Global Squash Drinks Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.67 Billion

USD

5.42 Billion

2025

2033

USD

3.67 Billion

USD

5.42 Billion

2025

2033

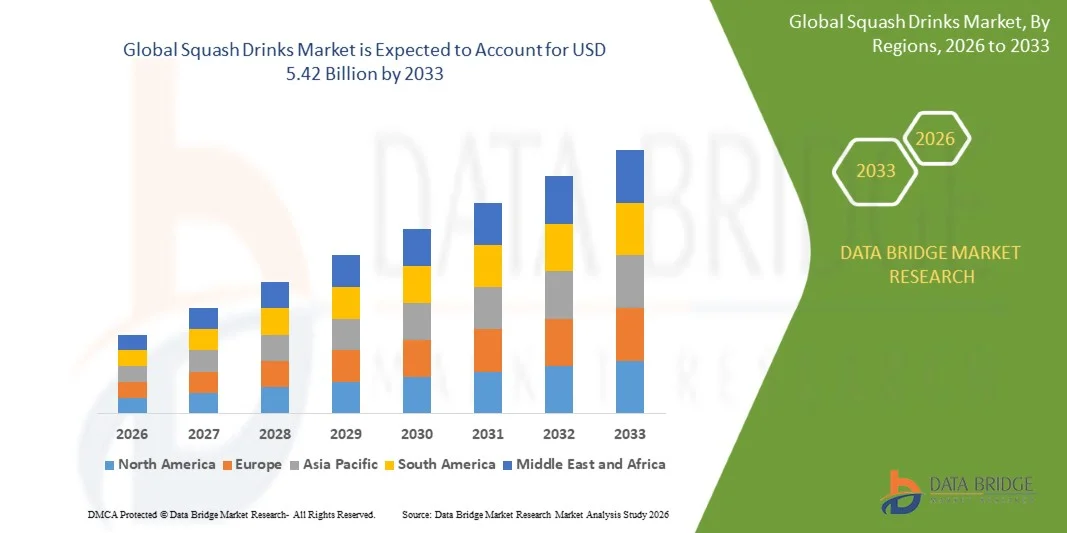

| 2026 –2033 | |

| USD 3.67 Billion | |

| USD 5.42 Billion | |

|

|

|

|

Global Squash Drinks Market Segmentation, By Product Type (No Added Sugars and Added Sugars), Nature (Regular and Blended), Base Types (Citrus Fruits, Berry, Tropical & Exotic Fruits, and Mixed Fruit), Distribution Channels (Super/Hypermarket, Convenience Stores, Independent Grocery Stores, and Online Retailers) - Industry Trends and Forecast to 2033

Squash Drinks Market Size

- The global squash drinks market size was valued at USD 3.67 billion in 2025 and is expected to reach USD 5.42 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for convenient and ready-to-drink beverages

- Increasing health consciousness among consumers, leading to higher demand for low-sugar, fruit-based, and natural ingredient squash drinks

Squash Drinks Market Analysis

- The market is witnessing innovation in flavors, natural ingredients, and functional additives, enhancing consumer appeal

- Expanding distribution channels, including supermarkets, online retail, and convenience stores, are supporting wider product availability and adoption

- North America dominated the squash drinks market with the largest revenue share of 38.5% in 2025, driven by growing health awareness, demand for convenient beverage options, and increasing adoption of flavored and functional drinks

- Asia-Pacific region is expected to witness the highest growth rate in the global squash drinks market, driven by rapid urbanization, increasing middle-class population, rising adoption of flavored and ready-to-mix beverages, and expanding distribution networks across retail and online channels

- The Added Sugars segment held the largest market revenue share in 2025, driven by consumer preference for traditional sweetened beverages and the availability of a wide range of flavors. Added sugar squash drinks are widely consumed for their taste, convenience, and long shelf life, making them a staple choice for households

