Global Quinoa Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.08 Billion

USD

2.05 Billion

2024

2032

USD

1.08 Billion

USD

2.05 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 2.05 Billion | |

|

|

|

|

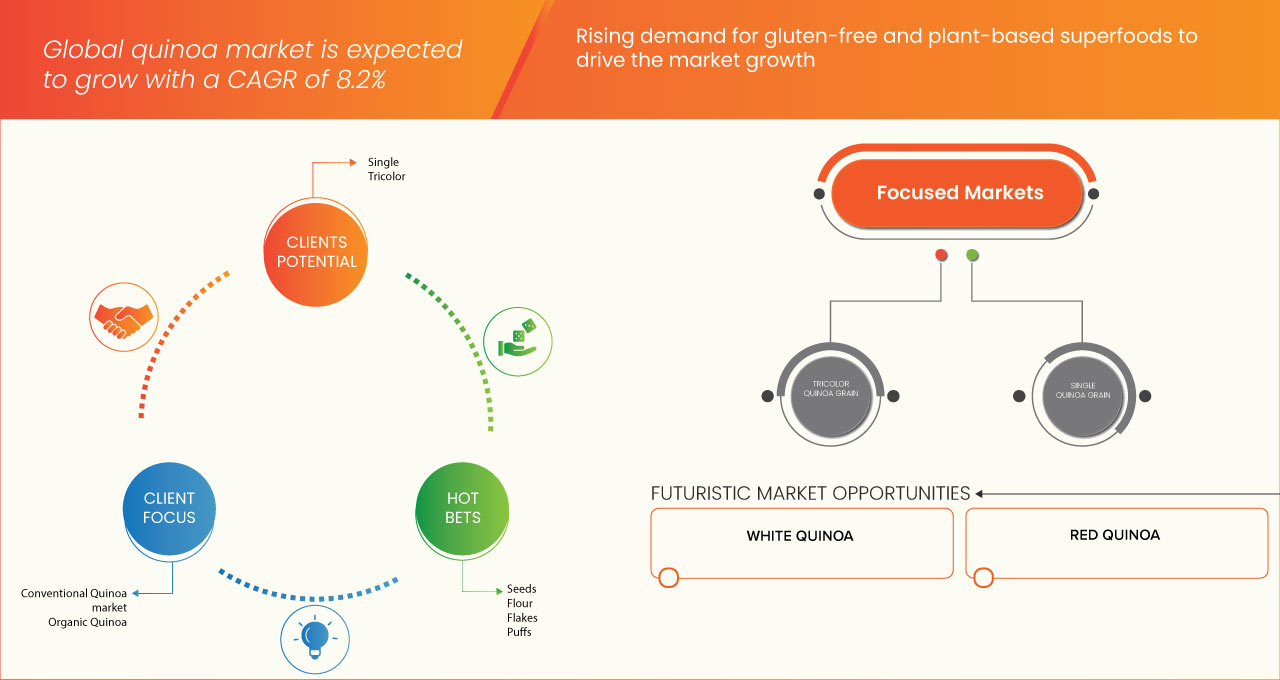

Segmentação do mercado global de quinoa, por tipo (simples e tricolor), por natureza (quinoa convencional e quinoa orgânica), por produto (sementes, farinha, flocos e puffs), por tipo de embalagem (sacos, bolsas, caixa, pote e outros), por canal de distribuição (offline e online) - Tendências do setor e previsões até 2032

