Global Hvdc Transmission Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

13.28 Billion

USD

21.17 Billion

2024

2032

USD

13.28 Billion

USD

21.17 Billion

2024

2032

| 2025 –2032 | |

| USD 13.28 Billion | |

| USD 21.17 Billion | |

|

|

|

|

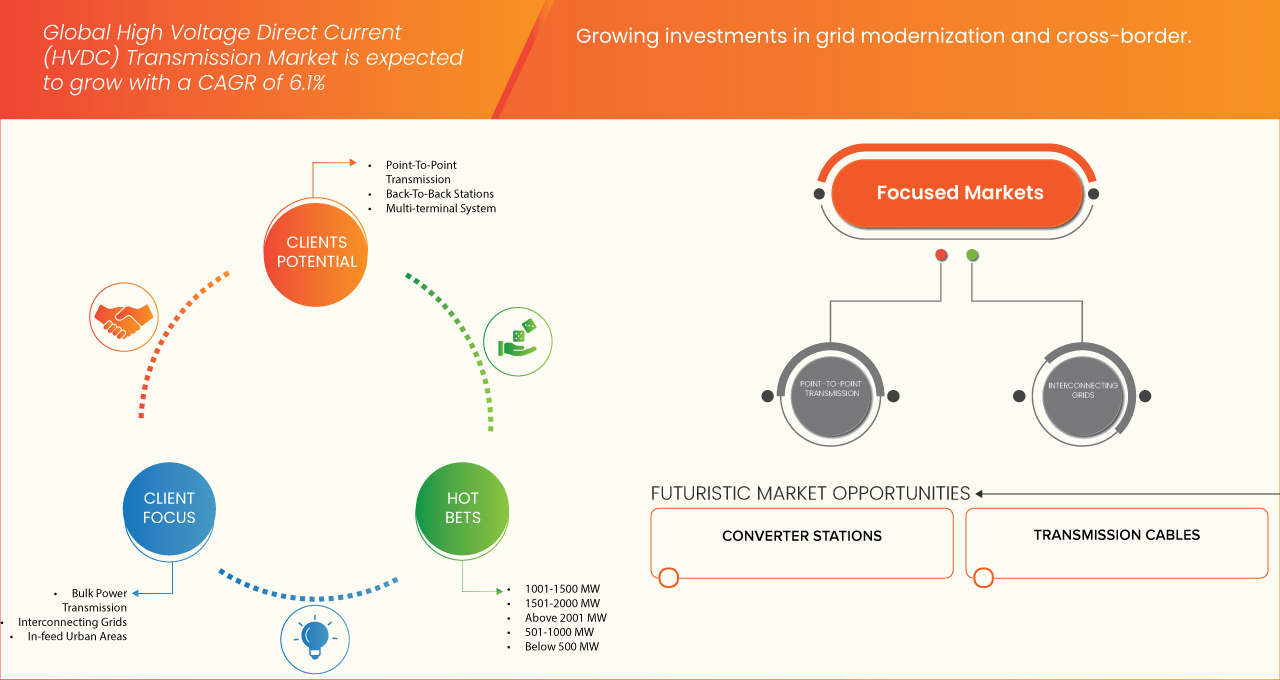

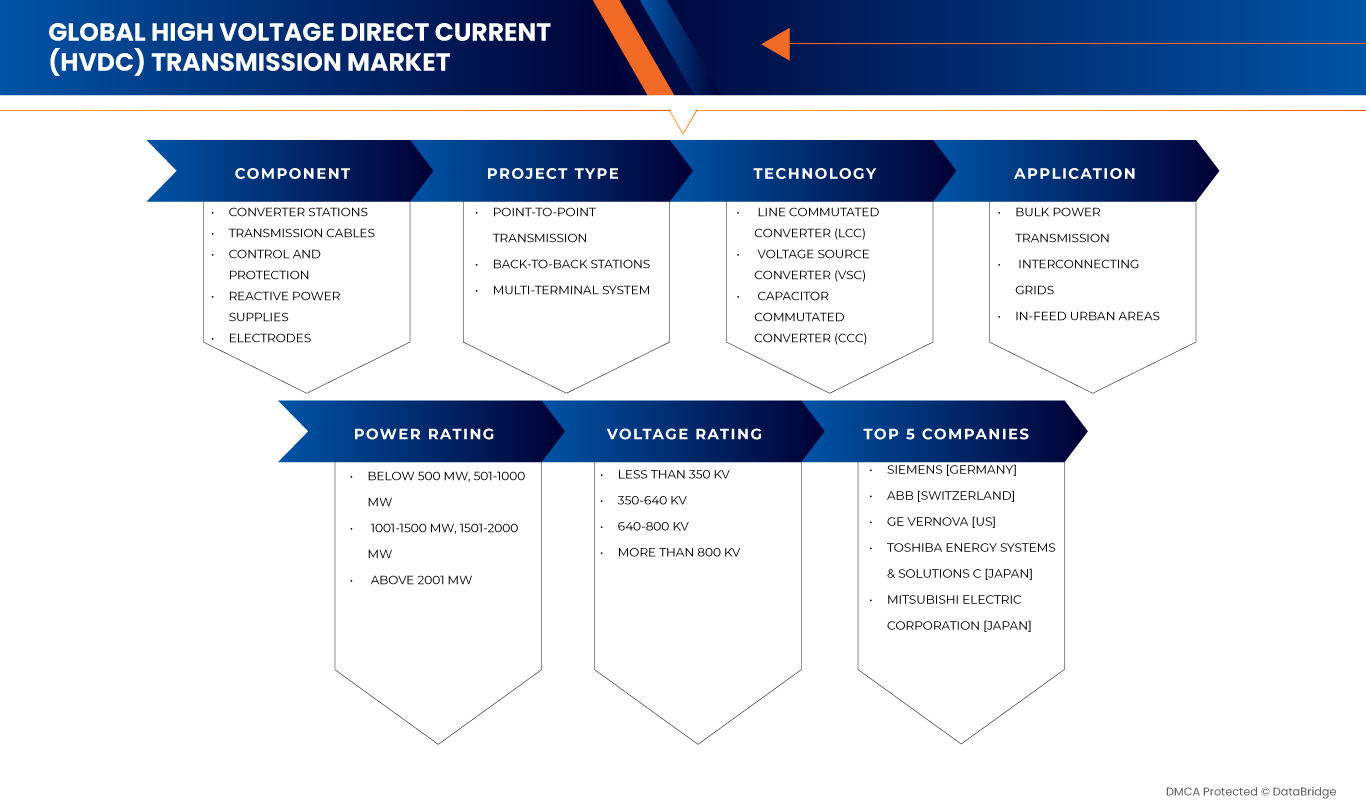

Mercado global de transmissão de corrente contínua de alta tensão (HVDC) por componente (estações conversoras, cabos de transmissão, controle e proteção, fontes de alimentação reativas, eletrodos), tipo de projeto (transmissão ponto a ponto, estações back-to-back e sistema multiterminal), tecnologia (conversor comutado por linha, conversor de fonte de tensão e conversor comutado por capacitor), aplicação (transmissão de energia em massa, redes de interconexão e áreas urbanas de alimentação), potência nominal (1001-1500 MW, 1501-2000 MW, acima de 2001 MW, 501-1000 MW e abaixo de 500 MW), tensão nominal (350-640 kV, 640-800 kV, menos de 350 kV e mais de 800 kV) – Tendências e previsões do setor até 2032

Tamanho do mercado de transmissão de corrente contínua de alta tensão (HVDC)