Report Scope and Squash Drinks Market Segmentation

|

Attributes |

Squash Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Squash Drinks Market Trends

“Rising Demand for Convenient and Health-Oriented Beverages”

- The growing focus on ready-to-drink and functional beverages is significantly shaping the squash drinks market, as consumers increasingly prefer products that are easy to prepare, flavorful, and enriched with natural fruit extracts. Squash drinks are gaining traction due to their versatility in beverage preparation and potential for low-sugar or fortified variants, strengthening adoption across retail, foodservice, and household consumption

- Increasing awareness around health, wellness, and balanced nutrition has accelerated the demand for squash drinks with reduced sugar, natural flavors, and added vitamins. Health-conscious consumers are actively seeking products that align with dietary preferences, prompting brands to innovate with healthier formulations and convenient packaging options

- Convenience and flavor innovation trends are influencing purchasing decisions, with manufacturers emphasizing ready-to-mix options, natural ingredients, and transparent labeling. These factors help brands differentiate products in a competitive market and build consumer trust, while marketing campaigns highlight benefits such as refreshment, hydration, and natural fruit content

- For instance, in 2024, Britvic in the U.K. and Dabur in India expanded their product portfolios by introducing new fruit-flavored and low-sugar squash variants. These launches were in response to rising consumer preference for convenient, tasty, and health-oriented drinks, with distribution across retail, e-commerce, and specialty channels. The products were also promoted as wholesome choices, enhancing brand loyalty and repeat purchases

- While demand for squash drinks is growing, sustained market expansion depends on continuous product innovation, competitive pricing, and maintaining flavor and quality standards. Manufacturers are also focusing on expanding distribution networks, improving shelf life, and developing formulations that balance taste, nutrition, and convenience for broader adoption

Squash Drinks Market Dynamics

Driver

“Growing Preference for Convenient and Health-Oriented Beverages”

- Rising consumer demand for ready-to-mix, flavorful, and low-sugar drinks is a major driver for the squash drinks market. Manufacturers are increasingly introducing natural, fruit-based, and functional variants to meet health and convenience expectations, improve product appeal, and comply with labeling trends

- Expanding applications in households, restaurants, cafes, and foodservice sectors are influencing market growth. Squash drinks enhance refreshment and taste while allowing easy preparation, enabling manufacturers to cater to evolving consumer lifestyles. The increasing focus on health-conscious diets globally further reinforces this trend

- Beverage manufacturers are actively promoting squash drink-based formulations through product innovation, marketing campaigns, and strategic partnerships. These efforts are supported by the growing consumer preference for natural, low-sugar, and functional beverages, and they also encourage collaborations between ingredient suppliers and brands to improve quality and reduce environmental footprint

- For instance, in 2023, Coca-Cola in the U.S. and Rasna in India reported increased incorporation of fruit concentrates and reduced sugar formulations in squash drinks. This expansion followed higher consumer demand for convenient, health-oriented, and flavorful beverages, driving repeat purchases and product differentiation. Both companies also highlighted natural ingredients and convenience in marketing campaigns to strengthen consumer trust and brand loyalty

- Although rising health and convenience trends support growth, wider adoption depends on cost optimization, ingredient sourcing, and scalable production processes. Investment in supply chain efficiency, sustainable sourcing, and flavor innovation technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Competition and Price Sensitivity”

- The presence of numerous established brands and private-label products increases market competition, limiting pricing power for some manufacturers and challenging new entrants. Competitive pricing pressures may affect margins and profitability

- Consumer price sensitivity remains high in certain regions, particularly in developing markets where budget-conscious households may prefer low-cost alternatives. This can restrict adoption of premium or fortified squash drinks despite growing health awareness

- Supply chain and distribution challenges also impact market growth, as squash drinks require consistent ingredient quality, packaging reliability, and timely delivery. Logistical complexities, especially for perishable or flavored concentrates, increase operational costs

