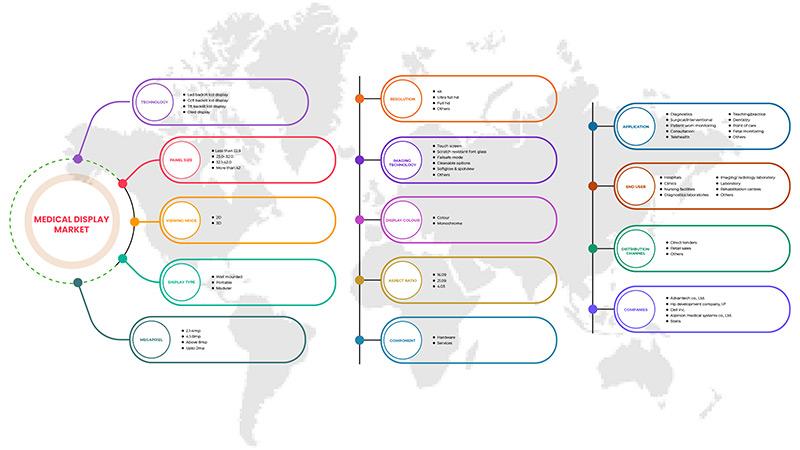

Global Medical Display Market, By Technology (LED-Backlit LCD Display, CCFL-Backlit LCD Display, TFT LCD Display And OLED Display), Panel Size (Under 22.9 Inch Panels, 23.0 - 32.0 Inch Panels, 27.0-41.9 Inch Panels and Above 42 Inch Panels), Viewing Mode (2D and 3D), Megapixel (UP TO 2MP, 2.1–4MP, 4.1–8MP and above 8MP), Resolution (4K, Ultra Full HD, Full HD and Others), Display Type (Wall Mounted, Portable, Modular), Imaging Technology (Touch Screen, Scratch Resistant Font Glass, Failsafe Mode, Cleanable Options, Softglow and Spotview And Others), Display Color (Colour, Monochrome), Aspect Ratio (16.09, 21.09, 4.03), Component (Hardware and Services), Application (Consultation, Diagnostic, Surgical/Interventional, Telehealth, Teaching / Practice, Fetal Monitoring, Dentistry, Point Of Care, Patient-Worn Monitoring And Others) End User (Hospitals, Clinics, Nursing Facilities, Diagnostic Laboratories, Imaging/Radiology Lab, Laboratory, Rehabilitation Centers And Others), Distribution Channel (Direct Tender, Retail Sales and Others) - Industry Trends and Forecast to 2029.

Medical Display Market Analysis and Insights

The main reasons for the growth of the medical display market is the rising demand for minimally invasive treatments (MIT) due to multiple benefits such as less post-operative pain, fewer operative, and major post-operative complications, shortened hospital stay, faster recovery times, less scarring, less stress on the immune system, smaller incision, and for some procedures it reduced operating time and reduced costs as well.

