Global Mass Spectrometry Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

6.76 Billion

USD

13.06 Billion

2024

2032

USD

6.76 Billion

USD

13.06 Billion

2024

2032

| 2025 –2032 | |

| USD 6.76 Billion | |

| USD 13.06 Billion | |

|

|

|

|

Segmentação do mercado global de espectrometria de massa, por tecnologia (espectrometria de massa híbrida, espectrometria de massa única e outras), modalidade (bancada e autónoma), aplicação (investigação em ciências biológicas, descoberta de medicamentos, testes ambientais, testes alimentares, indústrias aplicadas, diagnósticos clínicos e outros), utilizador final (indústria farmacêutica, institutos académicos e de investigação, indústria alimentar e de bebidas, indústria petroquímica e outros), canal de distribuição (licitações diretas, vendas a retalho e outros) - tendências da indústria e previsão para 2032

Análise de mercado de espectrometria de massa

O mercado global de espectrometria de massa refere-se à indústria centrada no desenvolvimento, produção e aplicação de tecnologias de espectrometria de massa, que são ferramentas analíticas utilizadas para identificar a composição, estrutura e quantidade de substâncias químicas com base na sua relação massa-carga. O mercado é impulsionado pela crescente procura de ferramentas analíticas avançadas nas indústrias farmacêutica e biotecnológica para o desenvolvimento de medicamentos e controlo de qualidade, para além do crescente foco em testes ambientais e regulamentos de segurança alimentar. No entanto, o elevado custo dos instrumentos de espectrometria de massa continua a ser uma restrição significativa, limitando a adoção, principalmente entre os laboratórios de menor dimensão. Uma oportunidade está nos avanços tecnológicos, como os espectrómetros de massa híbridos e portáteis, que estão a expandir o alcance do mercado para novas aplicações, como os diagnósticos clínicos. Um dos principais desafios é a necessidade de profissionais qualificados para operar e manter sistemas complexos, o que pode dificultar a utilização eficiente e o crescimento do mercado.

