Global Single Use Filtration Assemblies Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.69 Billion

USD

8.66 Billion

2025

2033

USD

3.69 Billion

USD

8.66 Billion

2025

2033

| 2026 –2033 | |

| USD 3.69 Billion | |

| USD 8.66 Billion | |

|

|

|

|

Segmentação do mercado global de conjuntos de filtração descartáveis, por tipo (filtração por membrana, filtração profunda, centrifugação e outros), aplicação (mercado de fabricação farmacêutica, mercado de bioprocessamento ou biofarmacêuticos e uso laboratorial), produto (filtros, cartuchos, membranas, manifolds, cassetes, seringas e outros) - Tendências e previsões do setor até 2033

Tamanho do mercado de conjuntos de filtração de uso único

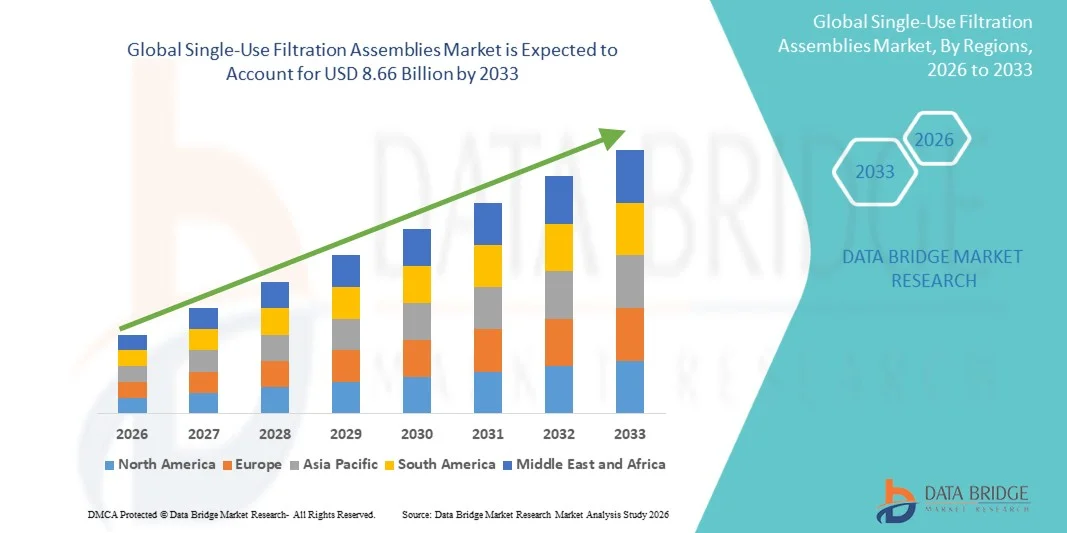

- O mercado global de conjuntos de filtração descartáveis foi avaliado em US$ 3,69 bilhões em 2025 e deverá atingir US$ 8,66 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 11,26% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de processos avançados de fabricação biofarmacêutica e pela necessidade de sistemas de produção eficientes e livres de contaminação, o que leva a uma maior eficiência do processo e à redução do risco de contaminação cruzada em ambientes clínicos e comerciais.

- Além disso, a crescente demanda por soluções de filtração flexíveis, escaláveis e econômicas em produtos biológicos, vacinas e outros processos de fabricação estéreis está impulsionando a adoção de conjuntos de filtração de uso único, aumentando significativamente o crescimento do setor.

Análise de mercado de conjuntos de filtração de uso único

- Os sistemas de filtração de uso único, que oferecem soluções descartáveis para processos biofarmacêuticos e biotecnológicos , são componentes cada vez mais essenciais dos modernos sistemas de bioprocessamento, tanto em pesquisa quanto em produção comercial, devido à sua eficiência, esterilidade e facilidade de integração.

