Global Glassware Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.88 Billion

USD

4.36 Billion

2024

2032

USD

2.88 Billion

USD

4.36 Billion

2024

2032

| 2025 –2032 | |

| USD 2.88 Billion | |

| USD 4.36 Billion | |

|

|

|

|

Segmentação do mercado global de artigos de vidro, por material (vidro de cal sodada, vidro de chumbo, resistente ao calor e outros), estilo (vidro sem haste, taças, uso diário e outros), canal de distribuição (B2B, lojas especializadas, supermercados/hipermercados, comércio eletrônico e outros), faixa de preço (média, premium e econômica), uso final (hotéis e restaurantes, bares e cafés, residências, cantinas corporativas e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de artigos de vidro

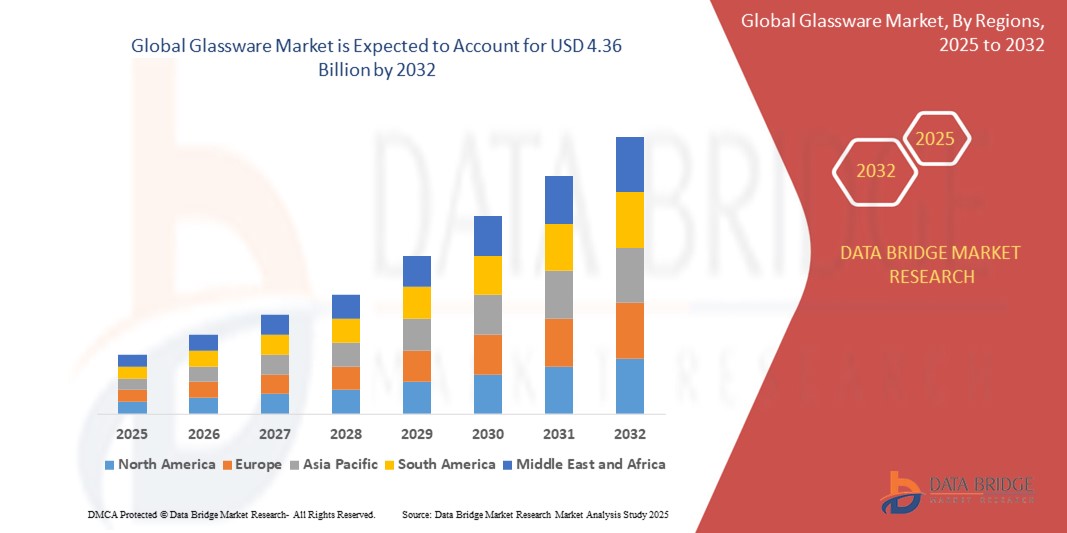

- O tamanho do mercado global de artigos de vidro foi avaliado em US$ 2,88 bilhões em 2024 e deve atingir US$ 4,36 bilhões até 2032 , com um CAGR de 5,30% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por produtos premium para refeições e cozinha, pela crescente preferência do consumidor por alternativas ecológicas e reutilizáveis ao plástico e pela expansão dos setores de serviços de alimentação e hospitalidade em todo o mundo.

- Além disso, o aumento dos canais de varejo on-line e dos influenciadores de decoração para casa está aumentando significativamente a visibilidade e a acessibilidade de artigos de vidro personalizados e de design em regiões urbanas e semi-urbanas.

Análise de Mercado de Vidraria

- A crescente adoção de artigos de vidro elegantes e duráveis em ambientes residenciais, impulsionada pelas tendências de refeições caseiras e apelo estético, é um fator-chave para o crescimento do mercado

- O setor de serviços de alimentação e hospitalidade continua sendo um grande gerador de receita, com restaurantes, bares e hotéis investindo em artigos de vidro de alta qualidade para melhorar a experiência do cliente

- A América do Norte dominou o mercado global de artigos de vidro com a maior participação na receita de 36,8% em 2024, impulsionada pela crescente preferência do consumidor por estética de jantar premium, pela crescente demanda por itens domésticos reutilizáveis e pela crescente mudança do plástico

- Espera-se que a região da Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado global de artigos de vidro, impulsionada pela crescente urbanização, aumento da renda disponível e um aumento na demanda por utensílios domésticos modernos e produtos de jantar premium em economias emergentes como China, Índia e países do Sudeste Asiático.

- O segmento de vidro soda-cálcico foi responsável pela maior fatia de mercado em 2024, devido ao seu amplo uso em vidrarias do dia a dia, devido à sua acessibilidade, trabalhabilidade e aparência transparente. É o material mais utilizado em copos, pratos e itens de vidro de uso geral em aplicações residenciais e comerciais.

Escopo do Relatório e Segmentação do Mercado de Vidraria

|

Atributos |

Principais insights do mercado de artigos de vidro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de vidros

“Crescente popularidade de artigos de vidro artesanais e artesanais”

- Os consumidores estão cada vez mais atraídos por artigos de vidro artesanais e artesanais que refletem o gosto pessoal, a singularidade e a herança cultural, afastando-se dos itens produzidos em massa.