Tamanho do mercado de espectrometria de massa

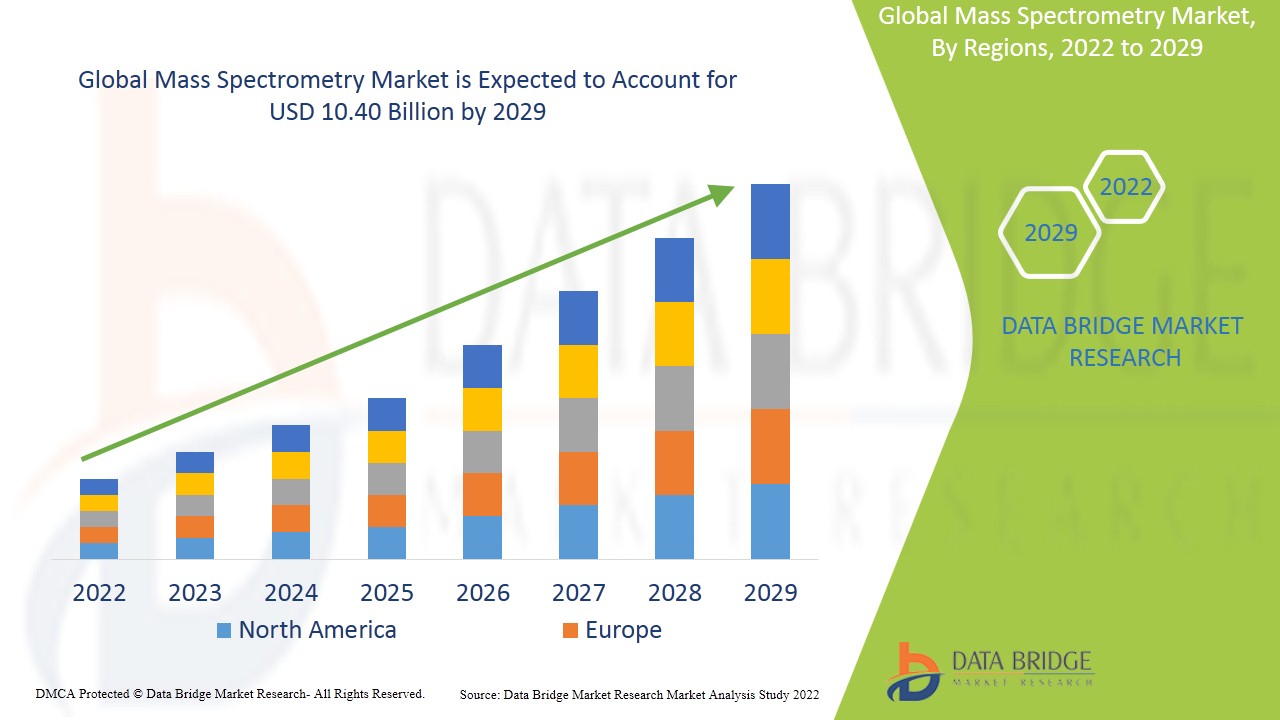

O tamanho do mercado global de espectrometria de massa foi avaliado em 6,76 mil milhões de dólares em 2024 e está projetado para atingir 13,06 mil milhões de dólares até 2032, com um CAGR de 8,58% durante o período previsto de 2025 a 2032. Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia , análise de pipeline, análise de preços e enquadramento regulamentar.

Tendências do mercado de espectrometria de massa

“Aumento da adoção nos diagnósticos clínicos”

A crescente adoção da espectrometria de massa nos diagnósticos clínicos é impulsionada pela sua capacidade de analisar amostras biológicas complexas, promovendo o avanço da medicina personalizada e do diagnóstico de doenças. Na proteómica, identifica e quantifica proteínas ligadas a doenças como o cancro, enquanto na metabolómica traça o perfil de alterações metabólicas associadas a condições como a diabetes e as doenças neurodegenerativas. A espectrometria de massa desempenha também um papel fundamental na descoberta de biomarcadores, permitindo a identificação de moléculas que sinalizam a presença ou progressão de doenças, apoiando o diagnóstico precoce e preciso. Esta tecnologia melhora o tratamento personalizado ao ajudar a adaptar as terapias ao perfil biológico único do paciente e está a avançar no diagnóstico não invasivo através da análise de fluidos como o hálito, urina ou saliva, melhorando o conforto e a adesão do paciente.

Âmbito do Relatório e Segmentação do Mercado da Espectrometria de Massas

|

Atributos |

Principais insights de mercado sobre espectrometria de massa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

EUA, Canadá e México, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Suíça, Turquia, Bélgica, Holanda e resto da Europa, China, Índia, Japão, Coreia do Sul, Indonésia, Tailândia, Malásia, Filipinas, Singapura, Austrália e Nova Zelândia e resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito, Israel e resto do Médio Oriente e África |

|

Principais participantes do mercado |

Thermo Fisher Scientific, Inc. (EUA), Shimadzu Corporation (Japão), Agilent Technologies, Inc. (EUA), Bruker Corp (EUA), Waters Corporation (EUA), Danaher Corporation (EUA), PerkinElmer, Inc. (EUA), Rigaku Corporation (Japão), JEOL Ltd. (EUA), LECO Corporation (EUA), Hiden Analytical (Reino Unido), Hitachi Ltd. (Japão), Kore Technology (Reino Unido), Ametek. Inc. (EUA) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia dos doentes, análise de pipeline, análise de preços e estrutura regulamentar. |

Definição de Mercado de Espectrometria de Massas

A espectrometria de massa (frequentemente abreviada como MS) é uma técnica analítica utilizada para medir a relação massa-carga de iões, permitindo a identificação e quantificação de compostos dentro de uma amostra. O processo envolve a ionização da amostra, normalmente através de métodos como o impacto de eletrões ou a ionização por eletrospray, e depois a aceleração dos iões num analisador de massa. Este analisador separa os iões com base nas suas proporções massa-carga, e os dados resultantes são utilizados para construir um espectro de massas que revela a composição, estrutura e concentração das moléculas presentes na amostra. A espectrometria de massa é amplamente utilizada em vários campos, incluindo a química, a bioquímica e a ciência ambiental, para aplicações como a análise de fármacos, a proteómica e a metabolómica.