- A crescente demanda por conjuntos de filtração descartáveis é impulsionada principalmente pela ampla adoção da fabricação de produtos biológicos, pelo foco regulatório cada vez maior no controle de contaminação e pela preferência crescente por soluções de filtração flexíveis e escaláveis.

- A América do Norte dominou o mercado de conjuntos de filtração descartáveis, com a maior participação na receita, de 42% em 2025. Essa participação é caracterizada por uma forte infraestrutura de fabricação biofarmacêutica, alta adoção de tecnologias avançadas de filtração e uma presença robusta de importantes players do setor. Os EUA contribuíram com a maior parte dessa participação devido ao aumento da produção de produtos biológicos e ao apoio regulatório às tecnologias descartáveis.

- A região Ásia-Pacífico deverá ser a de crescimento mais rápido no mercado de conjuntos de filtração descartáveis durante o período de previsão, registrando uma taxa de crescimento anual composta (CAGR) de 9,1% de 2026 a 2033, impulsionada pelo aumento da produção de produtos biológicos, pela expansão das organizações de fabricação por contrato (CMOs) e pelo aumento dos investimentos em sistemas de filtração flexíveis em países como China e Índia.

- O segmento de bioprocessamento/biofarmacêutico representou a maior fatia da receita de mercado, com 51% em 2025, impulsionado pela crescente demanda global por anticorpos monoclonais, vacinas, terapias celulares e proteínas recombinantes.

Escopo do relatório e segmentação do mercado de conjuntos de filtração de uso único

|

Atributos |

Principais informações de mercado sobre conjuntos de filtração de uso único |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de conjuntos de filtração de uso único

“ Adoção crescente de tecnologia de uso único em processos biofarmacêuticos ”

- Uma das principais tendências no mercado global de conjuntos de filtração descartáveis é a crescente adoção da tecnologia descartável em processos de fabricação biofarmacêutica e laboratoriais.

- Por exemplo, em 2023, a Sartorius lançou um sistema de filtração modular descartável para a produção de vacinas, com ênfase na troca mais rápida de produtos e na redução do risco de contaminação. Os conjuntos descartáveis estão substituindo os sistemas de filtração tradicionais de aço inoxidável devido ao menor risco de contaminação cruzada, aos tempos de troca mais rápidos e às menores necessidades de limpeza.

- Os fabricantes biofarmacêuticos estão utilizando cada vez mais sistemas de filtração descartáveis para processos críticos, como filtração estéril, clarificação e remoção de vírus, garantindo maior eficiência operacional e conformidade com as normas regulamentares.

- Os sistemas de uso único oferecem flexibilidade para aumentar ou diminuir os volumes de produção, o que é particularmente benéfico para ensaios clínicos, organizações de fabricação por contrato (CMOs) e produção de produtos biológicos em pequena escala.

- A tendência para conjuntos de filtração descartáveis é reforçada pelo crescente foco em produtos biológicos, vacinas, terapias celulares e medicamentos personalizados, que exigem soluções de filtração adaptáveis e econômicas.

- Empresas como Sartorius, Pall Corporation e Merck estão desenvolvendo sistemas de filtração modulares de uso único que podem ser facilmente integrados aos processos existentes, facilitando a produção otimizada e minimizando o tempo de inatividade.

- A crescente ênfase na fabricação livre de contaminação e na redução dos custos operacionais deverá impulsionar a adoção contínua de conjuntos de filtração de uso único em instalações de pesquisa, farmacêuticas e de bioprocessamento em todo o mundo.

Dinâmica do mercado de conjuntos de filtração de uso único

Motorista

“Crescimento da produção biofarmacêutica e necessidade de filtração eficiente”

- A expansão do setor biofarmacêutico global é um fator-chave para o mercado de conjuntos de filtração de uso único, impulsionado pela crescente demanda por anticorpos monoclonais, vacinas e outros produtos biológicos.

- Por exemplo, em 2022, a Merck relatou um aumento repentino nos pedidos de kits de uso único por parte de fabricantes terceirizados que produzem vacinas contra a COVID-19.