Tamanho do mercado de quinoa

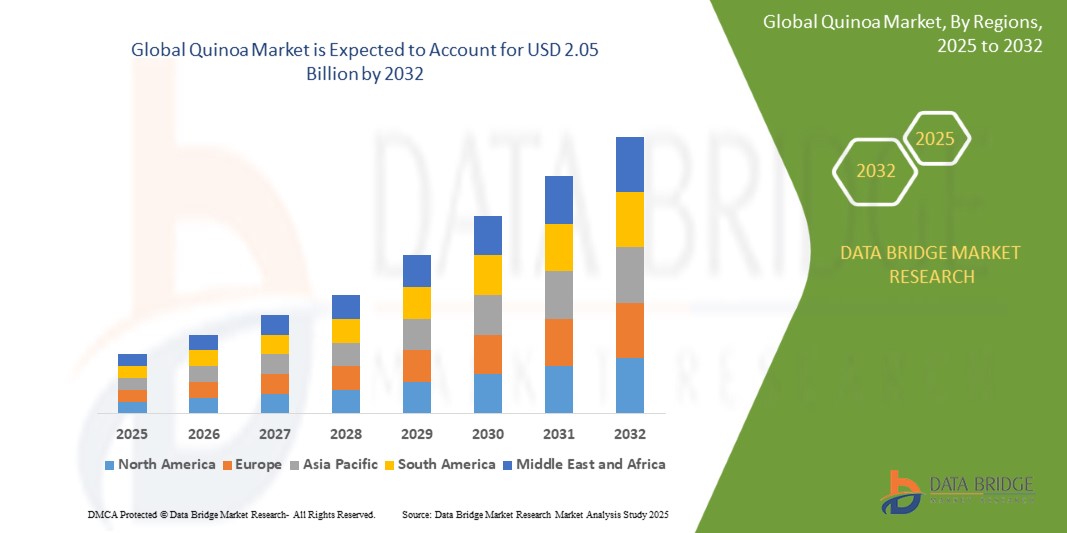

- O mercado global de quinoa foi avaliado em US$ 1,08 bilhão em 2024 e deve atingir US$ 2,05 bilhões até 2032

- Durante o período previsto de 2025 a 2032, o mercado provavelmente crescerá a um CAGR de 8,2%, impulsionado principalmente pela crescente demanda por alimentos sem glúten e de origem vegetal.

- Esse crescimento é impulsionado por fatores como a crescente conscientização sobre saúde entre consumidores urbanos globais e a rápida expansão das tendências de estilo de vida alimentar vegano e vegetariano.

Análise de Mercado de Quinoa

- A quinoa é um pseudocereal rico em nutrientes e sem glúten, derivado das sementes da planta Chenopodium quinoa, nativa da região andina da América do Sul. Embora frequentemente usada como um grão, tecnicamente é uma semente e é valorizada por seu alto teor de proteína, contendo todos os nove aminoácidos essenciais.

- A crescente aplicação da quinoa em produtos alimentícios funcionais e fortificados é um dos fatores que devem impulsionar o crescimento do mercado.

- Em 2025, espera-se que a América do Norte domine o mercado, com uma participação de 35,24%, devido à crescente conscientização sobre saúde, às dietas sem glúten e à base de plantas, ao aumento da produção nacional, ao forte crescimento das importações e aos produtos inovadores de quinoa, impulsionando a adoção pelo consumidor em geral.

- Espera-se que o segmento único domine o mercado com uma participação de 63,08% devido à crescente demanda do consumidor por rastreabilidade, autenticidade e qualidade premium, frequentemente associada a fontes éticas, sustentabilidade e distinções nutricionais regionais.

Escopo do Relatório e Segmentação do Mercado de Quinoa

|

Atributos |

Principais insights do mercado de quinoa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Holanda, Bélgica, Rússia, Suíça, Polônia, Dinamarca, Noruega, Turquia, Suécia, Resto da Europa, China, Índia, Japão, Austrália, Coreia do Sul, Tailândia, Malásia, Indonésia, Filipinas, Cingapura, Nova Zelândia, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, Emirados Árabes Unidos, Arábia Saudita, Israel, África do Sul, Egito e Resto do Oriente Médio e África |

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de quinoa

“Avanços em P&D visando eficiência agronômica, aprimoramento nutricional e inovação em processamento”

- A pesquisa e desenvolvimento (P&D) no cultivo e processamento de quinoa está abordando desafios importantes, como adaptabilidade climática, variabilidade de rendimento e perdas pós-colheita, revelando novo potencial comercial em mercados emergentes e maduros.

- Inovações em técnicas de melhoramento estão produzindo cultivares de quinoa com melhor tolerância à seca, resistência à salinidade e resiliência a pragas, ajudando a expandir o cultivo além das regiões andinas tradicionais para áreas na África, Ásia e Europa.

- A P&D agronômica também está aprimorando as características nutricionais da quinoa, como maior teor de proteína, maiores níveis de lisina e menores concentrações de saponina, tornando a cultura mais desejável para consumidores preocupados com a saúde e aplicações alimentícias especializadas, como alimentos para bebês, assados sem glúten e nutrição esportiva.

- Inovações pós-colheita, incluindo classificação automatizada, secagem em baixa temperatura e sistemas de descascamento de precisão, estão reduzindo os custos de processamento e melhorando a consistência na qualidade e na vida útil.

- Além disso, modelos integrados de desenvolvimento da cadeia de valor — combinando melhorias na fazenda com otimização do processamento — estão sendo explorados para aumentar a renda dos agricultores e reduzir o desperdício. Parcerias público-privadas, como as apoiadas por universidades agrícolas e ONGs, estão acelerando ainda mais os esforços de P&D nessa área.

