Global Mobile Wallet Payment Technologies Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

19.71 Billion

USD

65.52 Billion

2025

2033

USD

19.71 Billion

USD

65.52 Billion

2025

2033

| 2026 –2033 | |

| USD 19.71 Billion | |

| USD 65.52 Billion | |

|

|

|

|

Segmentação do mercado global de tecnologias de pagamento por carteira digital, por tipo (pagamento por proximidade e pagamento remoto), tipo de compra (transferências e recargas de crédito para celular, transferências e pagamentos de dinheiro, mercadorias e cupons e viagens e emissão de bilhetes), usuário final (setor de hotelaria e turismo, serviços financeiros, mídia e entretenimento, varejo, educação e TI e telecomunicações) - tendências e previsões do setor até 2033.

Tamanho do mercado de tecnologias de pagamento por carteira digital

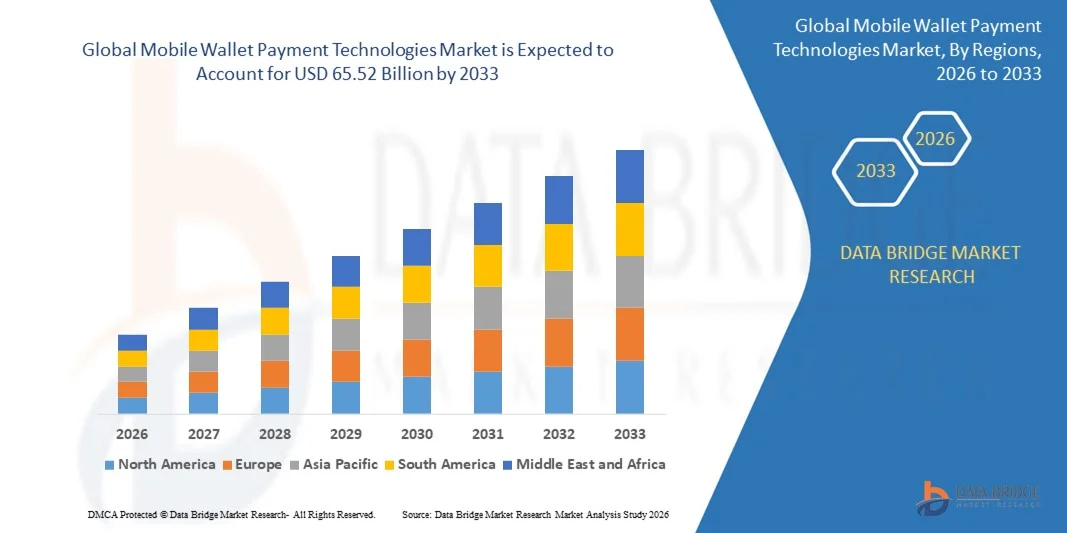

- O mercado global de tecnologias de pagamento por carteira móvel foi avaliado em US$ 19,71 bilhões em 2025 e deverá atingir US$ 65,52 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 16,20% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de pagamentos sem contato, pela maior penetração de smartphones e pela demanda cada vez maior por soluções de pagamento digital seguras e convenientes.

- A expansão das atividades de comércio eletrônico e as iniciativas governamentais de apoio que promovem transações sem dinheiro em espécie estão acelerando ainda mais o desenvolvimento do mercado.

Análise de mercado de tecnologias de pagamento por carteira digital

- O mercado está testemunhando um forte crescimento devido à rápida transformação digital nos setores de varejo, transporte e finanças, impulsionada pelos avanços nas tecnologias de NFC, código QR e autenticação biométrica.

- A crescente preferência do consumidor por experiências de pagamento descomplicadas, em tempo real e seguras está incentivando os provedores de serviços a oferecerem recursos inovadores em suas carteiras digitais e a fortalecerem suas estruturas de segurança cibernética.

