Middle East And Africa Boxes Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

21.34 Billion

USD

30.23 Billion

2025

2033

USD

21.34 Billion

USD

30.23 Billion

2025

2033

| 2026 –2033 | |

| USD 21.34 Billion | |

| USD 30.23 Billion | |

|

|

|

|

Segmentação do mercado de embalagens de caixas no Oriente Médio e África, por produto (caixas de papelão ondulado, caixas com fenda, caixas dobráveis, caixas rígidas, engradados e outros), por tipo (caixas padrão, caixas especiais), por material (papel e cartão, plásticos, metal, madeira, outros), por setor (atacado, varejo), por canal de vendas (vendas diretas, distribuidores/atacadistas, lojas de varejo), por tamanho (pequeno (até 5 kg), médio (5–20 kg), tamanhos personalizados, grande (20–50 kg), extra grande (acima de 50 kg)), tendências do setor e previsão até 2033.

Tamanho do mercado de embalagens de caixas no Oriente Médio e na África

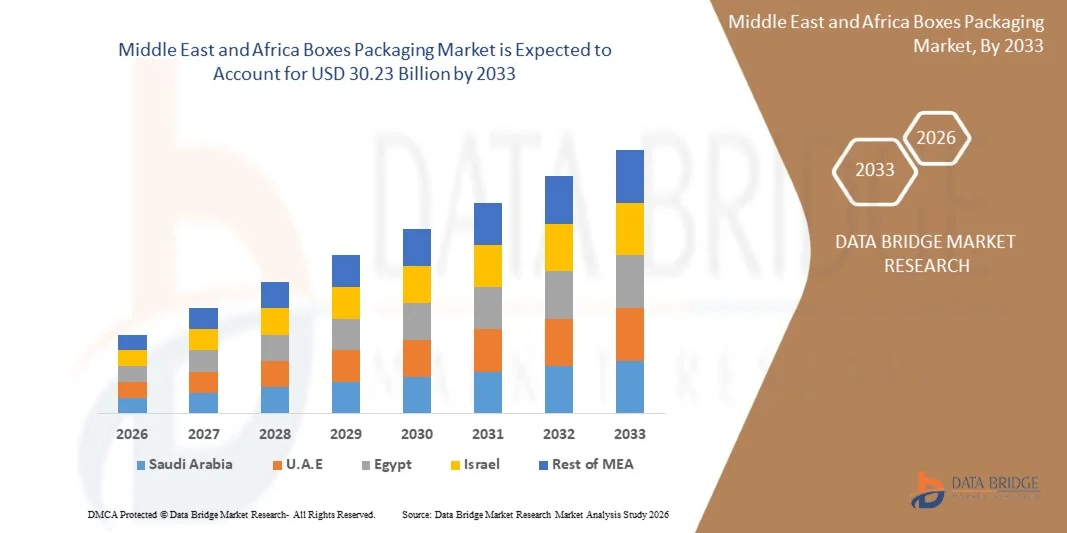

- O mercado de embalagens de caixas no Oriente Médio e na África foi avaliado em US$ 21,34 bilhões em 2025 e deverá atingir US$ 30,23 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,5% durante o período de previsão.

- O crescimento do mercado no Oriente Médio e na África é cada vez mais impulsionado pela crescente demanda por soluções de embalagens sustentáveis, recicláveis e ecologicamente corretas em setores-chave de uso final, incluindo alimentos e bebidas, produtos farmacêuticos, bens de consumo e produtos industriais. Os avanços contínuos na conversão de papel, nas tecnologias de ondulação e nos materiais de embalagem leves estão aprimorando a eficiência da produção e melhorando a durabilidade das embalagens, além de possibilitar maior digitalização e inovação em toda a cadeia de valor de embalagens da região.

- A crescente preferência de consumidores e empresas por embalagens ecologicamente conscientes está reforçando a tendência de utilização de formatos de caixas à base de fibras, biodegradáveis e recicláveis como alternativas viáveis aos plásticos convencionais. Essas tendências impulsionadas pela sustentabilidade estão acelerando a adoção de soluções avançadas de embalagens em caixas e contribuindo substancialmente para a expansão do mercado de embalagens em caixas no Oriente Médio e na África.

Análise do mercado de embalagens de caixas no Oriente Médio e na África

- As embalagens em caixa, especialmente aquelas feitas de papelão, papelão ondulado e outros materiais recicláveis, estão se tornando cada vez mais essenciais em diversos setores no Oriente Médio e na África — incluindo alimentos e bebidas, bens de consumo, produtos farmacêuticos, comércio eletrônico e aplicações industriais — devido à sua resistência, versatilidade, sustentabilidade e capacidade de garantir o transporte seguro e a proteção do produto.

- A crescente demanda por embalagens de caixas na região é impulsionada por uma forte tendência em direção a soluções de embalagens ecológicas, recicláveis e de base biológica, pela crescente conscientização ambiental entre os consumidores e pela ênfase regulatória cada vez maior na redução do desperdício de plástico e na promoção de práticas de embalagem sustentáveis. Esses fatores, em conjunto, estão fortalecendo a adoção de embalagens de caixas à base de fibras e contribuindo significativamente para a expansão do mercado de embalagens de caixas no Oriente Médio e na África.

- A Arábia Saudita é a força dominante no mercado de embalagens de caixas no Oriente Médio e na África, representando 54,79% da participação da região em 2026, e projeta-se que cresça a uma taxa composta de crescimento anual (CAGR) de 5,0% de 2026 a 2033. Esse crescimento é impulsionado pela crescente adoção de tecnologias avançadas de embalagem, pela expansão dos setores de manufatura e varejo e pela forte presença de grandes convertedores de embalagens e redes de distribuição. Além disso, a crescente demanda por soluções de embalagem de alta qualidade, duráveis e sustentáveis — particularmente nos setores de alimentos e bebidas, bens de consumo, produtos farmacêuticos e comércio eletrônico — continua a reforçar a expansão do mercado em todo o país.