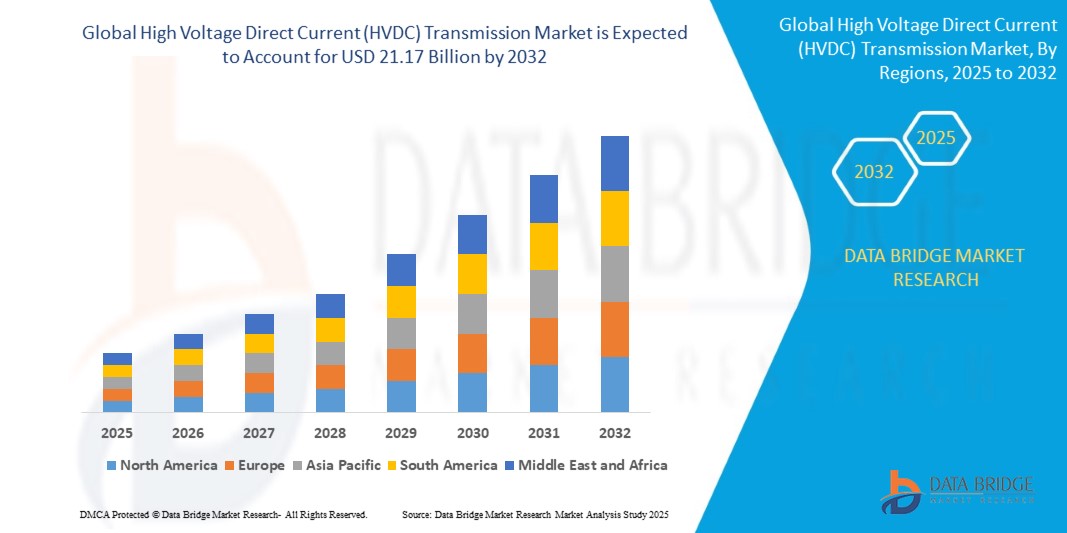

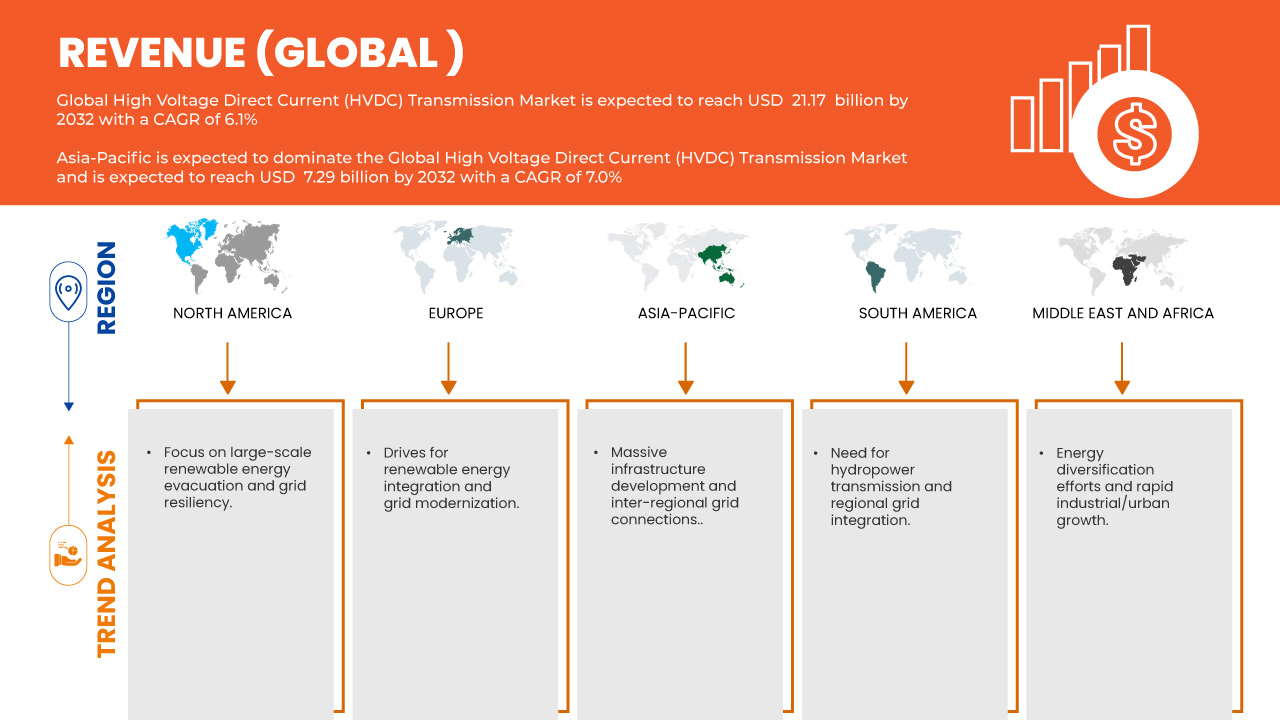

- O tamanho do mercado global de transmissão de corrente contínua de alta tensão (HVDC) foi avaliado em US$ 13,28 bilhões em 2024 e deve atingir US$ 21,17 bilhões até 2032 , com um CAGR de 6,1% durante o período previsto.

- Esse crescimento é impulsionado pela rápida adoção de transmissão de energia eficiente de longa distância, pela crescente integração de fontes de energia renováveis e pela necessidade global de maior estabilidade e interconectividade da rede elétrica entre redes elétricas nacionais e regionais. O aumento nos projetos de modernização e expansão da rede elétrica acelera ainda mais a expansão do mercado.

- Avanços nas tecnologias HVDC, incluindo a mudança para conversores de fonte de tensão (VSC) para controle e flexibilidade superiores, juntamente com iniciativas governamentais que promovem energia limpa e investimentos em interconexões internacionais, estão impulsionando o crescimento do mercado, especialmente em regiões com desenvolvimento robusto de energia renovável e grandes áreas geográficas que exigem transferência de energia em grandes quantidades.

Análise do mercado de transmissão de corrente contínua de alta tensão (HVDC)

- Os componentes HVDC são sistemas essenciais que permitem a transmissão eficiente e estável de energia em grandes quantidades por longas distâncias, especialmente para integração de energia renovável e interconexão de redes. Esses componentes, incluindo estações conversoras (com conversores, transformadores e filtros), cabos de transmissão (aéreos, subterrâneos, submarinos) e sistemas de controle e proteção, são essenciais para aplicações como transferência de energia em grandes quantidades, interconexões de redes e alimentação de energia urbana.