- A América do Norte dominou o mercado de tecnologias de pagamento por carteira digital, com a maior participação na receita em 2025, impulsionada pela crescente adoção de finanças digitais, forte penetração de smartphones e a rápida transição para pagamentos sem contato no varejo e no transporte.

- A região da Ásia-Pacífico deverá apresentar a maior taxa de crescimento no mercado global de tecnologias de pagamento por carteira digital , impulsionada pela crescente digitalização, rápida urbanização e iniciativas governamentais para uma economia sem dinheiro físico.

- O segmento de pagamentos remotos detinha a maior participação na receita de mercado em 2025, impulsionado pela ampla adoção de transações via aplicativos que permitem o pagamento de contas, compras online e transferências entre pessoas. As carteiras digitais remotas oferecem integração perfeita com plataformas de e-commerce, camadas de segurança aprimoradas e processos de finalização de compra mais rápidos, tornando-se a opção preferida dos consumidores em mercados desenvolvidos e emergentes.

Escopo do relatório e segmentação do mercado de tecnologias de pagamento por carteira digital.

|

Atributos |

Tecnologias de pagamento por carteira digital: principais insights de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

• Mastercard (EUA) • Boku Inc. (EUA) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de tecnologias de pagamento por carteira digital

Ascensão das soluções de pagamento móvel sem contato e em tempo real

A rápida ascensão das soluções de pagamento sem contato e por aproximação está transformando o cenário das tecnologias de pagamento por carteira digital, possibilitando transações instantâneas, seguras e descomplicadas. A conveniência e a velocidade desses sistemas impulsionam uma maior adesão por parte dos consumidores, principalmente em regiões urbanas, onde os pagamentos digitais estão se tornando o método preferido para compras do dia a dia. Essa mudança é ainda mais reforçada pelo aumento das atualizações de terminais de ponto de venda (POS) e pela crescente confiança em pagamentos sem contato, em decorrência da tendência global em direção a transações mais higiênicas.

A crescente demanda por processamento de pagamentos em tempo real nos setores de varejo, transporte e hotelaria está acelerando a implementação de smartphones com tecnologia NFC e plataformas de pagamento móvel baseadas em QR Code. Essas ferramentas são especialmente benéficas em áreas com acesso limitado a serviços bancários tradicionais, ajudando a reduzir as lacunas de inclusão financeira. O ecossistema digital em expansão, impulsionado pela inovação fintech e por redes de pagamento interoperáveis, continua a ampliar as capacidades de transação em tempo real.

A acessibilidade e a facilidade de uso dos aplicativos de carteira digital estão impulsionando seu uso tanto em mercados desenvolvidos quanto emergentes, viabilizando pagamentos rotineiros como contas, transferências entre pessoas e compras em lojas físicas. Os consumidores se beneficiam de maior conveniência e menor dependência de dinheiro em espécie. A integração de programas de fidelidade, recursos de cashback e ferramentas financeiras personalizadas aumenta ainda mais o engajamento do usuário e a fidelização.

Por exemplo, em 2023, diversas redes varejistas no Sudeste Asiático relataram um aumento nas transações de clientes após a integração de pagamentos por carteira digital via QR Code, melhorando a eficiência no caixa e aumentando a satisfação do cliente. Os varejistas também observaram filas reduzidas e operações mais tranquilas nos horários de pico devido ao processamento de pagamentos mais rápido. Essa tendência de adoção incentivou mais pequenos comerciantes a migrarem para a aceitação digital para se manterem competitivos.

Embora a adoção de carteiras digitais esteja crescendo rapidamente, seu impacto a longo prazo depende da inovação contínua, de melhorias na segurança cibernética e de uma maior aceitação por parte dos comerciantes. Os provedores de pagamento devem priorizar a prevenção de fraudes, a integração perfeita e o design intuitivo para aproveitar ao máximo essa demanda crescente. Expandir os recursos de pagamento offline e a compatibilidade internacional também será crucial para dar suporte à escalabilidade global futura.

