Middle East And Africa Branded Generics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

20.89 Billion

USD

34.25 Billion

2024

2032

USD

20.89 Billion

USD

34.25 Billion

2024

2032

| 2025 –2032 | |

| USD 20.89 Billion | |

| USD 34.25 Billion | |

|

|

|

|

Segmentação do mercado de medicamentos genéricos de marca no Oriente Médio e África, por classe terapêutica (anti-hipertensivos, hormônios, antimetabólitos, hipolipemiantes, antiepilépticos, agentes alquilantes, antidepressivos, antipsicóticos, outros), por aplicação (doenças cardiovasculares, tratamento da dor e anti-inflamatórios, oncologia, diabetes, neurologia, doenças gastrointestinais, dermatologia, outros), por via de administração (oral, injetável, tópica, outras), por tipo de produto (genéricos de marca com valor agregado, genéricos de marca comercial), por perfil demográfico do paciente (adulto, geriátrico, pediátrico), por usuário final (hospitais, clínicas, atendimento domiciliar, instituições acadêmicas e de pesquisa, outros), por canal de distribuição (farmácias de varejo, farmácias hospitalares, licitações diretas, outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de genéricos de marca no Oriente Médio e na África

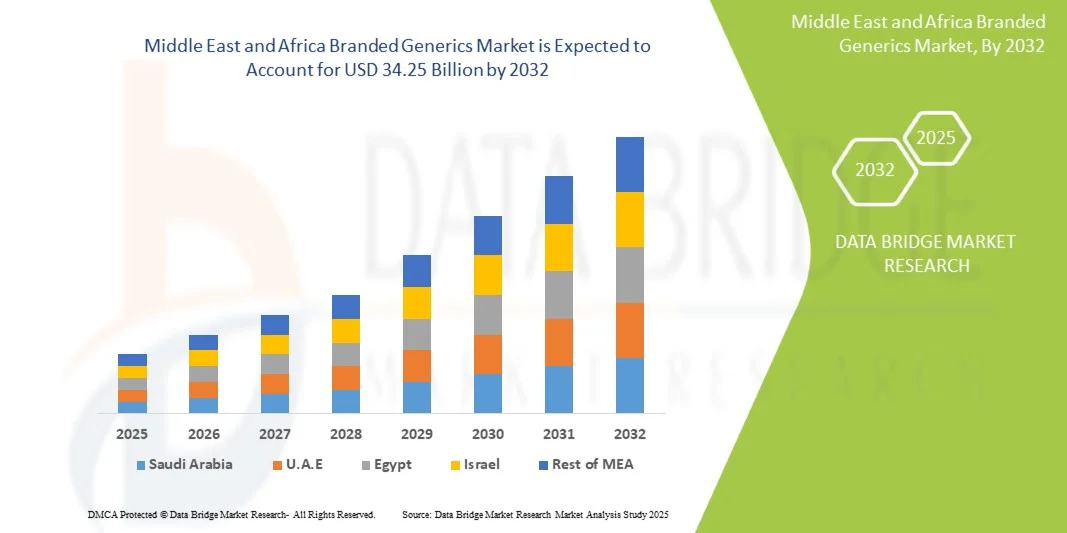

- O mercado de medicamentos genéricos de marca no Oriente Médio e na África foi avaliado em US$ 20,89 bilhões em 2024 e espera-se que atinja US$ 34,25 bilhões até 2032.

- Durante o período de previsão de 2025 a 2032, o mercado deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,4%, impulsionado principalmente pelo aumento dos gastos com saúde, pela crescente prevalência de doenças crônicas e pela demanda por medicamentos acessíveis e de alta qualidade, tanto em mercados desenvolvidos quanto emergentes.

- Esse crescimento é ainda mais impulsionado pela expiração de patentes de medicamentos originais, políticas governamentais que apoiam tratamentos custo-efetivos, expansão do acesso à saúde em economias emergentes e crescente adoção de canais de saúde digital e farmácias online. Inovações contínuas em formulações de medicamentos, estratégias aprimoradas de adesão do paciente e a expansão dos portfólios de genéricos de marca por empresas farmacêuticas líderes também devem acelerar a expansão do mercado globalmente.

Análise do Mercado de Medicamentos Genéricos de Marca no Oriente Médio e na África

- O mercado de medicamentos genéricos de marca no Oriente Médio e na África está experimentando um crescimento robusto, impulsionado pela crescente demanda por produtos farmacêuticos de alta qualidade e custo acessível, que combinam a acessibilidade dos genéricos com o reconhecimento da marca. Os genéricos de marca desempenham um papel vital na melhoria da adesão ao tratamento, na ampliação do acesso a medicamentos essenciais e na geração de oportunidades de receita para empresas farmacêuticas tanto em mercados emergentes quanto em mercados desenvolvidos. O mercado enfrenta desafios, incluindo variações regulatórias entre os países, pressões sobre os preços e a necessidade de inovação contínua para manter a fidelidade à marca.