- O mercado é impulsionado pelo aumento global da demanda por eletricidade, impulsionando a necessidade de uma transmissão mais eficiente. O tamanho do mercado global de transmissão HVDC foi avaliado em US$ 13,28 bilhões em 2022 e a projeção é de que atinja US$ 21,17 bilhões até 2032, com um CAGR de 6,1% entre 2023 e 2032. A crescente integração de fontes de energia renováveis, especialmente de locais remotos e parques eólicos offshore, impulsiona ainda mais a demanda por HVDC.

- A adoção de tecnologias avançadas, como Conversores de Fonte de Tensão (VSC), aprimora o desempenho do HVDC, oferecendo controle, flexibilidade e compatibilidade superiores com fontes de energia renováveis. A tecnologia VSC deteve a maior participação de mercado em receita, com mais de 32,26%, em estações conversoras de HVDC em 2024. O foco crescente na modernização da rede e na interconectividade transfronteiriça é um importante impulsionador do crescimento.

- A região Ásia-Pacífico liderou o mercado global de transmissão HVDC, com uma participação de receita de mais de 32,26% em 2024 (especificamente para estações conversoras HVDC), impulsionada pelo robusto crescimento econômico, rápida industrialização, crescente urbanização e investimentos governamentais significativos na modernização da rede e integração de energia renovável em países como China, Índia e Coreia do Sul. A China domina devido aos seus enormes investimentos em infraestrutura UHVDC (Ultra High Voltage Direct Current).

- Espera-se que a região Ásia-Pacífico testemunhe um crescimento significativo durante o período previsto (o CAGR não é declarado especificamente para 2025-2032, mas o CAGR geral do mercado de HVDC para 2025-2032 é projetado em torno de 6,1%), impulsionado pela necessidade de atualizar a infraestrutura de energia obsoleta, aumentando a integração de energia renovável (especialmente eólica offshore) e investimentos em P&D em resiliência da rede.