Dinâmica do mercado de tecnologias de pagamento por carteira digital

Motorista

A crescente tendência para pagamentos digitais e a penetração cada vez maior de smartphones.

A transição global de transações em dinheiro para transações digitais está impulsionando consumidores, varejistas e instituições financeiras a adotarem soluções de carteira digital como uma alternativa de pagamento segura e eficiente. A conveniência de transações instantâneas e a menor dependência de dinheiro físico estão acelerando a aceitação no mercado. O crescimento de aplicativos fintech e a melhoria da conectividade de rede também contribuem para a ampla aceitação em diversos segmentos demográficos.

Os consumidores estão cada vez mais conscientes dos benefícios das carteiras digitais, incluindo programas de recompensas, finalização de compra mais rápida, autenticação segura e a capacidade de gerenciar vários métodos de pagamento em uma única plataforma. Essa mudança é ainda mais impulsionada pela expansão do comércio eletrônico e dos serviços baseados em aplicativos. Recursos de gamificação e promoções personalizadas dentro das carteiras digitais também estão melhorando as taxas de retenção de clientes.

• Iniciativas governamentais que incentivam sistemas financeiros digitais, como políticas de pagamentos sem dinheiro físico e plataformas nacionais de pagamento, estão fortalecendo a infraestrutura para a adoção de carteiras digitais. Esses esforços estão aumentando a confiança do usuário e possibilitando um desenvolvimento mais amplo do ecossistema. Colaborações público-privadas e o apoio regulatório para sistemas de pagamento em tempo real estão acelerando ainda mais a transição para transações móveis.

• Por exemplo, em 2022, vários países da Europa e da região Ásia-Pacífico expandiram a obrigatoriedade de pagamentos digitais para serviços públicos e pequenas empresas, impulsionando significativamente o cadastro em carteiras digitais e o volume de transações. Essa expansão incentivou uma integração mais rápida da população não bancarizada aos sistemas financeiros formais. O efeito cascata dessa adoção também promoveu investimentos em tecnologia de pagamentos entre comerciantes locais.

• Embora a forte demanda do consumidor e os marcos regulatórios favoráveis estejam impulsionando a expansão do mercado, ainda existem desafios relacionados à interoperabilidade, à segurança cibernética e ao treinamento de comerciantes para garantir uma adoção perfeita. Garantir a compatibilidade entre plataformas e reduzir as falhas nas transações será essencial para manter a confiança do consumidor. Campanhas contínuas de conscientização e incentivos para comerciantes darão ainda mais suporte ao crescimento do ecossistema.

Restrição/Desafio

Riscos de cibersegurança e infraestrutura digital limitada em economias emergentes

• O aumento das ameaças à segurança cibernética, como violações de dados, ataques de phishing e acesso não autorizado, continua a desafiar o ecossistema de carteiras digitais. Ferramentas de segurança avançadas, incluindo criptografia, tokenização e autenticação biométrica, exigem investimentos significativos, limitando a adoção por provedores menores. A crescente sofisticação dos ataques cibernéticos também exige atualizações contínuas nos sistemas de detecção de fraudes.

Muitas regiões em desenvolvimento ainda enfrentam infraestrutura digital inadequada, incluindo conectividade à internet instável e baixa penetração de smartphones. Essas limitações dificultam o uso de carteiras digitais e reduzem a confiança nos sistemas de pagamento digital, atrasando o crescimento do setor. A instabilidade no fornecimento de energia e a infraestrutura de telecomunicações obsoleta restringem ainda mais o acesso consistente a serviços digitais.

A penetração no mercado é ainda mais limitada pela baixa alfabetização digital e pela aceitação restrita por parte dos comerciantes em áreas remotas, onde o dinheiro em espécie continua sendo o método de pagamento dominante. Essa lacuna geralmente resulta em uma adoção mais lenta e em um volume de transações reduzido. Programas de treinamento e distribuição subsidiada de equipamentos continuam sendo cruciais para superar essas barreiras.