- Prevê-se que o segmento de embalagens de caixas de papelão ondulado domine o mercado com uma participação de 39,37% em 2026, impulsionado pela sua ampla adequação a aplicações de embalagens ecologicamente corretas, pela crescente preferência por materiais recicláveis e biodegradáveis e pela inovação contínua focada no aprimoramento da resistência, da imprimibilidade e dos atributos de sustentabilidade.

Escopo do relatório e segmentação do mercado de embalagens de caixas no Oriente Médio e na África

|

Atributos |

Análises de mercado essenciais para embalagens de caixas no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens de caixas no Oriente Médio e na África

“ Integração de soluções de embalagens inteligentes, sustentáveis e de alto desempenho ”

- Uma tendência fundamental e em rápida expansão no mercado de embalagens de caixas no Oriente Médio e na África é a crescente integração de materiais avançados e ecoeficientes com tecnologias de embalagens inteligentes, visando aprimorar a durabilidade, a visibilidade da cadeia de suprimentos e o desempenho em sustentabilidade. Essa mudança está sendo reforçada pelo aumento das regulamentações ambientais, pelo compromisso das marcas com embalagens circulares e pela transição do setor para formatos de embalagens leves, renováveis e recicláveis.

- Os principais participantes do setor estão investindo cada vez mais em inovações baseadas em fibras, embalagens com tecnologia digital e projetos estruturais otimizados para materiais, que aprimoram a proteção, reduzem o desperdício de material e dão suporte a sistemas de logística automatizados. As empresas estão desenvolvendo soluções de papelão ondulado e fibra moldada de última geração, projetadas para oferecer relações resistência/peso superiores, maior resistência à umidade e qualidade de impressão aprimorada, ajudando os proprietários de marcas a atender aos requisitos funcionais e de sustentabilidade.

- Materiais de fibra de alto desempenho — como revestimentos de papel kraft reforçados, fibras recicladas especiais e misturas de celulose bioenriquecidas — estão ganhando espaço devido à sua capacidade de melhorar a capacidade de carga, manter a estabilidade estrutural durante o transporte e reforçar marcas premium. Os fabricantes também estão trabalhando em formulações personalizadas para diversas condições climáticas, garantindo consistência de desempenho em diferentes ambientes de umidade, temperatura e manuseio.

- Tecnologias de embalagens inteligentes — incluindo caixas com RFID, sistemas de rastreabilidade baseados em QR Code e contêineres de transporte com sensores integrados — estão surgindo como recursos de valor agregado que permitem rastreamento, autenticação e monitoramento de condições em tempo real em cadeias de suprimentos complexas. Essas capacidades aumentam a eficiência operacional e reduzem as perdas relacionadas a danos, flutuações de temperatura e extravio.

Dinâmica do mercado de embalagens de caixas no Oriente Médio e na África

Motorista

“Crescimento do setor de comércio eletrônico e varejo”

- A rápida expansão do comércio eletrônico e do varejo global está se tornando um fator-chave para o mercado global de caixas e embalagens. À medida que os consumidores migram das compras tradicionais em lojas físicas para o varejo online, a necessidade de soluções de embalagem protetoras, confiáveis e eficientes — especialmente caixas de papelão ondulado, embalagens de cartão e embalagens sustentáveis — aumentou consideravelmente.

- Essa mudança estrutural no formato do varejo está remodelando as cadeias de suprimentos: mais encomendas pequenas, remessas frequentes, devoluções e entregas em domicílio exigem soluções de embalagem padronizadas e escaláveis. Consequentemente, a embalagem deixou de ser um custo periférico e se tornou um elemento fundamental da infraestrutura do comércio eletrônico, sustentando o crescimento da demanda global por embalagens.

Por exemplo,

- Em fevereiro de 2025, o Departamento do Censo dos Estados Unidos informou que as vendas de comércio eletrônico no varejo americano no quarto trimestre de 2024 totalizaram US$ 308,9 bilhões, marcando um crescimento contínuo no varejo online e um forte volume de encomendas que impulsionaram a expansão da capacidade de distribuição e logística por meio do comércio eletrônico e do varejo digital.

- Em fevereiro de 2023, o Eurostat informou que as compras online continuaram a crescer em toda a União Europeia, com a penetração do comércio eletrônico em ascensão e os principais Estados-Membros apresentando aumentos notáveis na atividade de varejo online, impulsionando o crescimento do setor de comércio eletrônico.

- Em abril de 2022, o Escritório de Estatísticas Nacionais do Reino Unido informou que as vendas pela internet permaneceram significativamente acima dos níveis pré-pandemia e que as vendas online representaram uma parcela sustentada do varejo total, o que, por sua vez, motivou a expansão do comércio eletrônico e do espaço físico de varejo.

- O crescimento sistêmico do e-commerce e a evolução dos formatos de varejo em todo o mundo estão claramente elevando a demanda por embalagens — particularmente caixas, embalagens de papelão e soluções sustentáveis/de papelão ondulado. À medida que o varejo online se expande ainda mais (inclusive para novas regiões geográficas, categorias e formatos de entrega rápida), a demanda por embalagens continuará a crescer. Para analistas de mercado e investidores, isso reforça a ideia de que as embalagens não são apenas uma commodity, mas sim um segmento de crescimento estratégico intimamente ligado à expansão do varejo/e-commerce.

Restrição/ Desafio

“ Volatilidade nos preços da celulose e do papel ”

- A fabricação de embalagens de papel (caixas de papelão ondulado, caixas de cartão, embalagens de papelão) depende fortemente de celulose, papel kraft, fibra reciclada e energia — todos os quais sofreram oscilações de preço acentuadas nos últimos anos. Quando os preços da celulose e do papel sobem de forma imprevisível, os custos dos produtores aumentam, reduzindo as margens de lucro. Como os produtores de embalagens geralmente operam sob contratos fixos com os clientes finais (varejistas, empresas de comércio eletrônico, fabricantes), eles podem não conseguir repassar rapidamente o aumento dos custos.

