Middle East And Africa Active Medical Implantable Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

826.38 Million

USD

1,184.22 Million

2025

2033

USD

826.38 Million

USD

1,184.22 Million

2025

2033

| 2026 –2033 | |

| USD 826.38 Million | |

| USD 1,184.22 Million | |

|

|

|

|

Segmentação do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e África, por produto (dispositivos de terapia de ressincronização cardíaca (TRC-D), desfibriladores cardioversores implantáveis, marcapassos cardíacos implantáveis, implantes oculares, neuroestimuladores, dispositivos auditivos implantáveis ativos, dispositivos de assistência ventricular, monitores cardíacos implantáveis/gravadores de loop implantáveis, braquiterapia, monitores de glicose implantáveis, implantes para pé caído, implantes de ombro, bombas de infusão implantáveis e acessórios implantáveis), tipo de cirurgia (métodos cirúrgicos tradicionais e cirurgia minimamente invasiva), procedimento (neurovascular, cardiovascular, auditivo e outros), usuário final (hospitais, clínicas especializadas, centros cirúrgicos ambulatoriais e clínicas) - Tendências e previsões do setor até 2033.

Tamanho do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

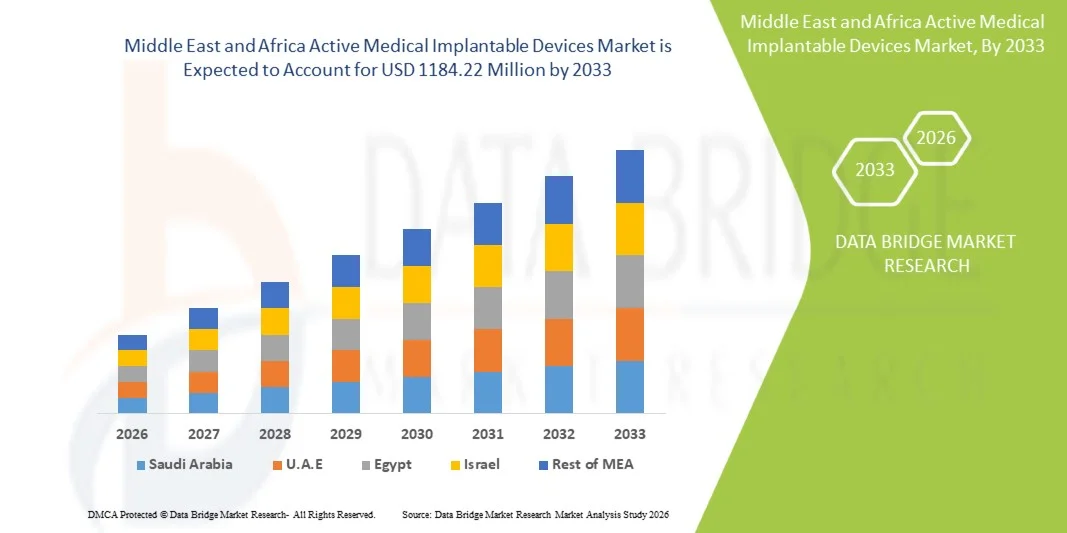

- O mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África foi avaliado em US$ 826,38 milhões em 2025 e deverá atingir US$ 1.184,22 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,60% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças crônicas, pelo aumento da população idosa e pelos contínuos avanços tecnológicos em dispositivos médicos implantáveis, como marca-passos, desfibriladores cardioversores implantáveis, neuroestimuladores e sistemas implantáveis de administração de medicamentos, resultando em melhores desfechos para os pacientes e no controle de doenças a longo prazo.

- Além disso, a crescente demanda por tratamentos minimamente invasivos, maior confiabilidade dos dispositivos, maior duração da bateria e melhor integração de tecnologias de saúde digital estão consolidando os dispositivos médicos implantáveis ativos como soluções essenciais na assistência médica moderna. Esses fatores convergentes estão acelerando a adoção de dispositivos médicos implantáveis ativos, impulsionando significativamente o crescimento do setor.