- Esses produtos geralmente apresentam artesanato local, técnicas tradicionais de sopro de vidro e estilos regionais distintos que atraem compradores nacionais e internacionais.

- Os artigos de vidro artesanais estão ganhando popularidade em experiências gastronômicas premium, onde a estética e a narrativa são consideradas parte da jornada geral do cliente

- Plataformas online, influenciadores de decoração e blogueiros de estilo de vida estão desempenhando um papel fundamental na ampliação da conscientização e da demanda por itens de vidro feitos à mão

- Peças de vidro personalizadas e de edição limitada são frequentemente usadas em ocasiões especiais, presentes de luxo e decoração de interiores

- Por exemplo, marcas como a Glassybaby (EUA), que vende velas votivas sopradas à mão com uma causa social, e a LSA International (Reino Unido), conhecida pelos seus utensílios de bar artesanais, têm registado um interesse sustentado por parte dos consumidores através de canais online e de boutiques.

Dinâmica do mercado de vidros

Motorista

“Crescente demanda por alternativas ecológicas e reutilizáveis ao plástico”

- A crescente consciência ambiental está levando consumidores e instituições a escolher o vidro em vez do plástico devido à sua reciclabilidade, durabilidade e propriedades inertes

- Produtos de vidro, como garrafas, potes de armazenamento e recipientes para almoço, estão se tornando itens essenciais em lares ecologicamente corretos, especialmente entre os millennials e a geração Z.

- Medidas regulatórias em todas as regiões — incluindo proibições de plásticos de uso único — estão pressionando fabricantes e varejistas a expandir suas ofertas de vidros sustentáveis

- As empresas do setor de serviços de alimentação estão migrando para copos e itens de servir de vidro reutilizáveis para atender aos padrões ecológicos e melhorar a imagem da marca

- O aumento da inovação em vidro temperado e borossilicato melhorou a segurança e a vida útil do produto, tornando os artigos de vidro mais práticos para o uso diário

- Seguindo a diretiva da UE sobre plásticos de uso único, as principais redes de supermercados na Alemanha e na França substituíram as embalagens de plástico por recipientes de vidro para laticínios e condimentos, aumentando a demanda por artigos de vidro em toda a Europa.

Restrição/Desafio

“Alta fragilidade e risco de quebra durante o transporte e uso”

- Os artigos de vidro são inerentemente frágeis e suscetíveis a rachaduras ou estilhaços durante o transporte, manuseio e limpeza, especialmente em ambientes de alto tráfego.

- Distribuidores e varejistas são obrigados a investir em materiais de embalagem resistentes e que absorvem choques, o que aumenta os custos logísticos e reduz as margens de lucro.

- O risco de ferimentos ou responsabilidade por vidro quebrado impede certos estabelecimentos comerciais de adotar vidro em vez de materiais mais resistentes a impactos

- Os consumidores em lares com crianças ou idosos muitas vezes evitam artigos de vidro devido a preocupações com a segurança, o que limita seu apelo em segmentos familiares

- A falta de seguros padronizados ou de políticas de substituição para produtos de vidro desencoraja pedidos em grandes quantidades, especialmente em mercados sensíveis a custos

- Por exemplo, restaurantes e cafés independentes no Sudeste Asiático relatam quebras frequentes de artigos de vidro importados, o que os leva a optar por alternativas de melamina ou policarbonato nas operações do dia a dia, apesar dos compromissos estéticos.

Escopo do mercado de artigos de vidro

O mercado é segmentado com base no material, estilo, canal de distribuição, faixa de preço e uso final.

• Por Material

Com base no material, o mercado de vidros é segmentado em vidro sodo-cálcico, vidro de chumbo, resistente ao calor e outros. O segmento de vidro sodo-cálcico foi responsável pela maior fatia de mercado em 2024, devido ao seu amplo uso em vidros do dia a dia, devido à sua acessibilidade, trabalhabilidade e aparência transparente. É o material mais comumente usado em copos, pratos e itens de vidro de uso geral em aplicações residenciais e comerciais.

Espera-se que o segmento de vidros resistentes ao calor apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda do consumidor por utensílios de vidro duráveis e próprios para micro-ondas. Sua capacidade de suportar alto estresse térmico os torna adequados para assar, cozinhar e armazenar alimentos, principalmente em residências urbanas e cozinhas comerciais que priorizam utensílios de cozinha multifuncionais.

• Por Estilo

Com base no estilo, o mercado de artigos de vidro é segmentado em copos sem haste, copos com haste, copos de uso diário e outros. O segmento de uso diário dominou o mercado em 2024, visto que esses produtos atendem a uma ampla gama de funções em residências, escritórios e espaços de hospitalidade. Os consumidores preferem esses itens práticos por sua versatilidade, facilidade de limpeza e design empilhável.