- Os fabricantes estão priorizando a eficiência dos processos e a segurança dos produtos, o que leva à substituição generalizada dos sistemas de filtragem convencionais por alternativas descartáveis que oferecem implantação rápida e menores requisitos de manutenção.

- A crescente prevalência de doenças crônicas e a necessidade cada vez maior de terapias biológicas inovadoras impulsionam ainda mais a demanda por sistemas de filtração confiáveis e escaláveis que mantenham a integridade do produto.

- O apoio governamental à produção de vacinas, especialmente durante emergências de saúde pública, está impulsionando os investimentos em tecnologias de filtração de uso único.

- As organizações de fabricação por contrato (CMOs) estão adotando conjuntos de uso único para fornecer soluções de produção flexíveis para múltiplos clientes, minimizando os esforços de validação de limpeza, reduzindo o tempo de resposta e controlando os custos operacionais.

- A adoção de conjuntos de filtração de uso único também é respaldada por sua capacidade de atender a requisitos regulatórios rigorosos, como as diretrizes da FDA e da EMA, garantindo maior reprodutibilidade e segurança em produtos biofarmacêuticos.

- De forma geral, a demanda combinada por flexibilidade, eficiência e conformidade nos processos modernos de biofabricação está impulsionando um forte crescimento no mercado de conjuntos de filtração de uso único.

Restrição/Desafio

“ Preocupações relativas à compatibilidade de materiais e aos custos operacionais ”

- Um dos principais desafios no mercado de conjuntos de filtração de uso único é a compatibilidade dos materiais com diversos produtos biológicos e fluidos de processo.

- Por exemplo, em 2021, uma pequena empresa de biotecnologia relatou redução no rendimento de proteínas ao usar uma membrana polimérica incompatível em um processo de filtração de anticorpos monoclonais.

- A seleção inadequada de materiais de membrana pode resultar em redução da eficiência de filtração, perda de produto ou riscos de contaminação.

- Além disso, embora os sistemas de uso único reduzam os custos de limpeza e esterilização, o custo inicial de aquisição de conjuntos descartáveis pode ser maior do que o de sistemas de filtração convencionais, principalmente para instalações de produção em larga escala.

- A necessidade recorrente de consumíveis também contribui para as despesas operacionais, o que pode ser uma barreira para organizações menores ou fabricantes de baixo volume.

- Questões de descarte e considerações ambientais relacionadas a conjuntos de uso único, incluindo o gerenciamento adequado de resíduos e preocupações com a sustentabilidade, também podem representar desafios para a adoção em larga escala.

- Os fabricantes devem equilibrar a eficiência operacional com a responsabilidade ambiental, implementando programas de reciclagem ou utilizando materiais biodegradáveis no projeto de montagem.

- Abordar essas preocupações por meio de uma seleção criteriosa de materiais, otimização de custos e conformidade regulatória é essencial para incentivar uma adoção mais ampla de conjuntos de filtração de uso único em aplicações biofarmacêuticas de pesquisa e industriais.

Escopo do mercado de conjuntos de filtração de uso único

O mercado está segmentado com base no tipo, na aplicação e no produto.

