Global Insulin Market For Type 1 And Type 2 Diabetes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

19.06 Billion

USD

25.70 Billion

2024

2032

USD

19.06 Billion

USD

25.70 Billion

2024

2032

| 2025 –2032 | |

| USD 19.06 Billion | |

| USD 25.70 Billion | |

|

|

|

|

Mercado global de insulina para diabetes tipo 1 e tipo 2: segmentação, tipo (diabetes tipo 2 e diabetes tipo 1), tipo de produto (insulina de ação prolongada, insulina de ação rápida, insulina de ação curta e outros), local de absorção (basal, em bolus e outros), faixa etária (pacientes adultos, pacientes geriátricos e pacientes pediátricos), fonte (insulina analógica, insulina humana e outros), método de administração (canetas de insulina, frascos e seringas, bombas de insulina, insulina inalável e sistemas de administração de insulina implantáveis), gênero (masculino e feminino), canal de distribuição (farmácias de varejo, farmácias hospitalares, farmácias on-line e clínicas de diabetes e farmácias especializadas) - Tendências do setor e previsão até 2032

Mercado de insulina para diabetes tipo 1 e tipo 2 Tamanho do mercado

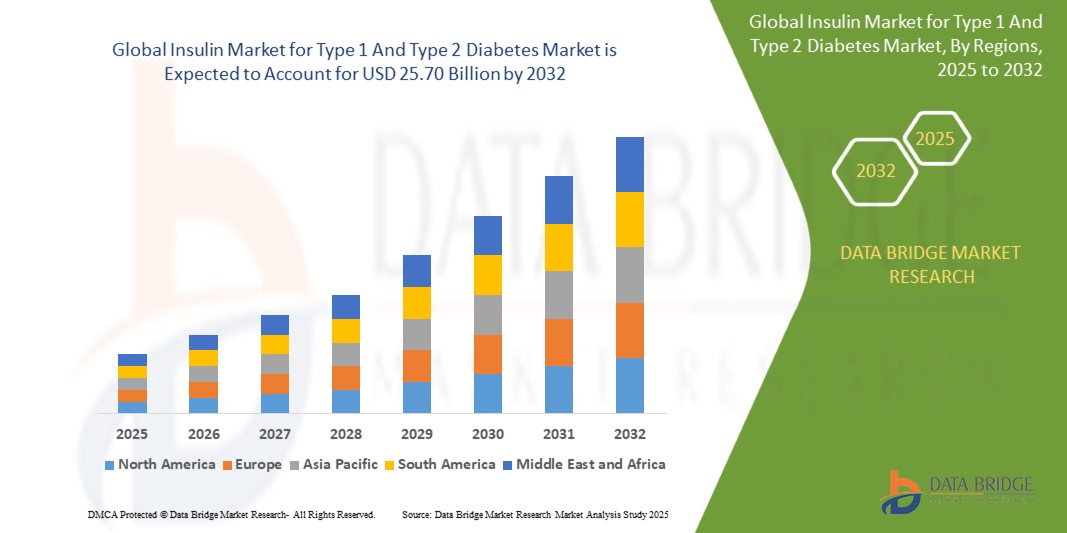

- O mercado global de insulina para diabetes tipo 1 e tipo 2 foi avaliado em US$ 19,06 bilhões em 2024 e deve atingir US$ 25,70 bilhões até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 3,9%, impulsionado principalmente pelo lançamento antecipado de terapias

- Esse crescimento é impulsionado por fatores como a crescente prevalência de diabetes, especialmente tipo 1 e tipo 2, que impulsiona a demanda por insulina. Além disso, os avanços nos sistemas de administração de insulina e a crescente adoção de cuidados personalizados para o diabetes.

Análise de Mercado de Insulina para Diabetes Tipo 1 e Tipo 2

- O diabetes tipo 1 é uma doença autoimune em que o sistema imunológico do corpo ataca e destrói as células beta produtoras de insulina no pâncreas, levando à deficiência de insulina. O diabetes tipo 2 ocorre quando o corpo se torna resistente à insulina ou não a produz em quantidade suficiente. A terapia com insulina é usada para regular os níveis de glicose no sangue em ambas as condições, melhorando o controle glicêmico e prevenindo complicações como doenças cardiovasculares, insuficiência renal e danos nos nervos.