Dinâmica do mercado da espectrometria de massa

Motoristas

- Avanços tecnológicos em espectrometria de massas

Os avanços tecnológicos na espectrometria de massa impulsionaram significativamente o crescimento do mercado global de espectrometria de massa, aumentando a precisão, a velocidade e a variedade de aplicações em vários setores. Inovações como o desenvolvimento de sistemas híbridos de espectrometria de massa, técnicas de ionização melhoradas e a integração de inteligência artificial (IA) e aprendizagem automática alargaram o âmbito da espectrometria de massa em áreas como os produtos farmacêuticos, a biotecnologia, a análise ambiental e a segurança alimentar. Estes avanços permitem uma deteção mais rápida e precisa das moléculas, permitindo aos investigadores realizar análises complexas com maior sensibilidade e fiabilidade. Além disso, a miniaturização dos dispositivos de espectrometria de massa facilitou a utilização de sistemas portáteis em diagnósticos no local de atendimento e testes de campo, alargando o seu alcance de mercado. As melhorias contínuas nas capacidades de software e análise de dados também tornaram a tecnologia mais acessível, permitindo o processamento e a automatização de dados em tempo real, o que reduz o erro humano e melhora a produtividade nos laboratórios, aumentando ainda mais a procura.

Por exemplo,

- Em junho de 2023, de acordo com o artigo publicado pela Bioanalysis Zone, inovações como o espectrómetro de massa Orbitrap Astral levaram a uma maior sensibilidade e rendimento, beneficiando particularmente áreas como a proteómica, o diagnóstico e a medicina personalizada. Além disso, análise de dados melhorada por IA, métodos melhorados para estudos de interação proteica e avanços na quantificação de biomarcadores. Estes avanços estão a impulsionar o progresso na descoberta de medicamentos, ensaios clínicos e diagnósticos de doenças, tornando a espectrometria de massa mais eficiente e escalável. Estes avanços tecnológicos atuam como um motor no crescimento do mercado

- Em julho de 2023, de acordo com o artigo publicado na Elsevier, os recentes avanços na espectrometria de massa nativa (nMS) melhoraram a sua capacidade de analisar biomoléculas. As técnicas de ionização melhorada, como a ionização por electrospray, preservam o estado nativo das proteínas, enquanto os analisadores de massa de alta resolução, como o Orbitrap e o FT-ICR, permitem medições de massa precisas de biomoléculas maiores. A espectrometria de massa ambiente permite análises in situ sem necessidade de preparação extensiva de amostras, expandindo as aplicações em diagnósticos clínicos e estudos ambientais. A integração do nMS com técnicas como a cromatografia melhora as capacidades de análise de dados, enquanto o software avançado facilita a interpretação de dados complexos. Estes desenvolvimentos impulsionam o progresso em áreas como a proteómica e a descoberta de fármacos, permitindo análises detalhadas de estruturas e interações biomoleculares

- Em agosto de 2023, de acordo com o artigo publicado na Academic Research, os avanços tecnológicos da espectrometria de massa (EM) nas tecnologias ómicas, enfatizando o seu impacto na genómica, proteómica, metabolómica e lipidómica. Os principais desenvolvimentos incluem analisadores de massa de alta resolução, como o Orbitrap e o FT-ICR, que aumentam a sensibilidade e a precisão na análise molecular. As técnicas de ionização melhorada, como o MALDI e a ionização por electrospray, facilitam a análise de diversas biomoléculas nos seus estados nativos. A aquisição independente de dados (DIA) permite a recolha abrangente de dados, melhorando a reprodutibilidade e a quantificação em misturas complexas. A integração da MS com outras tecnologias ómicas, juntamente com os avanços na microfluídica e na automação, simplifica a preparação das amostras e aumenta a eficiência. Software sofisticado para análise de dados auxilia na interpretação de conjuntos de dados complexos, tornando a EM uma ferramenta essencial na investigação ómica e impulsionando inovações na descoberta de biomarcadores e na medicina personalizada.

Os avanços na espectrometria de massa impulsionaram significativamente o seu mercado, melhorando a precisão, a velocidade e a versatilidade em diversos setores. Capacidades de deteção melhoradas, sistemas portáteis e processamento de dados mais inteligente tornaram a tecnologia mais acessível e eficiente, expandindo a sua utilização em investigação, diagnóstico e aplicações industriais, impulsionando, em última análise, o crescimento do mercado.