Análise do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

- Dispositivos médicos implantáveis ativos, incluindo marca-passos, desfibriladores cardioversores implantáveis (CDIs), neuroestimuladores e sistemas implantáveis de administração de medicamentos, são componentes cada vez mais vitais da assistência médica moderna devido à sua capacidade de monitorar, regular e tratar continuamente condições médicas crônicas e potencialmente fatais com alta precisão e confiabilidade a longo prazo.

- A crescente demanda por dispositivos médicos implantáveis ativos é impulsionada principalmente pela prevalência cada vez maior de doenças cardiovasculares e neurológicas, pelo envelhecimento da população e pela preferência crescente por soluções de tratamento minimamente invasivas e tecnologicamente avançadas que melhoram os resultados para os pacientes e a qualidade de vida.

- A Arábia Saudita dominou o mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África, com a maior participação de receita, de aproximadamente 35,4% em 2025. Esse desempenho foi caracterizado por fortes investimentos governamentais em infraestrutura de saúde, expansão de hospitais de atendimento terciário e crescente adoção de tecnologias avançadas de implantes cardíacos e neurológicos, impulsionadas por iniciativas nacionais de modernização da saúde.

- Prevê-se que os Emirados Árabes Unidos sejam o país com o crescimento mais rápido no mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África durante o período de previsão, impulsionados pela rápida expansão de instalações de saúde privadas, aumento do turismo médico, crescente disponibilidade de centros especializados em cardiologia e neurologia e crescente adoção de terapias implantáveis tecnologicamente avançadas.

- Os métodos cirúrgicos tradicionais representaram a maior parcela da receita, com 61,9% em 2025, devido à sua longa aceitação clínica e disponibilidade em uma ampla gama de instalações de saúde em todo o mundo.

Escopo do relatório e segmentação do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África.

|

Atributos |

Análises de mercado essenciais para dispositivos médicos implantáveis ativos no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

“ Avanços na miniaturização e integração do monitoramento remoto ”

- Uma tendência fundamental e crescente no mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África é o rápido avanço na miniaturização dos dispositivos, combinado com recursos integrados de monitoramento remoto, permitindo um gerenciamento mais eficiente do paciente a longo prazo.

- Por exemplo, os dispositivos implantáveis de gerenciamento do ritmo cardíaco e os neuroestimuladores de última geração estão sendo cada vez mais projetados com formatos compactos, permitindo procedimentos de implantação minimamente invasivos e maior conforto para o paciente.

- Os dispositivos implantáveis modernos são frequentemente equipados com sistemas de telemetria sem fio que permitem a transmissão contínua de dados fisiológicos para os profissionais de saúde, possibilitando o monitoramento em tempo real e a detecção precoce de complicações.

- A integração com plataformas de saúde digital permite que os médicos ajustem remotamente as configurações da terapia, monitorem o desempenho do dispositivo e avaliem a adesão do paciente sem a necessidade de consultas presenciais frequentes, melhorando os resultados clínicos e a eficiência operacional.

- Além disso, a adoção de sistemas de monitoramento implantáveis conectados à nuvem está facilitando abordagens preditivas na área da saúde, permitindo que os médicos identifiquem padrões de progressão da doença e intervenham precocemente.

- À medida que os sistemas de saúde em todo o mundo enfatizam cada vez mais o monitoramento remoto de pacientes e o cuidado baseado em valor, a demanda por tecnologias médicas implantáveis compactas e conectadas deverá expandir significativamente em aplicações cardiovasculares, neurológicas e ortopédicas.

Dinâmica do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

Motorista

“Prevalência crescente de doenças crônicas e envelhecimento da população”

- O crescente fardo global de doenças crônicas, como distúrbios cardiovasculares, doenças neurológicas e diabetes, é um dos principais fatores que impulsionam a demanda por dispositivos médicos implantáveis ativos.

- Por exemplo, a crescente incidência de arritmias, insuficiência cardíaca, doença de Parkinson e condições de dor crônica está levando a uma maior adoção de marca-passos implantáveis, desfibriladores, neuroestimuladores e sistemas de administração de medicamentos.

- O rápido crescimento da população geriátrica, mais suscetível a doenças crônicas e degenerativas, está impulsionando ainda mais a necessidade de soluções terapêuticas de implantes de longo prazo que proporcionem tratamento e monitoramento contínuos.