Espera-se que o segmento de taças de vinho apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo aumento do consumo de vinho e coquetéis e pela crescente ênfase na estética gastronômica. Restaurantes, bares e residências de luxo estão investindo em taças de vinho premium para aprimorar a apresentação à mesa e a experiência do usuário.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado de artigos de vidro é segmentado em B2B, lojas especializadas, supermercados/hipermercados, e-commerce e outros. O segmento B2B representou a maior fatia de mercado em 2024, impulsionado principalmente pela compra a granel de hotéis, restaurantes e empresas de buffet corporativo.

Espera-se que o segmento de e-commerce apresente a maior taxa de crescimento entre 2025 e 2032, devido à conveniência das compras online, ao acesso a uma maior variedade de designs e ao crescimento das plataformas de varejo digital. O marketing de influência e as tendências de presentes online também estão acelerando as vendas de artigos de vidro online.

• Por faixa de preço

Com base na faixa de preço, o mercado de artigos de vidro é segmentado em médio, premium e econômico. O segmento médio deteve a maior participação em 2024, pois oferece uma combinação equilibrada de qualidade e preço acessível, atraindo a grande base de consumidores de renda média.

Espera-se que o segmento premium apresente a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por coleções de copos de grife e de marca para presentes, jantares formais e ocasiões especiais. A inclinação do setor de hospitalidade de luxo por produtos de mesa elegantes também está impulsionando essa tendência.

• Por uso final

Com base no uso final, o mercado é segmentado em hotéis e restaurantes, bares e cafés, residências, cantinas corporativas e outros. O segmento residencial liderou o mercado com a maior participação na receita em 2024, impulsionado pelo crescimento das preferências por refeições em domicílio, entrega de comida online e presentes.

Espera-se que o segmento de bares e cafés apresente uma taxa de crescimento mais rápida entre 2025 e 2032, impulsionado pela expansão global de redes de restaurantes casuais e pelo aumento de eventos sociais. Esses estabelecimentos priorizam copos não apenas pela funcionalidade, mas também por criar uma marca e um ambiente consistentes.

Análise regional do mercado de artigos de vidro

- A América do Norte dominou o mercado global de artigos de vidro com a maior participação na receita de 36,8% em 2024, impulsionada pela crescente preferência do consumidor por estética de jantar premium, pela crescente demanda por itens domésticos reutilizáveis e pela crescente mudança do plástico

- Os consumidores da região priorizam tanto a funcionalidade quanto o design, preferindo artigos de vidro temperados, sem chumbo e resistentes ao calor para uso doméstico e comercial.

- O mercado também se beneficia da forte demanda em restaurantes, hotéis e cafés, juntamente com altas rendas disponíveis e a influência de tendências de estilo de vida que enfatizam utensílios de mesa sustentáveis e elegantes.

Visão do mercado de artigos de vidro dos EUA

O mercado de copos e taças dos EUA foi responsável pela maior fatia da receita, de 79,4%, em 2024, na América do Norte, impulsionado pelo aumento de refeições em casa, experimentação culinária e compras de utensílios de cozinha premium. A demanda por copos e taças personalizados e artesanais continua crescendo, especialmente por meio de plataformas de e-commerce e varejistas especializados. A crescente adoção de hábitos ecoconscientes, como o uso de recipientes de vidro e copos reutilizáveis, também contribui para a expansão do mercado. O foco do setor de hospitalidade em aprimorar os padrões de apresentação impulsiona ainda mais a necessidade de copos e taças de qualidade.

Visão geral do mercado de vidros na Europa

Espera-se que o mercado europeu de copos e taças de vidro apresente uma taxa de crescimento mais rápida entre 2025 e 2032, impulsionado por uma cultura consolidada de consumo de vinhos e destilados, o que impulsiona a demanda por copos e taças de alta qualidade. As regulamentações de sustentabilidade e a conscientização do consumidor estão incentivando o uso de materiais recicláveis, com muitas famílias e restaurantes europeus optando por opções de copos e taças de vidro duráveis e elegantes. O crescimento é particularmente notável em países com tradições culinárias arraigadas e tendências de estilo de vida em evolução que favorecem produtos reutilizáveis e esteticamente atraentes.

Visão geral do mercado de artigos de vidro do Reino Unido

Espera-se que o mercado de artigos de vidro do Reino Unido apresente uma taxa de crescimento mais rápida entre 2025 e 2032, impulsionado pelo aumento das vendas no e-commerce, pela mudança nos hábitos alimentares e pela crescente popularidade das tendências de decoração para casa e utensílios de cozinha. Os consumidores estão investindo mais em experiências em casa, como configurações personalizadas para refeições e reformas na cozinha, o que leva a uma maior demanda por artigos de vidro acessíveis e elegantes. Marcas independentes e fabricantes de vidro artesanais também estão ganhando atenção, especialmente no segmento de presentes e artigos para casa premium.

Visão do mercado de vidros na Alemanha

Espera-se que o mercado de vidros da Alemanha apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua sólida base de produção, artesanato de alta qualidade e foco do consumidor em design sustentável e funcional. Com uma longa reputação na produção de vidro de precisão, as empresas alemãs continuam a liderar em inovação para vidros domésticos e comerciais. A preferência do setor de foodservice por itens de vidro reutilizáveis e resistentes à temperatura também desempenha um papel significativo no aumento da demanda em todos os setores.