Por exemplo, em 2023, diversos mercados africanos e do sul da Ásia relataram que uma parcela substancial de pequenos comerciantes não possuía dispositivos compatíveis ou treinamento para aceitar pagamentos móveis, o que impactava a expansão do ecossistema. Muitos comerciantes também expressaram preocupação com as taxas de transação e a confiabilidade do sistema. Esses desafios continuam a dificultar a transição de operações baseadas em dinheiro para operações móveis.

Embora as tecnologias de pagamento móvel continuem a avançar, abordar as preocupações com a segurança, as limitações de infraestrutura e as lacunas de conhecimento permanece essencial para desbloquear todo o potencial do mercado. O fortalecimento dos marcos regulatórios, a promoção da conscientização pública e o aprimoramento da capacidade de telecomunicações desempenharão um papel fundamental na redução das disparidades regionais. O crescimento a longo prazo dependerá fortemente dos esforços colaborativos entre governos, empresas de tecnologia financeira e provedores de rede.

Escopo do mercado de tecnologias de pagamento por carteira digital

O mercado é segmentado com base no tipo, tipo de compra e usuário final.

- Por tipo

Com base no tipo, o mercado de tecnologias de pagamento por carteira digital é segmentado em pagamento por proximidade e pagamento remoto. O segmento de pagamento remoto detinha a maior participação na receita de mercado em 2025, impulsionado pela ampla adoção de transações baseadas em aplicativos que suportam pagamentos de contas, compras online e transferências ponto a ponto. As carteiras digitais remotas oferecem integração perfeita com plataformas de comércio eletrônico, camadas de segurança aprimoradas e recursos de finalização de compra mais rápidos, tornando-as uma opção preferida para consumidores em mercados desenvolvidos e emergentes.

O segmento de pagamentos por proximidade deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento do uso de smartphones com tecnologia NFC e sistemas baseados em QR Code que permitem pagamentos instantâneos em lojas físicas. As carteiras digitais de proximidade estão cada vez mais populares devido à sua conveniência, rapidez e ampla aceitação em estabelecimentos comerciais e serviços de transporte. A expansão da infraestrutura de pagamentos sem contato em todo o mundo também contribui para o rápido crescimento desse segmento.

- Por tipo de compra

Com base no tipo de compra, o mercado de tecnologias de pagamento por carteira digital é segmentado em transferências e recargas de crédito para celular, transferências e pagamentos de dinheiro, mercadorias e cupons, e viagens e emissão de passagens. O segmento de transferências e pagamentos de dinheiro detinha a maior participação na receita de mercado em 2025, devido à crescente demanda por transações digitais rápidas, seguras e de baixo custo em aplicações nacionais e internacionais. Esse segmento se beneficia da crescente integração com sistemas bancários, iniciativas digitais governamentais e forte adesão entre usuários que buscam alternativas aos pagamentos tradicionais em dinheiro.

O segmento de viagens e bilhetes deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente digitalização em transportes públicos, companhias aéreas e plataformas de venda de bilhetes para eventos. As carteiras digitais são cada vez mais utilizadas para reservas, check-ins e cobrança automática de tarifas, oferecendo uma alternativa prática aos bilhetes físicos. A crescente adoção de soluções de bilhetes baseadas em QR Code e tecnologia NFC deverá acelerar ainda mais a expansão deste segmento.

- Por usuário final

Com base no usuário final, o mercado de tecnologias de pagamento por carteira digital é segmentado nos setores de hotelaria e turismo, serviços financeiros, mídia e entretenimento, varejo, educação e TI e telecomunicações. O setor varejista detinha a maior participação na receita de mercado em 2025, devido à rápida adoção de pagamentos sem contato, integrações com programas de fidelidade e sistemas de finalização de compra via dispositivos móveis. Os varejistas utilizam cada vez mais carteiras digitais para agilizar as transações, aprimorar a experiência do cliente e dar suporte a estratégias de comércio omnichannel, contribuindo para a forte dominância do segmento.