- Os avanços tecnológicos que aumentam a longevidade dos dispositivos, a eficiência da bateria e a precisão terapêutica também estão incentivando os médicos a recomendar terapias implantáveis como opções de tratamento preferenciais em relação a intervenções cirúrgicas ou farmacológicas repetidas.

- Além disso, a melhoria dos sistemas de reembolso e a expansão da infraestrutura de saúde em economias emergentes estão aumentando o acesso dos pacientes a terapias com dispositivos implantáveis, contribuindo para o crescimento sustentado do mercado durante o período de previsão.

Restrição/Desafio

“ Altos custos de procedimento e requisitos regulatórios rigorosos ”

- Os elevados custos totais do tratamento, incluindo preços de dispositivos, procedimentos de implantação cirúrgica e cuidados pós-operatórios, continuam sendo uma barreira significativa para a adoção em larga escala, principalmente em mercados de saúde sensíveis a custos.

- Por exemplo, dispositivos cardíacos implantáveis e sistemas de neuroestimulação frequentemente envolvem custos iniciais substanciais, limitando o acesso para populações de pacientes sem seguro ou com seguro insuficiente em diversas regiões.

- Os rigorosos processos de aprovação regulamentar para tecnologias médicas implantáveis também representam desafios para os fabricantes, uma vez que os extensos ensaios clínicos e os longos prazos de avaliação aumentam os custos de desenvolvimento e atrasam a comercialização do produto.

- Preocupações relacionadas à segurança dos dispositivos, à confiabilidade a longo prazo e a possíveis complicações, como infecções ou mau funcionamento, exigem requisitos de conformidade rigorosos, aumentando a complexidade operacional para as empresas.

- Abordar esses desafios por meio de estratégias de fabricação com boa relação custo-benefício, melhor cobertura de reembolso e processos regulatórios simplificados será fundamental para garantir maior acessibilidade e expansão sustentada do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África.

Escopo do mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

O mercado é segmentado com base no produto, tipo de cirurgia, procedimento e usuário final.

• Por produto

Com base no produto, o mercado de Dispositivos Médicos Implantáveis é segmentado em Dispositivos de Terapia de Ressincronização Cardíaca (TRC-D), Desfibriladores Cardioversores Implantáveis, Marcapassos Cardíacos Implantáveis, Implantes Oculares, Neuroestimuladores, Dispositivos Auditivos Implantáveis Ativos, Dispositivos de Assistência Ventricular, Monitores Cardíacos Implantáveis/Gravadores de Loop Inseríveis, Braquiterapia, Monitores de Glicose Implantáveis, Implantes para Pé Caído, Implantes para Ombro, Bombas de Infusão Implantáveis e Acessórios Implantáveis. Os Marcapassos Cardíacos Implantáveis dominaram o mercado com uma participação de 28,6% da receita em 2025, impulsionados pela crescente prevalência global de arritmias e pelo envelhecimento da população, que exige o gerenciamento do ritmo cardíaco a longo prazo. Os marcapassos continuam sendo um dos dispositivos cardíacos mais implantados devido à sua confiabilidade clínica, aos sistemas de reembolso estabelecidos e aos avanços tecnológicos contínuos, como marcapassos compatíveis com ressonância magnética e sem eletrodos. Os profissionais de saúde preferem cada vez mais os marcapassos de última geração, que oferecem maior duração da bateria, monitoramento sem fio e maior segurança para o paciente. A forte adoção em economias desenvolvidas e emergentes contribui ainda mais para a dominância do segmento. A crescente conscientização sobre a detecção precoce de doenças cardíacas e o aumento dos programas de triagem também impulsionam o crescimento dos procedimentos. Além disso, a integração de sistemas de monitoramento remoto de pacientes melhora os resultados a longo prazo, incentivando a preferência dos médicos. Iniciativas governamentais de saúde voltadas para o controle de doenças cardiovasculares também aumentam as taxas de implante. A ampla disponibilidade de cardiologistas treinados e infraestrutura para procedimentos sustenta a utilização constante. Inovações tecnológicas que reduzem a complexidade dos procedimentos fortalecem ainda mais as tendências de adoção. O aumento do volume de compras hospitalares e os fortes investimentos dos fabricantes também impulsionam o crescimento da receita. Atualizações contínuas e ciclos de substituição para sistemas de marcapassos mais antigos sustentam ainda mais a demanda. Como as doenças cardiovasculares continuam sendo uma das principais causas de mortalidade em todo o mundo, espera-se que os marcapassos mantenham uma posição de mercado sólida durante o período de previsão.