- Aplicações crescentes da espectrometria de massa (MS) em produtos farmacêuticos e biotecnologia

As crescentes aplicações da espectrometria de massa (EM) em produtos farmacêuticos e na biotecnologia são os principais impulsionadores da expansão do mercado global de espectrometria de massa. À medida que a indústria farmacêutica se concentra cada vez mais na descoberta e no desenvolvimento de medicamentos, a procura por técnicas analíticas avançadas tem aumentado. A EM desempenha um papel vital em várias fases do processo de desenvolvimento de medicamentos, incluindo a análise de pequenas moléculas, biofármacos e matrizes biológicas complexas, permitindo aos investigadores identificar e quantificar medicamentos, metabolitos e impurezas com elevada sensibilidade e especificidade. Além disso, os avanços na tecnologia de EM, como a integração de espectrometria de massa de alta resolução e técnicas de ionização inovadoras, facilitaram a triagem de alto rendimento e os estudos de metabolómica, simplificando assim os fluxos de trabalho e acelerando o tempo de colocação no mercado de novos produtos terapêuticos. As entidades reguladoras também reconheceram a fiabilidade da espectrometria de massa, levando à sua aceitação em conformidade com rigorosos padrões de segurança e eficácia. O surgimento da medicina personalizada, que exige a análise detalhada de biomarcadores e a criação de perfis de medicamentos específicos para cada paciente, veio alargar ainda mais a procura de espectrometria de massa no setor da biotecnologia. Esta convergência de avanços tecnológicos, apoio regulamentar e necessidades de saúde em evolução continua a impulsionar o crescimento do mercado global de espectrometria de massa, posicionando-o como uma ferramenta indispensável para a inovação em produtos farmacêuticos e biotecnologia.

Por exemplo,

- Em março de 2023, de acordo com o artigo publicado na Technology Networks, existe uma importância crescente da espectrometria de massa (EM) em aplicações farmacêuticas e biotecnológicas. A espectrometria de massa tem um papel essencial no desenvolvimento de medicamentos, no controlo de qualidade e na análise de produtos biofarmacêuticos. A tecnologia fornece insights detalhados sobre a estrutura e composição molecular, que são cruciais para garantir a eficácia e a segurança do produto. A procura por métodos analíticos mais sofisticados impulsiona a inovação na espectrometria de massas, contribuindo para a sua crescente utilização na caracterização de biomoléculas e bioprodutos

- Em setembro de 2023, de acordo com o artigo publicado na Elsevier, a espectrometria de massa quantitativa permite a medição precisa de biomoléculas, melhorando a caracterização de proteínas, peptídeos e metabolitos. Otimiza processos como a purificação e a formulação, garantindo maiores rendimentos e consistência. O crescente reconhecimento das agências reguladoras reforça ainda mais a sua utilização para validação de métodos. As aplicações da tecnologia de espectrometria de massa, como as características de alta resolução e o software de análise de dados, aumentam a sensibilidade e o rendimento, enquanto a integração com outras técnicas analíticas alarga o seu âmbito de aplicação. No geral, a espectrometria de massa quantitativa está a transformar o desenvolvimento e a fabricação biofarmacêutica

- Em julho de 2023, de acordo com o artigo publicado no NCBI, a espectrometria de massa (EM) é crucial na análise farmacêutica, aumentando a sensibilidade e a especificidade para detetar compostos de baixa abundância em amostras biológicas complexas. É utilizado em todos os estágios de desenvolvimento de medicamentos e suporta aplicações como a metabolómica e a proteómica. Existe uma importância crescente da espectrometria de massa (EM) nas aplicações farmacêuticas e biotecnológicas, particularmente na descoberta, desenvolvimento e controlo de qualidade de medicamentos. Realça a capacidade da tecnologia para analisar biomoléculas complexas, fornecendo dados precisos e sensíveis essenciais para os biofármacos modernos. Além disso, os avanços nas técnicas e instrumentação de EM estão a acelerar a investigação e a aumentar a produtividade, tornando-a uma ferramenta essencial para garantir a segurança e eficácia dos medicamentos.

A crescente utilização da espectrometria de massa (EM) em produtos farmacêuticos e na biotecnologia é um fator-chave que impulsiona o mercado global de espectrometria de massa. A sua capacidade de identificar e quantificar com precisão medicamentos e metabolitos, aliada aos avanços na tecnologia para o rastreio de alto rendimento, simplificou o desenvolvimento de medicamentos. O apoio regulamentar e a mudança para a medicina personalizada aumentam ainda mais a procura de EM, enfatizando o seu papel crucial na inovação nestes sectores.

