Global Intraoperative Imaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.18 Billion

USD

5.00 Billion

2024

2032

USD

3.18 Billion

USD

5.00 Billion

2024

2032

| 2025 –2032 | |

| USD 3.18 Billion | |

| USD 5.00 Billion | |

|

|

|

|

Global Intraoperative Imaging Market Segmentation, By Product (Mobile C-Arms, Intraoperative Computed Tomography, IntraoperativeMagnetic Resonance Imaging, and Intraoperative Ultrasound), Component (System, Software, and Services), Application (Neurosurgery, Orthopedic and Trauma Surgery, Spine Surgery, Cardiovascular Surgery, and Other Applications), End User (Hospitals, Ambulatory Surgical Centers and Clinics, Academic Institutes, and Research Centers) - Industry Trends and Forecast to 2032

Intraoperative Imaging Market Size

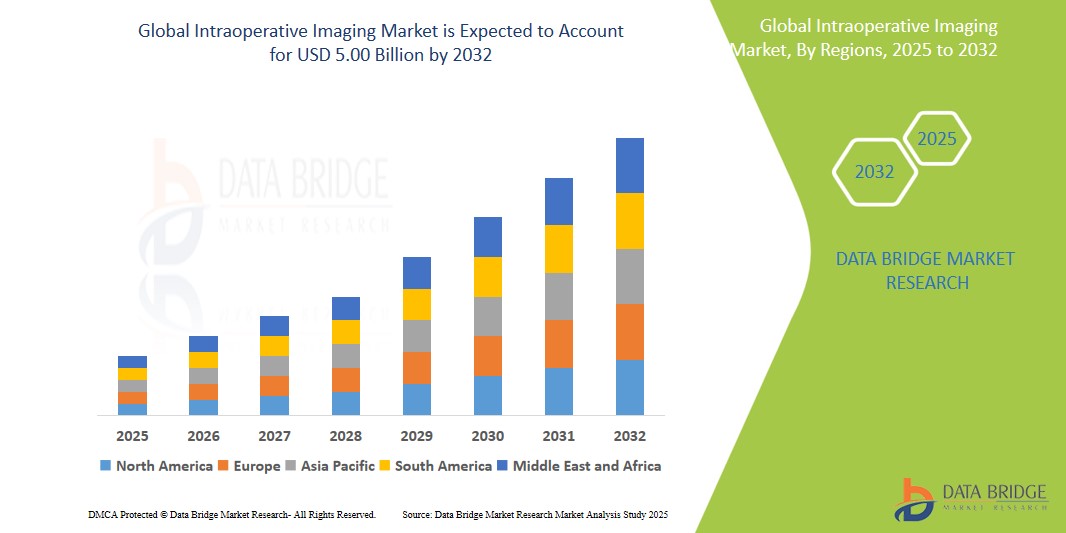

- The global intraoperative imaging market size was valued atUSD 3.18 billion in 2024 and is expected to reachUSD 5.00 billion by 2032, at aCAGR of 5.82%during the forecast period

- This growth is driven by rise in the incidence of chronic diseases

Intraoperative Imaging Market Analysis

- Intraoperative Imaging systems are essential medical tools used during surgical procedures to provide real-time visualization of anatomical structures, enhancing surgical precision, reducing complications, and improving patient outcomes. These imaging technologies include intraoperative MRI, CT, and ultrasound, offering critical guidance for complex surgeries

- The demand for intraoperative imaging is primarily driven by the increasing volume of complex surgical procedures, rising preference for minimally invasive surgeries, and technological advancements that deliver higher image resolution, faster processing, and better integration with surgical navigation systems

- North America is expected to dominate the intraoperative imaging market with the largest market share of 35.54%, owing to its advanced healthcare infrastructure, strong adoption of innovative surgical technologies, favorable reimbursement policies, and the presence of key market leaders in the region

- Asia-Pacific is projected to be the fastest-growing region in the intraoperative imaging market during the forecast period, supported by rapid improvements in healthcare infrastructure, growing investments in surgical care, rising awareness of image-guided surgeries, and increased healthcare spending in emerging economies such as China and India