• Por tipo

Com base no tipo, o mercado de conjuntos de filtração descartáveis é segmentado em filtração por membrana, filtração profunda, centrifugação e outros. O segmento de filtração por membrana dominou a maior participação de mercado em receita, com 46% em 2025, impulsionado por sua alta eficiência na remoção de impurezas, versatilidade em diferentes bioprocessos e compatibilidade com a fabricação em larga e pequena escala. A filtração por membrana é amplamente utilizada em processos críticos, como filtração estéril, remoção de vírus e clarificação de proteínas, proporcionando desempenho confiável e consistente. Fabricantes farmacêuticos e biofarmacêuticos preferem filtros de membrana devido à sua conformidade regulatória, reprodutibilidade e menor risco de contaminação cruzada. A disponibilidade de diferentes tipos de membrana, como PVDF, PES e celulose, permite a personalização para aplicações específicas. Empresas como Sartorius, Pall Corporation e Merck aprimoraram a tecnologia de membranas para melhorar a capacidade de filtração e reduzir o tempo de processamento. A filtração por membrana também oferece custos operacionais mais baixos em comparação com os sistemas tradicionais de aço inoxidável, minimizando os requisitos de limpeza e validação. A crescente adoção em vacinas, anticorpos monoclonais e terapias celulares reforça ainda mais sua dominância no mercado. A forte demanda do segmento na América do Norte e na Europa é atribuída à infraestrutura biofarmacêutica bem estabelecida e aos rigorosos padrões de qualidade. A filtração por membrana continua sendo a escolha preferida tanto para laboratórios de pesquisa quanto para instalações de produção comercial em todo o mundo.

O segmento de filtração profunda deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 10,5%, entre 2026 e 2033, impulsionado por sua capacidade de lidar com altas cargas de partículas e reduzir o entupimento em processos upstream e downstream. A filtração profunda é cada vez mais utilizada na clarificação de culturas celulares e na remoção de impurezas de grande porte durante a purificação de proteínas. Os fabricantes preferem filtros de profundidade pela flexibilidade no processamento em lotes, facilidade de escalabilidade e redução do tempo de inatividade. Empresas biofarmacêuticas emergentes na região Ásia-Pacífico estão adotando soluções de filtração profunda devido à sua relação custo-benefício e adaptabilidade à produção em pequenos volumes. Cassetes e cartuchos de filtração profunda permitem rápida integração aos processos existentes sem grandes modificações na infraestrutura. O segmento também está ganhando força devido às inovações em meios filtrantes, que aumentam a eficiência de retenção de partículas, mantendo altas taxas de fluxo. A conformidade regulatória, incluindo a adesão às diretrizes da FDA e da EMA, impulsiona a confiança e a adoção em processos comerciais. A filtração profunda é particularmente vantajosa na fabricação de vacinas, na produção de produtos biológicos e no processamento de proteínas terapêuticas. Empresas como a Merck e a Pall lançaram produtos avançados de filtração profunda para melhorar a produtividade. Espera-se que o foco crescente em processos livres de contaminação e ciclos de produção rápidos sustente um forte crescimento da filtração profunda durante o período de previsão.

• Mediante inscrição

Com base na aplicação, o mercado de conjuntos de filtração de uso único é segmentado em fabricação farmacêutica, bioprocessamento/biofarmacêutica e uso laboratorial. O segmento de bioprocessamento/biofarmacêutica representou a maior participação na receita do mercado, com 51% em 2025, impulsionado pela crescente demanda global por anticorpos monoclonais, vacinas, terapias celulares e proteínas recombinantes. Esse segmento se beneficia da crescente tendência de terceirização da fabricação para organizações de fabricação por contrato (CMOs) e da necessidade de sistemas de filtração flexíveis e escaláveis que garantam esterilidade e eficiência do processo. Os processos biofarmacêuticos frequentemente exigem múltiplas etapas de filtração, incluindo esterilização, remoção de vírus e clarificação, onde os conjuntos de uso único oferecem alta confiabilidade. As principais empresas farmacêuticas estão incorporando a filtração de uso único para reduzir os riscos de contaminação cruzada, acelerar as trocas de produtos e minimizar a validação da limpeza. A conformidade regulatória com a FDA, EMA e outras diretrizes garante a qualidade consistente do produto. O domínio do segmento também é impulsionado pela adoção em regiões desenvolvidas com infraestrutura avançada de fabricação de produtos biológicos, como a América do Norte e a Europa. As inovações tecnológicas em meios de filtração e conjuntos modulares fortalecem ainda mais sua posição. Os crescentes investimentos na produção de vacinas, terapias celulares e gênicas e medicamentos personalizados também impulsionam o segmento. Os sistemas de filtração para bioprocessamento permitem o rápido aumento ou redução de escala para atender a tamanhos de lote variáveis, aumentando a eficiência operacional. As melhorias contínuas nas tecnologias de membrana e filtração profunda consolidam ainda mais o domínio biofarmacêutico neste mercado.