Oportunidades

- Avanços na automação e inteligência artificial (IA) em espectrometria de massas

A integração da automação e da Inteligência Artificial (IA) na espectrometria de massa apresenta uma oportunidade transformadora para o mercado global. Os avanços na automatização agilizam o processamento e a análise de amostras, melhorando a produtividade e a eficiência nos laboratórios. Isto permite aos investigadores manipular volumes maiores de amostras e obter resultados mais rapidamente, acelerando assim os cronogramas de investigação. As ferramentas de análise de dados orientadas por IA podem melhorar significativamente a precisão e a velocidade da interpretação, permitindo que conjuntos de dados mais complexos sejam processados com maior precisão. Além disso, os algoritmos de aprendizagem automática podem otimizar as condições experimentais, resultando num melhor desempenho do instrumento e na redução dos custos operacionais. À medida que os laboratórios adotam cada vez mais estas tecnologias, a procura por sistemas avançados de espectrometria de massa que incorporem a automatização e a IA aumentará, impulsionando a inovação e a expansão do mercado em diversos campos, como produtos farmacêuticos, testes ambientais e diagnósticos clínicos.

Por exemplo,

- Em julho de 2024, de acordo com o artigo publicado na Science Direct, a aplicação da IA na interpretação de dados espectroscópicos está a evoluir rapidamente, permitindo a extração de insights valiosos de conjuntos de dados complexos. Este avanço tecnológico cria uma oportunidade significativa para o mercado global de espectrometria de massa ao melhorar as capacidades de análise de dados. A eficiência e a precisão melhoradas nos resultados impulsionarão a procura por sistemas avançados de espectrometria de massa, apoiando a inovação em vários setores, incluindo produtos farmacêuticos e testes ambientais

- Em junho de 2024, de acordo com o artigo publicado na Separation Science, a espectrometria de massa apresenta uma oportunidade única para a aprendizagem automática e a IA melhorarem a interpretação de dados. Devido à complexidade dos espectros de massa, é muitas vezes necessária uma análise especializada para extrair insights significativos, com muitos detalhes a permanecerem obscuros. No entanto, a IA destaca-se na identificação de padrões nestes dados. Ferramentas como o Prosit demonstraram o potencial da IA na previsão e deteção de peptídeos, destacando oportunidades de mercado significativas

Em fevereiro de 2024, de acordo com o artigo publicado no NCBI, a integração da aprendizagem automática (ML) na análise de espectrometria de massa (MS) ganhou força, com abordagens inovadoras a surgirem em todo o campo. À medida que a aprendizagem profunda e as redes neuronais artificiais (RNAs) são cada vez mais utilizadas, torna-se crucial avaliar e comparar estes métodos de ML. Esta convergência apresenta uma oportunidade significativa para o mercado global de espectrometria de massa, promovendo avanços e melhorando as capacidades analíticas

Em janeiro de 2024, de acordo com o artigo publicado no Science Direct, a aprendizagem automática utilizará modelos computacionais para extrair informações diretamente dos dados, transformando entradas brutas em insights acionáveis sem depender de equações predefinidas. A aplicação de vários modelos de IA a dados de espectrometria de massa produz resultados precisos num curto espaço de tempo, o que é particularmente valioso para o futuro processamento em voo de dados de espectrometria de massa. Este avanço representa uma oportunidade significativa para o mercado global de espectrometria de massa

O crescimento da automação e da inteligência artificial (IA) na espectrometria de massa oferece oportunidades significativas para o crescimento do mercado. A automatização melhora o processamento e a análise de amostras, aumentando a eficiência e a produtividade nos laboratórios. Esta capacidade permite resultados mais rápidos e o manuseamento de tamanhos de amostra maiores, acelerando assim os esforços de investigação. A análise de dados com tecnologia de IA melhora a precisão e a velocidade da interpretação, permitindo aos investigadores trabalhar com conjuntos de dados complexos de forma mais eficaz. Além disso, a aprendizagem automática pode otimizar as condições experimentais, melhorando o desempenho do instrumento e reduzindo os custos. À medida que mais laboratórios adotam estas tecnologias, a procura por sistemas avançados de espectrometria de massa que incorporem a automatização e a IA aumentará, impulsionando a inovação em setores como os produtos farmacêuticos, os testes ambientais e o diagnóstico clínico.

