Global Polyisoprene Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.66 Billion

USD

5.02 Billion

2025

2033

USD

2.66 Billion

USD

5.02 Billion

2025

2033

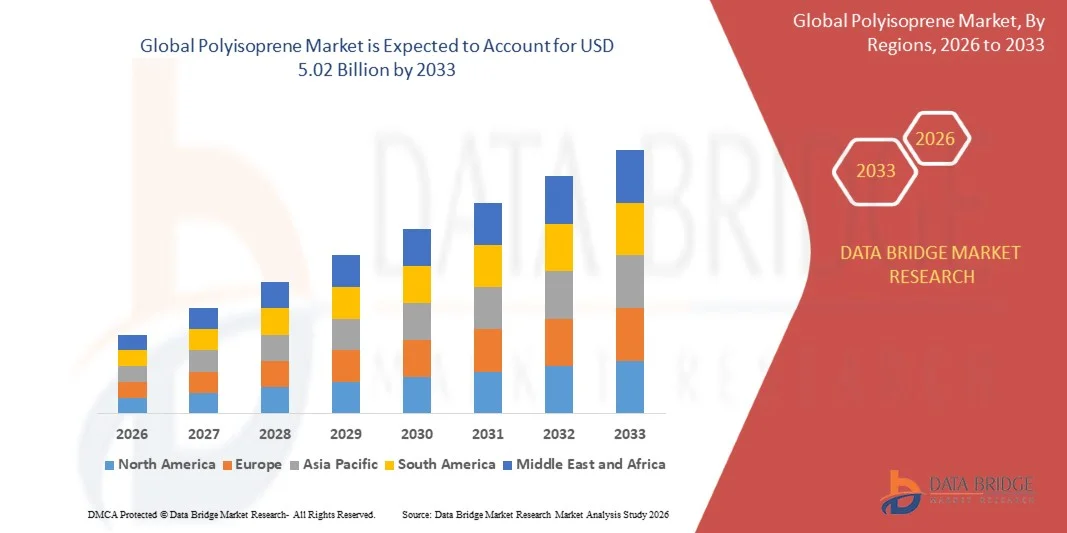

| 2026 –2033 | |

| USD 2.66 Billion | |

| USD 5.02 Billion | |

|

|

|

|

Global Polyisoprene Market Segmentation, By Type (Synthetic Polyisoprene and Natural Polyisoprene), Polymerization Process (Solution Polymerization and Emulsion Polymerization), Grade (High Cis Polyisoprene, Low Cis Polyisoprene, and Very Low Cis Polyisoprene), Application (Medical Gloves, Condoms, Medical Balloons, Catheters, and Adhesives), End-Use (Medical, Consumer Goods, and Industrial)- Industry Trends and Forecast to 2033

Polyisoprene Market Size

- The global polyisoprene market size was valued at USD 2.66 billion in 2025 and is expected to reach USD 5.02 billion by 2033, at a CAGR of 8.25% during the forecast period

- The market growth is largely fuelled by the rising demand for medical and healthcare products, including gloves and catheters, where polyisoprene offers superior elasticity, hypoallergenic properties, and comfort compared to natural rubber

- Increasing applications in automotive, adhesives, and footwear industries are also driving demand, as polyisoprene provides flexibility, durability, and resistance to wear and tear

Polyisoprene Market Analysis

- The market is characterized by technological advancements in polyisoprene production processes, including synthetic and bio-based methods, enhancing product quality and scalability

- Rising adoption across end-use industries, coupled with supportive government regulations on medical device safety and performance standards, is reinforcing steady growth in the global polyisoprene market

- Europe polyisoprene market dominated the polyisoprene market with the largest revenue share of 51.4% in 2025, primarily driven by expansion in the healthcare and consumer goods sectors. Increasing adoption of polyisoprene-based medical devices and gloves, coupled with awareness about eco-friendly and sustainable materials, is fostering demand