Dinâmica do Mercado de Quinoa

Motorista

“CRESCENTE DEMANDA POR ALIMENTOS SEM GLÚTEN E À BASE DE PLANTAS”

- O mercado é significativamente impulsionado pela crescente mudança dos consumidores em direção a padrões alimentares sem glúten e à base de plantas. A quinoa, sendo um pseudocereal naturalmente sem glúten, surgiu como uma alternativa preferida para pessoas com doença celíaca, intolerância ao glúten ou que adotam dietas sem glúten como estilo de vida. Além disso, o alto teor de proteína do grão, que inclui todos os nove aminoácidos essenciais, o posiciona como uma fonte superior de proteína vegetal, tornando-o altamente atraente para vegetarianos, veganos e flexitarianos.

- À medida que a conscientização global sobre saúde, bem-estar e transparência nutricional continua a crescer, o rico perfil de fibras, vitaminas, minerais e antioxidantes da quinoa se alinha perfeitamente com as preferências em evolução dos consumidores preocupados com a saúde. A ascensão da inovação em alimentos de origem vegetal em categorias como alternativas à carne, substitutos de laticínios e lanches funcionais também integrou a quinoa às aplicações tradicionais, aumentando ainda mais sua visibilidade e consumo.

Por exemplo,

- Em setembro de 2024, de acordo com uma notícia publicada pela American Heart Association, a quinoa foi reconhecida como uma potência nutricional moderna, elogiada por seu conteúdo de proteína vegetal e propriedades sem glúten, tornando-a uma escolha alimentar ideal para consumidores preocupados com a saúde que buscam hábitos alimentares equilibrados, sem alérgenos e sustentáveis.

- Em março de 2024, de acordo com um artigo publicado pelo Medical News Today, a quinoa foi destacada como um grão rico em nutrientes, sem glúten, rico em proteínas vegetais e aminoácidos essenciais, reforçando seu valor em dietas vegetarianas e veganas e apoiando sua crescente popularidade entre consumidores globais preocupados com a saúde que buscam nutrição balanceada.

Oportunidade

“EXPANDENDO O CULTIVO DE QUINOA NOS PAÍSES DA ÁSIA, ÁFRICA, AMÉRICA DO NORTE E EUROPA”

A expansão do cultivo de quinoa em regiões não tradicionais, como Ásia, África, América do Norte e Europa, representa uma oportunidade significativa para o mercado da quinoa. Tradicionalmente cultivada nas regiões andinas da América do Sul, a adaptabilidade da quinoa a diversas condições agroecológicas permitiu sua introdução bem-sucedida em diversas regiões. Países como Índia, China, Quênia, Marrocos, Estados Unidos, Canadá, França e Dinamarca iniciaram testes ou cultivo comercial de quinoa para atender à crescente demanda local e global.

Essa diversificação geográfica atenua os riscos da cadeia de suprimentos associados à dependência excessiva da produção andina, incluindo a volatilidade climática e as perturbações socioeconômicas. Além disso, reforça a segurança alimentar regional ao introduzir uma cultura resiliente e rica em nutrientes, capaz de crescer em solos semiáridos e salinos — condições cada vez mais prevalentes devido às mudanças climáticas.

Por exemplo,

- Em julho de 2023, de acordo com um artigo publicado no ResearchGate intitulado Desenvolvimento Mundial de Práticas de Gestão Agronômica para o Cultivo de Quinoa: Uma Revisão Sistemática, descobriu-se que a quinoa era cultivada com sucesso em mais de 100 países, incluindo regiões da Ásia, África, Europa e América do Norte, destacando sua adaptabilidade global e potencial de expansão de mercado.

- Em março de 2022, de acordo com um artigo publicado pela Elsevier BV, o cultivo de quinoa expandiu-se com sucesso para regiões não tradicionais, incluindo Ásia, África e Europa, demonstrando alta adaptabilidade a condições agroecológicas adversas e oferecendo soluções promissoras para segurança alimentar, resiliência climática e desenvolvimento agrícola sustentável em ambientes com recursos limitados.

Restrição/Desafio

“INCERTEZAS REGULAMENTARES E COMERCIAIS”

- O mercado de quinoa é notavelmente limitado por marcos regulatórios em constante evolução e incertezas comerciais que impedem o comércio internacional tranquilo. Regiões importadoras, como a União Europeia, impõem regulamentações rigorosas que abrangem resíduos de pesticidas, segurança alimentar, certificação orgânica, rotulagem e rastreabilidade para produtos de quinoa. O cumprimento dessas leis exige investimentos significativos em testes, documentação e certificação, afetando desproporcionalmente pequenos e médios produtores e exportadores.