- O diabetes tipo 1 (DM1) é tipicamente diagnosticado na infância ou adolescência e requer terapia com insulina por toda a vida, visto que o pâncreas produz pouca ou nenhuma insulina. É uma doença autoimune em que o sistema imunológico ataca erroneamente as células beta produtoras de insulina. O diabetes tipo 2 (DM2) é mais comum e ocorre principalmente em adultos, embora seja cada vez mais observado em crianças devido ao aumento das taxas de obesidade. O DM2 é caracterizado pela resistência à insulina, em que o corpo não utiliza a insulina de forma eficaz. Com o tempo, o pâncreas não consegue produzir insulina suficiente para manter os níveis normais de glicose no sangue. Ambos os tipos de diabetes requerem monitoramento regular e terapia com insulina para controlar os níveis de açúcar no sangue de forma eficaz. O tratamento com insulina ajuda a prevenir complicações a longo prazo, como retinopatia, neuropatia e doenças cardiovasculares, melhorando a qualidade de vida geral dos pacientes.

- A região da América do Norte se destaca como uma das regiões dominantes no mercado de insulina para diabetes tipo 1 e tipo 2, impulsionada por sua infraestrutura avançada de saúde e alta adoção de tecnologias inovadoras de administração de insulina.

- Por exemplo, os EUA continuam a liderar a utilização de bombas de insulina e de sistemas de monitorização contínua da glicose, permitindo uma melhor gestão da diabetes.

- Com um foco crescente no tratamento do diabetes e em soluções centradas no paciente , a região impulsiona avanços significativos em terapias de insulina, contribuindo significativamente para o crescimento do mercado global

Escopo do Relatório e Segmentação do Mercado de Insulina para Diabetes Tipo 1 e Tipo 2

|

Atributos |

Mercado de insulina para diabetes tipo 1 e tipo 2: principais insights de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do Mercado de Insulina para Diabetes Tipo 1 e Tipo 2

“Aumento da adoção de sistemas inteligentes de administração de insulina”

- Uma tendência proeminente no mercado global de insulina para diabetes tipo 1 e tipo 2 é a crescente adoção de sistemas inteligentes de administração de insulina

- Esses dispositivos avançados melhoram o gerenciamento do diabetes ao oferecer monitoramento em tempo real e ajustes de dose de insulina com base nos níveis de glicose, melhorando a precisão e os resultados gerais do tratamento.

- Por exemplo, as bombas de insulina integradas com sistemas de monitorização contínua da glicose (MCG) permitem a administração automatizada de insulina, ajustando as doses com base em dados em tempo real, o que ajuda a manter o controlo óptimo da glicose com intervenção manual mínima.

- As plataformas digitais também facilitam o rastreamento contínuo de dados, permitindo que pacientes e profissionais de saúde monitorem tendências, melhorem os planos de tratamento e previnam complicações.

- Esta tendência está transformando o tratamento do diabetes, promovendo melhor adesão e resultados por parte dos pacientes e impulsionando a demanda por tecnologias avançadas de administração de insulina no mercado.

Mercado de insulina para diabetes tipo 1 e tipo 2: dinâmica de mercado

Motorista

“Aumento da prevalência da diabetes”

- O número crescente de pessoas diagnosticadas com diabetes cria uma demanda substancial por terapias eficazes com insulina, o que, por sua vez, impulsiona o crescimento do mercado global de insulina. Fatores como sedentarismo, dietas pouco saudáveis e envelhecimento da população contribuem para essa tendência, resultando em uma base maior de pacientes que necessitam de soluções para o gerenciamento do diabetes.

- A crescente demanda por produtos de insulina estimula a inovação e a competição entre as empresas farmacêuticas, levando ao desenvolvimento de novas formulações e métodos de administração. Esse ambiente dinâmico apoia as terapias existentes e incentiva a introdução de biossimilares acessíveis e tecnologias aprimoradas, expandindo ainda mais as oportunidades de mercado.

Por exemplo,

- Em 2024, segundo a OMS, o número de pessoas vivendo com diabetes aumentou de 200 milhões em 1990 para 830 milhões em 2022. Esse aumento foi mais rápido em países de baixa e média renda do que em países de alta renda. O diabetes causou mais de 2 milhões de mortes em 2021, com complicações significativas como insuficiência renal e doenças cardíacas.

- Em março de 2024, segundo o NCBI, a prevalência de diabetes aumentou significativamente, com 537 milhões de adultos afetados em 2021, representando 10,5% da população. Até 2030, projeta-se que esse número aumente para 643 milhões (11,3%). Os custos com saúde relacionados ao diabetes foram de US$ 966 bilhões em 2021, com previsão de ultrapassar US$ 1,054 bilhão até 2045.