- Adoção crescente de espectrómetros de massa compactos e portáteis

A crescente adoção de espectrómetros de massa compactos e portáteis apresenta uma oportunidade significativa para o mercado global de espectrometria de massa. Estes dispositivos avançados facilitam a análise no local em diversas aplicações, como monitorização ambiental, testes de segurança alimentar e diagnósticos clínicos. O seu pequeno tamanho e design fácil de utilizar tornam-nos ideais para utilização em campo ou em locais remotos, permitindo resultados imediatos sem a necessidade de uma ampla infraestrutura laboratorial. À medida que as indústrias procuram maior eficiência e aquisição rápida de dados, espera-se que a procura por soluções portáteis de espectrometria de massa aumente. Esta tendência não só melhora as capacidades de diagnóstico, como também promove a inovação nas técnicas analíticas. Ao satisfazer a crescente necessidade de métodos de teste acessíveis e eficientes, os espectrómetros de massa compactos estão prontos para desempenhar um papel crucial no futuro do mercado da espectrometria de massa.

Por exemplo,

- Em novembro de 2022, de acordo com o artigo publicado no NCBI, a espectrometria de massa (EM) é um método analítico altamente informativo, essencial para vários estudos 'ómicos. No entanto, os espectrómetros de massa tradicionais são geralmente volumosos e requerem condições de alto vácuo, limitando a sua acessibilidade e utilização no campo. O desenvolvimento de espectrómetros de massa portáteis pode alargar significativamente a gama de aplicações e a base de utilizadores para a análise de MS, representando uma oportunidade significativa para o mercado global de espectrometria de massa

- Em maio de 2022, de acordo com o artigo publicado no Research Gate, o rápido avanço da ciência e da tecnologia tornou os espectrómetros de massa portáteis instrumentos analíticos essenciais para a investigação. A miniaturização e as aplicações de quatro tipos — espectrómetros de massa de setor magnético, de tempo de voo, quadrupolo e de armadilha de iões — demonstram o seu design compacto e a sua facilidade de utilização. Esta tendência destaca uma oportunidade significativa para o mercado global de espectrometria de massa

A crescente utilização de espectrómetros de massa compactos e portáteis cria uma oportunidade valiosa para o mercado global de espectrometria de massa. Estes dispositivos inovadores permitem análises no local em vários campos, incluindo monitorização ambiental, segurança alimentar e diagnóstico clínico. O seu pequeno tamanho e facilidade de utilização tornam-nos perfeitos para locais remotos, proporcionando resultados rápidos sem a necessidade de grandes configurações laboratoriais. À medida que as indústrias priorizam a eficiência e a recolha rápida de dados, a procura por estas soluções portáteis irá provavelmente aumentar. Esta tendência melhora as capacidades de diagnóstico e impulsiona a inovação em métodos analíticos, posicionando os espectrómetros de massa compactos como ferramentas vitais para o futuro do mercado da espectrometria de massa.

Restrições/Desafios

- Elevado custo da espectrometria de massa

O elevado custo dos sistemas de espectrometria de massa e as suas despesas operacionais associadas funcionam como uma restrição significativa no mercado global de espectrometria de massa, limitando a acessibilidade para muitos laboratórios, especialmente em economias emergentes e instituições de investigação mais pequenas. O investimento inicial necessário para instrumentos avançados de espectrometria de massa é substancial, abrangendo não só o preço de compra, mas também as despesas relacionadas com a instalação, manutenção e a necessidade de pessoal especializado para operar e interpretar os resultados. Além disso, os custos contínuos dos consumíveis, como reagentes e padrões de calibração, podem sobrecarregar ainda mais os orçamentos, tornando difícil para as organizações com recursos limitados adotar ou atualizar os seus recursos de espectrometria de massa. Esta barreira financeira pode dificultar a adoção de tecnologias de espectrometria de massa, particularmente em áreas que exigem soluções analíticas económicas, atrasando assim os avanços na investigação e aplicações clínicas. Consequentemente, apesar da crescente procura de espectrometria de massa em vários setores, o elevado custo associado a estas tecnologias continua a representar um desafio significativo, limitando potencialmente o crescimento do mercado e a utilização geral da espectrometria de massa em aplicações críticas.