- Entre os componentes, o segmento de estações conversoras é normalmente o maior detentor de participação de mercado em projetos de HVDC, devido ao seu papel crítico na conversão de CA para CC e vice-versa, além de sua complexidade e alto custo. Outros componentes importantes incluem cabos de transmissão e sistemas de controle e proteção.

Escopo do Relatório e Segmentação do Mercado de Transmissão de Corrente Contínua de Alta Tensão (HVDC)

|

Atributos |

Principais insights de mercado sobre transmissão de corrente contínua de alta tensão (HVDC) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de transmissão de corrente contínua de alta tensão (HVDC)

“ Avanços na integração de energias renováveis, modernização da rede e digitalização ”

- Adoção generalizada da tecnologia de conversor de fonte de tensão (VSC): mais de 60% dos novos projetos de HVDC em 2023 e 2024 utilizaram a tecnologia VSC por seu controle aprimorado, flexibilidade e compatibilidade com fontes de energia renováveis, apoiando a integração eficiente da rede.

- Integração da digitalização e da IoT: a adoção da IoT e de tecnologias digitais em sistemas HVDC cresceu 25% em 2024, permitindo monitoramento em tempo real, manutenção preditiva e detecção avançada de falhas para maior confiabilidade da rede.

- Miniaturização de componentes HVDC: avanços em tecnologias de conversores, como conversores multinível modulares (MMCs), levaram a um aumento de 20% em sistemas HVDC compactos, ideais para aplicações com restrições de espaço, como parques eólicos offshore.

- Ascensão dos sistemas HVDC multiterminais: a implantação de sistemas HVDC multiterminais aumentou 15% em 2024, aumentando a flexibilidade do sistema e dando suporte à comercialização de energia internacional e à integração de energia renovável.

- Foco em projetos de HVDC com eficiência energética: mais de 30% dos novos sistemas HVDC em 2024 priorizaram a transmissão de baixa perda, alinhando-se às metas globais de sustentabilidade e reduzindo as pegadas de carbono no fornecimento de energia.

- Crescimento dos canais de aquisição on-line: as vendas on-line de componentes HVDC cresceram 10% ao ano, impulsionadas por plataformas de comércio eletrônico que atendem empresas de serviços públicos e desenvolvedores de infraestrutura.

Dinâmica do mercado de transmissão de corrente contínua de alta tensão (HVDC)

Motorista

“Crescimento das Energias Renováveis, Interconexão da Rede e Demandas de Eficiência Energética”

- Expansão global de energia renovável: com capacidade de energia renovável excedendo 3.700 GW globalmente em 2023, os sistemas HVDC são essenciais para integrar energia eólica e solar, impulsionando a demanda por transmissão de longa distância com baixas perdas.

- Proliferação de projetos eólicos offshore: a capacidade eólica offshore global atingiu 64 GW em 2023, aumentando a demanda por sistemas HVDC para conectar parques eólicos remotos às redes continentais, aumentando a segurança energética.

- Aumento das interconexões de rede transfronteiriças: investimentos em projetos de HVDC transfronteiriços, como a interconexão Arábia Saudita-Egito (3.000 MW), estão impulsionando a demanda por troca de energia eficiente e resiliência da rede.

- Ascensão das redes inteligentes e da urbanização: os investimentos globais em redes inteligentes atingiram US$ 105 bilhões em 2023, com sistemas HVDC permitindo a distribuição eficiente de energia em regiões de rápida urbanização, como a Ásia-Pacífico.

- Crescente demanda por eletricidade: a demanda global por eletricidade aumentou 2,4% em 2022, alimentando a necessidade de sistemas HVDC para transmitir grandes volumes de energia com perdas mínimas em longas distâncias.

- Políticas e incentivos governamentais: iniciativas como a meta de 40% de energia renovável da UE até 2030 e o investimento de US$ 1 trilhão da China em linhas de transmissão até 2030 estão acelerando a adoção de HVDC por meio de financiamento e suporte regulatório.

Restrição/Desafio

“ Custos elevados, complexidade técnica e problemas de padronização ”

- Altos custos de investimento inicial: O alto custo das estações conversoras HVDC, com distâncias de equilíbrio de 37 milhas para linhas submarinas e 124 milhas para linhas aéreas, limita a adoção em regiões sensíveis a custos.

- Riscos de segurança cibernética em sistemas digitalizados: O uso crescente da IoT em sistemas HVDC aumentou as preocupações com a segurança cibernética, com o mercado de segurança cibernética para infraestrutura de energia crescendo a um CAGR de 15,2% para lidar com ameaças.

- Complexidades técnicas na integração de sistemas: a integração de HVDC com redes CA existentes exige conhecimento especializado, aumentando os custos de desenvolvimento e os cronogramas de projetos para as concessionárias de serviços públicos.

- Requisitos regulatórios rigorosos: a conformidade com padrões como IEC e códigos de rede regionais aumenta os custos e a complexidade para fabricantes de HVDC, especialmente para projetos internacionais.

- Desafios de interoperabilidade: a falta de padronização entre as tecnologias VSC e Line-Commutated Converter (LCC) dificulta a integração perfeita, exigindo adaptações dispendiosas para ambientes de rede mista.

- Obsolescência tecnológica rápida: a necessidade de inovação contínua para atender aos padrões de rede e energia renovável em evolução pressiona os fabricantes a investir pesadamente em P&D, impactando a lucratividade de empresas menores.

Escopo do mercado de transmissão de corrente contínua de alta tensão (HVDC)

- O mercado global de transmissão HVDC é segmentado por componente, tipo de projeto, tecnologia, aplicação, classificação de potência e classificação de tensão.