Visão do mercado de vidros da Ásia-Pacífico

Espera-se que o mercado de artigos de vidro da Ásia-Pacífico apresente uma taxa de crescimento mais rápida entre 2025 e 2032, impulsionado pela crescente urbanização, pelo aumento da renda disponível e pela expansão dos setores de hospitalidade e serviços de alimentação. Mercados como China, Índia e Japão estão testemunhando uma forte demanda por artigos de vidro para o dia a dia e premium, à medida que as preferências dos consumidores evoluem. Regulamentações governamentais que incentivam embalagens e soluções sustentáveis para refeições também estão impulsionando empresas e famílias a optarem por alternativas à base de vidro.

Visão geral do mercado de artigos de vidro do Japão

Espera-se que o mercado de artigos de vidro do Japão apresente uma taxa de crescimento mais rápida entre 2025 e 2032, devido ao crescente interesse pela estética minimalista, artigos para casa de alta qualidade e artesanato tradicional. O crescente número de famílias unipessoais e com dupla renda levou a um aumento do investimento em utensílios de cozinha compactos, elegantes e versáteis. Além disso, a ênfase cultural na apresentação dos alimentos sustenta a demanda constante por utensílios de mesa esteticamente refinados, incluindo artigos de vidro artesanais e de alta durabilidade.

Visão do mercado de artigos de vidro da China

O mercado de vidros da China conquistou a maior fatia da receita na região Ásia-Pacífico em 2024, impulsionado pelo forte ecossistema industrial do país, pela expansão da classe média e pela crescente preferência por produtos sustentáveis. Marcas nacionais estão capitalizando o crescente apetite por vidros decorativos e funcionais, tanto para uso pessoal quanto para presentear. O crescimento do turismo doméstico e do desenvolvimento da hotelaria também está gerando forte demanda por vidros de nível comercial em hotéis, restaurantes e cafés.

Participação no mercado de artigos de vidro

A indústria de vidros é liderada principalmente por empresas bem estabelecidas, incluindo:

- Corning Incorporated (EUA)

- OI Glass (EUA)

- Ardagh Group SA (Luxemburgo)

- Vidrala (Espanha)

- Verallia (França)

- Nihon Yamamura Glass Co., Ltd. (Japão)

- AGC Inc. (Japão)

- Gerresheimer AG (Alemanha)

- Vetropack Holding Ltd (Suíça)

- Stoelzle Glass Group (Áustria)

- KOA GLASS CO., LTD. (Coreia do Sul)

- Hindusthan National Glass & Industries Limited (Índia)

- Nippon Sheet Glass Co., Ltd. (Reino Unido)

- Schott AG (Alemanha)

- Vidro PGP (Índia)

- Saint-Gobain (França)

- Bormioli Luigi SpA (Itália)

- Hindusthan National Glass & Industries Ltd. (Índia)

- Vitro (México)

- Gerresheimer AG (Alemanha)

Últimos desenvolvimentos no mercado global de artigos de vidro

- Em abril de 2022, a Chiefway anunciou a criação da primeira fábrica de vidro inteligente da Malásia, marcando um desenvolvimento estratégico que visa atender à crescente demanda por soluções sustentáveis e inteligentes para residências. Espera-se que a nova fábrica aumente a oferta local de produtos de vidro ecológicos, reduza a dependência de importações e apoie o crescimento do mercado regional de residências inteligentes. Este desenvolvimento fortalece a posição da Malásia no setor de materiais inteligentes, ao mesmo tempo em que se alinha às tendências globais de sustentabilidade.

- Em junho de 2022, a Saverglass revelou seus planos de expandir sua capacidade de produção de garrafas de vidro até 2023 para atender à crescente demanda do continente americano. Essa iniciativa visa melhorar a eficiência da cadeia de suprimentos, reduzir os prazos de entrega para clientes da América do Norte e da América Latina e reforçar a posição da empresa como um player-chave no mercado de embalagens de vidro premium. Espera-se que a expansão apoie significativamente o crescimento das indústrias de bebidas e artigos de luxo na região.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of GLOBAL GLASSWARE MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- product LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET application COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- global

- asia-pacific

- middle east and africa

- North America

- South America

- Europe

- market overview

- drivers

- Growing levels of investment in the hotel and catering industry

- Changes in lifestyle of the consumers

- Rising popularity of fine dining across the globe

- Increasing demand for premium decorative glassware products

- restraints

- Availability of cheap quality products

- Rising demand for steel and paper base drinkware

- Difficulty in maintaining the glassware products

- opportunities

- Advancements in glassware production technologies

- Rising demand for glassware products for clinical use in hospitals and forensic laboratories