- Isso gera incerteza, prejudica a rentabilidade, desestimula a expansão ou o investimento e pode reduzir a demanda por embalagens tradicionais em formato de caixa, especialmente em segmentos sensíveis a preços.

- Por exemplo, em outubro de 2024, o Times of India noticiou que o papel kraft — uma matéria-prima essencial para caixas de papelão ondulado — havia "aumentado mais de 20% nos últimos três meses", exercendo forte pressão sobre os custos dos fabricantes de caixas de papelão ondulado, muitos dos quais operam com margens de lucro reduzidas.

- Em fevereiro de 2025, o boletim informativo Pulp and Paper Times observou que a desvalorização da rupia indiana e o aumento dos preços globais da celulose (a celulose de madeira macia cotada em torno de US$ 890/tonelada) aumentaram significativamente o custo das matérias-primas importadas para os fabricantes de papel locais, pressionando ainda mais os custos gerais de produção.

- A volatilidade inerente das matérias-primas de celulose, fibra reciclada e papelão — impulsionada por interrupções na cadeia de suprimentos, picos nos custos de energia, flutuações cambiais e mudanças na demanda — impõe uma restrição significativa ao mercado global de caixas e embalagens. Como as embalagens à base de papel dependem fortemente desses insumos, oscilações imprevisíveis de custos corroem a lucratividade, tornam os preços instáveis e prejudicam a atratividade das caixas para alguns usuários. Para um setor construído sobre volume e margens apertadas, essa volatilidade nos custos de insumos pode suprimir o crescimento, reduzir o investimento e restringir a expansão do mercado.

Escopo do mercado de embalagens de caixas no Oriente Médio e na África

O mercado de embalagens de caixas no Oriente Médio e na África é segmentado em seis segmentos principais, com base em produto, tipo, material, setor, canal de vendas e tamanho.

Por produto

Com base no tipo de produto, o mercado de embalagens de caixas no Oriente Médio e na África é categorizado em Caixas de Papelão Ondulado, Caixas com Fendas, Caixas Dobráveis, Caixas Rígidas, Engradados e Outros formatos de embalagem. Entre esses, o segmento de Caixas de Papelão Ondulado deverá ocupar a posição de liderança em 2026, representando 39,37% da participação total de mercado. Essa dominância pode ser atribuída à ampla adoção de embalagens de papelão ondulado em diversos setores — incluindo comércio eletrônico, alimentos e bebidas, bens de consumo e produtos industriais — devido à sua relação custo-benefício, durabilidade, leveza e reciclabilidade. Além disso, projeta-se que o segmento registre a maior taxa de crescimento anual composta (CAGR) de 4,6% durante o período de previsão de 2026 a 2033, refletindo a crescente demanda por soluções de embalagem eficientes e sustentáveis em todo o mundo. A sólida trajetória de crescimento das caixas de papelão ondulado ressalta seu papel fundamental no fornecimento de soluções de embalagem protetoras, versáteis e ecologicamente corretas em um cenário de mercado em rápida evolução.

Por tipo

Com base no tipo, o mercado de embalagens de caixas no Oriente Médio e na África é classificado em Caixas Padrão e Caixas Especiais. O segmento de Caixas Padrão deverá liderar o mercado em 2026, detendo uma participação significativa de 75,91% do mercado total. Essa forte posição de mercado é impulsionada pela ampla aplicabilidade das caixas padrão em diversos setores, como comércio eletrônico, varejo, alimentos e bebidas, eletrônicos e bens de consumo, onde elas servem como soluções de embalagem confiáveis, econômicas e versáteis. As caixas padrão são preferidas devido à sua facilidade de fabricação, empilhamento, durabilidade e compatibilidade com sistemas automatizados de embalagem, tornando-as uma escolha essencial para operações de embalagem de alto volume.

Por material

Com base no material, o mercado de embalagens de caixas no Oriente Médio e na África é segmentado em Papel e Cartão, Plásticos, Metal, Madeira e Outros. Dentre esses, o segmento de Papel e Cartão deverá dominar o mercado em 2026, detendo uma participação substancial de 65,62%. Essa dominância se deve, em grande parte, à sustentabilidade, custo-benefício, reciclabilidade e versatilidade do segmento, que o tornam altamente adequado para uma ampla gama de aplicações, incluindo alimentos e bebidas, eletrônicos, bens de consumo e embalagens para e-commerce. Os materiais de papel e cartão também atendem aos requisitos de branding e personalização, permitindo que fabricantes e varejistas ofereçam soluções de embalagem visualmente atraentes, ao mesmo tempo que atendem às regulamentações ambientais e à demanda do consumidor por produtos ecologicamente corretos.

Por setor

Com base no setor, o mercado de embalagens de caixas no Oriente Médio e na África é segmentado em Atacado e Varejo. Em 2026, o segmento de Atacado deverá dominar o mercado, representando uma participação significativa de 74,64%. Essa dominância é impulsionada pelas necessidades de distribuição em larga escala e remessas em grande volume de fabricantes, distribuidores e fornecedores em diversos setores, como alimentos e bebidas, bens de consumo, produtos farmacêuticos e comércio eletrônico. As operações de atacado exigem soluções de embalagem duráveis, econômicas e de alta capacidade que garantam a segurança do produto durante o transporte e o armazenamento, o que posiciona as caixas como a opção preferencial para logística em grande escala.

Por canal de vendas

Com base no canal de vendas, o mercado de embalagens de caixas no Oriente Médio e na África é segmentado em Vendas Diretas, Distribuidores/Atacadistas e Lojas de Varejo. Em 2026, espera-se que o segmento de Vendas Diretas lidere o mercado, detendo uma participação substancial de 62,46%. Essa dominância é atribuída ao crescente engajamento direto dos fabricantes com os usuários finais e grandes clientes corporativos para fornecer soluções de embalagem personalizadas, em grande escala e de alta qualidade. As vendas diretas facilitam relacionamentos mais sólidos com os clientes, tempos de resposta mais rápidos e ofertas sob medida que atendem a requisitos específicos de embalagem em setores como comércio eletrônico, bens de consumo, farmacêutico e alimentos e bebidas.

