in a continuous film and sealed longitudinally and transversely, offering high-speed packing, uniform presentation, and effective barrier protection. It is widely used for single and multi-pack applications due to its versatility and compatibility with automated production lines

- The rising demand for flow wrap packaging is primarily supported by the growth of packaged food consumption, expansion of retail and e-commerce channels, and increasing focus on sustainability-driven material innovations that balance performance, cost efficiency, and regulatory compliance

- Asia-Pacific dominated the flow wrap packaging market with a share of 40.90% in 2025, due to high consumption of packaged foods, expanding urban populations, and rapid growth of organized retail and e-commerce sectors

- North America is expected to be the fastest growing region in the flow wrap packaging market during the forecast period due to high demand for convenience foods, growth in ready-to-eat meals, and increasing automation in packaging operations

- Plastic segment dominated the market with a market share of 60.96% in 2025, due to its high flexibility, seal integrity, moisture resistance, and cost efficiency across high-speed packaging lines. Plastic flow wraps are widely preferred for extending shelf life and maintaining product visibility, particularly in mass-produced food and personal care items. Their compatibility with automated packaging equipment and strong barrier performance against contaminants continues to reinforce dominance across global markets

Report Scope and Flow Wrap Packaging Market Segmentation

|

Attributes |

Flow Wrap Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flow Wrap Packaging Market Trends

“Shift Toward Recyclable and Paper-Based Flow Wrap Materials”

- A significant trend in the flow wrap packaging market is the accelerating shift toward recyclable, paper-based, and mono-material flow wrap structures, driven by rising sustainability commitments from brand owners and tightening regulations on plastic packaging waste. Manufacturers are increasingly redesigning flow wrap formats to meet recyclability standards while maintaining machinability and product protection across food and consumer goods applications

- For instance, in April 2024, Cox & Co introduced paper-based flow wrap packaging for its single-origin chocolate products, eliminating plastic and enabling kerbside recyclability while retaining a minimum shelf life of 12 months. This development demonstrates how paper flow wraps are gaining commercial viability in premium food segments without compromising performance

- The food and confectionery sector is actively adopting recyclable flow wrap alternatives to align with circular economy goals and extended producer responsibility frameworks. This shift is influencing material innovation focused on fiber-based and mono-material solutions compatible with existing high-speed flow wrapping lines

- Packaging producers are investing in research to enhance barrier properties and seal integrity of sustainable flow wrap materials. These efforts aim to close the performance gap between traditional plastic laminates and recyclable alternatives

- Retailers and consumer brands are increasingly prioritizing packaging formats that clearly communicate recyclability to end users. This is strengthening demand for simplified material structures that support consumer trust and regulatory compliance

- The market is steadily transitioning toward sustainable flow wrap solutions that balance environmental impact, functional performance, and cost efficiency. This trend is reinforcing long-term structural change in material selection across the global flow wrap packaging industry

Flow Wrap Packaging Market Dynamics

Driver

“Rising Demand for High-Speed and Cost-Efficient Packaging”

- The growing demand for high-speed and cost-efficient packaging solutions across food, bakery, snacks, and personal care industries is a key driver supporting the flow wrap packaging market. Flow wrap formats enable rapid production, reduced material usage, and consistent product presentation, making them highly attractive for large-scale manufacturing

- For instance, companies such as Huhtamaki and Mondi supply flow wrap packaging solutions designed for compatibility with automated, high-output packaging lines used by global food brands. These solutions help manufacturers improve throughput while maintaining packaging quality and operational efficiency

- The expansion of packaged and convenience food consumption is increasing reliance on packaging systems that support continuous, high-volume operations. Flow wrap packaging meets these requirements by enabling fast sealing and minimal downtime

- Manufacturers are under increasing pressure to optimize packaging costs amid fluctuating raw material prices. Flow wrap formats support downgauging and material reduction strategies that help control overall packaging expenditures

- This sustained focus on speed, efficiency, and cost control continues to position flow wrap packaging as a preferred solution across high-growth consumer product categories

Restraint/Challenge

“Performance and Shelf-Life Limitations of Sustainable Materials”

- The flow wrap packaging market faces challenges related to the performance and shelf-life limitations of sustainable and recyclable materials when compared with traditional multi-layer plastic laminates. Achieving adequate moisture, oxygen, and grease barriers remains a critical concern for food and confectionery applications

- For instance, Innovia Films has highlighted storage and temperature sensitivity considerations for its ultra-low density flow wrap films, which require controlled conditions to maintain material integrity over extended periods. Such constraints can limit adoption in regions with variable climatic conditions