O segmento de uso laboratorial deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 11,2%, entre 2026 e 2033, devido ao crescente número de laboratórios de pesquisa e à adoção cada vez maior de filtração descartável em fluxos de trabalho analíticos, diagnósticos e experimentais. Os sistemas de filtração descartáveis em laboratórios permitem o manuseio de amostras sem contaminação, processamento rápido e tempo de inatividade mínimo entre experimentos. Esse segmento se beneficia da crescente demanda em pesquisas acadêmicas, organizações de pesquisa contratadas (CROs) e empresas de diagnóstico para vacinas, produtos biológicos e testes terapêuticos. Inovações como dispositivos de filtração pré-esterilizados e prontos para uso, além de configurações modulares, aprimoram a conveniência operacional e a reprodutibilidade. As aplicações de filtração em laboratório incluem clarificação de amostras, remoção de vírus, purificação de proteínas e processamento de culturas celulares. As economias emergentes da região Ásia-Pacífico estão investindo cada vez mais em instalações de pesquisa, impulsionando a adoção da filtração em laboratório. Os sistemas de filtração descartáveis também minimizam o risco de contaminação cruzada e reduzem as necessidades de limpeza, o que é fundamental para laboratórios de alto rendimento. Empresas como a Sartorius e a Merck oferecem conjuntos descartáveis voltados para laboratório, otimizados para fluxos de trabalho de baixo volume e alta precisão. A conformidade regulatória e a facilidade de integração com sistemas automatizados impulsionam uma aceitação mais ampla. A flexibilidade, a eficiência e a segurança proporcionadas pelos conjuntos descartáveis fazem do segmento de laboratório uma das áreas de aplicação de crescimento mais rápido no mercado.

• Por produto

Com base no produto, o mercado de conjuntos de filtração de uso único é segmentado em filtros, cartuchos, membranas, manifolds, cassetes, seringas e outros. O segmento de membranas detinha a maior participação na receita de mercado, com 48% em 2025, visto que as membranas constituem o componente crítico da maioria dos sistemas de filtração, oferecendo separação precisa, garantia de esterilidade e alta produtividade para processos biofarmacêuticos e laboratoriais. As membranas são utilizadas em aplicações de remoção de vírus, filtração estéril, purificação de proteínas e clarificação. A adoção de membranas de alto desempenho feitas de PVDF, PES e acetato de celulose aprimorou a confiabilidade e a eficiência do processo. Os principais fabricantes fornecem sistemas de membrana modulares adequados tanto para produção em larga escala quanto para fluxos de trabalho de pesquisa em pequenos lotes. O segmento se beneficia da aceitação regulatória, facilidade de validação e menor risco de contaminação cruzada. Os filtros de membrana também oferecem versatilidade em diversas aplicações de bioprocessamento, incluindo cultura de células, produção de vacinas e fabricação de proteínas terapêuticas. O segmento de membranas continua a apresentar forte demanda na América do Norte e na Europa, devido à maturidade das indústrias de produtos biológicos e farmacêuticos. A inovação contínua em tamanho de poros, taxa de fluxo e compatibilidade química garante sua liderança de mercado. A alta adoção do segmento em fluxos de trabalho farmacêuticos e laboratoriais consolida sua posição dominante globalmente.