Por tamanho

Com base no tamanho, o mercado de embalagens de caixas no Oriente Médio e na África é segmentado em Pequeno (até 5 kg), Médio (5–20 kg), Tamanhos Personalizados, Grande (20–50 kg) e Extra Grande (acima de 50 kg). Em 2026, espera-se que o segmento Pequeno (até 5 kg) lidere o mercado, representando 48,60% da participação total. Essa dominância é impulsionada pela crescente demanda por soluções de embalagem compactas e convenientes em setores como comércio eletrônico, alimentos e bebidas, cuidados pessoais e farmacêutico, onde caixas leves e fáceis de manusear são preferidas. A tendência para embalagens menores está alinhada com as preferências do consumidor por portabilidade, facilidade de manuseio e menor necessidade de espaço de armazenamento.

Análise Regional do Mercado de Embalagens de Caixas

O mercado de embalagens de caixas no Oriente Médio e na África está testemunhando um crescimento constante e robusto, impulsionado pela crescente demanda por soluções de embalagens sustentáveis e ecológicas, pela adoção de tecnologias avançadas de embalagem e pelo foco cada vez maior em materiais recicláveis e sem resíduos. A região está investindo significativamente em designs e materiais de embalagem inovadores para aprimorar a proteção do produto, a eficiência operacional e a sustentabilidade ambiental em setores como alimentos e bebidas, cuidados pessoais e comércio eletrônico.

Análise do mercado de embalagens de caixas na Arábia Saudita

A Arábia Saudita é a força dominante no mercado de embalagens de caixas no Oriente Médio e na África, representando 54,79% da participação da região em 2026, e projeta-se que cresça a uma taxa composta de crescimento anual (CAGR) de 5,0% de 2026 a 2033. Esse crescimento é impulsionado pela crescente adoção de tecnologias avançadas de embalagem, pela expansão dos setores de manufatura e varejo e pela forte presença de grandes convertedores de embalagens e redes de distribuição. Além disso, a crescente demanda por soluções de embalagem de alta qualidade, duráveis e sustentáveis — particularmente nos setores de alimentos e bebidas, bens de consumo, produtos farmacêuticos e comércio eletrônico — continua a reforçar a expansão do mercado em todo o país.

Participação de mercado de embalagens de caixas no Oriente Médio e na África

O setor de embalagens de caixas é liderado principalmente por empresas consolidadas, incluindo:

- Pratt Industries (EUA)

- Green Bay Packaging Inc. (EUA)

- TGI Packaging Pvt. Ltd. (Índia)

- International Paper (EUA)

- DS Smith (Reino Unido)

- Mondi (Reino Unido)

- Amcor PLC (Suíça)

- Smurfit WestRock (Irlanda)

- Sealed Air Corporation (EUA)

- Packaging Corporation of America (EUA)

- Oji Holdings Corporation (Japão)

- Rengo Co., Ltd. (Japão)

- Stora Enso Oyj (Finlândia)

- Georgia-Pacific LLC (EUA)

- Nine Dragons Paper Holdings Ltd. (China)

- Suneco Box (Índia)

- Avon Containers Pvt. Ltd. (Índia)

- Caixas personalizadas de elite (Índia)

- Ecom Packaging (Índia)

- Embalagem Blue Box (Índia)

- Packtek (Índia)

- Packtek Packaging (Índia)

- Boxon Group AB (Suécia)

- Packhelp (Polônia)

- Prem Industries India Limited (Índia)

- Altpac (Austrália)

- Packman Packaging Private Limited (Índia)

Últimos desenvolvimentos no mercado de embalagens de caixas no Oriente Médio e na África

- Em janeiro de 2025, a International Paper enfatizou a tendência contínua de "papelização", a transição de embalagens plásticas para embalagens à base de papel, impulsionada por preocupações ambientais. A empresa promove designs reutilizáveis e transparência em sustentabilidade para atender às preferências em constante evolução dos consumidores.

- Em fevereiro de 2024, a Smurfit Westrock publicou seu primeiro “Relatório de Sustentabilidade 2024”, destacando soluções de embalagens sustentáveis e foco na economia circular. Isso demonstra o compromisso com a sustentabilidade e com embalagens recicláveis, cada vez mais importantes para clientes de e-commerce e para a conformidade com regulamentações e normas ambientais em todo o mundo, agregando valor ao portfólio de embalagens para varejistas online.

- Em outubro de 2025, a Klabin foi homenageada com o Prêmio Sesi ODS 2025 na categoria Social – Grandes Empresas por sua iniciativa “Klabin Transforma Semeando Educação”, que fortalece a educação pública nas regiões onde atua. O programa, ativo desde 2019, expandiu-se para 20 municípios em quatro estados brasileiros, beneficiando cerca de 30.000 alunos, professores e gestores escolares. Este reconhecimento destaca o compromisso da Klabin com o desenvolvimento regional sustentável e seu alinhamento com os Objetivos de Desenvolvimento Sustentável da ONU por meio de ações impactantes de educação comunitária.

- Em novembro de 2025, a Mondi concluiu a aquisição das operações de conversão de papelão ondulado e cartão sólido da Schumacher Packaging na Europa Ocidental. Essa aquisição adicionou mais de 1 bilhão de metros quadrados de capacidade de embalagem, fortaleceu significativamente a presença da Mondi na Alemanha, Benelux e Reino Unido e expandiu suas capacidades em papelão ondulado e cartão sólido — especialmente para os segmentos de comércio eletrônico e bens de consumo de massa.