- challenges

- Complexity in manufacturing glassware products

- Rising difficulty in recycling glassware products

- IMPACT OF COVID-19 on the Global GLASSWARE MARKET

- ANALYSIS on IMPACT OF COVID-19 ON THE GLOBAL GLASSWARE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GLOBAL GLASSWARE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Global GLASSWARE market, BY Material

- overview

- Soda Lime Glass

- Lead Glass

- Heat Resistant

- OTHERS

- Global GLASSWARE market, BY style

- OVERVIEW

- Stemware

- Red wine glass

- BORDEAUX

- CABERNET

- ZINFANDEL

- BURGUNDY

- PINOT NOIR

- ROSE

- white wine glass

- SPARKLING

- CHARDONNAY

- VIOGNIER

- SWEET WINE

- VINTAGE

- STEMLESS GLASS

- Liquor Glass

- Beer Glass

- Everyday Usage

- Others

- Global GLASSWARE market, BY Distribution channel

- OVERVIEW

- B2B

- Specialized Stores

- Supermarkets/Hypermarkets

- E Commerce

- Others

- Global GLASSWARE market, BY price range

- OVERVIEW

- Medium

- Premium

- Economy

- Global GLASSWARE market, BY End-use

- OVERVIEW

- Hotels & Restaurants

- Bars & Cafe

- HOUSEHOLD

- Corporate Canteens

- others

- GLOBAL Glassware market, BY GEOGRAPHY

- overview

- Asia-PACIFIC

- China

- India

- Japan

- South Korea

- Singapore

- Malaysia

- Thailand

- Australia and New Zealand

- Indonesia

- Philippines

- Hong Kong

- Taiwan

- Rest of Asia-Pacific

- Europe

- Germany

- France

- italy

- u.k.

- turkey

- switzerland

- Spain

- russia

- netherlands

- belgium

- rest of europe

- North America

- U.S.

- CANADA

- Mexico

- South america

- brazil

- argentina

- rest of south america

- Middle East and Africa

- U.a.e

- Saudi Arabia

- South africa

- Egypt

- israel

- rest of middle east and africa

- GLOBAL GLASSWARE MARKET, COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: north america

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- Merger & Acquisition

- new product developments

- Awards

- Partnerships

- swot analysis

- company profiles

- Libbey inc

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Lifetime brands, inc.

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- villeroy & Boch

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATEs

- WMF GmbH

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Fiskars Australia Pty Ltd.

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Bormioli Rocco S.p.A.

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- Cumbria Crystal

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- degrenne

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT update

- Hrastnik1860

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATEs

- lenox corporation

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- noritakechina

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Stölzle Lausitz GmbH

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATEs

- The Oneida Group Inc.

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- The Zrike Company, inc.

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- QUESTIONNAIRE

- related reports

Lista de Tabela

TABLE 1 IMPORT DATA of Drinking glasses (excluding glasses of glass ceramics or of lead crystal and stemware) HS Code - 701337 (USD Thousand)

TABLE 2 EXPORT DATA OF DRINKING GLASSES (EXCLUDING GLASSES OF GLASS CERAMICS OR OF LEAD CRYSTAL AND STEMWARE) HS CODE - 701337 (USD THOUSAND)

TABLE 3 Type of reusable cups consumers would prefer for drinkware in U.S, 2015

TABLE 4 Global Glassware Market, By material, 2019-2028 (usd thousand)

TABLE 5 Global Glassware Market, By material, 2019-2028 (Thousand Units)

TABLE 6 Global Soda lime glass in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 7 Global SODA LIME GLASS in GLASSWARE market, BY region, 2019-2028 (Thousand UNITS)

TABLE 8 Global Lead Glass in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 9 Global Lead Glass in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 10 Global Heat resistant in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 11 Global Heat resistant in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 12 Global others in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 13 Global others in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 14 Global GLASSWARE market, BY style, 2019-2028 (USD Thousand)

TABLE 15 Global Stemware IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 16 Global Stemware IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 17 Global red wine glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 18 Global white wine glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 19 Global stemless glass IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 20 Global Stemless Glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 21 Global Everyday usage IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 22 Global Others IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 23 Global GLASSWARE market, BY distribution channel, 2019-2028 (USD Thousand)

TABLE 24 Global B2b in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 25 Global specialized stores in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 26 Global supermarkets/hypermarkets in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 27 Global e-commerce in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 28 Global others in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 29 Global GLASSWARE market, BY price range, 2019-2028 (USD Thousand)

TABLE 30 Global medium in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 31 Global Premium in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 32 Global Economy in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 33 Global GLASSWARE market, BY end-use, 2019-2028 (USD Thousand)

TABLE 34 Global Hotels & Restaurants IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 35 Global Bars & café IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 36 Global Household IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 37 Global Corporate Canteens IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 38 Global others IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 39 GLOBAL glassware market, By region, 2019-2028 (USD thousand)

TABLE 40 GLOBAL glassware market, By region, 2019-2028 (thousand Units)

TABLE 41 Asia-Pacific glassware Market, BY COUNtry, 2019-2028 (USD Thousand)