- For instance, in 2024, distributors in Southeast Asia and Africa reported slower uptake of premium fruit-flavored squash drinks due to higher prices and limited awareness of enhanced nutritional benefits. This affected shelf space allocation in retail outlets, limiting visibility and sales

- Overcoming these challenges will require competitive pricing strategies, robust distribution networks, and targeted marketing initiatives for consumers and retailers. Collaboration with foodservice operators, e-commerce platforms, and ingredient suppliers can help unlock the long-term growth potential of the global squash drinks market. Furthermore, continuous flavor innovation and value-added formulations will be essential for widespread adoption

Squash Drinks Market Scope

The market is segmented on the basis of product type, nature, base types, and distribution channels

• By Product Type

On the basis of product type, the squash drinks market is segmented into No Added Sugars and Added Sugars. The Added Sugars segment held the largest market revenue share in 2025, driven by consumer preference for traditional sweetened beverages and the availability of a wide range of flavors. Added sugar squash drinks are widely consumed for their taste, convenience, and long shelf life, making them a staple choice for households.

The No Added Sugars segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing health awareness and demand for low-calorie alternatives. No added sugar squash drinks are gaining popularity among health-conscious consumers and fitness enthusiasts, often promoted as a better-for-you option without compromising on flavor.

• By Nature

On the basis of nature, the market is segmented into Regular and Blended. The Regular segment held the largest market revenue share in 2025, owing to its wide availability and consistent flavor profile that appeals to traditional consumers. Regular squash drinks are commonly used for everyday consumption and household use.

The Blended segment is projected to register the highest growth from 2026 to 2033, supported by rising demand for innovative flavor combinations and functional beverage options. Blended squash drinks often combine multiple fruit extracts, enhancing nutritional value and catering to evolving taste preferences

• By Base Types

On the basis of base types, the market is segmented into Citrus Fruits, Berry, Tropical & Exotic Fruits, and Mixed Fruit. The Citrus Fruits segment dominated the market in 2025, driven by consumer preference for tangy and refreshing flavors and the wide availability of citrus-based products. Citrus squash drinks are commonly consumed for hydration and as a refreshing beverage option.

The Tropical & Exotic Fruits segment is expected to grow at the fastest pace from 2026 to 2033, fueled by increasing interest in exotic flavors and premium fruit varieties. Tropical & exotic fruit squash drinks often target niche consumers seeking unique taste experiences and higher perceived quality.

• By Distribution Channels

On the basis of distribution channels, the market is segmented into Super/Hypermarket, Convenience Stores, Independent Grocery Stores, and Online Retailers. The Super/Hypermarket segment held the largest market share in 2025, owing to extensive product availability, promotional activities, and competitive pricing. These channels are preferred by consumers for bulk purchases and variety of options.

The Online Retailers segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing adoption of e-commerce, convenience of home delivery, and expanding online product portfolios. Online platforms provide consumers with easy access to a wide range of squash drink variants and exclusive offers.

Squash Drinks Market Regional Analysis

- North America dominated the squash drinks market with the largest revenue share of 38.5% in 2025, driven by growing health awareness, demand for convenient beverage options, and increasing adoption of flavored and functional drinks

- Consumers in the region prefer products that offer taste, refreshment, and nutritional benefits, making squash drinks a popular choice for households and on-the-go consumption

- This widespread adoption is further supported by high disposable incomes, busy lifestyles, and the growing preference for low-calorie and no-added-sugar beverages, establishing squash drinks as a favored option across retail and online channels

U.S. Squash Drinks Market Insight

The U.S. squash drinks market captured the largest revenue share in 2025 within North America, fueled by the rising demand for flavored and sugar-free beverages. Consumers are increasingly seeking convenient and healthy drink options for everyday consumption. The growing preference for fruit-based and functional beverages, combined with strong distribution through supermarkets and online retail, further drives the market. Moreover, product innovations, such as blended and exotic fruit flavors, are significantly contributing to market expansion.