- Asia-Pacific region is expected to witness the highest growth rate in the global polyisoprene market, driven by rapid urbanization, expanding manufacturing base, increasing disposable incomes, and rising demand for medical gloves, adhesives, and industrial elastomers

- The synthetic polyisoprene segment held the largest market revenue share in 2025, driven by its consistent quality, controlled properties, and wide adoption in medical and industrial applications. Synthetic polyisoprene is preferred in high-performance applications due to its uniform molecular structure and reliable mechanical characteristics. It also offers superior chemical resistance, processability, and long-term durability compared to natural variants. Manufacturers increasingly adopt synthetic polyisoprene to meet stringent regulatory requirements in healthcare and consumer products

Report Scope and Polyisoprene Market Segmentation

|

Attributes |

Polyisoprene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyisoprene Market Trends

“Rising Demand in Medical and Industrial Applications”

• The growing emphasis on medical and healthcare products is significantly shaping the polyisoprene market, as consumers and manufacturers increasingly prefer synthetic and natural polyisoprene for gloves, catheters, and other medical devices. Polyisoprene’s excellent elasticity, biocompatibility, and comfort are driving its adoption across medical, automotive, and industrial sectors, encouraging manufacturers to innovate with higher-performance grades and new formulations

• Increasing use in automotive and industrial applications has accelerated the demand for polyisoprene in seals, gaskets, and adhesives. Rising infrastructure development, vehicle production, and industrial automation are prompting manufacturers to prioritize materials that offer durability, flexibility, and cost-effectiveness. This has also led to collaborations between suppliers and manufacturers to enhance functional and performance benefits

• Regulatory standards and environmental considerations are influencing material choices, with manufacturers focusing on synthetic polyisoprene that meets stringent quality and safety requirements. These factors help brands differentiate products in competitive markets and maintain compliance, while driving R&D toward more sustainable and high-performance solutions

• For instance, in 2024, Top Glove in Malaysia and Ansell in the U.S. expanded production capacities to meet rising global demand for medical-grade polyisoprene gloves. These expansions were in response to increased healthcare requirements and industrial applications, with distribution across medical, industrial, and consumer markets. The moves strengthened market presence and ensured reliable supply for critical applications

• While demand for polyisoprene is growing, sustained market expansion depends on cost-efficient production, scalable manufacturing, and continuous innovation. Manufacturers are focusing on improving material quality, supply chain efficiency, and environmental sustainability to maintain competitive advantage and meet the evolving requirements of diverse end-use industries

Polyisoprene Market Dynamics

Driver

“Growing Demand in Medical and Industrial Applications”

• Rising demand for medical-grade products such as gloves, catheters, and surgical instruments is a major driver for the polyisoprene market. Manufacturers are increasingly investing in high-quality synthetic polyisoprene to meet stringent healthcare standards and ensure patient safety, while expanding into new applications in industrial and automotive sectors

• Expanding applications in automotive, adhesives, and consumer goods are further fueling market growth. Polyisoprene’s elasticity, chemical resistance, and durability make it a preferred material for seals, gaskets, and molded components. The increasing use in emerging industrial sectors further reinforces this trend

• Material innovation and collaborations between suppliers and manufacturers are promoting the adoption of polyisoprene-based products. These efforts are supported by the growing focus on quality, performance, and regulatory compliance, encouraging sustainable production and enhancing overall market confidence

• For instance, in 2023, Bridgestone in Japan and Top Glove in Malaysia reported increased utilization of polyisoprene in industrial and healthcare products. This followed higher global demand for medical and automotive applications, driving repeat orders, product differentiation, and reliability in supply

• Although rising medical and industrial demand supports growth, wider adoption depends on raw material availability, cost optimization, and scalable production technologies. Investment in sustainable sourcing, advanced manufacturing, and R&D will be critical for meeting global demand and maintaining market leadership