- Os segmentos de tratamento de doenças crônicas, oncologia, doenças cardiovasculares e doenças infecciosas são os principais impulsionadores do crescimento. A crescente prevalência de doenças não transmissíveis, a maior conscientização sobre saúde e a expansão do acesso à saúde em economias emergentes estão impulsionando a demanda por medicamentos genéricos de marca. Além disso, a crescente adoção de biossimilares e genéricos especializados está moldando a dinâmica do mercado, oferecendo alternativas aos medicamentos de marca, que são mais caros, mantendo a eficácia e a segurança. As empresas farmacêuticas estão utilizando estratégias de marketing, educação do paciente e parcerias estratégicas para aumentar a adesão aos medicamentos genéricos de marca.

- A Arábia Saudita domina o mercado, e os Emirados Árabes Unidos são o país que cresce mais rapidamente, devido à capacidade consolidada da região na fabricação de medicamentos genéricos, às políticas governamentais favoráveis e ao aumento dos gastos com saúde.

- Espera-se que o segmento de anti-hipertensivos domine o mercado com uma participação de 30,52%, impulsionado pela preferência dos pacientes por dosagem conveniente, custo-benefício e ampla aplicabilidade em diversas áreas terapêuticas.

Escopo do relatório e segmentação do mercado de medicamentos genéricos de marca no Oriente Médio e na África.

|

Atributos |

Principais informações sobre o mercado de medicamentos genéricos de marca no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de medicamentos genéricos de marca no Oriente Médio e na África

“A crescente demanda por medicamentos acessíveis e de alta qualidade impulsiona o crescimento do mercado de genéricos de marca no Oriente Médio e na África”

- O aumento dos custos com saúde, o envelhecimento da população e a crescente prevalência de doenças crônicas e relacionadas ao estilo de vida estão impulsionando a demanda por medicamentos acessíveis e de alta qualidade no Oriente Médio e na África, sustentando o crescimento dos genéricos de marca. Os genéricos de marca oferecem uma alternativa economicamente viável aos medicamentos de referência, mantendo altos padrões de eficácia e segurança, o que os torna essenciais tanto em mercados desenvolvidos quanto emergentes.

- Governos e planos de saúde estão promovendo ativamente o uso de medicamentos genéricos de marca por meio de políticas, sistemas de reembolso e programas de substituição por genéricos, visando conter os gastos com saúde, ampliar o acesso ao tratamento e melhorar a adesão do paciente. Essas medidas estão impulsionando a adoção de medicamentos genéricos em diversas áreas terapêuticas, incluindo doenças cardiovasculares, diabetes, oncologia e distúrbios do sistema nervoso central.

- Por exemplo, em março de 2024, a FDA (Food and Drug Administration) dos EUA aprovou diversas novas formulações genéricas de marca para categorias terapêuticas de alta demanda, como diabetes e hipertensão, demonstrando o crescente desenvolvimento de novos medicamentos e o apoio regulatório a alternativas economicamente viáveis aos medicamentos de marca. Isso ilustra a expansão contínua do mercado de genéricos de marca no Oriente Médio e na África, em resposta às necessidades dos pacientes e do sistema de saúde.

- As economias emergentes, particularmente na Arábia Saudita e na América Latina, estão testemunhando uma adoção acelerada de medicamentos genéricos de marca devido à expansão da infraestrutura de saúde, ao crescimento da classe média e às iniciativas governamentais voltadas para a melhoria do acesso ao tratamento. As empresas estão ampliando a produção local, investindo em pesquisa e desenvolvimento e aprimorando as redes de distribuição para atender à crescente demanda nessas regiões.

- À medida que os sistemas de saúde do Oriente Médio e da África continuam a enfatizar a acessibilidade, a disponibilidade e a adesão ao tratamento, o papel dos medicamentos genéricos de marca se tornará cada vez mais crucial para garantir a sustentabilidade da assistência médica, impulsionando a inovação na fabricação, embalagem e desenvolvimento de medicamentos com foco no paciente.

Dinâmica do mercado de medicamentos genéricos de marca no Oriente Médio e na África

Motorista

“Expiração das patentes de medicamentos de grande sucesso”

- A iminente expiração das patentes de medicamentos de grande sucesso está entre os principais fatores estruturais que impulsionam a expansão do mercado de genéricos de marca no Oriente Médio e na África. Quando um medicamento inovador de alta receita perde a exclusividade, abre-se espaço para que fabricantes de genéricos e biossimilares lancem versões concorrentes, corroendo a participação de mercado do medicamento inovador e redirecionando a demanda para alternativas de menor custo.

- Esse "abismo de patentes" desencadeia uma série de efeitos subsequentes: os fabricantes se apressam em registrar Novos Medicamentos Abreviados (ANDAs) ou pedidos de biossimilares, as autoridades regulatórias aceleram a análise, as operadoras de planos de saúde favorecem cada vez mais os genéricos e os pacientes obtêm acesso a genéricos de marca mais acessíveis.

- Ao longo da última década, a onda de perda de exclusividade em grandes medicamentos criou oportunidades recorrentes para empresas já estabelecidas no mercado de genéricos e para novos entrantes, remodelando a dinâmica de preços, incentivando a consolidação na fabricação de genéricos e acelerando a expansão geográfica para mercados emergentes. De fato, a magnitude das receitas em jogo com a expiração de patentes muitas vezes fornece a justificativa econômica para o investimento em genéricos e biossimilares complexos.