- A crescente prevalência global de diabetes está alimentando a necessidade de tratamentos inovadores e convenientes, que possam melhorar significativamente a qualidade de vida dos pacientes e a adesão à terapia. Embora os desafios relacionados à biodisponibilidade e aos custos de produção persistam, o potencial de mercado é vasto, oferecendo uma solução promissora para o tratamento do diabetes tipo 1 e tipo 2.

Oportunidade

“Avanços nas Tecnologias de Formulação e Administração de Insulina”

- Avanços na formulação de insulina, incluindo nanopartículas carreadoras, agentes mucoadesivos e revestimentos sensíveis ao pH, melhoraram significativamente a biodisponibilidade da insulina oral, tornando-a uma alternativa viável às injeções tradicionais. Inovações como análogos de insulina e sistemas inteligentes de administração de medicamentos aumentam a absorção e permitem o monitoramento da glicemia em tempo real. Esses avanços contribuem para a adesão do paciente, particularmente em mercados emergentes com prevalência crescente de diabetes, criando oportunidades significativas de crescimento para o mercado de insulina oral.

Por exemplo,

- Um artigo de julho de 2020 do NCBI destacou a necessidade urgente de tratamentos inovadores para enfrentar o crescente impacto do diabetes. As principais necessidades incluem melhorar a adesão dos pacientes aos regimes de tratamento, reduzir os custos com saúde e fornecer soluções eficazes e não invasivas para o controle do diabetes. Avanços como insulina oral e sistemas inteligentes de administração de medicamentos apresentam oportunidades promissoras para enfrentar esses desafios e melhorar os resultados dos pacientes.

- Em agosto de 2024, o MDPI relatou avanços em sistemas de administração de medicamentos, como nanopartículas e lipossomas, para melhorar a biodisponibilidade da insulina oral. Essas inovações oferecem uma oportunidade significativa para aprimorar o controle do diabetes, fornecendo tratamentos não invasivos e eficazes. À medida que as taxas globais de diabetes aumentam, esses avanços atendem à crescente demanda por soluções centradas no paciente. À medida que a prevalência do diabetes cresce globalmente, esses avanços em sistemas de administração de medicamentos atendem à necessidade de tratamentos mais acessíveis e focados no paciente.

- Os avanços contínuos na formulação e tecnologia de medicamentos estão transformando o cenário da insulina oral, proporcionando oportunidades significativas para um melhor controle do diabetes. Inovações no aumento da biodisponibilidade, novos sistemas de administração de medicamentos e a integração de ferramentas digitais de saúde abrem caminho para que a insulina oral se torne uma alternativa confiável e não invasiva às terapias injetáveis. À medida que a epidemia global de diabetes continua a aumentar, essas inovações tecnológicas não apenas aumentam a adesão dos pacientes, mas também permitem um controle mais eficiente e personalizado do diabetes, melhorando, em última análise, a qualidade de vida.

Restrição/Desafio

“Efeitos adversos da alta dosagem de insulina”

- Altas dosagens de insulina podem resultar em efeitos adversos consideráveis, como hipoglicemia, ganho de peso e potenciais problemas cardiovasculares, o que pode desencorajar pacientes e profissionais de saúde a adotar terapias com insulina.

- Como resultado, as preocupações com essas complicações podem levar a uma maior cautela nas práticas de prescrição, dificultando, em última análise, a expansão do mercado global de insulina para diabetes tipo 1 e tipo 2, à medida que os pacientes recorrem cada vez mais a tratamentos ou estratégias de gestão alternativos.

Por exemplo,

- Em julho de 2023, o NCBI declarou que a hipoglicemia é o efeito adverso mais comum da terapia com insulina. Outros efeitos adversos da terapia com insulina incluem ganho de peso e, raramente, distúrbios eletrolíticos, como hipocalemia, especialmente quando usada em conjunto com outros medicamentos que causam hipocalemia . Além disso, dor no local da injeção e lipodistrofia no local da injeção são os efeitos adversos mais comuns das injeções subcutâneas diárias.

- Além disso, o medo de reações adversas causadas por altas dosagens pode resultar em aumento nos custos de saúde devido à hospitalização ou à necessidade de medicamentos adicionais para controlar os efeitos colaterais. Esse ônus financeiro pode limitar o acesso a terapias com insulina, especialmente em regiões em desenvolvimento, onde os recursos de saúde são limitados, contribuindo ainda mais para um mercado global de insulina restrito. Maior conscientização e educação sobre esses riscos são essenciais, mas também ressaltam os desafios que o mercado enfrenta para incentivar a adesão generalizada aos regimes de insulina.