- Além disso, acordos internacionais como as Medidas Sanitárias e Fitossanitárias (SPS) e as Barreiras Técnicas ao Comércio (TBT) da OMC permitem que países individuais introduzam barreiras comerciais não tarifárias com base na saúde e segurança públicas, o que pode levar a uma implementação inconsistente ou protecionista.

Por exemplo,

- Em novembro de 2020, de acordo com um artigo publicado pelo Centro para a Promoção de Importações de Países em Desenvolvimento (CBI), os exportadores de quinoa enfrentam regulamentações rigorosas da União Europeia sobre resíduos de pesticidas, segurança alimentar e certificação orgânica, destacando barreiras comerciais e regulatórias significativas para a entrada no mercado e competitividade a longo prazo na região.

- Em março de 2025, de acordo com um artigo publicado pela Essfeed, as rigorosas regulamentações da União Europeia sobre limites de pesticidas e rastreabilidade impactaram significativamente as importações de quinoa, desafiando os exportadores de países em desenvolvimento a cumprir os padrões de conformidade e contribuindo para as incertezas comerciais no mercado global de quinoa.

Escopo do mercado de quinoa

O mercado global de quinoa é segmentado em cinco segmentos notáveis com base no tipo, natureza, produto, tipo de embalagem e canal de distribuição.

Por tipo

Com base no tipo, o mercado é segmentado em monocolor e tricolor. Em 2025, espera-se que o segmento monocolor domine o mercado, com uma participação de mercado de 63,08%. Espera-se que atinja US$ 1,26 bilhão até 2032, com um CAGR de 8,3% no período previsto de 2025 a 2032.

Por natureza

Com base na natureza, o mercado é segmentado em quinoa convencional e quinoa orgânica. Em 2025, espera-se que o segmento convencional domine o mercado, com uma participação de mercado de 92,67%, devido à crescente demanda do consumidor por rastreabilidade, autenticidade e qualidade premium, frequentemente associadas a fontes éticas, sustentabilidade e diferenciais nutricionais regionais.

Por produto

Com base no produto, o mercado é segmentado em sementes, farinhas, flocos e puffs. Em 2025, espera-se que o segmento de sementes domine o mercado, com uma participação de mercado de 69,03%, devido aos seus menores custos de produção, maior disponibilidade e adequação ao consumo em massa, atendendo à crescente demanda dos principais setores alimentício e varejista.

Por embalagem

Com base no tipo de embalagem, o mercado é segmentado em sacos, pouches, caixas, potes e outros. Em 2025, espera-se que o segmento de sacos domine o mercado, com uma participação de mercado de 45,28%, devido à sua versatilidade no preparo, longa vida útil e crescente demanda por superalimentos vegetais ricos em nutrientes, tanto no varejo quanto no setor de food service.

Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em offline e online. Em 2025, espera-se que o segmento offline domine o mercado, com uma participação de mercado de 73,88%, oferecendo soluções de embalagem práticas, econômicas e ecologicamente corretas, atendendo a compradores a granel, varejistas e consumidores ecologicamente conscientes que buscam opções de armazenamento sustentáveis.

Análise regional do mercado de quinoa

América do Norte

Em 2025, espera-se que a América do Norte domine o mercado, com uma participação de 35,24%, devido à crescente conscientização sobre saúde, às dietas sem glúten e à base de plantas, ao aumento da produção nacional, ao forte crescimento das importações e aos produtos inovadores de quinoa, impulsionando a adoção pelo consumidor em geral.

Visão geral do mercado de quinoa dos EUA

O mercado de quinoa nos EUA está crescendo de forma constante devido à crescente conscientização sobre saúde, às tendências de dietas à base de plantas e à demanda por alimentos sem glúten. O aumento da produção nacional e a diversidade de aplicações do produto em lanches, saladas e cereais impulsionam ainda mais a expansão do mercado nos setores de varejo e foodservice.

Europa

A Europa teve uma participação significativa na receita, de 27,63% em 2024, impulsionada pela crescente demanda por alimentos orgânicos, ricos em proteínas e sem glúten. Países como França, Alemanha e Reino Unido lideram o consumo, apoiados por consumidores preocupados com a saúde e pelo crescimento das importações da América Latina e de iniciativas nacionais de cultivo.

Visão geral do mercado de quinoa do Reino Unido

O mercado de quinoa do Reino Unido é impulsionado pelo crescente veganismo, pelas preferências por rótulos limpos e pela demanda por grãos ricos em proteína. Consumidores preocupados com a saúde e uma forte presença no varejo de orgânicos e superalimentos estão impulsionando as importações e incentivando o cultivo doméstico de quinoa em pequena escala.