Restraint/Challenge

“High Production Cost and Raw Material Volatility”

• The relatively high cost of polyisoprene compared to other elastomers remains a key challenge, limiting adoption among price-sensitive manufacturers. Complex synthesis and processing methods contribute to elevated pricing, affecting market penetration in emerging regions. High production costs also restrict smaller manufacturers from scaling operations, making it difficult to compete with more affordable alternatives in cost-driven industries

• Fluctuating availability of natural and synthetic raw materials can further affect cost stability and supply reliability. Limited access to high-quality raw materials may slow production and restrict market expansion. In addition, geopolitical factors, climate variability, and trade restrictions can exacerbate raw material shortages, creating uncertainties in long-term planning for manufacturers and suppliers

• Market awareness and technical know-how also impact adoption, particularly in developing regions where specialized applications are emerging. Limited understanding of functional advantages restricts uptake in certain industrial sectors. This lack of knowledge often results in slower integration of polyisoprene in innovative applications, delaying potential market growth and reducing opportunities for premium product segments

• For instance, in 2024, some glove manufacturers in Southeast Asia reported slower capacity utilization due to raw material shortages and high production costs, affecting both visibility and supply chain efficiency. The disruptions also led to increased lead times and higher operational expenses, impacting pricing and competitiveness. Companies had to implement strategic sourcing and inventory management practices to mitigate these challenges

• Overcoming these challenges will require investment in cost-efficient production, raw material sourcing, and R&D for higher-performance grades. Strengthening supply chain networks and promoting technical awareness will be essential for sustaining long-term growth in the global polyisoprene market. In addition, collaborations with raw material suppliers, adoption of alternative feedstocks, and process optimization can help reduce costs, stabilize supply, and enhance product quality across applications

Polyisoprene Market Scope

The market is segmented on the basis of type, polymerization process, grade, application, and end-use.

• By Type

On the basis of type, the polyisoprene market is segmented into synthetic polyisoprene and natural polyisoprene. The synthetic polyisoprene segment held the largest market revenue share in 2025, driven by its consistent quality, controlled properties, and wide adoption in medical and industrial applications. Synthetic polyisoprene is preferred in high-performance applications due to its uniform molecular structure and reliable mechanical characteristics. It also offers superior chemical resistance, processability, and long-term durability compared to natural variants. Manufacturers increasingly adopt synthetic polyisoprene to meet stringent regulatory requirements in healthcare and consumer products.

The natural polyisoprene segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for eco-friendly and bio-based elastomers. Natural polyisoprene is particularly popular in medical and consumer goods applications due to its biocompatibility, elasticity, and renewable origin. The rising awareness of sustainable materials and preference for plant-based alternatives are boosting adoption. In addition, natural polyisoprene is gaining traction in premium industrial products where performance and flexibility are critical.

• By Polymerization Process

On the basis of polymerization process, the market is segmented into solution polymerization and emulsion polymerization. Solution polymerization dominated the market in 2025 due to its ability to produce high-purity polyisoprene with controlled molecular weight, suitable for medical-grade products. It is also preferred in applications requiring precise mechanical properties, such as gloves, condoms, and catheters. The segment benefits from strong industry experience and established supply chains. Continuous innovation in solution polymerization techniques is further driving product performance improvements.

Emulsion polymerization is expected to witness the fastest growth rate from 2026 to 2033, owing to its cost-effectiveness, scalability, and suitability for industrial applications such as adhesives, rubber products, and coatings. Emulsion polymerization allows for large-volume production and adaptability to different end-use requirements. Its increasing adoption is supported by the rising demand for polyisoprene in automotive, construction, and consumer goods. Moreover, advancements in emulsion technology are enabling higher purity grades for niche applications.