O segmento de serviços financeiros, bancários e de seguros (BFSI) deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente penetração da banca digital e pela integração cada vez maior de carteiras digitais com serviços financeiros como microcrédito, pagamentos de seguros e ferramentas de poupança. As instituições financeiras estão acelerando a adoção dessas tecnologias para melhorar a eficiência operacional, oferecer soluções seguras para transações digitais e expandir o engajamento do cliente por meio de plataformas que priorizam o uso de dispositivos móveis.

Análise Regional do Mercado de Tecnologias de Pagamento por Carteira Digital

- A América do Norte dominou o mercado de tecnologias de pagamento por carteira digital, com a maior participação na receita em 2025, impulsionada pela crescente adoção de finanças digitais, forte penetração de smartphones e a rápida transição para pagamentos sem contato no varejo e no transporte.

- Os consumidores da região valorizam muito a rapidez, a segurança e a conveniência oferecidas pelas carteiras digitais, que contam com ferramentas avançadas de autenticação, como biometria, tokenização e detecção de fraudes em tempo real.

- Essa ampla adoção é ainda mais impulsionada pela alta renda disponível, pela infraestrutura digital avançada e pela crescente preferência por transações sem dinheiro físico, consolidando as carteiras digitais como um meio de pagamento preferencial tanto para consumidores quanto para empresas.

Análise do mercado de tecnologias de pagamento por carteira digital nos EUA

O mercado de tecnologias de pagamento por carteira digital nos EUA detinha a maior participação de receita na América do Norte em 2025, impulsionado pelo ecossistema em expansão de pagamentos sem contato e pela rápida transição para soluções financeiras digitais. Os consumidores dependem cada vez mais de carteiras digitais para transações diárias, transferências entre pessoas e compras online. A crescente popularidade de serviços baseados em aplicativos, combinada com a forte demanda por recursos de autenticação segura e experiências de finalização de compra mais rápidas, continua a impulsionar o crescimento do mercado. Além disso, a forte integração das carteiras digitais com plataformas de e-commerce, aplicativos de transporte por aplicativo e sistemas de pagamento no varejo está contribuindo significativamente para a expansão do mercado.

Análise do mercado europeu de tecnologias de pagamento por carteira digital

O mercado europeu de tecnologias de pagamento por carteira digital deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado principalmente por regulamentações rigorosas para pagamentos digitais, estruturas robustas de cibersegurança e pela crescente preferência dos consumidores por transações seguras e sem dinheiro físico. O crescimento das iniciativas de open banking e a maior interoperabilidade entre os provedores de serviços de pagamento também contribuem para essa adoção. Os consumidores europeus também estão adotando soluções de pagamento móvel pela conveniência que oferecem no transporte público, no varejo e na hotelaria. A região está testemunhando um crescimento notável tanto em mercados urbanos quanto semiurbanos, com as carteiras digitais sendo integradas a ecossistemas financeiros digitais mais amplos.

Análise do mercado de tecnologias de pagamento por carteira digital no Reino Unido

O mercado de tecnologias de pagamento por carteira digital no Reino Unido deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela tendência crescente de pagamentos digitais e pela forte confiança do consumidor nas inovações fintech. As preocupações com a segurança das transações, aliadas à demanda por soluções sem contato, estão incentivando tanto consumidores quanto comerciantes a adotarem carteiras digitais. A infraestrutura digital altamente desenvolvida do Reino Unido, o setor de e-commerce em expansão e a alta penetração de smartphones devem continuar a sustentar o crescimento do mercado. O uso crescente de carteiras digitais em transportes públicos, lojas físicas e serviços online está impulsionando ainda mais o mercado.