- Em julho de 2025, a Mondi lançou um portfólio ampliado de embalagens de papelão ondulado e cartão rígido, desenvolvido especificamente para a indústria alimentícia. A nova oferta visa os principais segmentos do setor alimentício e integra soluções de cartão rígido e recursos de impressão digital — um desenvolvimento viabilizado pela aquisição da Schumacher Packaging. Isso ajuda os clientes do setor alimentício a melhorar a visibilidade nas prateleiras, a diferenciação da marca, a eficiência no manuseio e a conformidade com as normas regulatórias.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PRICING ANALYSIS

4.4 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 INDUSTRY ECOSYSTEM ANALYSIS MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET

4.6.1 PROMINENT COMPANIES

4.6.2 SMALL & MEDIUM-SIZED COMPANIES

4.6.3 END USERS

4.6.4 RESEARCH AND DEVELOPMENT

4.7 BRAND OUTLOOK

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 PACKAGING AS A CENTRAL INFLUENCER OF PURCHASE DECISIONS

4.8.2 PACKAGING ATTRIBUTES THAT DRIVE CONSUMER PREFERENCES

4.8.3 GROWING IMPACT OF SUSTAINABILITY ON BUYING BEHAVIOUR

4.8.4 PSYCHOLOGICAL AND EMOTIONAL DIMENSIONS OF PACKAGING INFLUENCE

4.8.5 INFLUENCE OF CONSUMER SEGMENTATION AND PURCHASE CONTEXT

4.8.6 CHALLENGES IN ALIGNING PACKAGING WITH CONSUMER BEHAVIOUR

4.8.7 STRATEGIC IMPLICATIONS FOR PACKAGING PRODUCERS AND BRAND OWNERS

4.8.8 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN –

4.9.1 RAW MATERIAL COSTS

4.9.2 MANUFACTURING & PROCESSING COSTS

4.9.3 LABOR COSTS

4.9.4 LOGISTICS & TRANSPORTATION COSTS

4.9.5 PACKAGING MACHINERY & CAPITAL EXPENDITURE

4.9.6 ADMINISTRATIVE, SALES & DISTRIBUTION OVERHEADS

4.9.7 PROFIT MARGINS

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 Joint Ventures

4.10.1.2 Mergers and Acquisitions

4.10.1.3 Licensing and Partnership Agreements

4.10.1.4 Technology Collaborations

4.10.1.5 Strategic Divestments

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 PATENT ANALYSIS –

4.11.1 OVERVIEW

4.11.2 PATENT FILINGS BY GEOGRAPHY

4.11.3 LEADING APPLICANTS

4.11.4 IPC (INTERNATIONAL PATENT CLASSIFICATION) ANALYSIS

4.11.5 PUBLICATION TREND ANALYSIS (2016–2025)

4.12 PROFIT MARGINS SCENARIO –

4.12.1 OVERALL MARGIN DYNAMICS IN THE BOXES PACKAGING INDUSTRY

4.12.2 MARGIN PERFORMANCE FOR STANDARD CORRUGATED BOXES

4.12.3 HIGHER MARGINS IN VALUE-ADDED AND SPECIALTY BOXES

4.12.4 PREMIUM PROFITABILITY IN LUXURY AND RIGID BOXES

4.12.5 REGIONAL DIFFERENCES IMPACTING PROFITABILITY

4.12.6 ADVANTAGE OF VERTICAL INTEGRATION ON MARGINS

4.12.7 E-COMMERCE DEMAND AS A MARGIN BOOSTER

4.13 RAW MATERIAL COVERAGE

4.13.1 OVERVIEW OF THE RAW MATERIAL LANDSCAPE

4.13.2 FIBRE-BASED SUBSTRATES

4.13.2.1 Corrugated Containerboard

4.13.2.2 Folding Cartonboard and Solid Boards

4.13.2.3 Balance of Virgin and Recycled Fibre

4.13.2.4 Alternative and Next-Generation Fibres

4.13.3 NON-FIBRE BOX MATERIALS

4.13.3.1 Plastics

4.13.3.2 Metal and Composite Boxes

4.13.3.3 Wooden and Plywood Boxes

4.13.4 ADHESIVES AND SEALING SYSTEMS

4.13.4.1 Water-Based Adhesives

4.13.4.2 Hot-Melt and Solvent-Based Adhesives

4.13.4.3 Tapes and Mechanical Closures

4.13.5 PRINTING INKS, COATINGS, AND FUNCTIONAL BARRIERS

4.13.5.1 Printing Inks

4.13.5.2 Surface Coatings

4.13.5.3 Barrier Films and Liners

4.13.6 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 TECHNOLOGY LANDSCAPE AND STRATEGIC CONTEXT

4.15.2 AUTOMATION, ROBOTICS, AND INDUSTRY 4.0 INTEGRATION

4.15.2.1 Automated Converting and Finishing Lines

4.15.2.2 Robotics in Handling and Palletizing

4.15.2.3 Industry 4.0, Connectivity, and Predictive Intelligence

4.15.3 DIGITAL PRINTING AND ADVANCED GRAPHICS

4.15.3.1 Shift Toward Digital Printing Platforms

4.15.3.2 Variable Data, Personalization, and Intelligent Marking

4.15.4 RIGHT-SIZED PACKAGING AND ON-DEMAND PRODUCTION

4.15.4.1 Intelligent Right-Sizing Systems

4.15.4.2 On-Demand Box-Making Technologies

4.15.5 SMART AND CONNECTED PACKAGING

4.15.5.1 Smart Functionality and Digital Integration

4.15.5.2 Rack-and-Trace and Authentication Technologies

4.15.5.3 Condition Monitoring and IoT-Driven Insights

4.15.6 ADVANCED MATERIALS, COATINGS, AND STRUCTURAL ENGINEERING

4.15.6.1 Strength-Optimized Board Structures

4.15.6.2 Functional, Recyclable, and Bio-Based Coatings

4.15.6.3 Interactive and Augmented Packaging Features

4.15.7 E-COMMERCE-DRIVEN PACKAGING AND FULFILMENT TECHNOLOGY

4.15.7.1 High-Velocity Packaging Systems

4.15.7.2 Integrated Warehouse Automation

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 QUALITY AND RELIABILITY OF MATERIALS

4.17.2 TECHNICAL CAPABILITY AND CUSTOMIZATION CAPACITY

4.17.3 PRODUCTION CAPACITY, DELIVERY RELIABILITY, AND SUPPLY CONTINUITY

4.17.4 COST, VALUE, AND TOTAL OWNERSHIP CONSIDERATIONS

4.17.5 INDUSTRY EXPERIENCE AND PROVEN TRACK RECORD

4.17.6 SUSTAINABILITY, ETHICAL STANDARDS, AND REGULATORY COMPLIANCE

4.17.7 SERVICE QUALITY, COMMUNICATION, AND RESPONSIVENESS

4.17.8 QUALITY ASSURANCE, TESTING CAPABILITIES, AND RISK MANAGEMENT

4.17.9 STRUCTURED EVALUATION AND VENDOR SELECTION FRAMEWORKS

4.17.10 CONCLUSION

5 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.2 VENDOR SELECTION CRITERIA DYNAMICS

5.3 IMPACT ON SUPPLY CHAIN

5.3.1 RAW MATERIAL PROCUREMENT

5.3.2 MANUFACTURING AND PRODUCTION

5.3.3 LOGISTICS AND DISTRIBUTION

5.3.4 PRICE PITCHING AND POSITION OF MARKET

5.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.4.1 SUPPLY CHAIN OPTIMIZATION

5.4.2 JOINT VENTURE ESTABLISHMENTS

5.5 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING E-COMMERCE AND RETAIL SECTOR

7.1.2 SHIFT TOWARDS SUSTAINABLE PACKAGING SOLUTIONS

7.1.3 RISING DEMAND FOR SAFE AND TAMPER EVIDENT PACKAGING IN PHARMACEUTICAL AND HEALTHCARE

7.1.4 GROWING INTERNATIONAL TRADE

7.2 RESTRAINS

7.2.1 COMPETITION FROM OTHER PACKAGING FORMATS

7.2.2 VOLATILITY IN PULP AND PAPER PRICES

7.3 OPPORTUNITY

7.3.1 SMART BOX PACKAGING AND DIGITAL PRINTING INTEGRATION

7.3.2 CUSTOMIZATION AND PREMIUMIZATION TRENDS

7.4 CHALLENGES

7.4.1 REGULATORY COMPLIANCE AND WASTE MANAGEMENT

7.4.2 SUPPLY CHAIN DISRUPTIONS AND MATERIAL SHORTAGES

8 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 CORRUGATED BOXES

8.3 SLOTTED BOXES

8.4 FOLDING CARTONS

8.5 RIGID BOXES

8.6 CRATES

8.7 OTHERS

8.8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 SINGLE WALL

8.8.2 DOUBLE WALL

8.8.3 TRIPLE WALL

8.8.4 CUSTOM / DESIGNER BOXES

8.9 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

8.9.1 C FLUTE

8.9.2 B FLUTE

8.9.3 A FLUTE

8.9.4 E FLUTE

8.9.5 F FLUTE

8.1 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 MIDDLE EAST AND AFRICA

8.10.5 SOUTH AMERICA

8.11 MIDDLE EAST AND AFRICA SLOTTED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 MIDDLE EAST AND AFRICA

8.11.5 SOUTH AMERICA

8.12 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 TUCK TOP

8.12.2 SLEEVE

8.12.3 WINDOWED

8.12.4 DISPLAY CARTONS

8.12.5 OTHERS

8.13 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 MIDDLE EAST AND AFRICA

8.13.5 SOUTH AMERICA

8.14 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 THIN-WALLED RIGID BOXES

8.14.2 SET-UP / THICK-WALLED RIGID BOXES

8.15 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

8.15.1 STANDARD

8.15.2 LUXURY

8.16 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 PRODUCT PACKAGING BOXES

8.16.2 GIFT BOXES

8.17 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

8.17.1 MAGNETIC

8.17.2 RIBBON

8.17.3 SLIDING LID

8.17.4 OTHERS

8.18 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.18.1 ASIA-PACIFIC

8.18.2 NORTH AMERICA

8.18.3 EUROPE

8.18.4 MIDDLE EAST AND AFRICA

8.18.5 SOUTH AMERICA

8.19 MIDDLE EAST AND AFRICA CRATES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.19.1 ASIA-PACIFIC

8.19.2 NORTH AMERICA

8.19.3 EUROPE

8.19.4 MIDDLE EAST AND AFRICA

8.19.5 SOUTH AMERICA

8.2 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 MIDDLE EAST AND AFRICA

8.20.5 SOUTH AMERICA

9 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE

9.1 OVERVIEW

9.1.1 STANDARD BOXES

9.1.2 SPECIALTY BOXES

9.2 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.2.1 REGULAR SLOTTED CONTAINER (RSC)

9.2.2 DOUBLE COVERED BOXES

9.2.3 DIE-CUT BOXES

9.2.4 TELESCOPIC BOXES

9.2.5 HALF SLOTTED CONTAINER (HSC)

9.2.6 FULL OVERLAP CONTAINER (FOL)

9.2.7 OTHERS

9.3 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 NORTH AMERICA

9.3.3 EUROPE

9.3.4 MIDDLE EAST AND AFRICA

9.3.5 SOUTH AMERICA

9.4 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 PRINTED BOXES

9.4.2 HEAVY-DUTY BOXES

9.4.3 INSULATED BOXES

9.4.4 DANGEROUS GOODS (HAZARDOUS) BOXES

9.4.5 CUSTOMIZED BOXES

9.4.6 OTHERS

9.5 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 MIDDLE EAST AND AFRICA

9.5.5 SOUTH AMERICA

10 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL

10.1 OVERVIEW

10.1.1 PAPER & PAPERBOARD

10.1.2 PLASTICS

10.1.3 METAL

10.1.4 WOOD

10.1.5 OTHERS

10.2 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.2.1 KRAFT PAPER

10.2.2 COATED PAPER

10.2.3 WHITE TOP TESTLINER

10.2.4 CHIPBOARD

10.2.5 OTHERS

10.3 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 NORTH AMERICA

10.3.3 EUROPE

10.3.4 MIDDLE EAST AND AFRICA

10.3.5 SOUTH AMERICA

10.4 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.4.1 POLYPROPYLENE (PP)

10.4.2 POLYETHYLENE (PE)

10.4.3 PET

10.4.4 OTHERS

10.5 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 MIDDLE EAST AND AFRICA

10.5.5 SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.6.1 ALUMINIUM

10.6.2 TINPLATE

10.6.3 OTHERS

10.7 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 MIDDLE EAST AND AFRICA

10.7.5 SOUTH AMERICA

10.8 MIDDLE EAST AND AFRICA WOOD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 MIDDLE EAST AND AFRICA

10.8.5 SOUTH AMERICA

10.9 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 MIDDLE EAST AND AFRICA

10.9.5 SOUTH AMERICA

11 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 WHOLESALE

11.3 RETAIL

11.4 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 INDUSTRIAL GOODS (2500,2000,0001)

11.4.2 FOOD & BEVERAGES (1000,1100)

11.4.3 LOGISTICS & TRANSPORTATION (4900)

11.4.4 AUTOMOTIVE (4600)

11.4.5 CONSUMER ELECTRONICS (2500)

11.4.6 COSMETICS & PERSONAL CARE (2000,0001)

11.4.7 PHARMACEUTICALS (2100)

11.4.8 HEALTHCARE EQUIPMENT (0001,2500)

11.4.9 OTHERS

11.5 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 MIDDLE EAST AND AFRICA

11.5.5 SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 ELECTRICAL PRODUCTS

11.6.2 ELECTRONICS

11.6.3 CHEMICALS

11.6.4 OTHER INDUSTRIAL APPLICATIONS

11.7 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 BAKERY

11.7.2 DAIRY FOODS

11.7.3 CONFECTIONERY

11.7.4 FROZEN FOODS

11.7.5 BEVERAGES

11.7.6 OTHERS

11.8 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 BULK TRANSPORT

11.8.2 COURIER, EXPRESS & PARCEL (CEP)

11.8.3 COLD CHAIN

11.8.4 OTHERS

11.9 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 COMPONENTS PACKAGING

11.9.2 BATTERIES & ELECTRONICS

11.9.3 SPECIALISED PACKAGING

11.9.4 OTHERS

11.1 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 VEHICLE PARTS EXPORT

11.10.2 MODIFICATION COMPONENT

11.10.3 OTHERS

11.11 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 MOBILE PHONES

11.11.2 LAPTOPS

11.11.3 TVS

11.11.4 ACCESSORIES

11.11.5 OTHERS

11.12 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 SKIN CARE

11.12.2 PERFUMES

11.12.3 ORAL CARE

11.12.4 HAIR CARE

11.12.5 MAKEUP

11.12.6 OTHERS

11.13 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 MEDICAL DEVICE

11.13.2 HEALTHCARE KIT

11.13.3 OTHERS

11.14 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 FOOD & BEVERAGES (1000,1100)

11.14.2 CONSUMER ELECTRONICS (2500)

11.14.3 INDUSTRIAL GOODS (2500,2000,0001)

11.14.4 LOGISTICS & TRANSPORTATION (4900)

11.14.5 COSMETICS & PERSONAL CARE (2000,0001)

11.14.6 PHARMACEUTICALS (2100)

11.14.7 AUTOMOTIVE (4600)

11.14.8 HEALTHCARE EQUIPMENT (0001,2500)

11.14.9 OTHERS

11.15 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 NORTH AMERICA

11.15.3 EUROPE

11.15.4 MIDDLE EAST AND AFRICA

11.15.5 SOUTH AMERICA

12 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 DISTRIBUTORS / WHOLESALERS

12.4 RETAIL STORES

12.5 MIDDLE EAST AND AFRICA DIRECT SALES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 NORTH AMERICA

12.5.3 EUROPE

12.5.4 MIDDLE EAST AND AFRICA

12.5.5 SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA DISTRIBUTORS / WHOLESALERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 NORTH AMERICA

12.6.3 EUROPE

12.6.4 MIDDLE EAST AND AFRICA

12.6.5 SOUTH AMERICA

12.7 MIDDLE EAST AND AFRICA RETAIL STORES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 NORTH AMERICA

12.7.3 EUROPE

12.7.4 MIDDLE EAST AND AFRICA

12.7.5 SOUTH AMERICA

13 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE

13.1 OVERVIEW

13.1.1 SMALL (UP TO 5 KG)

13.1.2 MEDIUM (5–20 KG)

13.1.3 CUSTOM SIZES

13.1.4 LARGE (20–50 KG)

13.1.5 EXTRA-LARGE (ABOVE 50 KG)

13.2 MIDDLE EAST AND AFRICA SMALL (UP TO 5 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.2.1 ASIA-PACIFIC

13.2.2 NORTH AMERICA

13.2.3 EUROPE

13.2.4 MIDDLE EAST AND AFRICA

13.2.5 SOUTH AMERICA

13.3 MIDDLE EAST AND AFRICA MEDIUM (5–20 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.3.1 ASIA-PACIFIC

13.3.2 NORTH AMERICA

13.3.3 EUROPE

13.3.4 MIDDLE EAST AND AFRICA

13.3.5 SOUTH AMERICA

13.4 MIDDLE EAST AND AFRICA CUSTOM SIZES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 MIDDLE EAST AND AFRICA

13.4.5 SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA LARGE (20–50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 MIDDLE EAST AND AFRICA

13.5.5 SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA EXTRA-LARGE (ABOVE 50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 NORTH AMERICA