TABLE 42 Asia-Pacific glassware Market, BY COUNtry, 2019-2028 (Thousand Units)

TABLE 43 Asia-Pacific Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 44 Asia-Pacific Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 45 Asia-Pacific Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 46 Asia-Pacific Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 47 Asia-Pacific Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 48 Asia-Pacific White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 49 Asia-Pacific Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 50 Asia-Pacific Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 51 Asia-Pacific Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 52 Asia-Pacific Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 53 CHINA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 54 CHINA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 55 CHINA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 56 CHINA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 57 CHINA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 58 CHINA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 59 CHINA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 60 CHINA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 61 CHINA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 62 CHINA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 63 INDIA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 64 INDIA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 65 INDIA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 66 INDIA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 67 INDIA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 68 INDIA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 69 INDIA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 70 INDIA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 71 INDIA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 72 INDIA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 73 JAPAN Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 74 JAPAN Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 75 JAPAN Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 76 JAPAN Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 77 JAPAN Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 78 JAPAN White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 79 JAPAN Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 80 JAPAN Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 81 JAPAN Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 82 JAPAN Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 83 SOUTH KOREA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 84 SOUTH KOREA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 85 SOUTH KOREA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 86 SOUTH KOREA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 87 SOUTH KOREA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 88 SOUTH KOREA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 89 SOUTH KOREA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 90 SOUTH KOREA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 91 SOUTH KOREA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 92 SOUTH KOREA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 93 SINGAPORE Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 94 SINGAPORE Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 95 SINGAPORE Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 96 SINGAPORE Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 97 SINGAPORE Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 98 SINGAPORE White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 99 SINGAPORE Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 100 SINGAPORE Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 101 SINGAPORE Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 102 SINGAPORE Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 103 MALAYSIA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 104 MALAYSIA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 105 MALAYSIA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 106 MALAYSIA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 107 MALAYSIA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 108 MALAYSIA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 109 MALAYSIA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 110 MALAYSIA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 111 MALAYSIA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 112 MALAYSIA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 113 THAILAND Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 114 THAILAND Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 115 THAILAND Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 116 THAILAND Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 117 THAILAND Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 118 THAILAND White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 119 THAILAND Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 120 THAILAND Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 121 THAILAND Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 122 THAILAND Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 123 AUSTRALIA AND NEW ZEALAND Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 124 AUSTRALIA AND NEW ZEALAND Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 125 AUSTRALIA AND NEW ZEALAND Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 126 AUSTRALIA AND NEW ZEALAND Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 127 AUSTRALIA AND NEW ZEALAND Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 128 AUSTRALIA AND NEW ZEALAND White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 129 AUSTRALIA AND NEW ZEALAND Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 130 AUSTRALIA AND NEW ZEALAND Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 131 AUSTRALIA AND NEW ZEALAND Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 132 AUSTRALIA AND NEW ZEALAND Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 133 INDONESIA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 134 INDONESIA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 135 INDONESIA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 136 INDONESIA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 137 INDONESIA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 138 INDONESIA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 139 INDONESIA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 140 INDONESIA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 141 INDONESIA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 142 INDONESIA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 143 PHILIPPINES Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 144 PHILIPPINES Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 145 PHILIPPINES Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 146 PHILIPPINES Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 147 PHILIPPINES Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 148 PHILIPPINES White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 149 PHILIPPINES Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 150 PHILIPPINES Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 151 PHILIPPINES Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 152 PHILIPPINES Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 153 HONG KONG Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 154 HONG KONG Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 155 HONG KONG Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 156 HONG KONG Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 157 HONG KONG Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 158 HONG KONG White Wine Glass in Glassware Market, By Type 2019-2028 (USD Thousand)

TABLE 159 HONG KONG Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 160 HONG KONG Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 161 HONG KONG Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 162 HONG KONG Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 163 TAIWAN Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 164 TAIWAN Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 165 TAIWAN Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 166 TAIWAN Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 167 TAIWAN Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 168 TAIWAN White Wine Glass in Glassware Market, By Type 2019-2028 (USD Thousand)

TABLE 169 TAIWAN Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 170 TAIWAN Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 171 TAIWAN Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 172 TAIWAN Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 173 REST OF ASIA-PACIFIC Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 174 REST OF ASIA-PACIFIC Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 175 Europe glassware Market, BY COUNtry, 2019-2028 (USD Thousand)

TABLE 176 Europe glassware Market, BY COUNtry, 2019-2028 (Thousand Units)