Prevê-se que os neuroestimuladores apresentem o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) projetada de 9,7% de 2026 a 2033, impulsionados pela expansão de suas aplicações no tratamento da dor crônica, doença de Parkinson, epilepsia e lesões na medula espinhal. O aumento da prevalência de distúrbios neurológicos em todo o mundo está impulsionando significativamente a demanda por terapias avançadas de neuromodulação. Os contínuos avanços tecnológicos, incluindo baterias recarregáveis, implantes miniaturizados e sistemas de estimulação adaptáveis, estão aprimorando a eficácia do tratamento e a aceitação por parte dos pacientes. A crescente conscientização entre médicos e pacientes sobre procedimentos de neuromodulação minimamente invasivos também está incentivando sua adoção. A cobertura favorável de reembolso em sistemas de saúde desenvolvidos apoia a expansão do mercado. Os crescentes investimentos em pesquisa em neurociência e inovação de produtos por parte dos principais fabricantes de dispositivos médicos aceleram ainda mais a adoção. A crescente preferência por soluções de tratamento da dor a longo prazo sem o uso de medicamentos também contribui para o aumento da demanda. A expansão de centros especializados em tratamento neurológico em todo o mundo está fortalecendo a acessibilidade aos procedimentos. Melhorias na precisão dos dispositivos e nos recursos de estimulação programável aprimoram os resultados do tratamento, impulsionando a preferência dos médicos. Além disso, o envelhecimento da população, mais propensa a distúrbios neurológicos, continua a representar um grande grupo de pacientes. Espera-se que as aprovações regulatórias para novas indicações de neuromodulação expandam significativamente o uso clínico. Esses fatores combinados posicionam os neuroestimuladores como o segmento de produto de crescimento mais rápido no período previsto.

• Por tipo de cirurgia

Com base no tipo de cirurgia, o mercado é segmentado em Métodos Cirúrgicos Tradicionais e Cirurgia Minimamente Invasiva. Os métodos cirúrgicos tradicionais representaram a maior fatia da receita, com 61,9% em 2025, devido à sua longa aceitação clínica e disponibilidade em uma ampla gama de instalações de saúde em todo o mundo. Muitos procedimentos complexos de implante de dispositivos, particularmente implantes cardiovasculares e ortopédicos avançados, ainda exigem técnicas cirúrgicas abertas para garantir a colocação precisa e resultados ideais. Hospitais com infraestrutura cirúrgica consolidada e equipes cirúrgicas experientes continuam a utilizar procedimentos convencionais para casos complexos. Além disso, os sistemas de reembolso em diversas regiões permanecem mais alinhados com as práticas cirúrgicas tradicionais, o que contribui para a sua utilização contínua. A presença de protocolos cirúrgicos padronizados aumenta ainda mais a confiança dos médicos nesses métodos. Economias emergentes com acesso limitado a equipamentos minimamente invasivos avançados também contribuem significativamente para o volume de procedimentos tradicionais. O implante de dispositivos complexos que envolve múltiplas etapas cirúrgicas frequentemente exige abordagens cirúrgicas abertas, mantendo a estabilidade da demanda. Os programas de treinamento para cirurgiões têm se concentrado historicamente em procedimentos convencionais, reforçando a familiaridade com os procedimentos. Certos pacientes de alto risco também requerem cirurgia aberta para melhor monitoramento e controle durante o implante. Além disso, as considerações de custo no desenvolvimento de sistemas de saúde frequentemente favorecem os procedimentos tradicionais em detrimento de tecnologias minimamente invasivas avançadas. A necessidade contínua dessas abordagens para indicações clínicas específicas garante a dominância sustentada do segmento ao longo do período de previsão.

Prevê-se que a cirurgia minimamente invasiva seja o segmento de crescimento mais rápido, registrando uma taxa de crescimento anual composta (CAGR) de 10,6% entre 2026 e 2033, impulsionada pela crescente demanda por tempos de recuperação mais curtos, menor trauma cirúrgico e custos de hospitalização mais baixos. Os avanços tecnológicos em imagem, assistência robótica e técnicas de implantação baseadas em cateteres estão permitindo uma adoção mais ampla em diversos procedimentos com dispositivos implantáveis. Os pacientes preferem cada vez mais os procedimentos minimamente invasivos devido à reabilitação mais rápida e aos melhores resultados estéticos. Os profissionais de saúde também estão promovendo essas abordagens, pois elas reduzem as complicações e os custos com cuidados pós-operatórios. A crescente disponibilidade de programas de treinamento especializado em cirurgia minimamente invasiva está melhorando a adesão dos médicos. Os fabricantes de dispositivos estão projetando implantes especificamente otimizados para técnicas de implantação baseadas em cateteres ou por pequenas incisões, o que impulsiona ainda mais a expansão do segmento. Os crescentes investimentos em infraestrutura cirúrgica avançada estão acelerando a acessibilidade em todo o mundo. Além disso, políticas de reembolso favoráveis para procedimentos minimamente invasivos em diversos países desenvolvidos estão incentivando a adoção. A inovação contínua em plataformas de cirurgia robótica aprimora ainda mais a precisão e as taxas de sucesso dos procedimentos. A expansão de centros cirúrgicos ambulatoriais equipados com recursos minimamente invasivos também fortalece o crescimento do segmento. A crescente conscientização dos pacientes sobre as alternativas cirúrgicas está contribuindo para o aumento da demanda. Esses fatores, em conjunto, posicionam a cirurgia minimamente invasiva como o segmento cirúrgico de crescimento mais rápido durante o período de previsão.

• Por procedimento

Com base no procedimento, o mercado é segmentado em Neurovascular, Cardiovascular, Auditivo e Outros. Os procedimentos cardiovasculares dominaram o mercado com uma participação de 44,3% da receita em 2025, impulsionados pela alta prevalência global de doenças cardíacas que requerem dispositivos cardíacos implantáveis, como marca-passos, desfibriladores, dispositivos de assistência ventricular e monitores cardíacos. O aumento da incidência de hipertensão, doença arterial coronariana e distúrbios do ritmo cardíaco contribui significativamente para o alto volume de procedimentos. As melhorias contínuas nas tecnologias de implantes cardíacos aprimoram os resultados clínicos e incentivam a adoção por parte dos médicos. Iniciativas governamentais voltadas para a redução da mortalidade cardiovascular também apoiam a expansão dos procedimentos. A ampla disponibilidade de hospitais cardíacos especializados e cardiologistas treinados impulsiona ainda mais o crescimento dos procedimentos. A crescente cobertura de planos de saúde para procedimentos cardíacos em diversas regiões facilita o acesso. O envelhecimento da população, principalmente em economias desenvolvidas, contribui significativamente para a demanda dos pacientes. Inovações tecnológicas, como sistemas de monitoramento cardíaco remoto, também aumentam o uso a longo prazo de dispositivos cardíacos implantáveis. A crescente conscientização sobre diagnóstico precoce e programas de cardiologia preventiva também contribui para as taxas de implantação. Lançamentos contínuos de produtos e atualizações de dispositivos sustentam os ciclos de demanda por substituição. A forte necessidade clínica de implantes cardíacos garante o domínio contínuo dos procedimentos cardiovasculares.

Prevê-se que os procedimentos neurovasculares apresentem o crescimento mais rápido, expandindo a uma taxa composta de crescimento anual (CAGR) de 9,9% de 2026 a 2033, impulsionados pela crescente prevalência de distúrbios neurológicos como acidente vascular cerebral (AVC), epilepsia e doença de Parkinson. A crescente adoção de neuroestimuladores e implantes neurovasculares avançados para tratamento terapêutico está impulsionando significativamente o crescimento desses procedimentos. Os avanços tecnológicos contínuos, que permitem o direcionamento neural preciso e a estimulação programável, estão melhorando as taxas de sucesso clínico. A crescente conscientização entre os neurologistas sobre a eficácia da terapia de neuromodulação está acelerando a adoção. Os investimentos crescentes em pesquisa em neurociência também estão apoiando novas aplicações de tratamento. O aumento da população idosa propensa a condições neurológicas expande ainda mais a base de pacientes. O apoio favorável ao reembolso de terapias de neuromodulação em diversos mercados desenvolvidos incentiva a adoção do tratamento. O crescimento de centros de neurologia especializados em todo o mundo aumenta a acessibilidade aos procedimentos. As técnicas de implantação minimamente invasivas aumentam ainda mais a preferência dos pacientes por intervenções neurovasculares. Espera-se que o aumento de ensaios clínicos explorando novas indicações de neuromodulação expanda o escopo do tratamento. A crescente colaboração entre fabricantes de dispositivos e profissionais de saúde também fortalece a adoção. Esses fatores, em conjunto, posicionam os procedimentos neurovasculares como o segmento de crescimento mais rápido durante o período de previsão.

• Pelo usuário final

Com base no usuário final, o mercado é segmentado em Hospitais, Clínicas Especializadas, Centros Cirúrgicos Ambulatoriais e Clínicas. Os hospitais representaram a maior participação na receita, com 58,7% em 2025, principalmente devido à sua infraestrutura cirúrgica avançada, disponibilidade de especialistas multidisciplinares e capacidade de gerenciar procedimentos complexos de implantação que exigem monitoramento pós-operatório intensivo. A maioria das cirurgias de dispositivos implantáveis, particularmente os procedimentos cardiovasculares e neurológicos, são realizadas em ambiente hospitalar devido à necessidade de sistemas de imagem avançados e instalações de atendimento de emergência. Os hospitais também atendem um volume maior de pacientes, contribuindo significativamente para o número de procedimentos. Regimes de reembolso favoráveis geralmente apoiam os procedimentos hospitalares, reforçando a dominância do segmento. Além disso, os hospitais normalmente mantêm programas de acompanhamento de longo prazo para pacientes com dispositivos implantados, fortalecendo a preferência institucional. O aumento dos investimentos governamentais em infraestrutura hospitalar, principalmente em economias emergentes, expande ainda mais a capacidade de realização de procedimentos. A presença de cirurgiões altamente treinados e unidades cirúrgicas especializadas aumenta a confiabilidade dos procedimentos. Os hospitais também participam de ensaios clínicos e da adoção precoce de tecnologias avançadas de implantes, fortalecendo sua posição de liderança. A crescente colaboração entre hospitais e fabricantes de dispositivos médicos para a adoção de dispositivos avançados também impulsiona o crescimento da receita. A alta confiança dos pacientes e os padrões de encaminhamento contribuem ainda mais para a utilização dos serviços hospitalares. A combinação desses fatores garante a continuidade da predominância dos hospitais ao longo do período de previsão.

Espera-se que os Centros Cirúrgicos Ambulatoriais (CCAs) apresentem o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 10,8% entre 2026 e 2033, impulsionados pela crescente demanda por procedimentos cirúrgicos ambulatoriais com melhor custo-benefício e pela adoção cada vez maior de técnicas de implantação minimamente invasivas. Os CCAs oferecem tempos de procedimento mais curtos, custos de hospitalização reduzidos e maior rotatividade de pacientes, tornando-os atraentes tanto para profissionais de saúde quanto para pacientes. Os avanços nas tecnologias de implantação de dispositivos minimamente invasivos permitem que mais procedimentos sejam realizados com segurança em ambientes ambulatoriais. Modelos de reembolso favoráveis que incentivam o atendimento ambulatorial também estão impulsionando a expansão do segmento. Investimentos crescentes em equipamentos cirúrgicos avançados nos CCAs aprimoram as capacidades dos procedimentos. Os pacientes preferem cada vez mais as instalações ambulatoriais devido aos menores tempos de espera e à alta mais rápida. A expansão de provedores de saúde privados que estabelecem CCAs especializados também contribui para o crescimento do mercado. O apoio regulatório ao atendimento cirúrgico descentralizado acelera ainda mais a adoção. As melhorias contínuas nas tecnologias de anestesia e monitoramento pós-operatório aumentam a segurança dos procedimentos em ambientes ambulatoriais. Parcerias crescentes entre médicos e CCAs também ampliam a disponibilidade de serviços. O crescente foco dos sistemas de saúde na otimização de custos impulsiona ainda mais o crescimento das cirurgias ambulatoriais. Esses fatores, em conjunto, posicionam os Centros de Cirurgia Ambulatorial (ASC) como o segmento de usuários finais de crescimento mais rápido no mercado de dispositivos médicos implantáveis.

Análise Regional do Mercado de Dispositivos Médicos Implantáveis Ativos no Oriente Médio e África

- Prevê-se que o mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África cresça a uma taxa composta de crescimento anual substancial durante o período de previsão, impulsionado principalmente pelo aumento dos investimentos em saúde, pela expansão do acesso a procedimentos cirúrgicos avançados e pela crescente prevalência de distúrbios cardiovasculares e neurológicos em toda a região.

- Os governos estão fortalecendo ativamente a infraestrutura de saúde por meio de iniciativas de modernização, criação de centros especializados em cardiologia e neurologia e expansão de hospitais terciários, o que está acelerando a adoção de tecnologias médicas implantáveis.

- Além disso, a crescente conscientização sobre o manejo precoce de doenças e a melhoria dos sistemas de reembolso em diversos países estão contribuindo para um acesso mais amplo dos pacientes a terapias implantáveis nos setores de saúde público e privado.

Análise do mercado de dispositivos médicos implantáveis ativos na Arábia Saudita, Oriente Médio e África

O mercado de dispositivos médicos implantáveis ativos na Arábia Saudita, Oriente Médio e África dominou o mercado da região, com a maior participação de receita, de aproximadamente 35,4% em 2025. Esse crescimento foi impulsionado por fortes investimentos governamentais em infraestrutura de saúde, expansão de hospitais terciários e crescente adoção de dispositivos avançados de gerenciamento do ritmo cardíaco, neuroestimuladores e sistemas implantáveis de administração de medicamentos. Programas nacionais de transformação da saúde, com foco na acessibilidade a tratamentos avançados, aliados à crescente carga de doenças cardiovasculares e neurológicas crônicas, estão impulsionando significativamente a demanda por tecnologias terapêuticas implantáveis no país. Investimentos contínuos em centros de tratamento especializados e programas de treinamento para procedimentos cirúrgicos avançados estão fortalecendo ainda mais o crescimento do mercado.

Análise do Mercado de Dispositivos Médicos Implantáveis Ativos nos Emirados Árabes Unidos, Oriente Médio e África

O mercado de dispositivos médicos implantáveis ativos nos Emirados Árabes Unidos, Oriente Médio e África deverá ser o de crescimento mais rápido na região durante o período de previsão, impulsionado pela rápida expansão de instalações de saúde privadas, pelo aumento do turismo médico e pela crescente disponibilidade de centros de tratamento cardíaco e neurológico altamente especializados. A crescente adoção de terapias implantáveis tecnologicamente avançadas, apoiada por políticas de saúde favoráveis e investimentos crescentes em iniciativas de saúde digital e medicina de precisão, está acelerando ainda mais a expansão do mercado. Além disso, a presença de hospitais com acreditação internacional e a forte colaboração entre fabricantes globais de dispositivos e provedores de saúde regionais estão aumentando o acesso a tecnologias médicas implantáveis de última geração em todo o país.

Participação de mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

O setor de Dispositivos Médicos Implantáveis Ativos é liderado principalmente por empresas consolidadas, incluindo:

- Medtronic plc (Irlanda)

- Abbott (EUA)

- Boston Scientific Corporation (EUA)

- BIOTRONIK SE & Co. KG (Alemanha)

- LivaNova PLC (Reino Unido)

- Cochlear Limited (Austrália)

- Sonova Holding AG (Suíça)

- Demant A/S (Dinamarca)

- Zimmer Biomet Holdings, Inc. (EUA)

- Edwards Lifesciences Corporation (EUA)

- Corporação Científica MicroPort (China)

- Lepu Medical Technology (China)

- Nihon Kohden Corporation (Japão)

- Corporação Olympus (Japão)

- Nurotron Biotechnology Co., Ltd. (China)

- Integer Holdings Corporation (EUA)

- Smith & Nephew plc (Reino Unido)

- Corporação Stryker (EUA)

- Corporação Terumo (Japão)

- Siemens Healthineers AG (Alemanha)

Últimos desenvolvimentos no mercado de dispositivos médicos implantáveis ativos no Oriente Médio e na África

- Em julho de 2023, a Abbott, líder global em tecnologia para a saúde, anunciou que a Food and Drug Administration (FDA) dos EUA aprovou o sistema de marca-passo AVEIR DR, de câmara dupla e sem eletrodos. Este é o primeiro marca-passo sem eletrodos do mundo capaz de estimular simultaneamente o átrio direito e o ventrículo direito. O dispositivo utiliza a tecnologia de comunicação implante-a-implante (i2i) para permitir a comunicação sincronizada batimento a batimento entre dois marca-passos em miniatura implantados diretamente no coração, eliminando a necessidade de eletrodos de estimulação tradicionais e bolsas cirúrgicas. Essa aprovação expandiu significativamente o acesso à terapia de estimulação sem eletrodos para pacientes com arritmias cardíacas e representou um grande avanço na tecnologia de dispositivos cardíacos implantáveis minimamente invasivos.

- Em junho de 2024, a Abbott anunciou que o sistema de marca-passo AVEIR DR, de câmara dupla e sem eletrodos, recebeu a marcação CE na Europa, ampliando a disponibilidade da primeira tecnologia de estimulação cardíaca de câmara dupla sem eletrodos do mundo para os mercados europeus. O sistema permite a sincronização sem fio entre dois dispositivos implantados usando comunicação condutiva de alta frequência, reduzindo as complicações associadas aos eletrodos tradicionais e, ao mesmo tempo, aumentando o conforto do paciente e melhorando os resultados da recuperação. Esse marco regulatório fortaleceu a presença da Abbott no segmento de gerenciamento do ritmo cardíaco e acelerou a adoção global de dispositivos cardíacos implantáveis sem eletrodos de última geração.

- Em setembro de 2024, a Senseonics Holdings anunciou que a FDA (Food and Drug Administration) dos EUA aprovou o sistema de monitoramento contínuo de glicose (MCG) implantável Eversense® 365, o primeiro MCG implantável projetado para operar continuamente por até um ano. O pequeno sensor implantável, inserido sob a pele da parte superior do braço, fornece leituras de glicose em tempo real a cada cinco minutos para um aplicativo móvel, estendendo significativamente a vida útil do dispositivo em comparação com os modelos anteriores de MCG implantável com duração de seis meses. Esse desenvolvimento representou um grande avanço na tecnologia de monitoramento implantável de diabetes e melhorou a adesão e a conveniência do paciente a longo prazo.

- Em fevereiro de 2025, a Medtronic anunciou que a Food and Drug Administration (FDA) dos EUA aprovou seu sistema adaptativo de estimulação cerebral profunda (ECP) para o tratamento da doença de Parkinson, marcando o primeiro sistema de implante cerebral capaz de ajustar a estimulação em tempo real com base nos sinais neurológicos do paciente. O implante adaptativo responde dinamicamente à atividade cerebral para melhorar o controle dos sintomas e reduzir os movimentos involuntários, representando um marco significativo na tecnologia de neuroestimulação inteligente e fortalecendo o papel dos dispositivos implantáveis inteligentes no tratamento de distúrbios neurológicos.

- Em outubro de 2025, a Abbott anunciou o lançamento comercial do sistema de marca-passo AVEIR DR, de câmara dupla e sem eletrodos, na Índia, introduzindo a primeira tecnologia de estimulação cardíaca de câmara dupla sem eletrodos do mundo na região. O sistema implantável em miniatura, menor que uma pilha AAA, é implantado por meio de um procedimento minimamente invasivo com cateter e permite a estimulação sincronizada sem fios, reduzindo os riscos de complicações e melhorando o tempo de recuperação do paciente. O lançamento regional expandiu o acesso global a tecnologias avançadas de implantes cardíacos e apoiou a crescente adoção de dispositivos implantáveis minimamente invasivos em mercados emergentes de saúde.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.