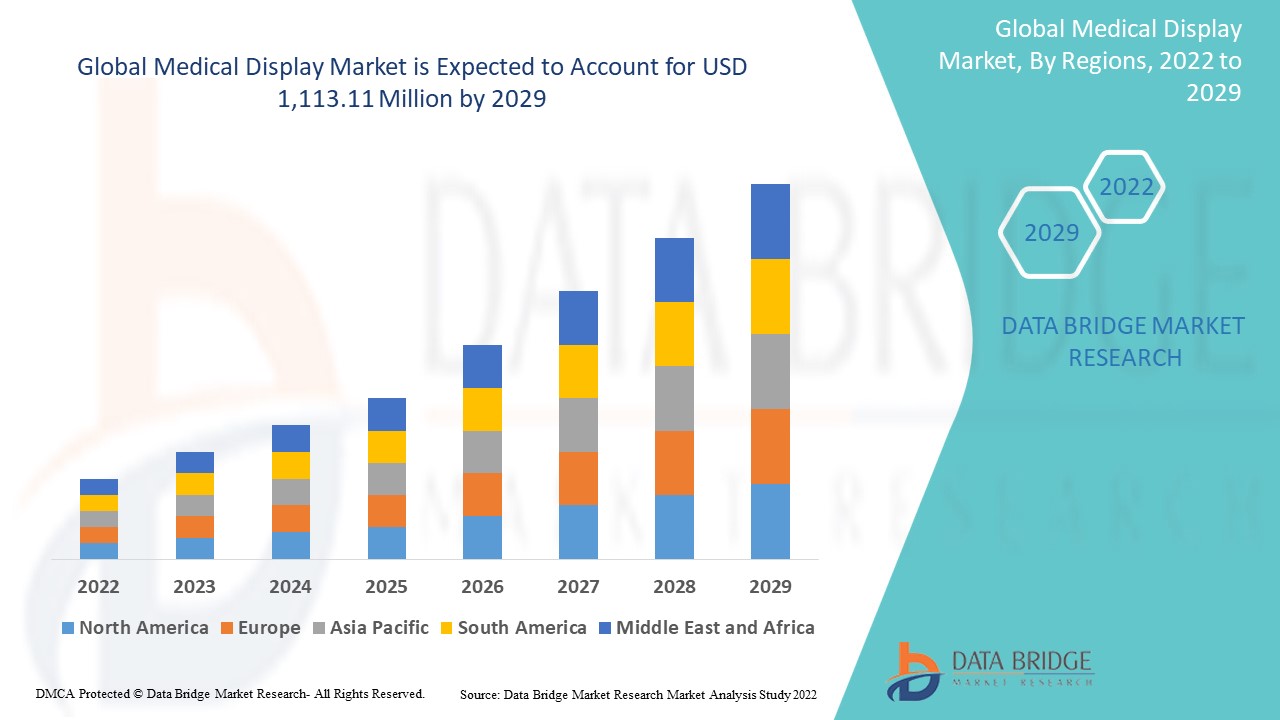

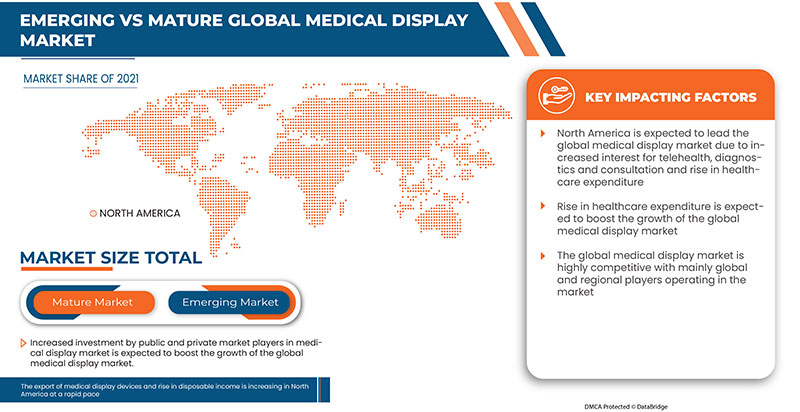

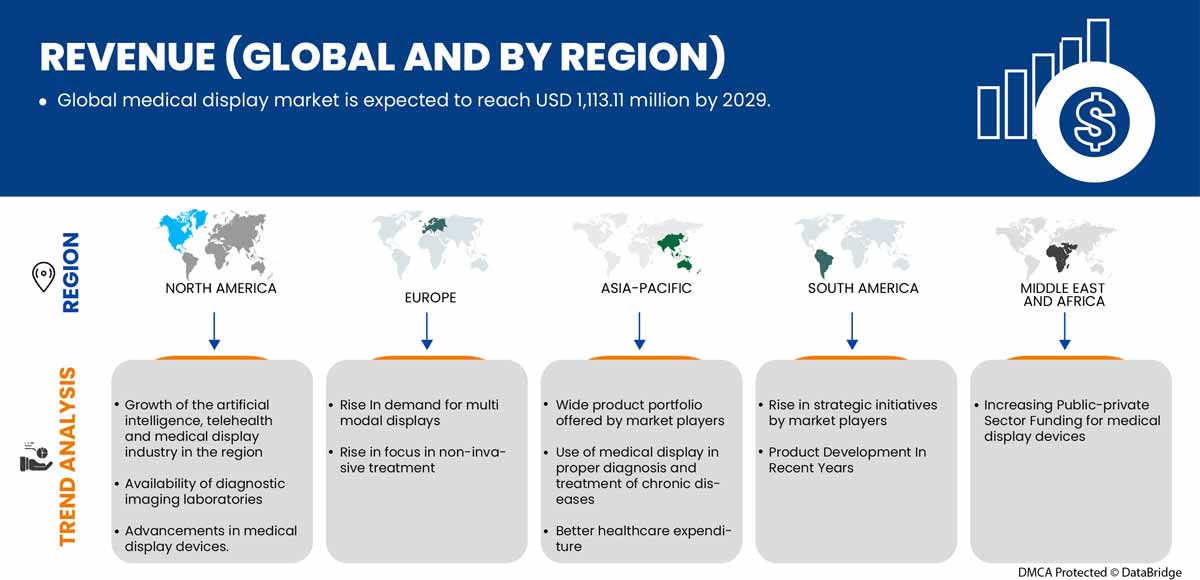

Data Bridge Market Research analyzes that the medical display market is expected to reach the value of USD 1,113.11 million by 2029, at a CAGR of 6.2% during the forecast period. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Technology (LED-Backlit Lcd Display, CCFL-Backlit LCD Display, TFT LCD Display And OLED Display), Panel Size (Under 22.9" Inch Panels, 23.0"- 32.0" Inch Panels, 27.0-41.9 Inch Panels and Above 42 Inch Panels), Viewing Mode (2D and 3D), Megapixel (UP TO 2MP, 2.1–4MP, 4.1–8MP and above 8MP), Resolution (4K, Ultra Full HD, Full HD and Others), Display Type (Wall Mounted, Portable, Modular), Imaging Technology (Touch Screen, Scratch Resistant Font Glass, Failsafe Mode, Cleanable Options, Softglow & Spotview And Others), Display Color (Colour, Monochrome), Aspect Ratio (16.09, 21.09, 4.03), Component (Hardware and Services), Application (Consultation, Diagnostic, Surgical/Interventional, Telehealth, Teaching / Practice, Fetal Monitoring, Dentistry, Point Of Care, Patient-Worn Monitoring And Others) End User (Hospitals, Clinics, Nursing Facilities, Diagnostic Laboratories, Imaging/Radiology Lab, Laboratory, Rehabilitation Centers And Others), Distribution Channel (Direct Tender, Retail Sales and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Switzerland, Netherlands, Turkey, Belgium, Rest of Europe, China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E, Israel, Egypt, Rest of Middle East & Africa |

|

Market Players Covered |

BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial &Trading Co,Ltd, COJE CO.,LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, L.P., Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips N.V., EIZO INC., Novanta Inc. , FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, among others. |

Medical Display Market Definition

A medical display is a monitor that meets the high demands of medical imaging. It usually comes with special image-enhancing technologies to ensure consistent brightness over the lifetime of the display, noise-free images, ergonomic reading and automated compliance with digital imaging and communications in medicine (DICOM) and other medical standards.

The development of medical imaging technologies has progressed healthcare, providing powerful diagnostic tools, supporting the non-invasive assessment of injuries and internal issues, and enabling diseases to be detected far earlier than ever before. Medical displays are preferred over consumer displays when used for medical imaging. The reason is simple: medical displays meet set requirements for image quality, medical regulations, and quality assurance.