Por exemplo,

- Em agosto de 2019, de acordo com o artigo publicado na American Chemical Society, um espectrómetro de massa triplo quadrupolo custa normalmente cerca de 350.000 dólares, embora isto possa variar de acordo com as suas características. Um instrumento de tempo de voo de alta resolução varia geralmente entre 350.000 e 400.000 dólares, enquanto um modelo de alcance de massa alargado da Orbitrap pode custar entre aproximadamente 400.000 e 800.000 dólares. O elevado custo da espectrometria de massa moderna atua como uma restrição ao crescimento do mercado

- Em julho de 2019, de acordo com o artigo publicado pelo Journal of Infectiology & Epidemiology, a espectrometria de massa MALDI-TOF oferece vantagens significativas na identificação rápida e precisa de microrganismos, mas o seu elevado custo continua a ser uma limitação substancial. O custo de aquisição e manutenção de equipamentos de espectrometria de massa, juntamente com a necessidade de formação e infraestruturas especializadas, representa uma barreira à adoção generalizada, especialmente em ambientes com recursos limitados

Os custos proibitivos dos sistemas de espectrometria de massa e as suas despesas operacionais contínuas servem como um obstáculo notável no mercado global de espectrometria de massa. O investimento inicial substancial necessário para instrumentos avançados, juntamente com uma elevada manutenção, consumíveis e a necessidade de pessoal qualificado, limita o acesso de muitas instituições de investigação e laboratórios mais pequenos, especialmente em regiões em desenvolvimento. Este encargo financeiro pode impedir que as organizações adotem ou melhorem os seus recursos de espectrometria de massa, atrasando, em última análise, o progresso na investigação e nas aplicações clínicas.

- Escassez de mão-de-obra qualificada

O mercado da espectrometria de massa enfrenta um desafio significativo devido à escassez de profissionais qualificados capazes de operar sistemas avançados de espectrometria de massa e interpretar dados complexos. A natureza complexa da espectrometria de massa exige formação e experiência especializadas, o que pode ser difícil de encontrar. Esta escassez não só limita a adoção da tecnologia de espectrometria de massa, uma vez que as organizações podem hesitar em investir sem pessoal qualificado, como também pode levar a resultados inconsistentes devido à variabilidade na qualidade e interpretação dos dados. Além disso, as empresas podem incorrer em maiores custos de formação para qualificar a equipa existente, sobrecarregando ainda mais os orçamentos operacionais. A falta de trabalhadores qualificados pode sufocar a inovação, uma vez que novas técnicas e aplicações podem ficar inexploradas, enquanto a experiência limitada cria estrangulamentos nos fluxos de trabalho, abrandando os processos de investigação e análise. Lidar com esta escassez de mão-de-obra é crucial para o crescimento e avanço contínuos do mercado da espectrometria de massa.

Por exemplo,

- Em fevereiro de 2023, de acordo com o artigo publicado na Biomedical Research Network, o setor da saúde está a enfrentar uma escassez crítica de profissionais essenciais de laboratório médico que trabalham nos bastidores. Esta falta de técnicos qualificados limita a operação eficaz e as capacidades de análise dos sistemas de espectrometria de massa. Como resultado, esta escassez atua como um desafio significativo, dificultando o crescimento e a adoção generalizada da espectrometria de massa em ambientes de cuidados de saúde.

- Em outubro de 2022, de acordo com o artigo publicado pela THG PUBLISHING PVT LTD, o Laboratório Regional de Exames Químicos em Kakkanad está a enfrentar desafios operacionais devido à escassez de pessoal e a equipamentos modernos inadequados. Esta situação reflete um problema mais amplo que afeta o mercado global de espectrometria de massa, onde restrições semelhantes podem prejudicar a eficiência e a eficácia do laboratório. Como resultado, esta deficiência de pessoal e equipamento constitui um desafio significativo ao crescimento do mercado

O mercado da espectrometria de massa é significativamente prejudicado pela escassez de profissionais qualificados, capazes de operar sistemas avançados e analisar dados complexos. Esta falta de conhecimento especializado restringe a adoção de tecnologia, uma vez que as organizações podem ter relutância em investir sem pessoal qualificado. Além disso, os resultados inconsistentes podem surgir de interpretações de dados variadas, e as empresas enfrentam custos de formação mais elevados para desenvolver a equipa existente. Esta lacuna de competências pode sufocar a inovação e criar estrangulamentos no fluxo de trabalho, abrandando a pesquisa e a análise. Lidar com a escassez de trabalhadores qualificados é essencial para o crescimento contínuo do mercado de espectrometria de massa.