Escopo do Mercado Global de Insulina para Diabetes Tipo 1 e Tipo 2

O mercado é segmentado com base no tipo, tipo de produto, local de absorção, faixa etária, fonte, método de entrega, gênero e canal de distribuição.

|

Segmentação |

Sub-segmentação |

|

Por tipo |

|

|

Por tipo de produto |

|

|

Por local de absorção |

|

|

Por faixa etária

|

|

|

Por fonte |

|

|

Por método de entrega |

|

|

Por gênero

|

|

|

Por canal de distribuição

|

|

Análise regional do mercado de insulina para diabetes tipo 1 e tipo 2

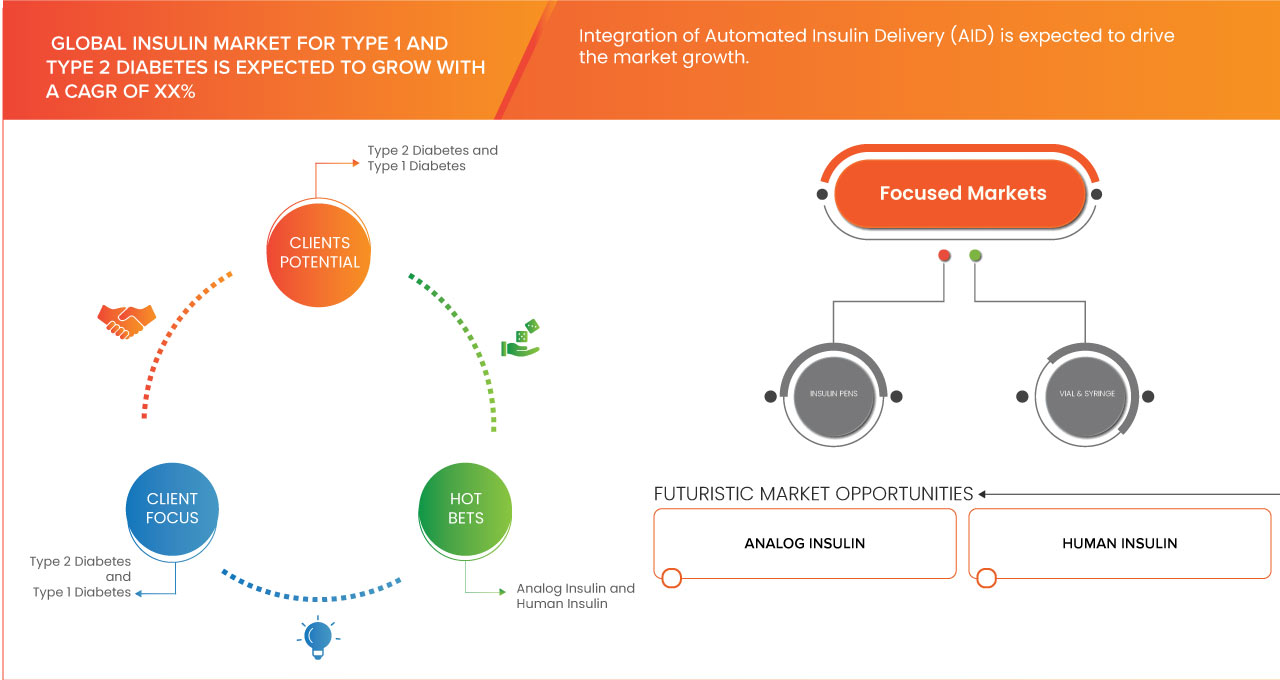

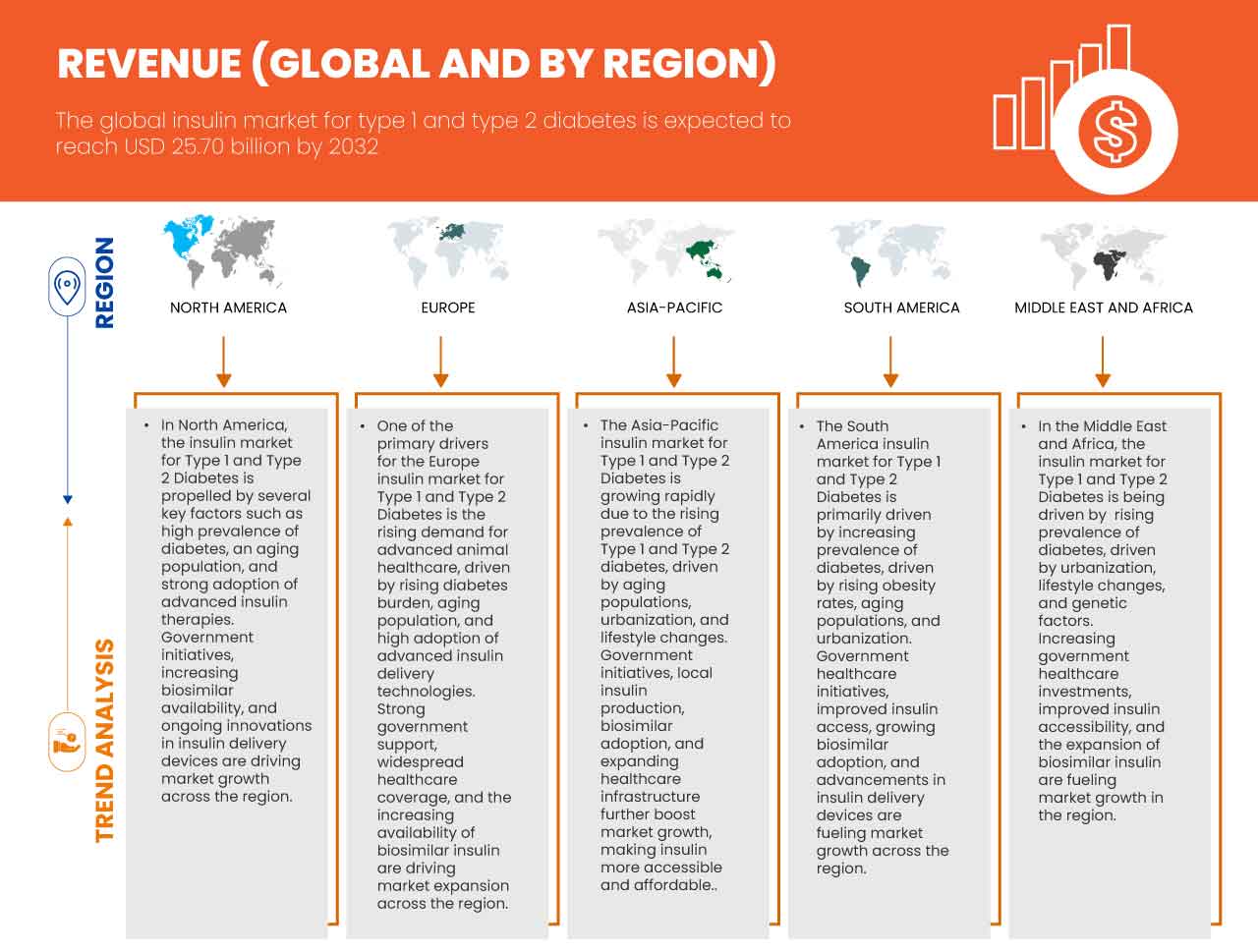

“A América do Norte é a região dominante no mercado de insulina para diabetes tipo 1 e tipo 2”

- A América do Norte domina o mercado de insulina para diabetes tipo 1 e tipo 2, impulsionada pela infraestrutura avançada de saúde, alta adoção de terapias inovadoras de insulina e forte presença de empresas farmacêuticas líderes

- Os EUA detêm uma participação significativa devido à crescente prevalência de diabetes, ao aumento da demanda por sistemas avançados de administração de insulina e às inovações contínuas em tecnologias de gerenciamento de diabetes