- Paper-based and mono-material flow wrap structures often face trade-offs between recyclability and barrier performance. This can impact product freshness and restrict suitability for certain shelf-stable or moisture-sensitive products

- Manufacturers must invest in additional coatings, treatments, or material engineering to enhance sustainable flow wrap performance. These requirements can increase production complexity and slow large-scale commercialization

- These performance-related challenges continue to moderate the pace of sustainable material adoption in flow wrap packaging. Overcoming these limitations is critical for achieving broader market penetration while meeting environmental and functional expectations

Flow Wrap Packaging Market Scope

The market is segmented on the basis of material, application, and end-use.

• By Material

On the basis of material, the flow wrap packaging market is segmented into plastic, paper, and aluminum foil. The plastic segment dominated the largest market revenue share of 60.96% in 2025, supported by its high flexibility, seal integrity, moisture resistance, and cost efficiency across high-speed packaging lines. Plastic flow wraps are widely preferred for extending shelf life and maintaining product visibility, particularly in mass-produced food and personal care items. Their compatibility with automated packaging equipment and strong barrier performance against contaminants continues to reinforce dominance across global markets.

The paper segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising sustainability mandates and brand commitments toward recyclable and biodegradable packaging. Growing consumer preference for eco-conscious packaging and advancements in coated and barrier paper technologies are accelerating adoption. Paper-based flow wraps are increasingly used where environmental perception and regulatory compliance are critical purchase factors.

• By Application

On the basis of application, the flow wrap packaging market is segmented into packaged snacks, chocolate & confectionary, bakery products, medical devices, and personal hygiene products. Packaged snacks accounted for the dominant revenue share in 2025, owing to high consumption frequency, demand for portion control, and the need for extended freshness during distribution. Flow wrap formats support high-volume production while preserving texture and flavor, making them integral to snack manufacturing operations worldwide.

The medical devices segment is projected to grow at the fastest pace during the forecast period, driven by increasing sterilization requirements and stringent packaging standards. Flow wrap packaging offers tamper evidence, contamination control, and compatibility with sterile barrier systems. Expansion of healthcare infrastructure and rising single-use medical device consumption are further accelerating growth in this segment.

• By End-use

On the basis of end-use, the flow wrap packaging market is segmented into food & beverages, medical & pharma, cosmetics & personal care, industrial goods, household products, pet food & supplies, and tobacco products. The food & beverages segment dominated the market in 2025, supported by large-scale production of ready-to-eat foods and increasing demand for convenient, hygienic packaging formats. Flow wrap solutions enable efficient sealing, branding, and shelf stability, making them essential for food manufacturers.

The medical & pharma segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising regulatory scrutiny and demand for secure, compliant packaging solutions. Flow wrap packaging supports traceability, product protection, and sterile presentation, which are critical for pharmaceutical and medical applications. Growth in global healthcare spending and medical exports continues to strengthen this segment’s outlook.

Flow Wrap Packaging Market Regional Analysis

- Asia-Pacific dominated the flow wrap packaging market with the largest revenue share of 40.90% in 2025, driven by high consumption of packaged foods, expanding urban populations, and rapid growth of organized retail and e-commerce sectors

- The region’s strong manufacturing base, availability of low-cost flexible packaging materials, and rising investments in automated packaging lines are accelerating market expansion

- Growing demand for convenience foods, increasing focus on shelf-life extension, and supportive government initiatives for food processing industries are contributing to sustained adoption of flow wrap packaging

China Flow Wrap Packaging Market Insight

China held the largest share in the Asia-Pacific flow wrap packaging market in 2025, supported by its massive food and beverage industry, large-scale manufacturing ecosystem, and strong domestic consumption of packaged snacks, bakery, and confectionery products. The country’s advanced packaging machinery manufacturing capabilities, export-oriented production model, and continuous investments in automated packaging infrastructure are key growth drivers. Expansion of e-commerce logistics and retail-ready packaging formats is further strengthening demand.

India Flow Wrap Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rapid expansion of packaged food, bakery, dairy, and pharmaceutical sectors. Growth in organized retail, rising urbanization, and increasing demand for hygienic single-serve packaging formats are accelerating adoption of flow wrap packaging. Government initiatives supporting food processing infrastructure and the growth of domestic FMCG brands are further boosting market expansion.