- Por componente

O mercado é segmentado em estações conversoras, cabos de transmissão, controle e proteção, fontes de alimentação reativa e eletrodos. As estações conversoras detiveram a maior participação na receita, 49,07%, em 2024, impulsionadas por seu papel essencial na conversão CA-CC. O segmento de cabos de transmissão deverá crescer a uma CAGR de 6,0%, a mais rápida, entre 2025 e 2032, impulsionado pela demanda por cabos submarinos e subterrâneos para projetos eólicos offshore e transfronteiriços.

- Por tipo de projeto

O mercado é segmentado em transmissão ponto a ponto, estações back-to-back e sistemas multiterminais. A transmissão ponto a ponto dominou, com uma participação de 44,94% em 2024, impulsionada pelas necessidades de transferência de energia em grandes quantidades a longa distância. Espera-se que os sistemas de transmissão ponto a ponto cresçam a uma taxa composta de crescimento anual (CAGR) mais rápida, de 6,4%, entre 2025 e 2032, impulsionada pelo aumento das interconexões com a rede.

- Por Tecnologia

O mercado é segmentado em Conversores Comutados por Linha (LCC), Conversores de Fonte de Tensão (VSC) e Conversores Comutados por Capacitor (CCC). O segmento de Conversores Comutados por Linha (LCC) liderou com uma participação de 50,61% em 2024, devido ao seu controle superior e compatibilidade com energias renováveis. Espera-se que o segmento de conversores de fonte de tensão cresça a uma taxa composta de crescimento anual (CAGR) de 5,9% entre 2025 e 2032.

- Por aplicação

O mercado é segmentado em transmissão de energia em massa, redes de interconexão e áreas urbanas de alimentação. A transmissão de energia em massa representou a maior fatia, 59,49%, em 2024, impulsionada pela necessidade de entrega eficiente de energia a longa distância. Espera-se que as redes de interconexão cresçam a uma taxa composta de crescimento anual (CAGR) mais rápida, de 5,9%, entre 2025 e 2032, impulsionada pelo comércio transfronteiriço de energia e por iniciativas de resiliência da rede.

- Por classificação de potência

O mercado é segmentado em abaixo de 1001-1500 MW, 1501-2000 MW, acima de 2001 MW

501-1000 MW, abaixo de 500 MW. O segmento acima de 1001-1500 MW detinha a maior participação, de 34,47%, em 2024, impulsionado por projetos de energia renovável de larga escala e UHVDC. Espera-se que o segmento acima de 2001 MW cresça à taxa composta de crescimento anual (CAGR) mais rápida, de 6,7%, de 2025 a 2032, devido a projetos de modernização da rede de médio porte.

- Por classificação de tensão

O mercado é segmentado em menos de 350-640 kV, 640-800 kV, menos de 350 kV e mais de 800 kV. O segmento acima de 350-640 kV dominou com uma participação de 42,36% em 2024, impulsionado por projetos UHVDC na Ásia-Pacífico. Espera-se que o segmento de 350-640 kV cresça a uma taxa composta de crescimento anual (CAGR) mais rápida, de 6,5%, de 2025 a 2032, impulsionado pela energia eólica offshore e pelas interconexões regionais .

Análise regional do mercado de transmissão de corrente contínua de alta tensão (HVDC)

Visão geral do mercado de transmissão de corrente contínua de alta tensão (HVDC) na América do Norte

A América do Norte deverá crescer a uma CAGR de 5,9% entre 2025 e 2032, impulsionada por projetos eólicos offshore e esforços de modernização da rede. Os EUA representaram 75,87% do mercado regional em 2024, apoiados pelo financiamento de US$ 10 milhões do Departamento de Energia (DOE) para inovação em HVDC e projetos como o Sunrise Wind.

Visão do mercado de transmissão de corrente contínua de alta tensão (HVDC) dos EUA

Os EUA lideram o mercado norte-americano, impulsionados por seu foco em energia eólica offshore (por exemplo, Sunrise Wind) e atualizações de rede para dar suporte à integração de energia renovável e aumentar a confiabilidade da rede.

Visão geral do mercado de transmissão de corrente contínua de alta tensão (HVDC) na Europa

A Europa teve uma participação significativa na receita de 22,74% em 2024, impulsionada por interconectores transfronteiriços e projetos de energia renovável. Os principais contribuintes incluem Alemanha, Reino Unido e Noruega, com iniciativas como a NordLink impulsionando a adoção de HVDC.

Visão geral do mercado de transmissão de corrente contínua de alta tensão (HVDC) do Reino Unido

O Reino Unido está experimentando um crescimento constante, impulsionado por sua capacidade eólica offshore (12,7 GW em 2023) e interconectores HVDC como o North Sea Link, melhorando a comercialização de energia e a estabilidade da rede.

Visão do mercado de transmissão de corrente contínua de alta tensão (HVDC) da Alemanha

O mercado da Alemanha está crescendo a um CAGR notável, impulsionado por sua liderança na integração de energia renovável, particularmente eólica offshore nos Mares do Norte e Báltico, apoiada por empresas como a Siemens Energy.

Visão do mercado de transmissão de corrente contínua de alta tensão (HVDC) da Ásia-Pacífico

A Ásia-Pacífico dominou o mercado global de HVDC com uma participação de receita de 32,26% em 2024, impulsionada pela rápida urbanização, industrialização e investimentos significativos em infraestrutura de energia na China, Índia e Coreia do Sul.