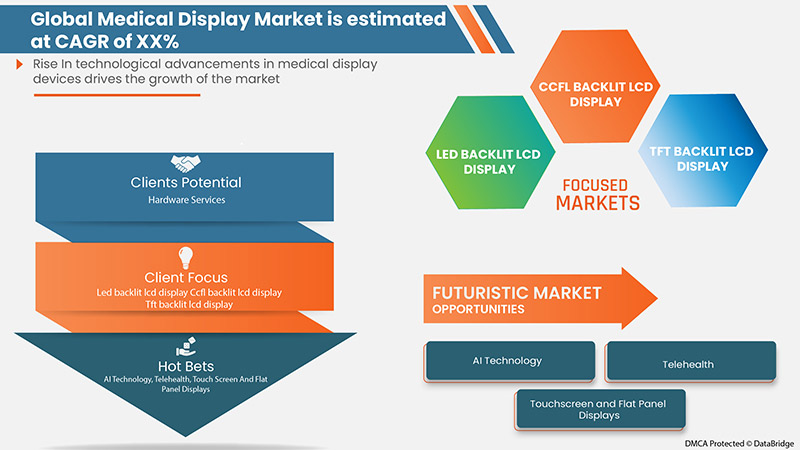

The future of medical display devices are based on the developments in artificial intelligence (AI) and data analytics. Medical devices are advancing disease management by allowing clinicians to personalize medicine like never before. These technologies provide revelatory insights into individual patients in real-time.

Medical Display Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- The Growing Trend Towards Minimally Invasive Treatment

The main reasons for the growth of the global medical display market is the rising demand for minimally invasive treatments (MIT) due to multiple benefits such as less post-operative pain, fewer operative, and major post-operative complications, shortened hospital stay, faster recovery times, less scarring, less stress on the immune system, smaller incision, and for some procedures it reduced operating time and reduced costs as well.

Minimal invasive surgery is an excellent approach for diagnosing and treating a wide range of thoracic disorders that previously required sternotomy or open thoracotomy. The prevalence of chronic diseases requiring surgery has increased worldwide. Due to the many advantages of minimally invasive treatment, many patients prefer it. In addition, vascular and endovascular surgeries, neurological and spinal surgeries, orthopedic trauma care, and cardiac surgeries are performed in hybrid operating rooms. This feature allows hospitals to perform advanced surgical operations, which increases the demand for medical displays. In addition, increasing healthcare costs and the number of pathology and radiology laboratories drive the demand for medical monitors.

Minimally invasive surgery allows surgeons to use modern technology and advanced surgical techniques to operate on the human body in a less harmful way. This is expected to boost the demand for minimally invasive surgeries.

- Growing Healthcare Infrastructure

Governments and non-profit organizations in several countries mainly focus on developing health infrastructure to minimize disease burden and provide better health services. In addition, the adoption of technologically advanced medical devices, screens, monitors, and various other devices has increased. All such factors are likely to create favorable opportunities for market growth during the forecast period. In addition, heavy investments by key players in innovative product launches and updated features in the coming years can also boost the market.

Além disso, prevê-se que a crescente procura de serviços de saúde rentáveis, a crescente procura de soluções técnicas, a crescente mobilidade da informação, o aumento das iniciativas e incentivos governamentais e o aumento do financiamento para exposições médicas de alta qualidade em hospitais e centros de investigação impulsionem estes cuidados de saúde. A infraestrutura de software médico constituiu a base para os avanços recentes em monitores médicos, bibliotecas médicas digitais e sistemas de informação de gestão. Espera-se que estes fatores impulsionem o crescimento do mercado global de monitores médicos.

Oportunidade

- Avanços tecnológicos nos instrumentos de exibição médica

À medida que o foco do mercado se volta para a produção de formas farmacêuticas de administração oral, existe uma luta constante para desenvolver formulações apropriadas de novas moléculas que permitam a administração oral e, simultaneamente, garantam que o medicamento tem uma biodisponibilidade ideal nos doentes. Para ultrapassar isto, os fabricantes de excipientes farmacêuticos estão a desenvolver produtos mais fáceis e a reduzir o tempo e o custo de desenvolvimento. O desenvolvimento de tecnologias de exibição médica mudou o setor da saúde, fornecendo ferramentas de diagnóstico, telessaúde, fornecendo suporte para o tratamento não invasivo, permitindo que as doenças sejam avaliadas e detetadas mais precocemente.

O lançamento de desenvolvimentos tecnológicos em dispositivos de visualização médica está a melhorar a eficiência dos dispositivos de visualização médica e a aumentar a facilidade de utilização dos mesmos. O aumento das aplicações tecnológicas em dispositivos de ecrã médico resultaria em menos força de trabalho e num diagnóstico e recuperação rápidos de doenças. No futuro, a tecnologia de inteligência artificial irá substituir o mercado dos ecrãs médicos. Espera-se que este fator atue como uma oportunidade para o crescimento do mercado global de monitores médicos no período previsto.