TABLE 177 Europe Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 178 Europe Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 179 Europe Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 180 Europe Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 181 Europe Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 182 Europe White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 183 Europe Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 184 Europe Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 185 Europe Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 186 Europe Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 187 Germany Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 188 Germany Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 189 Germany Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 190 Germany Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 191 Germany Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 192 Germany White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 193 Germany Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 194 Germany Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 195 Germany Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 196 Germany Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 197 France Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 198 France Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 199 France Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 200 France Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 201 France Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 202 France White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 203 France Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 204 France Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 205 France Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 206 France Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 207 Italy Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 208 Italy Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 209 Italy Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 210 Italy Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 211 Italy Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 212 Italy White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 213 Italy Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 214 Italy Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 215 Italy Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 216 Italy Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 217 U.K. Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 218 U.K. Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 219 U.K. Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 220 U.K. Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 221 U.K. Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 222 U.K. White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 223 U.K. Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 224 U.K. Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 225 U.K. Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 226 U.K. Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 227 Turkey Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 228 Turkey Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 229 Turkey Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 230 Turkey Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 231 Turkey Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 232 Turkey White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 233 Turkey Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 234 Turkey Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 235 Turkey Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 236 Turkey Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 237 Switzerland Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 238 Switzerland Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 239 Switzerland Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 240 Switzerland Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 241 Switzerland Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 242 Switzerland White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 243 Switzerland Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 244 Switzerland Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 245 Switzerland Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 246 Switzerland Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 247 Spain Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 248 Spain Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 249 Spain Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 250 Spain Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 251 Spain Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 252 Spain White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 253 Spain Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 254 Spain Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 255 Spain Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 256 Spain Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 257 Russia Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 258 Russia Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 259 Russia Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 260 Russia Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 261 Russia Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 262 Russia White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 263 Russia Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 264 Russia Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 265 Russia Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 266 Russia Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 267 Netherlands Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 268 Netherlands Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 269 Netherlands Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 270 Netherlands Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 271 Netherlands Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 272 Netherlands White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 273 Netherlands Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 274 Netherlands Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 275 Netherlands Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 276 Netherlands Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 277 Belgium Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 278 Belgium Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 279 Belgium Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 280 Belgium Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 281 Belgium Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 282 Belgium White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 283 Belgium Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 284 Belgium Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 285 Belgium Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 286 Belgium Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 287 rest of europe Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 288 rest of europe Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 289 North America Glassware Market, BY COUNTRY, 2019-2028 (USD Thousand)

TABLE 290 North America Glassware Market, BY COUNTRY,2019-2028 (Thousand units)

TABLE 291 North America Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 292 North America Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 293 North America Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 294 North America Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 295 North America Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 296 North America White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 297 North America Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 298 North America Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 299 North America Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 300 North America Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 301 U.S. Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 302 U.S. Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 303 U.S. Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 304 U.S. Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 305 U.S. Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 306 U.S. White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 307 U.S. Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 308 U.S. Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 309 U.S. Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 310 U.S. Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 311 CANADA Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 312 CANADA Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 313 CANADA Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 314 CANADA Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 315 CANADA Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 316 CANADA White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 317 CANADA Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 318 CANADA Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 319 CANADA Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 320 CANADA Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 321 MEXICO Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 322 MEXICO Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 323 MEXICO Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 324 MEXICO Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 325 MEXICO Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 326 MEXICO White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 327 MEXICO Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 328 MEXICO Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 329 MEXICO Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 330 MEXICO Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 331 South america glassware Market, BY COUNtry,2019-2028 (USD Thousand)

TABLE 332 South america glassware Market, BY COUNtry,2019-2028 (Thousand Units)

TABLE 333 South america Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 334 South america Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 335 South america Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 336 South america Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 337 South america Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 338 South america White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 339 South america Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 340 South america Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 341 South america Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 342 South america Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 343 Brazil Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 344 Brazil Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 345 Brazil Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 346 Brazil Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 347 Brazil Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 348 Brazil White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 349 Brazil Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 350 Brazil Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 351 Brazil Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 352 Brazil Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 353 Argentina Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 354 Argentina Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 355 Argentina Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 356 Argentina Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 357 Argentina Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 358 Argentina White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 359 Argentina Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 360 Argentina Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 361 Argentina Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 362 Argentina Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 363 rest of south america Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 364 rest of south america Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 365 Middle East and Africa glassware Market, BY COUNtry,2019-2028 (USD Thousand)

TABLE 366 Middle East and Africa glassware Market, BY COUNtry, 2019-2028 (Thousand Units)

TABLE 367 Middle East and Africa Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 368 Middle East and Africa Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 369 Middle East and Africa Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 370 Middle East and Africa Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 371 Middle East and Africa Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 372 Middle East and Africa White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 373 Middle East and Africa Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 374 Middle East and Africa Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 375 Middle East and Africa Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 376 Middle East and Africa Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 377 U.A.E Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 378 U.A.E Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 379 U.A.E Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 380 U.A.E Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 381 U.A.E Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 382 U.A.E White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 383 U.A.E Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 384 U.A.E Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 385 U.A.E Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 386 U.A.E Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 387 Saudi Arabia Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 388 Saudi Arabia Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 389 Saudi Arabia Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 390 Saudi Arabia Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 391 Saudi Arabia Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 392 Saudi Arabia White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 393 Saudi Arabia Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 394 Saudi Arabia Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 395 Saudi Arabia Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 396 Saudi Arabia Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 397 South africa Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 398 South africa Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 399 South africa Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 400 South africa Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 401 South africa Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 402 South africa White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 403 South africa Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 404 South africa Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 405 South africa Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 406 South africa Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 407 Egypt Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 408 Egypt Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 409 Egypt Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 410 Egypt Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 411 Egypt Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 412 Egypt White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 413 Egypt Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 414 Egypt Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 415 Egypt Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 416 Egypt Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 417 Israel Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 418 Israel Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 419 Israel Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 420 Israel Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 421 Israel Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 422 Israel White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 423 Israel Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 424 Israel Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 425 Israel Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 426 Israel Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 427 rest of Middle East and Africa Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 428 rest of Middle East and Africa Glassware Market, By Material, 2019-2028 (Thousand Units)