- É importante destacar que o momento e a previsibilidade da expiração de patentes oferecem janelas de planejamento estratégico para que as empresas de genéricos antecipem lançamentos, invistam em projetos de desenvolvimento, formem alianças e preparem dossiês regulatórios antes da perda da exclusividade.

- Consequentemente, o setor de genéricos de marca torna-se uma fronteira cíclica de fator competitivo, intimamente ligada à expiração de patentes de medicamentos de grande sucesso.

Restrição/Desafio

“Litígios de Patentes e Riscos de Propriedade Intelectual”

- Litígios de patentes e riscos relacionados à propriedade intelectual representam uma restrição significativa para o mercado de medicamentos genéricos de marca no Oriente Médio e na África. A complexidade e a duração das disputas de patentes podem atrasar a entrada de alternativas genéricas, prejudicando a concorrência no mercado e mantendo os preços dos medicamentos elevados.

- Essas batalhas judiciais frequentemente envolvem múltiplas camadas de reivindicações de patentes, incluindo patentes de método de uso e patentes secundárias, que podem estender o período de exclusividade de medicamentos de marca além da expiração da patente original.

- Além disso, o ônus financeiro de se defender de processos por violação de patentes pode dissuadir fabricantes de genéricos, especialmente empresas menores, de entrar no mercado. O cenário em constante evolução das leis de patentes e o uso estratégico de portfólios de patentes por empresas detentoras das patentes originais complicam ainda mais a dinâmica do mercado, podendo levar a um mercado global de medicamentos de marca e genéricos.

- Por exemplo, em outubro de 2025, o jornal The Economic Times noticiou que a Natco Pharma, sediada em Hyderabad, venceu uma disputa de patentes contra a farmacêutica suíça Roche referente ao medicamento Risdiplam, usado no tratamento da atrofia muscular espinhal.

- Essas barreiras legais e financeiras afetam tanto a lucratividade dos fabricantes quanto o acesso dos pacientes a medicamentos acessíveis. De modo geral, os litígios de patentes e os riscos de propriedade intelectual continuam sendo os principais entraves que influenciam a concorrência e o crescimento no mercado de genéricos de marca no Oriente Médio e na África.

Escopo do mercado de genéricos de marca no Oriente Médio e na África

O mercado de medicamentos genéricos de marca no Oriente Médio e na África está segmentado em sete segmentos principais, com base na classe do medicamento, aplicação, via de administração, tipo de produto, perfil demográfico do paciente, usuário final e canal de distribuição.

• Por classe de medicamento

Com base na classe de medicamentos, o mercado de genéricos de marca no Oriente Médio e na África é segmentado em anti-hipertensivos, hormônios, antimetabólitos, hipolipemiantes, antiepilépticos, agentes alquilantes, antidepressivos, antipsicóticos e outros. Em 2025, espera-se que o segmento de anti-hipertensivos domine o mercado com 30,52% de participação, impulsionado pela crescente prevalência de doenças cardiovasculares, pela maior conscientização sobre o controle da hipertensão e pela preferência cada vez maior por alternativas genéricas com melhor custo-benefício por parte de pacientes e profissionais de saúde.

Prevê-se que o segmento de anti-hipertensivos ganhe força com uma taxa de crescimento anual composta (CAGR) de 8,0% durante o período de previsão de 2025 a 2032, impulsionado pela inovação contínua em terapias de combinação de dose fixa, iniciativas governamentais que promovem medicamentos acessíveis e a expansão do acesso à saúde em economias emergentes, fatores que, em conjunto, impulsionam a adoção de medicamentos genéricos de marca para anti-hipertensivos.

• Mediante inscrição

Com base na aplicação, o mercado é segmentado em doenças cardiovasculares, tratamento da dor e anti-inflamatórios, oncologia, diabetes, neurologia, doenças gastrointestinais, dermatologia e outras. Em 2025, espera-se que o segmento de doenças cardiovasculares domine o mercado com 36,62% de participação, devido à crescente prevalência de distúrbios cardíacos em todo o mundo, ao aumento da população idosa e à crescente conscientização sobre cuidados cardiovasculares preventivos, juntamente com a disponibilidade de medicamentos genéricos de marca com custo acessível.

Prevê-se que o segmento de doenças cardiovasculares cresça de forma constante, com uma taxa de crescimento anual composta (CAGR) de 7,4%, à medida que os sistemas de saúde nos mercados emergentes melhoram o acesso a medicamentos essenciais, as terapias de combinação de dose fixa ganham popularidade e a pesquisa e o desenvolvimento contínuos aprimoram a eficácia e o perfil de segurança dos medicamentos genéricos de marca para o tratamento cardiovascular.

• Por via de administração

Com base na via de administração, o mercado de medicamentos genéricos de marca no Oriente Médio e na África é segmentado em administração oral, injetável, tópica e outras. Em 2025, espera-se que o segmento oral domine o mercado com 60,45% de participação, devido à conveniência da administração oral, à alta adesão do paciente, à ampla disponibilidade de formulações orais e à relação custo-benefício em comparação com outras vias.