Visão geral do mercado de quinoa na Alemanha

O mercado de quinoa na Alemanha está crescendo devido ao seu foco em dietas sustentáveis, à base de plantas e ricas em proteínas. A forte demanda em supermercados orgânicos e redes de alimentos saudáveis, juntamente com o aumento do lançamento de produtos veganos, está impulsionando o consumo de quinoa, especialmente entre grupos demográficos urbanos e voltados para a atividade física.

Ásia-Pacífico

A região Ásia-Pacífico detém 21,56% de participação de mercado em 2024, impulsionada pela crescente conscientização sobre saúde, pelo aumento da renda da classe média e pela demanda por superalimentos funcionais. Países como China, Índia, Japão e Austrália estão testemunhando um aumento nas importações de quinoa, enquanto o cultivo local está emergindo em nichos de mercado da saúde.

Visão geral do mercado de quinoa japonesa

O mercado de quinoa no Japão está se expandindo devido ao crescente interesse por dietas com baixo teor de carboidratos e alto teor de proteína e alimentos funcionais. O envelhecimento da população e a crescente demanda por produtos sem glúten e adequados para diabéticos estão impulsionando o uso da quinoa em cereais, bebidas e soluções de refeições saudáveis prontas para consumo.

Visão do mercado de quinoa da China

O mercado de quinoa na China está em constante crescimento, impulsionado pelo cultivo apoiado pelo governo em regiões como Qinghai e Gansu. O crescente foco do consumidor em nutrição, controle de peso e tendências ocidentais de saúde está impulsionando a demanda por quinoa em lanches, alimentos saudáveis e categorias premium do varejo.

Participação no mercado de quinoa

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- QUINOA FOODS COMPANY SRL

- CORPORAÇÃO DE PRODUÇÃO DE QUINOA DO NORTE

- Quinoa Corporation

- A Companhia Britânica de Quinoa

- Nutrir você

- Tattva Orgânico

- Indústrias Agrícolas Adinath

- SARCHIO SPA

- COMIDA DE AARY

- MOINHOS ARDENTES

- Appkin Agro Private Limited

- Elworld Orgânico

- Apex Internacional

- SHANTILAL E FILHOS HUF

- Vedaliya Industries LLP.

- Fazendas Shiloh

- ROYAL NUT COMPANY

- MAATITATVA AGRO INDUSTRIES PRIVATE LIMITADA

- Dev Agro Indústrias

- Produtos puros

- Alter Eco Alimentos

- Irupana

Últimos desenvolvimentos no mercado global de quinoa

- Em fevereiro de 2024, a empresa de investimentos Trek One Capital concluiu a aquisição da Alter Eco Foods, marca orgânica premium conhecida por quinoa, granola, chocolate e trufas. O acordo visa acelerar o crescimento da linha de lanches premium e expandir os canais de distribuição.

- Em maio de 2025, a Mehrotra Consumer Products apresentou sua “Quinoa Orgânica” na Saudi Food Show em Riad, destacando seu superalimento sem glúten, rico em proteínas e antioxidantes para compradores internacionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 COST ANALYSIS BREAKDOWN OF THE GLOBAL QUINOA MARKET

4.3 FACTORS AFFECTING BUYING DECISION

4.3.1 PRICE

4.3.2 PRODUCT QUALITY

4.3.3 BRAND REPUTATION

4.3.4 ADVERTISEMENT AND PROMOTIONS

4.3.5 PRODUCT AVAILABILITY

4.3.6 FINANCIAL ACCESSIBILITY

4.3.7 PEER AND EXPERT RECOMMENDATIONS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON GLOBAL QUINOA MARKET

4.4.1 IMPACT OF PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON DEMAND

4.4.5 IMPACT ON STRATEGIC DECISIONS

4.5 INDUSTRY ECO-SYSTEM ANALYSIS

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 RISK ASSESSMENT AND MITIGATION

4.6.7 FUTURE OUTLOOK

4.7 PATENT QUALITY AND STRENGTH

4.8 PATENT FAMILIES

4.8.1 LICENSING AND COLLABORATIONS

4.8.1.1 COMPANY PATENT LANDSCAPE

4.8.1.2 REGION PATENT LANDSCAPE

4.8.1.3 IP STRATEGY AND MANAGEMENT

4.8.2 PATENT ANALYSIS

4.8.3 CONSUMER BUYING BEHAVIOUR

4.9 PRODUCT ADOPTION SCENARIO

4.9.1 CONSUMER SEGMENT PENETRATION

4.9.2 INDUSTRIAL AND FOOD SERVICE ADOPTION

4.9.3 GEOGRAPHICAL EXPANSION

4.9.4 BARRIERS TO ADOPTION

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 KEY RAW MATERIAL: QUINOA SEEDS