Restrição/Desafios

- Custos elevados de dispositivos de exibição médica

O elevado custo dos dispositivos de visualização e a elevada implementação são os principais fatores que restringem o crescimento do mercado, especialmente em países onde o cenário de reembolso é mau. A maioria das unidades de saúde dos países em desenvolvimento, como hospitais e centros de diagnóstico, não podem pagar estes dispositivos devido aos elevados custos de instalação e manutenção e devido ao elevado custo destes equipamentos médicos e aos baixos recursos financeiros, as unidades de saúde nos países emergentes mostram-se relutantes em investir em novos sistemas tecnologicamente avançados. Estes fatores podem dificultar a digitalização nas unidades de saúde e ter impacto na adoção de tecnologias avançadas para diagnóstico e análise.

O avanço da tecnologia que leva ao desenvolvimento de dispositivos de visualização avançados e inovadores aumenta o custo dos dispositivos. Desta forma, espera-se que o elevado custo dos dispositivos de visualização restrinja o crescimento do mercado.

Desenvolvimentos recentes

- Em junho de 2022, a EIZO Corporation lançou o RadiForce MX243W – um monitor de 24,1 polegadas e 2,3 megapixéis (1920 x 1200 pixéis). O monitor de 24,1 polegadas e 2,3 megapixéis (1920 x 1200 pixéis) foi concebido para uma monitorização cuidadosa e diagnóstico da fisiologia completa do sistema do paciente em clínicas e hospitais. O lançamento resultou na adição de um novo dispositivo médico ao portefólio e ofereceu uma pureza de mercado excecional

- Em maio de 2021, a Barco lançou o monitor médico Nio Fusion de 12 MP. O lançamento do produto resultou num portfólio de produtos melhorado e num aumento das vendas e expansão da linha de produtos de exposição médica na América do Norte e na Europa

Âmbito do mercado global de displays médicos

O mercado global de ecrãs médicos está categorizado em treze segmentos notáveis que se baseiam na tecnologia, tamanho do painel, modo de visualização, megapixel, resolução, tipo de ecrã, tecnologia de imagem, cor do ecrã, proporção, componente, aplicação, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

MERCADO GLOBAL DE DISPLAY MÉDICO, POR TECNOLOGIA

- ECRÃ LCD COM ILUMINAÇÃO LED

- ECRÃ LCD COM RETROILUMINAÇÃO CCFL

- ECRÃ LCD TFT

- TELA OLED

Com base na tecnologia, o mercado dos ecrãs médicos está segmentado em ecrãs LCD com retroiluminação LED, ecrãs LCD com retroiluminação CCFL, ecrãs LCD TFT e ecrãs OLED.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR TAMANHO DE PAINEL

- PAINÉIS COM MENOS DE 22,9 POLEGADAS

- PAINÉIS DE 23,0-26,9 POLEGADAS

- PAINÉIS DE 27,0-41,9 POLEGADAS

- PAINÉIS ACIMA DE 42 POLEGADAS

Com base no tamanho do painel, o mercado dos displays médicos está segmentado em painéis inferiores a 22,9 polegadas, painéis de 23,0" a 32,0" polegadas, painéis de 27,0 a 41,9 polegadas e painéis maiores que 42 polegadas.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR MODO DE VISUALIZAÇÃO

- 2D

- 3D

Com base no modo de visualização, o mercado dos ecrãs médicos está segmentado em 2D e 3D.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR MEGAPIXEL

- ATÉ 2MP

- 2,1–4 MP

- 4,1–8 MP

- ACIMA DE 8MP

Com base nos megapíxeis, o mercado dos ecrãs médicos está segmentado em ATÉ 2 MP, 2,1–4 MP, 4,1–8 MP e acima de 8 MP.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR RESOLUÇÃO

- FULL HD

- UTRA FULL HD

- 4K

- OUTROS

Com base na resolução, o mercado dos monitores médicos está segmentado em full HD, ultra-full HD, 4K e outros.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR TIPO DE EXIBIÇÃO