Visão do mercado de transmissão de corrente contínua de alta tensão (HVDC) do Japão

O mercado japonês está se expandindo a um CAGR constante, impulsionado por sua ênfase em energia renovável e tecnologias HVDC avançadas, com empresas como a Toshiba impulsionando a inovação.

Visão do mercado de transmissão de corrente contínua de alta tensão (HVDC) da China

A China deteve a maior fatia de receita de 26,96% na região Ásia-Pacífico em 2024, impulsionada por sua liderança em projetos UHVDC, integração massiva de energia renovável e investimentos em infraestrutura apoiados pelo governo.

Participação no mercado de transmissão de corrente contínua de alta tensão (HVDC)

- O setor de transmissão de corrente contínua de alta tensão (HVDC) é liderado principalmente por empresas bem estabelecidas, incluindo:

- Siemens [Alemanha]

- ABB [Suíça]

- GE Vernova [EUA]

- Toshiba Energy Systems & Solutions C [Japão]

- Mitsubishi Electric Corporation [Japão]

- Emerson Electric Co. [EUA]

- Schneider Electric [França]

- Nexans [França]

- NKT A/S [Dinamarca]

- Hitachi, Ltd. [Japão]

- Sumitomo Electric Industries, Ltd. [Japão]

- Prysmian SpA [Itália]

- Supercondutor Americano [EUA]

- LS ELECTRIC Co., Ltd. [Coreia do Sul]

- Stantec [Canadá]

- Infineon Technologies AG [Alemanha]

- ATCO Ltd [Canadá]

- ESCO Technologies Inc. [EUA]

- Laboratórios de Engenharia Schweitzer [EUA]

- Delta Electronics, Inc. [Taiwan]

Últimos desenvolvimentos no mercado global de transmissão de corrente contínua de alta tensão (HVDC)

- Em junho de 2025, a ABB implantou seu disjuntor de média tensão VD4-AF1 na siderúrgica da Duferco Travi e Profilati, na Itália, para garantir a continuidade dos negócios. Este disjuntor, projetado especificamente para operações em fornos a arco, suporta mais de 150.000 operações sem necessidade de manutenção e fornece diagnósticos avançados para reduzir o estresse do transformador, aumentando assim a confiabilidade operacional e minimizando o tempo de inatividade. A ABB fortalece sua posição em aplicações industriais pesadas, enquanto sua avançada tecnologia de rede contribui para maior eficiência e estabilidade no mercado global de transmissão HVDC.

- Em junho de 2025, a ABB enfatizou a importância de parcerias estratégicas para acelerar a transição para aparelhagens de manobra livres de SF₆, marcando uma grande mudança na infraestrutura de média tensão em meio às crescentes pressões da rede e às demandas regulatórias. Ao desenvolver soluções adaptáveis e confiáveis em conjunto com as concessionárias, a ABB promove a colaboração de longo prazo e a confiança em tecnologias sustentáveis. A ABB se beneficia ao se posicionar como uma parceira confiável em inovação, enquanto a abordagem colaborativa apoia a modernização no mercado global de transmissão de HVDC por meio de soluções de rede escaláveis e de baixa emissão.

- Em janeiro de 2025, a ABB avançou na automação de subestações com o lançamento de seu sistema virtualizado de proteção e controle centralizado (VPC), o SSC600 SW, que integra múltiplas funções de relé em uma única plataforma digital. Essa inovação aumenta a resiliência da rede, reduz os custos do ciclo de vida em até 15% e melhora a escalabilidade para concessionárias que se adaptam à integração de energias renováveis e à crescente complexidade da rede. A ABB se beneficia ao liderar a evolução das subestações digitais, enquanto a solução oferece suporte ao mercado global de transmissão HVDC com controle de rede aprimorado, flexibilidade e recursos de proteção em tempo real.

- Em agosto de 2024, a divisão Grid Solutions da GE Vernova lançou o portfólio GRiDEA na CIGRE em Paris, apresentando aparelhagens de alta tensão sem SF₆ e tecnologias de rede sustentáveis para apoiar a descarbonização. O portfólio visa reduzir as emissões, minimizar o uso de matéria-prima e prolongar a vida útil dos equipamentos por meio de monitoramento e projeto avançados. A GE Vernova se beneficia ao reforçar sua liderança em eletrificação sustentável, ao mesmo tempo em que contribui significativamente para o mercado global de transmissão HVDC com soluções de transmissão ecologicamente corretas e preparadas para o futuro.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL

4.1.2 ECONOMIC

4.1.3 SOCIAL

4.1.4 TECHNOLOGICAL

4.1.5 ENVIRONMENTAL

4.1.6 LEGAL

4.2 PORTERS FIVE FORCES

4.2.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.2.2 BARGAINING POWER OF BUYERS / CONSUMERS – HIGH

4.2.3 THREAT OF NEW ENTRANTS – LOW

4.2.4 THREAT OF SUBSTITUTE PRODUCTS – LOW TO MODERATE

4.2.5 BARGAINING POWER OF SUPPLIERS – MODERATE

4.3 PATENT ANALYSIS

4.3.1 PATENT QUALITY AND STRENGTH

4.3.2 PATENT FAMILIES

4.3.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.3.4 LICENSING AND COLLABORATIONS