O segmento de medicamentos orais deverá apresentar um crescimento acelerado de 6,6% durante o período de previsão, impulsionado pela crescente prevalência de doenças crônicas que exigem medicação a longo prazo, pela preferência cada vez maior por terapias autoadministradas e pelo lançamento contínuo de formulações orais inovadoras com biodisponibilidade aprimorada e designs mais amigáveis ao paciente.

• Por tipo de produto

Com base no tipo de produto, o mercado é segmentado em genéricos de marca com valor agregado e genéricos de marca comercial. Em 2025, espera-se que o segmento de genéricos de marca com valor agregado domine o mercado com uma participação de 70,32%, impulsionado por sua maior eficácia, perfis de segurança aprimorados, formulações centradas no paciente e capacidade de oferecer benefícios terapêuticos diferenciados em relação aos genéricos padrão.

O segmento de genéricos de marca com valor agregado está ganhando importância e crescendo a uma taxa composta de crescimento anual (CAGR) de 6,5%, devido à crescente preferência dos profissionais de saúde por formulações que melhoram a adesão do paciente ao tratamento, à demanda crescente por terapias combinadas, à inovação contínua em tecnologias de administração de medicamentos e ao foco em atender às necessidades médicas não atendidas no tratamento de doenças crônicas e complexas.

• Por dados demográficos do paciente

Com base nos dados demográficos dos pacientes, o mercado é segmentado em adultos, idosos e pediátricos. Em 2025, espera-se que o segmento de adultos domine o mercado com uma participação de 68,75%, devido à maior prevalência de doenças crônicas e relacionadas ao estilo de vida, como distúrbios cardiovasculares, diabetes e hipertensão, na população adulta, o que impulsiona uma demanda constante por medicamentos genéricos de marca.

Espera-se que o segmento adulto cresça a uma taxa composta de crescimento anual (CAGR) de 6,5%, impulsionado pelo aumento da conscientização sobre saúde, pelo crescente acesso a medicamentos acessíveis, pelo aumento da população de classe média em economias emergentes e pela preferência por medicamentos genéricos de marca com valor agregado, que oferecem melhor eficácia e adesão entre pacientes adultos.

• Pelo usuário final

Com base no usuário final, o mercado é segmentado em hospitais, clínicas, assistência domiciliar, instituições acadêmicas e de pesquisa, e outros. Em 2025, espera-se que o segmento de hospitais domine o mercado com uma participação de 56,55%, impulsionado pelo alto volume de tratamentos de pacientes, pela preferência por medicamentos de marca e genéricos de alta qualidade para cuidados intensivos e pelas práticas de compras centralizadas dos hospitais, que garantem o fornecimento consistente de medicamentos essenciais.

Prevê-se que o segmento hospitalar registre o crescimento mais rápido, de 6,7%, entre 2025 e 2032, impulsionado pela expansão da infraestrutura hospitalar, pelo aumento do número de hospitais especializados e multiespecializados, pelo aumento das internações hospitalares por doenças crônicas e agudas e pela crescente adoção de medicamentos genéricos de marca com valor agregado no atendimento hospitalar para melhores resultados terapêuticos.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em farmácias de varejo, farmácias hospitalares, licitações diretas e outros. Em 2025, espera-se que o segmento de farmácias de varejo domine o mercado com uma participação de 57,45%, impulsionado pela ampla disponibilidade de medicamentos genéricos de marca em pontos de venda, pela preferência do consumidor por acesso facilitado a medicamentos e pela forte presença de redes de farmácias e drogarias independentes em áreas urbanas e semiurbanas.

Prevê-se que o segmento de farmácias de varejo registre o crescimento mais rápido, de 6,6%, durante o período de 2025 a 2032, impulsionado pelo aumento das tendências de automedicação, pela crescente conscientização sobre os genéricos de marca com melhor custo-benefício, pela expansão das redes de farmácias e por iniciativas governamentais que apoiam o acesso a medicamentos essenciais a preços acessíveis por meio dos canais de varejo.

Mercado de genéricos de marca no Oriente Médio e na África – Análise Regional

- Prevê-se que a Arábia Saudita domine o mercado de medicamentos genéricos de marca no Oriente Médio e na África, com a maior participação na receita, de 28,55% em 2025, impulsionada pela forte demanda por produtos farmacêuticos acessíveis e de alta qualidade e pelo aumento dos gastos com saúde em toda a região.

- A expansão é impulsionada pelo crescente apoio governamental à infraestrutura de saúde, pela prevalência cada vez maior de doenças crônicas e pela crescente conscientização sobre a adesão ao tratamento, fatores que, em conjunto, impulsionam a adoção de medicamentos genéricos de marca.

- Países como Índia, China, Japão e Coreia do Sul lideram a região devido às suas capacidades de fabricação farmacêutica bem estabelecidas, ao apoio regulatório aos genéricos e ao crescente investimento na produção nacional de produtos para a saúde.

- Além disso, políticas favoráveis que promovem a produção local de medicamentos, o acesso à saúde e as exportações farmacêuticas aceleram ainda mais o crescimento do mercado na Arábia Saudita.