Análise do mercado de tecnologias de pagamento por carteira digital na Alemanha

O mercado alemão de tecnologias de pagamento por carteira digital deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente conscientização sobre segurança digital e pela confiança cada vez maior em transações financeiras via dispositivos móveis. A forte ênfase da Alemanha na proteção da privacidade e em tecnologias de pagamento seguras está alinhada ao uso crescente de carteiras digitais para pagamentos no varejo e em serviços. A infraestrutura digital avançada do país e a crescente adoção de dispositivos com tecnologia NFC estão impulsionando a penetração no mercado. Além disso, a integração de carteiras digitais com aplicativos bancários e sistemas de pagamento para comerciantes está se tornando cada vez mais comum, refletindo a mudança em direção a soluções financeiras digitais seguras.

Análise do Mercado de Tecnologias de Pagamento por Carteira Móvel na Região Ásia-Pacífico

O mercado de tecnologias de pagamento por carteira digital na região Ásia-Pacífico deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela rápida urbanização, pela crescente penetração de smartphones e pela demanda cada vez maior por soluções de pagamento digital em países como China, Índia e Japão. O forte incentivo da região à inclusão financeira digital, apoiado por iniciativas governamentais e inovação fintech, está acelerando o uso de carteiras digitais. Além disso, a posição da região Ásia-Pacífico como um polo global para o desenvolvimento de tecnologia de pagamento móvel aumenta a acessibilidade e a disponibilidade, possibilitando a ampla adoção tanto em mercados urbanos quanto rurais.

Análise do mercado de tecnologias de pagamento por carteira digital no Japão

O mercado japonês de tecnologias de pagamento por carteira digital deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido ao ambiente tecnológico avançado do país, à crescente demanda por conveniência e à rápida adoção de sistemas de pagamento sem contato. Os consumidores japoneses priorizam a segurança e a confiabilidade, impulsionando a adoção de plataformas de carteira digital altamente seguras, integradas aos setores de transporte, varejo e serviços. A crescente integração das carteiras digitais com dispositivos IoT e infraestrutura de cidades inteligentes também contribui para o crescimento do mercado. Além disso, o envelhecimento da população japonesa deverá impulsionar a demanda por soluções de pagamento digital fáceis de usar.

Análise do mercado de tecnologias de pagamento por carteira móvel na China

O mercado de tecnologias de pagamento por carteira digital na China representou a maior fatia de receita na região Ásia-Pacífico em 2025, devido à enorme base de usuários digitais do país, ao forte ecossistema móvel e à ampla adoção de sistemas de pagamento baseados em QR Code e aplicativos. A China se destaca como um dos maiores mercados mundiais de pagamentos digitais, com carteiras digitais sendo cada vez mais utilizadas nos setores de varejo, transporte, hotelaria e transações entre pessoas físicas. O impulso em direção a cidades inteligentes, a expansão do comércio digital e a forte presença de fintechs no mercado chinês continuam a impulsionar o crescimento do mercado, sustentados pela alta aceitação do consumidor e pela integração perfeita entre plataformas.

Participação de mercado das tecnologias de pagamento por carteira digital

O setor de tecnologias de pagamento por carteira digital é liderado principalmente por empresas consolidadas, incluindo:

• Mastercard (EUA)

• Econet Wireless Zimbabwe (Zimbábue)

• Visa (EUA)

• Fortumo (Estônia)

• American Express Company (EUA)

• Boku Inc. (EUA)

• Airtel India (Índia)

• Stripe (EUA)

• PayPal (EUA)

• Microsoft (EUA)

• Vodacom (África do Sul)

• Google (EUA)

• PayU (Países Baixos)

• Comviva (Índia)

• Novatti Group Pty Ltd (Austrália)

• Paysafe Holdings UK Limited (Reino Unido)

• Bank of America Corporation (EUA)

• Wirecard (Alemanha)

• First Data Corporation (EUA)

• Paytm (Índia)

• Apple Inc. (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.