- A disponibilidade de políticas de saúde bem estabelecidas e estruturas de reembolso robustas, juntamente com investimentos substanciais em pesquisa e desenvolvimento pelos principais fabricantes de insulina, fortalecem ainda mais o mercado.

- Além disso, o foco crescente no tratamento personalizado do diabetes, juntamente com o aumento na adoção de bombas de insulina e sistemas de monitoramento contínuo de glicose (CGM), está alimentando a expansão do mercado em toda a região.

“A Ásia-Pacífico deverá registar a maior taxa de crescimento”

- Espera-se que a região da Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado de insulina para diabetes tipo 1 e tipo 2 , impulsionada por rápidas melhorias na infraestrutura de saúde, aumento da conscientização sobre o gerenciamento do diabetes e adoção crescente de terapias avançadas de insulina.

- Países como China, Índia e Japão estão emergindo como mercados-chave devido ao envelhecimento crescente da população , que é mais suscetível a complicações relacionadas ao diabetes.

- O Japão , com seus sistemas de saúde avançados e um número crescente de especialistas em diabetes, continua sendo um mercado crucial para terapias com insulina. O país continua a liderar a adoção de dispositivos inovadores de administração de insulina, como bombas de insulina e sistemas de monitoramento contínuo de glicose (MCG).