O segmento de cartuchos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 10,8%, entre 2026 e 2033, devido à sua adaptabilidade em processos de filtração upstream e downstream e à facilidade de integração em linhas de produção existentes. Os cartuchos são amplamente utilizados na clarificação, esterilização e remoção de partículas na produção de produtos biológicos. Os fabricantes preferem os cartuchos por sua modularidade, desempenho consistente e redução do tempo de inatividade. O segmento também se beneficia da crescente adoção em manufatura de pequena escala, laboratórios de pesquisa e instalações biofarmacêuticas emergentes na região Ásia-Pacífico. Inovações no design de cartuchos, incluindo opções pré-esterilizadas, descartáveis e de alta capacidade, estão impulsionando a adoção. Os cartuchos permitem a troca rápida entre lotes, melhorando a eficiência operacional. A conformidade regulatória, a reprodutibilidade e o baixo risco de contaminação contribuem para sua crescente preferência. Empresas como Pall e Sartorius estão lançando sistemas avançados de cartuchos para remoção de vírus, purificação de proteínas e filtração estéril. Os cartuchos oferecem flexibilidade, escalabilidade e desempenho confiável, consolidando-se como um importante fator de crescimento no mercado de conjuntos de filtração descartáveis.

Análise Regional do Mercado de Conjuntos de Filtração de Uso Único

- A América do Norte dominou o mercado de conjuntos de filtração descartáveis, com a maior participação na receita, de 42% em 2025.

- Caracterizada por uma infraestrutura robusta de fabricação biofarmacêutica, alta adoção de tecnologias avançadas de filtração e forte presença de importantes empresas do setor.

- O mercado contribuiu com a maior parte dessa participação devido ao aumento da produção de produtos biológicos e ao apoio regulatório às tecnologias de uso único.

Análise do Mercado de Conjuntos de Filtração Descartáveis nos EUA

O mercado de conjuntos de filtração descartáveis dos EUA detinha a maior participação de receita na América do Norte em 2025, impulsionado pela expansão da produção de produtos biológicos, pela crescente adoção de tecnologias descartáveis em organizações de fabricação por contrato (CMOs) e pelos investimentos contínuos em sistemas de filtração flexíveis e livres de contaminação. A presença de infraestrutura laboratorial avançada, mão de obra qualificada e iniciativas governamentais favoráveis à fabricação de produtos biológicos estão acelerando ainda mais o crescimento do mercado.

Análise do mercado europeu de sistemas de filtração descartáveis

Prevê-se que o mercado europeu de conjuntos de filtração descartáveis cresça a uma taxa composta de crescimento anual substancial durante o período de previsão, impulsionado principalmente pelo aumento da produção biofarmacêutica, pela crescente adoção de tecnologias descartáveis e por normas regulamentares rigorosas para o controlo da contaminação. Países como a Alemanha, a França e a Suíça estão a registar um aumento dos investimentos em instalações biofarmacêuticas e em capacidades de fabrico por contrato.

Análise do mercado de conjuntos de filtração descartáveis no Reino Unido

Prevê-se que o mercado de conjuntos de filtração descartáveis no Reino Unido cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pela expansão da fabricação de produtos biológicos, investimentos em sistemas de filtração avançados e pela crescente tendência de terceirização da produção para fabricantes terceirizados (CMOs). Os marcos regulatórios que apoiam a adoção de sistemas descartáveis também estão incentivando a expansão do mercado.

Análise do mercado de sistemas de filtração descartáveis na Alemanha

O mercado alemão de sistemas de filtração descartáveis deverá expandir a uma taxa de crescimento anual composta (CAGR) considerável durante o período de previsão, impulsionado pela forte presença de empresas biofarmacêuticas, pelo foco crescente na produção livre de contaminação e pelo aumento dos investimentos em tecnologias descartáveis. A integração de sistemas de filtração avançados na fabricação de vacinas e produtos biológicos também contribui para esse crescimento.

