Global Metal Finishing Chemicals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.70 Billion

USD

16.36 Billion

2024

2032

USD

10.70 Billion

USD

16.36 Billion

2024

2032

| 2025 –2032 | |

| USD 10.70 Billion | |

| USD 16.36 Billion | |

|

|

|

|

Global Metal Finishing Chemicals Market Segmentation, By Type (Plating Chemicals, Proprietary Chemicals, Cleaning Chemicals, Conversion Coating Chemicals), Process (Electroplating, Plating, Anodizing, Carbonizing, Polishing, Thermal Or Plasma Spray Coating, Others), Material (Zinc, Nickel, Chromium, Aluminum, Copper, Precious Metals, Others), End-Use Industry (Automotive, Electrical & Electronics, Industrial Machinery, Aerospace & Defence, Construction, Others)- Industry Trends and Forecast to 2032

Metal Finishing Chemicals Market Size

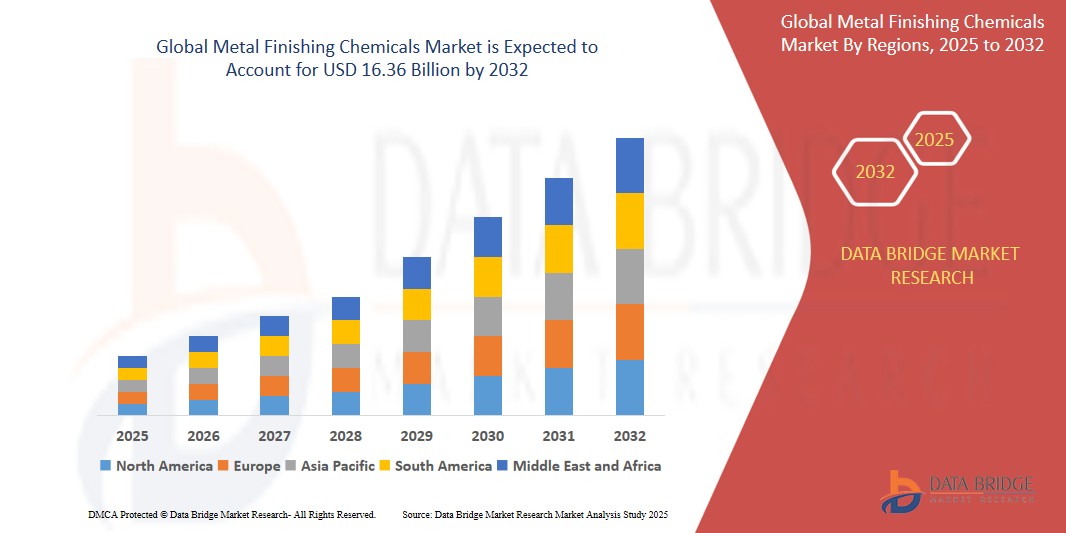

- The global Metal Finishing Chemicals market was valued atUSD 10.70 billion in 2024 and is expected to reachUSD 16.36 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of5.45%, primarily driven by the growing number of applications from automotive industry.

- This growth is driven by factors such as the rise in the usages of chemicals in aerospace maintenance, repair and overhauls.

Metal Finishing Chemicals Market Analysis

- Metal Finishing Chemicals are essential materials used to improve the surface properties of metal components, providing corrosion resistance, enhancing appearance, and ensuring durability across industries like automotive, aerospace, electronics, and construction. They are vital for processes such as electroplating, anodizing, and polishing.

- The demand for these chemicals is significantly driven by the rising need for high-performance and corrosion-resistant materials, especially in automotive lightweighting and the growing electronics sector. Over half of the global demand is fueled by industries pushing for enhanced surface functionality and environmental compliance, particularly in automotive manufacturing and consumer electronics.

- The Asia-Pacific region stands out as one of the dominant regions for Metal Finishing Chemicals, driven by rapid industrialization, a booming automotive sector, and increasing manufacturing activities across countries like China, India, and Japan.

- For instance, China leads the global electroplating and surface treatment market, with strong government support for expanding manufacturing capabilities and stringent environmental regulations encouraging the use of advanced metal finishing technologies.

- Globally, Metal Finishing Chemicals rank as one of the most crucial chemical categories in surface engineering, second only to industrial coatings, and play a pivotal role in enhancing the longevity, aesthetics, and functionality of critical metal components across multiple industries.