- China e Índia , com suas grandes populações de diabéticos e taxas crescentes de complicações de saúde relacionadas ao diabetes, estão testemunhando um aumento nos investimentos governamentais e privados em soluções modernas para o tratamento do diabetes. A presença crescente de fabricantes globais de insulina e a melhoria do acesso a opções avançadas de tratamento para diabetes contribuem ainda mais para o crescimento do mercado.

Participação de mercado do mercado de insulina para diabetes tipo 1 e tipo 2

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Novo Nordisk A/S (Dinamarca)

- Eli Lilly and Company (EUA)

- Sanofi (França)

- Biocon (Índia)

- Lupin (Índia)

- Grupo Farmacêutico Shanghai Fosun Wanbang (Jiangsu) Co., Ltd. (China)

- Diasome Pharmaceuticals, Inc. (EUA)

- SciGen Pte. Ltd. (Singapura)

- Wockhardt (Índia)

- MJ Biopharma Pvt. Ltd. (Índia)

- Oramed Pharmaceuticals (EUA)

- Adocia (França)

- Nektar Therapeutics (EUA)

Últimos desenvolvimentos no mercado global de insulina para diabetes tipo 1 e tipo 2

- Em setembro de 2024, a Novo Nordisk anunciou uma nova parceria para estabelecer a produção de insulina humana na África do Sul, reforçando seu compromisso com o tratamento do diabetes na África . Atualmente, atendendo 500.000 pessoas na África Subsaariana, esta iniciativa visa expandir o acesso à insulina, com a meta de fornecer insulina a 4,1 milhões de pessoas com diabetes tipo 1 e tipo 2 em todo o continente até 2026.

- Em agosto, a Eli Lilly anunciou resultados positivos do estudo SURMOUNT-1, mostrando que a administração semanal de tirzepatida (Zepbound/Mounjaro) reduziu o risco de diabetes tipo 2 em 94% em adultos com pré-diabetes e obesidade ou sobrepeso. A dose de 15 mg levou a uma perda média de peso de 22,9% ao longo de 176 semanas, demonstrando eficácia sustentada.

- Em dezembro de 2022, a Sanofi expandiu sua colaboração com a Innate Pharma, com foco em engajadores de células NK (natural killers) em oncologia. A Sanofi licenciou o programa de engajadores de células NK direcionados a B7H3 da plataforma ANKET da Innate, com a opção de adicionar mais dois alvos. Esta parceria visa desenvolver novas terapias contra o câncer, incluindo tratamentos para tumores sólidos, aprimorando o pipeline de imuno-oncologia da Sanofi. Espera-se que a colaboração forneça opções inovadoras de tratamento contra o câncer com um forte perfil de segurança, beneficiando os pacientes ao oferecer terapias potenciais para diversos tipos de câncer. A Sanofi assumirá as responsabilidades adicionais de desenvolvimento, fabricação e comercialização.

- Em dezembro de 2024 , a Lupin adquiriu a Huminsulin da Lilly para ampliar o portfólio de diabetes. A aquisição teve como objetivo expandir o portfólio de diabetes e fornecer cuidados de saúde de alta qualidade e acessíveis aos nossos pacientes.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 COMPETITIVE INTELLIGENCE

4.4 GLOBAL AND REGIONAL PREVALENCE:

4.5 INDUSTRY INSIGHTS

4.6 KEY MARKETING STRATEGIES FOR THE GLOBAL INSULIN MARKET TYPE 1 & TYPE 2 DIABETES

4.7 MARKETED DRUG ANALYSIS

5 PIPELINE ANALYSIS

6 REGULATORY FRAMEWORK

6.1 REGULATORY FRAMEWORK FOR THE ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.1.1 REGULATORY APPROVAL PROCESS

6.1.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.1.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.1.4 LICENSING AND REGISTRATION

6.1.5 POST-MARKETING SURVEILLANCE

6.1.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.2 REGULATORY FRAMEWORK FOR THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.2.1 REGULATORY APPROVAL PROCESS

6.2.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.2.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.2.4 LICENSING AND REGISTRATION

6.2.5 POST-MARKETING SURVEILLANCE

6.2.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.3 REGULATORY FRAMEWORK FOR THE SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.3.1 REGULATORY APPROVAL PROCESS

6.3.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.3.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.3.4 LICENSING AND REGISTRATION

6.3.5 POST-MARKETING SURVEILLANCE

6.3.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.4 REGULATORY FRAMEWORK FOR THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.4.1 REGULATORY APPROVAL PROCESS

6.4.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.4.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.4.4 LICENSING AND REGISTRATION