13.6.3 EUROPE

13.6.4 MIDDLE EAST AND AFRICA

13.6.5 SOUTH AMERICA

14 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UAE

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 QATAR

14.1.7 KUWAIT

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 MANUFACTURERS COMPANY PROFILE

17.1 INTERNATIONAL PAPER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SMURFIT WESTROCK

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 DS SMITH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 PACKAGING CORPORATION OF AMERICA.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 OJI HOLDINGS CORPORATION.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AVON CONTAINERS PVT. LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ALTPAC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AMCOR PLC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 BOXON AB

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BLUE BOX PACKAGING

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ECB

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ECOM PACKAGING

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GREEN BAY PACKAGING INC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 GEORGIA-PACIFIC LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 GRAPHIC PACKAGING INTERNATIONAL, LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 KLABIN S.A

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 MONDI

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 MAYR-MELNHOF KARTON AG

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 PREM INDUSTRIES INDIA LIMITED

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PACKHELP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 PACKTEK

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PACKMAN PACKAGING PRIVATE LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 PRATT INDUSTRIES, INC.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 RENGO CO., LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 STORA ENSO

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENT

17.27 SEALED AIR

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENT

17.28 SUNECO BOX

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 TGIPACKAGING.IN.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 3M

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

18 DISTRIBUTOR COMPANY PROFILE

18.1 BUNZL PLC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 IMPERIAL DADE

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 VERITIV OPERATING COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 PAPER MART

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 ULINE

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 KEY CONCERNS AND THEIR IMPACTS

TABLE 2 BRAND OUTLOOK

TABLE 3 PATENT PUBLICATIONS SHOW A CLEAR UPWARD TREND:

TABLE 4 REGULATORY COVERAGE

TABLE 5 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SLOTTED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CRATES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA WOOD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA DIRECT SALES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA DISTRIBUTORS / WHOLESALERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RETAIL STORES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SMALL (UP TO 5 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MEDIUM (5–20 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA CUSTOM SIZES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA LARGE (20–50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA EXTRA-LARGE (ABOVE 50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 85 USD THOUSAND

TABLE 86 SAUDI ARABIA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 SAUDI ARABIA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 SAUDI ARABIA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 98 SAUDI ARABIA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 SAUDI ARABIA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 SAUDI ARABIA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 SAUDI ARABIA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 102 SAUDI ARABIA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 SAUDI ARABIA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 SAUDI ARABIA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 SAUDI ARABIA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 SAUDI ARABIA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 SAUDI ARABIA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 SAUDI ARABIA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 SAUDI ARABIA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 SAUDI ARABIA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 SAUDI ARABIA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 113 SAUDI ARABIA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 114 USD THOUSAND

TABLE 115 UAE BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 116 UAE CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 UAE CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 UAE FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 121 UAE LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 UAE BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 UAE STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 UAE SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 UAE BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 127 UAE PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 UAE PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 UAE METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 UAE BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 131 UAE WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 UAE INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 UAE FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 UAE LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 UAE AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 UAE COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 UAE CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 UAE COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 UAE HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 UAE RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 UAE BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 142 UAE BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 143 USD THOUSAND

TABLE 144 SOUTH AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 150 SOUTH AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SOUTH AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SOUTH AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 SOUTH AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 SOUTH AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 SOUTH AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 SOUTH AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 SOUTH AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 SOUTH AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 SOUTH AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 171 SOUTH AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 172 USD THOUSAND

TABLE 173 EGYPT BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 174 EGYPT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 EGYPT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 EGYPT FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 179 EGYPT LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EGYPT BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 EGYPT STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 EGYPT SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 EGYPT BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 185 EGYPT PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 EGYPT PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EGYPT METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 EGYPT BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 189 EGYPT WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 EGYPT INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 EGYPT FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 EGYPT LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 EGYPT AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 EGYPT COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 EGYPT CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 EGYPT COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 EGYPT HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 EGYPT RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 EGYPT BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 200 EGYPT BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 201 USD THOUSAND

TABLE 202 ISRAEL BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 203 ISRAEL CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 ISRAEL CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 ISRAEL FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 208 ISRAEL LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 ISRAEL BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 ISRAEL STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 ISRAEL SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 ISRAEL BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 214 ISRAEL PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 ISRAEL PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 ISRAEL METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 ISRAEL BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 218 ISRAEL WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 ISRAEL INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 ISRAEL FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 ISRAEL LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 ISRAEL AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 ISRAEL COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 ISRAEL CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 ISRAEL COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 ISRAEL HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 ISRAEL RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 ISRAEL BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 229 ISRAEL BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 230 USD THOUSAND

TABLE 231 QATAR BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 232 QATAR CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 QATAR CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 QATAR FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 237 QATAR LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 QATAR BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 QATAR STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 QATAR SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 QATAR BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 243 QATAR PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 QATAR PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 QATAR METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 QATAR BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 247 QATAR WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 QATAR INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 QATAR FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 QATAR LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 QATAR AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 QATAR COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 QATAR CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 QATAR COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 QATAR HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 QATAR RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 QATAR BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 258 QATAR BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 259 USD THOUSAND

TABLE 260 KUWAIT BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 261 KUWAIT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 KUWAIT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 KUWAIT FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 266 KUWAIT LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 KUWAIT BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 KUWAIT STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 KUWAIT SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 KUWAIT BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 272 KUWAIT PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 KUWAIT PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 KUWAIT METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 KUWAIT BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 276 KUWAIT WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 KUWAIT INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 KUWAIT FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 KUWAIT LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 280 KUWAIT AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 KUWAIT COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 282 KUWAIT CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 KUWAIT COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 KUWAIT HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 KUWAIT RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 KUWAIT BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 287 KUWAIT BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 288 USD THOUSAND

TABLE 289 OMAN BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 290 OMAN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 OMAN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 OMAN FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 295 OMAN LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 OMAN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)