Oriente Médio e África: Análise do Mercado de Genéricos de Marca no Oriente Médio e África

O Oriente Médio e a África representam uma região de crescimento emergente para o mercado de medicamentos genéricos de marca na região, impulsionada pelo aumento do acesso à saúde, expansão da infraestrutura e crescentes iniciativas governamentais para melhorar a acessibilidade aos tratamentos. Países como Arábia Saudita, Emirados Árabes Unidos e África do Sul estão investindo na produção farmacêutica local, na modernização da saúde e em programas de saúde digital, o que está impulsionando a adoção do mercado. Embora ainda em fase de desenvolvimento em comparação com outras regiões, espera-se que a crescente conscientização sobre tratamentos custo-efetivos, a melhoria da cobertura de saúde e as reformas regulatórias impulsionem um crescimento constante e de longo prazo para os medicamentos genéricos de marca no Oriente Médio e na África.

Análise do Mercado de Medicamentos Genéricos de Marca na Arábia Saudita, Oriente Médio e África

A Arábia Saudita ocupa uma posição importante no mercado de genéricos de marca do Oriente Médio e da África, sustentada por sua sólida infraestrutura de saúde, avançada capacidade de produção farmacêutica e iniciativas governamentais que incentivam a produção nacional de medicamentos. O foco do país no tratamento de doenças crônicas, oncologia e terapias cardiovasculares está aumentando a demanda por genéricos de marca. Além disso, parcerias estratégicas entre empresas farmacêuticas e instituições de pesquisa estão impulsionando a inovação em genéricos de alto valor agregado e terapias especializadas. A crescente ênfase da França no acesso à saúde, na acessibilidade financeira e na adesão ao tratamento reforça ainda mais sua importância no cenário farmacêutico europeu.

Análise do Mercado de Medicamentos Genéricos de Marca no Egito, Oriente Médio e África

O Egito está emergindo como um mercado em crescimento no setor de genéricos de marca no Oriente Médio e na África, impulsionado pela expansão da cobertura de saúde, pelo aumento da demanda por terapias acessíveis e pela crescente adoção de soluções para o gerenciamento de doenças crônicas. O foco do país na modernização da saúde, em iniciativas de saúde digital e na produção farmacêutica regional acelerou o uso de genéricos de marca. Além disso, a colaboração entre fabricantes locais, instituições de pesquisa e empresas farmacêuticas internacionais está apoiando a inovação e a comercialização de produtos genéricos de alta qualidade. Os investimentos da Espanha em infraestrutura de saúde e em campanhas de conscientização do paciente estão contribuindo para o crescimento constante do mercado.

Análise do Mercado de Medicamentos Genéricos de Marca na África do Sul, Oriente Médio e África

Prevê-se que a África do Sul registre a maior taxa de crescimento anual composta (CAGR) do Oriente Médio e da África durante o período de previsão, impulsionada pelo aumento dos gastos com saúde, pela rápida industrialização da produção farmacêutica e pela crescente prevalência de doenças crônicas e relacionadas ao estilo de vida. Países como Índia, China e Japão lideram o crescimento, impulsionados pela expansão da capacidade de produção interna, pela fabricação de medicamentos com boa relação custo-benefício e por políticas regulatórias favoráveis. A forte capacidade de exportação farmacêutica da região, o crescente acesso à saúde e as iniciativas para a produção local de medicamentos estão acelerando ainda mais o crescimento do mercado. A crescente conscientização sobre a adesão ao tratamento e a demanda por medicamentos acessíveis e de alta qualidade continuam a fortalecer a posição dominante da região no mercado do Oriente Médio e da África.

Os principais líderes de mercado que atuam no setor são:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (EUA)

- Grupo Sandoz AG (Suíça)

- Laboratórios Dr. Reddy's Ltda. (Índia)

- Sun Pharmaceutical Industries Ltd. (Índia)

- Aurobindo Pharma (Índia)

- Cipla Pharmaceuticals (Índia)

- Fresenius Kabi (Alemanha)

- Abbott (EUA)

- Glenmark Farmacêutica (Índia)

- Hikma Pharmaceuticals PLC (Reino Unido)

- Lupin Pharmaceuticals (Índia)

- Emcure Pharmaceuticals (Índia)

- Bausch Health Companies Inc. (Canadá)

- Mankind Pharma (Índia)

- Jubilant Pharma (Índia)

- Natco Pharma (Índia)

- ARISTO Pharmaceuticals Private Limited (Índia)

- Biocon Limitada (Índia)

- Torrent Pharmaceuticals Ltd. (Índia)

- Endo, Inc. (EUA)

- Alembic Pharmaceuticals Limited (Índia)

- SAGENT Pharmaceuticals (EUA)

- Panacea Biotec (Índia)

Últimos desenvolvimentos no mercado de genéricos de marca no Oriente Médio e na África

- Em outubro de 2025, a FDA (Food and Drug Administration) dos EUA aprovou uma indicação ampliada para UZEDY (risperidona), suspensão injetável de liberação prolongada. Agora, o medicamento está aprovado para o tratamento da esquizofrenia em crianças e adolescentes de 13 a 17 anos, além de adultos. Isso proporciona uma opção de tratamento de longa duração para pacientes mais jovens que lidam com essa condição crônica.

- Em agosto de 2025, a Teva recebeu a aprovação da FDA (Food and Drug Administration) dos EUA e lançou a primeira versão genérica da injeção de Saxenda (liraglutida). Este agonista genérico do receptor GLP-1 é aprovado como ferramenta para o controle de peso em pacientes adultos e pediátricos, oferecendo uma opção mais acessível para o tratamento da obesidade crônica.