4.3.5 COMPANY PATENT LANDSCAPE

4.3.6 REGION PATENT LANDSCAPE

4.3.7 IP STRATEGY AND MANAGEMENT

4.3.8 PATENT ANALYSIS

4.4 VALUE CHAIN

4.4.1 COMPONENT MANUFACTURING:

4.4.2 SYSTEM INTEGRATION:

4.4.3 TRANSMISSION INFRASTRUCTURE DEVELOPMENT:

4.4.4 END-USERS:

4.5 SUPPLY CHAIN ANALYSIS

4.6 PENETRATION & GROWTH PROSPECT MAPPING FOR HVDC MARKET

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS IN THE GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET

4.8 TARIFFS & IMPACT ON THE MARKET

4.8.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.8.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.8.3 VENDOR SELECTION CRITERIA DYNAMICS

4.8.4 IMPACT ON SUPPLY CHAIN

4.8.5 RAW MATERIAL PROCUREMENT

4.8.6 MANUFACTURING AND PRODUCTION

4.8.7 LOGISTICS AND DISTRIBUTION

4.8.8 PRICE PITCHING AND POSITION OF MARKET

4.8.9 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.8.10 SUPPLY CHAIN OPTIMIZATION

4.8.11 JOINT VENTURE ESTABLISHMENTS

4.8.12 IMPACT ON PRICES

4.8.13 REGULATORY INCLINATION

4.8.14 GEOPOLITICAL SITUATION

4.8.15 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.8.16 FREE TRADE AGREEMENTS

4.8.17 ALLIANCES ESTABLISHEMENTS

4.8.18 STATUS ACCREDITION (INCLUDING MFTN)

4.8.19 DOMESTIC COURSE OF CORRECTION

4.8.20 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.8.21 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.9 IMPACT ON PRICES

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED TO TRANSMIT RENEWABLE ENERGY OVER LONG DISTANCES

6.1.2 GROWING INVESTMENTS IN GRID MODERNIZATION AND CROSS-BORDER

6.1.3 IMPROVED TECHNOLOGICAL CAPABILITIES IN HVDC SYSTEMS

6.1.4 STRONG POLICY PUSH FOR DECARBONIZATION AND ENERGY EFFICIENCY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL CAPITAL INVESTMENT

6.2.2 COMPLEX AND LENGTHY REGULATORY APPROVALS

6.3 OPPORTUNITIES

6.3.1 GOVERNMENTS WORLDWIDE ARE BOOSTING HVDC INVESTMENT TO ACHIEVE ENERGY TRANSITION AND ENHANCE GRID RELIABILITY

6.3.2 EMERGING APPLICATIONS IN HIGH-SPEED RAIL AND ELECTRIC VEHICLE CHARGING INFRASTRUCTURE.

6.3.3 ADVANCEMENTS IN CABLE TECHNOLOGY, CONVERTERS AND DIGITAL CONTROLS EXPAND USE CASES.

6.4 CHALLENGES

6.4.1 HVDC FACES TECHNICAL HURDLES IN AC GRID CONNECTIONS, MULTI-TERMINAL DC MANAGEMENT/FAULTS, AND ADVANCED MODELING.

6.4.2 HVDC FACES FINANCIAL HURDLES: HIGH UPFRONT COSTS AND SLOW RETURNS REQUIRE GOVERNMENT AND INVESTOR SUPPORT.

7 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 CONVERTER STATIONS

7.3 TRANSMISSION CABLES

7.4 CONTROL AND PROTECTION

7.5 REACTIVE POWER SUPPLIES

7.6 ELECTRODES

7.7 OTHERS

8 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE

8.1 OVERVIEW

8.2 POINT-TO-POINT TRANSMISSION

8.3 BACK-TO-BACK STATIONS

8.4 MULTI-TERMINAL SYSTEM

9 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 LINE COMMUTATED CONVERTER