6.4.5 POST-MARKETING SURVEILLANCE

6.4.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.5 REGULATORY FRAMEWORK FOR THE MIDDLE EAST & AFRICA (MEA) INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.5.1 REGULATORY APPROVAL PROCESS

6.5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.5.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.5.4 LICENSING AND REGISTRATION

6.5.5 POST-MARKETING SURVEILLANCE

6.5.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF DIABETES

7.1.2 GROWING ADOPTION OF INSULIN THERAPIES FOR TYPE 1 AND TYPE 2 DIABETES

7.1.3 INTEGRATION OF AUTOMATED INSULIN DELIVERY (AID)

7.1.4 INCREASING TECHNOLOGICAL INNOVATIONS FOR INSULIN

7.2 RESTRAINTS

7.2.1 ADVERSE EFFECTS OF HIGH DOSAGE OF INSULIN

7.2.2 HIGH PRODUCTION AND DEVELOPMENT COSTS ASSOCIATED WITH INSULIN

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN INSULIN FORMULATION AND DELIVERY TECHNOLOGIES

7.3.2 REVOLUTIONIZING DIABETES MANAGEMENT WITH NEEDLE-FREE INSULIN

7.3.3 INCREASING PHARMACEUTICAL INVESTMENTS AND STRATEGIC COLLABORATIONS

7.4 CHALLENGES

7.4.1 INSULIN ACCESSIBILITY CHALLENGES IN RURAL AND UNDERSERVED REGIONS

7.4.2 LIMITED SHELF LIFE ASSOCIATED WITH ORAL INSULIN

8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

8.1 OVERVIEW

8.2 TYPE 2 DIABETES

8.3 TYPE 1 DIABETES

9 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE

9.1 OVERVIEW

9.2 ANALOG INSULIN

9.3 HUMAN INSULIN

9.4 OTHERS

10 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LONG ACTING INSULIN

10.3 RAPID-ACTING INSULIN

10.4 SHORT ACTING INSULIN

10.5 OTHERS

11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER

11.1 OVERVIEW

11.2 MALE

11.3 FEMALE

12 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD

12.1 OVERVIEW

12.2 INSULIN PENS

12.3 VIAL & SYRINGE

12.4 INSULIN PUMPS

12.5 INHALABLE INSULIN

12.6 IMPLANTABLE INSULIN DELIVERY SYSTEMS

13 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT PATIENTS

13.3 GERIATRIC PATIENTS

13.4 PEDIATRIC PATIENTS

14 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE

14.1 OVERVIEW

14.2 BASAL

14.3 BOLUS

14.4 OTHERS

15 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL PHARMACIES

15.3 HOSPITAL PHARMACIES

15.4 ONLINE PHARMACIES

15.5 DIABETES CLINICS & SPECIALTY PHARMACIES

16 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION

16.1 OVERVIEW

16.2 NORTH AMERICA

16.2.1 U.S

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 FRANCE

16.3.3 U.K

16.3.4 ITALY

16.3.5 RUSSIA

16.3.6 SPAIN

16.3.7 TURKEY

16.3.8 NETHERLANDS

16.3.9 SWITZERLAND

16.3.10 AUSTRIA

16.3.11 IRELAND

16.3.12 NORWAY

16.3.13 POLAND

16.3.14 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 CHINA

16.4.2 INDIA

16.4.3 JAPAN

16.4.4 SOUTH KOREA

16.4.5 AUSTRALIA

16.4.6 INDONESIA

16.4.7 THAILAND

16.4.8 MALAYSIA

16.4.9 VIETNAM

16.4.10 PHILIPPINES

16.4.11 TAIWAN

16.4.12 SINGAPORE

16.4.13 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 CHILE

16.5.4 PERU

16.5.5 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SAUDI ARABIA

16.6.2 SOUTH AFRICA

16.6.3 EGYPT

16.6.4 U.A.E

16.6.5 ISRAEL

16.6.6 KUWAIT

16.6.7 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 NOVO NORDISK A/S

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 SWOT ANALYSIS

19.1.5 PIPELINE PORTFOLIO

19.1.6 RECENT DEVELOPMENT/ NEWS

19.2 LILLY

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 SWOT ANALYSIS

19.2.5 PRODUCT PORTFOLIO

19.2.6 RECENT DEVELOPMENT

19.3 SANOFI

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 SWOT ANALYSIS

19.3.5 PRODUCT PORTFOLIO

19.3.6 RECENT DEVELOPMENT

19.4 BIOCON

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 SWOT ANALYSIS

19.4.5 PIPELINE PRODUCT PORTFOLIO

19.4.6 RECENT DEVELOPMENT

19.5 LUPIN

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 SWOT ANALYSIS

19.5.5 PRODUCT PORTFOLIO

19.5.6 RECENT DEVELOPMENT

19.6 ADOCIA

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 SWOT ANALYSIS

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 DIASOME PHARMACEUTICALS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 SWOT ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 MJ BIOPHARM PVT LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 SWOT ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 NEKTAR