• By Grade

On the basis of grade, the market is segmented into high cis polyisoprene, low cis polyisoprene, and very low cis polyisoprene. High cis polyisoprene accounted for the largest share in 2025 due to its superior elasticity, strength, and resilience, making it ideal for medical gloves, condoms, and precision components. Its high tensile strength, durability, and excellent fatigue resistance are critical for performance-intensive applications. High cis polyisoprene also enables manufacturers to meet strict safety and quality standards in healthcare.

Low cis and very low cis polyisoprene segments are expected to register significant growth from 2026 to 2033, driven by their specialized applications in adhesives, balloons, and other industrial products requiring tailored mechanical properties. These grades offer unique stiffness, chemical resistance, and processing advantages. Expanding demand from niche industrial segments and consumer products is propelling growth. The ability to customize cis content allows manufacturers to engineer polyisoprene for specific end-use performance requirements.

• By Application

On the basis of application, the polyisoprene market is segmented into medical gloves, condoms, medical balloons, catheters, and adhesives. The medical gloves segment held the largest market share in 2025, fueled by growing healthcare awareness, stringent hygiene regulations, and increased demand for disposable gloves in hospitals and clinics. The COVID-19 pandemic further accelerated demand for high-quality gloves, creating sustained market growth. Innovations in polyisoprene gloves, such as powder-free and hypoallergenic variants, are also driving adoption.

Condoms and adhesives segments is expected to witness the fastest growth rate from 2026 to 2033, supported by rising consumer awareness, expanding industrial usage, and increasing safety and performance requirements. Medical balloons and catheters are gaining traction due to their critical role in minimally invasive surgeries and cardiovascular procedures. The market is also benefiting from the expansion of the pharmaceutical and medical device industries globally. Continuous product development and focus on premium quality are boosting adoption across applications.

• By End-Use

On the basis of end-use, the market is segmented into medical, consumer goods, and industrial. The medical segment dominated the market in 2025 due to the extensive use of polyisoprene in gloves, catheters, and other healthcare products. Rising patient safety requirements, stringent healthcare regulations, and increasing awareness of hygiene are key growth drivers. The segment also benefits from technological advancements in medical devices that require high-performance elastomers.

The consumer goods and industrial segments are expected to witness the fastest growth from 2026 to 2033, driven by increased demand in sports equipment, adhesives, and other specialized elastomeric applications. Growth in automotive, electronics, and construction sectors is also boosting industrial adoption. The expansion of high-performance consumer products and innovative applications in adhesives and coatings is further supporting market growth. Increased focus on sustainability and renewable materials in consumer goods is likely to enhance the adoption of polyisoprene.

Polyisoprene Market Regional Analysis

- Europe polyisoprene market dominated the polyisoprene market with the largest revenue share of 51.4% in 2025, primarily driven by expansion in the healthcare and consumer goods sectors. Increasing adoption of polyisoprene-based medical devices and gloves, coupled with awareness about eco-friendly and sustainable materials, is fostering demand

- Strong industrial infrastructure, technological advancements, and government support for healthcare manufacturing are further fueling market expansion in the region

Germany Polyisoprene Market Insight

The Germany polyisoprene market dominated the Europe polyisoprene market with the largest revenue share in 2025, fueled by increasing awareness about high-quality medical and industrial products. Adoption of polyisoprene in medical balloons, catheters, and consumer goods is on the rise due to superior elasticity and biocompatibility. Germany’s focus on innovation, robust healthcare infrastructure, and industrial manufacturing capabilities further support market expansion.

U.K. Polyisoprene Market Insight

The U.K. polyisoprene market is expected to witness robust growth from 2026 to 2033, driven by rising demand for high-performance medical gloves and adhesives. The increasing prevalence of chronic diseases and surgical procedures is boosting consumption in the healthcare sector. In addition, growing research and development initiatives, coupled with an emphasis on synthetic polyisoprene for industrial applications, are stimulating market growth.