4.10.2 MAJOR QUINOA-PRODUCING COUNTRIES

4.10.3 SOURCING CHANNELS

4.10.4 CERTIFICATIONS & QUALITY STANDARDS

4.10.5 CHALLENGES IN RAW MATERIAL SOURCING

4.10.6 TRENDS IN SOURCING STRATEGY

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS

7.1.2 INCREASING HEALTH AWARENESS AMONG GLOBAL URBAN CONSUMERS

7.1.3 FAST EXPANDING VEGAN AND VEGETARIAN DIETARY LIFESTYLE TRENDS

7.1.4 GROWING APPLICATION OF QUINOA IN FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION COSTS LIMIT LARGE-SCALE COMMERCIAL EXPANSION

7.2.2 EXPANSION OF SINGLE-CROP QUINOA LEADING TO SOIL DEGRADATION, BIODIVERSITY LOSS, AND SUSCEPTIBILITY TO CLIMATE STRESS

7.3 OPPORTUNITIES

7.3.1 EXPANDING QUINOA FARMING IN ASIA, AFRICA, NORTH AMERICA, AND EUROPE COUNTRIES

7.3.2 GOVERNMENT SUPPORT & POLICY INCENTIVES PROMOTING FARMERS TO ADOPT QUINOA AS A CLIMATE-RESILIENT CROP

7.3.3 RISING POPULARITY OF ORGANIC AND SUSTAINABLE AGRICULTURE PRACTICES

7.4 CHALLENGES

7.4.1 REGULATORY & TRADE UNCERTAINTIES

7.4.2 QUALITY INCONSISTENCIES ACROSS INTERNATIONAL QUINOA SUPPLY CHAINS

8 GLOBAL QUINOA MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE

8.3 TRICOLOR

9 GLOBAL QUINOA MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 SEEDS

9.3 FLOUR

9.4 FLAKES

9.5 PUFFS

10 GLOBAL QUINOA MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BAGS

10.3 POUCHES

10.4 BOX

10.5 JAR

10.6 OTHERS

11 GLOBAL QUINOA MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL QUINOA

11.3 ORGANIC QUINOA

12 GLOBAL QUINOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 GLOBAL QUINOA MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 FRANCE

13.3.3 U.K.

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 NETHERLANDS

13.3.7 BELGIUM

13.3.8 RUSSIA

13.3.9 SWITZERLAND

13.3.10 POLAND

13.3.11 DENMARK

13.3.12 NORWAY

13.3.13 TURKEY

13.3.14 SWEDEN

13.3.15 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 INDIA

13.4.3 JAPAN

13.4.4 AUSTRALIA

13.4.5 SOUTH KOREA

13.4.6 THAILAND

13.4.7 MALAYSIA

13.4.8 INDONESIA

13.4.9 PHILIPPINES

13.4.10 SINGAPORE

13.4.11 NEW ZEALAND

13.4.12 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 UAE

13.6.2 SAUDI ARABIA

13.6.3 ISRAEL

13.6.4 SOUTH AFRICA

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL QUINOA MARKET COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ARDENT MILLS

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 ADINATH AGRO INDUSTRIES

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 NOURISH YOU

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APEX INTERNATIONAL

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 AARY'S FOOD

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALTER ECO FOODS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 APPKIN AGRO PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DEV AGRO INDUSTRIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ELWORLD ORGANIC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 IRUPANA ANDEN ORGANIC FOOD S.A.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MAATITATVA AGRO INDUSTRIES PRIVATE LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 NORTHERN QUINOA PRODUCTION CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORGANIC TATTVA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT/NEWS

16.14 PURE PRODUCTS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 QUINOA CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 QUINOA FOODS COMPANY SRL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ROYAL NUT COMPANY.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SARCHIO SPA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SHANTILAL & SONS HUF

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHILOH FARMS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 THE BRITISH QUINOA COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 VEDALIYA INDUSTRIES LLP.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 GLOBAL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL QUINOA MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 GLOBAL SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL SINGLE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL TRICOLOR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL SEEDS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL FLOUR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL FLAKES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL PUFFS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL BAGS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL POUCHES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL BOX IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL JAR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL OTHERS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL CONVENTIONAL QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL ORGANIC QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL OFFLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL ONLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 30 NORTH AMERICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA QUINOA MARKET, BY DISTRIBUTION CHANNEL 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL 2018-2032 (USD THOUSAND)