9.3 VOLTAGE SOURCE CONVERTER

9.4 CAPACITOR COMMUTATED CONVERTER

10 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BULK POWER TRANSMISSION

10.2.1 CONVERTER STATIONS

10.2.2 TRANSMISSION CABLES

10.2.3 CONTROL AND PROTECTION

10.2.4 REACTIVE POWER SUPPLIES

10.2.5 ELECTRODES

10.2.6 OTHERS

10.3 INTERCONNECTING GRIDS

10.3.1 CONVERTER STATIONS

10.3.2 TRANSMISSION CABLES

10.3.3 CONTROL AND PROTECTION

10.3.4 REACTIVE POWER SUPPLIES

10.3.5 ELECTRODES

10.3.6 OTHERS

10.4 IN-FEED URBAN AREAS

10.4.1 CONVERTER STATIONS

10.4.2 TRANSMISSION CABLES

10.4.3 CONTROL AND PROTECTION

10.4.4 REACTIVE POWER SUPPLIES

10.4.5 ELECTRODES

10.4.6 OTHERS

11 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING

11.1 OVERVIEW

11.2 1001-1500 MW

11.3 1501-2000 MW

11.4 ABOVE 2001 MW

11.5 501-1000 MW

11.6 BELOW 500 MW

12 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING

12.1 OVERVIEW

12.2 350-640 KV

12.3 640-800 KV

12.4 LESS THAN 350 KV

12.5 MORE THAN 800 KV

13 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA-PACIFIC

13.2.1 CHINA

13.2.2 INDIA

13.2.3 SOUTH KOREA

13.2.4 JAPAN

13.2.5 SINGAPORE

13.2.6 AUSTRALIA

13.2.7 MALAYSIA

13.2.8 THAILAND

13.2.9 INDONESIA

13.2.10 PHILIPPINES

13.2.11 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 UNITED KINGDOM

13.4.3 FRANCE

13.4.4 ITALY

13.4.5 SPAIN

13.4.6 NETHERLANDS

13.4.7 BELGIUM

13.4.8 SWITZERLAND

13.4.9 TURKEY

13.4.10 RUSSIA

13.4.11 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 U.A.E

13.6.3 SOUTH ARABIA

13.6.4 EGYPT

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NA

14.3 COMPANY SHARE ANALYSIS: APAC

14.4 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ABB

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS/NEWS

16.2 SIEMENS

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 GE VERNOVA

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS/NEWS

16.4 PRYSMIAN GROUP

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HITACHI, LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS/NEWS

16.6 AMERICAN SUPERCONDUCTOR

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ATCO LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 DELTA ELECTRONICS, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT/NEWS

16.9 EMERSON ELECTRIC CO.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS/NEWS

16.1 ESCO TECHNOLOGIES INC. (DOBLE ENGINEERING COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 INFINEON TECHNOLOGIES AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT/NEWS

16.12 LS ELECTRIC CO, LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MITSUBISHI ELECTRIC CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS/NEWS

16.14 NEXANS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS/NEWS

16.15 NKT A S

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS/NEWS

16.16 SCHNEIDER ELECTRIC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS/NEWS

16.17 SCHWEITZER ENGINEERING LABORATORIES, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS/NEWS

16.18 STANTEC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICES PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 SUMITOMO ELECTRIC INDUSTRIES, LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS/NEWS

16.2 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 HVDC TRANSMISSION IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 3 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 4 REGULATORY INCLINATION

TABLE 5 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 6 ALLIANCES ESTABLISHEMENTS

TABLE 7 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 8 REGULATORY COVERAGE

TABLE 9 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL CONVERTER STATIONS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL TRANSMISSION CABLES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL CONTROL AND PROTECTION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL REACTIVE POWER SUPPLIES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ELECTRODES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL POINT-TO-POINT TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL BACK-TO-BACK STATIONS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL MULTI-TERMINAL SYSTEM IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL LINE COMMUTATED CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL VOLTAGE SOURCE CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL CAPACITOR COMMUTATED CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL 1001-1500 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL 1501-2000 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL ABOVE 2001 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL 501-1000 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL BELOW 500 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL 350-640 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL 640-800 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL LESS THAN 350 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL MORE THAN 800 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 43 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 56 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CHINA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 62 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 63 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 65 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 INDIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH KOREA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH KOREA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH KOREA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 80 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 81 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 83 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 JAPAN BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 89 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 90 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 92 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 SINGAPORE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SINGAPORE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SINGAPORE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 97 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 98 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 99 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 101 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 AUSTRALIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 AUSTRALIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 AUSTRALIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 106 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 107 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 108 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 110 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 MALAYSIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MALAYSIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MALAYSIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 115 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 THAILAND INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 125 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 126 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 128 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 INDONESIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 INDONESIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDONESIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 133 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 134 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 135 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 137 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 PHILIPPINES BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 PHILIPPINES INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 PHILIPPINES IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 142 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 143 REST OF ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 146 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 148 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 NORTH AMERICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 153 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 172 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 173 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 181 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 182 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 183 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 EUROPE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 EUROPE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 EUROPE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 190 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 191 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 192 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 194 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 GERMANY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 GERMANY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 GERMANY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 199 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 200 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 201 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 203 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 UNITED KINGDOM BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 UNITED KINGDOM INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 UNITED KINGDOM IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 208 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 209 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 210 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 212 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 FRANCE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 FRANCE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 FRANCE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 217 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 218 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 219 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 221 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 ITALY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 ITALY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 227 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 228 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 SPAIN BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SPAIN INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SPAIN IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 235 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 245 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 246 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 248 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 BELGIUM BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 BELGIUM INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 BELGIUM IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 253 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 254 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 SWITZERLAND BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SWITZERLAND INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 264 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 266 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 TURKEY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 TURKEY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 TURKEY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 271 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 280 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 281 REST OF EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 282 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 283 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 284 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 286 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 287 SOUTH AMERICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SOUTH AMERICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SOUTH AMERICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 291 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 292 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 293 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 295 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 296 BRAZIL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 BRAZIL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 BRAZIL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 300 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 301 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 302 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 304 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 305 ARGENTINA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ARGENTINA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ARGENTINA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 309 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 310 REST OF SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 311 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 312 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 313 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 315 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 316 MIDDLE EAST AND AFRICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 MIDDLE EAST AND AFRICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 MIDDLE EAST AND AFRICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 320 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AFRICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AFRICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SOUTH AFRICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 329 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 330 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 331 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 333 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 334 U.A.E BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 U.A.E INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 U.A.E IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 338 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 339 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 340 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 342 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 343 SOUTH ARABIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SOUTH ARABIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SOUTH ARABIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 347 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 348 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 349 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 351 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 352 EGYPT BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 EGYPT INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 EGYPT IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 356 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 357 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 358 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 360 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 361 ISRAEL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 ISRAEL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 ISRAEL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 365 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 366 REST OF MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET

FIGURE 2 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY