Middle East And Africa Biological Buffers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

28.79 Million

USD

50.41 Million

2024

2032

USD

28.79 Million

USD

50.41 Million

2024

2032

| 2025 –2032 | |

| USD 28.79 Million | |

| USD 50.41 Million | |

|

|

|

|

Segmentação do mercado de tampões biológicos no Oriente Médio e África, por tipo de tampões (tampões para produtos e outros tampões à base de sal), formulação (pó e líquido), aplicação (farmacêutica e biofarmacêutica, cultura celular e biologia molecular, aplicações clínicas e de diagnóstico e aplicações químicas e industriais, outras), usuário final (empresas farmacêuticas e biofarmacêuticas, empresas de biotecnologia, institutos acadêmicos e de pesquisa, laboratórios de diagnóstico, organizações de pesquisa contratadas (CROs) e CMOs) - Tendências do setor e previsão até 2035

Análise e tamanho do mercado de tampões biológicos no Oriente Médio e África

O mercado de Tampões Biológicos do Oriente Médio e África se refere a um mercado focado na produção, distribuição e venda de tampões biológicos, que são soluções contendo um ácido fraco e sua base conjugada (ou uma base fraca e seu ácido conjugado) usadas para manter um ambiente de pH estável em ambientes laboratoriais e biomédicos. O mercado abrange uma ampla gama de tampões biológicos, incluindo tampões de fosfato, tampões Tris, tampões HEPES e outros, atendendo a diversas aplicações em áreas como pesquisa em ciências biológicas, biotecnologia, produtos farmacêuticos e diagnósticos, entre outras.

Tamanho do mercado de amortecedores biológicos no Oriente Médio e África

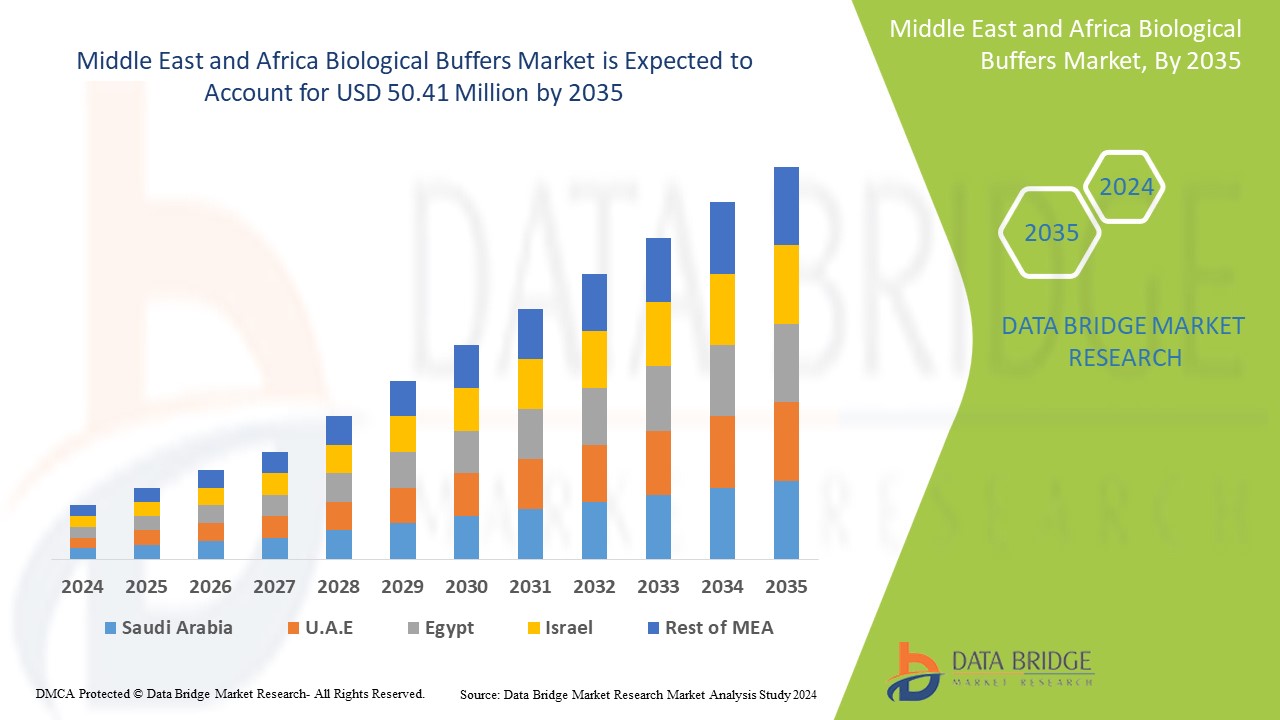

A Data Bridge Market Research analisa que o mercado de tampões biológicos do Oriente Médio e da África deve atingir US$ 50,41 milhões até 2035, ante US$ 28,79 milhões em 2024, crescendo a um CAGR substancial de 5,3% no período previsto de 2025 a 2035. Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de consumo de produção e análises PESTLE.

Tendências do mercado de tampões biológicos

“Adoção crescente de tecnologia baseada em IA”

O mercado de tamponamento biológico está passando por uma mudança significativa em direção a soluções baseadas em IA. À medida que laboratórios e empresas biofarmacêuticas priorizam precisão, eficiência e conformidade regulatória, a inteligência artificial e o aprendizado de máquina estão sendo integrados aos processos de formulação e controle de qualidade de tampões. Essas tecnologias ajudam a otimizar a estabilização do pH, aprimorar as previsões de desempenho dos tampões e agilizar os fluxos de trabalho de produção. Além disso, a crescente necessidade de monitoramento em tempo real e ajustes automatizados em setores como desenvolvimento de medicamentos, pesquisa clínica e bioprocessamento está impulsionando a demanda. À medida que os padrões regulatórios se tornam mais rigorosos e a transformação digital acelera, as soluções de tamponamento biológico baseadas em IA estão prestes a se tornar um padrão na indústria.

Report Scope and Biological Buffers Market Segmentation

|

Attributes |

Biological Buffers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, Rest of Middle East and Africa |

|

Key Market Players |

F. Hoffmann-La Roche Ltd (Switzerland), Bio-Rad Laboratories, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Takara Bio Inc. (Japan), and Merck KGaA (Germany) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Biological Buffers Market Definition

Biological buffers are solutions containing a weak acid and its conjugate base (or a weak base and its conjugate acid) that resist changes in pH upon the addition of an acid or base. They are crucial in biological systems and laboratory settings to maintain a stable pH environment, as enzymes and other biomolecules are highly sensitive to pH fluctuations. Common biological buffers include phosphate, Tris, and HEPES, each with a specific buffering range suitable for different applications.

Middle East and Africa Biological Buffers market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Escalating Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular ailments, is a significant driver of the Middle East and Africa biological buffer market. This rise necessitates increased research and development efforts to understand disease mechanisms, develop diagnostic tools, and formulate effective treatments. Biological buffers play a crucial role in these endeavors, as they provide the stable pH environments essential for conducting accurate experiments and assays in various fields, including cell culture, drug discovery, and protein analysis.

For instance,

- Em janeiro de 2024, de acordo com o artigo publicado no NCBI, doenças crônicas como diabetes, doenças cardíacas, derrame e câncer têm contribuído significativamente para as taxas globais de morbidade e mortalidade. Essas doenças não apenas afetam milhões de vidas, mas também exercem uma pressão substancial sobre os sistemas de saúde em todo o mundo. Espera-se que o impacto financeiro do gerenciamento de doenças crônicas aumente drasticamente, com o custo global estimado em US$ 47 trilhões até 2030. Esse número impressionante destaca o crescente impacto das doenças crônicas, que exigem cuidados médicos contínuos, tratamentos avançados e amplos recursos de saúde.

- Em julho de 2024, de acordo com os dados publicados pela OMS, estima-se que 39,9 milhões [36,1–44,6 milhões] de pessoas viviam com HIV no final de 2023, das quais 1,4 milhão [1,1–1,7 milhão] de crianças (0–14 anos) e 38,6 [34,9–43,1 milhões] de adultos (15+ anos). 1,3 milhão [1,0–1,7 milhão] de pessoas adquiriram o HIV em 2023. 120.000 [83.000–170.000] crianças adquiriram o HIV em 2023. 1,2 milhão [950 000–1,5 milhão] de adultos adquiriram o HIV em 2023

A prevalência dessas doenças varia de acordo com a localização, com cerca de 17% dos idosos em áreas rurais e 29% em regiões urbanas afetados por doenças crônicas. Entre essas condições, hipertensão e diabetes são particularmente prevalentes, representando juntas cerca de 68% de todas as doenças crônicas na população idosa. Isso ressalta a necessidade urgente de intervenções de saúde focadas e estratégias de gestão para lidar com a crescente carga de doenças crônicas entre a população idosa da Índia.

- Aumento da adoção das técnicas Western BLOT e Elisa

As técnicas de Western Blot e Elisa são fundamentais na pesquisa e no diagnóstico em ciências biológicas, permitindo a detecção e quantificação de proteínas e outras biomoléculas. À medida que os esforços de pesquisa se expandem, particularmente em áreas como descoberta de medicamentos, diagnóstico de doenças e identificação de biomarcadores, a demanda por essas técnicas cresce, impulsionando a necessidade de tampões confiáveis e de alta qualidade, cruciais para o desempenho ideal dos ensaios.

Por exemplo,

- Em abril de 2023, de acordo com o artigo publicado na National Library of Medicine, este artigo destaca o uso crescente do ELISA (Enzyme-Linked Immunosorbent Assay) devido à sua versatilidade, sensibilidade e especificidade na detecção e quantificação de substâncias biológicas. Esse aumento na adoção é impulsionado por sua aplicabilidade em diagnósticos médicos, segurança alimentar e pesquisa. A capacidade do ELISA de detectar uma ampla gama de antígenos e anticorpos, aliada aos avanços em automação e multiplexação, o torna um método preferencial tanto em ambientes clínicos quanto laboratoriais. A simplicidade, a reprodutibilidade e a relação custo-benefício do ensaio contribuem ainda mais para seu uso crescente.

- Em abril de 2021, de acordo com o artigo publicado no IUBMB Journals, o Western Blot (WB), também conhecido como immunoblot, é um método fundamental frequentemente empregado por biólogos para estudar vários aspectos de biomoléculas proteicas. Além da pesquisa, é amplamente utilizado no diagnóstico de doenças devido à sua capacidade de detectar proteínas diretamente, tornando-se uma ferramenta diagnóstica altamente eficaz, rotineiramente utilizada em ambientes clínicos. Sua versatilidade e confiabilidade levaram à sua ampla adoção em laboratórios de biologia, consolidando-o como uma das técnicas mais essenciais para aplicações em pesquisa e clínica.

Oportunidades

- Aumento do Financiamento Público-Privado em Pesquisa Biomédica

Com a alocação de mais recursos financeiros para pesquisa e desenvolvimento científico, as empresas têm o potencial de investir em formulações e tecnologias inovadoras que aprimoram o desempenho de tampões de bloqueio. Esse financiamento apoia a criação de soluções personalizadas, adaptadas a aplicações específicas, melhorando a especificidade e reduzindo o ruído de fundo em ensaios. Além disso, promove a colaboração com instituições de pesquisa, levando a avanços na tecnologia de tampões. O aumento do investimento facilita o desenvolvimento de produtos sustentáveis e ecologicamente corretos, em linha com a crescente demanda dos consumidores por soluções ecologicamente corretas. De modo geral, o aproveitamento dessa tendência de financiamento impulsiona avanços no mercado de tampões de bloqueio e promove uma vantagem competitiva em um cenário em rápida evolução.

Por exemplo,

- Em maio de 2021, de acordo com o artigo publicado no NCBI, o aumento do financiamento público-privado para pesquisa biomédica, juntamente com o aumento das aplicações de técnicas de western blotting e o aumento das inovações em produtos, cria um ambiente favorável ao crescimento. Essa tendência representa uma oportunidade significativa para a expansão e evolução do mercado de buffers de bloqueio.

- Em março de 2023, de acordo com o artigo publicado no NCBI, a Target 2035, uma federação internacional de cientistas biomédicos, está alavancando princípios abertos para criar ferramentas farmacológicas para cada proteína humana, essenciais para o estudo da saúde e da doença. À medida que as empresas farmacêuticas contribuem com conhecimento e reagentes, esta iniciativa representa uma oportunidade valiosa para o crescimento e a inovação do mercado de tampões de bloqueio.

O recente aumento no financiamento público-privado oferece uma oportunidade substancial para o mercado de tampões de bloqueio. O aumento do apoio financeiro à pesquisa científica permite que as empresas invistam em formulações inovadoras que melhoram o desempenho dos tampões. Esse financiamento incentiva o desenvolvimento de soluções personalizadas, aumenta a especificidade e promove a colaboração com instituições de pesquisa, promovendo, em última análise, produtos ecologicamente corretos. Essa tendência posiciona o mercado de tampões de bloqueio para um crescimento significativo.

- Métodos Analíticos para Segurança Alimentar e Testes Ambientais

Indústrias como segurança alimentar e testes ambientais dependem cada vez mais de métodos analíticos precisos, onde tampões de bloqueio de alta qualidade desempenham um papel crítico na minimização do ruído de fundo e no aumento da sensibilidade dos ensaios. À medida que os padrões regulatórios se tornam mais rigorosos, a demanda por soluções de bloqueio eficazes nesses setores tende a aumentar. Ao desenvolver tampões especializados, adaptados aos requisitos exclusivos de testes de segurança alimentar – como detecção de alérgenos e identificação de patógenos – e monitoramento ambiental – como análise de poluentes – os fabricantes podem explorar um mercado em crescimento. Essa abordagem direcionada não apenas atende às necessidades específicas do setor, mas também ajuda a estabelecer uma vantagem competitiva. Empresas que inovam e oferecem soluções personalizáveis para essas aplicações de nicho podem se posicionar para um crescimento significativo no mercado mais amplo de tampões de bloqueio.

Por exemplo,

- Em setembro de 2021, de acordo com o artigo publicado na Springer Nature, o uso de técnicas de Ensaio Imunoenzimático (ELISA) em análises de alimentos destaca uma oportunidade significativa para o mercado de tampões de bloqueio. Sua sensibilidade e especificidade permitem a detecção de diversos componentes, incluindo pesticidas e toxinas. Essa versatilidade cria uma oportunidade valiosa para tampões de bloqueio especializados, adaptados a aplicações de segurança alimentar.

- Em maio de 2020, de acordo com o artigo publicado na Science Direct, a prevalência de contaminação química em alimentos representa uma oportunidade significativa para o mercado de tampões de bloqueio. O competitivo ensaio imunoenzimático (Cp-ELISA) é amplamente utilizado para detectar esses contaminantes devido ao seu alto rendimento e baixo custo, destacando a necessidade de tampões de bloqueio eficazes para aprimorar o desempenho do ensaio.

- Em fevereiro de 2020, de acordo com o artigo publicado na Springer Nature, o monitoramento de produtos farmacêuticos em ambientes aquáticos usando técnicas de ensaio imunoenzimático (ELISA) cria uma oportunidade valiosa para o mercado de tampões de bloqueio. À medida que a demanda por detecção precisa de contaminantes cresce, tampões de bloqueio eficazes tornam-se essenciais para melhorar a sensibilidade e a confiabilidade dos ensaios em testes ambientais.

The rising geriatric population is a key driver in the Middle East and Africa biological buffers market, as older adults are more susceptible to various eye conditions that can lead to corneal damage and the need for transplants. Age-related eye diseases, such as Fuchs' endothelial dystrophy, bullous keratopathy, and other degenerative corneal disorders, become more prevalent with advancing age, significantly increasing the demand for Biological Bufferss. Also, older adults are more likely to experience complications from cataract surgery or develop chronic conditions like diabetes, which can further contribute to corneal deterioration. As the Middle East and Africa population ages, the number of individuals requiring biological bufferss is expected to rise, particularly in regions with rapidly aging demographics. This trend is further fueled by increased awareness about the availability and success rates of Biological Bufferss, as well as advancements in surgical techniques that offer better outcomes and faster recovery times for older patients. As a result, the growing geriatric population is a major factor driving the expansion of the Middle East and Africa biological buffers market, highlighting the need for accessible and effective treatment options for age-related corneal diseases.

Restraint/Challenge

- Alternative Technologies and Approaches for Inhibiting Biological Buffers

The biological buffer market faces substantial challenges due to the rise of alternative methodologies and advanced techniques, such as label-free detection and microfluidics, which allow for precise interactions without the need for traditional blocking buffers, thereby reducing background noise. Innovations in immunoassays, including multiplexing, improve specificity and further lessen dependence on conventional blocking strategies. Moreover, the application of nanotechnology for targeted binding complicates the traditional role of biological buffers. As these alternatives gain traction, offering cost-effective solutions, they may introduce background noise in sensitive assays, creating a dual challenge. As these methods become more widely accepted in research and clinical applications, the market is under pressure to innovate and adapt, potentially shifting demand and altering the competitive landscape.

For instance,

- In July 2021, according to the article published in Springer Nature Limited, Cell-free gene expression (CFE) offers an alternative to traditional cell-based methods for protein synthesis and labeling in structural biology and proteomics. This innovative approach enhances specificity and reduces non-specific interactions, presenting a challenge in the blocking buffer market as demand shifts towards more efficient methodologies

- In March 2024, according to the article published in MDPI, the synthesis of fully synthetic copolymers based on pHPMA or poly(2-oxazoline), designed to suppress non-specific interactions. These copolymers could serve as potential replacements for BSA or other proteins in diagnostic assays, presenting a significant challenge in the blocking buffer market

- In August 2023, according to the article published in MDPI, the enhanced immunoblotting process by simplifying gel preparation, optimizing the electrophoresis buffer, and substituting methanol with ethanol to improve safety. These modifications boost efficiency nearly four-fold, allowing even low-quality antibodies to be visualized effectively. This innovation presents a challenge in the blocking buffer market.

Biological Buffers Market Scope

The Middle East and Africa biological buffers market is categorized into four notable segments based on buffers type, formulation, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Buffers Type

- Goods Buffers

- Tris Buffers

- Tris (Tris(Hydroxymethyl)Aminomethane)

- Tris NA

- Tris-HCL

- Hepes Buffers

- Hepes

- Hepes NA

- Mops Buffers

- Mops

- Mops NA

- Mes Buffers

- MES

- MES NA

- Bis-Tris Buffers

- BIS-TRIS

- Bis-TRIS HCL

- Others

- Tris Buffers

- Other Salt-Based Buffers

- Phosphate Buffers

- Phosphate Buffered Saline (PBS)

- Sodium Phosphate

- Potassium Phosphate

- Acetate Buffers

- Sodium Acetate

- Potassium Acetate

- Citrate Buffers

- Sodium Citrate

- Citric Acid

- Amino Acid Buffers

- Glycine Buffer

- Histidine Buffer

- Phosphate Buffers

Formulation

- Powder

- Liquid

Application

- Pharmaceutical & Biopharmaceuticals

- Drug Development

- Vaccine Formulation

- Biologics Manufacturing

- Cell Culture & Molecular Biology

- PCR & Electrophoresis

- Cell Culture Media Preparation

- DNA & RNA Isolation

- Protein Purification

- Clinical & Diagnostic Applications

- In-Vitro Diagnostics (IVD)

- Clinical Testing Kits

- Chemical & Industrial Applications

- Biotechnology Research

- Food & Beverage Processing

- Others

End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Research & Academic Institutes

- Diagnostic Laboratories

- Contract Research Organizations (CROS) & CMOS

Biological Buffers Market Regional Analysis

Biological buffers market is analyzed, and market size insights and trends are provided by based on buffer type, formulation, application, and end user.

The countries covered in this market report are South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, rest of Middle East and Africa.

South Africa is expected to dominate the market due to high R&D spending, key market player presence, advanced infrastructure, a strong healthcare system, and stringent regulations.

South Africa is expected to be the fastest growing market due to its increasing healthcare spending, expanding pharmaceutical industry with a developing healthcare infrastructure and a rising prevalence.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Biological Buffers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Biological Buffers Market Leaders operating in the market are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bio-Rad Laboratories, Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- Takara Bio Inc. (Japan), Merck KGaA (Germany),

- Avantor, Inc. (U.S.)

- Advancion Corporation (U.S.)

- Santa Cruz Biotechnology Inc. (U.S.)

- MP Biomedicals (U.S.)

- Promega Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- QIAGEN (Germany)

- HiMedia Laboratories (India)

- Cayman Chemical (U.S.)

- Biosynth (Switzerland)

- SERVA Electrophoresis GmbH (Germany)

- FUJIFILM Wako Pure Chemical Corporation (Japan)

- Reagecon Diagnostics Ltd (Ireland)

- GoldBio (U.S.)

- nacalai.com (Japan)

- HOPAX (Taiwan)

Latest Developments in Biological Buffers Market

- In February 2024, Roche entered into collaboration agreement with PathAI to expand digital pathology capabilities for companion diagnostics. The collaboration provides Roche with PathAI’s advanced AI technology for improving companion diagnostics. It ensures exclusive, tailored solutions and accelerates algorithm development while allowing Roche to continue developing its own diagnostics

- In July 2024, Roche announced the successful acquisition of LumiraDx’s Point of Care technology, following the necessary antitrust and regulatory approvals. This integration enhanced Roche’s diagnostics portfolio with a user-friendly platform that consolidates various immunoassay and clinical chemistry tests. The acquisition aimed to improve access to diagnostic testing, particularly in primary care and underserved regions, aligning with Roche's commitment to decentralised healthcare solutions

- In July 2023, Bio-Rad and QIAGEN have announced a patent settlement and cross-licensing agreement that resolves ongoing disputes regarding specific technologies. This partnership allows both companies to enhance their product portfolios and accelerate innovation in the life sciences sector, ultimately benefiting their customers by providing broader access to advanced technologies and improved solutions in research and diagnostics

- In May 2023, Thermo Fisher and BRIN have partnered to enhance research capabilities in Indonesia, focusing on advancing scientific innovation and collaboration in life sciences, biotechnology, and environmental studies for local researchers

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFER MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE U.S.

5.2 REGULATORY SUBMISSIONS

5.3 INTERNATIONAL HARMONIZATION

5.4 EUROPE REGULATORY SCENARIO

5.5 REGULATORY SUBMISSIONS

5.6 INTERNATIONAL HARMONIZATION

5.7 JAPAN REGULATORY SCENARIO

5.8 REGULATORY SUBMISSIONS

5.9 INTERNATIONAL HARMONIZATION

5.1 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT

6.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE OF BLOCKING BUFFERS

6.2.2 POTENTIAL OF CONTAMINATION OR BATCH INCONSISTENCIES FOR BIOLOGICAL BUFFERS

6.3 OPPORTUNITY

6.3.1 INCREASE IN PUBLIC-PRIVATE FUNDING IN BIOMEDICAL RESEARCH

6.3.2 ANALYTICAL METHODS FOR FOOD SAFETY AND ENVIRONMENTAL TESTING.

6.3.3 DIAGNOSTIC AND CLINICAL APPLICATIONS USE BLOCKING BUFFERS.

6.4 CHALLENGES

6.4.1 ALTERNATIVE TECHNOLOGIES AND APPROACHES FOR INHIBITING BIOLOGICAL BUFFERS.

6.4.2 DISRUPTIONS IN THE SUPPLY CHAIN OF BIOLOGICAL BUFFERS.

7 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE

7.1 OVERVIEW

7.2 GOODS BUFFERS

7.2.1 TRIS BUFFERS

7.2.2 HEPES BUFFERS

7.2.3 MOPS BUFFERS

7.2.4 MES BUFFERS

7.2.5 BIS-TRIS BUFFERS

7.3 OTHER SALT-BASED BUFFERS

7.3.1 PHOSPHATE BUFFERS

7.3.2 ACETATE BUFFERS

7.3.3 CITRATE BUFFERS

7.3.4 AMINO ACID BUFFERS

8 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMACEUTICAL & BIOPHARMACEUTICALS

9.3 CELL CULTURE & MOLECULAR BIOLOGY

9.4 CLINICAL & DIAGNOSTIC APPLICATIONS

9.5 CHEMICAL & INDUSTRIAL APPLICATIONS

9.6 OTHERS

10 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

10.3 BIOTECHNOLOGY COMPANIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 DIAGNOSTIC LABORATORIES

10.6 CONTRACT RESEARCH ORGANIZATIONS (CROS) & CMOS

11 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 UAE

11.1.4 EGYPT

11.1.5 KUWAIT

11.1.6 ISRAEL

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT

14 COMPANY PROFILES

14.1 F. HOFFMANN-LA ROCHE LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 BIO-RAD LABORATORIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 THERMO FISHER SCIENTIFIC, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 TAKARA BIO INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MERCK KGAA, DARMSTADT, GERMANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ADVANCION CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BECKMAN COULTER

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 BIOSYNTH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FUJIFILM WAKO PURE CHEMICAL CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GOLDBIO

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HOPAX

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HIMEDIA LABORATORIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NACALAI TESQUE, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PROMEGA CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 REAGECON DIAGNOSTICS LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SANTA CRUZ BIOTECHNOLOGY INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 SERVA ELECTROPHORESIS GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TEVA PHARMACEUTICALS USA, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND

TABLE 6 MIDDLE EAST AND AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWDER IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA LIQUID IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION,2018-2035 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA BIOTECHNOLOGY COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA RESEARCH & ACADEMIC INSTITUTES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DIAGNOSTIC LABORATORIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CONTRACT RESEARCH ORGANIZATIONS (CROS) IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 54 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 SOUTH AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 56 SOUTH AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 57 SOUTH AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 58 SOUTH AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 59 SOUTH AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 60 SOUTH AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 61 SOUTH AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 62 SOUTH AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 63 SOUTH AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 64 SOUTH AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 65 SOUTH AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 66 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 67 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 SOUTH AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 69 SOUTH AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 70 SOUTH AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 SOUTH AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 72 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 73 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 74 SAUDI ARABIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 75 SAUDI ARABIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 76 SAUDI ARABIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 77 SAUDI ARABIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 78 SAUDI ARABIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 79 SAUDI ARABIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 80 SAUDI ARABIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 81 SAUDI ARABIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 82 SAUDI ARABIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 84 SAUDI ARABIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 85 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 86 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 87 SAUDI ARABIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 88 SAUDI ARABIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 89 SAUDI ARABIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 90 SAUDI ARABIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 91 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 92 UAE BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 93 UAE GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 94 UAE TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 95 UAE HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 96 UAE MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 97 UAE MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 98 UAE BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 99 UAE OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 100 UAE PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 101 UAE ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 102 UAE CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 UAE AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 104 UAE BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 105 UAE BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 106 UAE PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 107 UAE CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 108 UAE CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 109 UAE CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 110 UAE BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 111 EGYPT BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 112 EGYPT GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 113 EGYPT TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 114 EGYPT HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 115 EGYPT MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 116 EGYPT MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 117 EGYPT BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 118 EGYPT OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 EGYPT PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 120 EGYPT ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 121 EGYPT CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 122 EGYPT AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 123 EGYPT BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 124 EGYPT BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 125 EGYPT PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 126 EGYPT CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 127 EGYPT CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 128 EGYPT CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 129 EGYPT BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 130 KUWAIT BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 131 KUWAIT GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 132 KUWAIT TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 133 KUWAIT HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 134 KUWAIT MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 KUWAIT MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 136 KUWAIT BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 137 KUWAIT OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 138 KUWAIT PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 139 KUWAIT ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 140 KUWAIT CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 141 KUWAIT AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 142 KUWAIT BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 143 KUWAIT BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 144 KUWAIT PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 145 KUWAIT CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 146 KUWAIT CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 147 KUWAIT CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 148 KUWAIT BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 149 ISRAEL BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 150 ISRAEL GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 ISRAEL TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 152 ISRAEL HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 153 ISRAEL MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 154 ISRAEL MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 155 ISRAEL BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 156 ISRAEL OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 157 ISRAEL PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 158 ISRAEL ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 159 ISRAEL CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 160 ISRAEL AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 161 ISRAEL BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 162 ISRAEL BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 ISRAEL PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 164 ISRAEL CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 165 ISRAEL CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 166 ISRAEL CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 ISRAEL BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 168 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

Lista de Figura

FIGURE 1 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2035

FIGURE 12 GOODS BUFFERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET IN THE FORECAST PERIOD OF 2025 & 2035

FIGURE 13 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC

FIGURE 16 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2024

FIGURE 17 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2025-2035 (USD THOUSAND)

FIGURE 18 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, CAGR (2025-2035)

FIGURE 19 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2024

FIGURE 21 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2025-2035 (USD THOUSAND)

FIGURE 22 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, CAGR (2025-2035)

FIGURE 23 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 24 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2025-2035 (USD THOUSAND)

FIGURE 26 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, CAGR (2025-2035)

FIGURE 27 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, 2024

FIGURE 29 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, 2025-2035 (USD THOUSAND)

FIGURE 30 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, CAGR (2025-2035)

FIGURE 31 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SNAPSHOT (2024)

FIGURE 33 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.