- The mobile C-arms segment is expected to dominate the market with the largest market share of 32.14%, due to its ability to move easily around the patient helps capture the optimal angle for a high-quality image while ensuring patient comfort

Report Scope and Intraoperative Imaging Market Segmentation

|

Attributes |

Intraoperative Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intraoperative Imaging Market Trends

“Rising Integration ofArtificial Intelligence (AI) in Intraoperative Imaging”

- A key trend in the intraoperative imaging market is the increasing integration of artificial intelligence (AI) to enhance real-time decision-making during surgeries, offering surgeons improved image interpretation, surgical planning, and precision

- AI-driven imaging solutions help in automating image analysis, reducing interpretation errors, and predicting surgical outcomes with greater accuracy, which significantly boosts surgical efficiency and patient safety

- For instance, several leading hospitals have started implementing AI-assisted intraoperative MRI and CT systems to provide real-time, AI-guided surgical feedback for brain tumor resections

- The growing incorporation of AI is transforming the intraoperative imaging landscape, driving faster and more accurate interventions, and shaping the future of image-guided surgery worldwide

Intraoperative Imaging Market Dynamics

Driver

“Growing Demand for Minimally Invasive Surgeries”

- A major driver in the intraoperative imaging market is the rising demand for minimally invasive surgical procedures, which require precise imaging to guide surgical tools and ensure better outcomes with minimal tissue disruption

- Minimally invasive surgeries are associated with shorter hospital stays, reduced recovery times, lower infection risks, and overall cost savings, boosting their global popularity among patients and surgeons alike

- Intraoperative Imaging systems such as MRI, CT, and ultrasound play a critical role in enabling real-time visualization during such surgeries, improving surgical accuracy

- For instance, according to a 2023 report by the American Hospital Association, there has been a 20% increase in minimally invasive neurosurgeries in the U.S., largely supported by the adoption of intraoperative imaging systems

- The preference for less invasive techniques is fueling the demand for high-precision intraoperative imaging solutions, contributing significantly to market growth

Opportunity

“Expansion into Emerging Markets”

- A major opportunity for the intraoperative imaging market lies in the rapid expansion into emerging economies, where improving healthcare infrastructure, rising surgical volumes, and growing investments in advanced medical technologies are creating new avenues for growth.

- Governments and private healthcare providers in regions such as Asia-Pacific, Latin America, and the Middle East are increasingly investing in sophisticated imaging systems to enhance surgical capabilities

- For instance, in 2024, India's government announced an investment initiative focused on upgrading 150 hospitals with intraoperative MRI and CT facilities under its national healthcare expansion plan

- The strong growth potential in emerging markets offers significant opportunities for manufacturers to expand their geographic footprint and introduce affordable, innovative imaging solutions

Restraint/Challenge

“Limited Adoption Due to High Initial Capital Investment”

- One of the primary challenges facing the intraoperative imaging market is the significant upfront cost associated with acquiring and implementing advanced imaging technologies, especially in smaller or resource-constrained healthcare settings

- The high capital expenditure required for purchasing systems such as intraoperative MRI and CT scanners can be prohibitive, especially for hospitals and surgical centers in developing regions or those with limited budgets

- For instance, a 2022 survey by the World Health Organization revealed that nearly 40% of hospitals in lower-income countries cited the high costs of advanced imaging systems as a major barrier to their adoption

- The substantial financial investment required for these technologies is limiting the broader uptake of intraoperative imaging systems, especially in price-sensitive markets, thus slowing overall market growth

Intraoperative Imaging Market Scope

The market is segmented on the basis of product, component, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Component |

|

|

By Application |

|

|

By End User |

|

In 2025, the mobile C-arms is projected to dominate the market with a largest share in product segment

The mobile C-arms segment is expected to dominate the intraoperative imaging market with the largest market share of 32.14% in 2025 due to its ability to move easily around the patient helps capture the optimal angle for a high-quality image while ensuring patient comfort. Moreover, technological advancements are expected to further drive the growth of the segment during the forecast period.

The neurosurgery is expected to account for the largest share during the forecast period in application segment

In 2025, the neurosurgery segment is expected to dominate the market with the largest market share of 31.04% due to rising prevalence of neurological disorders such as epilepsy, stroke, Parkinson's disease, migraines, brain tumors, multiple sclerosis, Alzheimer's disease, and various forms of dementia.