North America Polyisoprene Market Insight

North America is expected to witness robust growth from 2026 to 2033, driven by high demand for medical gloves, adhesives, and industrial applications. The region’s strong automotive and healthcare sectors, coupled with well-established manufacturing infrastructure, are supporting consistent consumption of both synthetic and natural polyisoprene. The presence of well-established healthcare and automotive industries, along with rising awareness about latex-based products, is encouraging market growth. High disposable incomes, advanced manufacturing capabilities, and strong R&D infrastructure support the adoption of synthetic and natural polyisoprene across multiple sectors.

U.S. Polyisoprene Market Insight

The U.S. polyisoprene market captured the largest revenue share in North America in 2025, fueled by growing use of medical-grade gloves, condoms, and catheters in the healthcare sector. Increasing awareness about product quality, safety, and compliance with stringent FDA regulations is driving demand. Moreover, the rising preference for synthetic polyisoprene in industrial applications due to its superior elasticity and durability further propels market growth.

Asia-Pacific Polyisoprene Market Insight

The Asia-Pacific polyisoprene market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for medical gloves, adhesives, and condoms in countries such as China, India, and Japan. Rapid urbanization, expanding healthcare infrastructure, and increasing disposable incomes are boosting adoption. Moreover, APAC’s emergence as a manufacturing hub for polyisoprene products is improving affordability and accessibility, fueling widespread consumption across medical, consumer, and industrial applications.

Japan Polyisoprene Market Insight

The Japan polyisoprene market is expected to witness significant growth from 2026 to 2033 due to high healthcare standards, technological advancements, and rising use of synthetic polyisoprene in medical devices. An aging population and increasing awareness about product safety are driving demand for medical gloves, catheters, and balloons. Integration of polyisoprene in consumer and industrial applications further contributes to market expansion.

China Polyisoprene Market Insight

The China polyisoprene market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising demand in healthcare, consumer goods, and industrial sectors. Rapid urbanization, a growing middle-class population, and government initiatives supporting medical device manufacturing are key drivers. In addition, China’s position as a major manufacturing hub for synthetic and natural polyisoprene ensures reliable supply and cost-effective solutions, supporting long-term market growth.

Polyisoprene Market Share

The Polyisoprene industry is primarily led by well-established companies, including:

- Braskem (Brazil)

- The Goodyear Tire and Rubber Company (U.S.)

- SIBUR (Russia)

- FINETECH INDUSTRIES LIMITED (India)

- ZEON Corporation (Japan)

- Ningbo Jinhai Chenguang Chemical Corporation (China)

- Haihang Industry Co., Ltd. (China)

- FORTREC PTE LTD. (Singapore)

- Chevron Phillips Chemical Company (U.S.)

- Bridgestone Corporation (Japan)

- Michelin (France)

- Continental AG (Germany)

- Sumitomo Rubber Industries Ltd (Japan)

- Sinopec (China)

- Dow (U.S.)

Latest Developments in Global Polyisoprene Market

- In October 2023, Goodyear Tire & Rubber Company, strategic collaboration, partnered with Visolis to produce bio-based isoprene by upcycling non-edible biomass and agricultural waste. This initiative leverages Visolis's innovative technology to convert lignocellulosic feedstocks into high-quality isoprene, supporting sustainable manufacturing. The collaboration is expected to reduce reliance on petroleum-based raw materials, enhance Goodyear’s eco-friendly product portfolio, and drive growth in the global polyisoprene market by aligning with sustainability trends

- In April 2023, Kuraray Co., Ltd., plant expansion, initiated operations at its new Thailand-based facility for isoprene-related products. The plant is designed to meet growing demand for advanced materials, including heat-resistant polyamide resin PA9T (Genestar), hydrogenated styrenic elastomer HSBC (SEPTON), and isobutylene derivative MPD. This expansion strengthens Kuraray’s production capacity, ensures reliable supply of high-performance elastomers, and positions the company to capture a larger share of the global polyisoprene market amid rising industrial and consumer applications

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.