TABLE 37 U.S. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 39 U.S. SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 46 CANADA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 CANADA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 48 CANADA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 55 MEXICO QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 57 MEXICO SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 67 EUROPE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 74 GERMANY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 76 GERMANY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 GERMANY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY QUINOA MARKET, BY PRODUCT 2018-2032 (USD THOUSAND)

TABLE 79 GERMANY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 85 FRANCE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 87 FRANCE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 88 FRANCE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 FRANCE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 90 FRANCE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 FRANCE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 U.K. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 94 U.K. SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 96 U.K. QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 U.K. QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 99 U.K. OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 U.K. ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 ITALY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 ITALY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 103 ITALY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 ITALY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 105 ITALY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 ITALY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ITALY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 ITALY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 110 SPAIN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SPAIN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 112 SPAIN SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SPAIN QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 114 SPAIN QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 115 SPAIN QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SPAIN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 SPAIN OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 118 SPAIN ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 121 NETHERLANDS SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 NETHERLANDS QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 NETHERLANDS OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 NETHERLANDS ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 BELGIUM QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 BELGIUM QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 130 BELGIUM SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 BELGIUM QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 132 BELGIUM QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 133 BELGIUM QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 BELGIUM QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 BELGIUM OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 BELGIUM ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 139 RUSSIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 RUSSIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 RUSSIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 145 RUSSIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 SWITZERLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SWITZERLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 148 SWITZERLAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 155 POLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 POLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 157 POLAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 POLAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 159 POLAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 POLAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 POLAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 POLAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 163 POLAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 164 DENMARK QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 DENMARK QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 166 DENMARK SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 DENMARK QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 168 DENMARK QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 169 DENMARK QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 DENMARK QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 171 DENMARK OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 DENMARK ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 NORWAY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NORWAY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 175 NORWAY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NORWAY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 177 NORWAY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 178 NORWAY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NORWAY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 180 NORWAY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 181 NORWAY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 182 TURKEY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 TURKEY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 184 TURKEY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 TURKEY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 186 TURKEY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 187 TURKEY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 TURKEY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 189 TURKEY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 190 TURKEY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 SWEDEN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SWEDEN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 193 SWEDEN SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SWEDEN QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 195 SWEDEN QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 196 SWEDEN QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SWEDEN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 198 SWEDEN OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 199 SWEDEN ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 200 REST OF EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 REST OF EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 202 ASIA-PACIFIC QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 205 ASIA-PACIFIC SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 ASIA-PACIFIC QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 207 ASIA-PACIFIC QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 208 ASIA-PACIFIC QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 ASIA-PACIFIC QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 210 ASIA-PACIFIC OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 211 ASIA-PACIFIC ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 214 CHINA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CHINA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 216 CHINA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 217 CHINA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 CHINA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 219 CHINA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 220 CHINA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 221 INDIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 INDIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 223 INDIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 INDIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 225 INDIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 226 INDIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 INDIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 228 INDIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 229 INDIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 230 JAPAN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 JAPAN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 232 JAPAN SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 JAPAN QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 234 JAPAN QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 235 JAPAN QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 JAPAN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 237 JAPAN OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 238 JAPAN ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 239 AUSTRALIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 AUSTRALIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 241 AUSTRALIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 AUSTRALIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 243 AUSTRALIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 246 AUSTRALIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 SOUTH KOREA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SOUTH KOREA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 250 SOUTH KOREA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SOUTH KOREA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 252 SOUTH KOREA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 253 SOUTH KOREA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 SOUTH KOREA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 255 SOUTH KOREA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 256 SOUTH KOREA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 257 THAILAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 THAILAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 259 THAILAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 THAILAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 261 THAILAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 262 THAILAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 THAILAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 264 THAILAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 265 THAILAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 266 MALAYSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MALAYSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 268 MALAYSIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MALAYSIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 270 MALAYSIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 271 MALAYSIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MALAYSIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 273 MALAYSIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MALAYSIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 277 INDONESIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 279 INDONESIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 INDONESIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 283 INDONESIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 284 PHILIPPINES QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 PHILIPPINES QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 286 PHILIPPINES SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 PHILIPPINES QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 288 PHILIPPINES QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 289 PHILIPPINES QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 PHILIPPINES QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 291 PHILIPPINES OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 292 PHILIPPINES ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 293 SINGAPORE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SINGAPORE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 295 SINGAPORE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SINGAPORE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 297 SINGAPORE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 298 SINGAPORE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SINGAPORE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 300 SINGAPORE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 301 SINGAPORE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 302 NEW ZEALAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 NEW ZEALAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 304 NEW ZEALAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 NEW ZEALAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 306 NEW ZEALAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 307 NEW ZEALAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 NEW ZEALAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 309 NEW ZEALAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 NEW ZEALAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 311 REST OF ASIA-PACIFIC QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 REST OF ASIA-PACIFIC QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 313 SOUTH AMERICA QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 316 SOUTH AMERICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 319 SOUTH AMERICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SOUTH AMERICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AMERICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AMERICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 323 BRAZIL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 BRAZIL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 325 BRAZIL SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 BRAZIL QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 327 BRAZIL QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 328 BRAZIL QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BRAZIL QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 330 BRAZIL OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 331 BRAZIL ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 332 ARGENTINA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 ARGENTINA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 334 ARGENTINA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 ARGENTINA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 336 ARGENTINA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 337 ARGENTINA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ARGENTINA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 339 ARGENTINA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 340 ARGENTINA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 341 REST OF SOUTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 REST OF SOUTH AMERICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 343 MIDDLE EAST AND AFRICA QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 344 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 346 MIDDLE EAST AND AFRICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 MIDDLE EAST AND AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 348 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 349 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 MIDDLE EAST AND AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 351 MIDDLE EAST AND AFRICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 352 MIDDLE EAST AND AFRICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 353 UAE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 UAE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 355 UAE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 UAE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 357 UAE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 358 UAE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 UAE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 360 UAE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 361 UAE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 362 SAUDI ARABIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SAUDI ARABIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 364 SAUDI ARABIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SAUDI ARABIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 366 SAUDI ARABIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 367 SAUDI ARABIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 SAUDI ARABIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 369 SAUDI ARABIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 370 SAUDI ARABIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 371 ISRAEL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 ISRAEL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 373 ISRAEL SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 ISRAEL QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 375 ISRAEL QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 376 ISRAEL QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 ISRAEL QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 ISRAEL OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 379 ISRAEL ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 380 SOUTH AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 SOUTH AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 382 SOUTH AFRICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 SOUTH AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 384 SOUTH AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 385 SOUTH AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 SOUTH AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 387 SOUTH AFRICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 388 SOUTH AFRICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 389 EGYPT QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 EGYPT QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 391 EGYPT SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 EGYPT QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 393 EGYPT QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 394 EGYPT QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 EGYPT QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 396 EGYPT OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 397 EGYPT ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 398 REST OF MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 REST OF MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