19.9.1 COMPANY SNAPSHOT

19.9.2 SWOT ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT NEWS

19.1 ORAMED

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 SWOT ANALYSIS

19.10.4 PIPELINE PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 SCIGEN PTE. LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 SWOT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 SHANGHAI FOSUN PHARMACEUTICAL(GROUP)CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 SWOT ANALYSIS

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 WOCKHARDT

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 SWOT ANALYSIS

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

20 QUESTIONNAIRE

Lista de Tabela

TABLE 1 THE TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

TABLE 2 DISTRIBUTION OF EXPENDITURE ACROSS REGIONS:

TABLE 3 NUMBER OF ADULTS WITH DIABETES IS EXPECTED TO INCREASE SIGNIFICANTLY IN SEVERAL COUNTRIES:

TABLE 4 REGIONAL DIABETES STATISTICS: PREVALENCE, TREATMENT, AND OUTCOMES

TABLE 5 GLOBAL CLINICAL TRIAL MARKET FOR ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 6 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE GLOBAL ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 7 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE GLOBAL ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL TYPE 2 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL TYPE 1 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ANALOG INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL HUMAN INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL LONG ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL RAPID-ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SHORT ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL MALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL FEMALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL INSULIN PENS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL VIAL & SYRINGE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL INSULIN PUMPS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL INHALABLE INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL IMPLANTABLE INSULIN DELIVERY SYSTEMS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL ADULT PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL GERIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL PEDIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL BASAL IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL BOLUS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL RETAIL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL HOSPITAL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL ONLINE PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL DIABETES CLINICS & SPECIALTY PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION, 2021-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 93 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 96 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 116 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 120 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 121 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 123 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 124 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 125 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 128 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 129 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 130 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 131 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 132 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 136 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 137 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 138 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 139 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 140 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 141 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 144 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 145 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 146 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 147 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 148 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 168 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 170 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 171 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 172 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 176 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 177 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 178 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 179 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 180 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 181 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 184 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 185 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 186 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 187 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 188 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 189 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 192 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 193 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 194 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 195 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 196 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 197 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 205 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 206 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 217 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 218 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 219 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 220 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 221 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 222 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 225 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 226 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 227 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 228 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 229 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 230 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 233 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 238 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 241 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 242 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 243 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 246 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 249 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 250 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 251 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 252 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 253 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 257 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 258 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 259 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 260 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 261 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 262 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 265 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 266 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 267 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 268 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 269 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 275 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 276 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 277 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 278 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 281 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 282 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 283 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 284 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 285 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 286 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 289 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 290 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 291 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 292 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 293 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 297 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 298 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 299 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 300 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 301 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 302 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 305 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 306 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 307 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 308 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 309 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 311 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 316 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 319 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 322 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 323 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 324 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 325 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 326 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 327 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 330 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 331 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 332 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 333 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 334 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 335 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 338 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 339 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 340 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 341 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 342 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 343 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 346 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 347 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 348 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 349 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 350 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 351 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 354 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 355 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 356 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 357 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 358 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 359 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 360 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 363 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 364 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 365 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 366 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 367 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 368 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 371 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 372 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 373 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 374 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 375 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 376 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 379 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 380 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 381 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 382 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 383 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 384 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 387 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 388 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 389 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 390 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 391 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 392 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 395 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 396 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 397 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 398 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 399 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 400 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 403 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 404 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 405 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 406 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 407 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 408 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 411 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 412 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 413 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 414 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 415 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 416 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 419 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 420 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 421 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 422 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 423 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 2 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DATA TRIANGULATION

FIGURE 3 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DROC ANALYSIS

FIGURE 4 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

FIGURE 11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF DIABETES IS EXPECTED TO DRIVE THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TYPE 2 DIABETES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE THE MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING REGION FOR GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

FIGURE 18 GLOBAL HEALTHCARE EXPENDITURE FOR DIABETES

FIGURE 19 NUMBER OF PEOPLE WITH DIABETES IN 2045 (MILLIONS)

FIGURE 20 DROC ANALYSIS

FIGURE 21 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2024

FIGURE 22 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 23 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, CAGR (2025-2032)

FIGURE 24 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, LIFELINE CURVE

FIGURE 25 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2024

FIGURE 26 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, CAGR (2025-2032)