Este relatório de mercado fornece detalhes dos novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise do crescimento estratégico do mercado, tamanho do mercado, crescimento do mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito de mercado da espectrometria de massa

O mercado está segmentado com base na tecnologia, modalidade, aplicação, utilizador final e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tecnologia

- Espectrometria de massas híbrida

- Orbitrap-MS

- FT-EM

- Outros

- Espectrometria de massa única

- Hora do voo

- Quadrupolo

- Outros

- Outros

Modalidade

- Bancada

- Autônomo

Aplicação

- Indústria Farmacêutica

- Institutos de Investigação e Acadêmicos

- Indústria alimentar e de bebidas

- Indústria Petroquímica

- Outros

Canal de Distribuição

- Licitações Diretas

- Vendas no retalho

- Outros

Análise regional do mercado de espectrometria de massa

O mercado é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tecnologia, modalidade, aplicação, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo mercado são os EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Holanda, Suíça, Turquia, Resto da Europa, China, Japão, Índia, Austrália, Coreia do Sul, Tailândia, Indonésia, Malásia, Singapura, Vietname, Filipinas, Resto da APAC, Brasil, Argentina, Resto da América do Sul, Arábia Saudita, África do Sul, Egito, Emirados Árabes Unidos, Israel, Resto do MEA.

Espera-se que a América do Norte domine o mercado devido à sua infraestrutura de investigação avançada, aos investimentos significativos em saúde e ciências biológicas e à elevada adoção de tecnologias de ponta, como a espectrometria de massa híbrida e em tandem. O forte apoio das iniciativas governamentais e das agências reguladoras promove a inovação e impulsiona o crescimento do mercado na região.

Prevê-se que a Ásia-Pacífico seja a região com o crescimento mais rápido devido aos rápidos avanços nas infraestruturas de saúde e ao aumento dos investimentos em investigação e desenvolvimento na região.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de espectrometria de massa

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado em espectrometria de massas que operam no mercado são:

- Thermo Fisher Scientific, Inc. (EUA)

- Shimadzu Corporation (Japão)

- Agilent Technologies, Inc. (EUA)

- Bruker Corp (EUA)

- Waters Corporation (EUA)

- Danaher Corporation (EUA)

- PerkinElmer, Inc.

- Corporação Rigaku

- JEOL Ltd. (Japão)

- Corporação LECO

- Hiden Analytical (Inglaterra)

- Hitachi Ltd. (Japão)

- Kore Technology (Reino Unido)

- Ametek. Inc. (EUA)

Últimos desenvolvimentos no mercado da espectrometria de massa

- Em outubro de 2024, a Waters Corporation lançou novos reagentes, enzimas e software de nível LC-MS para melhorar a análise de RNA para vacinas e terapias de mRNA. As ferramentas simplificam a confirmação da sequência e melhoram a sensibilidade, acelerando o desenvolvimento e garantindo a segurança e a eficácia dos produtos farmacêuticos baseados em RNA

- Em junho de 2024, a Agilent Technologies revelou o sistema GC/MS triplo quadrupolo 7010D e a célula ExD para o LC/Q-TOF AdvanceBio 6545XT na ASMS 2024, melhorando a sensibilidade, a caracterização estrutural e a eficiência analítica em segurança alimentar, testes ambientais e investigação biofarmacêutica.

- Em maio de 2024, a The Bruker Corp concluiu a aquisição da NanoString Technologies, adquirindo ativos importantes, incluindo as linhas de produtos nCounter, GeoMx, CosMx e AtoMx™ por aproximadamente 392,6 milhões de dólares. Este movimento estratégico melhorou as capacidades da Bruker em perfis de expressão genética e transcriptómica espacial para investigação

- Em outubro de 2023, a Waters Corporation estabeleceu uma parceria com a Universidade de San Agustin para estabelecer o primeiro centro de imagiologia de espectrometria de massa das Filipinas. Equipado com o SYNAPT HDMS, o centro pretende promover a descoberta de medicamentos naturais para o cancro e doenças infeciosas

- Em junho de 2023, a Agilent Technologies apresentou os sistemas de espectrometria de massa 6495D LC/TQ e Revident LC/Q-TOF na ASMS 2023, aumentando a sensibilidade e a eficiência para análises direcionadas. Os novos softwares MassHunter Explorer e ChemVista simplificam a exploração e identificação de dados, revolucionando os fluxos de trabalho em vários campos científicos

- Em maio de 2023, a Thermo Fisher e a BRIN estabeleceram uma parceria para melhorar as capacidades de investigação na Indonésia, com foco no avanço da inovação científica e na colaboração em ciências biológicas, biotecnologia e estudos ambientais para investigadores locais

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.