Europe Flow Wrap Packaging Market Insight

The Europe flow wrap packaging market is expanding steadily, supported by strong demand for sustainable packaging, high-quality packaging standards, and advanced automation in manufacturing. The region emphasizes recyclable films, material efficiency, and high-speed packaging systems, particularly in food, confectionery, and pharmaceutical packaging. Growth is further supported by regulatory pressure for eco-friendly packaging solutions and technological innovation in machinery design.

Germany Flow Wrap Packaging Market Insight

Germany’s flow wrap packaging market is driven by its leadership in packaging machinery manufacturing, strong industrial automation capabilities, and advanced food processing industry. The country’s focus on engineering precision, energy-efficient systems, and smart factory integration is strengthening adoption of high-performance flow wrap technologies. Demand is particularly strong in bakery, confectionery, and industrial packaging applications.

U.K. Flow Wrap Packaging Market Insight

The U.K. market is supported by a mature packaged food industry, strong retail supply chains, and increasing focus on sustainable flexible packaging. Growth in private-label food brands, demand for portion-controlled packaging, and investments in automated packaging lines are driving market expansion. Rising emphasis on recyclable and mono-material packaging formats is further supporting adoption.

North America Flow Wrap Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high demand for convenience foods, growth in ready-to-eat meals, and increasing automation in packaging operations. Strong focus on productivity optimization, labor cost reduction, and smart packaging technologies is accelerating adoption. Expansion of e-commerce and demand for durable protective packaging are further supporting market growth.

U.S. Flow Wrap Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its large packaged food industry, advanced packaging infrastructure, and strong presence of global FMCG and pharmaceutical companies. High adoption of automated flow wrap machinery, demand for high-speed production lines, and focus on operational efficiency are key growth drivers. Growing investments in sustainable packaging materials and smart manufacturing systems further strengthen the U.S. market position.

Flow Wrap Packaging Market Share

The flow wrap packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Constantia Flexibles Group (Austria)

- Sealed Air Corporation (U.S.)

- Huhtamäki Oyj (Finland)

- Billerud AB (Sweden)

- Mondi plc (U.K.)

- Sonoco Products Company (U.S.)

- Glenroy, Inc. (U.S.)

- Coveris Holdings S.A. (Austria)

- Winpak Ltd. (Canada)

- KM Packaging Services Ltd. (U.K.)

- Polysack Flexible Packaging Ltd. (Israel)

- ePac Holdings, LLC. (U.S.)

- Asteria Group (Packaging PrintCo NV) (Belgium)

Latest Developments in Global Flow Wrap Packaging Market

- In April 2024, Cox & Co advanced the flow wrap packaging market by replacing compostable plastic with fully paper-based flow wrap packaging, reinforcing the industry’s shift toward kerbside-recyclable solutions. This move directly responds to rising consumer pressure for plastic-free packaging while demonstrating that paper flow wraps can still deliver a minimum 12-month shelf life for chocolate products. The transition is also commercially significant, as the 35% reduction in packaging costs helps brands offset volatile cocoa prices, strengthening the economic case for sustainable flow wrap adoption across premium confectionery segments

- In 2023, Huhtamaki expanded its flow wrap packaging footprint by investing in a new manufacturing plant in China, positioning itself closer to high-growth Asia Pacific consumer goods markets. This investment improves regional supply chain efficiency and enables faster customization for local food and FMCG brands, supporting the accelerating demand for high-volume flexible packaging formats. The move highlights how capacity expansion in Asia Pacific is becoming a key competitive lever in the global flow wrap packaging market

- In November 2022, Innovia Films influenced material innovation in the flow wrap packaging market with the launch of an ultra-low density film engineered for ice cream applications. The film’s high puncture resistance reduces product damage and food waste, addressing a critical performance challenge in cold chain packaging. Its ability to maintain integrity for up to six months under controlled conditions demonstrates how downgauged films can balance material reduction with functional durability

- In September 2022, Mondi introduced recyclable mono-material flow wrap structures for food packaging, accelerating the market’s transition away from multi-layer plastic laminates that are difficult to recycle. These solutions align with evolving global recycling guidelines while maintaining barrier properties needed for freshness and shelf life. The development supports brand owners seeking compliance with extended producer responsibility regulations and sustainability commitments

- In June 2021, Amcor strengthened the flow wrap packaging market by launching high-barrier recyclable flow wrap solutions for snacks and confectionery products. This development enabled brands to meet recyclability targets without sacrificing machinability on existing high-speed flow wrapping lines. The innovation underscores how compatibility with current packaging infrastructure remains a decisive factor in large-scale adoption of sustainable flow wrap formats

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.