- MONTADO NA PAREDE

- PORTÁTIL

- MODULAR

Com base no tipo de display, o mercado dos displays médicos está segmentado em de parede, portáteis e modulares.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR TECNOLOGIA DE IMAGEM

- TELA DE TOQUE

- VIDRO DE FONTE RESISTENTE A RISCOS

- MODO À PROVA DE FALHAS

- OPÇÕES LIMPA-SE

- SOFTGLOW E SPOTVIEW

- OUTROS

Com base na tecnologia de imagem, o mercado dos monitores médicos está segmentado em ecrã táctil, vidro de fonte resistente a riscos, modo à prova de falhas, opções laváveis, softglow e spotview, entre outros.

MERCADO GLOBAL DE DISPLAY MÉDICO, POR COR DO DISPLAY

- COR

- MONOCROMÁTICO

Com base na cor da tela, o mercado das telas médicas está segmentado em coloridas e monocromáticas.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR PROPORÇÃO DE ASPECTO

- 16:09

- 21:09

- 4:03

Com base no rácio, o mercado de monitores médicos está segmentado em 16:09, 21:09 e 4:03.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR COMPONENTE

- HARDWARE

- SERVIÇOS

Com base no componente, o mercado de monitores médicos está segmentado em hardware e serviços.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR APLICAÇÃO

- DIAGNÓSTICO

- CIRÚRGICO/INTERVENCIONAL

- MONITORIZAÇÃO UTILIZADA PELO PACIENTE

- CONSULTA

- TELESSAÚDE

- ENSINO/PRÁTICA

- ODONTOLOGIA

- PONTO DE ATENDIMENTO

- MONITORIZAÇÃO FETAL

- OUTROS

Com base na aplicação, o mercado de monitores médicos está segmentado em consulta, diagnóstico, cirúrgico/intervencionista, telessaúde, ensino/prática, monitorização fetal, medicina dentária, ponto de atendimento, monitorização utilizada pelo paciente e outros.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR UTILIZADOR FINAL

- HOSPITAIS

- POR TECNOLOGIA

- CLÍNICAS

- INSTALAÇÕES DE ENFERMAGEM

- LABORATÓRIOS DE DIAGNÓSTICO

- LABORATÓRIO DE IMAGEM/RADIOLOGIA

- LABORATÓRIO

- CENTROS DE REABILITAÇÃO

- OUTROS

Com base no utilizador final, o mercado de monitores médicos está segmentado em hospitais, clínicas, unidades de enfermagem, laboratórios de diagnóstico, laboratórios de imagiologia/radiologia, laboratórios, centros de reabilitação e outros.

MERCADO GLOBAL DE EXIBIÇÃO MÉDICA, POR CANAL DE DISTRIBUIÇÃO

- LICITAÇÃO DIRETA

- VENDAS NO VAREJO

- OUTROS

Com base no canal de distribuição, o mercado de expositores médicos está segmentado em licitação direta, vendas a retalho e outros.

Análise/Insights regionais do mercado de ecrãs médicos

O mercado de displays médicos é analisado e são fornecidas informações sobre o tamanho do mercado: tecnologia, tamanho do painel, modo de visualização, megapixéis, resolução, tipo de display, tecnologia de imagem, cor do display, proporção, componente, aplicação, utilizador final e canal de distribuição.

Os países abrangidos neste relatório de mercado são os EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Suíça, Países Baixos, Turquia, Bélgica, Resto da Europa, China, Japão, Índia, Austrália, Coreia do Sul , Singapura , Tailândia, Malásia, Indonésia, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito e Resto do Médio Oriente e África.

Espera-se que a Ásia-Pacífico domine o mercado, uma vez que é o maior mercado de dispositivos médicos do mundo. A China domina a região da Ásia-Pacífico devido ao rápido crescimento do mercado de cuidados de saúde, juntamente com o aumento da produção de ecrãs médicos.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado dos displays médicos

The medical display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the medical display market.

Some of the major players operating in the market are BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial &Trading Co,Ltd, COJE CO.,LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, L.P., Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips N.V., EIZO INC., Novanta Inc. , FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, among others.