Análise do Mercado de Sistemas de Filtração Descartáveis na Região Ásia-Pacífico

O mercado de conjuntos de filtração descartáveis na região Ásia-Pacífico está preparado para crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 9,1%, durante o período de previsão de 2026 a 2033, impulsionado pelo aumento da produção de produtos biológicos, pela expansão das organizações de fabricação por contrato e pelo aumento dos investimentos em sistemas de filtração flexíveis em países como China, Índia e Japão. O crescente apoio governamental e a adoção de tecnologias descartáveis em mercados emergentes estão impulsionando ainda mais a expansão do mercado.

Análise do mercado japonês de conjuntos de filtração descartáveis

O mercado japonês de sistemas de filtração descartáveis está ganhando impulso devido ao forte setor biofarmacêutico do país, à crescente demanda por produtos biológicos e à adoção de tecnologias descartáveis para uma produção eficiente e livre de contaminação. Investimentos em sistemas de filtração avançados e na melhoria contínua de processos estão impulsionando o crescimento do mercado.

Análise do Mercado de Conjuntos de Filtração Descartáveis na China

O mercado chinês de sistemas de filtração descartáveis representou a maior fatia de receita na região Ásia-Pacífico em 2025, devido à rápida expansão da fabricação de produtos biológicos, ao crescente número de Organizações de Fabricação por Contrato (CMOs) e à adoção cada vez maior de sistemas de filtração descartáveis. O incentivo à produção nacional de produtos biológicos e as iniciativas regulatórias favoráveis são fatores-chave para o crescimento do mercado.

Participação de mercado de conjuntos de filtração de uso único

O setor de conjuntos de filtração de uso único é liderado principalmente por empresas consolidadas, incluindo:

- GE Healthcare Ciências da Vida (EUA)

- Sartorius AG (Alemanha)

- Merck KGaA (Alemanha)

- Pall Corporation (EUA)

- Thermo Fisher Scientific (EUA)

- Cytiva (EUA)

- Repligen Corporation (EUA)

- Empresa 3M (EUA)

- Eppendorf AG (Alemanha)

- DiaSorin SpA (Itália)

- Biofiltração HydroDyne (EUA)

- Asahi Kasei Corporation (Japão)

- Soluções de membrana (EUA)

- Porex Corporation (EUA)

- SP Industries (EUA)

- Franz Ziel GmbH (Alemanha)

- Avantec BioSystems (EUA)

- MilliporeSigma (EUA)

- Corning Inc. (EUA)

- Grupo de Tecnologia de Fluidos Watson-Marlow (Reino Unido)

Últimos desenvolvimentos no mercado global de conjuntos de filtração de uso único

- Em junho de 2021, a 3M Health Care lançou o clarificador 3M Harvest RC, uma solução de purificação em estágio único projetada para proteínas terapêuticas recombinantes, simplificando o processo tradicional de colheita e clarificação em múltiplos estágios para fabricantes de produtos biológicos.

- Em setembro de 2022, a Pall Corporation (uma subsidiária da Danaher Corporation) expandiu sua linha de produtos de bioprocessamento com três novos sistemas Allegro Connect, que combinam recursos de filtração viral, filtração profunda e gerenciamento de tampões, ajudando os fabricantes de produtos biológicos a automatizar fluxos de trabalho críticos de filtração downstream.

- Em janeiro de 2024, a Repligen Corporation inaugurou uma nova unidade fabril de 4.645 metros quadrados na Suécia, dedicada à produção de conjuntos de filtração descartáveis para o mercado europeu — uma iniciativa que reflete a crescente demanda por componentes de filtração descartáveis na produção de produtos biológicos e vacinas.

- Em julho de 2024, a empresa de pesquisa de mercado Spherical Insights & Consulting publicou uma previsão projetando que o mercado global de conjuntos de filtração de uso único cresceria de US$ 2,43 bilhões em 2023 para US$ 10,09 bilhões em 2033 (CAGR de aproximadamente 15,3%), destacando a crescente adoção de sistemas de uso único na fabricação biofarmacêutica.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.