Intraoperative Imaging Market Regional Analysis

“North America Holds the Largest Share in the Intraoperative Imaging Market”

- North America dominates the intraoperative imaging market with the largest market share of 35.54%, driven by the strong presence of key industry players, highly developed healthcare infrastructure, increasing adoption of advanced surgical imaging technologies, and supportive reimbursement policies for intraoperative procedures

- The U.S. holds the largest share within the region due to the widespread use of intraoperative MRI, CT, and ultrasound systems, the rising number of complex surgical procedures, and continuous innovation in imaging modalities tailored for real-time surgical navigation

- Increasing investments in neurosurgery, orthopedic surgery, and oncology applications, coupled with favorable regulatory approvals and growing demand for precision surgeries, are expected to further strengthen North America's leadership in the global intraoperative imaging market

“Asia-Pacific is Projected to Register the Highest CAGR in the Intraoperative Imaging Market”

- Asia-Pacific is expected to witness the highest growth rate in the intraoperative imaging market, fueled by rapid improvements in healthcare infrastructure, rising surgical volumes, growing awareness of advanced surgical imaging technologies, and expanding access to healthcare services in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives for healthcare modernization, increasing investments in hospital facilities, and the growing burden of chronic diseases requiring surgical intervention

- Japan, known for its technological leadership and high healthcare standards, is actively adopting cutting-edge intraoperative imaging solutions, while China and India are witnessing a surge in demand due to healthcare reforms, public-private partnerships, and increased training of medical professionals in image-guided surgeries

Intraoperative Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens (Germany)

- Medtronic (Ireland)

- Ziehm Imaging GmbH (Germany)

- IMRIS Imaging, Inc. (U.S.)

- Toshiba Corporation (Japan)

- Shimadzu Corporation (Japan)

- Brainlab AG (Germany)

- NeuroLogica Corp (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Shenzhen Anke High-tech Co., Ltd. (China)

Latest Developments in Global Intraoperative Imaging Market

- In February 2024, GE Healthcare announced a strategic collaboration with Biofourmis, aimed at enhancing continuity of care by enabling safe, effective, and accessible home-based healthcare, supporting patients beyond traditional hospital settings. This partnership combines the strengths of two industry leaders to scale and deliver next-generation care-at-home solutions, setting a strong foundation for the future of remote healthcare delivery

- In January 2024, Siemens Healthineers AG expanded its partnership with City Cancer Challenge (C/Can) on a global level, with the objective of supporting C/Can city projects in low- and middle-income countries. This initiative reflects Siemens Healthineers’ commitment to strengthening cancer care infrastructure globally and improving healthcare equity

- In October 2023, GE Healthcare achieved a key milestone by leading the U.S. Food and Drug Administration (FDA) list of artificial intelligence (AI)-enabled medical devices, with 58 listed 510(k) clearances or authorizations in the United States. This accomplishment highlights GE Healthcare’s leadership in driving innovation and integrating AI technology into modern medical solutions

- In November 2022, Ziehm Imaging GmbH introduced a new Indium Gallium Zinc Oxide (IGZO) flat-panel detector for intraoperative imaging at the Radiological Society of North America (RSNA) conference, offering superior image quality while minimizing radiation exposure for patients. This advancement underscores Ziehm Imaging’s focus on enhancing imaging safety and effectiveness in surgical environments

- In July 2022, Siemens Healthineers unveiled the Mobilett Impact, a next-generation mobile X-ray system, at the European Congress of Radiology (ECR) in Vienna, designed to allow complete imaging workflows at the patient's bedside. This launch reinforces Siemens Healthineers' dedication to improving patient-centered care and operational efficiency in hospitals

- In April 2022, SPARSH Hospital partnered with the Sita Bhateja Trust to introduce the advanced O-arm surgical imaging system and StealthStation S8 surgical navigation system, enhancing the precision and visualization in brain and spine surgeries. This collaboration marks a significant step toward elevating surgical outcomes and technological adoption in healthcare

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.