Research Methodology: Medical Display Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE GLOBAL MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: GLOBAL MEDICAL DISPLAY MARKET

5 GLOBAL MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 GLOBAL MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 GLOBAL MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 GLOBAL MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 GLOBAL MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 GLOBAL MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 GLOBAL MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 GLOBAL MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 GLOBAL MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 GLOBAL MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 GLOBAL MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 GLOBAL MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 GLOBAL MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 OVERVIEW

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 ASIA-PACIFIC

20.3.1 CHINA

20.3.2 JAPAN

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 MALAYSIA

20.3.9 INDONESIA

20.3.10 PHILIPPINES

20.3.11 REST OF ASIA-PACIFIC

20.4 EUROPE

20.4.1 GERMANY

20.4.2 FRANCE

20.4.3 U.K.

20.4.4 ITALY

20.4.5 RUSSIA

20.4.6 SPAIN

20.4.7 TURKEY

20.4.8 NETHERLANDS

20.4.9 SWITZERLAND

20.4.10 BELGIUM

20.4.11 REST OF EUROPE

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 SAUDI ARABIA

20.6.3 U.A.E

20.6.4 EGYPT

20.6.5 ISRAEL

20.6.6 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 GLOBAL DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 GLOBAL BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 GLOBAL SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 GLOBAL BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 GLOBAL PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 GLOBAL CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 GLOBAL TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 GLOBAL TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 GLOBAL TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 GLOBAL TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 GLOBAL DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 GLOBAL DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 GLOBAL POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 GLOBAL POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 GLOBAL FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 GLOBAL FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 GLOBAL MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GLOBAL HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 GLOBAL HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 GLOBAL BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 GLOBAL BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 GLOBAL CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 GLOBAL CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 GLOBAL NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 GLOBAL NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 GLOBAL DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 GLOBAL DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 GLOBAL IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 GLOBAL LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 GLOBAL LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 GLOBAL REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 GLOBAL REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 GLOBAL MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 GLOBAL TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 GLOBAL SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 GLOBAL FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 GLOBAL CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 GLOBAL SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 GLOBAL MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 GLOBAL 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 GLOBAL 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 GLOBAL 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 GLOBAL MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 GLOBAL DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 GLOBAL RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 GLOBAL OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 GLOBAL MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 GLOBAL MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 GLOBAL MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MEDICAL DISPLAYMARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL MEDICAL DISPLAY MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE GLOBAL MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR MEDICAL DISPLAY AND ASIA-PACIFIC IS ESTIMATED TO BE INCREASING WITH A STRONG CAGR IN THE FORECAST PERIOD FROM 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MEDICAL DISPLAY MARKET

FIGURE 17 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 18 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 19 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 20 GLOBAL MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 21 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 22 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 23 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 24 GLOBAL MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 25 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 26 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 27 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 28 GLOBAL MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 29 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 30 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 31 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 32 GLOBAL MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 33 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 34 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 35 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 36 GLOBAL MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 37 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 38 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 39 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 40 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 41 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 42 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 43 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 44 GLOBAL MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 45 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 46 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 47 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 48 GLOBAL MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 49 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 50 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 51 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 52 GLOBAL MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 53 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 54 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 55 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 56 GLOBAL MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 57 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 58 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 59 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 60 GLOBAL MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 61 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 62 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 63 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 64 GLOBAL MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 65 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 66 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 67 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 68 GLOBAL MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 69 GLOBAL MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 70 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2021)

FIGURE 71 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2022 & 2029)

FIGURE 72 GLOBAL MEDICAL DISPLAY MARKET: BY REGION (2021 & 2029)

FIGURE 73 GLOBAL MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 74 NORTH AMERICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 75 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 76 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 77 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 78 NORTH AMERICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 79 ASIA-PACIFIC MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 80 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 81 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 82 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 83 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 84 EUROPE MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 85 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 86 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 87 EUROPE MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 88 EUROPE MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 89 SOUTH AMERICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 90 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 91 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 92 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 93 SOUTH AMERICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 94 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 95 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 96 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 97 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 98 GLOBAL MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 99 NORTH AMERICA MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 100 EUROPE MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

FIGURE 101 ASIA-PACIFIC MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.