Report Scope and Metal Finishing Chemicals Market Segmentation

|

Attributes |

Metal Finishing Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• DOW (U.S.) • NOF CORPORATION (Japan) • ELEMENTIS PLC (United Kingdom) • Atotech (Germany) • Chemetall GmbH (Germany) • Coral (India) • Houghton International Inc. (U.S.) • McGean-Rohco Inc. (U.S.) • A Brite Company (U.S.) • COVENTYA International (France) • C.Uyemura & CO., LTD. (Japan) • Grauer & Weil (India) Limited (India) • Henkel Adhesives Technologies India Private Limited (India) • Industrial Metal Finishing, Inc. (U.S.) • Metal Finishing Technologies, LLC (U.S.) • Quaker Chemical Corporation (U.S.) • RASCHIG GmbH (Germany) • Wuhan Jadechem International Trade Co., Ltd. (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metal Finishing Chemicals Market Trends

“Shift Towards Eco-friendly and Sustainable Metal Finishing Solutions”

- One prominent trend in the global Metal Finishing Chemicals market is the increasing shift toward eco-friendly and sustainable solutions.

- This trend is driven by rising environmental regulations and the growing demand for green manufacturing practices across industries such as automotive, aerospace, and electronics.

- For instance, chromium-free coatings and water-based chemicals are becoming more popular due to their lower environmental impact and regulatory compliance. These sustainable options help manufacturers reduce their carbon footprint and align with global sustainability goals.

- In addition, the development of biodegradable and non-toxic chemicals is providing an opportunity for companies to meet stricter environmental standards while offering high-performance results.

- This trend is reshaping the metal finishing landscape, driving the demand for more sustainable practices and leading to increased market growth for eco-friendly chemicals.

Metal Finishing Chemicals Market Dynamics

Driver

“Increasing Demand for High-Performance Materials in Manufacturing”

- The growing demand for high-performance materials in industries such as automotive, aerospace, and electronics is significantly driving the need for advanced Metal Finishing Chemicals.

- As industries strive for lighter, stronger, and more durable materials, the role of metal finishing chemicals becomes crucial in improving corrosion resistance, surface hardness, and overall appearance.

- Automotive manufacturers, for example, are pushing for materials that reduce weight while maintaining strength and durability, which in turn demands advanced coating solutions.

- Additionally, the aerospace sector requires finishing solutions that can withstand extreme temperatures and environments, further increasing demand for specialized metal finishing chemicals.

For instance,

- In July 2024, according to the International Energy Agency (IEA), the global automotive industry's focus on electric vehicle production is driving the need for lighter metal components. This, in turn, boosts the demand for advanced surface treatment solutions, including coatings and electroplating, to improve the durability and performance of metals.

- In June 2023, the aerospace sector reported a surge in demand for high-quality, corrosion-resistant materials that are critical for maintaining the safety and efficiency of aircraft, a trend that directly impacts the demand for metal finishing chemicals.

Opportunity

“Growth of Eco-friendly and Sustainable Finishing Solutions”

- As global environmental regulations tighten and industries seek sustainable manufacturing processes, there is a significant opportunity for the development and adoption of eco-friendly metal finishing chemicals.

- Manufacturers are increasingly focusing on solutions that are water-based, biodegradable, and chromium-free, which are not only safer for the environment but also align with green certifications and regulatory requirements.

- The automotive and electronics industries, in particular, are looking for alternatives to toxic chemicals like hexavalent chromium, which has led to the rise of eco-friendly coatings and non-toxic finishing agents.

For instance,

- In July 2023, the European Union introduced stricter regulations on hazardous chemicals in manufacturing processes, leading to a shift toward sustainable and eco-friendly alternatives in surface treatments. This regulatory shift creates significant opportunities for companies to innovate in sustainable metal finishing chemicals.

- In December 2022, automotive manufacturers in the U.S. announced their commitment to reducing environmental impact, pushing for increased use of water-based and environmentally friendly finishing chemicals in vehicle production.

Restraint/Challenge

“High Production Costs and Regulatory Compliance”

- The production of advanced metal finishing chemicals involves high research and development costs, especially when creating eco-friendly or specialized chemical formulations.

- Compliance with increasingly stringent environmental regulations also adds to operational costs for manufacturers, particularly those producing chromium-free, biodegradable, or low-VOC products.

- These factors can increase the final cost of metal finishing chemicals, limiting their adoption, particularly in cost-sensitive industries or regions with less developed regulatory standards.

For instance,

- In August 2024, a report by Chemical Engineering News highlighted that the production of eco-friendly metal finishing chemicals is 20-30% more expensive than conventional chemical alternatives, which could impact the price competitiveness of manufacturers in markets with low cost tolerance.