Lista de Figura

FIGURE 1 GLOBAL QUINOA MARKET

FIGURE 2 GLOBAL QUINOA MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL QUINOA MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL QUINOA MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL QUINOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL QUINOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL QUINOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL QUINOA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL QUINOA MARKET: EXECUTIVE SUMMARY

FIGURE 11 GLOBAL QUINOA MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE GLOBAL QUINOA MARKET, BY TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL QUINOA MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS IS EXPECTED TO DRIVE THE GLOBAL QUINOA MARKET IN THE FORECAST PERIOD

FIGURE 16 THE SINGLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL QUINOA MARKET IN 2025 AND 2032

FIGURE 17 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR GLOBAL QUINOA MARKET IN THE FORECAST PERIOD

FIGURE 18 GLOBAL LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 PATENT FAMILIES

FIGURE 20 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 22 GLOBAL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

FIGURE 23 GLOBAL QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

FIGURE 24 GLOBAL QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

FIGURE 25 GLOBAL QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

FIGURE 26 GLOBAL QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

FIGURE 27 GLOBAL QUINOA MARKET: SNAPSHOT (2023)

FIGURE 28 NORTH AMERICA QUINOA MARKET: SNAPSHOT (2023)

FIGURE 29 EUROPE QUINOA MARKET: SNAPSHOT (2023)

FIGURE 30 ASIA-PACIFIC QUINOA MARKET: SNAPSHOT (2023)

FIGURE 31 SOUTH AMERICA QUINOA MARKET: SNAPSHOT (2023)

FIGURE 32 MIDDLE EAST & AFRICA QUINOA MARKET: SNAPSHOT (2023)

FIGURE 33 GLOBAL QUINOA MARKET: COMPANY SHARE 2024 (%)

FIGURE 34 NORTH AMERICA QUINOA MARKET: COMPANY SHARE 2024 (%)

FIGURE 35 EUROPE QUINOA MARKET: COMPANY SHARE 2024 (%)

FIGURE 36 ASIA-PACIFIC QUINOA MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.