Europe Squash Drinks Market Insight

The Europe squash drinks market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing health consciousness, rising disposable incomes, and demand for low-sugar beverage options. The surge in urbanization and busy lifestyles is encouraging the adoption of convenient and ready-to-mix drinks. European consumers are also attracted to natural fruit flavors, organic variants, and functional beverages, driving growth across retail, foodservice, and online channels.

U.K. Squash Drinks Market Insight

The U.K. squash drinks market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health awareness and the preference for low-sugar, nutrient-rich beverages. Consumers are increasingly opting for flavored squash drinks that offer taste without compromising health. In addition, the growing e-commerce sector and retail penetration are further boosting product availability and adoption.

Germany Squash Drinks Market Insight

The Germany squash drinks market is expected to witness the fastest growth rate from 2026 to 2033, fueled by consumer preference for healthy, natural, and functional beverages. Increasing urbanization, busy lifestyles, and a strong inclination towards innovative fruit blends are encouraging market growth. The demand for convenient packaging and shelf-stable options also supports adoption in both retail and online channels.

Asia-Pacific Squash Drinks Market Insight

The Asia-Pacific squash drinks market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, rapid urbanization, and increasing health awareness in countries such as China, Japan, and India. The region’s growing preference for convenient and flavored beverages, supported by expanding modern retail and e-commerce, is driving adoption. Furthermore, availability of diverse fruit bases and competitive pricing is helping squash drinks reach a wider consumer base.

Japan Squash Drinks Market Insight

The Japan squash drinks market is expected to witness the fastest growth rate from 2026 to 2033 due to high consumer demand for low-sugar, functional, and flavored beverages. Japanese consumers increasingly seek convenient and nutritious drink options for both home and on-the-go consumption. Product innovations, such as blended fruit flavors and ready-to-mix formats, along with strong retail and e-commerce penetration, are fueling market growth.

China Squash Drinks Market Insight

The China squash drinks market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, increasing health awareness, and rising demand for fruit-based beverages. Squash drinks are becoming increasingly popular in households, retail, and online channels. The growing trend of flavored and functional drinks, combined with strong local manufacturing and competitive pricing, is driving market expansion.

Squash Drinks Market Share

The Squash Drinks industry is primarily led by well-established companies, including:

Here’s the updated list with 14 companies, no links, and headquarters in brackets as requested:

- Unilever (U.K./Netherlands)

- Britvic PLC (U.K.)

- Hamdard (India)

- The Coca-Cola Company (U.S.)

- Rasna (India)

- Prigat (Israel)

- Primor (Israel)

- SUNTORY HOLDINGS LIMITED (Japan)

- Sunquick (U.K.)

- PepsiCo (U.S.)

- Nestlé (Switzerland)

- Dabur (India)

- Cott Corporation (Canada)

- Refresco (Netherlands)

Latest Developments in Global Squash Drinks Market

- In April 2025, Capri-Sun expanded its beverage portfolio by launching a new squash product range. The range includes an enhanced version of its traditional Orange Squash and two innovative flavors, Monster Alarm and Jungle Drink. This launch is designed to attract younger consumers and diversify the brand’s offerings. The move strengthens Capri-Sun’s market presence and helps capture a larger share of the squash drinks segment

- In March 2025, Nichols introduced Vimto Wonderfuel, a functional squash variant under its Vimto brand targeting the breakfast segment. The product is enriched with vitamins B, C, and D, along with iron and zinc. It aims to provide added nutritional benefits and appeal to health-conscious consumers. This launch is expected to boost demand in the functional squash drinks category and enhance brand value

- In October 2024, Britvic PLC’s Robinsons brand strengthened its market presence by introducing two squash variants inspired by the musical Wicked. The launch adds unique flavors and enhances product diversity. It engages fans of the franchise while attracting new consumers. The initiative is expected to increase sales and reinforce Robinsons’ position in the squash drinks market

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.