Lista de Figura

FIGURE 1 GLOBAL GLASSWARE MARKET: segmentation

FIGURE 2 GLOBAL GLASSWARE MARKET: data triangulation

FIGURE 3 GLOBAL GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL GLASSWARE MARKET: global VS regional MARKET analysis

FIGURE 5 GLOBAL GLASSWARE MARKET: company research analysis

FIGURE 6 GLOBAL GLASSWARE MARKET: THE product LIFE LINE CURVE

FIGURE 7 GLOBAL GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL GLASSWARE MARKET: MARKET application COVERAGE GRID

FIGURE 11 GLOBAL GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL GLASSWARE MARKET: vendor share analysis

FIGURE 13 GLOBAL GLASSWARE MARKET: SEGMENTATION

FIGURE 14 Asia-PAcific is expected to DOMINATE THE GLOBAL GLASSWARE MARKET and IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN the forecast period of 2021 to 2028

FIGURE 15 Rising popularity of fine dining across the globe is DRIVING the GLOBAL GLASSWARE MARKET in the forecast period of 2021 to 2028

FIGURE 16 soda lime glass SEGMENT is expected to account for the largest share of the GLOBAL GLASSWARE MARKET in 2021 & 2028

FIGURE 17 Asia-Pacific is the fastest growing market for GLASSWARE MARKET manufacturers in the forecast period of 2021 to 2028

FIGURE 18 DRIVERS, RESTRAINTs, OPPORTUNITies AND CHALLENGEs OF global glassware Market

FIGURE 19 Global Luxury Hotel Count, in Luxury Class, 2002-2018 (Approximate)

FIGURE 20 Global GLASSWARE market, BY material, 2020

FIGURE 21 Global GLASSWARE market,BY style, 2020

FIGURE 22 Global GLASSWARE market, BY distribution channel, 2020

FIGURE 23 Global GLASSWARE market, BY price range, 2020

FIGURE 24 Global GLASSWARE market, BY end-use, 2020

FIGURE 25 GLOBAL glassware market: SNAPSHOT (2020)

FIGURE 26 GLOBAL glassware market: by geography (2020)

FIGURE 27 GLOBAL glassware market: by geography (2021 & 2028)

FIGURE 28 GLOBAL glassware market: by geography (2020 & 2028)

FIGURE 29 GLOBAL glassware market: by material (2021-2028)

FIGURE 30 ASIA-PACIFIC Glassware market: SNAPSHOT (2020)

FIGURE 31 ASIA-PACIFIC Glassware market: by COUNTRY (2020)

FIGURE 32 ASIA-PACIFIC Glassware market: by COUNTRY (2021 & 2028)

FIGURE 33 ASIA-PACIFIC Glassware market: by COUNTRY (2020 & 2028)

FIGURE 34 ASIA-PACIFIC Glassware market: by Material (2021-2028)

FIGURE 35 EUROPE Glassware market: SNAPSHOT (2020)

FIGURE 36 EUROPE Glassware market: by COUNTRY (2020)

FIGURE 37 EUROPE Glassware market: by COUNTRY (2021 & 2028)

FIGURE 38 EUROPE Glassware market: by COUNTRY (2020 & 2028)

FIGURE 39 EUROPE Glassware market: by Material (2021-2028)

FIGURE 40 NORTH AMERICA Glassware market: SNAPSHOT (2020)

FIGURE 41 NORTH AMERICA Glassware market: by COUNTRY (2020)

FIGURE 42 NORTH AMERICA Glassware market: by COUNTRY (2021 & 2028)

FIGURE 43 NORTH AMERICA Glassware market: by COUNTRY (2020 & 2028)

FIGURE 44 NORTH AMERICA Glassware market: by material (2021-2028)

FIGURE 45 SOUTH AMERICA Glassware market: SNAPSHOT (2020)

FIGURE 46 SOUTH AMERICA Glassware market: by COUNTRY (2020)

FIGURE 47 SOUTH AMERICA Glassware market: by COUNTRY (2021 & 2028)

FIGURE 48 SOUTH AMERICA Glassware market: by COUNTRY (2020 & 2028)

FIGURE 49 SOUTH AMERICA Glassware market: by Material (2021-2028)

FIGURE 50 MIDDLE EAST AND AFRICA Glassware market: SNAPSHOT (2020)

FIGURE 51 MIDDLE EAST AND AFRICA Glassware market: by COUNTRY (2020)

FIGURE 52 MIDDLE EAST AND AFRICA Glassware market: by COUNTRY (2021 & 2028)

FIGURE 53 MIDDLE EAST AND AFRICA Glassware market: by COUNTRY (2020 & 2028)

FIGURE 54 MIDDLE EAST AND AFRICA Glassware market: by Material (2021-2028)

FIGURE 55 GLOBAL GLASSWARE MARKET: company share 2020 (%)

FIGURE 56 north AMERICA GLASSWARE MARKET: COMPANY SHARE 2020 (%)

FIGURE 57 EUROPE GLASSWARE MARKET: company share 2020 (%)

FIGURE 58 Asia-Pacific GLASSWARE MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.