Metal Finishing Chemicals Market Scope

The market is segmented on the basis Type, Process, Material, End-Use Industry,

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Process |

|

|

By End-Use Industry

|

|

|

By Material |

|

Metal Finishing Chemicals Market Regional Analysis

“North America is the Dominant Region in the Metal Finishing Chemicals Market”

- North America dominates the Metal Finishing Chemicals market, driven by advanced manufacturing capabilities, technological innovations, and a robust industrial base, particularly in industries such as automotive, aerospace, and electronics.

- The U.S. holds a significant market share due to the high demand for high-performance materials that require specialized metal finishing treatments, such as coatings for corrosion resistance, surface hardening, and aesthetic enhancement.

- The region’s strong regulatory framework and emphasis on advanced manufacturing processes, along with a significant presence of leading metal finishing chemical producers, contribute to the market’s dominance.

- Additionally, the growing emphasis on sustainability and eco-friendly chemical alternatives in the U.S. and Canada is further driving the demand for innovative metal finishing solutions.

- The automotive industry’s push for lightweight, durable materials and the aerospace sector’s need for corrosion-resistant finishes are significant factors fueling the region’s dominance in the global market.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific (APAC) region is expected to witness the highest growth rate in the Metal Finishing Chemicals market, fueled by rapid industrialization, growing manufacturing sectors, and increasing demand for high-quality materials in the automotive, electronics, and consumer goods industries.

- China and India are emerging as key markets, driven by their large manufacturing bases and growing adoption of high-performance materials in sectors like automotive and electronics.

- China, being a global manufacturing hub, demands advanced surface treatment chemicals to meet the high standards required for precision components in industries such as automotive and electronics. The increasing push for sustainable practices in Chinese manufacturing is further contributing to the market’s growth.

- Japan, with its advanced manufacturing technologies and strong industrial base in electronics and automotive, is a crucial market for specialized metal finishing chemicals. Japan continues to adopt innovative metal finishing solutions, particularly those that enhance corrosion resistance and surface durability in precision-engineered products.

- The growing demand for eco-friendly and sustainable chemical solutions across APAC, coupled with government initiatives promoting high-tech manufacturing, positions this region for continued market expansion in the coming years.

Metal Finishing Chemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Type dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DOW (U.S.)

- NOF CORPORATION (Japan)

- ELEMENTIS PLC (United Kingdom)

- Atotech (Germany)

- Chemetall GmbH (Germany)

- Coral (India)

- Houghton International Inc. (U.S.)

- McGean-Rohco Inc. (U.S.)

- A Brite Company (U.S.)

- COVENTYA International (France)

- C.Uyemura & CO., LTD. (Japan)

- Grauer & Weil (India) Limited (India)

- Henkel Adhesives Technologies India Private Limited (India)

- Industrial Metal Finishing, Inc. (U.S.)

- Metal Finishing Technologies, LLC (U.S.)

- Quaker Chemical Corporation (U.S.)

- RASCHIG GmbH (Germany)

- Wuhan Jadechem International Trade Co., Ltd. (China)

Latest Developments in Global Metal Finishing Chemicals Market

- In March 2025, Elementis PLC, a global leader in metal finishing chemicals, announced the launch of its new eco-friendly, chromium-free surface treatment solutions. These new formulations meet increasingly stringent environmental regulations while offering high-performance properties such as enhanced corrosion resistance and durability. The products are aimed at the automotive and aerospace industries, where the demand for sustainable and high-performance materials is growing rapidly.

- In December 2024, Atotech revealed its new line of high-efficiency plating chemicals designed for the electronics industry. The new products enable faster processing times and improved adhesion properties, making them ideal for the production of microelectronics and semiconductors. This launch is in response to the increasing demand for advanced materials in the smart device and automotive electronics markets, where precision and reliability are critical.

- In November 2024, Chemetall GmbH announced the introduction of a new environmentally friendly coating system for automotive and aerospace applications. The system is designed to reduce energy consumption and the environmental impact during the finishing process. It aligns with global sustainability efforts and offers improved resistance to corrosion and wear, further strengthening the company’s position as a leader in sustainable metal finishing solutions.

- In October 2024, Houghton International Inc. unveiled a new range of cutting-edge lubrication chemicals for industrial metalworking applications. These chemicals, designed for high-performance machinery and metal forming processes, offer superior cooling and lubrication properties, extending the lifespan of industrial tools while increasing overall manufacturing efficiency.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.