- Em agosto de 2025, a Viatris recebeu a aprovação da FDA (Food and Drug Administration) dos EUA para a primeira versão genérica da Injeção de Sacarato de Ferro, um medicamento usado para tratar anemia por deficiência de ferro. Esse desenvolvimento proporciona uma opção de tratamento mais acessível para pacientes e profissionais de saúde nos Estados Unidos. A aprovação fortalece o portfólio de medicamentos injetáveis genéricos da Viatris e amplia o acesso dos pacientes a essa terapia essencial.

- Em abril de 2025, a Viatris submeteu pedidos suplementares de novo medicamento ao Ministério da Saúde, Trabalho e Bem-Estar do Japão, buscando aprovação para o EFFEXOR (venlafaxina) no tratamento do Transtorno de Ansiedade Generalizada. Essa medida regulatória visa expandir o uso terapêutico desse medicamento no mercado japonês. Se aprovado, proporcionará uma nova opção de tratamento para pacientes no Japão que sofrem dessa condição.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES ANALYSIS

4.2 BRAND OUTLOOK

4.2.1 PRODUCT VS BRAND OVERVIEW

4.2.1.1 PRODUCT OVERVIEW

4.2.1.2 BRAND OVERVIEW

4.3 CONSUMER BUYING BEHAVIOUR – MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PATENT ANALYSIS – MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

4.5.1 PATENT QUALITY AND STRENGTH

4.5.2 PATENT FAMILIES

4.5.3 LICENSING AND COLLABORATIONS

4.5.4 REGIONAL PATENT LANDSCAPE

4.5.5 IP STRATEGY AND MANAGEMENT

4.6 PRICING ANALYSIS

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL SUPPLY

4.7.3 COMPONENT MANUFACTURING AND PROCESSING

4.7.4 EQUIPMENT AND TECHNOLOGY PROVIDERS

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.7.7 CONCLUSION

5 REGULATION COVERAGE

5.1 REGULATION COVERAGE (NORTH AMERICA)

5.2 REGULATION COVERAGE (SOUTH AMERICA)

5.3 REGULATION COVERAGE (EUROPE)

5.4 REGULATION COVERAGE (MIDDLE EAST & AFRICA)

5.5 REGULATION COVERAGE (ASIA-PACIFIC)

5.6 SUPPLY CHAIN ANALYSIS OF MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

5.6.1 OVERVIEW

5.6.2 LOGISTIC COST SCENARIO

5.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5.6.4 CONCLUSION

5.7 TECHNOLOGICAL ADVANCEMENTS– MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

5.7.1 ADVANCED FORMULATION TECHNOLOGIES

5.7.2 CONTINUOUS MANUFACTURING AND PROCESS OPTIMIZATION

5.7.3 ANTI-COUNTERFEITING AND SMART PACKAGING TECHNOLOGIES

5.7.4 MODIFIED DRUG DELIVERY SYSTEMS

5.7.5 DIGITAL TRANSFORMATION AND E-PRESCRIPTION INTEGRATION

5.7.6 ADVANCED ANALYTICAL AND QUALITY ASSURANCE TOOLS

5.7.7 PERSONALIZED GENERIC THERAPY DEVELOPMENT

5.7.8 SUSTAINABILITY AND ECO-FRIENDLY MANUFACTURING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 PATENT EXPIRATIONS OF BLOCKBUSTER DRUGS

6.1.2 RISING PREVALENCE OF CHRONIC DISEASES

6.1.3 COST-EFFECTIVE ALTERNATIVE TO INNOVATOR DRUGS

6.1.4 SIMPLIFIED APPROVAL PATHWAYS FOR BRANDED GENERICS

6.2 RESTRAINS

6.2.1 PATENT LITIGATION AND INTELLECTUAL PROPERTY RISKS

6.2.2 COUNTERFEIT AND SUBSTANDARD DRUGS

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF BRANDED GENERIC DRUG IN EMERGING MARKETS

6.3.2 PATENT CLIFF OF MAJOR DRUGS

6.3.3 EXPANSION INTO SPECIALTY AND COMPLEX GENERICS

6.4 CHALLENGES

6.4.1 INTENSE PRICE PRESSURE AMONG COMPETITORS

6.4.2 QUALITY PERCEPTION & PHYSICIAN/PATIENT TRUST IN BRANDED GENERIC DRUG

7 MIDDLE EAST AND AFRICA BRANDED GENERIC MARKET, BY DRUG CLASS

7.1 OVERVIEW

7.2 ANTI-HYPERTENSIVE

7.2.1 DIURETICS

7.2.2 CE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS)

7.2.3 ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS)

7.2.4 BETA BLOCKERS (BBS)

7.2.5 CALCIUM CHANNEL BLOCKERS (CCBS)

7.2.6 DIRECT VASODILATORS

7.2.7 ALPHA-1 BLOCKERS

7.2.8 CENTRAL ALPHA-2 AGONISTS

7.2.9 HORMONES

7.2.10 STEROID HORMONES

7.2.11 SEX HORMONES

7.2.12 ESTROGENS

7.2.13 PROGESTOGENS

7.2.14 ANDROGENS

7.2.15 THYROID HORMONES

7.2.16 OTHER HORMONES

7.3 ANTIMETABOLITES

7.3.1 PURINE ANALOGUES

7.3.2 PYRIMIDINE ANALOGUES

7.3.3 FOLATE ANTAGONISTS

7.4 LIPID LOWERING DRUGS

7.4.1 STATINS (HMG-COA REDUCTASE INHIBITORS)

7.4.2 COMBINATION PRODUCTS AND OTHER AGENTS

7.4.3 FIBRATES

7.4.4 BILE ACID SEQUESTRANTS

7.4.5 PCSK9 INHIBITORS

7.5 ANTI-EPILEPTICS

7.6 ALKYLATING AGENTS

7.6.1 NITROGEN MUSTARDS

7.6.2 NITROSOUREAS

7.6.3 ALKYL SULFONATES

7.6.4 TRIAZENES

7.6.5 ETHYLENIMINES

7.7 ANTI-DEPRESSANTS

7.7.1 SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS)

7.7.2 SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS)

7.7.3 TRICYCLIC ANTIDEPRESSANTS (TCAS)

7.7.4 ATYPICAL ANTIDEPRESSANTS

7.7.5 MONOAMINE OXIDASE INHIBITORS (MAOIS)

7.7.6 NMDA RECEPTOR ANTAGONISTS

7.8 ANTI-PSYCHOTICS

7.8.1 SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS

7.8.2 FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS

7.8.3 PHENOTHIAZINES

7.8.4 THIOXANTHENES

7.8.5 NEXT-GENERATION ANTIPSYCHOTICS

7.9 OTHERS

8 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CARDIOVASCULAR DISEASES

8.3 PAIN MANAGEMENT AND ANTI-INFLAMMATORY

8.4 ONCOLOGY

8.5 DIABETES

8.6 NEUROLOGY

8.7 GASTROINTESTINAL DISEASES

8.8 DERMATOLOGY

8.9 OTHERS

9 MIDDLE EAST AND AFRICA BRANDED GENERIC MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 ORAL

9.3 INJECTABLEA

9.4 TOPICAL ADMINISTRATION

9.5 OTHERS

10 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 VALUE-ADDED BRANDED GENERICS

10.3 TRADE NAMED GENERICS

11 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULT

11.3 GERIATRIC

11.4 PEDIATRIC

12 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 HOMECARE

12.5 ACADEMIC & RESEARCH INSTITUTES

12.6 OTHERS

13 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL PHARMACIES

13.3 HOSPITAL PHARMACIES

13.4 DIRECT TENDERS

13.5 OTHERS

14 MIDDLE EAST AND AFRICA SHIP REPAIR AND MAINTENANCE SERVICES MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES

14.1.3 EGYPT

14.1.4 SOUTH AFRICA

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 BAHRAIN

14.1.8 QATAR

14.1.9 OMAN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TEVA PHARMACEUTICAL INDUSTRIES LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 VIATRIS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SANDOZ GROUP AG

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DR.REDDY’S LABORATORIES LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SUN PHARMACEUTICAL INDUSTRIES LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ABBOTT

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALEMBIC PHARMACEUTICALS LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 AMNEAL PHARMACEUTICALS LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ARISTO PHARMACEUTICALS PRIVATE LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ASPEN HOLDINGS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 AUROBINDO PHARMA USA (SUBSIDIARY OF AUROBINDO PHARMA LIMITED)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BAUSCH HEALTH COMPANIES INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOCON.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 CIPLA

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 EMCURE PHARMACEUTICALS LIMITED

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 ENDO, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 FRESENIUS SE & CO. KGAA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 GLENMARK PHARMACEUTICALS LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 HIKMA PHARMACEUTICALS PLC

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 INTAS PHARMACEUTICALS LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 JUBILANT GENERICS LIMITED (SUBSIDIARY OF JUBILANT PHARMA COMPANY)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LUPIN

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MANKIND PHARMA LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NATCO PHARMA LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENTS

17.25 NEULAND LABORATORIES LTD.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 ORCHIDPHARMA LTD.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENT

17.27 PANACEA BIOTEC

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENT

17.28 SAGENT

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 STRIDES PHARMA SCIENCE LIMITED.

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENT

17.3 TORRENT PHARMACEUTICALS LTD.

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

17.31 USV PRIVATE LIMITED.

17.31.1 COMPANY SNAPSHOT

17.31.2 SERVICE PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 WOCKHARDT LIMITED

17.32.1 COMPANY SNAPSHOT

17.32.2 REVENUE ANALYSIS

17.32.3 PRODUCT PORTFOLIO

17.32.4 RECENT DEVELOPMENT

17.33 MCKESSON CORPORATION

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENT

17.34 CENCORA, INC.

17.34.1 COMPANY SNAPSHOT

17.34.2 REVENUE ANALYSIS

17.34.3 PRODUCT PORTFOLIO

17.34.4 RECENT DEVELOPMENT

17.35 CARDINAL HEALTH

17.35.1 COMPANY SNAPSHOT

17.35.2 REVENUE ANALYSIS

17.35.3 PRODUCT PORTFOLIO

17.35.4 RECENT DEVELOPMENT

17.36 ALVOGEN

17.36.1 COMPANY SNAPSHOT

17.36.2 SERVICE PORTFOLIO

17.36.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 BRAND COMPARATIVE ANALYSIS OF THE MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

TABLE 2 PATENT LANDSCAPE

TABLE 3 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ANTI-PSYCHOTICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI-INFLAMMATORY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA VALUE-ADDED BRANDED GENERICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA TRADE NAMED GENERICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA ADULT IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA GERIATRIC IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PEDIATRIC IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA HOSPITALS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA CLINICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA HOMECARE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA HOSPITAL PHARMACIES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA DIRECT TENDERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SAUDI ARABIA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 176 SAUDI ARABIA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SAUDI ARABIA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SAUDI ARABIA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SAUDI ARABIA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SAUDI ARABIA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SAUDI ARABIA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SAUDI ARABIA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SAUDI ARABIA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SAUDI ARABIA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SAUDI ARABIA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SAUDI ARABIA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SAUDI ARABIA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SAUDI ARABIA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SAUDI ARABIA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SAUDI ARABIA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SAUDI ARABIA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SAUDI ARABIA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SAUDI ARABIA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SAUDI ARABIA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SAUDI ARABIA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SAUDI ARABIA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SAUDI ARABIA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SAUDI ARABIA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SAUDI ARABIA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SAUDI ARABIA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SAUDI ARABIA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SAUDI ARABIA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SAUDI ARABIA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SAUDI ARABIA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SAUDI ARABIA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SAUDI ARABIA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SAUDI ARABIA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SAUDI ARABIA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SAUDI ARABIA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SAUDI ARABIA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SAUDI ARABIA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SAUDI ARABIA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SAUDI ARABIA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SAUDI ARABIA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SAUDI ARABIA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SAUDI ARABIA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SAUDI ARABIA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SAUDI ARABIA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SAUDI ARABIA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SAUDI ARABIA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SAUDI ARABIA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SAUDI ARABIA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SAUDI ARABIA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 SAUDI ARABIA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SAUDI ARABIA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SAUDI ARABIA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SAUDI ARABIA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SAUDI ARABIA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SAUDI ARABIA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SAUDI ARABIA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SAUDI ARABIA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SAUDI ARABIA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 235 SAUDI ARABIA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SAUDI ARABIA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SAUDI ARABIA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 244 UNITED ARAB EMIRATES ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 UNITED ARAB EMIRATES DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 UNITED ARAB EMIRATES ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 UNITED ARAB EMIRATES ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 UNITED ARAB EMIRATES BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 UNITED ARAB EMIRATES CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 UNITED ARAB EMIRATES DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 UNITED ARAB EMIRATES ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 UNITED ARAB EMIRATES CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 UNITED ARAB EMIRATES HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 UNITED ARAB EMIRATES STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 UNITED ARAB EMIRATES SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 UNITED ARAB EMIRATES ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 UNITED ARAB EMIRATES PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 UNITED ARAB EMIRATES ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 UNITED ARAB EMIRATES THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 UNITED ARAB EMIRATES OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 UNITED ARAB EMIRATES ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 UNITED ARAB EMIRATES PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 UNITED ARAB EMIRATES PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 UNITED ARAB EMIRATES FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 UNITED ARAB EMIRATES LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 UNITED ARAB EMIRATES STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 UNITED ARAB EMIRATES COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 UNITED ARAB EMIRATES FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 UNITED ARAB EMIRATES BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 UNITED ARAB EMIRATES PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 UNITED ARAB EMIRATES ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 UNITED ARAB EMIRATES ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 UNITED ARAB EMIRATES NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 UNITED ARAB EMIRATES NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 UNITED ARAB EMIRATES ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 UNITED ARAB EMIRATES TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 UNITED ARAB EMIRATES ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 UNITED ARAB EMIRATES ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 UNITED ARAB EMIRATES SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 UNITED ARAB EMIRATES SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 UNITED ARAB EMIRATES TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 UNITED ARAB EMIRATES ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 UNITED ARAB EMIRATES MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 UNITED ARAB EMIRATES NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 UNITED ARAB EMIRATES ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 UNITED ARAB EMIRATES SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 UNITED ARAB EMIRATES FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 UNITED ARAB EMIRATES PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 UNITED ARAB EMIRATES NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 UNITED ARAB EMIRATES GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 UNITED ARAB EMIRATES DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 UNITED ARAB EMIRATES OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 303 UNITED ARAB EMIRATES ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 UNITED ARAB EMIRATES INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 UNITED ARAB EMIRATES TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 308 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 309 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 UNITED ARAB EMIRATES RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 EGYPT BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 312 EGYPT ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 EGYPT DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 EGYPT ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 EGYPT ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 EGYPT BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 EGYPT CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 EGYPT DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 EGYPT ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 EGYPT CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 EGYPT HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 EGYPT STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 EGYPT SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 EGYPT ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 EGYPT PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 EGYPT ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 EGYPT THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 EGYPT OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 EGYPT ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 EGYPT PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 EGYPT PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 EGYPT FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 EGYPT LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 EGYPT STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)